Major Funding Rounds Drive Next-Gen Therapies in January 2025

With the thriving development of the biopharmaceutical industry, January 2025 witnessed several significant financing events exceeding $100 million, infusing fresh resources into pioneering companies dedicated to addressing unmet medical needs. For many startups focused on developing next-generation therapies and technologies, this period of fundraising activities represents a crucial milestone in achieving scientific breakthroughs and advancing commercialization of their products. Whether concentrating on gene editing technologies for personalized treatment plans or exploring new paths for vaccine development with biotechnological platforms, each successful financing case underpins the crystallization of scientists' wisdom and a hopeful vision for future health. Additionally, the active response from the capital market provides a solid foundation and support for companies seeking to expand production scales, accelerate clinical trial processes, or broaden international markets.

1.Alebund Pharmaceuticals completes a 550 million yuan Series C financing to accelerate the R&D and commercialization process of innovative therapies for kidney diseases

On January 7, 2025, Alebund Pharmaceuticals announced the successful completion of its Series C financing, raising a total of 550 million yuan (approximately $75.046 million). Founded in 2018 and headquartered in Shanghai, Alebund Pharmaceuticals is a comprehensive biopharmaceutical company specializing in the development of innovative drugs for kidney diseases and related chronic conditions. The company aims to provide better clinical treatments for patients worldwide with chronic kidney disease (CKD) and related disorders and has established a rich and balanced product pipeline covering various kidney disease areas including CKD, IgA nephropathy, diabetic nephropathy, focal segmental glomerulosclerosis (FSGS), and autosomal dominant polycystic kidney disease (ADPKD).

The funds raised will primarily be used to accelerate the R&D process of its core products. Part of the funds will be used to advance the New Drug Application (NDA) and pivotal Phase III global clinical trials for AP301, a novel iron-based phosphate binder designed to treat hyperphosphatemia in patients with chronic renal failure. AP301 works by effectively binding to dietary phosphates in the gastrointestinal tract, reducing phosphate absorption, thus lowering serum phosphate levels and improving long-term clinical outcomes. The key Phase III clinical trial of AP301 has already witnessed the enrollment of its first patient in China and conducted an investigator meeting, marking an important step towards marketization. Additionally, funds will also support the Phase II clinical trials in the U.S. and China for AP306, a small molecule pan-phosphate transporter inhibitor. This represents the first globally to enter clinical development, holding a pioneering significance.

2.Kardigan Secures $300 Million in Series A Funding to Accelerate Development of Precision Therapies for Cardiovascular Diseases

On January 10, 2025, Kardigan announced the completion of a $300 million Series A funding round led by Perceptive Advisors, ARCH Venture Partners, and Sequoia Heritage. The funds will be used to advance research in areas of unmet need within cardiology, specifically focusing on the development of treatment protocols for heart failure caused by primary and secondary cardiomyopathies. Kardigan utilizes a proprietary set of cardiac-specific tools that enable deep insights into the mechanisms of action of its therapeutic candidates and the personalized responses of patients to treatments. This approach allows the company to optimize clinical trial processes, ensuring that new therapies are provided to those most likely to benefit while seeking alternative treatments for those less likely to benefit. Additionally, Kardigan’s R&D platform not only focuses on discovery and translational research but also integrates strategic licensing and acquisitions, forming a comprehensively integrated biopharmaceutical company. In terms of R&D pipeline, Kardigan concentrates on concurrently developing multiple targeted therapeutic approaches to offer more effective treatment options for patients with cardiovascular diseases. For example, the company is exploring a range of disease-modifying drugs that shift the therapeutic paradigm from symptom management to functional cure. Kardigan’s projects encompass several key areas of cardiovascular disease, including but not limited to primary and secondary cardiomyopathies leading to heart failure. Notably, Kardigan’s R&D strategy also includes establishing a cardiac intelligence model that enables the team to generate and share data across various projects, further enhancing research efficiency and success rates.

3.Neko Health Raises $260 Million in Series B Funding to Accelerate Innovation in Preventive Medical Technology and Global Market Expansion

On January 22, 2025, Neko Health completed a $260 million Series B funding round led by Lightspeed Venture Partners, with additional support from General Catalyst, O.G. Venture Partners, Rosello, Lakestar, and Atomico among other prominent investment firms. The funding will be used to expedite Neko Health's rapid expansion in the European and US markets and continue investing in the development of its innovative non-invasive health diagnostic technology. This funding round not only signifies investor confidence in Neko Health’s technology and services but also reflects a growing market trend towards preventive medical services. Neko Health aims to address the global rise in chronic disease burden by providing efficient, convenient, and comprehensive health management solutions. Neko Health's core technology is a non-invasive full-body scanner that can map millions of health data points within minutes, helping to identify multiple health risk factors. This technology incorporates high-resolution 2D and 3D imaging, thermal imaging, cardiovascular measurements, grip strength tests, intraocular pressure assessments, and blood tests with AI analysis to rapidly provide personalized health insights to clients. Neko Health's scans can detect risks for skin cancer, metabolic syndrome symptoms, stroke and heart disease, prediabetes signs, and blood abnormalities. Since its first service launch in London and Stockholm in 2023, the company has completed over 10,000 scans and amassed a global waiting list exceeding 100,000 people.

4.Aviceda Therapeutics Secures $207.5 Million in Series C Funding to Advance Ophthalmic Innovations to New Milestones

On January 7, 2025, Aviceda Therapeutics completed a $207.5 million Series C financing round, co-led by Omega Funds and TCGX, with support from Enavate Sciences, Jeito Capital, Blue Owl Healthcare Opportunities, and other investment institutions. This capital will primarily fund the clinical development of their lead project, AVD-104, especially the critical Phase 3 clinical trial targeting Geographic Atrophy (GA), a vision-threatening condition commonly secondary to late-stage Age-Related Macular Degeneration (AMD).

Based in Cambridge, Massachusetts, Aviceda Therapeutics is a biotechnology firm focused on developing the next generation of immunomodulators. Utilizing its proprietary high-affinity Siglecs ligand (HALOS™) nanotechnology platform, the company aims to tackle chronic unresolved inflammation. Its primary candidate, AVD-104, is a vitreous-injectable nanoparticle that works via a dual mechanism on inflammatory cells and the complement pathway to slow the progression of GA lesions and improve visual function in patients. Currently, AVD-104 is undergoing a Phase 2b/3 clinical trial, with key data expected to be released in the second half of 2025.

5.Colossal Biosciences Raises $200 Million in Series C Funding to Accelerate Genetic Engineering Breakthroughs and Vision for De-extincting Species

On January 15, 2025, Colossal Biosciences completed a $200 million Series C funding round co-led by TWG Global, Mark Walter, and Thomas Tull. This funding round brought the company's total funding to $435 million and increased its valuation to $10.2 billion. The capital will be used to further advance genetic engineering technologies and develop new software, hardware, and wetware solutions to support its core projects of resurrecting extinct species, such as the woolly mammoth, thylacine, and dodo bird, and exploring applications in species conservation and human healthcare.

Colossal Biosciences is a company dedicated to de-extincting species using cutting-edge technologies like CRISPR gene editing, along with innovative approaches like artificial wombs to restore extinct species and increase Earth's biodiversity. Beyond bringing extinct species back to life, Colossal is also exploring how its technologies can be applied in broader ecological conservation, agricultural technologies, and human medical fields. The company plans to spin off several enterprises in the next two years, including one focused on artificial womb technology, which may offer new possibilities for human reproductive treatments.

6.Windward Bio Secures $200 Million in Series A Funding to Accelerate Long-Acting TSLP Antibody and Immunotherapy Pipeline

On January 10, 2025, Windward Bio announced the completion of a $200 million Series A financing round co-led by OrbiMed, Novo Holdings, and Blue Owl Healthcare Opportunities, with participation from other prominent investment firms including SR One, Omega Funds, RTW Investments, Qiming Venture Partners, Quan Capital, and Pivotal bioVenture Partners. This capital will primarily fund the Phase 2 clinical trials of WIN378 and support Windward Bio in developing a pipeline of long-acting bispecific antibodies for immune diseases.

Based in Switzerland, Windward Bio is a clinical-stage pharmaceutical company whose main project, WIN378 (also known as HBM9378/SKB378), is a fully human monoclonal antibody targeting the thymic stromal lymphopoietin (TSLP) ligand. WIN378 works by blocking the interaction between TSLP and its receptor, inhibiting the associated signaling pathway, playing a significant role in treating severe respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD). The antibody is designed with an extended half-life, potentially allowing for bi-annual dosing, which could significantly reduce treatment burden and improve quality of life for patients.

Besides WIN378, Windward Bio plans to expand its R&D pipeline focused on developing long-acting bispecific antibodies utilizing validated targets and principles of synergistic biology to achieve optimal therapeutic effects. The company is building an early discovery pipeline that includes several projects focused on the development of long-acting bispecific antibodies for immune diseases. With the latest $200 million in Series A funding, these funds will support advancing two undisclosed projects through the preclinical stages required for new drug research applications (INDs). Additionally, the company is preparing to initiate a Phase II clinical trial for severe asthma, with initial clinical data expected in 2026. For COPD treatment, Windward Bio has clear development aims and plans to conduct additional clinical trials in regions such as the US, Europe, and Japan to meet the needs of an estimated 5 million patients with late-stage, poorly controlled conditions.

7.Timberlyne Therapeutics Closes $180 Million Series A Funding to Accelerate Clinical Studies of CD38 Antibody CM313

On January 9, 2025, Timberlyne Therapeutics completed a $180 million Series A funding round led by renowned investment firms Abingworth, Bain Capital Life Sciences, and Venrock Healthcare Capital Partners, with additional participation from Boyu Capital, Lilly Asia Ventures, Braidwell LP, and 3H Health Investment. These funds will primarily be used to advance the clinical development of their flagship project CM313, a monoclonal antibody targeting CD38 for treating various autoimmune diseases and cancers.

Timberlyne Therapeutics, a clinical-stage biopharmaceutical company, focuses on developing innovative therapies for autoimmune diseases and cancer. Their flagship product, CM313, is a potentially best-in-class anti-CD38 monoclonal antibody that has demonstrated positive clinical outcomes in conditions including immune thrombocytopenic purpura (ITP), systemic lupus erythematosus (SLE), and relapsed/refractory multiple myeloma (RRMM). By targeting CD38, CM313 modulates various immune cell types, aiming for a rapid and sustained therapeutic response.

8.Ouro Medicines has completed a Series A funding round of $120 million

On January 10, 2025, to speed up the global development of its immunotherapy, OM336. The financing was led by TPG Life Sciences Innovations, NEA, and Norwest Venture Partners, with additional support from Monograph Capital, GSK, UPMC Enterprises, Boyu/Zoo Capital, LongRiver Investments, and other prominent investment firms. This capital will primarily facilitate the global development of the company's flagship product OM336 (CM336), focusing on clinical studies for multiple myeloma and exploring its potential applications in autoimmune diseases.

Ouro Medicines is a biotechnology company dedicated to developing immune reset therapies, aiming to provide innovative treatment options for patients with chronic immune-mediated diseases. The company's core product, OM336, is a BCMA-targeted bispecific T cell engager (TCE) antibody that enables sustained disease remission by precisely targeting and depleting pathogenic cell populations without relying on long-term immunosuppression. OM336 is currently undergoing a Phase 2 clinical trial for multiple myeloma and is planned to enter Phase 1 trials in 2025 to evaluate its efficacy in B cell-mediated diseases like systemic lupus erythematosus, scleroderma, and rheumatoid arthritis.

9.Aspect Biosystems has announced the completion of a $115 million Series B funding round

On January 8, 2025, to accelerate the clinical development of its bioprinted tissue therapies. Led by Dimension, a multi-stage investment firm focused on the intersection of technology and life sciences, the round also saw participation from Novo Nordisk, Radical Ventures, InBC, Pallasite Ventures, Pangaea Ventures, Rhino Ventures, and T1D Fund. The funds will be used to accelerate the clinical development of bioprinted tissue therapies and expand its full-stack tissue therapy platform.

Aspect Biosystems is a leading biotechnology company revolutionizing regenerative medicine through bioprinting technology. The company has developed an AI-driven full-stack tissue therapy platform, integrating proprietary bioprinting technology, computational design tools, and advanced biomaterials and therapeutic cells. The core products are focused on developing novel cell therapies for severe metabolic and endocrine disorders, providing patients with functional treatment options.

10.Geneoscopy raised $105 million in Series C funding to advance the commercialization of its non-invasive colorectal cancer screening tool, ColoSense®

On January 8, 2025, Geneoscopy announced the completion of a Series C funding round totaling $105 million, led by Bio-Rad Laboratories and supported by several investment institutions including Petrichor, Labcorp, Morningside Ventures, Lightchain Capital, NT Investments, Granger Management, Mercy Health, and Tri Locum Partners. This funding will primarily support the commercialization of ColoSense®, a home-based fecal colorectal cancer screening test, and further the development of the company's pipeline for diagnosing inflammatory bowel disease (IBD).

Geneoscopy is a life sciences company focused on developing diagnostic tests for gastrointestinal health, with a core technology that isolates human RNA from patients’ stool samples, enabling effective screening for colorectal cancer. By integrating Bio-Rad's Droplet Digital PCR (ddPCR) technology, Geneoscopy offers a non-invasive screening approach that yields higher patient compliance compared to traditional colonoscopy. Additionally, the company plans to collaborate with Labcorp to expand the market coverage of the ColoSense® test, integrating it into comprehensive screening programs offered by healthcare providers.

Summary

The dynamics in the capital markets of the biopharmaceutical sector in 2025 reveal several important trends in industry development. On one hand, personalized medicine, preventive medicine, and regenerative medicine have become investment hotspots, reflecting the market’s high expectations for innovative therapies that can meet unmet medical needs. Alebund Pharmaceuticals, which focuses on treating chronic kidney disease, Kardigan, which is dedicated to developing precision therapies for cardiology, and Neko Health, which advances early disease detection through non-invasive health diagnostic technologies, illustrate successful financing not only showcases their technological strength but also represents the shift towards more personalized and preventive medical models. With advancements in artificial intelligence and big data analytics, these companies are offering more precise and effective treatment options to patients.

On the other hand, despite significant progress, the biopharmaceutical industry's research and development process remains challenging. From laboratory research to clinical trials, and onto product commercialization, each stage requires substantial resource investment and prolonged effort. Companies that have secured funding need to effectively manage and utilize these resources to ensure that R&D investments translate into tangible treatment outcomes. Additionally, given the increasingly competitive market, maintaining a technological edge and avoiding redundant development are strategic imperatives for these companies. Furthermore, transnational collaboration and mergers and acquisitions are accelerating, which aids in resource integration and technology exchange, promoting the development of the global biopharmaceutical industry.

How to get the latest progress on drug deals?

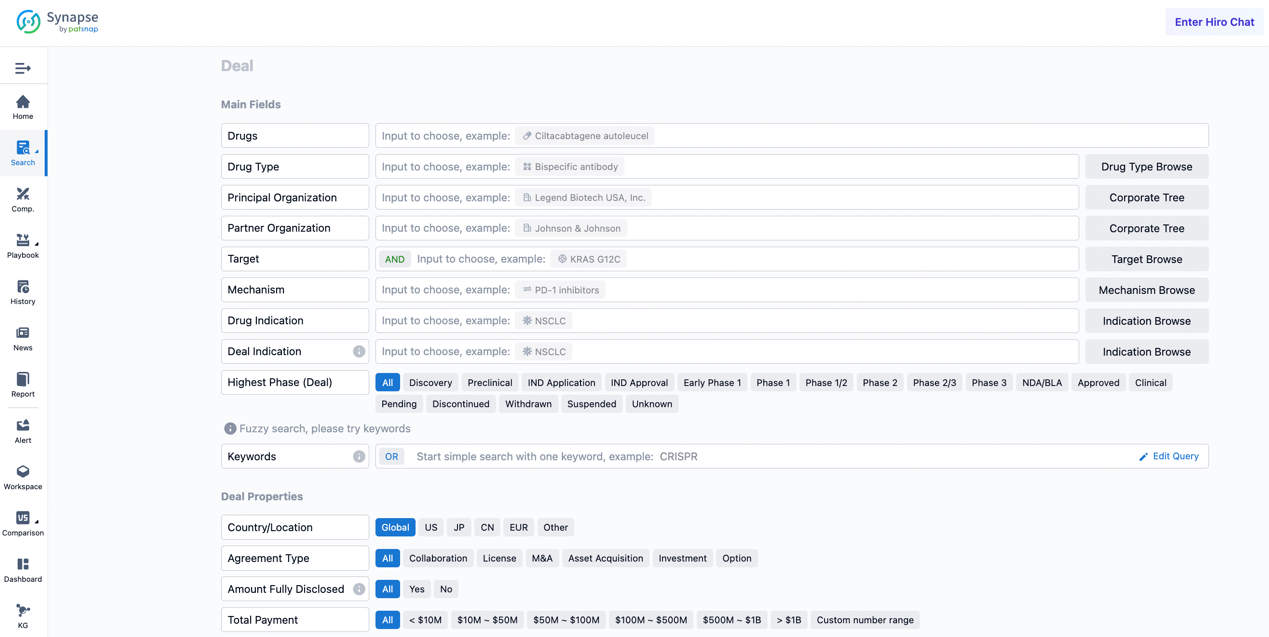

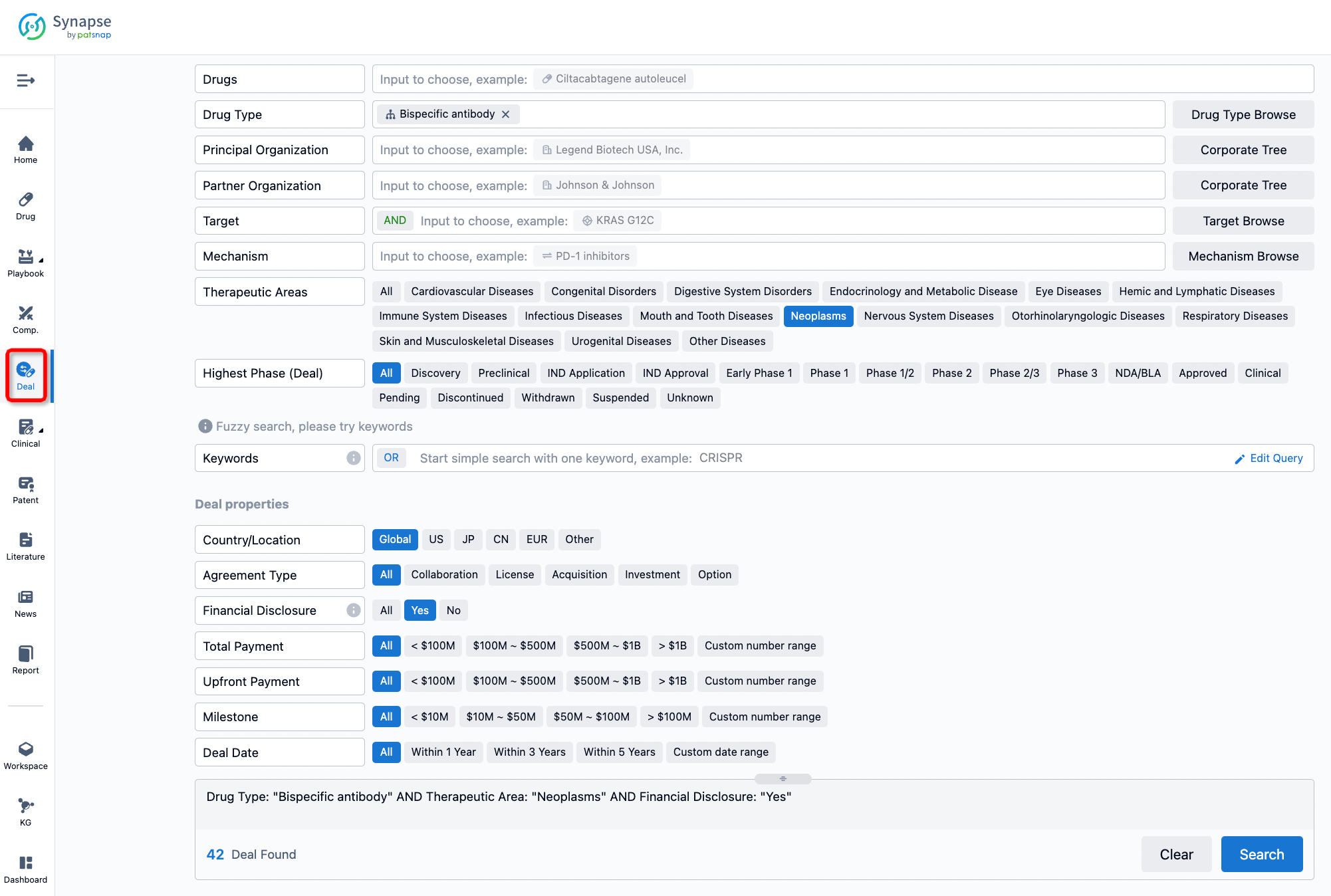

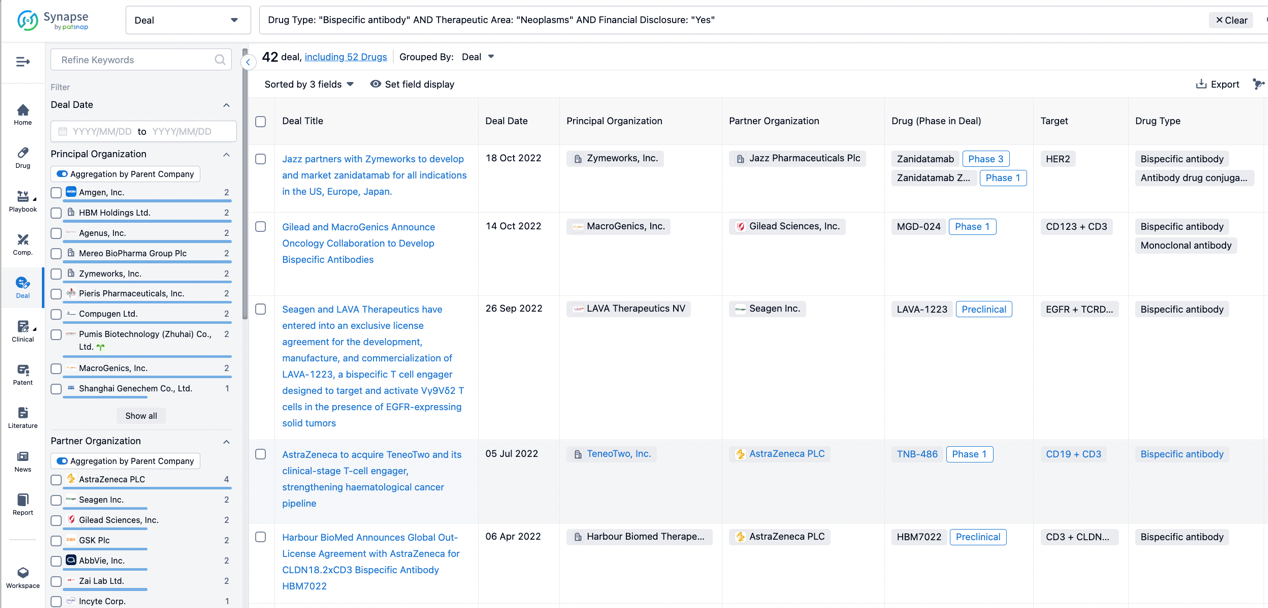

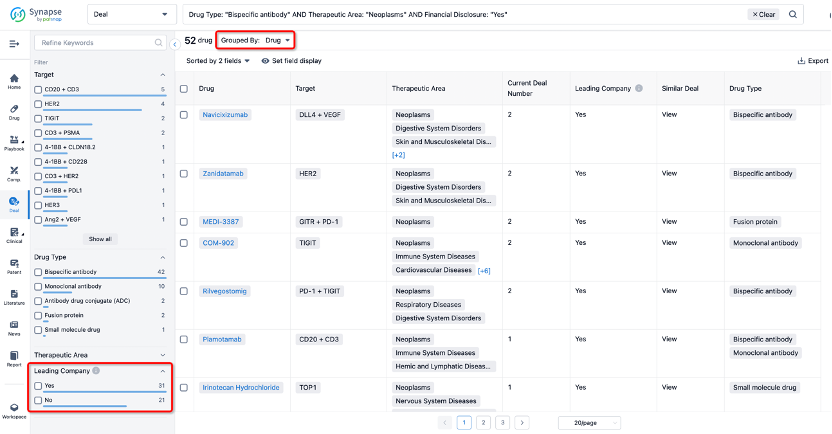

If you would like to access the latest transaction event information, you can click on the 'Deal' module from the homepage of the Synapse database. Within the Deal module, you can search for global pharmaceutical transaction information using labels such as Drugs, Organization, Target, Drug Type, Deal Date.

Furthermore, you can obtain the original link to the transaction coverage by clicking on the "Deal Name."

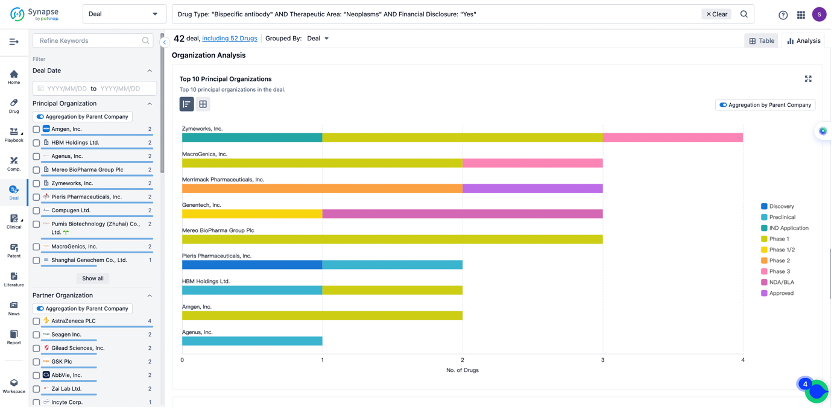

In the analysis view, you can see the most active assignors, assignees, popular targets, and other dimensions of analysis, as well as the distribution of research and development statuses at the time of the transaction, to help you better understand the search results.

The Synapse database also supports the ability to view current transactions from the dimension of "drugs" (by selecting "drugs" from the "Adjust Dimension" dropdown menu above). Targeting transactions involving renowned pharmaceutical companies that are of interest to the industry, such as Merck, Roche, etc., Synapse has identified a group of "leading companies" through drugs that have achieved global sales exceeding 1 billion US dollars in 2022. Transactions involving drugs from these leading companies can be filtered by clicking on the "Leading Company" tag on the left-hand side.

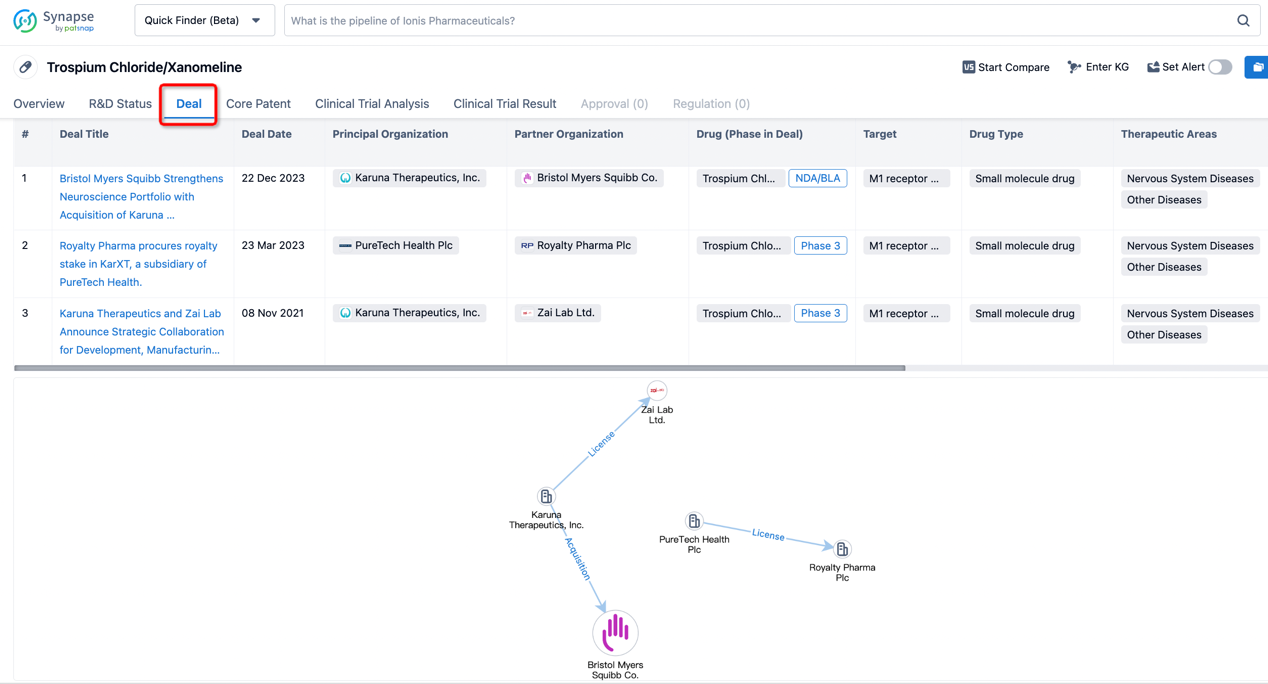

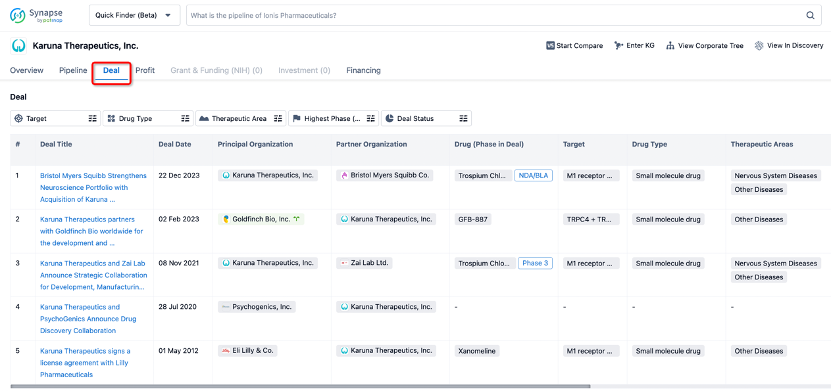

In addition to the drug transaction module, you can also view related transaction history on the drug detail page and the institution detail page.

Click on the image below to explore new pharmaceutical funding transactions!