Request Demo

Last update 21 Jul 2025

Smallpox(BioFactura)

Last update 21 Jul 2025

Overview

Basic Info

Drug Type Antibody |

Synonyms- |

Target- |

Action- |

Mechanism- |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhasePreclinical |

First Approval Date- |

Regulation- |

Related

100 Clinical Results associated with Smallpox(BioFactura)

Login to view more data

100 Translational Medicine associated with Smallpox(BioFactura)

Login to view more data

100 Patents (Medical) associated with Smallpox(BioFactura)

Login to view more data

823

Literatures (Medical) associated with Smallpox(BioFactura)31 Dec 2025·Virulence

Mpox: Global epidemic situation and countermeasures

Review

Author: Luo, Yinghua ; Jin, Chenghao ; Hou, Wenshuang ; Tang, Yanjun ; Wu, Nan ; Liu, Yanzhi ; Quan, Quan

Mpox, is a zoonotic disease caused by the monkeypox virus and is primarily endemic to Africa. As countries gradually stop smallpox vaccination, resistance to the smallpox virus is declining, increasing the risk of infection with mpox and other viruses. On 14 August 2024, the World Health Organization announced that the spread of mpox constituted a public health emergency of international concern. Mpox's transmission routes and symptoms are complex and pose new challenges to global health. Several vaccines (such as ACAM2000, JYNNEOS, LC16m8, and genetically engineered vaccines) and antiviral drugs (such as tecovirimat, brincidofovir, cidofovir, and varicella immunoglobulin intravenous injection) have been developed and marketed to prevent and control this disease. This review aims to introduce the epidemic situation, epidemiological characteristics, physiological and pathological characteristics, and preventive measures for mpox in detail, to provide a scientific basis for the prevention and control of mpox viruses worldwide.

01 Jun 2025·Lancet Microbe

Immunogenicity of MVA-BN vaccine deployed as mpox prophylaxis: a prospective, single-centre, cohort study and analysis of transcriptomic predictors of response

Article

Author: Fullerton, James ; Hollett, Kate ; Richards, Duncan ; Coles, Mark ; Murray, Sam M ; Fadzillah, Nurul Huda Mohamad ; Provine, Nicholas M ; Mandal, Sema ; Grifoni, Alba ; Ateere, Alberta ; Harris, Stephanie A ; Peng, Yanchun ; Klenerman, Paul ; Pudjohartono, Maria Fransiska ; Nassanga, Beatrice ; De Maeyer, Roel P H ; Cooper, Cushla ; Hallis, Bassam ; McShane, Helen ; Chen, Ji-Li ; Sette, Allessandro ; Dong, Tao ; Satti, Iman ; Rowe, Cathy ; Drennan, Philip G ; Otter, Ashley ; Jones, Scott

BACKGROUND:

Since 2022, mpox has emerged as a global health threat, with two clades (I and II) causing outbreaks of international public health concern. The third generation smallpox vaccine modified vaccinia Ankara, manufactured by Bavarian Nordic (MVA-BN), has emerged as a key component of mpox prevention. To date, the immunogenicity of this vaccine, including determinants of response, has been incompletely described, especially when MVA-BN has been administered intradermally at a fifth of the registered dose (so-called fractionated dosing), as recommended as a dose-sparing strategy. The aim of this study was to explore the immunogenicity of MVA-BN and baseline determinants of vaccine response in an observational public-health response setting.

METHODS:

We conducted a prospective cohort study and immunological analysis of responses to MVA-BN in patients attending a sexual health vaccination clinic in Oxford, UK. Blood samples were taken at baseline, day 14, and day 28 after first vaccine, and 28 and 90 days following a second vaccine. A subcohort had additional blood samples collected day 1 following their first vaccine (optional timepoint). We assessed IgG responses to mpox and vaccinia antigens using Luminex assay (MpoxPlex) using generalised linear mixed modelling, and T-cell responses using IFN-γ enzyme-linked immunospot and activation-induced marker assay. Associations between blood transcriptomic signatures (baseline, day 1) and immunogenicity were assessed using differential expression analysis and gene set enrichment methods.

FINDINGS:

We recruited 34 participants between Dec 1, 2022 and May 3, 2023 of whom 33 received fractionated dosing. Of the 30 without previous smallpox vaccination, 14 (47%) seroconverted by day 28, increasing to 25 (89%) 90 days after second vaccination. However, individuals seronegative on day 28 had persistently lower responses compared with individuals seropositive on day 28 (numerically lower antibody responses to six of seven dynamic antigens in the MPoxPlex assay, p<0·05). Serological response on day 28 was positively associated with type I and II interferon signatures 1 day after vaccination (n=18; median module score 0·13 vs 0·06; p=1·1 × 10-⁶), but negatively associated with these signatures at baseline (normalised enrichment score -2·81 and -2·86, respectively).

INTERPRETATION:

Baseline inflammatory states might inhibit MVA-BN serological immunogenicity by inhibiting the upregulation of MVA-induced innate immune signalling. If confirmed mechanistically, these insights could inform improved vaccination strategies against mpox in diverse geographic and demographic settings. Given the likelihood of vaccine supply limitations presently and in future outbreak settings, the utility of dose-sparing vaccine strategies as a general approach to maximising population benefit warrants further study.

FUNDING:

UKRI via the UK Monkeypox Research Consortium, Chinese Academy of Medical Sciences Innovation Fund for Medical Sciences, the Kennedy Trust for Rheumatology Research, the John Climax Donation, the Medical Research Council (UK), the Wellcome Trust, the Center for Cooperative Human Immunology (National Institutes of Health), and the National Institute for Health and Care Research Oxford Biomedical Research Centre.

31 May 2025·Virology Journal

Exploring monkeypox virus antibody levels: insights from human immunological research.

Review

Author: Wu, Jing ; Zhang, Xiaomin

Monkeypox(mpox) is a zoonotic disease caused by the monkeypox virus (MPXV), which was previously endemic to West and Central Africa. However, it has recently appeared in several non-endemic countries beyond Africa. On July 23, 202 WHO declared mpox outbreak a public health emergency of international concern, a declaration reaffirmed on August 14, 2024. In this context, understanding the antibody levels of MPXV in the population has become crucial, especially given the historical cross-protection provided by smallpox vaccination. To provide a comprehensive overview of the current understanding of MPXV antibody levels and the protective efficacy of smallpox vaccination, we conducted a review of the existing literature. We reviewed relevant studies published in peer-reviewed journals from 1958 to 2025, focusing on those that reported research on MPXV antibodies and the effects of smallpox vaccination. Here, we review the research progress of MPXV and smallpox virus(VARV) in epidemiology, etiology, mutation and mechanism of virus infection, clinical characteristics and vaccine application. In addition, the differences in MPXV levels in different populations and the cross-protective effect of smallpox vaccine against mpox were also discussed. Our review indicates that MPXV antibody levels are closely related to the level of immunity in the population, particularly among individuals who have received smallpox vaccination. This narrative review aims to synthesize existing evidence on the role of smallpox vaccination in protecting against mpox and to offer evidence-based guidance for public health policy. We aim to establish a theoretical foundation and practical recommendations for future research and mpox prevention strategies.

3

News (Medical) associated with Smallpox(BioFactura)09 Jul 2025

Recurring order from an undisclosed European country to strengthen public preparedness.Combined with other recent orders from non-European countries, the Company has now secured above DKK 3,000 million in contracts in the Public Preparedness business in 2025, thus entering the targeted guidance interval for this business. COPENHAGEN, Denmark, July 9, 2025 – Bavarian Nordic A/S (OMX: BAVA) today announced the award of a contract valued over DKK 200 million to supply its MVA-BN® smallpox/mpox vaccine to a European country. This is another larger order in recent years from the country to strengthen national preparedness against biological threats and epidemics like smallpox and mpox. Paul Chaplin, President & CEO of Bavarian Nordic, said: “As Europe continues to strengthen its resilience in the face of evolving geopolitical threats, we are proud to support efforts to increase public health security by supplying our MVA-BN® smallpox/mpox vaccine, which remains a vital tool for managing mpox outbreaks as well as for safeguarding populations against future smallpox threats. This new order underscores the growing recognition of biological preparedness as a cornerstone of national and regional security. We remain committed to working with EU and its member states to ensure rapid access to critical medical countermeasures, reinforcing public health infrastructure and contributing to a safer, more secure future. We are also pleased to extend our collaboration with countries outside Europe, demonstrating the value of our long-term partnerships to build and strengthen preparedness.” The order will be delivered in 2025. Along with other orders recently secured from non-European countries, it brings the total value of secured contracts in the Public Preparedness business to slightly above DKK 3,000 million, thus within the targeted guidance interval for this arm of the business for 2025 (DKK 3,000-4,000 million). Total revenue and EBITDA margin for the year remain unchanged at DKK 5,700-6,700 million and 26-30% respectively. About the smallpox/mpox vaccineMVA-BN or Modified Vaccinia Ankara-Bavarian Nordic is the only non-replicating mpox vaccine approved in the U.S., Switzerland, Singapore and Mexico (marketed as JYNNEOS®), Canada (marketed as IMVAMUNE®), and the EU/EAA and United Kingdom (marketed as IMVANEX®). Originally developed as a smallpox vaccine in collaboration with the U.S. government to ensure the supply of a smallpox vaccine for the entire population, including immunocompromised individuals who are not recommended vaccination with traditional replicating smallpox vaccines, MVA-BN has been indicated for use in the general population in individuals considered at risk for smallpox or mpox infection. About Bavarian NordicBavarian Nordic is a global vaccine company with a mission to improve health and save lives through innovative vaccines. We are a preferred supplier of mpox and smallpox vaccines to governments to enhance public health preparedness and have a leading portfolio of travel vaccines. For more information, visit www.bavarian-nordic.com Forward-looking statements This announcement includes forward-looking statements that involve risks, uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. Forward-looking statements include statements concerning our plans, objectives, goals, future events, performance and/or other information that is not historical information. All such forward-looking statements are expressly qualified by these cautionary statements and any other cautionary statements which may accompany the forward-looking statements. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent events or circumstances after the date made, except as required by law. Contact investors:Europe: Rolf Sass Sørensen, Vice President Investor Relations, rss@bavarian-nordic.com, Tel: +45 61 77 47 43US: Graham Morrell, Gilmartin Group, graham@gilmartinir.com, Tel: +1 781 686 9600 Contact media:Nicole Seroff, Vice President Corporate Communications, nise@bavarian-nordic.com, Tel: +45 53 88 06 03 Company Announcement no. 19 / 2025

Attachment

2025-19-en

VaccineDrug Approval

06 May 2025

Exercised options total USD 143.6 millionSecures manufacturing and supply of freeze-dried JYNNEOS® to the U.S. in 2026 COPENHAGEN, Denmark, May 6, 2025 – Bavarian Nordic A/S (OMX: BAVA) announced today that the Biomedical Advanced Research and Development Authority (BARDA), part of the Administration for Strategic Preparedness and Response (ASPR) in the U.S. Department of Health and Human Services (HHS), has exercised additional options valued at USD 143.6 million under the existing contract to supply a freeze-dried formulation of JYNNEOS® smallpox vaccine. The options support the manufacturing and supply of freeze-dried JYNNEOS by conversion of bulk vaccine, previously manufactured under other contract options, as well as supplemental payments for all doses procured under the freeze-dried contract, triggered by the demonstration of an extended shelf-life. The supplemental payments will be invoiced pro rata with deliveries of the freeze-dried vaccines. Deliveries under the new contract options are planned for 2026. Bavarian Nordic’s financial guidance for 2025 remains unchanged at total revenues of DKK 5,700-6,700 million and an EBITDA margin of 26-30%. From the Public Preparedness business, revenue of DKK 3,000-4,000 million is still expected, of which DKK 2,650 million has been secured, which is an increase of DKK 150 million following exercise of the options. Paul Chaplin, President & CEO of Bavarian Nordic, said: “Following the recent FDA approval of the freeze-dried formulation of our smallpox/mpox vaccine, we applaud the U.S. government’s steadfast commitment to improving national health security through the exercise of these options. The freeze-dried vaccine, with its improved shelf life, provides a significant contribution to securing the long-term availability of countermeasures to protect U.S citizens against life-threatening diseases.” About our contracts with the U.S. governmentSince 2003, Bavarian Nordic has worked with the U.S. government on the development, manufacturing and supply of a non-replicating smallpox vaccine to ensure all populations can be protected from smallpox and mpox, including people with weakened immune systems who are at high risk of adverse reactions to traditional smallpox vaccines, which are based on replicating vaccinia virus strains. Approved by the FDA in 2019, JYNNEOS was the first smallpox vaccine successfully developed under Project BioShield, a program created by the U.S. Congress in 2004 to accelerate the research, development, procurement, and availability of medical countermeasures against biological, chemical, radiological, and nuclear (CBRN) threats through public-private partnerships. Bavarian Nordic has supplied a liquid-frozen formulation of JYNNEOS to the U.S. government for stockpiling since 2010 and in response to the mpox outbreak in 2022-2023. BARDA has supported the development of a freeze-dried formulation of the vaccine to replenish the stockpile and in 2017 awarded the Company a ten-year contract, which includes options valued at USD 299 million for the fill and finish of freeze-dried vaccines, of which USD 284 million has been exercised to-date. The freeze-dried formulation of JYNNEOS, approved by the FDA in March 2025, provides certain advantages over the liquid-frozen formulation in terms of transportation, storage conditions and shelf life, all of which are important factors for long-term stockpiling. This project has been supported in whole or in part with federal funds from the Department of Health and Human Services; Administration for Strategic Preparedness and Response; Biomedical Advanced Research and Development Authority (BARDA), under contract number HHSO100201700019C. About Bavarian NordicBavarian Nordic is a global vaccine company with a mission to improve health and save lives through innovative vaccines. We are a preferred supplier of mpox and smallpox vaccines to governments to enhance public health preparedness and have a leading portfolio of travel vaccines. For more information, visit www.bavarian-nordic.com Forward-looking statements This announcement includes forward-looking statements that involve risks, uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. Forward-looking statements include statements concerning our plans, objectives, goals, future events, performance and/or other information that is not historical information. All such forward-looking statements are expressly qualified by these cautionary statements and any other cautionary statements which may accompany the forward-looking statements. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent events or circumstances after the date made, except as required by law. Contact investors:Europe: Rolf Sass Sørensen, Vice President Investor Relations, rss@bavarian-nordic.com, Tel: +45 61 77 47 43US: Graham Morrell, Paddock Circle Advisors, graham@paddockcircle.com, Tel: +1 781 686 9600 Contact media:Nicole Seroff, Vice President Corporate Communications, nise@bavarian-nordic.com, Tel: +45 53 88 06 03 Company Announcement no. 15 / 2025

Attachment

2025-15-en

VaccineDrug Approval

06 Mar 2025

While Bavarian Nordic's public preparedness sales dropped in 2024, the vaccine specialist’s travel health business—which includes shots for rabies and tick-borne encephalitis (TBE), among others—grew 22%.

While the ebb and flow of mpox outbreaks may have taken a toll on Bavarian Nordic’s 2024 sales performance, the year also validated, in large part, the travel vaccines business the Danish company has been building out since the start of the decade.In the years to come, Bavarian Nordic foresees that more commercially minded-business taking the lead over the sort of government supply contracts that have been the company’s bread and butter thus far, Bavarian Nordic CEO Paul Chaplin said in an interview.Last year, Bavarian Nordic’s total revenue dropped 19% to 5.7 billion Danish kroner (around $527 million), the company reported Wednesday.That drop is largely explained by the fact that Bavarian Nordic’s public preparedness business, which includes its smallpox and mpox vaccines and makes up nearly 60% of the company’s revenue, plunged around 44% to 3.2 billion kroner ($295 million) last year.Still, there was a silver lining for Bavarian Nordic, as the vaccine specialist’s travel health business—which includes shots for rabies and tick-borne encephalitis (TBE), among others—grew 22%. “We started a journey, back in 2020 really, to become a much more robust, profitable vaccine company,” Chaplin told Fierce Pharma. “[20]24 was our fifth consecutive year now of reporting profitable growth.”That said, “the issue with public preparedness is it’s a little lumpy in terms of the revenue,” Chaplin explained. “It’s not a classical revenue stream.”As it stands, Bavarian Nordic assumes base sales from its public preparedness business between 1.5 billion to 2 billion kroner with “some spikes” from outbreaks of disease such as mpox.“To be honest, from an investor point of view, that is a very difficult one to model or to appreciate,” Chaplin admitted.In turn, Bavarian is looking to continue to expand its commercial business in earnest, both through the launch of vaccines like the company’s newly approved chikungunya shot Vimkunya, and by acquiring more commercial assets via M&A, the CEO said.Ultimately, Chaplin anticipates Bavarian Nordic’s “more traditional portfolio” of vaccines to become the dominant one, with public preparedness becoming a “smaller component” of the firm’s overall strategy.That should “create less noise in terms of the revenue swings that we see from year to year,” Chaplin explained.“Before 2020, we really only had smallpox and mpox, and it was direct sales to governments,” Chaplin explained. “We want to add more, what I would call, regular revenue streams into the business.”That desire prompted Bavarian Nordic to purchase its rabies and TBE vaccines from GSK, followed by a transaction for Emergent Bio’s travel health business in 2023, which added shots for typhoid, cholera and chikungunya to Bavarian’s vaccine armamentarium.“That was a bold move at the time, because we had no real commercial setup,” Chaplin said of the GSK deal.Since then, the company has built out commercial infrastructure in places like Germany and the U.S., navigated marketing during COVID, and is now in the process of expanding its commercial base into countries like the U.K., France, Austria, Switzerland and Canada, Chaplin said.As for why those travel vaccines are now proliferating under Bavarian Nordic, the shots simply “weren’t that meaningful to a company the size of GSK that had a portfolio of 30-plus vaccines,” Chaplin speculated.“I think they fit better in a smaller company like Bavarian Nordic than they do in a larger company with different growth agendas,” he said.Looking ahead, much of Bavarian Nordic’s focus in 2025 will hinge on the rollout of its commercial chikungunya shot. To build the market for Vimkunya, education of healthcare professionals will be key, Chaplin said, highlighting two types of HCPs in particular: Those who know about the virus but may not be aware of its severity, and those are largely oblivious to chikungunya altogether.While Bavarian Nordic is already seeing demand for Vimkunya start to build in Europe and the U.S., the company’s prospects in the States are slightly less clear at the moment, given the recent cancellation of a Centers for Disease Control and Prevention advisory committee meeting that would have determined whether to recommend Vimkunya, Chaplin noted.As Bavarian holds out hope that the meeting gets rescheduled, the lack of a positive recommendation will likely diminish sales, Chaplin said. Nevertheless, the CEO stressed that the company continues to go full speed ahead with its awareness efforts.Speaking to the current uncertainty around U.S. immunization policy going forward, Chaplin acknowledged that vaccine hesitancy has been on the rise globally for some time now, with the issue exacerbated even further by the COVID-19 pandemic.Even still, Bavarian Nordic has witnessed a “rebound” in vaccine uptake in more recent years and is seeing “strong growth in our sector against the backdrop of some vaccine skepticism,” Chaplin said.Whatever happens with U.S. vaccine policy, “we will all be in the same boat as vaccine manufacturers, and we’ll have to adapt to the situation,” he added. Looking ahead to the rest of the year, Bavarian Nordic aims to grow earnings some 26% to 30% over that same span.As for what could be next in the company’s travel health portfolio, Bavarian Nordic on Wednesday unveiled two new early-stage pipeline programs for Lyme disease and Epstein-Barr virus.Despite high unmet need for a vaccine in both conditions, both candidates are backed by existing, validated technologies and Bavarian Nordic has been working on each asset for around 3 years now, Chaplin pointed out. Bavarian Nordic’s Lyme and Epstein-Barr prospects are slated to enter the clinic next year.

VaccineDrug Approval

100 Deals associated with Smallpox(BioFactura)

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Smallpox | Preclinical | United States | 08 Dec 2024 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

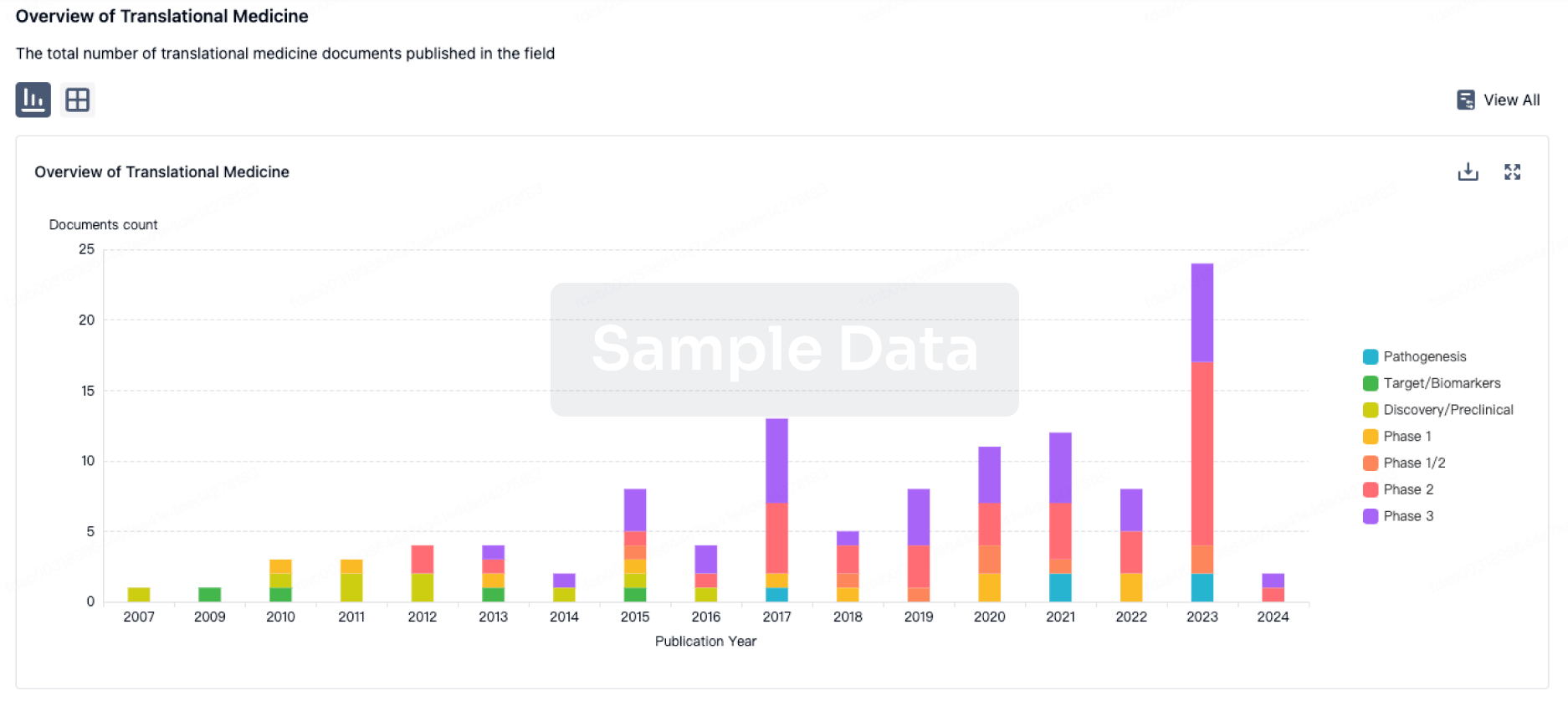

Translational Medicine

Boost your research with our translational medicine data.

login

or

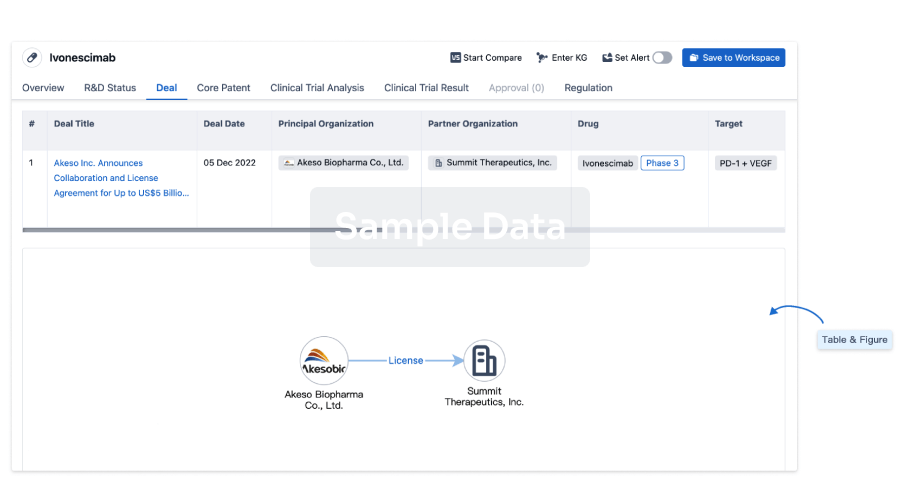

Deal

Boost your decision using our deal data.

login

or

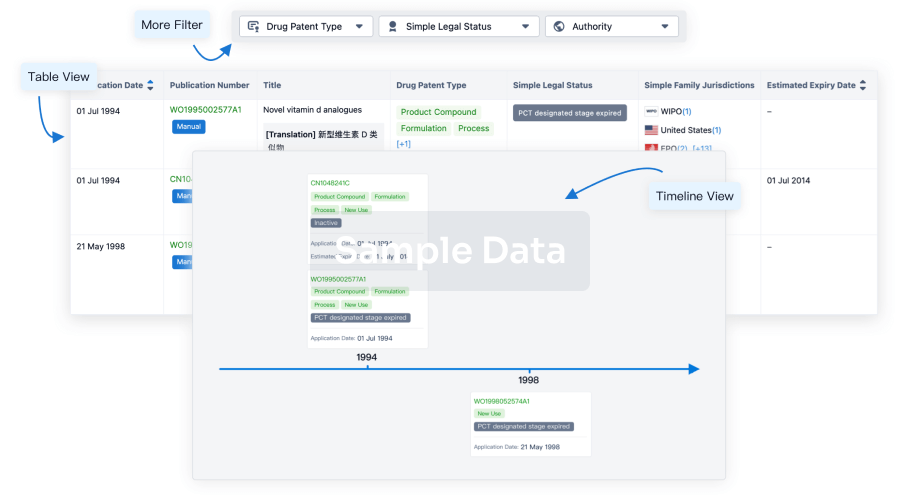

Core Patent

Boost your research with our Core Patent data.

login

or

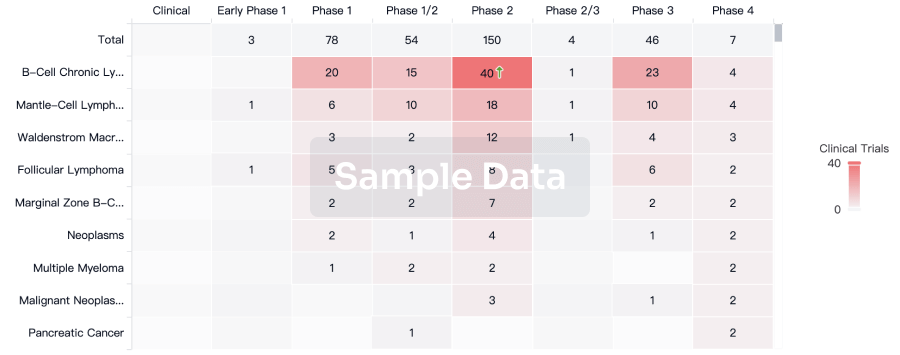

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

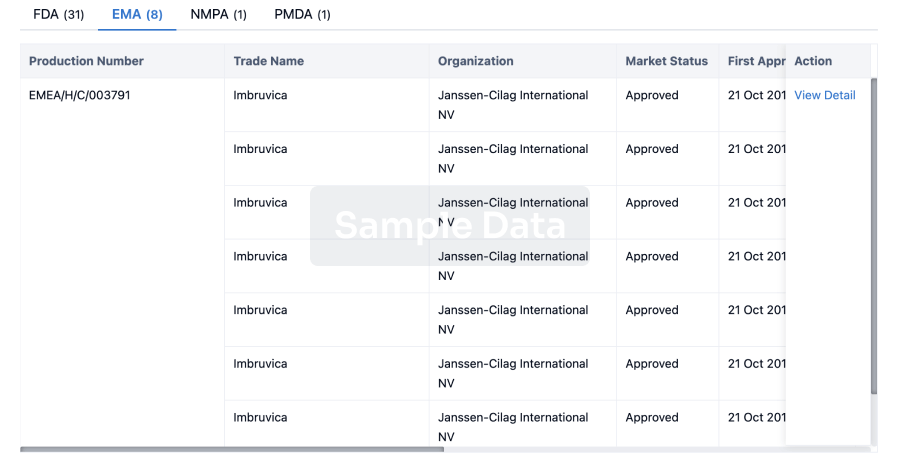

Approval

Accelerate your research with the latest regulatory approval information.

login

or

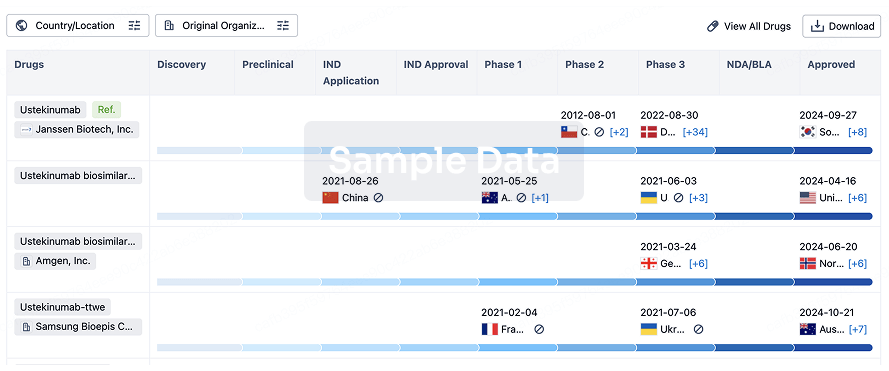

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

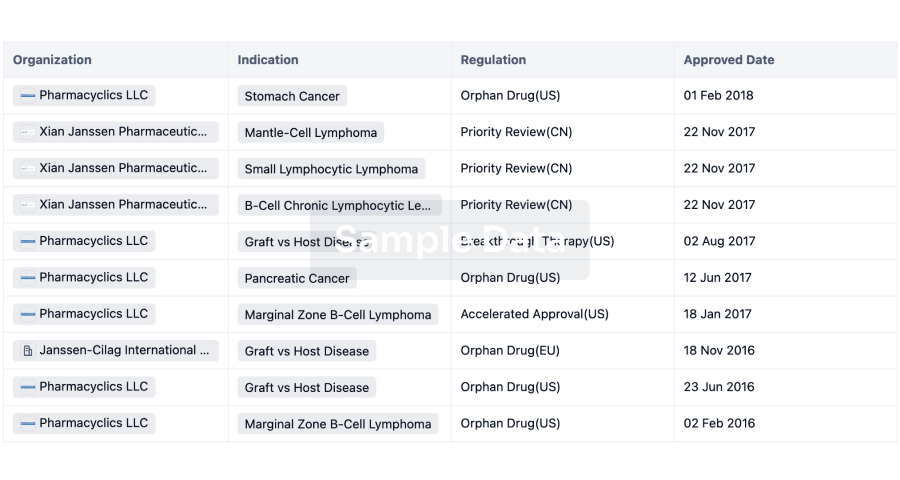

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free