Request Demo

Last update 08 May 2025

Liver Cell Adenoma

Last update 08 May 2025

Basic Info

Synonyms ADENOMA LIVER, Adenoma liver, Adenoma of Liver Cells + [61] |

Introduction A benign epithelial tumor of the LIVER. |

Related

14

Clinical Trials associated with Liver Cell AdenomaCTIS2023-505278-13-00

JAKIH « A phase 2 open-label single-arm trial of JAK1 inhibitor for the treatment of large inflammatory hepatocellular adenomas » - APHP220916

Start Date01 Oct 2024 |

Sponsor / Collaborator |

NCT06490757

A Phase 2 Open-label Single-arm Trial of JAK1 Inhibitor for the Treatment of Large Inflammatory Hepatocellular Adenomas

Hepatocellular adenomas (HCA) are tumors rare benign hepatic infections that develop on a liver normal and in young women taking a estrogen-based contraception. The main molecular subgroup of AHCs is the AHC subgroup inflammatory, which are associated with a risk of bleeding from the tumor and malignant transformation. Therefore, most of women with large inflammatory AHC (>5 cm) require liver resection which can be associated with morbidity and aesthetic problems, and rarely to mortality. On the basis of the knowledge of the molecular classification of AHCs humans and preclinical data testing the JAK1/2 inhibitors, we hypothesize that a short duration of treatment with the inhibitor of JAK1/2 (baricitinib) may be effective in patients with large inflammatory AHC size.

Start Date02 Sep 2024 |

Sponsor / Collaborator |

NL-OMON49811

KETOgenic diet therapy in patients with HEPatocellular adenoma - Ketohep(py)-Study

Start Date02 Apr 2021 |

Sponsor / Collaborator |

100 Clinical Results associated with Liver Cell Adenoma

Login to view more data

100 Translational Medicine associated with Liver Cell Adenoma

Login to view more data

0 Patents (Medical) associated with Liver Cell Adenoma

Login to view more data

3,705

Literatures (Medical) associated with Liver Cell Adenoma01 May 2025·Radiology Case Reports

Hepatic adenoma in pregnancy: A novel arterial embolization of hepatic adenoma in a pregnant patient

Article

Author: West, Jonathan ; Keen, Deborah ; Fulton, Jeanette ; Hannah, Miranda

01 Apr 2025·Seminars in Ultrasound, CT and MRI

Rare Malignant Liver Tumors: Current Insights and Imaging Challenges

Review

Author: Salles-Silva, Eleonora ; de Castro, Paula Lemos ; Ambrozino, Luiza Carvalho ; Parente, Daniella Braz ; Almeida, Maria Fernanda Arruda ; Lahan-Martins, Daniel ; D'Ippolito, Giuseppe ; de Araújo, Antonio Luis-Eiras ; Lucchesi, Fabiano Rubião ; Torres, Ulysses S ; Pacheco, Eduardo Oliveira

01 Apr 2025·Annales de Pathologie

Une lésion placentaire rare : l’hétérotopie hépatique intraparenchymateuse

Article

Author: Martineau, Romain ; Wells, Constance ; Gallo, Mathieu

1

News (Medical) associated with Liver Cell Adenoma15 Aug 2016

August 15, 2016

By

Mark Terry

, BioSpace.com Breaking News Staff

Some investors track what hedge fund managers are doing, hoping to glean some clue as to market trends. Most recently,

David Tepper

, who runs

Appaloosa Management

,

unloaded

a huge amount of

Standard & Poor

’s 500 and bought up a large amount of

Allergan

shares.

Tepper’s Appaloosa held almost $550 million in the SPDR S&P 500 ETF. SPDR is Standard & Poor’s Depositary Receipts, an earlier name of the ETF, and is designed to track the S&P 500 stock market index. Now, at Tepper’s most recent filing, it’s down to around $5 million.

On the other hand, three months earlier, Appaloosa held about $75 million in Allergan shares. According to the most recent filing, Tepper’s fund holds almost $300 million in Allergan shares.

As The Wall Street Journal writes, “The disclosures came in Appaloosa’s 13F filings, closely-watched across Wall Street for insights into the investment patterns of secretive hedge-fund managers. Still they can paint an incomplete picture: While filings show so-called long positions in U.S. stocks, or bets on such equities rising, they do not show shorts, or bets against stocks, or investments in assets like fixed income or currencies.”

Much of the stocks Appaloosa

relinquished

were in the energy sector. Tepper cut its shares of

Williams Partners and Energy Transfer Partners

by about 30 percent, and exited

Range Resources

and

Cabot Oil and Gas

.

Most sources note that Tepper recently moved from New Jersey to Florida, which has a better tax rate. New investments included

Quorum Health

, but Appaloosa cut investment in

HCA

by 61 percent, now 1.2 million shares.

Perhaps not surprisingly, Appaloosa sold off 945,000 shares of Canadian drug company

Valeant Pharmaceuticals International

. The company has been in trouble for two years, under investigation for insider trading, $30 billion in debt, and struggling with other federal investigations. Most

recently

, the company’s new chief executive,

Joe Papa

, is considering selling off its recently approved Relistor, to help pay down debt. There is also talk it might consider selling off

Bausch & Lomb

.

Allergan has had its ups and downs, but is currently trading for $249.61. It hit a low of $201.62 on May 6, not long after the

merger deal

with

Pfizer

collapsed.

There has been a lot of speculation on a major acquisition by Allergan since the Pfizer deal died. It has a history of acquisitions, having come into existence from several of them, and it’s just completed

selling off

its generic business to Israel-based

Teva Pharmaceutical

for $40.5 billion. That’ll leave Allergan with $33.75 billion in cash.

Allergan recently bought

ForSight Vision5

for $95 million. ForSight has non-invasive eye treatment produces for glaucoma, dry eye, and allergies. It currently has a drug delivery system, a periocular ring that fits around the eye and delivers Bimatoprost to the patient over six months. It is currently in Phase II trials. That’s consistent with Allergan’s own eye care products Restasis and Ozurdex. ForSight’s product is also targeted at glaucoma, which affects about 80 million people worldwide by 2020.

SeekingAlpha writes, “In order to stay competitive in a rapidly developing industry, Allergan’s leadership is remaining cash rich and focusing on developing branded technologies to support key growth segments. A $95 million ForSight acquisition appears like an intelligent first purchase to innovate their drug delivery method. … The kicker of it all is that Allergan still has $19.9 billion left to invest, so who or what will be the next target?”

Despite near constant speculation that Allergan might acquire Cambridge, Massachusetts-based

Biogen

, that sort of deal doesn’t appear to be in the cards. At the company’s half-year financial

meeting

on Aug. 2, Allergan’s chief executive officer,

Brent Saunders

, told investors he had no interest in Biogen or other large acquisitions.

AcquisitionPhase 2Drug Approval

Analysis

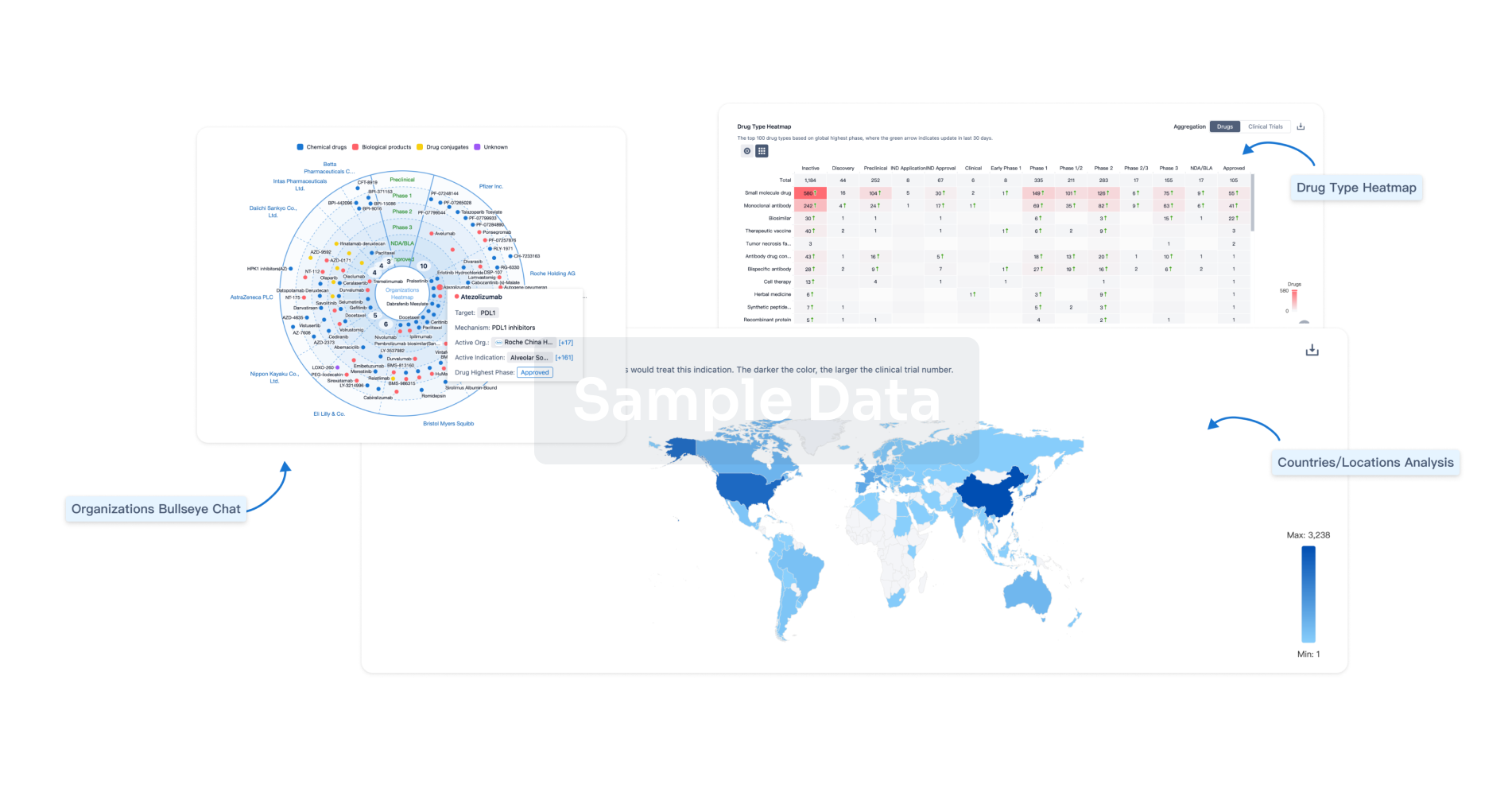

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free