Request Demo

Last update 14 Jun 2025

M1 PAM(Suven Life Sciences)

Last update 14 Jun 2025

Overview

Basic Info

Drug Type Small molecule drug |

Synonyms- |

Target |

Action modulators |

Mechanism M1 receptor modulators(Muscarinic acetylcholine receptor M1 modulators) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization- |

Drug Highest PhaseDiscovery |

First Approval Date- |

Regulation- |

Related

100 Clinical Results associated with M1 PAM(Suven Life Sciences)

Login to view more data

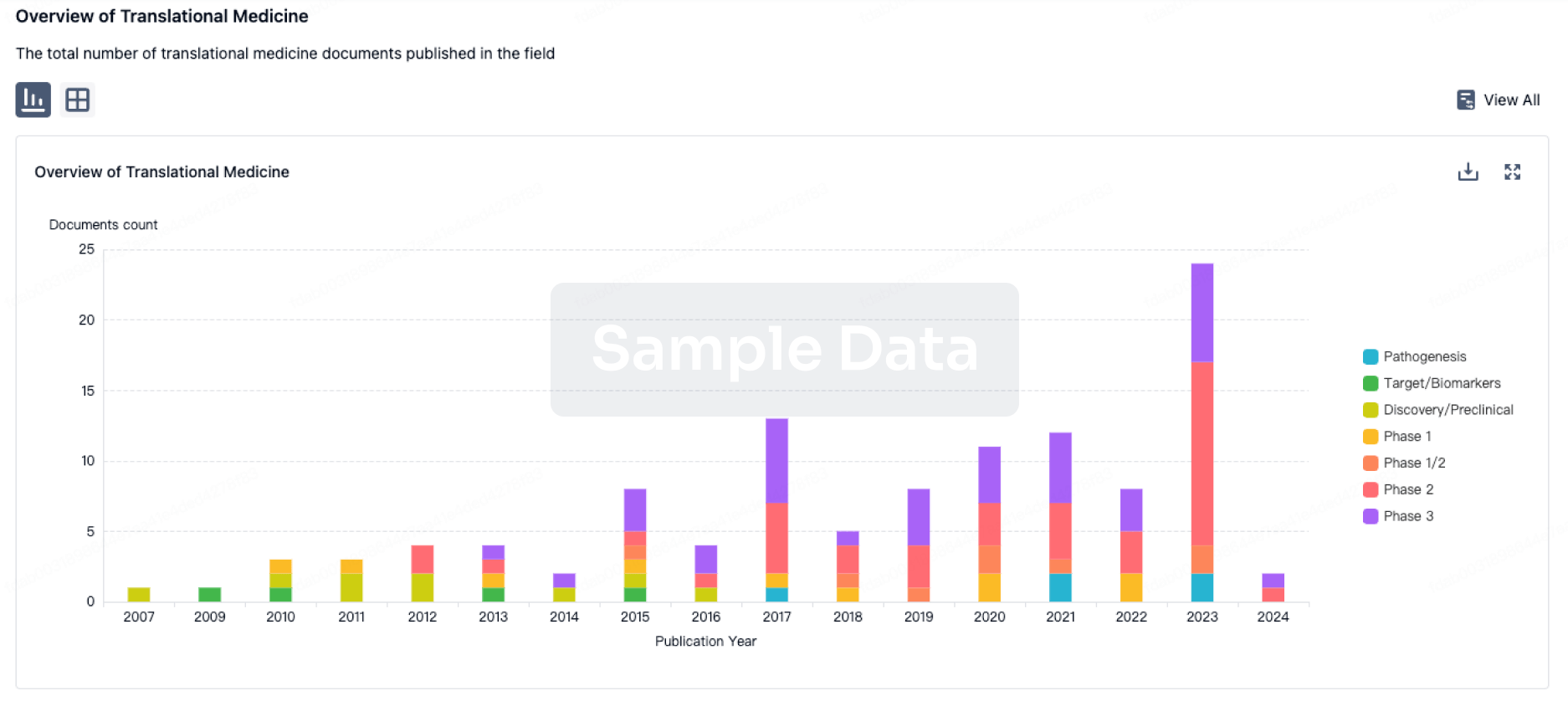

100 Translational Medicine associated with M1 PAM(Suven Life Sciences)

Login to view more data

100 Patents (Medical) associated with M1 PAM(Suven Life Sciences)

Login to view more data

5

Literatures (Medical) associated with M1 PAM(Suven Life Sciences)01 Jul 2021·PsychopharmacologyQ3 · MEDICINE

Reduction of falls in a rat model of PD falls by the M1 PAM TAK-071

Q3 · MEDICINE

Article

Author: Sarter, Martin ; Kucinski, Aaron

RATIONALE:

In addition to the disease-defining motor symptoms, patients with Parkinson's disease (PD) exhibit gait dysfunction, postural instability, and a propensity for falls. These dopamine (DA) replacement-resistant symptoms in part have been attributed to loss of basal forebrain (BF) cholinergic neurons and, in interaction with striatal dopamine (DA) loss, to the resulting disruption of the attentional control of balance and complex movements. Rats with dual cholinergic-DA losses ("DL rats") were previously demonstrated to model PD falls and associated impairments of gait and balance.

OBJECTIVES:

We previously found that the muscarinic M1-positive allosteric modulator (PAM) TAK-071 improved the attentional performance of rats with BF cholinergic losses. Here, we tested the hypotheses that TAK-071 reduces fall rates in DL rats.

RESULTS:

Prior to DL surgery, female rats were trained to traverse a rotating straight rod as well as a rod with two zigzag segments. DL rats were refamiliarized with such traversals post-surgery and tested over 7 days on increasingly demanding testing conditions. TAK-071 (0.1, 0.3 mg/kg, p.o.) was administered prior to daily test sessions over this 7-day period. As before, DL rats fell more frequently than sham-operated control rats. Treatment of DL rats with TAK-071 reduced falls from the rotating rod and the rotating zigzag rod, specifically when the angled part of the zigzag segment, upon entering, was at a steep, near vertical angle.

CONCLUSIONS:

TAK-071 may benefit complex movement control, specifically in situations which disrupt the patterning of forward movement and require the interplay between cognitive and motor functions to modify movement based on information about the state of dynamic surfaces, balance, and gait.

01 Dec 2020·Neuropsychopharmacology : official publication of the American College of NeuropsychopharmacologyQ1 · MEDICINE

Modulation of arousal and sleep/wake architecture by M1 PAM VU0453595 across young and aged rodents and nonhuman primates

Q1 · MEDICINE

Article

Author: Lindsley, Craig W ; Bubser, Michael ; Nedelcovych, Michael T ; Russell, Jason K ; Bridges, Thomas M ; Conn, P Jeffrey ; Newhouse, Paul A ; Jones, Carrie K ; Gould, Robert W ; Nader, Michael A ; Blobaum, Anna L

Degeneration of basal forebrain cholinergic circuitry represents an early event in the development of Alzheimer's disease (AD). These alterations in central cholinergic function are associated with disruptions in arousal, sleep/wake architecture, and cognition. Changes in sleep/wake architecture are also present in normal aging and may represent a significant risk factor for AD. M1 muscarinic acetylcholine receptor (mAChR) positive allosteric modulators (PAMs) have been reported to enhance cognition across preclinical species and may also provide beneficial effects for age- and/or neurodegenerative disease-related changes in arousal and sleep. In the present study, electroencephalography was conducted in young animals (mice, rats and nonhuman primates [NHPs]) and in aged mice to examine the effects of the selective M1 PAM VU0453595 in comparison with the acetylcholinesterase inhibitor donepezil, M1/M4 agonist xanomeline (in NHPs), and M1 PAM BQCA (in rats) on sleep/wake architecture and arousal. In young wildtype mice, rats, and NHPs, but not in M1 mAChR KO mice, VU0453595 produced dose-related increases in high frequency gamma power, a correlate of arousal and cognition enhancement, without altering duration of time across all sleep/wake stages. Effects of VU0453595 in NHPs were observed within a dose range that did not induce cholinergic-mediated adverse effects. In contrast, donepezil and xanomeline increased time awake in rodents and engendered dose-limiting adverse effects in NHPs. Finally, VU0453595 attenuated age-related decreases in REM sleep duration in aged wildtype mice. Development of M1 PAMs represents a viable strategy for attenuating age-related and dementia-related pathological disturbances of sleep and arousal.

01 Jan 2020·Psychopharmacology

Rescuing the attentional performance of rats with cholinergic losses by the M1 positive allosteric modulator TAK-071

Article

Author: Phillips, Kyra B ; Sarter, Martin ; Koshy Cherian, Ajeesh ; Kucinski, Aaron

RATIONALE:

Loss of basal forebrain cholinergic neurons contributes to the severity of the cognitive decline in age-related dementia and, in patients with Parkinson's disease (PD), to impairments in gait and balance and the resulting risks for falls. Contrasting with the extensive evidence indicating an essential role of cholinergic activity in mediating cognitive, specifically attentional abilities, treatment with conventional acetylcholinesterase inhibitors (AChEIs) has not fulfilled the promise of efficacy of pro-cholinergic treatments.

OBJECTIVES:

Here, we investigated the potential usefulness of a muscarinic M1 positive allosteric modulator (PAM) in an animal model of cholinergic loss-induced impairments in attentional performance. Given evidence indicating that fast, transient cholinergic signaling mediates the detection of cues in attentional contexts, we hypothesized that a M1 PAM amplifies such transient signaling and thereby rescues attentional performance.

RESULTS:

Rats performed an operant sustained attention task (SAT), including in the presence of a distractor (dSAT) and during a post-distractor (post-dSAT) period. The post-dSAT period served to assess the capacity for recovering performance following a disruptive event. Basal forebrain infusions of the cholino-specific immunotoxin 192 IgG-saporin impaired SAT performance, and greater cholinergic losses predicted lower post-dSAT performance. Administration of TAK-071 (0.1, 0.3 mg/kg, p.o., administered over 6-day blocks) improved the performance of all rats during the post-dSAT period (main effect of dose). Drug-induced improvement of post-dSAT performance was relatively greater in lesioned rats, irrespective of sex, but also manifested in female control rats. TAK-071 primarily improved perceptual sensitivity (d') in lesioned rats and facilitated the adoption of a more liberal response bias (B˝D) in all female rats.

CONCLUSIONS:

These findings suggest that TAK-071 may benefit the attentional performance of patients with partial cholinergic losses and specifically in situations that tax top-down, or goal-driven, attentional control.

1

News (Medical) associated with M1 PAM(Suven Life Sciences)05 May 2021

SAN DIEGO--(BUSINESS WIRE)-- Acadia Pharmaceuticals Inc. (Nasdaq: ACAD), today announced its financial results for the first quarter ended March 31, 2021.

“NUPLAZID delivered strong year-over-year performance in the first quarter of 2021. Looking ahead, we see positive signs in the Parkinson’s disease psychosis market supporting revenue growth for the remainder of the year as we anticipate continued improvements in the conditions related to the pandemic,” said Steve Davis, Chief Executive Officer. “Furthermore, we look forward to a Type A meeting with the FDA to discuss an approval path for pimavanserin in dementia-related psychosis and we continue to advance our two Phase 3 programs for Rett syndrome and the negative symptoms of schizophrenia, as well as our Phase 2 pain program and earlier pipeline opportunities.”

Company Updates

The Company received a Complete Response Letter (CRL) from the U.S. Food and Drug Administration (FDA) regarding its supplemental New Drug Application (sNDA) for NUPLAZID® (pimavanserin) for the treatment of hallucinations and delusions associated with dementia-related psychosis (DRP). The Company plans to conduct a Type A meeting with the FDA to discuss the CRL and potential next steps to support an approval.

Top-line results from the Phase 3 LAVENDER study evaluating trofinetide for the treatment of Rett syndrome are expected in the fourth quarter of 2021.

A Phase 2 study was initiated evaluating ACP-044, a novel, first-in-class, orally administered, non-opioid analgesic for the treatment of postoperative pain following bunionectomy surgery in March 2021.

A Phase 2 study evaluating ACP-044 for the treatment of pain associated with osteoarthritis is expected to commence in the second quarter of 2021.

Financial Results

Revenue

Net sales of NUPLAZID (pimavanserin) were $106.6 million for the three months ended March 31, 2021, an increase of 18% as compared to $90.1 million reported for the three months ended March 31, 2020.

Research and Development

Research and development expenses for the three months ended March 31, 2021 were $57.0 million, compared to $72.6 million for the same period of 2020. This decrease was primarily due to the $10.0 million upfront payment to Vanderbilt University for the M1 PAM program incurred during the three months ended March 31, 2020 and decreased development costs associated with pimavanserin for major depressive disorder.

Selling, General and Administrative

Selling, general and administrative expenses for the three months ended March 31, 2021 were $111.7 million, compared to $102.0 million for the same period of 2020. This increase was primarily due to increased costs associated with preparations for the potential DRP launch, partially offset by a decrease in stock-based compensation expense.

Net Loss

For the three months ended March 31, 2021, Acadia reported a net loss of $66.4 million, or $0.42 per common share, compared to a net loss of $88.0 million, or $0.57 per common share, for the same period in 2020. The net losses for the three months ended March 31, 2021 and 2020 included $13.2 million and $22.3 million, respectively, of non-cash stock-based compensation expense.

Cash and Investments

At March 31, 2021, Acadia’s cash, cash equivalents, and investment securities totaled $577.8 million, compared to $632.0 million at December 31, 2020.

2021 Financial Guidance

Acadia is reiterating its NUPLAZID net sales guidance of $510 to $550 million.

GAAP R&D guidance is decreased to $280 to $300 million from the previous range of $300 to $320 million. Current R&D guidance includes approximately $25 million of stock-based compensation expense.

GAAP SG&A guidance is decreased to $385 to $415 million from the previous range of $560 to $590 million. Previous guidance included additional investments associated with the potential DRP launch in 2021 and updated guidance reflects a reduction in these expenses. Current SG&A guidance includes approximately $50 million of stock-based compensation expense.

Conference Call and Webcast Information

Acadia management will review its first quarter financial results and operations via conference call and webcast today at 5:00 p.m. Eastern Time. The conference call may be accessed by dialing 855-638-4820 for participants in the United States or Canada and 443-877-4067 for international callers (reference passcode 4568937). A telephone replay of the conference call may be accessed through May 19, 2021 by dialing 855-859-2056 for callers in the United States or Canada and 404-537-3406 for international callers (reference passcode 4568937). The conference call also will be webcast live on Acadia’s website, , under the investors section and will be archived there until June 2, 2021.

About NUPLAZID® (pimavanserin)

NUPLAZID is the first and only FDA-approved treatment for hallucinations and delusions associated with Parkinson’s disease psychosis. NUPLAZID is a selective serotonin inverse agonist/antagonist preferentially targeting 5-HT2A receptors that are thought to play an important role in Parkinson’s disease psychosis. NUPLAZID is an oral medicine taken once a day with a recommended dose of 34 mg. NUPLAZID is not approved for any other neuropsychiatric disorders. Acadia discovered and developed this new chemical entity and holds worldwide rights to develop and commercialize NUPLAZID.

About Trofinetide

Trofinetide is an investigational drug. It is a novel synthetic analog of the amino‐terminal tripeptide of IGF-1 designed to treat the core symptoms of Rett syndrome by potentially reducing neuroinflammation and supporting synaptic function. In the central nervous system, IGF-1 is produced by both of the major types of brain cells – neurons and glia. IGF-1 in the brain is critical for both normal development and for response to injury and disease. Trofinetide has been granted Fast Track Status and Orphan Drug Designation in the U.S. and Orphan Drug Designation in Europe for both Rett syndrome and Fragile X syndrome.

About Acadia Pharmaceuticals

Acadia is trailblazing breakthroughs in neuroscience to elevate life. For more than 25 years we have been working at the forefront of healthcare to bring vital solutions to people who need them most. We developed and commercialized the first and only approved therapy for hallucinations and delusions associated with Parkinson’s disease psychosis. Our late-stage development efforts are focused on dementia-related psychosis, negative symptoms of schizophrenia and Rett syndrome, and in early-stage clinical research we are exploring novel approaches to pain management, and cognition and neuropsychiatric symptoms in central nervous system disorders. For more information, visit us at and follow us on LinkedIn.

Forward-Looking Statements

Statements in this press release that are not strictly historical in nature are forward-looking statements. These statements include, but are not limited to, statements related to: the potential opportunity for future growth in sales of NUPLAZID; the timing of ongoing and future clinical studies for pimavanserin; the development and commercialization of trofinetide; and guidance for full-year 2021 NUPLAZID net sales for Parkinson’s disease psychosis only and certain expense line items. These statements are only predictions based on current information and expectations and involve a number of risks and uncertainties. Actual events or results may differ materially from those projected in any of such statements due to various factors, including the uncertainty of future commercial sales and related items that would impact net sales during 2021, the risks and uncertainties inherent in drug development, approval and commercialization, and the fact that past results of clinical trials may not be indicative of future trial results. For a discussion of these and other factors, please refer to Acadia’s annual report on Form 10-K for the year ended December 31, 2020 as well as Acadia’s subsequent filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All forward-looking statements are qualified in their entirety by this cautionary statement and Acadia undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof, except as required by law.

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

Three Months Ended March 31,

2021

2020

Revenues

Product sales, net

$

106,554

$

90,068

Total revenues

106,554

90,068

Operating expenses

Cost of product sales, license fees and royalties (1)

4,692

4,974

Research and development (1)

56,973

72,636

Selling, general and administrative (1)

111,661

101,973

Total operating expenses

173,326

179,583

Loss from operations

(66,772

)

(89,515

)

Interest income, net

200

2,989

Other income (expense)

145

(1,497

)

Loss before income taxes

(66,427

)

(88,023

)

Income tax expense

21

—

Net loss

$

(66,448

)

$

(88,023

)

Net loss per common share, basic and diluted

$

(0.42

)

$

(0.57

)

Weighted average common shares outstanding, basic and diluted

160,011

155,368

(1) Includes the following stock-based compensation expense

Cost of product sales, license fees and royalties

$

163

$

849

Research and development

$

4,830

$

8,457

Selling, general and administrative

$

8,191

$

13,042

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

March 31,

2021

December 31,

2020

(unaudited)

Assets

Cash, cash equivalents and investment securities

$

577,768

$

631,958

Accounts receivable, net

56,832

48,247

Interest and other receivables

558

2,035

Inventory

10,311

9,682

Prepaid expenses

28,515

25,694

Total current assets

673,984

717,616

Property and equipment, net

9,757

9,161

Operating lease right-of-use assets

63,111

47,283

Intangible assets, net

738

1,108

Restricted cash

5,770

5,770

Other assets

1,813

1,678

Total assets

$

755,173

$

782,616

Liabilities and stockholders’ equity

Accounts payable

$

8,849

$

8,493

Accrued liabilities

100,524

97,474

Total current liabilities

109,373

105,967

Operating lease liabilities

60,581

44,460

Other long-term liabilities

3,613

5,180

Total liabilities

173,567

155,607

Total stockholders’ equity

581,606

627,009

Total liabilities and stockholders’ equity

$

755,173

$

782,616

Financial StatementOrphan DrugFirst in ClassFast Track

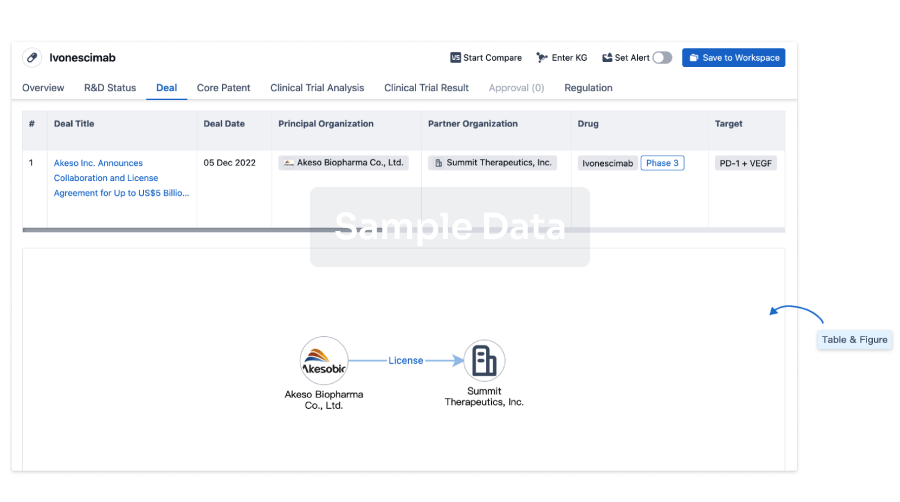

100 Deals associated with M1 PAM(Suven Life Sciences)

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Gastrointestinal Diseases | Discovery | India | 17 Apr 2024 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

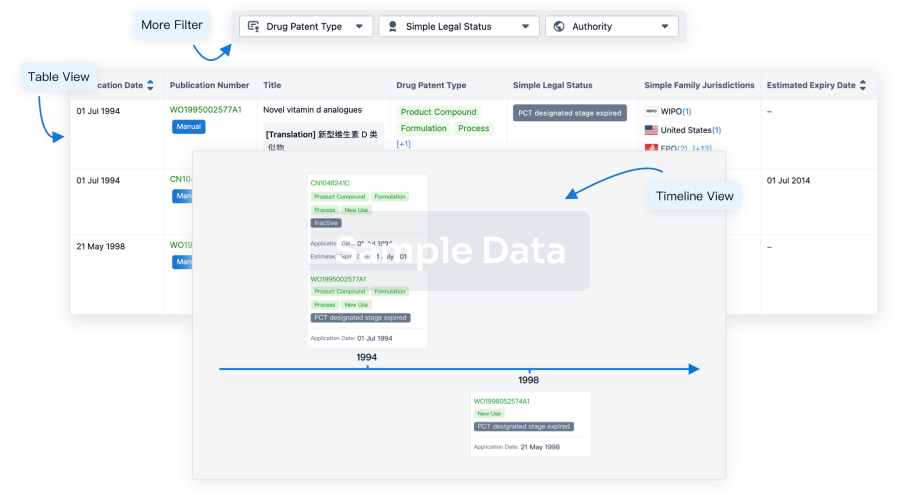

Core Patent

Boost your research with our Core Patent data.

login

or

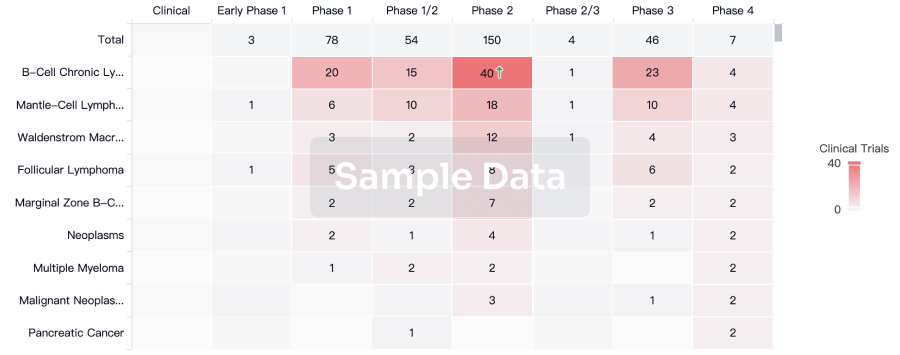

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free