Request Demo

Last update 08 May 2025

HLX-60

Last update 08 May 2025

Overview

Basic Info

Drug Type Monoclonal antibody |

Synonyms Anti-GARP monoclonal antibody(Shanghai Henlius Biotech) |

Target |

Action inhibitors |

Mechanism LRRC32 inhibitors(Transforming growth factor beta activator LRRC32 inhibitors) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization- |

Drug Highest PhasePhase 1 |

First Approval Date- |

Regulation- |

Login to view timeline

Related

3

Clinical Trials associated with HLX-60NCT05483530

A Phase 1 Clinical Study to Investigate the Safety, Tolerability and Efficacy of HLX60 (Anti-GARP Monoclonal Antibody) Combination With HLX10 (Anti-PD-1 Monoclonal Antibody) in Subjects With Advanced or Metastatic Solid Tumors

The purpose of the study is to evaluate the safety and tolerability of HLX60 combined with HLX10 in order to determine the maximum tolerated dose (MTD) and Recommended Phase 2 dose (RP2D) and to evaluate the preliminary efficacy for each combination regimen.

Start Date14 Dec 2022 |

Sponsor / Collaborator |

NCT05606380

A Phase I Clinical Study to Investigate the Safety, Tolerability and Pharmacokinetic Characteristics of HLX60 (Anti-GARP Monoclonal Antibody) in Subjects With Advanced/Metastatic Solid Tumors or Lymphoma

This trial is an open, dose escalation phase I clinical study. Subjects can only enter this study after they meet the inclusion and exclusion criteria.Into subjects will accept HLX60 intravenous infusion, every 3 weeks, treatment until lose clinical benefit, toxicity, death, revocation of informed consent.

Start Date02 Dec 2022 |

Sponsor / Collaborator |

CTR20222778

一项评估HLX60 (抗GARP单克隆抗体) 在晚期/转移性实体瘤或淋巴瘤患者中的安全性、耐受性及药代动力学特征的I期临床研究

[Translation] A Phase I clinical study to evaluate the safety, tolerability and pharmacokinetic characteristics of HLX60 (anti-GARP monoclonal antibody) in patients with advanced/metastatic solid tumors or lymphomas

主要研究目的:

在晚期/转移性实体瘤患或淋巴瘤者中评估HLX60的安全性和耐受性,确定最大耐受剂量(MTD)。

次要研究目的:

研究不同剂量HLX60在患者体内的药代动力学(PK)和药效学(PD)特征;

研究HLX60的免疫原性;

研究HLX60的潜在疗效;

研究HLX60治疗晚期/转移性实体瘤或淋巴瘤的潜在预后和预测性生物标志物。

[Translation]

Main study objectives:

To evaluate the safety and tolerability of HLX60 in patients with advanced/metastatic solid tumors or lymphomas and determine the maximum tolerated dose (MTD).

Secondary study objectives:

To study the pharmacokinetic (PK) and pharmacodynamic (PD) characteristics of different doses of HLX60 in patients;

To study the immunogenicity of HLX60;

To study the potential efficacy of HLX60;

To study the potential prognostic and predictive biomarkers of HLX60 in the treatment of advanced/metastatic solid tumors or lymphomas.

Start Date25 Nov 2022 |

Sponsor / Collaborator |

100 Clinical Results associated with HLX-60

Login to view more data

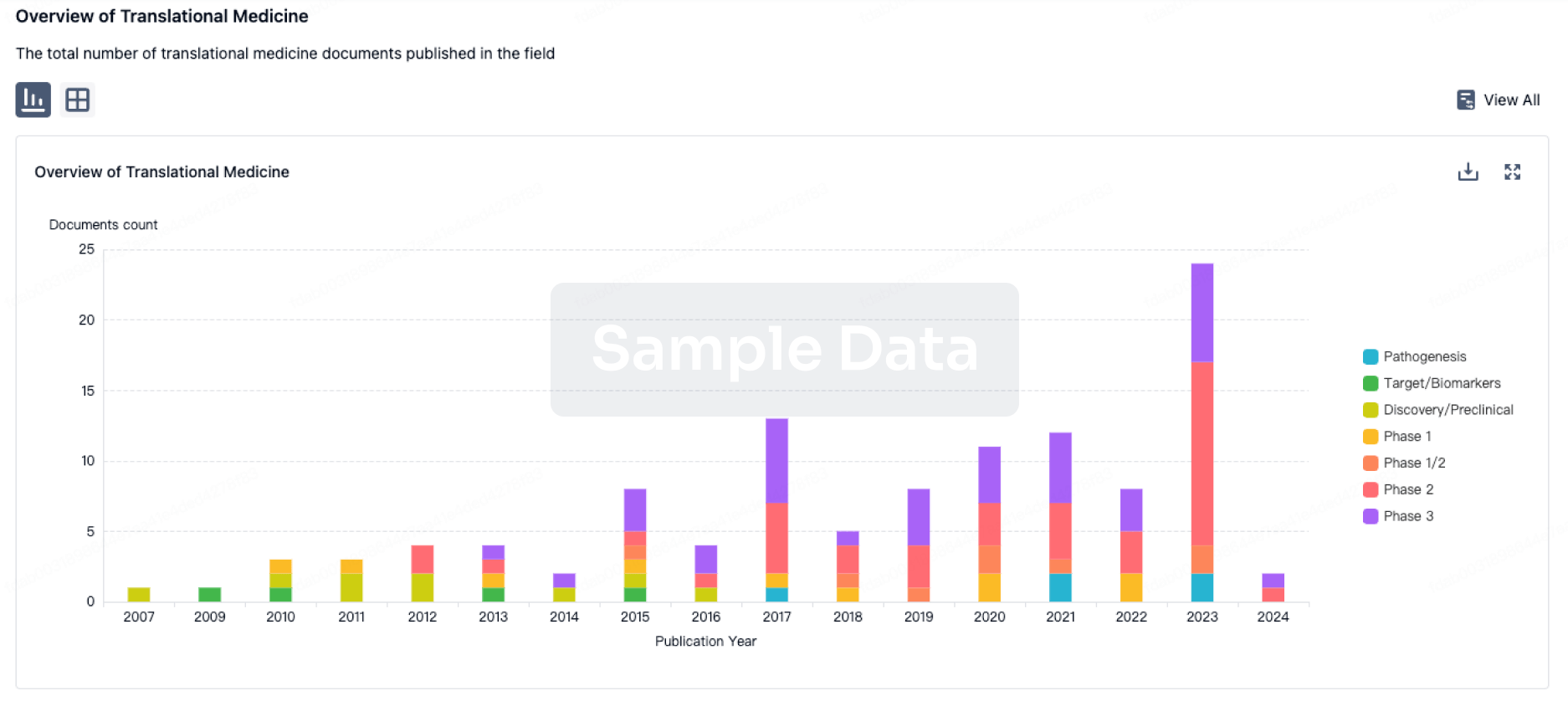

100 Translational Medicine associated with HLX-60

Login to view more data

100 Patents (Medical) associated with HLX-60

Login to view more data

2

Literatures (Medical) associated with HLX-6001 Sep 2022·Journal for ImmunoTherapy of Cancer

Selective targeting of GARP-LTGFβ axis in the tumor microenvironment augments PD-1 blockade via enhancing CD8+T cell antitumor immunity

Article

Author: Giuliani, Giuseppe D ; Song, No-Joon ; Yang, Yiping ; Bolyard, Chelsea ; Das, Komal ; Li, Zihai ; Kwon, Hyunwoo ; Li, Anqi ; Chakravarthy, Karthik B ; Ma, Qin ; He, Kai ; Riesenberg, Brian P ; Gewirth, Daniel T ; Carbone, David ; Gatti-Mays, Margaret ; Okimoto, Tamio ; Das, Jayajit ; Chung, Dongjun ; Wang, Yi ; Wu, Xingjun ; Chang, Yuzhou ; Velegraki, Maria

Medical Oncology

New insight into GARP striking role in cancer progression: application for cancer therapy

Review

Author: Eslami, Majid ; Yousefi, Bahman ; Lahimchi, Mohammad Reza

2

News (Medical) associated with HLX-6017 Apr 2023

SHANGHAI, April 16, 2023 /PRNewswire/ -- As a global innovative biopharmaceutical company, Henlius is committed to offering high-quality, affordable and innovative biopharmaceuticals to patients worldwide with 5 products launched in China. Leveraging the differentiated competitive edges of its products, Henlius adopts meticulous management model and precise market strategies to optimize the commercialization layout and further extend its market reach. In the first quarter of 2023, Henlius'revenue climbed 97.2% to RMB995.7 million. With expanding sales of its flagship products including HANQUYOU and HANSIZHUANG, the company has shown continous revenue growth.

HANQUYOU Continues to Soar

In the first quarter of 2023, Henlius' core anti-tumour product HANQUYOU (trastuzumab, trade name in Europe: Zercepac®, trade name in Australia: Tuzucip® and Trastucip®) extended its strong momentum, soaring by 66.7%, to RMB538.6 million.

HANQUYOU, indicated for the treatment of HER2-positive breast cancer and gastric cancer, is the first product sold and promoted in Chinese mainland by the company's in-house commercialisation team. The 150mg/60mg dual dosage and preservative-free formulation of HANQUYOU sets it apart, leading clinical practices and providing a personalized and cost-effective treatment option for breast cancer patients of any weight. In 2022, the 24,000L production capacity of Songjiang First Plant was approved to commence the commercial production of HANQUYOU, being a driving force behind the production increase and the accerlerated commercialisation of HANQUYOU. Furthermore, Henlius continues to expand the sales network of HANQUYOU. As at the end of 2022, the copany had more than 550 sales agents for HANQUYOU, with the goal of penetrating the Chinese mainland markets with efficiency far exceeding the industry average.

HANQUYOU is the first China-developed mAb approved both in China and Europe. It was approved for commercialisation by the European Commission (EC) and NMPA in July 2020 and August 2020, respectively. In February 2023, the Biologics License Application (BLA) for HANQUYOU has been accepted by the U.S. Food and Drug Administration (FDA), which will further expand the product's footprint in major markets of biologics in the U.S. and Europe. In addition, Henlius has aggressively pursued international commercialization of HANQUYOU, actively collaborating with global partners to bring its therapeutics to patients in the United States, Canada, Europe, and other emerging markets, covering about 100 countries and regions. Up to now, HANQUYOU has launched in over 30 countries and regions, including the United Kingdom, France, Germany, Switzerland, Australia, Finland, Spain, Singapore, Argentina and Saudi Arabia.

HANSIZHUANG Sees Unbated Growth

In the first quarter of 2023, the company's first innovative product, HANSIZHUANG (serplulimab) achieved a domestic sales revenue of RMB249.8 million. Notably, HANSIZHUANG realized a monthly sales of over RMB100 million in March 2023 in Chinese mainland, starting a new stage of its sales growth as well as providing strong momentum for the product's commercialization.

HANSIZHUANG was launched in China in March 2022,and has been approved for 3 indications including MSI-H solid tumour, squamous non-small cell lung cancer (sqNSCLC) and extensive stage small cell lung cancer (ES-SCLC) so far. As the world's first anti-PD-1 monoclonal antibody (mAb) for the first-line treatment of SCLC, HANSIZHUANG set a record for SCLC immunotherapy with a median OS (overall survival) of 15.8 months. With its outstanding quality and clinical efficacy, HANSIZHUANG has earned wide recognitions from the market and has seen rapid sales uptick. At the beginning of the product's commercialisation, an amazing "Henlius speed" has been demonstrated in the first deliveries and the first prescriptions of HANSIZHUANG, which also indicated the company's strong commercial operation and execution. As of the end of 2022, its sales team has been expanded to approximately 400 people. With a rich experience in oncology and meticulous management model, the team has covered over 23,000 healthcare providers from nearly 1000 domestic hospitals. Looking forward, the company will continue to accelerate the market coverage and penetration of HANSIZHUANG in the areas of lung cancer, gastrointestinal and gynecological tumours.

In March 2023, the European Medicines Agency (EMA) has validated the Marketing Authorization Application(MAA) for HANSIZHUANG for the first-line treatment of ES-SCLC. Another patient has also been dosed in a head-to-head bridging trial of HANSIZHUANG versus first-line standard of care atezolizumab for ES-SCLC in the U.S. The company also plans to submit a Biologics License Application (BLA) for HANSIZHUANG in the U.S. in 2024. Meanwhile, the company continues to explore the combination therapies between HANSIZHUANG and self-developed products such as HANBEITAI, HLX07 (anti-EGFR mAb), HLX26 (anti-LAG-3 mAb), HLX208 (BRAF V600E small molecule inhibitor) and HLX60 (anti-GARP mAb) to provide better therapies for the patients, more than 10 clinical trials on immuno-oncology combination therapies are in progress in a wide variety of indications.

Looking forward, Henlius will continue to delve into the area of oncology, auto-immune and other diseases. While maximizing the commercial value of biosimilars at home and abroad, Henlius will actively explore innovation drugs and tackle unmet clinical needs by leveraging its in-house R&D capabilities supplemented by external cooperation and license-in, so as to consolidate the best-in-class capabilities of "integrated research, manufacturing and commercialisation", and achieve steady development as a larger, international and more profitable Biopharma to provide more affordable and better therapies for patients worldwide.

About Henlius

Henlius (2696.HK) is a global biopharmaceutical company with the vision to offer high-quality, affordable, and innovative biologic medicines for patients worldwide with a focus on oncology, autoimmune diseases, and ophthalmic diseases. Up to date, 5 products have been launched in China, 1 has been approved for marketing in overseas markets, 18 indications are approved worldwide, and 3 marketing applications have been accepted for review in China, the U.S., and the EU, respectively. Since its inception in 2010, Henlius has built an integrated biopharmaceutical platform with core capabilities of high-efficiency and innovation embedded throughout the whole product life cycle including R&D, manufacturing and commercialization. It has established global innovation centers and Shanghai-based manufacturing facilities in line with global Good Manufacturing Practice (GMP), including Xuhui Plant certificated by China and the EU GMP and Songjiang First Plant certificated by China GMP.

Henlius has pro-actively built a diversified and high-quality product pipeline covering over 20 innovative monoclonal antibodies (mAbs) and has continued to explore immuno-oncology combination therapies with proprietary HANSIZHUANG (anti-PD-1 mAb) as backbone. Apart from the launched products HANLIKANG (rituximab), the first China-developed biosimilar, HANQUYOU (trastuzumab for injection, trade name in Europe: Zercepac®; trade names in Australia: Tuzucip® and Trastucip®, the first China-developed mAb biosimilar approved both in China and Europe, HANDAYUAN (adalimumab) and HANBEITAI (bevacizumab), the innovative product HANSIZHUANG has been approved by the NMPA for the treatment of MSI-H solid tumors, squamous non-small cell lung cancer (sqNSCLC) and extensive-stage small cell lung cancer (ES-SCLC), making it the world's first anti-PD-1 mAb for the first-line treatment of SCLC. Its NDA for the treatment of esophageal squamous cell carcinoma (ESCC) is under review. What's more, Henlius has conducted over 30 clinical studies for 16 products, expanding its presence in major markets as well as emerging markets.

SOURCE Henlius

Drug ApprovalImmunotherapyBiosimilar

31 Mar 2023

SHANGHAI, March 31, 2023 /PRNewswire/ -- Henlius (2696.HK) announced its 2022 annual results. In 2022, Henlius' revenue reached about RMB3.2147 billion, representing an increase of 91.1% YoY, primarily due to sales revenue and licensing revenue generated by the successive commercialisation of various products. As of now, Henlius has launched 5 products in China, 1 product has been approved in overseas markets, and 18 indications were approved worldwide, continuing to expand its global presence. Meanwhile, the company stays focused on differentiated innovation to accelerate the development of products in its pipeline. In 2022, the company's R&D expenditure reached approximately RMB2.1832 billion.

Wenjie Zhang, Chairman, Executive Director and Chief Executive Officer of Henlius, remarked: "2022 was a milestone for Henlius, as we strive for excellence in difficult times and seek progress in stability, achieving high-quality evolution towards Biopharma. Despite the pandemic, our performance has grown against the headwinds, with revenue surpassing RMB3 billion and sales of our 5 listed products increasing rapidly, once again demonstrating our strong commercial capabilities. In addition, our business collaborations lead the nation, with multiple products licensed out and an upfront payment totaling over RMB1.5 billion. Driven by our self-developed biosimilars and innovative products, we will continue to enhance our market competitiveness for a higher-level development, growing ourselves into a leader in China's biopharmaceutical industry, and working with all circles of society to achieve greater success."

A major breakthrough in commercialisation, entering a new phase of global development

In 2022, Henlius has defied the impact of the epidemic and reached a sales revenue of approximately RMB2.6754 billion increased by 79.0% YoY, providing a strong impetus for R&D, manufacturing and commercialisation. By the end of December 2022, the company has established a team of over 1,000 professionals to speed up the entire commercialisation process, to build a business presence in the China market and drive the market penetration on HANQUYOU and HANSIZHUANG. In 2022, these two core products of the company gained sales revenues of RMB1.7312 billion and RMB339.1 million respectively. In addition, the company received a profit-sharing of RMB553.9 million and RMB51.2 million for HANLIKANG and HANDAYUAN respectively.

Henlius' core anti-tumour product, HANQUYOU (trastuzumab, trade name in Europe: Zercepac®, trade name in Australia: Tuzucip® and Trastucip®), achieved a domestic sales revenue of RMB1.6959 billion, representing an increase of 95.4% YoY, overseas licensing and R&D services revenue, and sales revenue recorded RMB35.3 million and RMB168.6 million, respectively. The 150mg/60mg dual dosage and preservative-free formulation of HANQUYOU sets it apart, leading clinical practices and providing a personalized and cost-effective treatment option for breast cancer patients of any weight. On the other hand, in collaboration with Accord and other overseas commercial partners, Henlius has been actively promoting the global commercialisation of HANQUYOU, resulting in its approval in more than 30 countries, including the UK, France, Germany, Switzerland, Australia, Finland, Spain, Singapore, Argentina and Saudi Arabia. Notably, the Biologics License Application (BLA) for HANQUYOU has been accepted by the U.S. Food and Drug Administration (FDA), which will further expand the product's footprint in major markets of biologics in the U.S. and Europe.

The company's first innovative product, HANSIZHUANG (serplulimab), was launched in China in March 2022, with total sales revenue of RMB339.1 million in 9 months after launch and has been approved for 3 indications including MSI-H solid tumour, squamous non-small cell lung cancer (sqNSCLC) and extensive stage small cell lung cancer (ES-SCLC) so far. As the world's first anti-PD-1 monoclonal antibody (mAb) for the first-line treatment of small cell lung cancer, HANSIZHUANG set a record for SCLC immunotherapy with a median OS (overall survival) of 15.8 months, and its international multi-centre phase 3 clinical study ASTRUM-005 was published in the top medical journal JAMA (impact factor 157.3). The company has been pushing forward the global commercialisation of HANSIZHUANG to bring benefits to more patients and it was granted orphan drug designations by the European Commission (EC) and the U.S. FDA for the treatment of small cell lung cancer. As of now, the European Medicines Agency (EMA) has validated the Marketing Authorization Application(MAA) for HANSIZHUANG for the first-line treatment of ES-SCLC. Henlius also plans to submit a BLA for HANSIZHUANG in the U.S. in 2024. In addition, a New Drug application (NDA) for HANSIZHUANG for the first-line treatment of esophageal squamous cell carcinoma (ESCC) has been accepted by the NMPA in China, and the results of the study ASTRUM-007 were published in Nature Medicine (impact factor 87.2).

In 2022, the company made a new high in business collaboration and obtained overseas licensing and other revenue of approximately RMB539.3 million, representing an increase of 188.3% YoY. The company joined hands with international partners such as Organon, Abbott, Getz Pharma, Eurofarma and Fosun Pharma to accelerate overseas commercialisation of products such as HANSIZHUNAG, HANQUYOU, HANLIKANG, HANDAYUAN, HANBEITAI, HLX11, HLX14, etc. The upfront payment for overseas licensing revenues in 2022 totaled RMB1.5 billion, with a potential transaction amount of up to US$1.446 billion. Among which, the company sealed a deal with Organon for two biosimilars in development and is expected to receive up to a total of US$541 million, including an upfront payment of US$73 million, which marks the largest biosimilar licensing deal in the past five years. The company also entered into an exclusive license agreement with Fosun Pharma for commercialisation of HANSIZHUNAG in the U.S. with RMB1 billion of upfront payment, breaking into the U.S. biopharma market.

Enable differentiated innovation with global clinical data

In 2022, Henlius continued to broaden and deepen product innovation, commit greater resources to R&D pipeline with innovation product as a core, and consolidate the construction of R&D platforms such as antibody-drug conjugates (ADC) platforms. The pipeline cuts across a wider range of therapeutic areas and molecule types including bispecific antibodies and ADCs. The company initiated more than 30 clinical trials in China, the U.S., the EU, Australia and other countries and regions, with 16 new clinical trials approved and 15 first patient dosing completed in the year.

Along with the rapid commercialisation of HANSIZHUANG, the company is actively expanding its differentiation advantages to cover a wide range of high-incidence tumour types, including lung cancer and gastrointestinal cancer, and has enrolled more than 3,500 patients worldwide. It made breakthroughs and won recognitions from global academics. In 2022, Henlius explored more on HANSIZHUANG in wider population and more regions across the world. The first patient has been dosed in an international multi-centre phase 3 clinical trial (ASTRUM-020) of HANSIZHUANG in patients with limited-stage small cell lung cancer (LS-SCLC) in the U.S. Another patient has also been dosed in a head-to-head bridging trial of HANSIZHUANG versus first-line standard of care atezolizumab for ES-SCLC in the U.S, which propels the product towards U.S. market approval further. In addition, the company continues to explore the combination therapies between HANSIZHUANG and self-developed products such as HANBEITAI, HLX07 (anti-EGFR mAb), HLX26 (anti-LAG-3 mAb), HLX208 (BRAF V600E small molecule inhibitor) and HLX60 (anti-GARP mAb) to further maximize the anti-tumour synergy effect.

In 2022, Henlius has been unlocking the potential of the candidate targets including BRAF, LAG-3, TIGIT, 4-1BB, GARP and OX40, and joined forces with global partners to build global presence and open more markets. The company accelerated the international multi-centre Phase 3 clinical studies of HLX11(biosimilar to Pertuzumab), HLX14(biosimilar to Denosumab) and HLX04-O (anti-VEGF mAb), and completed the first-patient dosings in China, the U.S., the EU, Australia and other countries and regions. The company also enriched its early-stage pipeline by licensing-in, entering into strategic collaborations with Novacyte Therapeutics Biomedical Technology, Palleon and MediLink Therapeutics to further strengthen competitiveness in the global oncology therapeutics.

Enhance quality and efficiency to improve the integrated production platform

In 2022, the company's commercial production capacity doubled to 48,000 litres. The three production facilities, Xuhui Facility, Songjiang First Plant and Songjiang Second Plant, can altogether reach a larger operational scale with the total commercial production capacity expected to reach 144,000 litres in 2026. In 2022, Songjiang First Plant was put into commercial operation and its 24,000 litres can be fully used for the commercial production of HANQUYOU, which offered a strong support for its market expansion. In 2022, Songjiang First Plant obtained China GMP and EU Qualified Person (QP) certification and is expected to receive FDA GMP inspection in 2023. To secure more commercial production in the long run, the construction of Songjiang Second Plant is underway, with its first stage well on track and the first engineering run to be completed in 2023. Moreover, Henlius continues to promote lean manufacturing to improve production efficiency, drive cost reduction and reinforce the localization of key materials and equipment, by for example exploring the control system for large-scale stainless steel bioreactors.

Looking ahead, Henlius will continue to bolster up its commercialisation, keep improving the efficiency of innovation, and optimize the long-term planning of three manufacturing facilities to evolve towards a sustainable Biopharma with sharpened edges in R&D, manufacturing and commercialisation to bring more and better treatment options to patients worldwide.

About Henlius

Henlius (2696.HK) is a global biopharmaceutical company with the vision to offer high-quality, affordable, and innovative biologic medicines for patients worldwide with a focus on oncology, autoimmune diseases, and ophthalmic diseases. Up to date, 5 products have been launched in China, 1 has been approved for marketing in overseas markets, 18 indications are approved worldwide, and 3 marketing applications have been accepted for review in China, the U.S., and the EU, respectively. Since its inception in 2010, Henlius has built an integrated biopharmaceutical platform with core capabilities of high-efficiency and innovation embedded throughout the whole product life cycle including R&D, manufacturing and commercialisation. It has established global innovation centers and Shanghai-based manufacturing facilities in line with global Good Manufacturing Practice (GMP), including Xuhui Plant certificated by China and the EU GMP and Songjiang First Plant certificated by China GMP.

Henlius has pro-actively built a diversified and high-quality product pipeline covering over 20 innovative monoclonal antibodies (mAbs) and has continued to explore immuno-oncology combination therapies with proprietary HANSIZHUANG (anti-PD-1 mAb) as backbone. Apart from the launched products HANLIKANG (rituximab), the first China-developed biosimilar, HANQUYOU (trastuzumab for injection, trade name in Europe: Zercepac®; trade names in Australia: Tuzucip® and Trastucip®, the first China-developed mAb biosimilar approved both in China and Europe, HANDAYUAN (adalimumab) and HANBEITAI (bevacizumab), the innovative product HANSIZHUANG has been approved by the NMPA for the treatment of MSI-H solid tumors, squamous non-small cell lung cancer (sqNSCLC) and extensive-stage small cell lung cancer (ES-SCLC), making it the world's first anti-PD-1 mAb for the first-line treatment of SCLC. Its NDA for the treatment of esophageal squamous cell carcinoma (ESCC) is under review. What's more, Henlius has conducted over 30 clinical studies for 16 products, expanding its presence in major markets as well as emerging markets.

SOURCE Henlius

License out/inDrug ApprovalPhase 3Orphan DrugImmunotherapy

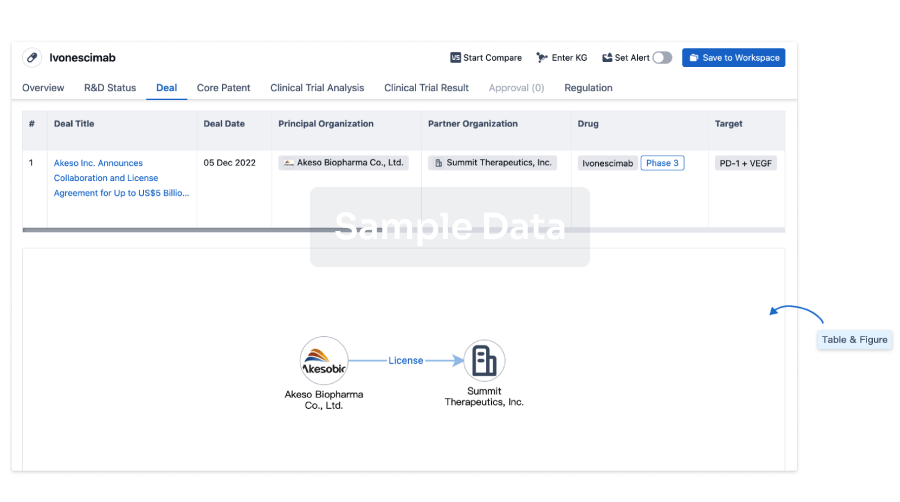

100 Deals associated with HLX-60

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Advanced Malignant Solid Neoplasm | Phase 1 | China | 25 Nov 2022 | |

| Hepatocellular Carcinoma | Phase 1 | China | 25 Nov 2022 | |

| Lymphoma | Phase 1 | China | 25 Nov 2022 | |

| Metastatic Solid Tumor | Phase 1 | China | 25 Nov 2022 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

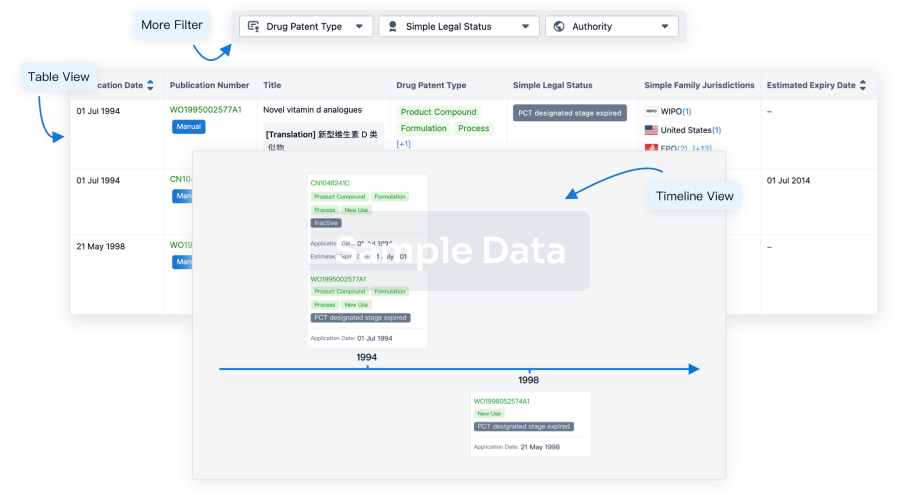

Core Patent

Boost your research with our Core Patent data.

login

or

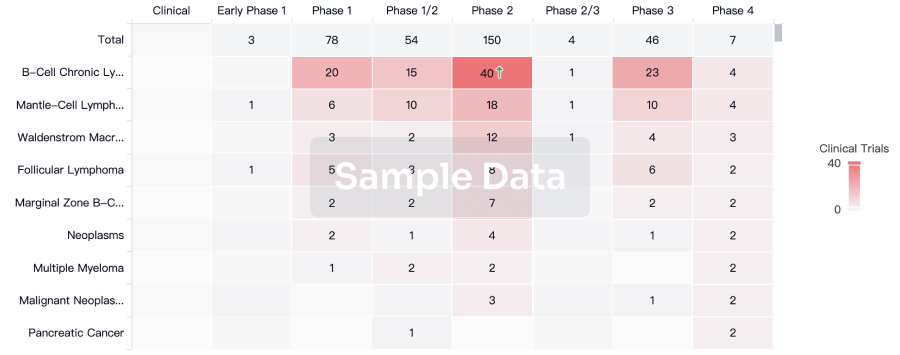

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

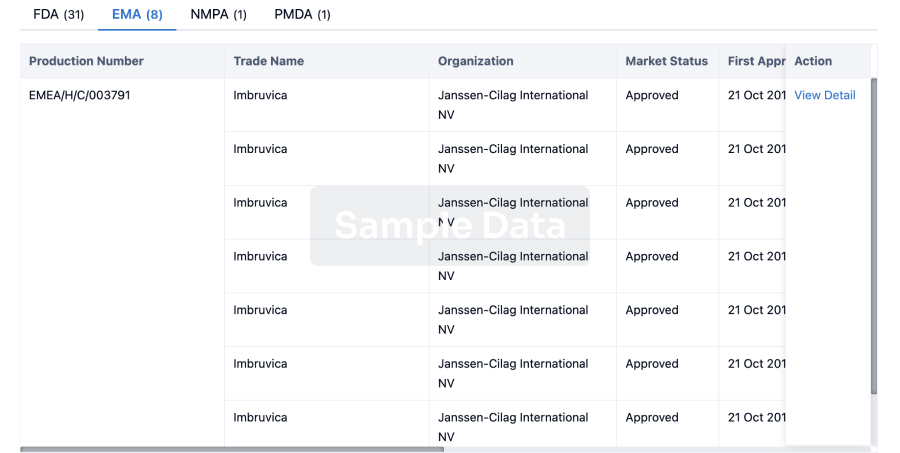

Approval

Accelerate your research with the latest regulatory approval information.

login

or

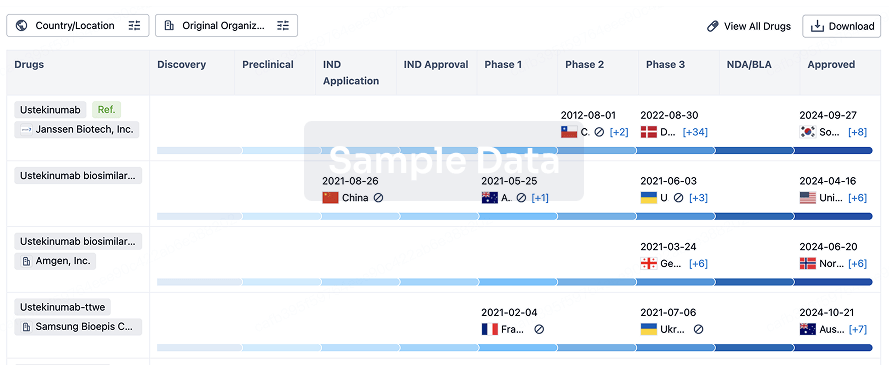

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

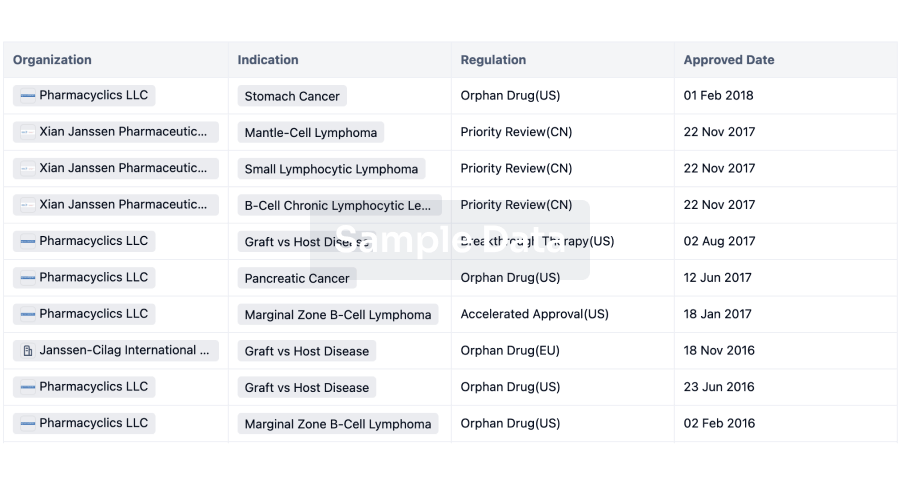

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free