WALTHAM, Mass.--(BUSINESS WIRE)--ImmunoGen Inc. (Nasdaq: IMGN), a leader in the expanding field of antibody-drug conjugates (ADCs) for the treatment of cancer, today announced findings from a retrospective pooled analysis of patients who achieved extended treatment benefit (ETB) with mirvetuximab soravtansine (mirvetuximab) monotherapy across three clinical trials in folate receptor alpha (FRα)–positive recurrent ovarian cancer. These findings were highlighted in a poster presentation at the 23rd Congress of the European Society of Gynaecological Oncology (ESGO) in Berlin, Germany. A trial in progress poster from the mirvetuximab program will also be presented.

"We believe the study outcomes presented at ESGO support the potential benefit mirvetuximab can have for a subset of patients on a long-term basis and add to the strong, existing foundation of data that supports mirvetuximab’s potential to become the new standard of care for FRα-positive ovarian cancer," said Anna Berkenblit, MD, Senior Vice President and Chief Medical Officer of ImmunoGen. “With the PDUFA date for mirvetuximab rapidly approaching, we look forward to the opportunity to bring this novel therapy to patients before the end of this year.”

CHARACTERIZATION OF EXTENDED TREATMENT BENEFIT FROM THREE PHASE 1 AND 3 CLINICAL TRIALS EXAMINING PATIENTS WITH FOLATE RECEPTOR ALPHA–POSITIVE RECURRENT OVARIAN CANCER TREATED WITH SINGLE-AGENT MIRVETUXIMAB SORAVTANSINE

Lead Author: Ana Oaknin, MD

Date/Time: October 28, 2022, 2:40 – 3:40 PM CET / 8:40 – 9:40 AM ET

Poster: #PA-048

A retrospective pooled analysis of patients who achieved ETB with mirvetuximab monotherapy was conducted across three studies - the Phase 1 IMGN853-0401 trial, the Phase 3 FORWARD I trial, and the Phase 3 SORAYA trial. ETB was defined as progression-free survival (PFS) for more than 12 months per investigator assessment. FRα expression levels were evaluated by immunohistochemistry (IHC).

Key findings:

In a pooled analysis of 466 patients, mirvetuximab monotherapy demonstrated ETB in 40 patients (9%).

Most patients with ETB had stage III disease (83%), 1 prior line of therapy (55%), and prior Avastin® (bevacizumab) exposure (60%).

EBT occurred in patients with a wide range of FRα expression, but did so predominantly among those with high FRα expression.

Patients with ETB had an objective response rate (ORR) of 77.5% (31 out of 40 patients), with 10 (25%) achieving a complete response and 21 (52.5%) achieving a partial response. The remaining 8 patients (20%) with ETB had a best response of stable disease and one patient was not evaluable.

Median duration of response (DOR) in patients with ETB was 22.1 months (95% CI, 13.8-60.0).

Median PFS in patients with ETB was 17.0 months (95% CI, 16.4-23.1).

In patients with ETB, the overall adverse event (AE) pro consistent with the previously reported integrated safety summary (ISS) of 464 patients, with no new safety signals identified and minimal cumulative toxicities.

AEs were primarily low-grade gastrointestinal and ocular events that generally resolved with supportive care or, if needed, dose modifications.

“Treatment options for patients with platinum-resistant ovarian cancer are extremely limited and characterized by low activity and considerable toxicity," said Ana Oaknin, Head of Gynecologic Tumors Unit,Vall d'Hebron Institute of Oncology, Senior Medical Oncologist and Attending Physician, Medical Oncology Department, Vall d'Hebron University Hospital. "The results from this analysis, coupled with a favorable tolerability and a consistent safety profile, add to the excitement I and many other physicians now have for the potential of mirvetuximab for women with FRα-positive platinum-resistant ovarian cancer.”

ADDITIONAL PRESENTATIONS

A trial in progress poster for a randomized Phase 2 investigator-sponsored trial (IST) of mirvetuximab in combination with carboplatin in patients with FRα-high recurrent ovarian cancer will also be presented.

Additional information can be found at www.congress.esgo.org.

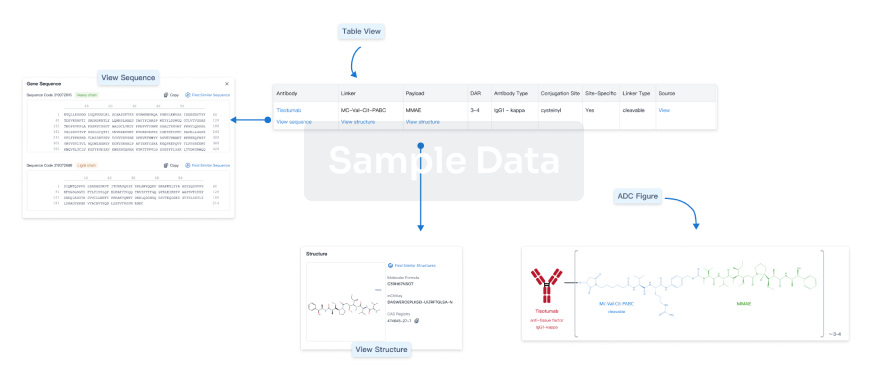

ABOUT MIRVETUXIMAB SORAVTANSINE

Mirvetuximab soravtansine is a first-in-class ADC comprising a folate receptor alpha-binding antibody, cleavable linker, and the maytansinoid payload DM4, a potent tubulin inhibitor designed to kill the targeted cancer cells.

ABOUT IMMUNOGEN

ImmunoGen is developing the next generation of antibody-drug conjugates (ADCs) to improve outcomes for cancer patients. By generating targeted therapies with enhanced anti-tumor activity and favorable tolerability pro we aim to disrupt the progression of cancer and offer our patients more good days. We call this our commitment to TARGET A BETTER NOW™.

Learn more about who we are, what we do, and how we do it at www.immunogen.com.

Avastin® is a registered trademark of Genentech, a member of the Roche Group.