Amsterdam, October 8th, 2007 LSP (Life Sciences Partners) today announces the closing of an overscribed € 27.2M Series B financing round of cellerix, a biopharmaceutical company leader in the clinical development and

production of innovative medicines based on adult stem cells. The round was led by LSP (Netherlands)

and Ventech (France), including as a co-lead Ysios Asset Management (Spain), advising a pool of

institutional investors. Roche Venture Fund and Novartis Venture Fund also joined the round, together

with the private investment group Genera, A&G, the rest of Cellerix’s existing shareholders (including

Genetrix, company’s majority shareholder), and Management. Concomitantly with the investment,

Joachim Rothe, General Partner at LSP, Mounia Chaoui, General Partner at Ventech and Joël Jean-Mairet,

Managing Partner at Ysios Asset Management will join Cellerix’ Board of Directors.

“Cellerix has systematically been assembling all the necessary ingredients to become a leader in stem

cell therapy and one of the very few companies with credible products in this field”, commented Joachim Rothe,

General Partner with LSP. “We are delighted to be working with the Company and the other investors to

assist Cellerix in this extremely exciting process”.

“The support of such an impressive group of specialised international investors is a tremendous

recognition of Cellerix leadership among biopharmaceutical cell therapy companies and backs our

efforts in the research and development of innovative treatments. Their experience will contribute to

the future development of Cellerix into a world-class biopharmaceutical company” remarked Eduardo Bravo,

Cellerix CEO, regarding the transaction. ”To the best of my knowledge, this is the largest international financing

ever raised by a Spanish biotech company”.

The funds raised will be invested in the completion of the clinical development of Cx401, which is the

Company’s lead product. Cx401 is a stem cell therapy based on the use of adult autologous stem cells

derived from adipose tissue for the treatment of complex perianal fistulas. This condition represents a

clinical unmet need in a market that is estimated by Cellerix to surpass EUR 1.5bn in Europe. Cellerix

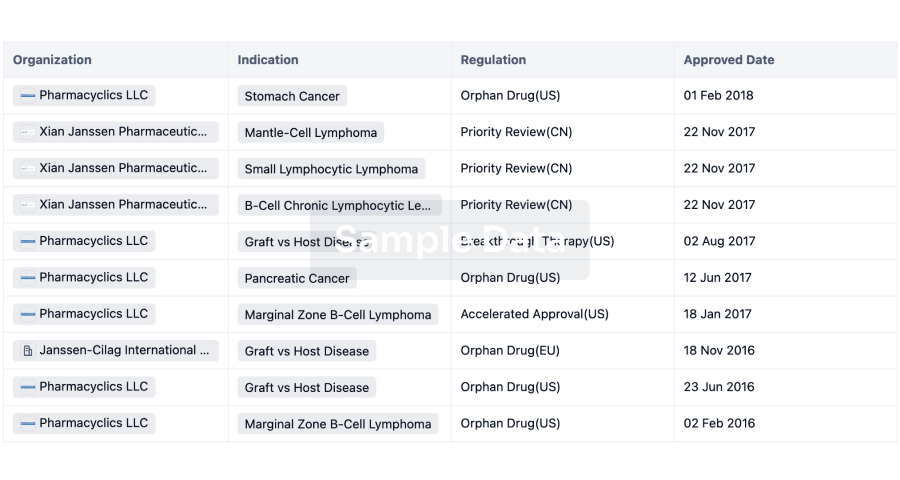

received Orphan Drug Designation for Cx401 in 2005, has initiated a pivotal Phase III trial and expects

to reach the market by 2010.

The funds will also allow the further development of the Company’s additional pipeline products, which include

Cx501, a chimeric skin being developed for the treatment of epidermolysis bullosa, with an Orphan Drug

Designation in 2006 and currently entering phase II clinical trials. Further products in the pipeline include Cx601

and Cx611, the new generation of allogenic products, undergoing preclinical development for the treatment of

fistulas and different alterations of the immune system such as rheumatoid arthritis.

ABN AMRO acted as placement agent of the operation.

About Cellerix

Cellerix is a clinical biopharmaceutical company that develops and produces innovative medicines based on the

use of adult stem cells. It currently has two products undergoing clinical trials: Cx401 for the treatment of perianal

fistulas, is in Phase III and Cx501, for skin regeneration, is currently in Phase II. Cx401 and Cx501 are the two

first cellular products to obtain the orphan status by the European Medicines Agency (EMEA). The new generation

of Cellerix products is based in the employment of allogeneic stem cells and is represented by Cx601 and Cx611,

currently undergoing preclinical development, for the treatment of fistulas and of different alterations of the immune

system respectively.

For further information about Cellerix:

About LSP

LSP (Life Sciences Partners) is a leading independent European venture capital firm, providing private equity

financing to early- to mid-stage life science companies. Since the late 1980s, LSP's management has invested in a

large number of highly innovative enterprises, many of which have grown to become leaders of the global life

science industry. For example, LSP was a founding investor in Crucell, DNage, Qiagen, Rhein Biotech and Pharming.

With EUR 400 million under management and offices in Amsterdam, Munich and Boston, LSP is one of Europe's

largest and most experienced specialist life science investors. See

For further information please contact:

Martijn Kleijwegt, Managing Partner

Tel: +31 (0) 20 6645500