Request Demo

Last update 13 Dec 2025

GB-0669

Last update 13 Dec 2025

Overview

Basic Info

Drug Type Monoclonal antibody |

Synonyms GB 0669 |

Target |

Action modulators |

Mechanism SARS-CoV-2 S protein modulators(SARS-CoV-2 S protein modulators) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization- |

Drug Highest PhasePhase 1 |

First Approval Date- |

Regulation- |

Login to view timeline

Related

1

Clinical Trials associated with GB-0669NCT07050511

A Phase 1, Randomized, Double-blind, Placebo-controlled, Sequential Group, Single Ascending Dose Study to Evaluate the Safety, Tolerability and Pharmacokinetics of GB-0669 in Healthy Subjects

The goal of this clinical trial is to test the safety and tolerability of a single ascending dose (SAD) of GB-0669 administered intravenously in adults. The goal of this study is also to measure the blood levels of GB-0669 in the body.

Study participants will be assigned to receive the study drug or placebo (the placebo is called saline; it is a liquid like salt water and made to look like the study drug but contains no active ingredient).

The study is blinded, which means you and the study doctor will not know whether you are getting the study drug or placebo.

Study participants will be assigned to one of 5 cohorts (study groups). Each cohort will have a single ascending dose (SAD). The first two SAD cohorts will have 3 study participants receiving GB-0669 and 3 study participants receiving placebo. The last three SAD cohorts will have 10 study participants receiving GB-0669 and 3 study participants receiving placebo. The SAD cohort dose levels will be as follows: 100 mg, 300 mg, 600 mg, 1200 mg, 2400 mg.

Study participants will be assigned to receive the study drug or placebo (the placebo is called saline; it is a liquid like salt water and made to look like the study drug but contains no active ingredient).

The study is blinded, which means you and the study doctor will not know whether you are getting the study drug or placebo.

Study participants will be assigned to one of 5 cohorts (study groups). Each cohort will have a single ascending dose (SAD). The first two SAD cohorts will have 3 study participants receiving GB-0669 and 3 study participants receiving placebo. The last three SAD cohorts will have 10 study participants receiving GB-0669 and 3 study participants receiving placebo. The SAD cohort dose levels will be as follows: 100 mg, 300 mg, 600 mg, 1200 mg, 2400 mg.

Start Date18 Jul 2023 |

Sponsor / Collaborator |

100 Clinical Results associated with GB-0669

Login to view more data

100 Translational Medicine associated with GB-0669

Login to view more data

100 Patents (Medical) associated with GB-0669

Login to view more data

33

Literatures (Medical) associated with GB-066901 Jan 2025·Frontiers in Immunology

From immune evasion to broad in silico binding: computational optimization of SARS-CoV-2 RBD-targeting nanobody.

Article

Author: Gao, Feng ; Cao, Shuyuan ; Sun, Bo

Introduction:

The rapid evolution of SARS-CoV-2 Omicron variants highlights the urgent need for therapeutic strategies that can target viral evolution and leverage host immune recognition mechanisms. This study uses molecular dynamics (MD) simulations to analyze the immune evasion mechanisms of class 1 nanobodies against emerging SARS-CoV-2 variants, and to develop an efficient in silico pipeline for rapid affinity optimization.

Methods:

We employed MD simulations and binding free energy calculations to investigate the immune evasion mechanisms of four class 1 nanobodies (R14, DL4, VH ab6, and Nanosota9) against wild-type (WT) and Omicron variants, including BA.2, JN.1, and KP.3/XEC. Building on these findings, we established a streamlined nanobody optimization pipeline integrating high-throughput mutagenesis of complementarity-determining regions (CDRs) and hotspot residues, protein-protein docking, and MD simulations.

Results:

MD analysis confirmed that the immune evasion mechanism of KP.3/XEC is significantly associated with the Q493E mutation, which weakens electrostatic interactions between the nanobodies and the receptor binding domain (RBD). Through our pipeline, we identified high-affinity mutants including 3 for R14, 3 for DL4, 11 for VH ab6, and 9 for Nanosota9. The optimized R14 variant L29W/S52C/A101V demonstrated exceptional performance, achieving a 62.6% binding energy improvement against JN.1 (-76.88 kcal/mol compared to -47.3 kcal/mol for original R14 nanobody) while maintaining < 15% affinity variation across variants (compared to > 40% for original R14 nanobody).

Discussion:

This study demonstrates that in silico affinity enhancement is a rapid and resource-efficient approach to repurpose nanobodies against SARS-CoV-2 variants, significantly accelerating affinity optimization while reducing experimental demands. This computational approach expedites the optimization of nanobody binding affinities while minimizing experimental resource requirements. By enhancing nanobody efficacy, our method provides a viable framework for developing targeted countermeasures against evolving SARS-CoV-2 variants and other pathogens.

01 May 2024·International immunopharmacology

Strategic development of a self-adjuvanting SARS-CoV-2 RBD vaccine: From adjuvant screening to enhanced immunogenicity with a modified TLR7 agonist

Article

Author: Sun, Tiantian ; Ding, Ning ; Xu, Ying ; Meng, Xiongyan ; Zong, Chengli ; Yang, Jing ; Meng, Shuai

Adjuvants enhance the body's immune response to a vaccine, often leading to better protection against diseases. Monophosphoryl lipid A analogues (MPLA, TLR4 agonists), α-galactosylceramide analogues (NKT cell agonists), and imidazoquinoline compounds (TLR7/8 agonists) are emerging novel adjuvants on market or under clinical trials. Despite significant interest in these adjuvants, a direct comparison of their adjuvant activities remains unexplored. We initially assessed the activities of various adjuvants from three distinct categories using the SARS-CoV-2 RBD trimer antigen. TLR4 and TLR7/8 agonists are discovered to elicit robust IgG2a/2b antibodies, which is crucial for eliciting antibody dependent cytotoxicity. While α-galactosylceramide analogs induced mainly IgG1 antibody. Then, because of the flexibility of the TLR7/8 agonist, we designed and synthesized a tri-component self-adjuvanting SARS-CoV-2 RBD vaccine, featuring a covalent TLR7 agonist and targeting mannoside. Animal studies indicated that this vaccine generated antigen-specific humoral immunity. Yet, its immunogenicity seems compromised, indicating the complexity of the vaccine.

05 Mar 2024·Microbiology spectrum

Intranasal SARS-CoV-2 RBD decorated nanoparticle vaccine enhances viral clearance in the Syrian hamster model

Article

Author: Kerr, Abigail E. ; Sutton, Troy C. ; Norton, Elizabeth B. ; Sim, Derek G. ; Hafenstein, Susan L. ; Minns, Allen M. ; Luley, Erin H. ; Field, Cassandra J. ; Bator, Carol M. ; Heinly, Talia A. ; Patel, Devanshi R. ; Moustafa, Ibrahim M. ; Rossi, Randall M. ; Lindner, Scott E.

ABSTRACT:

Multiple vaccines have been developed and licensed for severe acute respiratory syndrome coronavirus-2 (SARS-CoV-2). While these vaccines reduce disease severity, they do not prevent infection. To prevent infection and limit transmission, vaccines must be developed that induce immunity in the respiratory tract. Therefore, we performed proof-of-principle studies with an intranasal nanoparticle vaccine against SARS-CoV-2. The vaccine candidate consisted of the self-assembling 60-subunit I3-01 protein scaffold covalently decorated with the SARS-CoV-2 receptor-binding domain (RBD) using the SpyCatcher-SpyTag system. We verified the intended antigen display features by reconstructing the I3-01 scaffold to 3.4 A using cryogenicelectron microscopy. Using this RBD-grafted SpyCage scaffold (RBD + SpyCage), we performed two intranasal vaccination studies in the “gold-standard” pre-clinical Syrian hamster model. The initial study focused on assessing the immunogenicity of RBD + SpyCage combined with the LTA1 intranasal adjuvant. These studies showed RBD + SpyCage vaccination induced an antibody response that promoted viral clearance but did not prevent infection. Inclusion of the LTA1 adjuvant enhanced the magnitude of the antibody response but did not enhance protection. Thus, in an expanded study, in the absence of an intranasal adjuvant, we evaluated if covalent bonding of RBD to the scaffold was required to induce an antibody response. Covalent grafting of RBD was required for the vaccine to be immunogenic, and animals vaccinated with RBD + SpyCage more rapidly cleared SARS-CoV-2 from both the upper and lower respiratory tract. These findings demonstrate the intranasal SpyCage vaccine platform can induce protection against SARS-CoV-2 and, with additional modifications to improve immunogenicity, is a versatile platform for the development of intranasal vaccines targeting respiratory pathogens.

IMPORTANCE:

Despite the availability of efficacious COVID vaccines that reduce disease severity, SARS-CoV-2 continues to spread. To limit SARS-CoV-2 transmission, the next generation of vaccines must induce immunity in the mucosa of the upper respiratory tract. Therefore, we performed proof-of-principle, intranasal vaccination studies with a recombinant protein nanoparticle scaffold, SpyCage, decorated with the RBD of the S protein (SpyCage + RBD). We show that SpyCage + RBD was immunogenic and enhanced SARS-CoV-2 clearance from the nose and lungs of Syrian hamsters. Moreover, covalent grafting of the RBD to the scaffold was required to induce an immune response when given via the intranasal route. These proof-of-concept findings indicate that with further enhancements to immunogenicity (e.g., adjuvant incorporation and antigen optimization), the SpyCage scaffold has potential as a versatile, intranasal vaccine platform for respiratory pathogens.

9

News (Medical) associated with GB-066909 Oct 2024

The deep integration of experimental verification aims to lead programmable biology into a new era. Under The terms of the agreement, the collaboration will combine The Generate Platform's advanced technology with Novartis' deep expertise and capabilities in target biology, biologics development and clinical development to accelerate the development of innovative therapies. Although the number of targets and areas of treatment involved in the collaboration are currently under wraps.

Novartis has advanced a total of $65 million to Generate, of which $15 million is earmarked to increase its equity stake in Generate. In addition, Generate will receive more than $1 billion in milestone payments based on the progress of the partnership, with tiered royalty benefits.

Before that, Generate had signed a collaboration agreement with Amgen in 2022 worth up to $1.9 billion to work together on five clinically targeted protein therapies. A year later, Amgen further expanded its collaboration with Generate to include research and development on a sixth target.

Currently, Generate has built a rich research and development pipeline covering multiple disease areas such as immunology, oncology and infectious diseases. Two drug candidates, GB-0669 and GB-0895, have successfully entered the clinical stage. GB-0669 is a monoclonal antibody targeting the spike protein region of COVID-19, while GB-0895 is an anti-TSLP monoclonal antibody specifically designed for patients with severe asthma. In addition, the Generate pipeline includes bi-specific drugs for non-small cell lung cancer, CAR-T therapies for solid tumors, and as-yet-undisclosed ADC therapies. The company said it plans to move four to five new pipelines into clinical trials over the next two years.

After divesting its Sandoz business in 2023, Novartis has fully transformed itself into a company focused on innovative drug development. Its strategy focuses on four core therapeutic areas: cardio-nephro-metabolism, immunology, neuroscience and oncology. At the technology platform level, Novartis not only continues to strengthen the traditional chemical and biological drug platforms, but also actively expands the New Modality (novel therapy) platform, covering multiple frontier areas such as RLT (radioligand therapy), gene and cell therapy, and xRNA therapy.

In recent years, Novartis has actively implemented its new strategy through a series of deals. According to the statistics of the drug Intelligence network, since 2019 to the end of September this year, the total amount of Novartis BD transactions has exceeded $60 billion, and the total amount of transactions since this year alone has exceeded the $20 billion mark. From the field of disease, Novartis has carried out a key layout in the fields of tumor, immunization and kidney disease. In terms of drug types, Novartis has high hopes for emerging platforms, especially radiligand therapy, xRNA therapy and AI platforms.

In the cardiovascular-nephro-metabolic area, Novartis has achieved significant results with the successful application of xRNA therapy. Leqvio, for example, has been approved and rapidly released in more than 70 countries since it was approved by the FDA in 2020. Novartis expects peak annual sales of up to $3 billion. Building on Leqvio's success, Novartis has made multiple investments and partnerships totaling nearly $6 billion in xRNA therapeutics over the past two years to further consolidate and expand its leading position in the field.

In the field of oncology, although Novartis has not made significant breakthroughs in the field of PD-1 therapy and ADC, it has made remarkable achievements in the field of RLT (radioligand therapy, nuclear drug). At present, Novartis has two RLT products Lutathera and Pluvicto successfully launched and achieved rapid volume. Novartis believes that the unique advantages of RLT with significant efficacy and low side effects are vigorously layout in this field. In the past two years, it has entered into a number of mergers and acquisitions or cooperative transactions totaling nearly $7 billion to further expand its presence in the radiopharmaceutical field.

New technologies have become a new bright spot in Novartis' performance growth. According to Novartis' Q2 2024 financial results, sales of its radiolandin therapy Pluvicto reached $345 million in the quarter, an increase of 44%. Sales of the small nucleic acid drug Leqvio reached $182 million, an increase of 134%. Although the market size of New Modality is still in its infancy, it has great potential and relatively little competition. With the continuous cultivation and investment in these frontier areas, Novartis is gradually building a leading position in the industry, which is expected to form a solid market monopoly position in the future and bring considerable revenue growth for Novartis.

Drug ApprovalAcquisitionLicense out/in

24 Sep 2024

The cogs are turning at the AI-focused biotech, which has managed to Generate another Big Pharma partnership.

Novartis has inked a deal potentially worth more than $1 billion with Flagship-founded Generate:Biomedicines to develop protein therapeutics across multiple indications.The companies did not disclose specifics about potential disease areas, referring only to the pact as a “multi-target collaboration” in a Sept. 24 release.Under the terms of the agreement, Novartis is doling out $65 million in cash, an upfront payment that includes a $15 million purchase of equity in Generate. The Swiss Big Pharma is also offering the biotech more than $1 billion in milestone payments, plus tiered royalties up to low double-digit percentages. The partnership revolves around Generate’s generative AI platform, which integrates machine learning with high-throughput experimental validation with the aim of ushering in a new era of programmable biology.Paired with Novartis’ capabilities in target biology and clinical development, the partners hope to create new therapeutics at an accelerated pace, according to the release. “Partnering with a world-leading drug discovery and development organization like Novartis allows us to broaden the use of our cutting-edge generative biology platform to tackle even more areas of unmet medical need,” Generate CEO Mike Nally said in the release. “We look forward to working closely with the team at Novartis to continue to demonstrate the transformative potential of programming biology to create better medicines for patients, faster.” Founded by Flagship in 2018, Generate is no stranger to Big Pharma tie-ups. In 2022, Amgen inked an agreement worth up to $1.9 billion biobucks to develop five initial programs with Generate, leaving room for the potential to nominate up to five more programs later. Amgen has already taken up its option in part, with the pair currently working on six undisclosed programs together.Generate is known for its eye-popping fundraises, securing $273 million in a series C last year and a $370 million series B back in 2021.The biotech currently has two candidates in the clinic: GB-0669, a monoclonal antibody (mAb) targeting a region of the COVID-19 virus’ spike protein, and GB-0895, an anti-TSLP mAb for patients with severe asthma.At the beginning of this year, Generate said it planned on advancing an additional four to five assets into the clinic over the next two years. The company’s pipeline includes a preclinical bispecific targeting non-small cell lung cancer and being developed in collaboration with the University of Texas MD Anderson Cancer Center, as well as an armored CAR-T for solid tumors in partnership with the Roswell Park Comprehensive Cancer Center.The biotech is also working on a preclinical antibody drug conjugate plus a protein binder designed to serve as an ADC toxin neutralizer.

License out/in

04 Jan 2024

Challenges emerged in the drug discovery world in the spring last year with the failure of one of the first drugs to hit the clinic.

The geniuses of biotech—the Mozarts and Beethovens, as Generate Biomedicines CEO Mike Nally calls them—can only find so many new drugs. Without the limits of human discovery, AI can churn out as many programs as you have servers to run it. But then you hit another limit: how many programs can your biotech actually handle?

With that in mind, Nally is heading to the J.P. Morgan Healthcare Conference in San Francisco to build relationships for the biotech’s next partnerships. But just before heading to the Golden Gate City, Generate has announced that Amgen has picked up a sixth program in their two year-old disease-agnostic partnership.

Amgen has made an undisclosed upfront payment and added $370 million in future milestones to the original five-target deal, which had the same milestone potential for each of the programs. The deal also includes royalties on future sales.

The companies have been pretty mum on what, exactly, they are going after, saying that the drug discovery efforts are target specific, not disease specific. Nally said they are working on three different protein modalities so far. The collaboration has been “fruitful,” “wonderful,” and is going “exceptionally well,” he told Fierce Biotech in an interview. The sixth program came about naturally from the original collaboration.

“The sixth target was something that we both had an interest in, we both had some early work going on in, and we basically said well, if we worked on this together, the probability that we find a meaningful medicine for patients increases substantially,” Nally said.

Generate is heading into the biggest healthcare investing conference of the year in a stronger position than most companies after a brutal 2023 defined by layoffs, program reprioritizations and biotech closures. Nally’s team raised a whopping $273 million in September 2023, has $400 million in cash on hand, programs aplenty to work on and a handful of crucial data readouts coming this year.

Nally of course provided the stock CEO answer to the question of whether he’ll be trying to secure the company’s next financing at J.P. Morgan: “We always are thinking about our next fundraising round.”

There are no near-term plans to fundraise, but the CEO promised to be “opportunistic if conditions allow it”—such as if the biotech sees some clinical success that drives investor interest.

Another option buzzing in the background is an IPO. While Generate also is not planning to hit Wall Street any time soon, Nally is keeping a sharp eye on biotechs that do. He pointed to CG Oncology’s Wednesday IPO announcement, the first of 2024.

“The question we ask ourselves constantly is what is the best way to create a company that creates enduring value? Is that to be privately financed? Is it to be publicly financed?” Nally said. “At some point, obviously, public financing becomes the right answer for a company with ambitions like ours.”

But that point is probably not now: “We don’t have any definitive plans to go public, but we’ll obviously monitor market conditions and if it is the right way to build the company we’ll certainly proceed down that path.”

Nally says Generate managed to hold investor interest in such a tough environment because of its focus on AI—a hot area in biotech and the larger tech space. He suspects the signals emerging at the end of 2023 could mean his peers will see a brighter year, too.

“One of the things we've watched over the last few years has been the peak of the biotech market in the 2021 timeframe, and then the trough for a couple of years,” Nally said. “There were some green shoots coming out at the end of last year—the XBI rebounded really nicely in November, December, which leads to a bit of optimism as we enter 2024.”

But AI companies will need to put up the data this year to prove it’s more than just a cool tool. Challenges emerged in the drug discovery world in the spring last year when BenevolentAI announced that its AI-enabled eczema drug had failed a phase 2a trial. The company later cut the program and laid off staff.

And Exscientia chopped down a bloated AI-driven pipeline in October 2023 to ensure just the strongest programs are getting attention.

Nally said many companies have rushed into the space with big promises. “Unfortunately, we've seen this in biotech before,” he said. While today it’s AI drug discovery, previously it’s been the genomics revolution, or CRISPR gene editing. Only the strongest and best companies survive and actually deliver new options for patients.

“These tools have a potential to fundamentally find better answers than traditional approaches. At the same time, they're not a panacea across all of drug discovery, development, and ultimately commercialization,” Nally said of AI. “You need to blend both these new tools with really profound and in depth understanding of drug discovery and development.”

There’s three parts to drug discovery: the target, the molecule and then the clinic. AI can help with these components individually, but Nally doesn’t know of a company that’s using it for all three. Generate has been focused on the molecule side of the equation and can churn out 10-15 programs per year. But Nally says the partnership with Amgen and another with MD Anderson’s oncology experts helps the small, 300-person biotech find the expertise needed to interrogate the best programs.

Partnerships will be a big part of Generate’s future, which could bring in even more upfront cash to the balance sheet.

“We are few, but the challenges that patients face are many. We're gonna need a lot of great partners to help us get the most out of this platform,” Nally said.

Generate does, however, have its own internal pipeline which will get the spotlight in 2024. A phase 1 study for COVID-19 monoclonal antibody GB-0669 will read out at some point this year. The biotech is aiming the program towards immunocompromised patients, for whom vaccines do not provide protection, Nally said. There’s still an unmet need there. Generate’s candidate goes after the receptor binding of the spike protein to avoid the pitfalls of emerging variants that have taken down earlier monoclonal antibodies developed by Big Pharmas such as Pfizer, Regeneron, Eli Lilly and Gilead.

Another internal med is GB-0895 for asthma—an “exquisite molecule,” according to Nally. The TSLP-targeting antibody aims to cut dosing from every four weeks to every six months and may allow patients to come off of steroids. Nally said the therapy could have potential in chronic obstructive pulmonary disease, too.

Phase 1

100 Deals associated with GB-0669

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| COVID-19 | Phase 1 | United States | 18 Jul 2023 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

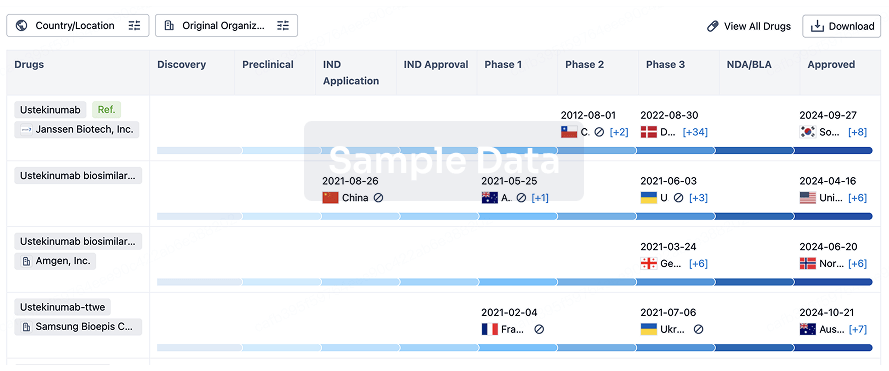

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free