Request Demo

Last update 16 Aug 2025

IAM-C1

Last update 16 Aug 2025

Overview

Basic Info

Drug Type Small molecule drug |

Synonyms IAM C1 |

Target |

Action inhibitors |

Mechanism CDK2 inhibitors(Cyclin-dependent kinase 2 inhibitors), CDK4 inhibitors(Cyclin-dependent kinase 4 inhibitors) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization- |

Drug Highest PhasePreclinical |

First Approval Date- |

Regulation- |

Related

100 Clinical Results associated with IAM-C1

Login to view more data

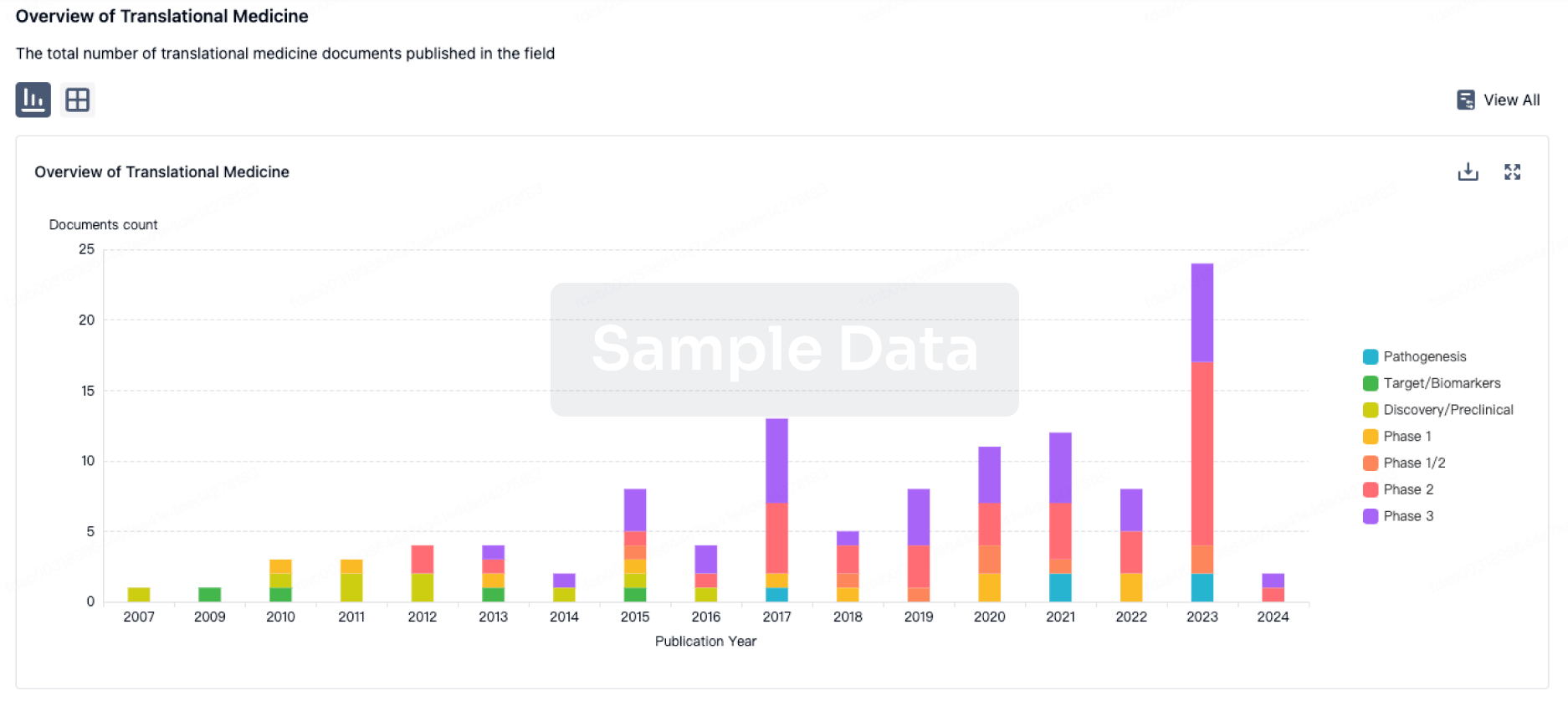

100 Translational Medicine associated with IAM-C1

Login to view more data

100 Patents (Medical) associated with IAM-C1

Login to view more data

3

News (Medical) associated with IAM-C118 Jun 2024

Less than a year after raising a $100-million B round, AI-powered drug discovery firm Iambic Therapeutics has added $50 million more to its coffers. The extension was led by new investors Mubadala Capital and Exor Ventures, with participation from Qatar Investment Authority as well as existing investors Illumina Ventures, Nexus Venture Partners, Coatue, Tao Capital Partners, and Abingworth. The latter co-led Iambic’s October series B along with Ascenta Capital. The new funds will help Iambic further progress its lead programme, IAM1363. The brain-penetrant small molecule, which inhibits both wild-type and oncogenic HER2, is being tested in a Phase I trial as both monotherapy and in combination with Herceptin (trastuzumab) in patients with HER2-positive cancers. The company is also close to entering the clinic with IAM-C1, a dual CDK2/4 inhibitor that has the potential to be first-in-class. Iambic said the candidate is intended to address treatment resistance in solid tumours such as breast cancer, and have a wider therapeutic index than approved CDK4/6 inhibitors. AI technologiesBoth of Iambic’s disclosed programmes were discovered using the company’s AI models for holistic drug design. By integrating its algorithms with an automated and high-throughput biology and chemistry experimental platform, the company says it can identify new chemical mechanisms to address intractable biological targets.The technology is also designed to speed up drug discovery workflow by processing thousands of molecular constructs and enabling weekly 'design-make-test' cycles. Additionally, the platform can optimise a potential candidate’s therapeutic window and discover compounds with highly differentiated properties. Mubadala partner Ayman AlAbdallah said Iambic’s AI-enabled drug discovery models have “demonstrated accuracy and speed… to rapidly advance candidates from discovery and into human studies.”

Phase 1PROTACs

05 Oct 2023

Drug discovery isn’t only about finding new targets. There’s still plenty of opportunity to find better ways to hit targets that are already drugged, according to Tom Miller, CEO of startup Iambic Therapeutics. Understanding how a molecule interacts with a known disease target enables drug hunters to design molecules that could be superior alternatives for patients.

Miller notes that a molecule’s ability to bind to a target protein while leaving related proteins unaffected improves its safety. It’s also important to understand how the distribution of a molecule across tissues in the body affect efficacy. Iambic’s drug discovery research employs artificial intelligence to make predictions about those properties and others.

“With a platform like this, we can not only optimize the molecule, we can [also] optimize the profile,” Miller said of Iambic’s technology.

In the span of two years, Iambic has developed four AI-discovered molecules, the most advanced of them now on the cusp of Phase 1 testing. To support those programs and develop more of them, the La Jolla, California-based startup has raised $100 million.

Some companies in the AI space take a “physics-based” approach to drug discovery, using software to run simulations that yield a better understanding of molecular dynamics—how small molecules interact with a protein of interest. Companies in this mold include Nimbus Therapeutics, Schrödinger, and Relay Therapeutics. A different group of AI drug companies run experiments to generate data that they then interrogate to gain biological and chemical insights, an approach taken by companies such as Exscientia and Recursion Pharmaceuticals.

Miller said Iambic brings both worlds together, making the most of physics-based insights that are then augmented with data to make better predictions. The company’s technology enables it to identify new molecules that offer superior efficacy and safety, he said. More than finding out whether a molecule can hit a target, Iambic’s technology reveals insights into other properties, such as potency to its target, its toxicity profile, and how the molecule moves through and interacts with the body.

“It’s the ability to predict across numerous endpoints for a successful drug,” Miller said.

Iambic’s technologies can be applied to multiple indications, but the company’s first four programs, including two on pace to reach the clinic next year, are for cancer. IAM-H1 is a small molecule that blocks HER2 and variants of this cancer-driving protein. In addition to its selectivity to this target, Iambic says this molecule also has the ability to penetrate the brain—an important property for treating cancer that has spread to the central nervous system.

IAM-C1 is a small molecule that selectively blocks CDK2 and CDK4, two enzymes associated with tumor growth. The three FDA-approved CDK inhibitors are Pfizer’s Ibrance, Kisqali from Novartis, and the Eli Lilly drug Verzenio. All three are blockbuster products that have become standard of care breast cancer treatments. Iambic claims its drug can selectively block its two enzyme targets while preserving enzymes closely related to those targets. Other properties of this Iambic drug include a better therapeutic window, which is the dose range in which a therapy is effective while causing minimal adverse effects. This molecule is also designed to address drug resistance in cell-cycle-driven cancers.

With the new financing, Iambic aims to advance its two lead programs into Phase 1 testing next year. A third cancer program addressing a yet-to-be-disclosed target could follow them into the clinic. In addition to the clinical trial work, Miller said his company will continue its drug discovery research. While Iambic is flexible in terms of the mechanism of action of potential drugs, Miller said Iambic’s focus is mainly small molecules rather than biologics. Expanding to indications beyond cancer could happen through partnerships.

Iambic already has a research collaboration with Eli Lilly, a deal struck last year that gave the pharma giant exclusive rights to the startup’s nucleic acid delivery technology. Lilly is interested in delivering therapeutic cargo to targets in the central and peripheral nervous systems. Iambic received $50 million up front, including an equity investment from Lilly. The startup could earn up to $400 million in milestones.

Iambic’s employee roster is split evenly between software engineers and drug development scientists. Miller said that this composition reflects the reality that AI-driven drug discovery research is interdisciplinary by nature.

“We really do believe that there is a duality that one has to capture to be successful at that interface,” he said. “We work hard to embrace the expertise of technology. But we also realize drug discovery and development builds on decades of hard-earned experience. And we need that reflected in the team as well.”

Miller co-founded Iambic in 2019 based on research from the University of Bristol and Caltech, where he was a professor of chemistry for 14 years. Iambic’s marriage of technology with biotechnology is reflected in its investor syndicate. In 2021, the startup raised a $53 million Series A round of financing led by Coatue, a technology investment firm, and Catalio Capital Management, which focuses on biomedical technology investments. That financing mainly supported development of the startup’s tech platform.

The company built its AI technology in collaboration with Nvidia, a company whose computing technologies are integral components in the platforms of many AI drug discovery firms. In addition to investing in Iambic, Miller said Nvidia will also continue to work with the startup to develop next-generation technologies for drug development.

Iambic was initially named Entos. With the Series B financing announced this week, it revealed the name change to Iambic. The latest financing was co-led by Ascenta Capital and Abingworth. New investors joining the round include Nvidia, Illumina Ventures, Gradiant Corporation, and independent board member Bill Rastetter. Earlier investors that participated in the latest financing include Nexus Ventures, Catalio Capital Management, Coatue, FreeFlow, OrbiMed, and Sequoia Capital.

03 Oct 2023

Iambic’s Unique AI-Driven Drug-Discovery Platform Identifies Potential First-in-Class and Best-in-Class Development Candidates Years Faster than Industry Norms

Funding will Support Continued AI Platform Innovations and Advancement of Multiple Candidates into Clinical Development, Including IAM-H1, a Selective Brain-Penetrant HER2 Inhibitor, and IAM-C1, a Selective Dual CDK2/4 Inhibitor

SAN DIEGO--(BUSINESS WIRE)-- Iambic Therapeutics (formerly known as Entos), a biotechnology company developing novel therapeutics from its unique generative AI discovery platform, today announced the closing of an oversubscribed $100 million Series B financing co-led by Ascenta Capital and Abingworth, and also including new investors NVIDIA, Illumina Ventures, Gradiant Corporation, and independent board member Bill Rastetter. Existing investors also participated, including Nexus Ventures, Catalio Capital Management, Coatue, FreeFlow, OrbiMed, and Sequoia Capital. As part of the Series B, Iambic is delighted to welcome two new board members, Evan Rachlin, M.D., from Ascenta Capital and Kurt von Emster from Abingworth.

“At Iambic, our world-class team has combined physics and AI to create a differentiated drug discovery platform that achieves a step-change in the speed and success rate for delivering best-in-class and first-in-class development candidates to clinic,” commented Tom Miller, Ph.D., Co-founder and Chief Executive Officer of Iambic. “With the Series B funding, we intend to advance multiple AI-discovered candidates into the clinic and expand our pipeline, demonstrating how the Iambic platform can deliver better therapeutics to patients in less time, with optimized target product profiles for greater likelihood of clinical success.”

“We were struck by the originality of these molecules, offering distinctive approaches in both deeply validated and more novel biological pathways,” added Evan Rachlin, M.D., Co-founder and Managing Partner of Ascenta Capital. “Iambic’s platform enables a more creative and expansive exploration of how to treat diseases with profound unmet needs. We are delighted to partner with Tom and his extraordinary team in translating these thoroughly tested medicines into humans.”

“Abingworth is proud to support the remarkably talented team at Iambic in its drive to revolutionize drug discovery and speed to the market with highly selective drugs,” said Kurt von Emster, Managing Partner and Head of Life Sciences at Abingworth.

“AI-driven technologies, including methods that Iambic and NVIDIA researchers have built together, are charting a new path for researchers in the discovery of new therapeutic candidates,” said Rory Kelleher, Director of Healthcare and Life Sciences at NVIDIA. “NVIDIA-accelerated computing and software are helping industry pioneers like Iambic drive scientific breakthroughs and our continued collaboration aims to speed innovation in drug discovery.”

“We believe technology innovations powered by advanced computing and omics-derived data insights will transform drug discovery and pave the way for the next wave of groundbreaking medicines,” said Ron Mazumder, Ph.D., MBA, Partner of Illumina Ventures. “Iambic’s physics-informed machine learning approach has yielded promising lead candidates with superior profiles in record time.”

Since its 2021 Series A financing, Iambic has rapidly built its AI-driven discovery platform, which unifies state-of-the-art, physics-informed machine learning and experimental automation, and has demonstrated the platform’s success in identifying therapeutic candidates with differentiated drug pro In addition to building out a deep bench of AI and drug-discovery experts, Iambic has discovered two candidates to advance into the clinic: IAM-H1, a highly selective and brain-penetrant inhibitor of HER2 and its oncogenic mutants, and IAM-C1, a potential first-in-class selective dual CDK2/4 inhibitor to address unmet needs in terms of therapeutic window and treatment resistance in cell-cycle-driven cancers. Further, Iambic has extended its leadership position in the AI community, creating methods such as NeuralPLexer and OrbNet to drive its discovery platform.

With the funds raised in the Series B, Iambic intends to advance multiple candidates into clinical development, expand its pipeline with additional candidates with best-in-class and first-in-class potential, and continue to innovate and build next-generation AI and automation technologies for drug discovery. It plans to leverage NVIDIA technology such as the NVIDIA DGX Cloud AI supercomputing platform and the NVIDIA BioNeMo cloud service to accelerate discovery.

The company retains the technology created under its prior name of Entos Inc., adopting the new name of Iambic Therapeutics to reflect its transition to a company with the additional capability of clinical development of candidates identified through its AI-driven discovery platform.

About the Iambic Therapeutics Physics-Informed AI-Driven Discovery Platform

The Iambic Therapeutics AI-driven platform was created to address the most challenging design problems in drug discovery, incorporating the most current AI technologies and purpose-built tools from Iambic. The integration of physics principles into the platform’s AI architectures improves data efficiency and allows molecular models to venture widely across the space of possible chemical structures. The platform’s algorithms enable identification of new chemical mechanisms for engaging difficult-to-address biological targets, discovery of defined product profiles that optimize therapeutic window, and exploration of the chemical space to discover candidates for development with highly differentiated properties. Through close integration of AI-generated molecular designs with automated experimental execution, Iambic completes design-make-test cycles on a weekly cadence.

About Iambic Therapeutics

Founded in 2019 and headquartered in La Jolla, California, Iambic Therapeutics is disrupting the therapeutics landscape with its unique AI-driven drug-discovery platform. Iambic has assembled a world-class team that unites pioneering AI experts and experienced drug hunters with strong track records of success in delivering clinically validated therapeutics. The Iambic platform has been demonstrated to deliver high-quality, differentiated therapeutics to clinic with unprecedented speed and across multiple target classes and mechanisms of action. The Iambic team is advancing an internal pipeline of clinical assets to address urgent unmet patient needs. Learn more about the Iambic team, platform, and pipeline at iambic.ai.

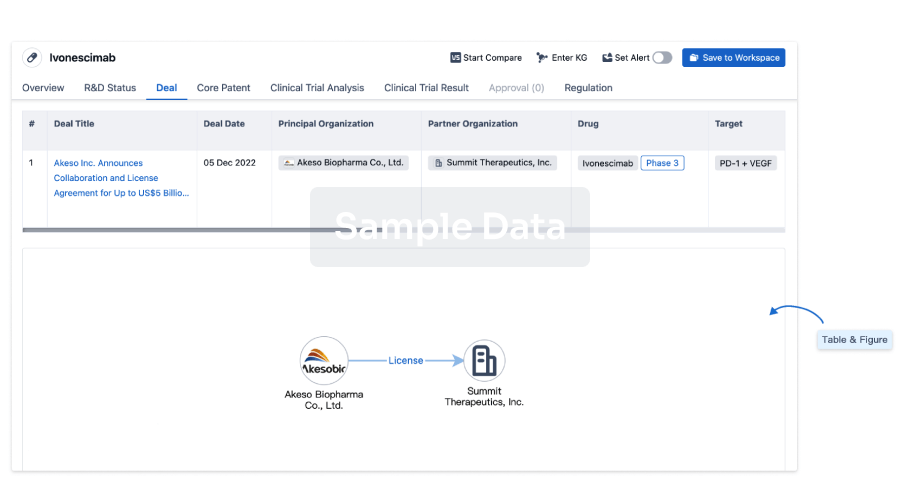

100 Deals associated with IAM-C1

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Hormone receptor positive HER2 negative breast cancer | Preclinical | United States | 01 Nov 2024 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

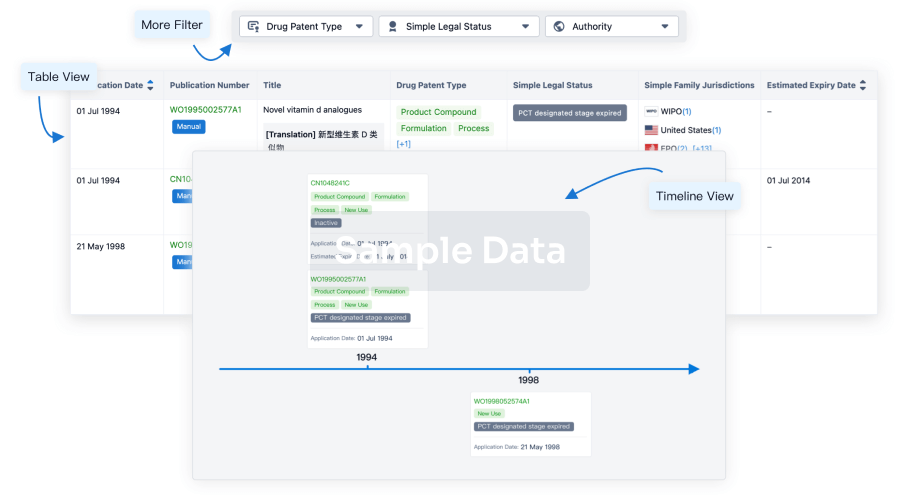

Core Patent

Boost your research with our Core Patent data.

login

or

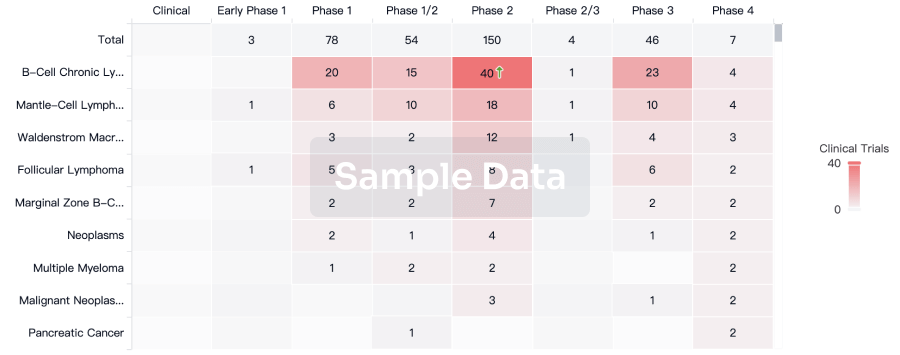

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free