Request Demo

Last update 24 May 2025

ORIL-003

Last update 24 May 2025

Overview

Basic Info

Drug Type Small molecule drug |

Synonyms steroid saponins(ORIL), ORIL-003 |

Target |

Action antagonists, inhibitors |

Mechanism EGFR antagonists(Epidermal growth factor receptor erbB1 antagonists), GRB2 inhibitors(Growth factor receptor-bound protein 2 inhibitors), HER3 antagonists(Receptor tyrosine-protein kinase erbB-3 antagonists) |

Therapeutic Areas |

Active Indication- |

Inactive Indication |

Originator Organization |

Active Organization- |

Inactive Organization |

License Organization- |

Drug Highest PhasePendingDiscovery |

First Approval Date- |

Regulation- |

Related

4

Clinical Trials associated with ORIL-003CTRI/2023/09/057982

Pilot study: Randomized control trial of efficacy of epidural Platelet rich plasma v/s epidural steroid in low back pain - Nil

Start Date01 Oct 2023 |

Sponsor / Collaborator- |

TCTR20200729002

Effect of different doses of steroid on respiratory distress syndrome in moderate to late preterm neonates born between 320-366 weeks of gestation: A randomized controlled trial

Start Date20 Dec 2020 |

Sponsor / Collaborator |

JPRN-UMIN000012469

Comparison of Adalimumab and Steroid in Intestinal Behcet's disease - Castle Study

Start Date02 Dec 2013 |

Sponsor / Collaborator |

100 Clinical Results associated with ORIL-003

Login to view more data

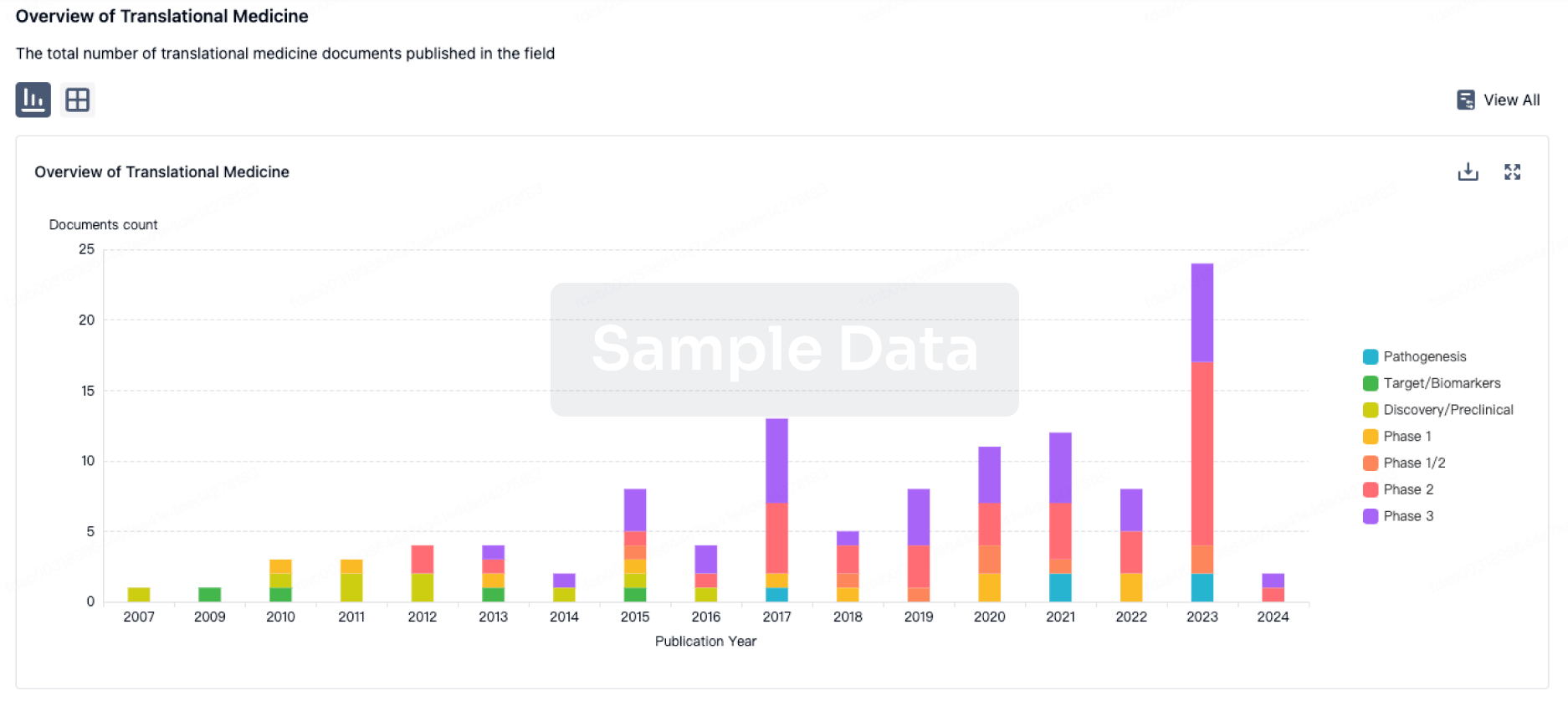

100 Translational Medicine associated with ORIL-003

Login to view more data

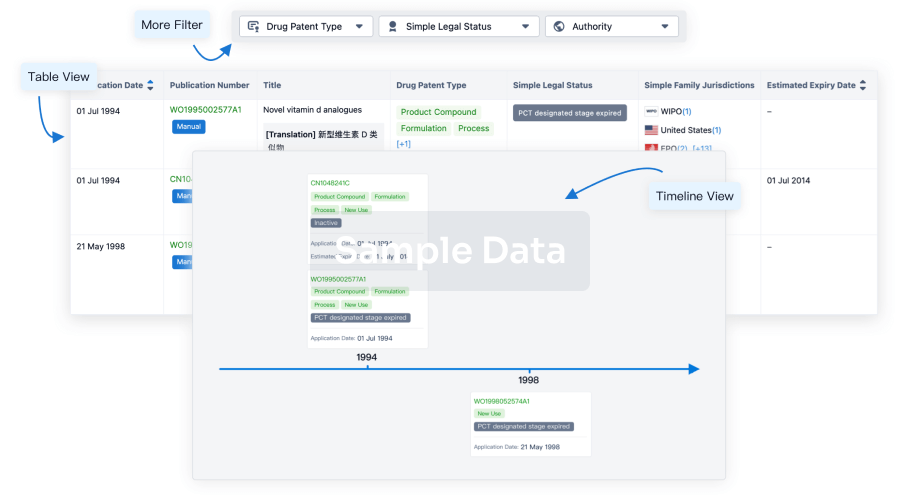

100 Patents (Medical) associated with ORIL-003

Login to view more data

1

Literatures (Medical) associated with ORIL-00301 Apr 2007·Bioorganic & medicinal chemistryQ3 · MEDICINE

Exploration of the correlation between the structure, hemolytic activity, and cytotoxicity of steroid saponins

Q3 · MEDICINE

Article

Author: Yichun Zhang ; Ziyan Zhu ; Ming Li ; Yibing Wang ; Shilei Zhu ; Biao Yu ; Yingxia Li

The hemolytic activity of a collection of 63 steroid saponins was determined. The correlations between these structures and their hemolytic and cytotoxic activities are discussed. It has been demonstrated that the hemolytic activity of steroid saponins is highly dependent on their structures, that is, the sugar length, the sugar linkage, the substitutes on the sugar, as well as the aglycone. It has also been disclosed that the hemolytic activity and cytotoxicity of steroid saponins are not correlated. These results suggest that steroid saponins execute hemolysis and cytotoxic activity in different mechanisms, and encourage to develop steroid saponins into potent antitumor agents devoid of the detrimental effect of hemolysis.

8

News (Medical) associated with ORIL-00309 Sep 2024

TAIPEI, Sept. 9, 2024 /PRNewswire/ -- Formosa Pharmaceuticals, Inc. (hereinafter referred to as "Formosa Pharma," 6838.TW) announced the successful first shipment to the United States of its new ophthalmic drug, Clobetasol Propionate Ophthalmic Suspension, 0.05% (APP13007), manufactured by Bora Pharmaceuticals Ophthalmic (hereinafter referred to as "Bora," 6472.TW). Formosa Pharma's U.S. partner, Eyenovia, Inc. (NASDAQ: EYEN), has initiated the pre-launch activities for APP13007 and is expected to begin commercialization in late September.

APP13007, developed through Formosa Pharma's proprietary APNT® nanotechnology platform, is the first drug approved by the U.S. FDA for ophthalmic use utilizing the super-potent corticosteroid, clobetasol propionate. Almost 7 million ophthalmic surgeries are performed annually in the U.S., and the ophthalmic steroid and steroid-combination drug market is valued at USD $1.3 billion. According to a recent survey conducted by Eyenovia of 100 U.S. ophthalmic surgeons, efficacy and cost were identified as the most important factors when choosing a treatment for postoperative inflammation and pain. APP13007 offers a more convenient dosing regimen with its proven efficacy, requiring only twice-daily administration compared to other treatments that require up to four doses per day.

Having recently obtained the Drug Export License from Taiwan's Food and Drug Administration (TFDA) in late August, Formosa Pharma has coordinated its first US shipment, a milestone advancement toward global commercialization.

Dr. Erick Co, President & CEO of Formosa Pharma, said, "This first shipment to Eyenovia for the much-anticipated commercial U.S. launch is an exclamation point on our development of APP13007. We thank all our partners for making this journey with us and are eager to provide this formidable therapy to ocular surgery patients worldwide. We look forward to creating continued value for our stakeholders and shareholders."

In addition to meeting demands for the U.S. market, Formosa Pharma is actively working with partners in other regions to prepare for regulatory submissions for APP13007, aiming to supply various international markets in the future.

About Formosa Pharmaceuticals, Inc.

Formosa Pharmaceuticals, Inc. (6838.TW) is a clinical stage biotechnology company with primary focus in the areas of ophthalmology and oncology. The company's proprietary nanoparticle formulation technology (APNT®), through which APP13007 was developed, improves the dissolution and bioavailability of APIs for topical, oral, and inhaler administration. Resulting formulations have high uniformity, purity, and stability, thereby allowing the utilization of poorly soluble or extremely potent drug agents which otherwise may face insurmountable challenges in delivery and penetration to target tissues. For more details about Formosa Pharma and APNT®, visit .

SOURCE Formosa Pharmaceuticals Inc.,

Drug Approval

19 Aug 2024

NORFOLK, Va.--(

BUSINESS WIRE

)--ReAlta Life Sciences, Inc. ("ReAlta" or the “Company”), a clinical-stage biotech company dedicated to saving lives by rebalancing the inflammatory response to address rare and acute inflammatory diseases, today announced that the U.S. Food and Drug Administration (FDA) has granted Orphan Drug Designation and Fast Track Designation to RLS-0071, the Company’s lead therapeutic candidate, for the treatment of hospitalized patients with steroid-refractory acute graft-versus-host disease (aGvHD).

aGvHD is a serious and often fatal complication following hematopoietic stem cell transplantation. It occurs when the donor's immune cells attack the recipient's tissues, leading to severe inflammation and tissue damage. Patients who do not respond to standard steroid treatments have limited therapeutic options and face a high risk of mortality. There are approximately 4,000 steroid-refractory aGvHD patients in the U.S., EU and Japan.

RLS-0071, an investigational medicine based on the Company’s novel EPICC peptide platform, aims to address this unmet medical need by leveraging its unique ability to modulate the complement and innate inflammatory pathways, offering a new hope for patients with this devastating condition. The Company is currently conducting a Phase 2, open label clinical trial of RLS-0071 in hospitalized patients with steroid-refractory aGvHD. For further details on this trial, please visit clinicaltrials.gov (

NCT06343792

).

"We are thrilled to receive both Orphan Drug and Fast Track Designations for RLS-0071 for the treatment of steroid-refractory acute graft-versus-host disease, underscoring the significant potential of RLS-0071 and its novel dual mechanism-of-action to address critical unmet needs for patients with this life-threatening condition," said Kenji Cunnion, MD, MPH, Chief Medical Officer of ReAlta. "RLS-0071 may address limitations of current treatment options for patients with aGvHD. We remain committed to advancing our clinical development program with the hope of bringing this promising therapy to patients as quickly as possible."

The FDA's Orphan Drug Designation is granted to investigational therapies intended for the treatment of rare diseases or conditions that affect fewer than 200,000 people in the United States. This designation provides ReAlta with certain benefits, including seven years of market exclusivity upon regulatory approval, exemption from FDA application fees, and tax credits for qualified clinical trials.

In addition to the Orphan Drug Designation, RLS-0071 has also received FDA Fast Track Designation for the treatment of aGvHD. Fast Track is a process designed to facilitate the development and expedite the review of drugs that treat serious conditions and fill an unmet medical need. This designation allows for more frequent interactions with the FDA and the potential for Priority Review, ultimately accelerating the timeline for bringing RLS-0071 to patients in need.

The Company is also currently conducting Phase 2 clinical trials of RLS-0071 in newborns with hypoxic-ischemic encephalopathy (HIE) (

NCT05778188

) and hospitalized patients with acute exacerbations of chronic obstructive pulmonary disease (

NCT06175065

).

About ReAlta Life Sciences

ReAlta Life Sciences, Inc. is a clinical mid-stage biotech company dedicated to saving lives by rebalancing the inflammatory response to address life threatening acute inflammatory and rare diseases. The Company’s EPICC peptides are based on research into the human astrovirus, HAstV-1, which causes a non-inflammatory, self-limiting gastroenteritis unique among viruses by inhibiting components of the innate immune system. ReAlta’s therapeutic peptides leverage these virus-derived mechanisms to rebalance complement and inflammatory processes in the body. The Company’s pipeline is led by RLS-0071, which has received IND clearance, Orphan Drug Designation, and Fast Track Designation by the U.S. Food and Drug Administration (FDA) , and Orphan Drug Designation by the European Medicines Agency, for the treatment of hypoxic-ischemic encephalopathy (HIE); IND clearance, Orphan Drug Designation, and Fast Track Designation by the FDA for the treatment of acute graft-versus-host disease (aGvHD); and IND clearance by the FDA for the treatment of acute exacerbations of chronic obstructive pulmonary disease. The company launched in 2018 and is located in Norfolk, Virginia and Aguadilla, Puerto Rico. For more information, please visit

www.realtalifesciences.com

.

Orphan DrugPhase 2Fast Track

23 Jul 2024

Study enrolled 268 patients, exceeding target enrollment.

Largest interventional study ever to be conducted in pulmonary sarcoidosis.

Topline data are expected in the third quarter of 2025.

July 22, 2024 -- aTyr Pharma, Inc. (Nasdaq: ATYR), a clinical stage biotechnology company engaged in the discovery and development of first-in-class medicines from its proprietary tRNA synthetase platform, today announced that it has completed enrollment in its global pivotal Phase 3 EFZO-FIT™ study of its lead therapeutic candidate, efzofitimod, in patients with pulmonary sarcoidosis, a major form of interstitial lung disease with limited treatment options. The study enrolled 268 patients at 85 centers in 9 countries, exceeding target enrollment. Topline data from the study are expected in the third quarter of 2025.

“Completing enrollment in this landmark study is an important milestone that brings us one step closer to delivering a potentially groundbreaking treatment to address the significant unmet need for pulmonary sarcoidosis patients,” said Sanjay S. Shukla, M.D., M.S., President and Chief Executive Officer of aTyr. “We are grateful to all of the patients and their caregivers, our principal investigators and their teams, our many advocacy partners and our partner Kyorin Pharmaceutical Co., Ltd., who helped make this accomplishment possible. The historic number of patients enrolled in this study signifies the strong patient demand for a new treatment option such as efzofitimod.”

“This is a monumental achievement for the sarcoidosis community. It is by far the largest interventional study ever to be conducted in sarcoidosis. We expect the results of this trial to yield valuable insights that will inform sarcoidosis research and treatment in the years to come,” said Daniel A. Culver, D.O., Chair of the Division of Pulmonary Medicine at The Cleveland Clinic and Lead Primary Investigator of the study. “We are optimistic based on the positive Phase 1b/2a results that efzofitimod could be a potentially transformative therapy for sarcoidosis patients, which is greatly needed. We look forward to the readout from this study in 2025.”

Efzofitimod is a tRNA synthetase derived therapy that selectively modulates activated myeloid cells through neuropilin-2 to resolve inflammation without immune suppression and potentially prevent the progression of fibrosis. Efzofitimod has received orphan drug designation in the U.S., E.U. and Japan for sarcoidosis and Fast Track designation in the U.S. for pulmonary sarcoidosis.

The EFZO-FIT™ study is a global Phase 3 randomized, double-blind, placebo-controlled study to evaluate the efficacy and safety of efzofitimod in patients with pulmonary sarcoidosis. This is a 52-week study consisting of three parallel cohorts randomized equally to either 3.0 mg/kg or 5.0 mg/kg of efzofitimod or placebo dosed intravenously once a month for a total of 12 doses. The study enrolled 268 subjects with pulmonary sarcoidosis at multiple centers in the United States, Europe, Japan and Brazil. The trial design incorporates a forced steroid taper. The primary endpoint of the study is steroid reduction. Secondary endpoints include measures of lung function and sarcoidosis symptoms. More information on the EFZO-FIT™ study is available at www.clinicaltrials.gov (NCT05415137) and www.efzofit.com.

Efzofitimod is a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease (ILD), a group of immune-mediated disorders that can cause inflammation and fibrosis, or scarring, of the lungs. Efzofitimod is a tRNA synthetase derived therapy that selectively modulates activated myeloid cells through neuropilin-2 to resolve inflammation without immune suppression and potentially prevent the progression of fibrosis. aTyr is currently investigating efzofitimod in the global Phase 3 EFZO-FIT™ study in patients with pulmonary sarcoidosis, a major form of ILD, and in the Phase 2 EFZO-CONNECT™ study in patients with systemic sclerosis (SSc, or scleroderma)-related ILD. These forms of ILD have limited therapeutic options and there is a need for safer and more effective, disease-modifying treatments that improve outcomes.

aTyr is a clinical stage biotechnology company leveraging evolutionary intelligence to translate tRNA synthetase biology into new therapies for fibrosis and inflammation. tRNA synthetases are ancient, essential proteins that have evolved novel domains that regulate diverse pathways extracellularly in humans. aTyr’s discovery platform is focused on unlocking hidden therapeutic intervention points by uncovering signaling pathways driven by its proprietary library of domains derived from all 20 tRNA synthetases. aTyr’s lead therapeutic candidate is efzofitimod, a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease, a group of immune-mediated disorders that can cause inflammation and progressive fibrosis, or scarring, of the lungs. For more information, please visit www.atyrpharma.com.

The content above comes from the network. if any infringement, please contact us to modify.

Orphan DrugFast Track

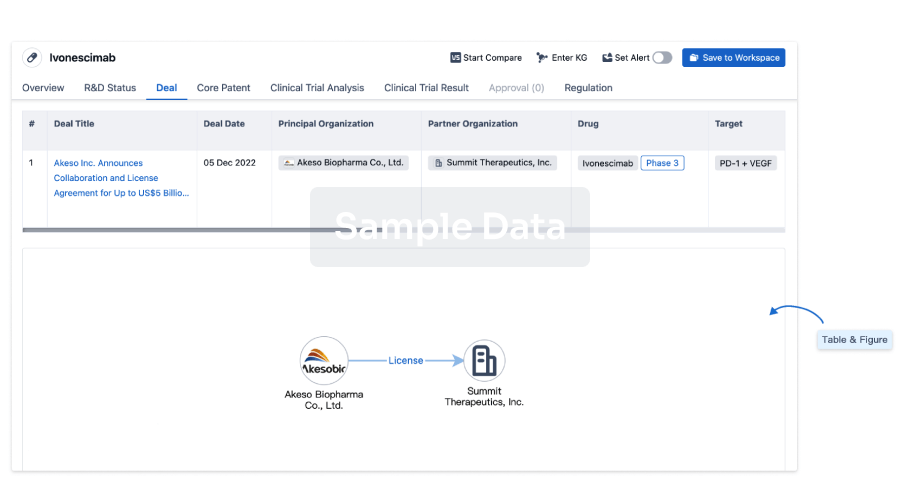

100 Deals associated with ORIL-003

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Neoplasms | Discovery | Australia | - |

Login to view more data

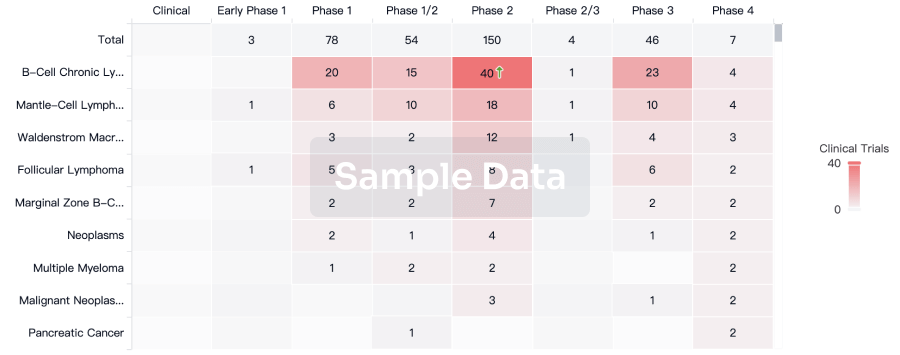

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

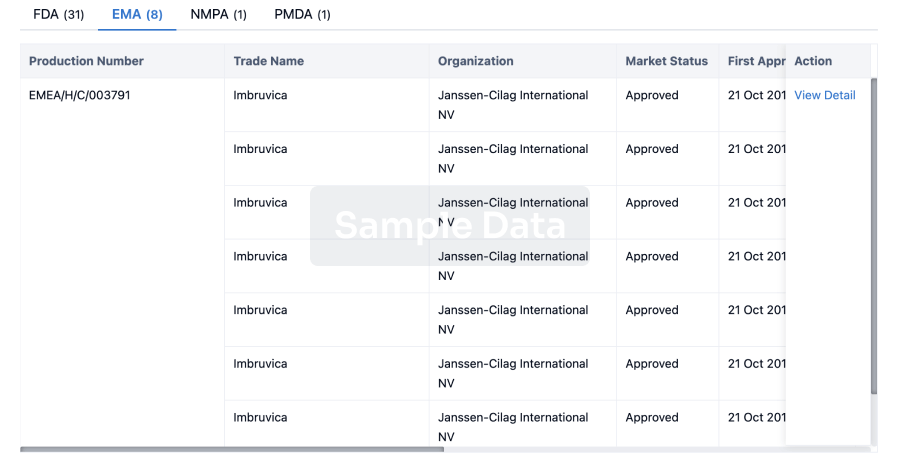

Approval

Accelerate your research with the latest regulatory approval information.

login

or

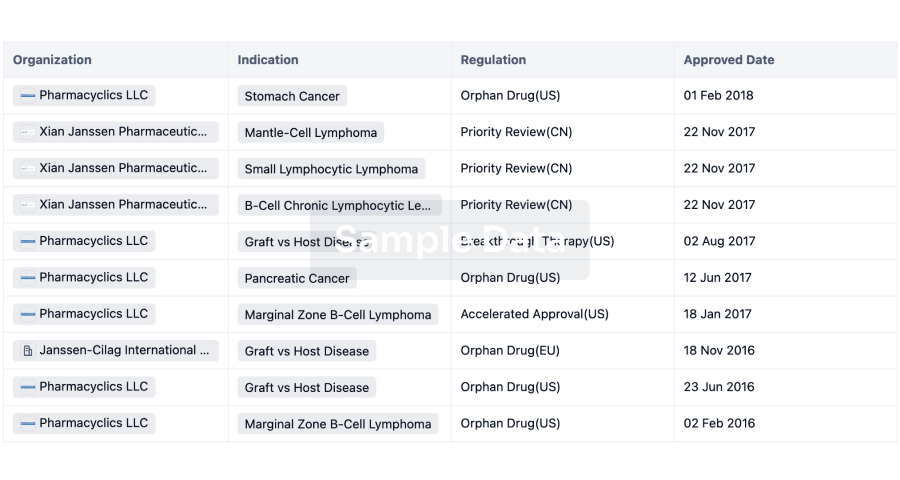

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free