Request Demo

Last update 28 Feb 2026

Tilatamig samrotecan

Last update 28 Feb 2026

Overview

Basic Info

Drug Type Antibody drug conjugate (ADC) |

Synonyms AZD 9592, AZD9592 |

Target |

Action antagonists, inhibitors |

Mechanism EGFR antagonists(Epidermal growth factor receptor erbB1 antagonists), TOP1 inhibitors(DNA topoisomerase I inhibitors), c-Met inhibitors(Hepatocyte growth factor receptor inhibitors) |

Therapeutic Areas |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization- |

Drug Highest PhasePhase 1 |

First Approval Date- |

Regulation- |

Login to view timeline

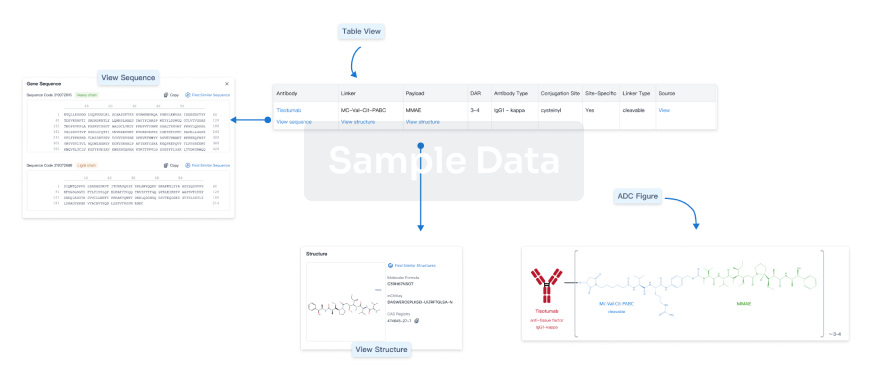

Structure/Sequence

Boost your research with our ADC technology data.

login

or

Sequence Code 1117026324H

Source: *****

Sequence Code 1117026325H

Source: *****

Sequence Code 1117026326L

Source: *****

Sequence Code 1117026327L

Source: *****

Related

2

Clinical Trials associated with Tilatamig samrotecanNCT06366451

A Phase 0 Multicenter Study of the Pharmacodynamic Effects of Intratumoral Microdose Administration of Rilvegostomig, Volrustomig, Sabestomig, and AZD9592

This is a multi-center, open-label, Phase 0 substudy designed to evaluate the localized pharmacodynamics (PD) of rilvegostomig, volrustomig, sabestomig, and AZD9592 within the tumor microenvironment (TME) when administered intratumorally in microdose quantities via the CIVO device in patients presenting with Head and Neck Squamous Cell Carcinoma (HNSCC) with a surface accessible lesion, who are scheduled for tumor and/or regional node dissection as part of their standard treatment. PD effects due to injected investigational agents, either as single agents or as AZD9592 drug combinations with the evaluated biologics, will be compared to those elicited by pembrolizumab alone, which will also be injected in microdose quantities via the CIVO device.

Start Date22 May 2024 |

Sponsor / Collaborator |

NCT05647122

A Phase I, Multicenter, Open-label, First-in-Human, Dose Escalation and Expansion Study of AZD9592 as Monotherapy and in Combination With Anti-cancer Agents in Patients With Advanced Solid Tumors

This is a first-in-human (FIH) Phase I, multi-center, open-label, study of AZD9592, in patients with advanced solid tumors. The study consists of several study modules, each evaluating the safety, tolerability, preliminary efficacy, pharmacokinetics (PK), pharmacodynamics, anti-tumor activity, and immunogenicity of AZD9592, as monotherapy or in combination with anti-cancer agents.

Start Date21 Dec 2022 |

Sponsor / Collaborator |

100 Clinical Results associated with Tilatamig samrotecan

Login to view more data

100 Translational Medicine associated with Tilatamig samrotecan

Login to view more data

100 Patents (Medical) associated with Tilatamig samrotecan

Login to view more data

1

Literatures (Medical) associated with Tilatamig samrotecanAntibodies

Anti-MET Antibody Therapies in Non-Small-Cell Lung Cancer: Current Progress and Future Directions

Review

Author: Wang, Kinsley ; Hsu, Robert

Background/Objectives: Non-small-cell lung cancer (NSCLC) remains a leading cause of cancer mortality globally, though advances in targeted therapies have improved treatment outcomes. The mesenchymal–epithelial transition (MET) gene plays a significant role in NSCLC, often through protein overexpression, exon 14 skipping mutations, and gene amplification, many of which arise as resistance mechanisms to other oncogenic drivers like epidermal growth factor receptor (EGFR) mutations. This review examines the development and clinical efficacy of anti-MET antibody therapies. Methods: A comprehensive literature search was conducted using major medical databases looking at key relevant studies on anti-MET antibody studies. Both authors reviewed the literature, assessed study quality, and interpreted the results from each study. Results: Amivantamab, a bispecific EGFR/MET antibody was approved to treat EGFR exon 20 insertion and now has recently been extended to target classical EGFR mutations with progression on osimertinib. Other important anti-MET targeted therapies in development include antibody drug conjugates such as telisotuzumab vedotin, REGN5093-M114, and AZD9592 and emibetuzumab, which is a humanized immunoglobulin G4 monoclonal bivalent MET antibody. Conclusions: MET plays a significant role in NSCLC and amivantamab along with other anti-MET targeted therapies play a role in directly targeting MET and addressing acquired resistance to oncogenic drivers. Future research should focus on developing novel MET antibody drugs and exploring new therapeutic combinations to enhance treatment efficacy and overcome resistance in NSCLC. Refining biomarker-driven approaches to ensure precise patient selection is also critical to optimizing treatment outcomes.

2

News (Medical) associated with Tilatamig samrotecan21 Feb 2024

AstraZeneca and Daiichi Sankyo set out how they planned to avoid adverse events from Dato-DXd at last year’s ESMO conference.

When he sat down with Fierce Biotech back in August 2022, David Fredrickson made no secret of the fact that AstraZeneca’s antibody-drug conjugates (ADCs) excited him most about the Big Pharma’s oncology pipeline.

Since then, ADCs have become the hottest ticket in town for biopharma dealmaking, with everyone from GSK to Eli Lilly and Bristol Myers Squibb fronting serious cash to pad out their own pipelines. As ADC fever spreads across the sector, Fredrickson’s own passion for the modality remains undimmed today.

“I remain incredibly enthusiastic that antibody-drug conjugates have the potential to replace classical chemotherapy across so many of the settings where today we see chemotherapies being utilized,” the executive vice president of AstraZeneca’s oncology business unit said in an interview Tuesday.

Fredrickson spoke to Fierce Biotech the week that the FDA accepted an application for the company’s TROP2-directed ADC datopotamab deruxtecan, or Dato-DXd for short. Like AstraZeneca’s blockbuster Enhertu, Dato-DXd is a collaboration with Japan’s Daiichi Sankyo, and the drug is currently being considered by the FDA as a treatment for non-squamous non-small cell lung cancer (NSCLC).

The agency expects to give its verdict Dec. 20, according to Daiichi (PDF). An approval application in HR-positive, HER2-negative breast cancer has also been submitted to the FDA.

The lung cancer submission is based on data from the phase 3 TROPION-Lung01 trial, which showed that median progression-free survival (PFS)—one of the study’s primary endpoints—was 5.6 months in patients treated with Dato-DXd versus 3.7 months among those treated with the chemotherapy docetaxel.

The trial also assessed Dato-DXd in patients with squamous NSCLC, but it didn’t demonstrate a PFS benefit in this group, resulting in the more limited non-squamous indication application that the FDA accepted this week.

There are still more data to come. While the trial has so far shown a “numerically favorable” trend for overall survival—the study’s other primary endpoint—AstraZeneca is waiting for a final analysis.

“Final overall survival data for TROPION-Lung01 will become available during the review period,” Fredrickson explained. “Maintaining the trend that we've seen so far would certainly be very positive. If it goes the other way, then that would be a separate review discussion that we'd have with the agency, obviously.”

The trial data have raised other issues, most notably an undetermined number of deaths attributed to interstitial lung disease that AstraZeneca and Daiichi discussed at last year’s European Society for Medical Oncology (ESMO) Congress.

Fredrickson accepts that the FDA will be taking these adverse events into account as part of its decision-making process, but he’s confident in the solution the companies set out at that conference.

“Interstitial lung disease is certainly a serious adverse event and one that needs to be well understood,” he said. “We were able to characterize and understand it in a way that we think allows for the awareness and monitoring programs that we've been working on for Enhertu to also be similarly applied to this program.”

With more data to come and a narrower initial regulatory focus, it’s perhaps unsurprising that Fredrickson doesn’t want to be drawn on whether AstraZeneca expects Dato-DXd to have the same blockbuster sales potential as its hugely successful sibling Enhertu.

“I believe that Dato has the potential to be very transformative, particularly in the treatment of lung cancer,” he said. “The data sets that we saw at ESMO of last year and that the filing has been based upon are what gives me that belief.”

“So we're optimistic that we're moving in the right direction, but we also recognize that there'll still be more data that's going to be coming along the way,” he added.

Should the FDA's December decision go AstraZeneca's way, there's a potentially lucrative prize to be had. The recent failure of Gilead Sciences’ Trodelvy to show a statistically significant overall survival benefit compared with chemo in a phase 3 lung cancer trial means Dato-DXd has a chance to become the first TROP2-targeted ADC to reach NSCLC.

AstraZeneca isn’t the only Big Pharma that’s now working with Daiichi in the ADC space, either. Coming up behind Dato-DXd are three other ADCs that the Japanese drugmaker has been working on, and for which Merck & Co. paid $4 billion upfront in October to co-develop.

Fredrickson gave no clue as to whether AstraZeneca also put in a bid for those assets, instead pointing to his company’s rapidly progressing stable of in-house ADCs. The Big Pharma already has four of its own candidates in phase 1/2 development, including the B7-H4-targeting AZD8205, which is in a midstage study for solid tumors, and a bispecific ADC dubbed AZD9592.

There’s also AZD0901, a Claudin18.2-specific antibody bought from KYM Biosciences last year that’s now in a phase 2 trial for solid tumors.

“We're making sure that we have what we think is the most robust portfolio of antibody-drug conjugates,” Fredrickson said. “We think that Enhertu and Dato are two of the obvious leaders, but we have our own wholly owned antibody-drug conjugates that we think have compelling payload-linker combinations and also compelling targets that are going to complement the work that we're doing in lung cancer, breast cancer, GI cancers and gynecologic malignancies—areas that we have strong leadership positions.”

“Enhertu, Dato and our wholly owned ADCs represent for us where we want to be placing our bets for the future of this class,” Fredrickson added.

ADCPhase 3Phase 2

25 May 2023

TAGRISSO® (osimertinib) plenary presentation will demonstrate significantly improved overall survival for patients with early-stage resectable EGFR-mutated lung cancer

ENHERTU® (fam-trastuzumab deruxtecan-nxki) will show potential across a broad range of advanced HER2-expressing advanced cancers

LYNPARZA® (olaparib) and IMFINZI® (durvalumab) combination will demonstrate delay in progression in newly diagnosed advanced ovarian cancer without a tumor BRCA mutation

WILMINGTON, Del.--(BUSINESS WIRE)-- AstraZeneca Pharmaceuticals LP advances its ambition to revolutionize cancer care with new data across its industry-leading portfolio of cancer medicines at the American Society of Clinical Oncology (ASCO) Annual Meeting, June 2 to 6, 2023.

More than 130 abstracts will feature 22 approved and potential new medicines across the Company’s diverse oncology portfolio and pipeline, including 11 oral presentations and a late-breaking plenary presentation of overall survival (OS) results from the ADAURA Phase III trial of TAGRISSO® (osimertinib) in the adjuvant treatment of patients with early-stage epidermal growth factor receptor-mutated (EGFRm) lung cancer.

Dave Fredrickson, Executive Vice President, Oncology Business Unit, AstraZeneca, said: “Our unwavering commitment to continually raising the standard of cancer care for patients with high unmet needs is evident in our data at ASCO this year. With our leading portfolio of medicines in lung cancer, our ambition is to have the right AstraZeneca medicine for more than half of all patients with this disease by 2030. We will showcase significant steps toward that goal with overall survival data from ADAURA that reinforce TAGRISSO as the backbone therapy in EGFR-mutated lung cancer.”

Susan Galbraith, Executive Vice President, Oncology R&D, AstraZeneca, said: “We are extending the benefits of our practice-changing cancer medicines, including TAGRISSO, IMFINZI and LYNPARZA, while also investing in new scientific platforms such as T-cell engagers and cell therapy to attack cancer from multiple angles and advance the next wave of options for patients. At ASCO, the extraordinary momentum for our antibody drug conjugate collaboration portfolio continues with data for ENHERTU underscoring its potential across many HER2-expressing tumor types beyond breast, lung and gastric, and updated results for datopotamab deruxtecan that reinforce our confidence in this TROP2-directed treatment.”

Improving outcomes across lung cancer settings

A late-breaking plenary presentation will showcase OS results from the ADAURA Phase III trial evaluating TAGRISSO in early-stage (IB, II and IIIA) EGFR-mutated non-small cell lung cancer (NSCLC).

Several posters will describe trials-in-progress of IMFINZI® (durvalumab) that further reinforce the Company’s progress toward moving lung cancer treatment to earlier stages of disease. These include NeoCOAST-2 evaluating IMFINZI in multiple novel immunotherapy combinations in resectable, early-stage NSCLC; PACIFIC-4 in combination with standard of care stereotactic body radiation therapy in medically unresectable Stage I/II NSCLC; PACIFIC-8 in combination with anti-TIGIT monoclonal antibody domvanalimab in unresectable Stage III NSCLC; and PACIFIC-9 in combination with novel immunotherapies oleclumab or monalizumab in patients with unresectable Stage III NSCLC.

Additionally, several presentations and posters will highlight the Company’s commitment to improving outcomes in advanced lung cancer with next-wave treatments and novel combinations. These include:

An oral presentation of updated results from the TROPION-Lung02 Phase Ib dose escalation and expansion trial of datopotamab deruxtecan (Dato-DXd) in combination with pembrolizumab with or without platinum chemotherapy in patients with previously untreated or pretreated, advanced or metastatic NSCLC without actionable genomic alterations. TROPION-Lung02 is the first trial to show results for an antibody drug conjugate (ADC) plus an immune checkpoint inhibitor combination with or without chemotherapy in this setting.

Interim results from the ARTEMIDE-01 Phase I trial assessing rilvegostomig (AZD2936), a PD-1/TIGIT bispecific antibody, in patients with advanced or metastatic NSCLC. The Company is advancing rilvegostomig into Phase III development this year.

A trial-in-progress poster describing the EGRET Phase I trial, a first-in-human study evaluating AZD9592, an EGFR/cMET bispecific ADC, in patients with advanced solid tumors including in combination with TAGRISSO in metastatic EGFRm NSCLC. This is the Company’s first bispecific ADC to enter the clinic and has shown a promising efficacy and safety pro preclinical models.

A trial-in-progress poster describing the LATIFY Phase III trial of ceralasertib, an ataxia telangiectasia and rad3-related (ATR) kinase inhibitor, plus IMFINZI in patients with locally advanced or metastatic NSCLC who progressed on or after anti-PD-(L)1 and platinum-based therapy. This combination has previously demonstrated promising efficacy in this setting in the ongoing HUDSON Phase II trial.

A trial-in-progress poster detailing the TROPION-Lung04 Phase Ib dose escalation and expansion study of datopotamab deruxtecan in various immunotherapy combinations with or without carboplatin in patients with previously untreated advanced or metastatic NSCLC, including recently initiated cohorts with bispecific immunotherapies rilvegostomig and volrustomig.

Showcasing the potential of ENHERTU® (fam-trastuzumab deruxtecan-nxki) across multiple HER2-expressing tumors

Several presentations will reinforce the potential of ENHERTU in a broad range of HER2-expressing tumors with significant unmet need, including gynecological, genitourinary, gastrointestinal and breast cancers.

A late-breaking oral presentation of interim results from the DESTINY-PanTumor02 Phase II trial will highlight the efficacy and safety of ENHERTU in heavily pretreated patients across multiple HER2-expressing advanced solid tumors including biliary tract, bladder, cervical, endometrial, ovarian, pancreatic, and rare cancers. In March, ENHERTU met the prespecified target for objective response rate and demonstrated durable responses across multiple HER2-expressing tumor types in this trial.

Additionally, an oral presentation of primary results from the DESTINY-CRC02 Phase II trial will be presented, demonstrating the safety and efficacy of ENHERTU in patients with HER2-positive advanced colorectal cancer with progression following standard-of-care treatment. This trial was initiated based on positive data for ENHERTU in the DESTINY-CRC01 Phase II trial.

Another oral presentation will feature a pooled benefit-risk analysis from the DESTINY-Breast01, 02 and 03 trials of ENHERTU in patients with breast cancer aged 65 and older compared to those younger than 65.

Potential to transform outcomes across tumors by attacking cancer from multiple angles

A late-breaking oral presentation will feature interim progression-free survival (PFS) results from the DUO-O Phase III trial evaluating a combination of LYNPARZA® (olaparib), IMFINZI, chemotherapy and bevacizumab in newly diagnosed patients with advanced high-grade epithelial ovarian cancer without tumor BRCA mutations. In April, it was announced that DUO-O demonstrated a statistically significant and clinically meaningful improvement in PFS for this LYNPARZA and IMFINZI combination versus chemotherapy plus bevacizumab alone.

Data will be also shared from a post-hoc exploratory analysis of the SERENA-2 Phase II trial in patients with advanced ER-positive breast cancer who have disease recurrence or progression after endocrine therapy. The analysis will show PFS data for patients treated with next-generation selective estrogen receptor degrader (ngSERD) camizestrant versus fulvestrant based on the type of ESR1 mutation at baseline, detected via circulating tumor DNA. Previously presented primary results from SERENA-2 demonstrated PFS benefit with camizestrant irrespective of ESR1 mutation status or prior treatment with CDK4/6 inhibitors.

Data will also be shared from a matching-adjusted indirect comparison (MAIC) of the efficacy and safety of CALQUENCE® (acalabrutinib) versus zanubrutinib in relapsed or refractory chronic lymphocytic leukemia, based on data from the ASCEND and ALPINE Phase III trials.

In addition, interim Phase I results evaluating AZD0486 (TNB-486), a CD19/CD3 next-generation T-cell engager, will show the potential of targeting CD19 in heavily pretreated patients with follicular lymphoma.

Results from a Phase Ib/II dose escalation and expansion trial of the novel immunotherapy oleclumab in combination with IMFINZI and chemotherapy will also be presented in patients with metastatic pancreatic cancer, including those with high levels of CD73 expression.

A poster discussion will feature health-related quality-of-life results from the PROpel Phase III trial of LYNPARZA plus abiraterone in patients with metastatic castration-resistant prostate cancer.

Two presentations will focus on immune-mediated adverse events (imAEs) in the HIMALAYA Phase III trial of IMFINZI plus IMJUDO® (tremelimumab-actl) in 1st-line unresectable liver cancer, including an oral presentation on outcomes by imAE occurrence and a poster on temporal patterns of imAE occurrence.

Collaboration in the scientific community is critical to improving outcomes for patients. AstraZeneca is collaborating with Daiichi Sankyo Company Limited to develop and commercialize ENHERTU and datopotamab deruxtecan; with Merck & Co., Inc., known as MSD outside of the US and Canada, to develop and commercialize LYNPARZA. AstraZeneca obtained full oncology rights to monalizumab from Innate Pharma in October 2018 through a co-development and commercialization agreement initiated in 2015.

Key AstraZeneca presentations during ASCO 2023

Lead Author

Abstract Title

Presentation details (CDT)

Tumor drivers and resistance

Herbst, R

Overall survival analysis from the ADAURA trial of adjuvant osimertinib in patients with resected EGFR mutated‑ (EGFRm) stage IB–IIIA non-small cell lung cancer (NSCLC).

Abstract #LBA3

Plenary Session

June 4, 2023

2:17pm

Oliveira, M

Clinical activity of camizestrant, a next-generation SERD, versus fulvestrant in patients with a detectable ESR1 mutation: Exploratory analysis of the SERENA-2 Phase 2 trial.

Abstract #1066

Poster Session

Breast Cancer—Metastatic

June 4, 2023

8:00am

Antibody drug conjugates

Meric-Bernstam, F

Efficacy and safety of trastuzumab deruxtecan (T-DXd) in patients (pts) with HER2-expressing solid tumors: DESTINY-PanTumor02 (DP-02) interim results.

Abstract #LBA3000

Oral Abstract Session Developmental Therapeutics—Molecularly Targeted Agents and Tumor Biology

June 5, 2023

8:00am

Raghav, K

Trastuzumab deruxtecan (T-DXd) in patients (pts) with HER2-overexpressing/amplified (HER2+) metastatic colorectal cancer (mCRC): Primary results from the multicenter, randomized, Phase 2 DESTINY-CRC02 study.

Abstract #3501

Oral Abstract Session Gastrointestinal Cancer—Colorectal and Anal

June 4, 2023

8:12am

Krop, I

An age-specific pooled analysis of trastuzumab deruxtecan (T‑DXd) in patients (pts) with HER2-positive (HER2+) metastatic breast cancer (mBC) from DESTINY-Breast01, -02, and -03.

Abstract #1006

Oral Abstract Session Breast Cancer—Metastatic

June 5, 2023

1:30pm

Goto, Y

TROPION-Lung02: Datopotamab deruxtecan (Dato-DXd) plus pembrolizumab (pembro) with or without platinum chemotherapy (Pt-CT) in advanced non-small cell lung cancer (aNSCLC).

Abstract #9004

Oral Abstract Session Lung Cancer—Non-Small Cell Metastatic

June 6, 2023

10:57am

Aggarwal, C

EGRET: A first-in-human study of the novel antibody-drug conjugate (ADC) AZD9592 as monotherapy or combined with other anticancer agents in patients (pts) with advanced solid tumors.

Abstract #TPS3156

Poster Session Developmental Therapeutics—Molecularly Targeted Agents and Tumor Biology

June 3, 2023

8:00am

Borghaei, H

TROPION-Lung04: Phase 1b, multicenter study of datopotamab deruxtecan (Dato-DXd) in combination with immunotherapy ± carboplatin in advanced/metastatic non-small cell lung cancer (mNSCLC).

Abstract#TPS3158

Poster Session Developmental Therapeutics—Molecularly Targeted Agents and Tumor Biology

June 3, 2023

8:00am

DNA damage response

Harter, P

Durvalumab with paclitaxel/carboplatin (PC) and bevacizumab (bev), followed by maintenance durvalumab, bev, and olaparib in patients (pts) with newly diagnosed advanced ovarian cancer (AOC) without a tumor BRCA1/2 mutation (non-tBRCAm): Results from the randomized, placebo (pbo)-controlled Phase III DUO-O trial.

Abstract #LBA5506

Oral Abstract Session Gynecologic Cancer

June 3, 2023

5:12pm

Armstrong, A

Health-related quality of life (HRQoL) and pain outcomes for patients (pts) with metastatic castration-resistant prostate cancer (mCRPC) who received abiraterone (abi) and olaparib (ola) versus (vs) abi and placebo (pbo) in the Phase III PROpel trial.

Abstract #5012

Poster Discussion Genitourinary Cancer—Prostate, Testicular, and Penile Session

June 3, 2023

1:27pm

Immuno-Oncology

Hübner, H

RNA expression levels from peripheral immune cells, a minimally invasive liquid biopsy source to predict response to therapy, survival and immune-related adverse events in patients with triple negative breast cancer enrolled in the GeparNuevo trial.

Abstract #1011

Oral Abstract Session

Clinical Science Symposium: Harnessing the Breast Cancer Immune Response

June 3, 2023

1:51pm

Lau, G

Outcomes by occurrence of immune-mediated adverse events (imAEs) with tremelimumab (T) plus durvalumab (D) in the Phase 3 HIMALAYA study in unresectable hepatocellular carcinoma (uHCC).

Abstract #4004

Oral Abstract Session Gastrointestinal Cancer—Gastroesophageal, Pancreatic, and Hepatobiliary

June 2, 2023

3:57pm

Besse, B

LATIFY: Phase 3 study of ceralasertib + durvalumab vs docetaxel in patients with locally advanced or metastatic non-small-cell lung cancer that progressed on or after anti-PD-(L)1 and platinum-based therapy.

Abstract #TPS9161

Poster Session Lung Cancer—Non-Small Cell Metastatic

June 4, 2023

8:00am (CDT)

Rohrberg, K

Safety, pharmacokinetics (PK), pharmacodynamics (PD) and preliminary efficacy of AZD2936, a bispecific antibody targeting PD-1 and TIGIT, in checkpoint inhibitor (CPI)-experienced advanced/metastatic non-small-cell lung cancer (NSCLC): First report of ARTEMIDE-01.

Abstract #9050

Poster Session Lung Cancer—Non-Small Cell Metastatic

June 4, 2023

8:00am

Guisier, F

NeoCOAST-2: A Phase 2 study of neoadjuvant durvalumab plus novel immunotherapies (IO) and chemotherapy (CT) or MEDI5752 (volrustomig) plus CT, followed by surgery and adjuvant durvalumab plus novel IO or volrustomig alone in patients with resectable non-small-cell lung cancer (NSCLC).

Abstract #TPS8604

Poster Session Lung Cancer—Non-Small Cell Local Regional/Small Cell/Other Thoracic Cancers

June 4, 2023

8:00am

Robinson, C

Phase 3 study of durvalumab with SBRT for unresected stage I/II, lymph-node negative NSCLC (PACIFIC-4/RTOG3515).

Abstract #TPS8607

Poster Session Lung Cancer—Non-Small Cell Local-Regional/Small Cell/Other Thoracic Cancers

June 4, 2023

8:00am

Özgüroğlu, M

Phase 3 trial of durvalumab combined with domvanalimab following concurrent chemoradiotherapy (cCRT) in patients with unresectable stage III NSCLC (PACIFIC-8).

Abstract #TPS8609

Poster Session Lung Cancer—Non-Small Cell Local-Regional/Small Cell/Other Thoracic Cancers

June 4, 2023

8:00am

Barlesi, F

Phase 3 study of durvalumab combined with oleclumab or monalizumab in patients with unresectable stage III NSCLC (PACIFIC-9).

Abstract #TPS8610

Poster Session Lung Cancer—Non-Small Cell Local-Regional/Small Cell/Other Thoracic Cancers

June 4, 2023

8:00am

Ganti, A

The prognostic value of patient reported outcomes (PROs) and clinical/demographic variables in the CASPIAN study.

Abstract #8516

Poster Discussion Session Lung Cancer—Non-Small Cell Local-Regional/Small Cell/Other Thoracic Cancers

June 4, 2023

11:45am

Lau, G

Temporal patterns of immune-mediated adverse events (imAEs) with tremelimumab (T) plus durvalumab (D) in the Phase 3 HIMALAYA study in unresectable hepatocellular carcinoma (uHCC).

Abstract #4073

Poster Session Gastrointestinal Cancer—Gastroesophageal, Pancreatic, and Hepatobiliary

June 5, 2023

8:00am

Coveler, A

Safety and clinical activity of oleclumab (O) ± durvalumab (D) + chemotherapy (CT) in patients (pts) with metastatic pancreatic ductal adenocarcinoma (mPDAC): A Phase 1b/2 randomized study.

Abstract #4136

Poster Session Gastrointestinal Cancer—Gastroesophageal, Pancreatic, and Hepatobiliary

June 5, 2023

8:00am

Hematology

Kittai, A

A matching-adjusted indirect comparison (MAIC) of the efficacy and safety of acalabrutinib (acala) versus zanubrutinib (zanu) in relapsed or refractory chronic lymphocytic leukemia (RR CLL).

Abstract #7540

Poster Session Hematologic Malignancies—Lymphoma and Chronic Lymphocytic Leukemia

June 5, 2023

8:00am

Nair, R

High complete response rate with TNB-486 in relapsed/refractory follicular lymphoma: Interim results an ongoing Phase 1 study.

Abstract #7524

Poster Session Hematologic Malignancies—Lymphoma and Chronic Lymphocytic Leukemia

June 5, 2023

8:00am

SELECT SAFETY INFORMATION FOR TAGRISSO® (osimertinib)

There are no contraindications for TAGRISSO

TAGRISSO is associated with several serious and sometimes fatal adverse reactions, including interstitial lung disease (ILD)/pneumonitis, QTc interval prolongation, cardiomyopathy, keratitis, erythema multiforme and Stevens-Johnson syndrome, cutaneous vasculitis, aplastic anemia, and embryo-fetal toxicity

The most common (≥20%) adverse reactions, including lab abnormalities, were leukopenia, lymphopenia, thrombocytopenia, diarrhea, anemia, rash, musculoskeletal pain, nail toxicity, neutropenia, dry skin, stomatitis, fatigue, and cough

INDICATIONS

TAGRISSO is indicated as adjuvant therapy after tumor resection in adult patients with non-small cell lung cancer (NSCLC) whose tumors have epidermal growth factor receptor (EGFR) exon 19 deletions or exon 21 L858R mutations, as detected by an FDA-approved test

TAGRISSO is indicated for the first-line treatment of adult patients with metastatic non-small cell lung cancer (NSCLC) whose tumors have epidermal growth factor receptor (EGFR) exon 19 deletions or exon 21 L858R mutations, as detected by an FDA-approved test

TAGRISSO is indicated for the treatment of adult patients with metastatic EGFR T790M mutation-positive NSCLC, as detected by an FDA-approved test, whose disease has progressed on or after EGFR tyrosine kinase inhibitor (TKI) therapy

Please see the complete Important Safety Information on tagrisso.com and complete Prescribing Information, including Patient Information for TAGRISSO.

IMPORTANT SAFETY INFORMATION FOR ENHERTU® (fam-trastuzumab deruxtecan-nxki)

Indications

ENHERTU is a HER2-directed antibody and topoisomerase inhibitor conjugate indicated for the treatment of adult patients with:

Unresectable or metastatic HER2-positive breast cancer who have received a prior anti-HER2-based regimen either:

– In the metastatic setting, or

– In the neoadjuvant or adjuvant setting and have developed disease recurrence during or within six months of completing therapy

Unresectable or metastatic HER2-low (IHC 1+ or IHC 2+/ISH-) breast cancer, as determined by an FDA-approved test, who have received a prior chemotherapy in the metastatic setting or developed disease recurrence during or within 6 months of completing adjuvant chemotherapy

Unresectable or metastatic non-small cell lung cancer (NSCLC) whose tumors have activating HER2 (ERBB2) mutations, as detected by an FDA-approved test, and who have received a prior systemic therapy

This indication is approved under accelerated approval based on objective response rate and duration of response. Continued approval for this indication may be contingent upon verification and description of clinical benefit in a confirmatory trial.

Locally advanced or metastatic HER2-positive gastric or gastroesophageal junction adenocarcinoma who have received a prior trastuzumab-based regimen

WARNING: INTERSTITIAL LUNG DISEASE and EMBRYO-FETAL TOXICITY

Interstitial lung disease (ILD) and pneumonitis, including fatal cases, have been reported with ENHERTU. Monitor for and promptly investigate signs and symptoms including cough, dyspnea, fever, and other new or worsening respiratory symptoms. Permanently discontinue ENHERTU in all patients with Grade 2 or higher ILD/pneumonitis. Advise patients of the risk and to immediately report symptoms.

Exposure to ENHERTU during pregnancy can cause embryo-fetal harm. Advise patients of these risks and the need for effective contraception.

Contraindications

None.

Warnings and Precautions

Interstitial Lung Disease / Pneumonitis

Severe, life-threatening, or fatal interstitial lung disease (ILD), including pneumonitis, can occur in patients treated with ENHERTU. A higher incidence of Grade 1 and 2 ILD/pneumonitis has been observed in patients with moderate renal impairment. Advise patients to immediately report cough, dyspnea, fever, and/or any new or worsening respiratory symptoms. Monitor patients for signs and symptoms of ILD. Promptly investigate evidence of ILD. Evaluate patients with suspected ILD by radiographic imaging. Consider consultation with a pulmonologist. For asymptomatic ILD/pneumonitis (Grade 1), interrupt ENHERTU until resolved to Grade 0, then if resolved in ≤28 days from date of onset, maintain dose. If resolved in >28 days from date of onset, reduce dose one level. Consider corticosteroid treatment as soon as ILD/pneumonitis is suspected (e.g., ≥0.5 mg/kg/day prednisolone or equivalent). For symptomatic ILD/pneumonitis (Grade 2 or greater), permanently discontinue ENHERTU. Promptly initiate systemic corticosteroid treatment as soon as ILD/pneumonitis is suspected (e.g., ≥1 mg/kg/day prednisolone or equivalent) and continue for at least 14 days followed by gradual taper for at least 4 weeks.

Metastatic Breast Cancer and HER2-Mutant NSCLC (5.4 mg/kg)

In patients with metastatic breast cancer and HER2-mutant NSCLC treated with ENHERTU 5.4 mg/kg, ILD occurred in 12% of patients. Fatal outcomes due to ILD and/or pneumonitis occurred in 1.0% of patients treated with ENHERTU. Median time to first onset was 5 months (range: 0.9 to 23).

Locally Advanced or Metastatic Gastric Cancer (6.4 mg/kg)

In patients with locally advanced or metastatic HER2-positive gastric or GEJ adenocarcinoma treated with ENHERTU 6.4 mg/kg, ILD occurred in 10% of patients. Median time to first onset was 2.8 months (range: 1.2 to 21).

Neutropenia

Severe neutropenia, including febrile neutropenia, can occur in patients treated with ENHERTU. Monitor complete blood counts prior to initiation of ENHERTU and prior to each dose, and as clinically indicated. For Grade 3 neutropenia (Absolute Neutrophil Count [ANC] <1.0 to 0.5 x 109/L), interrupt ENHERTU until resolved to Grade 2 or less, then maintain dose. For Grade 4 neutropenia (ANC <0.5 x 109/L), interrupt ENHERTU until resolved to Grade 2 or less, then reduce dose by one level. For febrile neutropenia (ANC <1.0 x 109/L and temperature >38.3º C or a sustained temperature of ≥38º C for more than 1 hour), interrupt ENHERTU until resolved, then reduce dose by one level.

Metastatic Breast Cancer and HER2-Mutant NSCLC (5.4 mg/kg)

In patients with metastatic breast cancer and HER2-mutant NSCLC treated with ENHERTU 5.4 mg/kg, a decrease in neutrophil count was reported in 65% of patients. Sixteen percent had Grade 3 or 4 decreased neutrophil count. Median time to first onset of decreased neutrophil count was 22 days (range: 2 to 664). Febrile neutropenia was reported in 1.1% of patients.

Locally Advanced or Metastatic Gastric Cancer (6.4 mg/kg)

In patients with locally advanced or metastatic HER2-positive gastric or GEJ adenocarcinoma treated with ENHERTU 6.4 mg/kg, a decrease in neutrophil count was reported in 72% of patients. Fifty-one percent had Grade 3 or 4 decreased neutrophil count. Median time to first onset of decreased neutrophil count was 16 days (range: 4 to 187). Febrile neutropenia was reported in 4.8% of patients.

Left Ventricular Dysfunction

Patients treated with ENHERTU may be at increased risk of developing left ventricular dysfunction. Left ventricular ejection fraction (LVEF) decrease has been observed with anti-HER2 therapies, including ENHERTU. Assess LVEF prior to initiation of ENHERTU and at regular intervals during treatment as clinically indicated. Manage LVEF decrease through treatment interruption. When LVEF is >45% and absolute decrease from baseline is 10-20%, continue treatment with ENHERTU. When LVEF is 40-45% and absolute decrease from baseline is <10%, continue treatment with ENHERTU and repeat LVEF assessment within 3 weeks. When LVEF is 40-45% and absolute decrease from baseline is 10-20%, interrupt ENHERTU and repeat LVEF assessment within 3 weeks. If LVEF has not recovered to within 10% from baseline, permanently discontinue ENHERTU. If LVEF recovers to within 10% from baseline, resume treatment with ENHERTU at the same dose. When LVEF is <40% or absolute decrease from baseline is >20%, interrupt ENHERTU and repeat LVEF assessment within 3 weeks. If LVEF of <40% or absolute decrease from baseline of >20% is confirmed, permanently discontinue ENHERTU. Permanently discontinue ENHERTU in patients with symptomatic congestive heart failure. Treatment with ENHERTU has not been studied in patients with a history of clinically significant cardiac disease or LVEF <50% prior to initiation of treatment.

Metastatic Breast Cancer and HER2-Mutant NSCLC (5.4 mg/kg)

In patients with metastatic breast cancer and HER2-mutant NSCLC treated with ENHERTU 5.4 mg/kg, LVEF decrease was reported in 3.6% of patients, of which 0.4% were Grade 3.

Locally Advanced or Metastatic Gastric Cancer (6.4 mg/kg)

In patients with locally advanced or metastatic HER2-positive gastric or GEJ adenocarcinoma treated with ENHERTU 6.4 mg/kg, no clinical adverse events of heart failure were reported; however, on echocardiography, 8% were found to have asymptomatic Grade 2 decrease in LVEF.

Embryo-Fetal Toxicity

ENHERTU can cause fetal harm when administered to a pregnant woman. Advise patients of the potential risks to a fetus. Verify the pregnancy status of females of reproductive potential prior to the initiation of ENHERTU. Advise females of reproductive potential to use effective contraception during treatment and for 7 months after the last dose of ENHERTU. Advise male patients with female partners of reproductive potential to use effective contraception during treatment with ENHERTU and for 4 months after the last dose of ENHERTU.

Additional Dose Modifications

Thrombocytopenia

For Grade 3 thrombocytopenia (platelets <50 to 25 x 109/L) interrupt ENHERTU until resolved to Grade 1 or less, then maintain dose. For Grade 4 thrombocytopenia (platelets <25 x 109/L) interrupt ENHERTU until resolved to Grade 1 or less, then reduce dose by one level.

Adverse Reactions

Metastatic Breast Cancer and HER2-Mutant NSCLC (5.4 mg/kg)

The pooled safety population reflects exposure to ENHERTU 5.4 mg/kg intravenously every 3 weeks in 984 patients in Study DS8201-A-J101 (NCT02564900), DESTINY-Breast01, DESTINY-Breast03, DESTINY-Breast04, and DESTINY-Lung02. Among these patients 65% were exposed for >6 months and 39% were exposed for >1 year. In this pooled safety population, the most common (≥20%) adverse reactions, including laboratory abnormalities, were nausea (76%), decreased white blood cell count (71%), decreased hemoglobin (66%), decreased neutrophil count (65%), decreased lymphocyte count (55%), fatigue (54%), decreased platelet count (47%), increased aspartate aminotransferase (48%), vomiting (44%), increased alanine aminotransferase (42%), alopecia (39%), increased blood alkaline phosphatase (39%), constipation (34%), musculoskeletal pain (32%), decreased appetite (32%), hypokalemia (28%), diarrhea (28%), and respiratory infection (24%).

HER2-Positive Metastatic Breast Cancer

DESTINY-Breast03

The safety of ENHERTU was evaluated in 257 patients with unresectable or metastatic HER2-positive breast cancer who received at least one dose of ENHERTU 5.4 mg/kg intravenously every three weeks in DESTINY-Breast03. The median duration of treatment was 14 months (range: 0.7 to 30).

Serious adverse reactions occurred in 19% of patients receiving ENHERTU. Serious adverse reactions in >1% of patients who received ENHERTU were vomiting, interstitial lung disease, pneumonia, pyrexia, and urinary tract infection. Fatalities due to adverse reactions occurred in 0.8% of patients including COVID-19 and sudden death (one patient each).

ENHERTU was permanently discontinued in 14% of patients, of which ILD/pneumonitis accounted for 8%. Dose interruptions due to adverse reactions occurred in 44% of patients treated with ENHERTU. The most frequent adverse reactions (>2%) associated with dose interruption were neutropenia, leukopenia, anemia, thrombocytopenia, pneumonia, nausea, fatigue, and ILD/pneumonitis. Dose reductions occurred in 21% of patients treated with ENHERTU. The most frequent adverse reactions (>2%) associated with dose reduction were nausea, neutropenia, and fatigue.

The most common (≥20%) adverse reactions, including laboratory abnormalities, were nausea (76%), decreased white blood cell count (74%), decreased neutrophil count (70%), increased aspartate aminotransferase (67%), decreased hemoglobin (64%), decreased lymphocyte count (55%), increased alanine aminotransferase (53%), decreased platelet count (52%), fatigue (49%), vomiting (49%), increased blood alkaline phosphatase (49%), alopecia (37%), hypokalemia (35%), constipation (34%), musculoskeletal pain (31%), diarrhea (29%), decreased appetite (29%), respiratory infection (22%), headache (22%), abdominal pain (21%), increased blood bilirubin (20%), and stomatitis (20%).

HER2-Low Metastatic Breast Cancer

DESTINY-Breast04

The safety of ENHERTU was evaluated in 371 patients with unresectable or metastatic HER2-low (IHC 1+ or IHC 2+/ISH-) breast cancer who received ENHERTU 5.4 mg/kg intravenously every 3 weeks in DESTINY-Breast04. The median duration of treatment was 8 months (range: 0.2 to 33) for patients who received ENHERTU.

Serious adverse reactions occurred in 28% of patients receiving ENHERTU. Serious adverse reactions in >1% of patients who received ENHERTU were ILD/pneumonitis, pneumonia, dyspnea, musculoskeletal pain, sepsis, anemia, febrile neutropenia, hypercalcemia, nausea, pyrexia, and vomiting. Fatalities due to adverse reactions occurred in 4% of patients including ILD/pneumonitis (3 patients); sepsis (2 patients); and ischemic colitis, disseminated intravascular coagulation, dyspnea, febrile neutropenia, general physical health deterioration, pleural effusion, and respiratory failure (1 patient each).

ENHERTU was permanently discontinued in 16% of patients, of which ILD/pneumonitis accounted for 8%. Dose interruptions due to adverse reactions occurred in 39% of patients treated with ENHERTU. The most frequent adverse reactions (>2%) associated with dose interruption were neutropenia, fatigue, anemia, leukopenia, COVID-19, ILD/pneumonitis, increased transaminases, and hyperbilirubinemia. Dose reductions occurred in 23% of patients treated with ENHERTU. The most frequent adverse reactions (>2%) associated with dose reduction were fatigue, nausea, thrombocytopenia, and neutropenia.

The most common (≥20%) adverse reactions, including laboratory abnormalities, were nausea (76%), decreased white blood cell count (70%), decreased hemoglobin (64%), decreased neutrophil count (64%), decreased lymphocyte count (55%), fatigue (54%), decreased platelet count (44%), alopecia (40%), vomiting (40%), increased aspartate aminotransferase (38%), increased alanine aminotransferase (36%), constipation (34%), increased blood alkaline phosphatase (34%), decreased appetite (32%), musculoskeletal pain (32%), diarrhea (27%), and hypokalemia (25%).

Unresectable or Metastatic HER2-Mutant NSCLC (5.4 mg/kg)

DESTINY-Lung02 evaluated two dose levels (5.4 mg/kg [n=101] and 6.4 mg/kg [n=50]); however, only the results for the recommended dose of 5.4 mg/kg intravenously every 3 weeks are described below due to increased toxicity observed with the higher dose in patients with NSCLC, including ILD/pneumonitis.

The safety of ENHERTU was evaluated in 101 patients with unresectable or metastatic HER2-mutant NSCLC who received ENHERTU 5.4 mg/kg intravenously every three weeks in DESTINY‑Lung02. Nineteen percent of patients were exposed for >6 months.

Serious adverse reactions occurred in 30% of patients receiving ENHERTU. Serious adverse reactions in >1% of patients who received ENHERTU were ILD/pneumonitis, thrombocytopenia, dyspnea, nausea, pleural effusion, and increased troponin I. Fatality occurred in 1 patient with suspected ILD/pneumonitis (1%).

ENHERTU was permanently discontinued in 8% of patients. Adverse reactions which resulted in permanent discontinuation of ENHERTU were ILD/pneumonitis, diarrhea, hypokalemia, hypomagnesemia, myocarditis, and vomiting. Dose interruptions of ENHERTU due to adverse reactions occurred in 23% of patients. Adverse reactions which required dose interruption (>2%) included neutropenia and ILD/pneumonitis. Dose reductions due to an adverse reaction occurred in 11% of patients.

The most common (≥20%) adverse reactions, including laboratory abnormalities, were nausea (61%), decreased white blood cell count (60%), decreased hemoglobin (58%), decreased neutrophil count (52%), decreased lymphocyte count (43%), decreased platelet count (40%), decreased albumin (39%), increased aspartate aminotransferase (35%), increased alanine aminotransferase (34%), fatigue (32%), constipation (31%), decreased appetite (30%), vomiting (26%), increased alkaline phosphatase (22%), and alopecia (21%).

Locally Advanced or Metastatic Gastric Cancer (6.4 mg/kg)

The safety of ENHERTU was evaluated in 187 patients with locally advanced or metastatic HER2-positive gastric or GEJ adenocarcinoma in DESTINY-Gastric01. Patients intravenously received at least one dose of either ENHERTU (N=125) 6.4 mg/kg every 3 weeks or either irinotecan (N=55) 150 mg/m2 biweekly or paclitaxel (N=7) 80 mg/m2 weekly for 3 weeks. The median duration of treatment was 4.6 months (range: 0.7 to 22.3) for patients who received ENHERTU.

Serious adverse reactions occurred in 44% of patients receiving ENHERTU 6.4 mg/kg. Serious adverse reactions in >2% of patients who received ENHERTU were decreased appetite, ILD, anemia, dehydration, pneumonia, cholestatic jaundice, pyrexia, and tumor hemorrhage. Fatalities due to adverse reactions occurred in 2.4% of patients: disseminated intravascular coagulation, large intestine perforation, and pneumonia occurred in one patient each (0.8%).

ENHERTU was permanently discontinued in 15% of patients, of which ILD accounted for 6%. Dose interruptions due to adverse reactions occurred in 62% of patients treated with ENHERTU. The most frequent adverse reactions (>2%) associated with dose interruption were neutropenia, anemia, decreased appetite, leukopenia, fatigue, thrombocytopenia, ILD, pneumonia, lymphopenia, upper respiratory tract infection, diarrhea, and hypokalemia. Dose reductions occurred in 32% of patients treated with ENHERTU. The most frequent adverse reactions (>2%) associated with dose reduction were neutropenia, decreased appetite, fatigue, nausea, and febrile neutropenia.

The most common (≥20%) adverse reactions, including laboratory abnormalities, were decreased hemoglobin (75%), decreased white blood cell count (74%), decreased neutrophil count (72%), decreased lymphocyte count (70%), decreased platelet count (68%), nausea (63%), decreased appetite (60%), increased aspartate aminotransferase (58%), fatigue (55%), increased blood alkaline phosphatase (54%), increased alanine aminotransferase (47%), diarrhea (32%), hypokalemia (30%), vomiting (26%), constipation (24%), increased blood bilirubin (24%), pyrexia (24%), and alopecia (22%).

Use in Specific Populations

Pregnancy: ENHERTU can cause fetal harm when administered to a pregnant woman. Advise patients of the potential risks to a fetus. There are clinical considerations if ENHERTU is used in pregnant women, or if a patient becomes pregnant within 7 months after the last dose of ENHERTU.

Lactation: There are no data regarding the presence of ENHERTU in human milk, the effects on the breastfed child, or the effects on milk production. Because of the potential for serious adverse reactions in a breastfed child, advise women not to breastfeed during treatment with ENHERTU and for 7 months after the last dose.

Females and Males of Reproductive Potential: Pregnancy testing: Verify pregnancy status of females of reproductive potential prior to initiation of ENHERTU. Contraception: Females: ENHERTU can cause fetal harm when administered to a pregnant woman. Advise females of reproductive potential to use effective contraception during treatment with ENHERTU and for 7 months after the last dose. Males: Advise male patients with female partners of reproductive potential to use effective contraception during treatment with ENHERTU and for 4 months after the last dose. Infertility: ENHERTU may impair male reproductive function and fertility.

Pediatric Use: Safety and effectiveness of ENHERTU have not been established in pediatric patients.

Geriatric Use: Of the 883 patients with breast cancer treated with ENHERTU 5.4 mg/kg, 22% were ≥65 years and 3.6% were ≥75 years. No overall differences in efficacy within clinical studies were observed between patients ≥65 years of age compared to younger patients. There was a higher incidence of Grade 3-4 adverse reactions observed in patients aged ≥65 years (60%) as compared to younger patients (48%). Of the 101 patients with unresectable or metastatic HER2-mutant NSCLC treated with ENHERTU 5.4 mg/kg, 40% were ≥65 years and 8% were ≥75 years. No overall differences in efficacy or safety were observed between patients ≥65 years of age compared to younger patients. Of the 125 patients with locally advanced or metastatic HER2-positive gastric or GEJ adenocarcinoma treated with ENHERTU 6.4 mg/kg in DESTINY-Gastric01, 56% were ≥65 years and 14% were ≥75 years. No overall differences in efficacy or safety were observed between patients ≥65 years of age compared to younger patients.

Renal Impairment: A higher incidence of Grade 1 and 2 ILD/pneumonitis has been observed in patients with moderate renal impairment. Monitor patients with moderate renal impairment more frequently. The recommended dosage of ENHERTU has not been established for patients with severe renal impairment (CLcr <30 mL/min).

Hepatic Impairment: In patients with moderate hepatic impairment, due to potentially increased exposure, closely monitor for increased toxicities related to the topoisomerase inhibitor. The recommended dosage of ENHERTU has not been established for patients with severe hepatic impairment (total bilirubin >3 times ULN and any AST).

To report SUSPECTED ADVERSE REACTIONS, contact Daiichi Sankyo, Inc. at 1-877-437-7763 or FDA at 1-800-FDA-1088 or fda.gov/medwatch.

Please see Full Prescribing Information, including Boxed WARNINGS, and Medication Guide.

SELECT SAFETY INFORMATION FOR LYNPARZA® (olaparib)

LYNPARZA is indicated:

- as maintenance therapy for women with BRCAm* advanced ovarian cancer after response to platinum-based chemotherapy

- in combination with bevacizumab as maintenance therapy for women with HRD+* advanced ovarian cancer after response to platinum-based chemotherapy

- as maintenance treatment of women with recurrent ovarian cancer after response to platinum-based chemotherapy

- for the adjuvant treatment of adult patients with deleterious or suspected deleterious gBRCAm,* HER2-negative high-risk early breast cancer who have been treated with neoadjuvant or adjuvant chemotherapy

- for the treatment of patients with gBRCAm,* HER2-negative metastatic breast cancer after receiving chemotherapy in the neoadjuvant, adjuvant, or metastatic setting and endocrine therapy, if appropriate

- as maintenance therapy for gBRCAm* metastatic pancreatic cancer that has not progressed cancer after 16 weeks of platinum-based chemotherapy

- for the treatment of patients with HRR gene-mutated* metastatic castration-resistant prostate cancer who have progressed following prior treatment with enzalutamide or abiraterone

*Select patients for this indication based on an FDA-approved companion diagnostic.

Select Safety Information

Serious and potentially fatal adverse events included:

Myelodysplastic syndrome/acute myeloid leukemia (MDS/AML): Monitor patients for hematological toxicity at baseline and monthly thereafter. Discontinue if MDS/AML is confirmed

Pneumonitis: Interrupt treatment if pneumonitis is suspected. Discontinue if pneumonitis is confirmed

Venous Thromboembolic Events: Including severe or fatal pulmonary embolism (PE). Monitor patients for signs and symptoms of venous thrombosis and PE, and treat as medically appropriate

Advise patients of the potential risk of embryo-fetal toxicity and to use effective contraception

Most common adverse reactions (≥10%) in clinical trials:

as a single agent were nausea, fatigue (including asthenia), anemia, vomiting, diarrhea, decreased appetite, headache, dysgeusia, cough, neutropenia, dyspnea, dizziness, dyspepsia, leukopenia, and thrombocytopenia

in combination with bevacizumab were nausea, fatigue (including asthenia), anemia, lymphopenia, vomiting, diarrhea, neutropenia, leukopenia, urinary tract infection, and headache

Please see the complete Important Safety Information on lynparza.com and complete Prescribing Information, including Medication Guide.

IMPORTANT SAFETY INFORMATION FOR IMFINZI® (durvalumab) and IMJUDO® (tremelimumab-actl)

There are no contraindications for IMFINZI® (durvalumab) or IMJUDO® (tremelimumab-actl).

Severe and Fatal Immune-Mediated Adverse Reactions

Important immune-mediated adverse reactions listed under Warnings and Precautions may not include all possible severe and fatal immune-mediated reactions. Immune-mediated adverse reactions, which may be severe or fatal, can occur in any organ system or tissue. Immune-mediated adverse reactions can occur at any time after starting treatment or after discontinuation. Monitor patients closely for symptoms and signs that may be clinical manifestations of underlying immune-mediated adverse reactions. Evaluate clinical chemistries including liver enzymes, creatinine, adrenocorticotropic hormone (ACTH) level, and thyroid function at baseline and before each dose. In cases of suspected immune-mediated adverse reactions, initiate appropriate workup to exclude alternative etiologies, including infection. Institute medical management promptly, including specialty consultation as appropriate. Withhold or permanently discontinue IMFINZI and IMJUDO depending on severity. See USPI Dosing and Administration for specific details. In general, if IMFINZI and IMJUDO requires interruption or discontinuation, administer systemic corticosteroid therapy (1 mg to 2 mg/kg/day prednisone or equivalent) until improvement to Grade 1 or less. Upon improvement to Grade 1 or less, initiate corticosteroid taper and continue to taper over at least 1 month. Consider administration of other systemic immunosuppressants in patients whose immune-mediated adverse reactions are not controlled with corticosteroid therapy.

Immune-Mediated Pneumonitis

IMFINZI and IMJUDO can cause immune-mediated pneumonitis, which may be fatal. The incidence of pneumonitis is higher in patients who have received prior thoracic radiation.

IMFINZI as a Single Agent

In patients who did not receive recent prior radiation, the incidence of immune-mediated pneumonitis was 2.4% (34/1414), including fatal (<0.1%), and Grade 3-4 (0.4%) adverse reactions. In patients who received recent prior radiation, the incidence of pneumonitis (including radiation pneumonitis) in patients with unresectable Stage III NSCLC following definitive chemoradiation within 42 days prior to initiation of IMFINZI in PACIFIC was 18.3% (87/475) in patients receiving IMFINZI and 12.8% (30/234) in patients receiving placebo. Of the patients who received IMFINZI (475), 1.1% were fatal and 2.7% were Grade 3 adverse reactions.

The frequency and severity of immune-mediated pneumonitis in patients who did not receive definitive chemoradiation prior to IMFINZI were similar in patients who received IMFINZI as a single agent or with ES-SCLC or BTC when in combination with chemotherapy.

IMFINZI with IMJUDO

Immune‑mediated pneumonitis occurred in 1.3% (5/388) of patients receiving IMFINZI and IMJUDO, including fatal (0.3%) and Grade 3 (0.2%) adverse reactions.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Immune-mediated pneumonitis occurred in 3.5% (21/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy, including fatal (0.5%), and Grade 3 (1%) adverse reactions.

Immune-Mediated Colitis

IMFINZI and IMJUDO can cause immune-mediated colitis that is frequently associated with diarrhea. Cytomegalovirus (CMV) infection/reactivation has been reported in patients with corticosteroid-refractory immune-mediated colitis. In cases of corticosteroid-refractory colitis, consider repeating infectious workup to exclude alternative etiologies.

IMFINZI as a Single Agent

Immune-mediated colitis occurred in 2% (37/1889) of patients receiving IMFINZI, including Grade 4 (<0.1%) and Grade 3 (0.4%) adverse reactions.

IMFINZI with IMJUDO

Immune‑mediated colitis or diarrhea occurred in 6% (23/388) of patients receiving IMFINZI and IMJUDO, including Grade 3 (3.6%) adverse reactions. Intestinal perforation has been observed in other studies of IMFINZI and IMJUDO.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Immune-mediated colitis occurred in 6.5% (39/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy including fatal (0.2%) and Grade 3 (2.5%) adverse reactions. Intestinal perforation and large intestine perforation were reported in 0.1% of patients.

Immune-Mediated Hepatitis

IMFINZI and IMJUDO can cause immune-mediated hepatitis, which may be fatal.

IMFINZI as a Single Agent

Immune-mediated hepatitis occurred in 2.8% (52/1889) of patients receiving IMFINZI, including fatal (0.2%), Grade 4 (0.3%) and Grade 3 (1.4%) adverse reactions.

IMFINZI with IMJUDO

Immune‑mediated hepatitis occurred in 7.5% (29/388) of patients receiving IMFINZI and IMJUDO, including fatal (0.8%), Grade 4 (0.3%) and Grade 3 (4.1%) adverse reactions.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Immune-mediated hepatitis occurred in 3.9% (23/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy, including fatal (0.3%), Grade 4 (0.5%), and Grade 3 (2%) adverse reactions.

Immune-Mediated Endocrinopathies

Adrenal Insufficiency: IMFINZI and IMJUDO can cause primary or secondary adrenal insufficiency. For Grade 2 or higher adrenal insufficiency, initiate symptomatic treatment, including hormone replacement as clinically indicated.

IMFINZI as a Single Agent

Immune-mediated adrenal insufficiency occurred in 0.5% (9/1889) of patients receiving IMFINZI, including Grade 3 (<0.1%) adverse reactions.

IMFINZI with IMJUDO

Immune-mediated adrenal insufficiency occurred in 1.5% (6/388) of patients receiving IMFINZI and IMJUDO, including Grade 3 (0.3%) adverse reactions.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Immune-mediated adrenal insufficiency occurred in 2.2% (13/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy, including Grade 3 (0.8%) adverse reactions.

Hypophysitis: IMFINZI and IMJUDO can cause immune-mediated hypophysitis. Hypophysitis can present with acute symptoms associated with mass effect such as headache, photophobia, or visual field cuts. Hypophysitis can cause hypopituitarism. Initiate symptomatic treatment including hormone replacement as clinically indicated.

IMFINZI as a Single Agent

Grade 3 hypophysitis/hypopituitarism occurred in <0.1% (1/1889) of patients who received IMFINZI.

IMFINZI with IMJUDO

Immune-mediated hypophysitis/hypopituitarism occurred in 1% (4/388) of patients receiving IMFINZI and IMJUDO.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Immune-mediated hypophysitis occurred in 1.3% (8/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy, including Grade 3 (0.5%) adverse reactions.

Thyroid Disorders (Thyroiditis, Hyperthyroidism, and Hypothyroidism): IMFINZI and IMJUDO can cause immune-mediated thyroid disorders. Thyroiditis can present with or without endocrinopathy. Hypothyroidism can follow hyperthyroidism. Initiate hormone replacement therapy for hypothyroidism or institute medical management of hyperthyroidism as clinically indicated.

IMFINZI as a Single Agent

Immune-mediated thyroiditis occurred in 0.5% (9/1889) of patients receiving IMFINZI, including Grade 3 (<0.1%) adverse reactions.

Immune-mediated hyperthyroidism occurred in 2.1% (39/1889) of patients receiving IMFINZI.

Immune-mediated hypothyroidism occurred in 8.3% (156/1889) of patients receiving IMFINZI, including Grade 3 (<0.1%) adverse reactions.

IMFINZI with IMJUDO

Immune-mediated thyroiditis occurred in 1.5% (6/388) of patients receiving IMFINZI and IMJUDO.

Immune-mediated hyperthyroidism occurred in 4.6% (18/388) of patients receiving IMFINZI and IMJUDO, including Grade 3 (0.3%) adverse reactions.

Immune-mediated hypothyroidism occurred in 11% (42/388) of patients receiving IMFINZI and IMJUDO.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Immune-mediated thyroiditis occurred in 1.2% (7/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy.

Immune-mediated hyperthyroidism occurred in 5% (30/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy, including Grade 3 (0.2%) adverse reactions.

Immune-mediated hypothyroidism occurred in 8.6% (51/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy, including Grade 3 (0.5%) adverse reactions.

Type 1 Diabetes Mellitus, which can present with diabetic ketoacidosis: Monitor patients for hyperglycemia or other signs and symptoms of diabetes. Initiate treatment with insulin as clinically indicated.

IMFINZI as a Single Agent

Grade 3 immune-mediated Type 1 diabetes mellitus occurred in <0.1% (1/1889) of patients receiving IMFINZI.

IMFINZI with IMJUDO

Two patients (0.5%, 2/388) had events of hyperglycemia requiring insulin therapy that had not resolved at last follow-up.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Immune-mediated Type 1 diabetes mellitus occurred in 0.5% (3/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy including Grade 3 (0.3%) adverse reactions.

Immune-Mediated Nephritis with Renal Dysfunction

IMFINZI and IMJUDO can cause immune-mediated nephritis.

IMFINZI as a Single Agent

Immune-mediated nephritis occurred in 0.5% (10/1889) of patients receiving IMFINZI, including Grade 3 (<0.1%) adverse reactions.

IMFINZI with IMJUDO

Immune-mediated nephritis occurred in 1% (4/388) of patients receiving IMFINZI and IMJUDO, including Grade 3 (0.5%) adverse reactions.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Immune-mediated nephritis occurred in 0.7% (4/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy, including Grade 3 (0.2%) adverse reactions.

Immune-Mediated Dermatology Reactions

IMFINZI and IMJUDO can cause immune-mediated rash or dermatitis. Exfoliative dermatitis, including Stevens-Johnson Syndrome (SJS), drug rash with eosinophilia and systemic symptoms (DRESS), and toxic epidermal necrolysis (TEN), have occurred with PD-1/L-1 and CTLA-4 blocking antibodies. Topical emollients and/or topical corticosteroids may be adequate to treat mild to moderate non-exfoliative rashes.

IMFINZI as a Single Agent

Immune-mediated rash or dermatitis occurred in 1.8% (34/1889) of patients receiving IMFINZI, including Grade 3 (0.4%) adverse reactions.

IMFINZI with IMJUDO

Immune-mediated rash or dermatitis occurred in 4.9% (19/388) of patients receiving IMFINZI and IMJUDO, including Grade 4 (0.3%) and Grade 3 (1.5%) adverse reactions.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Immune-mediated rash or dermatitis occurred in 7.2% (43/596) of patients receiving IMFINZI in combination with IMJUDO in combination with platinum-based chemotherapy, including Grade 3 (0.3%) adverse reactions.

Immune-Mediated Pancreatitis

IMFINZI in combination with IMJUDO can cause immune-mediated pancreatitis. Immune-mediated pancreatitis occurred in 2.3% (9/388) of patients receiving IMFINZI and IMJUDO, including Grade 4 (0.3%) and Grade 3 (1.5%) adverse reactions.

Other Immune-Mediated Adverse Reactions

The following clinically significant, immune-mediated adverse reactions occurred at an incidence of less than 1% each in patients who received IMFINZI and IMJUDO or were reported with the use of other immune-checkpoint inhibitors.

Cardiac/vascular: Myocarditis, pericarditis, vasculitis.

Nervous system: Meningitis, encephalitis, myelitis and demyelination, myasthenic syndrome/myasthenia gravis (including exacerbation), Guillain-Barré syndrome, nerve paresis, autoimmune neuropathy.

Ocular: Uveitis, iritis, and other ocular inflammatory toxicities can occur. Some cases can be associated with retinal detachment. Various grades of visual impairment to include blindness can occur. If uveitis occurs in combination with other immune-mediated adverse reactions, consider a Vogt-Koyanagi-Harada-like syndrome, as this may require treatment with systemic steroids to reduce the risk of permanent vision loss.

Gastrointestinal: Pancreatitis including increases in serum amylase and lipase levels, gastritis, duodenitis.

Musculoskeletal and connective tissue disorders: Myositis/polymyositis, rhabdomyolysis and associated sequelae including renal failure, arthritis, polymyalgia rheumatic.

Endocrine: Hypoparathyroidism.

Other (hematologic/immune): Hemolytic anemia, aplastic anemia, hemophagocytic lymphohistiocytosis, systemic inflammatory response syndrome, histiocytic necrotizing lymphadenitis (Kikuchi lymphadenitis), sarcoidosis, immune thrombocytopenia, solid organ transplant rejection.

Infusion-Related Reactions

IMFINZI and IMJUDO can cause severe or life-threatening infusion-related reactions. Monitor for signs and symptoms of infusion-related reactions. Interrupt, slow the rate of, or permanently discontinue IMFINZI and IMJUDO based on the severity. See USPI Dosing and Administration for specific details. For Grade 1 or 2 infusion-related reactions, consider using pre-medications with subsequent doses.

IMFINZI as a Single Agent

Infusion-related reactions occurred in 2.2% (42/1889) of patients receiving IMFINZI, including Grade 3 (0.3%) adverse reactions.

IMFINZI with IMJUDO

Infusion-related reactions occurred in 10 (2.6%) patients receiving IMFINZI and IMJUDO.

IMFINZI with IMJUDO and Platinum-Based Chemotherapy

Infusion-related reactions occurred in 2.9% (17/596) of patients receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy, including Grade 3 (0.3%) adverse reactions.

Complications of Allogeneic HSCT after IMFINZI

Fatal and other serious complications can occur in patients who receive allogeneic hematopoietic stem cell transplantation (HSCT) before or after being treated with a PD-1/L-1 blocking antibody. Transplant-related complications include hyperacute graft-versus-host-disease (GVHD), acute GVHD, chronic GVHD, hepatic veno-occlusive disease (VOD) after reduced intensity conditioning, and steroid-requiring febrile syndrome (without an identified infectious cause). These complications may occur despite intervening therapy between PD-1/L-1 blockade and allogeneic HSCT. Follow patients closely for evidence of transplant-related complications and intervene promptly. Consider the benefit versus risks of treatment with a PD-1/L-1 blocking antibody prior to or after an allogeneic HSCT.

Embryo-Fetal Toxicity

Based on their mechanism of action and data from animal studies, IMFINZI and IMJUDO can cause fetal harm when administered to a pregnant woman. Advise pregnant women of the potential risk to a fetus. In females of reproductive potential, verify pregnancy status prior to initiating IMFINZI and IMJUDO and advise them to use effective contraception during treatment with IMFINZI and IMJUDO and for 3 months after the last dose of IMFINZI and IMJUDO.

Lactation

There is no information regarding the presence of IMFINZI and IMJUDO in human milk; however, because of the potential for serious adverse reactions in breastfed infants from IMFINZI and IMJUDO, advise women not to breastfeed during treatment and for 3 months after the last dose.

Adverse Reactions

In patients with Stage III NSCLC in the PACIFIC study receiving IMFINZI (n=475), the most common adverse reactions (≥20%) were cough (40%), fatigue (34%), pneumonitis or radiation pneumonitis (34%), upper respiratory tract infections (26%), dyspnea (25%), and rash (23%). The most common Grade 3 or 4 adverse reactions (≥3%) were pneumonia (7%) and pneumonitis/radiation pneumonitis (3.4%)

In patients with Stage III NSCLC in the PACIFIC study receiving IMFINZI (n=475), discontinuation due to adverse reactions occurred in 15% of patients in the IMFINZI arm. Serious adverse reactions occurred in 29% of patients receiving IMFINZI. The most frequent serious adverse reactions (≥2%) were pneumonitis or radiation pneumonitis (7%) and pneumonia (6%). Fatal pneumonitis or radiation pneumonitis and fatal pneumonia occurred in <2% of patients and were similar across arms

In patients with mNSCLC in the POSEIDON study receiving IMFINZI and IMJUDO plus platinum-based chemotherapy (n=330), the most common adverse reactions (occurring in ≥20% of patients) were nausea (42%), fatigue (36%), musculoskeletal pain (29%), decreased appetite (28%), rash (27%), and diarrhea (22%).

In patients with mNSCLC in the POSEIDON study receiving IMFINZI in combination with IMJUDO and platinum-based chemotherapy (n=330), permanent discontinuation of IMFINZI or IMJUDO due to an adverse reaction occurred in 17% of patients. Serious adverse reactions occurred in 44% of patients, with the most frequent serious adverse reactions reported in at least 2% of patients being pneumonia (11%), anemia (5%), diarrhea (2.4%), thrombocytopenia (2.4%), pyrexia (2.4%), and febrile neutropenia (2.1%). Fatal adverse reactions occurred in a total of 4.2% of patients.

In patients with extensive-stage SCLC in the CASPIAN study receiving IMFINZI plus chemotherapy (n=265), the most common adverse reactions (≥20%) were nausea (34%), fatigue/asthenia (32%), and alopecia (31%). The most common Grade 3 or 4 adverse reaction (≥3%) was fatigue/asthenia (3.4%)

In patients with extensive-stage SCLC in the CASPIAN study receiving IMFINZI plus chemotherapy (n=265), IMFINZI was discontinued due to adverse reactions in 7% of the patients receiving IMFINZI plus chemotherapy. Serious adverse reactions occurred in 31% of patients receiving IMFINZI plus chemotherapy. The most frequent serious adverse reactions reported in at least 1% of patients were febrile neutropenia (4.5%), pneumonia (2.3%), anemia (1.9%), pancytopenia (1.5%), pneumonitis (1.1%), and COPD (1.1%). Fatal adverse reactions occurred in 4.9% of patients receiving IMFINZI plus chemotherapy

In patients with locally advanced or metastatic BTC in the TOPAZ-1 study receiving IMFINZI (n=338), the most common adverse reactions (occurring in ≥20% of patients) were fatigue, nausea, constipation, decreased appetite, abdominal pain, rash, and pyrexia

In patients with locally advanced or metastatic BTC in the TOPAZ-1 study receiving IMFINZI (n=338), discontinuation due to adverse reactions occurred in 6% of the patients receiving IMFINZI plus chemotherapy. Serious adverse reactions occurred in 47% of patients receiving IMFINZI plus chemotherapy. The most frequent serious adverse reactions reported in at least 2% of patients were cholangitis (7%), pyrexia (3.8%), anemia (3.6%), sepsis (3.3%) and acute kidney injury (2.4%). Fatal adverse reactions occurred in 3.6% of patients receiving IMFINZI plus chemotherapy. These include ischemic or hemorrhagic stroke (4 patients), sepsis (2 patients), and upper gastrointestinal hemorrhage (2 patients)

In patients with unresectable HCC in the HIMALAYA study receiving IMFINZI and IMJUDO, the most common adverse reactions (occurring in ≥20% of patients) were rash, diarrhea, fatigue, pruritus, musculoskeletal pain, and abdominal pain

In patients with unresectable HCC in the HIMALAYA study receiving IMFINZI and IMJUDO, serious adverse reactions occurred in 41% of patients. Serious adverse reactions in >1% of patients included hemorrhage (6%), diarrhea (4%), sepsis (2.1%), pneumonia (2.1%), rash (1.5%), vomiting (1.3%), acute kidney injury (1.3%), and anemia (1.3%). Fatal adverse reactions occurred in 8% of patients who received IMJUDO in combination with durvalumab, including death (1%), hemorrhage intracranial (0.5%), cardiac arrest (0.5%), pneumonitis (0.5%), hepatic failure (0.5%), and immune-mediated hepatitis (0.5%). Permanent discontinuation of treatment regimen due to an adverse reaction occurred in 14% of patients

The safety and effectiveness of IMFINZI and IMJUDO have not been established in pediatric patients.

Indications:

IMFINZI is indicated for the treatment of adult patients with unresectable Stage III non-small cell lung cancer (NSCLC) whose disease has not progressed following concurrent platinum-based chemotherapy and radiation therapy.

IMFINZI, in combination with IMJUDO and platinum-based chemotherapy, is indicated for the treatment of adult patients with metastatic NSCLC with no sensitizing epidermal growth factor receptor (EGFR) mutations or anaplastic lymphoma kinase (ALK) genomic tumor aberrations.

IMFINZI, in combination with etoposide and either carboplatin or cisplatin, is indicated for the first-line treatment of adult patients with extensive-stage small cell lung cancer (ES-SCLC).

IMFINZI, in combination with gemcitabine and cisplatin, is indicated for the treatment of adult patients with locally advanced or metastatic biliary tract cancer (BTC).

IMFINZI in combination with IMJUDO is indicated for the treatment of adult patients with unresectable hepatocellular carcinoma (uHCC).

Please see Full Prescribing Information for IMFINZI and IMJUDO, including Medication Guide.

SELECT SAFETY INFORMATION FOR CALQUENCE® (acalabrutinib)

INDICATION AND USAGE

CALQUENCE is indicated for the treatment of adult patients with chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL).

SELECT SAFETY INFORMATION

Serious adverse events, including fatal events, have occurred with CALQUENCE, including serious and opportunistic infections, hemorrhage, cytopenias, second primary malignancies, and atrial fibrillation and flutter. The most common adverse reactions (≥ 30%) of any grade in patients with CLL were anemia, neutropenia, thrombocytopenia, headache, upper respiratory tract infection, and diarrhea.

Please see full Prescribing Information, including Patient Information.

Notes

AstraZeneca in oncology

AstraZeneca is leading a revolution in oncology with the ambition to provide cures for cancer in every form, following the science to understand cancer and all its complexities to discover, develop and deliver life-changing medicines to patients.

The Company’s focus is on some of the most challenging cancers. It is through persistent innovation that AstraZeneca has built one of the most diverse portfolios and pipelines in the industry, with the potential to catalyze changes in the practice of medicine and transform the patient experience.

AstraZeneca has the vision to redefine cancer care and, one day, eliminate cancer as a cause of death.

About AstraZeneca

AstraZeneca is a global, science-led biopharmaceutical company that focuses on the discovery, development and commercialization of prescription medicines in Oncology, Rare Diseases and BioPharmaceuticals, including Cardiovascular, Renal & Metabolism, and Respiratory & Immunology. Based in Cambridge, UK, AstraZeneca operates in over 100 countries, and its innovative medicines are used by millions of patients worldwide. For more information, please visit and follow us on Twitter @AstraZenecaUS.

Clinical ResultPhase 3ASCOPhase 2Immunotherapy

100 Deals associated with Tilatamig samrotecan

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Adenocarcinoma of Lung | Phase 1 | United States | 18 Jul 2023 | |

| Adenocarcinoma of Lung | Phase 1 | China | 18 Jul 2023 | |

| Adenocarcinoma of Lung | Phase 1 | Japan | 18 Jul 2023 | |

| Adenocarcinoma of Lung | Phase 1 | Australia | 18 Jul 2023 | |

| Adenocarcinoma of Lung | Phase 1 | Canada | 18 Jul 2023 | |

| Adenocarcinoma of Lung | Phase 1 | France | 18 Jul 2023 | |

| Adenocarcinoma of Lung | Phase 1 | Italy | 18 Jul 2023 | |

| Adenocarcinoma of Lung | Phase 1 | Malaysia | 18 Jul 2023 | |

| Adenocarcinoma of Lung | Phase 1 | South Korea | 18 Jul 2023 | |

| Adenocarcinoma of Lung | Phase 1 | Spain | 18 Jul 2023 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or