Request Demo

Last update 11 May 2025

Anti-NRP2 mAb(aTyr)

Last update 11 May 2025

Overview

Basic Info

Drug Type Monoclonal antibody |

Synonyms- |

Target |

Action inhibitors |

Mechanism NRP-2 inhibitors(Neuropilin 2 inhibitors) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization- |

Drug Highest PhasePreclinical |

First Approval Date- |

Regulation- |

Related

100 Clinical Results associated with Anti-NRP2 mAb(aTyr)

Login to view more data

100 Translational Medicine associated with Anti-NRP2 mAb(aTyr)

Login to view more data

100 Patents (Medical) associated with Anti-NRP2 mAb(aTyr)

Login to view more data

1

Literatures (Medical) associated with Anti-NRP2 mAb(aTyr)03 May 2023·Science translational medicineQ1 · MEDICINE

Therapeutic blocking of VEGF binding to neuropilin-2 diminishes PD-L1 expression to activate antitumor immunity in prostate cancer

Q1 · MEDICINE

Article

Author: Li, Rui ; Xu, Zhiwen ; Kumar, Ayush ; Xiong, Choua ; Loda, Massimo ; Jiang, Zhong ; Wang, Mengdie ; St Louis, Pamela A ; Pakula, Hubert ; Mercurio, Arthur M ; Zhu, Lihua Julie ; Brehm, Michael A ; Wisniewski, Christi A ; Goel, Hira Lal ; Chhoy, Peter ; Ferreira, Lindsay M

Prostate cancers are largely unresponsive to immune checkpoint inhibitors (ICIs), and there is strong evidence that programmed death-ligand 1 (PD-L1) expression itself must be inhibited to activate antitumor immunity. Here, we report that neuropilin-2 (NRP2), which functions as a vascular endothelial growth factor (VEGF) receptor on tumor cells, is an attractive target to activate antitumor immunity in prostate cancer because VEGF-NRP2 signaling sustains PD-L1 expression.

NRP2

depletion increased T cell activation in vitro. In a syngeneic model of prostate cancer that is resistant to ICI, inhibition of the binding of VEGF to NRP2 using a mouse-specific anti-NRP2 monoclonal antibody (mAb) resulted in necrosis and tumor regression compared with both an anti–PD-L1 mAb and control immunoglobulin G. This therapy also decreased tumor PD-L1 expression and increased immune cell infiltration. We observed that the

NRP2

,

VEGFA

, and

VEGFC

genes are amplified in metastatic castration-resistant and neuroendocrine prostate cancer. We also found that individuals with NRP2

High

PD-L1

High

metastatic tumors had lower androgen receptor expression and higher neuroendocrine prostate cancer scores than other individuals with prostate cancer. In organoids derived from patients with neuroendocrine prostate cancer, therapeutic inhibition of VEGF binding to NRP2 using a high-affinity humanized mAb suitable for clinical use also diminished PD-L1 expression and caused a substantial increase in immune-mediated tumor cell killing, consistent with the animal studies. These findings provide justification for the initiation of clinical trials using this function-blocking NRP2 mAb in prostate cancer, especially for patients with aggressive disease.

5

News (Medical) associated with Anti-NRP2 mAb(aTyr)13 Aug 2024

Phase 3 EFZO-FIT™ study of efzofitimod in pulmonary sarcoidosis enrollment completed with 268 patients; topline data from this 52-week study expected in the third quarter of 2025. Ended the second quarter 2024 with $81.4 million in cash, cash equivalents, restricted cash and investments. SAN DIEGO, Aug. 13, 2024 (GLOBE NEWSWIRE) -- aTyr Pharma, Inc. (Nasdaq: ATYR) (“aTyr” or the “Company”), a clinical stage biotechnology company engaged in the discovery and development of first-in-class medicines from its proprietary tRNA synthetase platform, today announced second quarter 2024 results and provided a corporate update. “The second quarter of 2024 was a milestone quarter for aTyr, as we completed enrollment in our global pivotal Phase 3 EFZO-FIT™ study of efzofitimod in patients with pulmonary sarcoidosis, a major form of interstitial lung disease (ILD),” said Sanjay S. Shukla, M.D., M.S., President and Chief Executive Officer of aTyr. “This landmark study is the largest interventional study ever to be conducted in sarcoidosis and presents an opportunity to deliver a potentially transformative therapy to sarcoidosis patients who have been waiting more than 60 years for a new drug to be approved for this disease. We look forward to releasing topline data from this study in the third quarter of 2025.” Second Quarter 2024 and Subsequent Period Highlights Completed enrollment in the global pivotal Phase 3 EFZO-FIT™ study to evaluate the efficacy and safety of efzofitimod in patients with pulmonary sarcoidosis. This is a randomized, double-blind, placebo-controlled, 52-week study consisting of three parallel cohorts randomized equally to either 3.0 mg/kg or 5.0 mg/kg of efzofitimod or placebo dosed intravenously monthly for a total of 12 doses. The study enrolled 268 patients with pulmonary sarcoidosis at 85 centers in 9 countries, exceeding the targeted enrollment. Topline data from the study are expected in the third quarter of 2025. Patients who complete the study and wish to receive treatment with efzofitimod outside of the clinical trial are eligible to participate in an Individual Patient Expanded Access Program (EAP).Continued enrollment in the Phase 2 EFZO-CONNECT™ study to evaluate the efficacy, safety and tolerability of efzofitimod in patients with systemic sclerosis (SSc, or scleroderma)-related ILD (SSc-ILD). This proof-of-concept study is a randomized, double-blind, placebo-controlled, 28-week study consisting of three parallel cohorts randomized 2:2:1 to either 270 mg or 450 mg of efzofitimod or placebo dosed intravenously monthly for a total of 6 doses. The study intends to enroll up to 25 patients with SSc-ILD and is open for enrollment at multiple centers in the U.S. Patients who complete the study and wish to receive ongoing treatment with efzofitimod are eligible to participate in a 24-week open-label extension (OLE), which was recently incorporated into the study protocol. Based on current enrollment projections, the Company expects to report interim data from the study in the second quarter of 2025.Presented a poster describing efzofitimod’s mechanism of action at the American Thoracic Society (ATS) 2024 International Conference. The findings further demonstrated that neuropilin-2 (NRP2), efzofitimod’s binding partner, is an important new immune target in ILD and that efzofitimod modulates myeloid cells to confer its anti-inflammatory benefit.Entered into a research agreement with Stanford Medicine to explore the role of the Company’s anti-NRP2 antibodies in glioblastoma multiforme (GBM). Michael Lim, M.D., Chair of the Department of Neurosurgery at Stanford Medicine, will serve as the principal investigator for the study, which aims to explore the role anti-NRP2 antibodies in combination with chemotherapy to evaluate their role in reversing immune evasion in GBM, the most common type of primary brain cancer.Appointed Jayant Aphale, Ph.D., as Vice President, Technical Operations. Dr. Aphale has more than 30 years of experience working in technical operations and manufacturing for novel therapeutic and vaccine products at biotechnology and pharmaceutical companies. Dr. Aphale will serve as a member of the Company’s executive leadership team, overseeing manufacturing activities at contract development and manufacturing organizations and implementing strategies related to the continuous improvement of commercial manufacturing, supply chain management, process development of new products and product life cycle management. Second Quarter 2024 Financial Highlights and Cash Position Cash & Investment Position: Cash, cash equivalents, restricted cash and investments as of June 30, 2024, were $81.4 million.R&D Expenses: Research and development expenses were $14.0 million for the second quarter 2024, which consisted primarily of clinical trial costs for the Phase 3 EFZO-FIT™ and Phase 2 EFZO-CONNECT™ studies, manufacturing costs for the efzofitimod program and research and development costs for the efzofitimod and discovery programs.G&A Expenses: General and administrative expenses were $3.3 million for the second quarter 2024. About Efzofitimod Efzofitimod is a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease (ILD), a group of immune-mediated disorders that can cause inflammation and fibrosis, or scarring, of the lungs. Efzofitimod is a tRNA synthetase derived therapy that selectively modulates activated myeloid cells through neuropilin-2 to resolve inflammation without immune suppression and potentially prevent the progression of fibrosis. aTyr is currently investigating efzofitimod in the global Phase 3 EFZO-FIT™ study in patients with pulmonary sarcoidosis, a major form of ILD, and in the Phase 2 EFZO-CONNECT™ study in patients with systemic sclerosis (SSc, or scleroderma)-related ILD. These forms of ILD have limited therapeutic options and there is a need for safer and more effective, disease-modifying treatments that improve outcomes. About aTyr aTyr is a clinical stage biotechnology company leveraging evolutionary intelligence to translate tRNA synthetase biology into new therapies for fibrosis and inflammation. tRNA synthetases are ancient, essential proteins that have evolved novel domains that regulate diverse pathways extracellularly in humans. aTyr’s discovery platform is focused on unlocking hidden therapeutic intervention points by uncovering signaling pathways driven by its proprietary library of domains derived from all 20 tRNA synthetases. aTyr’s lead therapeutic candidate is efzofitimod, a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease, a group of immune-mediated disorders that can cause inflammation and progressive fibrosis, or scarring, of the lungs. For more information, please visit www.atyrpharma.com. Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are usually identified by the use of words such as “aims” “anticipates,” “believes,” “designed,” “expects,” “intends,” “may,” “plans,” “potential,” “project,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by such safe harbor provisions for forward-looking statements and are making this statement for purposes of complying with those safe harbor provisions. These forward-looking statements include, among others, statements regarding the expected size of, and number and nationality of patients to be enrolled in, the EFZO-FIT™ and EFZO-CONNECT™ studies; the design and benefits of our EAP for efzofitimod for patients with pulmonary sarcoidosis; the potential therapeutic benefits and applications of efzofitimod; the results and ultimate trajectory of our research agreement with Stanford Medicine; and timelines and plans with respect to certain development activities and development goals, including our expectation that our Phase 3 EFZO-FIT™ study of efzofitimod in patients with pulmonary sarcoidosis will report topline results in the third quarter of 2025 and expectation that our Phase 2 EFZO-CONNECT™ study will report interim data in the second quarter of 2025. These forward-looking statements also reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects, as reflected in or suggested by these forward-looking statements, are reasonable, we can give no assurance that the plans, intentions, expectations, strategies or prospects will be attained or achieved. All forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain. Furthermore, actual results may differ materially from those described in these forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, risks related to our reliance on third-party partners and the potential that such partners may not perform as anticipated, the fact that NRP2 and tRNA synthetase biology is not fully understood, uncertainty regarding the ultimate long-term impact of evolving macroeconomic and geopolitical conditions, the risk of delays in our clinical trials, risks associated with the discovery, development and regulation of our product candidates, including the risk that results from clinical trials or other studies may not support further development, the risk that we may cease or delay preclinical or clinical development activities for any of our existing or future product candidates for a variety of reasons, the fact that our collaboration agreements are subject to early termination, and the risk that we may not be able to raise the additional funding required for our business and product development plans, as well as those risks set forth in our most recent Annual Report on Form 10-K, Quarterly Reports on form 10-Q and in our other SEC filings. Except as required by law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Contact:Ashlee DunstonDirector, Investor Relations and Public Affairsadunston@atyrpharma.com ATYR PHARMA INC.Condensed Consolidated Statements of Operations(in thousands, except share and per share data)

Three Months Ended Six Months Ended June 30, June 30, 2024 2023 2024 2023 (unaudited) Revenues:

License and collaboration agreement revenues $— $— $235 $— Total revenues — — 235 — Operating expenses:

Research and development 13,973 9,840 27,337 19,219 General and administrative 3,342 3,718 6,849 7,126 Total operating expenses 17,315 13,558 34,186 26,345 Loss from operations (17,315) (13,558) (33,951) (26,345)Total other income (expense), net 1,009 1,216 2,158 2,051 Consolidated net loss (16,306) (12,342) (31,793) (24,294)Net (gain) loss attributable to noncontrolling interest in Pangu BioPharma Limited — 4 (4) 5 Net loss attributable to aTyr Pharma, Inc. $(16,306) $(12,338) $(31,797) $(24,289)Net loss per share, basic and diluted $(0.23) $(0.22) $(0.46) $(0.50)Shares used in computing net loss per share, basic and diluted 72,284,351 55,143,805 69,204,401 48,557,347 ATYR PHARMA INC.Condensed Consolidated Balance Sheets(in thousands)

June 30, December 31, 2024 2023 (unaudited) Cash, cash equivalents, restricted cash and available-for-sale investments $81,378 $101,650 Other receivables 1,628 2,436 Property and equipment, net 5,184 5,531 Operating lease, right-of-use assets 5,942 6,727 Financing lease, right-of-use assets 1,490 1,788 Prepaid expenses and other assets 10,317 2,521 Total assets $105,939 $120,653

Accounts payable and accrued expenses $10,664 $15,088 Current portion of operating lease liability 656 831 Current portion of financing lease liability 517 497 Long-term operating lease liability, net of current portion 11,514 12,339 Long-term financing lease liability, net of current portion 1,164 1,428 Total stockholders’ equity 81,424 90,470 Total liabilities and stockholders’ equity $105,939 $120,653

Phase 2Phase 3Financial StatementClinical ResultExecutive Change

30 Jul 2024

Study to explore role of the Company’s anti-NRP2 antibodies in glioblastoma multiforme (GBM), the most common type of primary brain cancer.SAN DIEGO, July 30, 2024 (GLOBE NEWSWIRE) -- aTyr Pharma, Inc. (Nasdaq: ATYR) (“aTyr” or “the Company”), a clinical stage biotechnology company engaged in the discovery and development of first-in-class medicines from its proprietary tRNA synthetase platform, today announced that it has entered into a research agreement with Stanford Medicine. Michael Lim, M.D., Chair of the Department of Neurosurgery at Stanford Medicine, will serve as the principal investigator for the study. Dr. Lim’s research focuses on understanding the basic mechanisms of immunosuppression in glioblastoma multiforme (GBM). “We know that the immune system plays an important role in GBM recurrence, and we have studied stimulating myeloid cells as a way to reverse immunosuppression in the tumor microenvironment,” said Dr. Lim. “We look forward to looking at the role in which anti-neuropilin-2 (NRP2) antibodies in combination with other therapies may play in reactivating the immune system in order to reduce tumor recurrence.” The research collaboration aims to explore the role of the Company’s novel function blocking antibodies against NRP2 in combination with chemotherapy to evaluate their role in reversing immune evasion in GBM. If preliminary studies are successful, the researchers plan to evaluate the NRP2 antibodies in combination with other immunomodulating agents, such as anti-PD-1, STING, or anti-CSF-1R, to address multiple targets of myeloid and T cell immunosuppression for the potential treatment of GBM. “We are pleased to initiate this research collaboration with Stanford Medicine and Dr. Lim, a leader in immunotherapy for brain tumors, to explore the potential for combination therapy with NRP2-targeted antibodies in GBM,” said Sanjay S. Shukla, M.D., M.S., President and Chief Executive Officer of aTyr. “While we are focused on advancing our tRNA synthetase derived therapies, we believe NRP2 may play an important yet largely underappreciated role in immune cross talk in many cancers, including GBM. This study presents an important opportunity to enhance our mechanistic understanding regarding the role of NRP2 in mediating immune suppression in an extremely aggressive cancer where there is a high unmet medical need.” GBM is a fast-growing and aggressive brain tumor that invades the nearby brain tissue but does not typically spread to other organs. GBM can result in death in less than 6 months. Current standard of care includes surgery followed by radiation and chemotherapy, which can extend survival but is not curative and the rate of recurrence is high. Research that explores the underlying causes and mechanism of recurrence may lead to new treatments that can address and help manage recurrence, which are greatly needed. About aTyr aTyr is a clinical stage biotechnology company leveraging evolutionary intelligence to translate tRNA synthetase biology into new therapies for fibrosis and inflammation. tRNA synthetases are ancient, essential proteins that have evolved novel domains that regulate diverse pathways extracellularly in humans. aTyr’s discovery platform is focused on unlocking hidden therapeutic intervention points by uncovering signaling pathways driven by its proprietary library of domains derived from all 20 tRNA synthetases. aTyr’s lead therapeutic candidate is efzofitimod, a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease, a group of immune-mediated disorders that can cause inflammation and progressive fibrosis, or scarring, of the lungs. For more information, please visit www.atyrpharma.com. Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are usually identified by the use of words such as “aim,” “anticipate,” “believes,” “designed,” “can,” “expects,” “intends,” “may,” “opportunity,” “plans,” “potential,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by such safe harbor provisions for forward-looking statements and are making this statement for purposes of complying with those safe harbor provisions. These forward-looking statements include, among others, statements regarding the potential therapeutic benefits and applications of NRP2 antibodies; timelines, plans and expected results with respect to certain research and development activities and the expected personnel involved in such activities; potential benefits of collaborations; and certain development goals. These forward-looking statements also reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects, as reflected in or suggested by these forward-looking statements, are reasonable, we can give no assurance that the plans, intentions, expectations, strategies or prospects will be attained or achieved. All forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain. Furthermore, actual results may differ materially from those described in these forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, uncertainty regarding geopolitical and macroeconomic events, risks associated with the discovery, development and regulation of our product candidates, the risks inherent in studies of potential medical therapies, the risk that we or our partners may cease or delay preclinical or clinical development activities for any of our existing or future product candidates for a variety of reasons (including difficulties or delays in patient enrollment in planned clinical trials), the possibility that existing collaborations could be terminated early, and the risk that we may not be able to raise the additional funding required for our business and product development plans, as well as those risks set forth in our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in our other SEC filings. Except as required by law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Contact:Ashlee DunstonDirector, Investor Relations and Public Affairsadunston@atyrpharma.com

ImmunotherapyClinical Study

29 Sep 2022

Compositions and methods patent covers antibodies targeting NRP2 which may have therapeutic applications in the areas of cancer and inflammationSAN DIEGO, Sept. 29, 2022 (GLOBE NEWSWIRE) -- aTyr Pharma, Inc. (Nasdaq: LIFE), a biotherapeutics company engaged in the discovery and development of first-in-class medicines from its proprietary tRNA synthetase platform, today announced that the U.S. Patent and Trademark Office (USPTO) has provided a Notice of Allowance for a patent covering methods for the use of anti-neuropilin-2 (NRP2) antibodies. The patent application No. 16/376,979 titled, “Compositions and methods comprising anti-NRP2 antibodies,” covers the use of a series of antibodies targeting NRP2 for differentiated therapeutic applications in the areas of cancer and inflammation. NRP2 is a cell surface receptor that plays multiple roles in neurodevelopment, maintaining cellular plasticity, cell migration, lymphatic development and regulating inflammatory responses in normal physiology. The blocking antibodies that aTyr has developed target distinct domains of NRP2, including those interacting with semaphorins, VEGF and certain chemokines. “We are pleased with the USPTO Notice of Allowance for this patent covering compositions and methods comprising anti-NRP2 antibodies, including our investigational new drug (IND) candidate ATYR2810, which is the first patent to be granted to our intellectual property estate for this program,” said Sanjay S. Shukla, M.D., M.S., President and Chief Executive Officer of aTyr. A Notice of Allowance is issued after the USPTO makes the determination that a patent should be granted from an application. A patent from the recently allowed application is expected to be issued in the coming months. aTyr’s global patent estate includes over 220 issued or allowed patents owned or exclusively licensed by aTyr and its Hong Kong subsidiary, Pangu BioPharma Limited, developed over a decade of research and development activities. This patent estate highlights aTyr’s unique leadership position in this emerging area of biology. These patents encompassed important new therapeutic modalities which underpin the broad pipeline of novel therapeutics in active development at the company. About aTyr aTyr is a biotherapeutics company engaged in the discovery and development of first-in-class medicines from its proprietary tRNA synthetase platform. aTyr’s research and development efforts are concentrated on a newly discovered area of biology, the extracellular functionality and signaling pathways of tRNA synthetases. aTyr has built a global intellectual property estate directed to a potential pipeline of protein compositions derived from 20 tRNA synthetase genes and their extracellular targets. aTyr’s primary focus is efzofitimod, a clinical-stage product candidate which binds to the neuropilin-2 receptor and is designed to downregulate immune engagement in fibrotic lung disease. For more information, please visit www.atyrpharma.com.Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are usually identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by such safe harbor provisions for forward-looking statements and are making this statement for purposes of complying with those safe harbor provisions. These forward-looking statements include statements regarding potential therapeutic benefits and applications of ATYR2810; timelines and plans with respect to certain development activities, including the timing of clinical trials; and certain development goals. These forward-looking statements also reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects, as reflected in or suggested by these forward-looking statements, are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. All forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain. Furthermore, actual results may differ materially from those described in these forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, uncertainty regarding the COVID-19 pandemic, risks associated with the discovery, development and regulation of our product candidates, the risk that we or our partners may cease or delay preclinical or clinical development activities for any of our existing or future product candidates for a variety of reasons (including difficulties or delays in patient enrollment in planned clinical trials), the possibility that existing collaborations could be terminated early, and the risk that we may not be able to raise the additional funding required for our business and product development plans, as well as those risks set forth in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 filed with the SEC on August 15, 2022, and in our other SEC filings. Except as required by law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Contact:Ashlee DunstonDirector, Investor Relations and Corporate Communicationsadunston@atyrpharma.com

Small molecular drugAntibodyFirst in ClassCollaborate

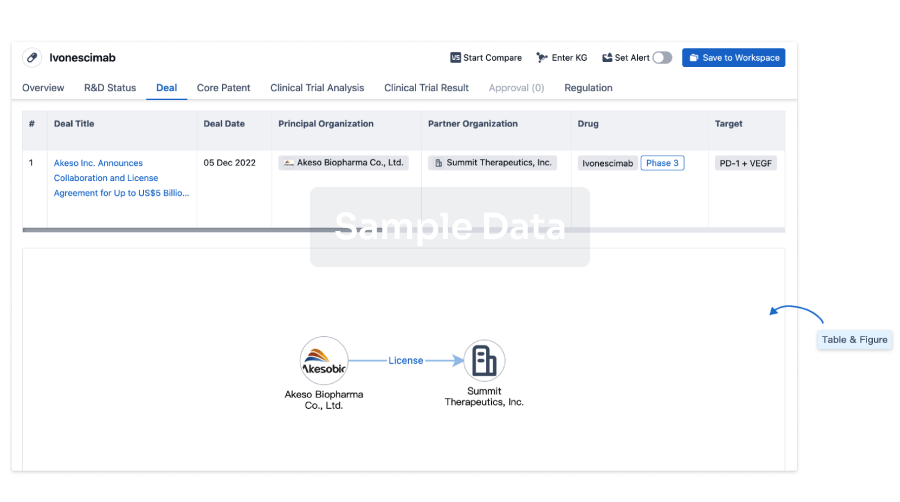

100 Deals associated with Anti-NRP2 mAb(aTyr)

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Prostatic Cancer | Preclinical | United States | 03 May 2023 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

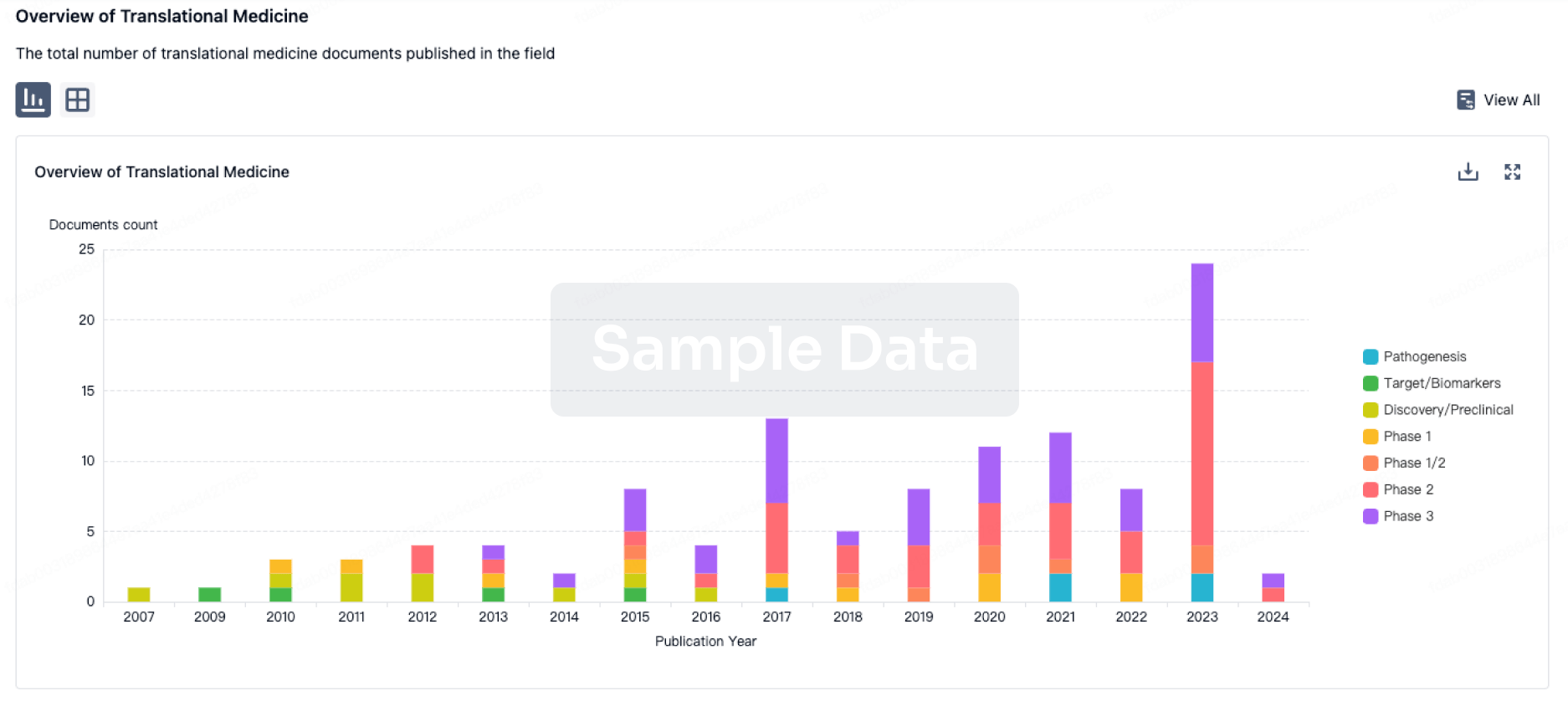

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

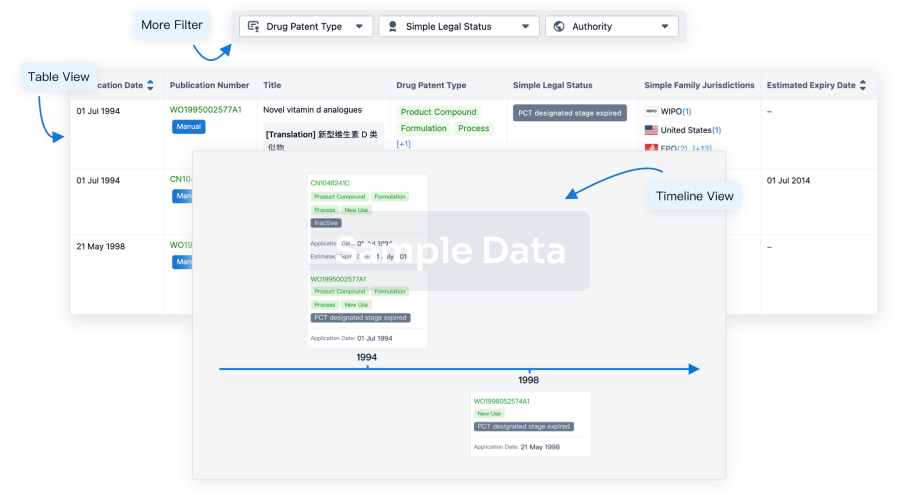

Core Patent

Boost your research with our Core Patent data.

login

or

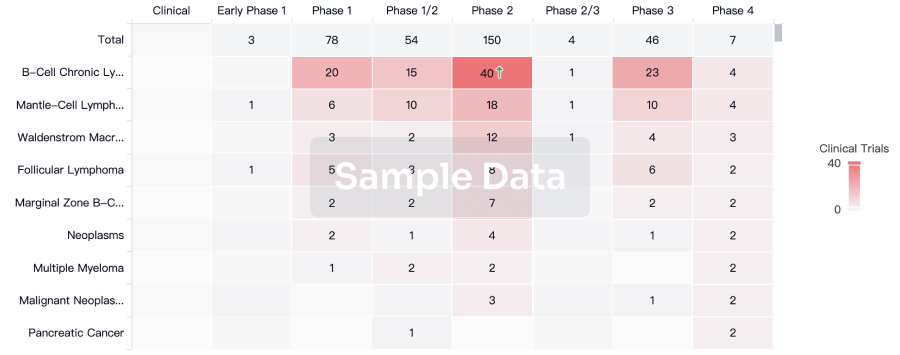

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

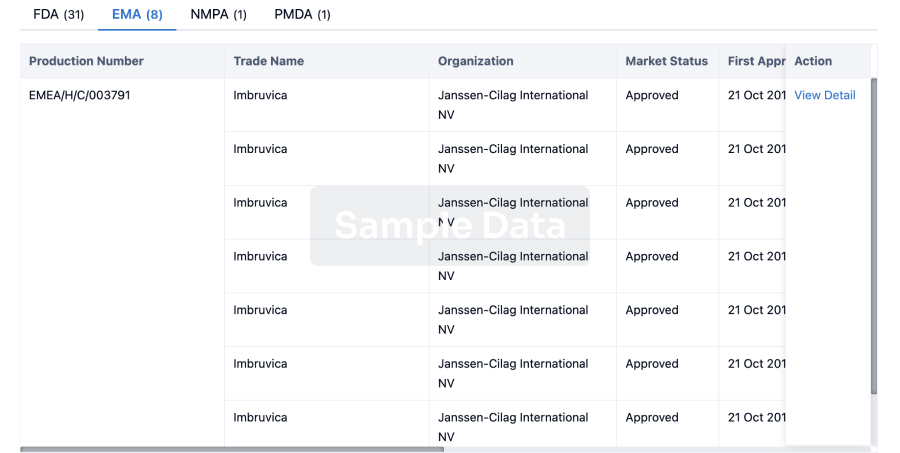

Approval

Accelerate your research with the latest regulatory approval information.

login

or

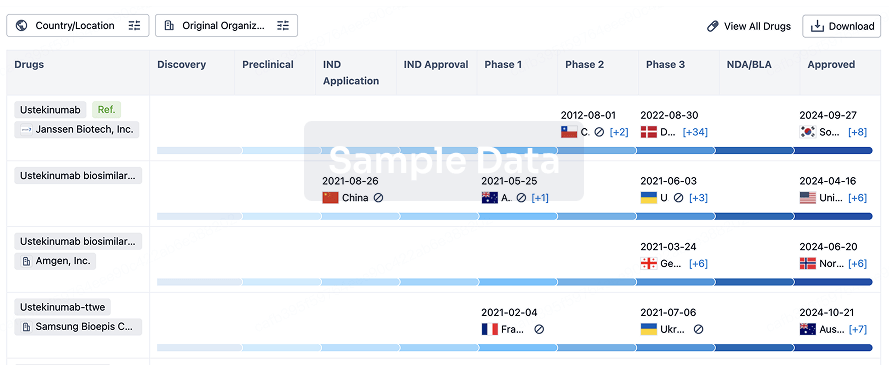

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

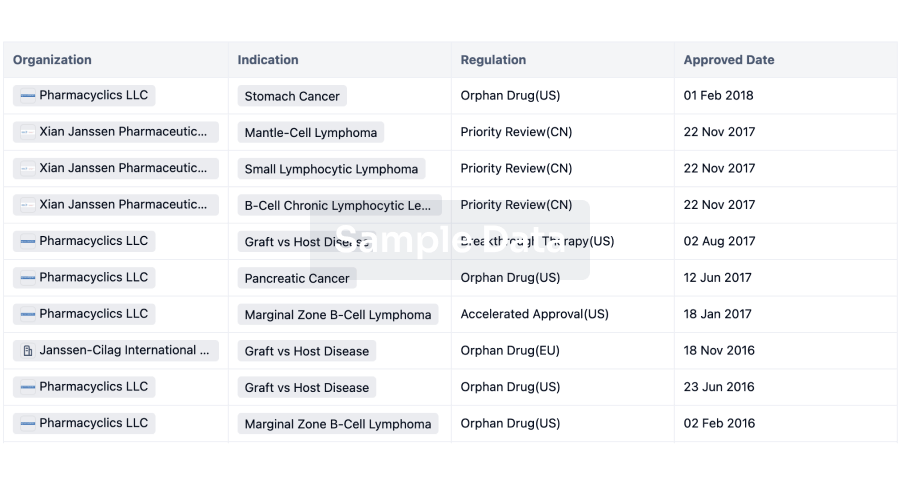

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free