Request Demo

Last update 14 Jan 2026

IBI-3001

Last update 14 Jan 2026

Overview

Basic Info

Drug Type Antibody drug conjugate (ADC) |

Synonyms IBI 3001, IBI3001 |

Target |

Action inhibitors, antagonists |

Mechanism CD276 inhibitors(CD276 antigen inhibitors), EGFR antagonists(Epidermal growth factor receptor erbB1 antagonists), TOP1 inhibitors(DNA topoisomerase I inhibitors) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhasePhase 1 |

First Approval Date- |

Regulation- |

Login to view timeline

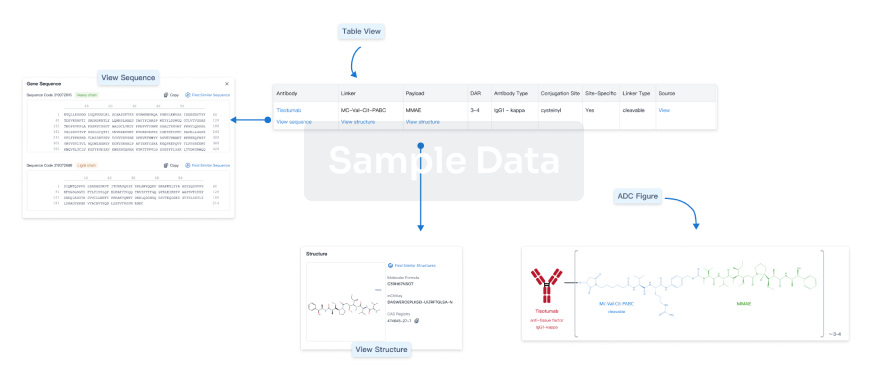

Structure/Sequence

Molecular FormulaC8H16N2O3 |

InChIKeyHSRXSKHRSXRCFC-WDSKDSINSA-N |

CAS Registry27493-61-4 |

Boost your research with our ADC technology data.

login

or

Related

1

Clinical Trials associated with IBI-3001NCT06349408

A Phase 1 Study of IBI3001 in Participants With Unresectable, Locally Advanced or Metastatic Solid Tumors

This is a Phase 1 multicenter, multi-regional, open-label, first-in-human study of IBI3001 in participants with unresectable, locally advanced or metastatic solid tumors. The purpose of this study is to identify the MTD/RP2D of IBI3001, and to explore the preliminary efficacy of IBI3001.

Start Date10 Jan 2025 |

Sponsor / Collaborator |

100 Clinical Results associated with IBI-3001

Login to view more data

100 Translational Medicine associated with IBI-3001

Login to view more data

100 Patents (Medical) associated with IBI-3001

Login to view more data

1

Literatures (Medical) associated with IBI-3001RSC Medicinal Chemistry

Technical, preclinical, and clinical developments of Fc-glycan-specific antibody–drug conjugates

Review

Author: Liu, Yunpeng ; Yang, Qiang

Fc-glycan-specific ADC is a significant advance in site-specific ADCs for cancer therapy. Notably, JSKN003 and IBI343 have demonstrated promising results in phase 1 clinical trials and are advancing into phase 3 studies.

15

News (Medical) associated with IBI-300104 Dec 2025

SAN FRANCISCO and SUZHOU, China, Dec. 4, 2025 /PRNewswire/ -- Innovent Biologics (HKEX: 01801) today announced that the global strategic collaboration with Takeda (TSE: 4502, NYSE: TAK) has closed and become effective following the satisfaction of all closing conditions. The collaboration, initially announced on October 22, 2025, aims to accelerate the global development and commercialization of Innovent's next-generation immuno-oncology (IO) and antibody-drug conjugate (ADC) therapies, including the global partnership on IBI363 (PD-1/IL-2α-bias) and IBI343 (CLDN18.2 ADC), and an option for an early-stage program IBI3001 (EGFR/B7H3 ADC).

Dr. Hui Zhou, Chief R&D Officer for Oncology Pipeline at Innovent, stated, "IBI363 and IBI343 represent our next-generation therapies designed to address critical unmet needs in global cancer treatment. With clear, aligned development plans, Innovent's deep understanding of these assets, combined with Takeda's extensive experience and strong development and commercialization capabilities, we are poised to maximize the clinical potential of these assets across multiple indications. We look forward to the collaboration with our partner going forward."

Under the agreement:

Innovent and Takeda will co-develop IBI363 globally, and co-commercialize IBI363 in the U.S., with Takeda leading the co-development and co-commercialization efforts under joint governance and aligned development plan. In addition, Innovent has granted Takeda exclusive commercialization rights for IBI363 outside Greater China and the U.S. Takeda has global manufacturing rights to supply IBI363 outside of Greater China, with such rights being co-exclusive with Innovent for commercial supply in the U.S.

Innovent has also granted Takeda exclusive global rights to develop, manufacture and commercialize IBI343 outside of Greater China.

Additionally, Takeda receives an exclusive option to license global rights for IBI3001, a first-in-class EGFR/B7H3 bispecific ADC in Phase 1 stage, outside Greater China.

Takeda will pay Innovent an upfront payment of US$1.2 billion, including a US$100 million equity investment in Innovent through new share issuance at premium, i.e., HK$112.56 per share. Furthermore, Innovent is eligible for development and sales milestone payments for IBI363, IBI343, and IBI3001 (if option exercised) totaling up to approximately $10.2 billion, for a total deal value of up to $11.4 billion. Innovent is also eligible to receive potential royalty payments for each molecule outside Greater China, except with respect to IBI363 in the U.S., where the parties will share profits or losses (40/60 Innovent/Takeda).

Detailed information about the collaboration can be found at the official website of Innovent Biologics.

About Innovent Biologics

Innovent is a leading biopharmaceutical company founded in 2011 with the mission to empower patients worldwide with affordable, high-quality biopharmaceuticals. The company discovers, develops, manufactures and commercializes innovative medicines that target some of the most intractable diseases. Its pioneering therapies treat cancer, cardiovascular and metabolic, autoimmune and eye diseases. Innovent has launched 17 products in the market. It has 1 new drug applications under regulatory review, 4 assets in Phase 3 or pivotal clinical trials and 15 more molecules in early clinical stage. Innovent partners with over 30 global healthcare companies, including Eli Lilly, Roche, Takeda, Sanofi, Incyte, LG Chem and MD Anderson Cancer Center.

Guided by the motto, "Start with Integrity, Succeed through Action" Innovent maintains the highest standard of industry practices and works collaboratively to advance the biopharmaceutical industry so that first-rate pharmaceutical drugs can become widely accessible. For more information, visit , or follow Innovent on Facebook and LinkedIn.

Forward-looking statement

This news release may contain certain forward-looking statements that are, by their nature, subject to significant risks and uncertainties. The words "anticipate", "believe", "estimate", "expect", "intend" and similar expressions, as they relate to Innovent, are intended to identify certain of such forward-looking statements. Innovent does not intend to update these forward-looking statements regularly.

These forward-looking statements are based on the existing beliefs, assumptions, expectations, estimates, projections and understandings of the management of Innovent with respect to future events at the time these statements are made. These statements are not a guarantee of future developments and are subject to risks, uncertainties and other factors, some of which are beyond Innovent's control and are difficult to predict. Consequently, actual results may differ materially from information contained in the forward-looking statements as a result of future changes or developments in our business, Innovent's competitive environment and political, economic, legal and social conditions.

Innovent, the Directors and the employees of Innovent assume (a) no obligation to correct or update the forward-looking statements contained in this site; and (b) no liability in the event that any of the forward-looking statements does not materialize or turn out to be incorrect.

SOURCE Innovent Biologics

21%

more press release views with

Request a Demo

License out/inADCPhase 1

04 Dec 2025

OSAKA, Japan and CAMBRIDGE, Massachusetts, December 4, 2025 – Takeda (TSE:4502/NYSE:TAK) today announced that a license and collaboration agreement with Innovent Biologics (HKEX: 01801) has closed following the satisfaction of all closing conditions. This agreement was originally announced on October 21, 2025.

Following the completion of the transaction, Takeda has acquired certain rights to IBI363 and IBI343, two next-generation, late-stage investigational oncology medicines, worldwide outside of Greater China.* IBI363 is being evaluated in non-small cell lung and colorectal cancers and has shown potential efficacy in additional solid tumor types. IBI343 is being evaluated in gastric and pancreatic cancers. These investigational medicines have the potential to address unmet needs for patients with a range of solid tumors.

Takeda will lead global co-development and U.S. co-commercialization of IBI363 and has exclusive commercialization rights outside the U.S. and Greater China. Takeda also has global manufacturing rights to supply IBI363 outside of Greater China, with such rights being co-exclusive with Innovent for commercial supply in the U.S. For IBI343, Takeda has exclusive rights to develop, manufacture and commercialize worldwide, outside of Greater China. Takeda intends to establish manufacturing for these investigational medicines in the U.S.

"Our collaboration with Innovent reflects the power of partnerships in oncology," said Teresa Bitetti, President, Global Oncology Business Unit, Takeda. "By combining innovative science with global development and commercialization expertise, we can advance more options for patients with the potential to address critical treatment gaps. This agreement reflects our deep commitment to developing medicines that enhance and extend the lives of people living with cancer."

As part of the agreement, Takeda also has an exclusive option to license global rights to IBI3001, an early-stage investigational medicine, outside of Greater China.

Takeda will pay Innovent US$1.2 billion upfront per the terms of the agreement before the end of Takeda’s fiscal year, ending March 31, 2026. This will include an equity investment of US$100 million in Innovent by Takeda. The financial impact of the deal for the fiscal year ending March 31, 2026 has been reflected in Takeda’s revised forecast announced on October 30, 2025.

*Mainland China, Hong Kong, Macau and Taiwan.

Takeda is focused on creating better health for people and a brighter future for the world. We aim to discover and deliver life-transforming treatments in our core therapeutic and business areas, including gastrointestinal and inflammation, rare diseases, plasma-derived therapies, oncology, neuroscience and vaccines. Together with our partners, we aim to improve the patient experience and advance a new frontier of treatment options through our dynamic and diverse pipeline. As a leading values-based, R&D-driven biopharmaceutical company headquartered in Japan, we are guided by our commitment to patients, our people and the planet. Our employees in approximately 80 countries and regions are driven by our purpose and are grounded in the values that have defined us for more than two centuries. For more information, visit www.takeda.com.

Tsuyoshi Tada

tsuyoshi.tada@takeda.com

Jennifer Anderson

jennifer.anderson@takeda.com

For the purposes of this notice, “press release” means this document, any oral presentation, any question and answer session and any written or oral material discussed or distributed by Takeda Pharmaceutical Company Limited (“Takeda”) regarding this release. This press release (including any oral briefing and any question-and-answer in connection with it) is not intended to, and does not constitute, represent or form part of any offer, invitation or solicitation of any offer to purchase, otherwise acquire, subscribe for, exchange, sell or otherwise dispose of, any securities or the solicitation of any vote or approval in any jurisdiction. No shares or other securities are being offered to the public by means of this press release. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. This press release is being given (together with any further information which may be provided to the recipient) on the condition that it is for use by the recipient for information purposes only (and not for the evaluation of any investment, acquisition, disposal or any other transaction). Any failure to comply with these restrictions may constitute a violation of applicable securities laws.

The companies in which Takeda directly and indirectly owns investments are separate entities. In this press release, “Takeda” is sometimes used for convenience where references are made to Takeda and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to subsidiaries in general or to those who work for them. These expressions are also used where no useful purpose is served by identifying the particular company or companies.

This press release and any materials distributed in connection with this press release may contain forward-looking statements, beliefs or opinions regarding Takeda’s future business, future position and results of operations, including estimates, forecasts, targets and plans for Takeda. Without limitation, forward-looking statements often include words such as “targets”, “plans”, “believes”, “hopes”, “continues”, “expects”, “aims”, “intends”, “ensures”, “will”, “may”, “should”, “would”, “could”, “anticipates”, “estimates”, “projects”, “forecasts”, “outlook” or similar expressions or the negative thereof. These forward-looking statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those expressed or implied by the forward-looking statements: the economic circumstances surrounding Takeda’s global business, including general economic conditions in Japan and the United States and with respect to international trade relations; competitive pressures and developments; changes to applicable laws and regulations, including tax, tariff and other trade-related rules; challenges inherent in new product development, including uncertainty of clinical success and decisions of regulatory authorities and the timing thereof; uncertainty of commercial success for new and existing products; manufacturing difficulties or delays; fluctuations in interest and currency exchange rates; claims or concerns regarding the safety or efficacy of marketed products or product candidates; the impact of health crises, like the novel coronavirus pandemic; the success of our environmental sustainability efforts, in enabling us to reduce our greenhouse gas emissions or meet our other environmental goals; the extent to which our efforts to increase efficiency, productivity or cost-savings, such as the integration of digital technologies, including artificial intelligence, in our business or other initiatives to restructure our operations will lead to the expected benefits; and other factors identified in Takeda’s most recent Annual Report on Form 20-F and Takeda’s other reports filed with the U.S. Securities and Exchange Commission, available on Takeda’s website at: https://www.takeda.com/investors/sec-filings-and-security-reports/ or at www.sec.gov. Takeda does not undertake to update any of the forward-looking statements contained in this press release or any other forward-looking statements it may make, except as required by law or stock exchange rule. Past performance is not an indicator of future results and the results or statements of Takeda in this press release may not be indicative of, and are not an estimate, forecast, guarantee or projection of Takeda’s future results.

This press release contains information about products that may not be available in all countries, or may be available under different trademarks, for different indications, in different dosages, or in different strengths. Nothing contained herein should be considered a solicitation, promotion or advertisement for any prescription drugs including the ones under development.

License out/in

22 Oct 2025

Takeda has identified Innovent Biologics assets as an answer to the question of which products will drive growth in the 2030s.\n Takeda is paying Innovent Biologics $1.2 billion upfront for rights to two cancer candidates. The deal, which includes (PDF) $10.2 billion in milestones, puts the biologics at the center of Takeda’s efforts to establish growth drivers for the post-Entyvio era.Inflammatory bowel disease drug Entyvio is central to Takeda’s commercial operations. With a series of patents set to expire through 2032, the drugmaker is preparing for rivals to try to launch biosimilar copies of Entyvio in the coming years. It is unclear exactly when biosimilars will start eroding the drug\'s sales, but Takeda knows the threat is coming. An attempt to make cell therapy a growth area failed. Takeda has identified Innovent assets as an answer to the question of which products will drive growth in the 2030s, continuing a string of major deals between global and Chinese drugmakers. The deal gives Takeda rights to two candidates, IBI363 and IBI343, that have shown promise in the treatment of patients with certain solid tumors. IBI363 is designed to unleash antitumor immune responses by blocking PD-1 signaling while also acting on IL-2 to activate and expand tumor-specific T cells. Multiple companies have bet on IL-2, most notably Bristol Myers Squibb through its huge, ill-fated Nektar Therapeutics deal, without realizing the potential of the cytokine to make cancer immunotherapies more broadly effective.Innovent is running phase 2 trials to test IBI363 in patients with types of lung and colorectal cancers. A global phase 3 trial in non-small cell lung cancer is expected to start in the coming months. The studies build on data in more than 1,200 patients that have persuaded Innovent IBI363 could become the backbone immuno-oncology treatment.Takeda will pay 60% of the cost of developing the candidate and pocket 60% of any profits. The Japanese company will lead co-commercialization efforts in the U.S. and have the exclusive right to commercialize the drug outside of the U.S. and China. IBI343 is a Claudin 18.2-directed antibody-drug conjugate. In a competitive field, Innovent has identified gastrointestinal toxicity as a way to differentiate its ADC from rival assets such as AstraZeneca’s AZD0901. Innovent is running a phase 3 gastric cancer trial in Japan and China and has completed a global phase 1/2 study. Takeda plans to expand into the first-line gastric and pancreatic cancer settings. The deal gives Takeda the right to develop and commercialize IBI343 outside China. Takeda has also landed an option on IBI3001, an ADC targeting EGFR and B7H3. Innovent is running a phase 1 solid tumor trial for that asset.

ImmunotherapyPhase 1ADCLicense out/inPhase 2

100 Deals associated with IBI-3001

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Locally Advanced Malignant Solid Neoplasm | Phase 1 | China | 10 Jan 2025 | |

| Locally Advanced Malignant Solid Neoplasm | Phase 1 | Australia | 10 Jan 2025 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free