November 2, 2015

By

Mark Terry

, BioSpace.com Breaking News Staff

Dublin-based

Shire

announced

today that it will acquire Burlington, Mass.-based

Dyax Corporation

for about $5.9 billion.

Shire

will pay $37.30 per

Dyax

share in cash, totaling around $5.9 billion. In addition, if

Dyax

’s pipeline product, DX-2930 for the treatment of HAE, a rare, debilitating genetic inflammatory condition, is approved,

Dyax

shareholders will receive a non-tradable contingent value right (CVR) that will pay $4 in cash per

Dyax

share. This could add an additional $646 million in aggregate contingent consideration to the deal.

Dyax

is publicly traded and focuses on plasma kallikrein (pKal) inhibitors for the treatment of HAE. It currently has a product on the market, Kalbitor, for the treatment of HAE in patients twelve-years-old and up.

Dyax

‘s DX-2930 is Phase III-ready, and has received Fast Track, Breakthrough Therapy, and Orphan Drug designations by the

U.S. Food and Drug Administration (FDA)

, and also has received Orphan Drug status in the European Union.

Dyax

, and now Shire, expect to start Phase III trials before the end of this year. The companies project, if approved, the drug could generate annual global sales of up to $2 billion.

“This highly complementary transaction aligns with and accelerates our strategy to build a global leading biotechnology company focused on rare diseases and specialty conditions,” said

Flemming Ornskov

,

Shire

’s chief executive officer, in a statement. “It adds to our portfolio of best-in-class therapies addressing unmet needs in our core therapeutic areas, expanding and extending our leadership position in HAE. We have closely followed DX-2930’s progress in the evolving HAE landscape for some time, and we admire the work of the

Dyax

team in moving this next-generation therapy forward.”

Since July,

Shire

has been attempting to

acquire

Illinois-based

Baxalta

, although so far the U.S. company has been fending off

Shire

’s advances. Baxalta, which had only spun off from

Baxter International

on July 1, has argued that the

Shire

offer undervalues the company and that a merger this close to its spinoff would be too disruptive.

Shire

approached Baxalta with a stock-only deal in July worth about $31 billion. When Baxalta refused to engage on the offer,

Shire

went public with the offer in an apparent effort to apply pressure to

Baxalta

’s board of directors and shareholders.

At news of the

Dyax

deal and a softening of

Shire

’s stock value, some analysts have thought the

Baxalta

takeover might be off the table, but Ornskov denies that. “Even with this transaction,” he added “we will continue to have the financial firepower to pursue other value-added strategic acquisitions, including

Baxalta

.”

Ronny Gal

, an analyst with

Bernstein

, observes in a research note today that the

Dyax

deal makes complete sense. “The HAE franchise is very important for

Shire

. It is currently the largest of its highly-prized orphan indicators, accounting for ~15 percent of revenue and ~20 percent of earnings.

Shire

has made substantial investment in the franchise by acquiring

ViroPharma

in November 2013 for $4 billion, bringing on board Cinryze, which would be under direct threat from DX-2930.”

Gal, however, does indicate that Bernstein analysts’ belief that the

Dyax

deal will probably broaden the odds of a Baxalta deal. “(T)his clearly deemphasizes the deal in our minds.” Gal also emphasizes that by acquiring

Dyax

,

Shire

minimized the risk of competition should DX-2930 be approved. “Given HAE competition was a threat for the stock in the intermediate run, today’s deal is an important de-risking step prolonging franchise to beyond the concern horizon (10+ years).”

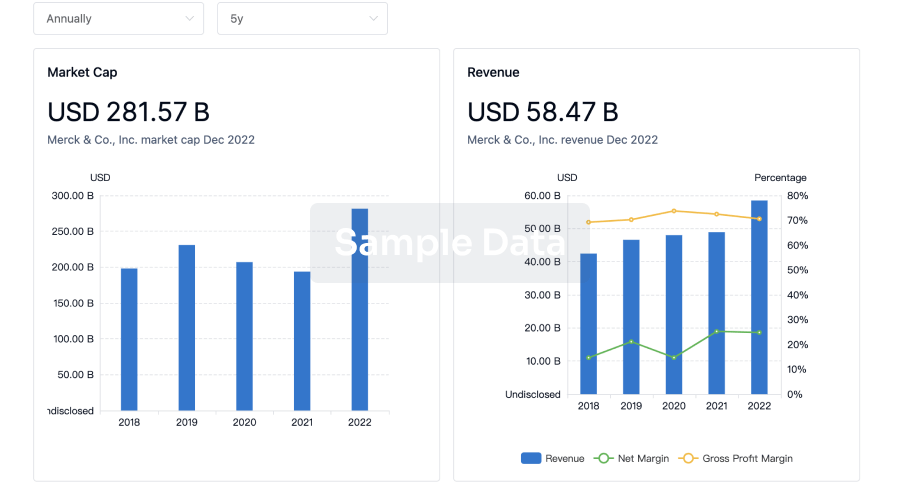

Shire

has been fairly volatile this year, although it’s been on the increase lately. Shares traded for $216.23 on Feb. 10, 2015, rose to $260.15 on May 29, dropped to $238.93 on July 8, and jumped back up to $268.08 on Aug. 3. Shares then collapsed to $196.86 on Oct. 13. They are currently trading for $227.05.