Request Demo

Last update 01 Nov 2025

KAT6 Inhibitor (JiangSu Hengrui)

Last update 01 Nov 2025

Overview

Basic Info

Drug Type Small molecule drug |

Synonyms- |

Target |

Action inhibitors |

Mechanism KAT6A inhibitors(lysine acetyltransferase 6A inhibitors), KAT6B inhibitors(lysine acetyltransferase 6B inhibitors), Epigenetic drug |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization- |

Drug Highest PhasePreclinical |

First Approval Date- |

Regulation- |

Related

100 Clinical Results associated with KAT6 Inhibitor (JiangSu Hengrui)

Login to view more data

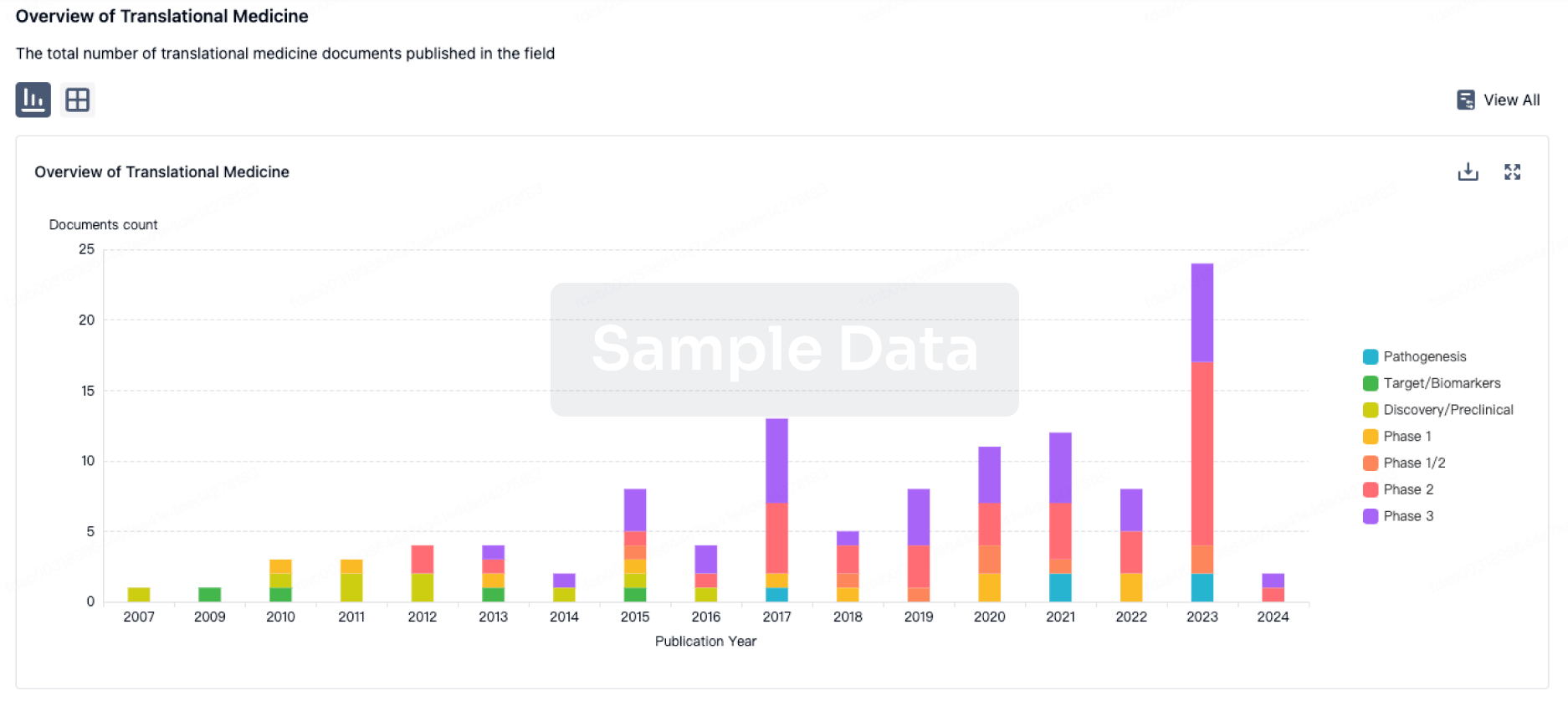

100 Translational Medicine associated with KAT6 Inhibitor (JiangSu Hengrui)

Login to view more data

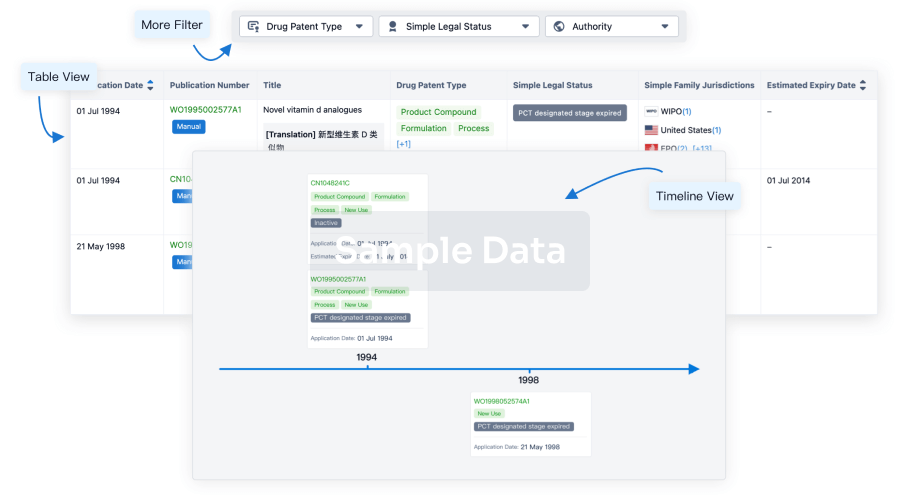

100 Patents (Medical) associated with KAT6 Inhibitor (JiangSu Hengrui)

Login to view more data

2

Literatures (Medical) associated with KAT6 Inhibitor (JiangSu Hengrui)01 Nov 2024·BIOORGANIC & MEDICINAL CHEMISTRY LETTERS

Identification of triazolyl KAT6 inhibitors via a templated fragment approach

Article

Author: Chen, Chun ; Pawley, Sarah B ; Buesking, Andrew W ; Pawley, Sarah B. ; Buesking, Andrew W. ; Cote, Joy M ; Carter, Jack ; Xu, Chaoyi ; Wang, Min ; Cote, Joy

KAT6, a histone acetyltransferase from the MYST family, has emerged as an attractive oncology target due to its role in regulating genes that control cell cycle progression and cellular senescence. Amplification of the KAT6A gene has been seen among patients with worse clinical outcome in ER+ breast cancers. Although multiple inhibitors have been reported, no KAT6 inhibitors have been approved to date. Here, we report the fragment-based discovery of a series of N-(1-phenyl-1H-1,2,3-triazol-4-yl)benzenesulfonamide KAT6 inhibitors and early hit-to-lead efforts to improve the KAT6 potency.

01 Dec 2018·Synthetic and systems biotechnologyQ2 · BIOLOGY

New KAT6 inhibitors induce senescence and arrest cancer growth

Q2 · BIOLOGY

ArticleOA

Author: Huang, Fei

Lysine acetyltransferases (KATs) catalyze lysine acetylation, a reversible protein modification implicated in a wide variety of disease states. Histone acetyltransferases (HATs) comprise a KAT sub-class that acetylate specific lysines in histones, hence playing an important role in the regulation of chromatin organization and function. HATs are critical regulators of signaling in many diseases, including cancer. KAT6A (also known as monocytic leukemia zinc finger protein, MOZ) and KAT6B (also known as MORF and QKF) belong to the MYST family of HATs, that comprise KAT5-KAT8. They are the targets of chromosomal translocations identified in acute myeloid leukaemia and various cancers. It seems logical therefore that inhibition of KAT6A and KAT6B may provide a therapeutic benefit in cancer. Baell et al. discovered a new class of anti-cancer drug that can put cancer cells into a permanent sleep or senescence, using high-throughput screening followed by medicinal chemistry optimization, in-cell assays, biochemical assessment of target engagement, and tumour models in mice and fish. This research showed promise in arresting tumour growth in pre-clinical models of blood and liver cancers as well as delaying or stopping relapse without damaging the cells' DNA or some harmful side-effects caused by chemotherapy and radiotherapy.

20

News (Medical) associated with KAT6 Inhibitor (JiangSu Hengrui)23 Apr 2025

ASCO press program to feature overall survival and progression-free survival data for BRAFTOVI ® (encorafenib) combination regimen in first-line BRAF V600E -mutant metastatic colorectal cancer and progression-free survival data from VERITAC-2 study of vepdegestrant in metastatic breast cancer

NEW YORK--(BUSINESS WIRE)--Pfizer Inc. (NYSE: PFE) will showcase data across its portfolio of potential breakthrough cancer medicines at the 2025 American Society of Clinical Oncology (ASCO®) Annual Meeting, taking place May 30 to June 3 in Chicago. Data from more than 60 company-sponsored, investigator-sponsored, and collaborative research abstracts, including 9 oral presentations and 6 rapid oral presentations, will be presented across Pfizer’s key tumor areas, including breast, genitourinary, hematologic, and thoracic cancers, as well as colorectal cancer.

“This has already been a significant year for Pfizer’s Oncology pipeline, with multiple Phase 3 data readouts and regulatory approvals, and the initiation of pivotal registrational programs across our major tumor areas of focus,” said Chris Boshoff, MD, PhD, Chief Scientific Officer and President, Research & Development, Pfizer. “The depth and diversity of our data presentations at ASCO are building on that momentum to bring us closer to our goal of delivering eight breakthrough cancer medicines by 2030.”

Pfizer will have two late-breaking oral presentations featured in ASCO’s embargoed pre-meeting press briefing on May 27. These include the primary analysis of the pivotal overall survival (OS) and progression-free survival (PFS) results from the Phase 3 BREAKWATER study investigating BRAFTOVI® (encorafenib) in combination with cetuximab (marketed as ERBITUX®) and mFOLFOX6 in patients with BRAF V600E-mutant metastatic colorectal cancer,* as well as the first presentation of the PFS results from the Phase 3 VERITAC-2 study of vepdegestrant in adults with estrogen receptor-positive, human epidermal growth factor receptor 2-negative (ER+/HER2-) advanced or metastatic breast cancer (a/mBC) in partnership with Arvinas.**

Pfizer will share additional updates from key late-stage programs, including five-year survival data from the Phase 3 ARCHES study of XTANDI® (enzalutamide) in combination with androgen deprivation therapy in metastatic hormone-sensitive prostate cancer (mHPSC),*** and the first combination data for ELREXFIO® (elranatamab) + daratumumab + lenalidomide from the ongoing MagnetisMM-6 study in patients with transplant-ineligible (TI) newly diagnosed multiple myeloma (NDMM).

Pfizer will also share new findings highlighting the company’s strategy to explore novel vedotin antibody-drug conjugates (ADCs) in combination with immune checkpoint inhibitors to potentially enhance anti-tumor activity. For the first time, Pfizer will present encouraging Phase 1 data on two novel investigational ADCs in combination with pembrolizumab in thoracic cancers: sigvotatug vedotin (SV), an integrin beta-6 (IB6)-directed ADC, in lung cancer and head and neck cancers, and PDL1V (PF-08046054), a PD-L1 directed ADC, in head and neck cancers. Additionally, new exploratory analyses will be presented from the pivotal EV-302 trial with PADCEV® (enfortumab vedotin) in combination with KEYTRUDA® (pembrolizumab) in patients with previously untreated locally advanced or metastatic urothelial carcinoma (la/mUC).****

Several presentations will highlight updated results from ongoing Phase 1 studies that inform the dosing strategy in registrational programs for two molecules targeting epigenetic regulators: mevrometostat, an investigational EZH2 inhibitor being evaluated in combination with XTANDI for metastatic castration-resistant prostate cancer (mCRPC); and PF-07248144, a potential first-in-class KAT6 inhibitor for ER+/HER2- metastatic breast cancer (mBC).

“Our data at ASCO this year reflect how we are strategically progressing our deep pipeline of next generation cancer medicines while simultaneously extending the impact of our foundational therapies to reach more people living with cancer,” said Megan O’Meara, Head of Early-Stage Development and Interim Head of Late-Stage Development, Pfizer Oncology. “Important early-stage updates highlight our extensive pipeline and depth within our core cancer types, as we advance up to nine new pivotal Phase 3 trials this year.”

Key ASCO Presentations

Colorectal Cancers

BRAFTOVI : A late-breaking session will detail PFS and OS results from the Phase 3 BREAKWATER study of BRAFTOVI in combination with cetuximab and mFOLFOX6 chemotherapy in BRAF V600E -mutant metastatic colorectal cancer, further establishing the benefit of the BRAFTOVI combination regimen following its FDA accelerated approval in late 2024. These pivotal study results follow the topline results announcement for PFS and OS and the objective response rate (ORR) results presented at ASCO GI . These new data will also be featured in the ASCO press program.

Breast Cancer

Vepdegestrant : In a late-breaking session, PFS data will be presented for the first time from the Phase 3 VERITAC-2 study of vepdegestrant, a PROTAC ER degrader, in ER+/HER2− a/mBC. These detailed data follow the topline results from VERITAC-2 announced earlier this year and will also be featured in the ASCO press program.

PF-07248144 (KAT6 inhibitor) : A rapid oral presentation will highlight dose optimization data from an ongoing Phase 1 study for PF-07248144, a potential first-in-class KAT6 inhibitor, in patients with ER+/HER2− mBC. These results support the recommended dosing for PF-07248144 ahead of the Phase 3 trial initiation in second-line mBC planned for 2H 2025.

IBRANCE ® (palbociclib) : Roche will present detailed results from the OS analysis of the Phase 3 INAVO120 study investigating ITOVEBI™ (inavolisib) in combination with IBRANCE and fulvestrant in patients with PIK3CA -mutated, HR+/HER2-, endocrine-resistant, locally a/mBC. This presentation will be featured in ASCO’s embargoed pre-meeting press briefing on May 21.

Genitourinary Cancers

XTANDI : Five-year follow-up overall survival data from the ARCHES study of XTANDI in combination with androgen deprivation therapy in patients with mHSPC will be featured in an oral presentation. In addition, updates from the Astellas-supported, investigator-sponsored ENZAMET Phase 3 research study, led by the Australian and New Zealand Urogenital and Prostate Cancer Trials Group (ANZUP) and sponsored by the University of Sydney, will also be presented, including 8 year-outcomes in men with mHSPC. These presentations further underscore the value of XTANDI across approved indications.

Mevrometostat : A poster presentation will highlight pharmacokinetic and safety data from the ongoing Phase 1 study for mevrometostat, an investigational EZH2 inhibitor, in combination with XTANDI. These updated data further inform the dosing strategy for mevrometostat in a robust registrational program that includes two Phase 3 trials in mCRPC, and a third trial in metastatic castration-sensitive prostate cancer (mCSPC) that is planned to start in 1H 2025.

PADCEV : Additional updates from the Phase 3 EV-302 study of PADCEV in combination with KEYTRUDA in previously untreated la/mUC will be presented, including an oral presentation with exploratory analysis of responders.

Hematologic Cancers

ELREXFIO : Initial safety and efficacy results from Part 1 of the ongoing MagnetisMM-6 study of ELREXFIO in combination with daratumumab and lenalidomide in patients with newly diagnosed MM that are not eligible for transplant will be presented as an oral presentation. Part 1 of the ongoing MagnetisMM-6 study evaluates the optimal dose of the ELREXFIO combination regimen in patients with RRMM or NDMM to determine the recommended phase 3 dose for part 2.

Thoracic Cancers

Sigvotatug vedotin (SV): Phase 1 results for SV, an IB6-directed vedotin ADC, in combination with pembrolizumab in non-small cell lung cancer (NSCLC) and head and neck squamous cell carcinoma (HNSCC) will be featured in a rapid oral presentation. This initial combination data for SV with pembrolizumab support a Phase 3 study in first line PD-L1-High NSCLC, initiated this year. The data also support the overall SV trial program that includes an ongoing Phase 3 monotherapy trial in second line+ NSCLC.

PDL1V (PF-08046054) : Two poster presentations will highlight interim Phase 1 results for PDL1V, a PD-L1 directed vedotin ADC, as monotherapy in NSCLC and initial safety and efficacy data in combination with pembrolizumab in patients with first-line recurrent or metastatic (r/m) HNSCC. These data provide additional support for the initiation of the two pivotal Phase 3 trials planned for PDL1V in 2025 in second line+ NSCLC and first line r/mHNSCC.

Additional information on key Pfizer-sponsored abstracts, including date and time of presentation, follows in the chart below. A complete list of Pfizer-sponsored accepted abstracts is available here.

Pfizer is continuing its commitment to help non-scientists understand the latest findings with the development of abstract plain language summaries (APLS) for company-sponsored research being presented at ASCO, which are written in non-technical language. Those interested in learning more can visit www.Pfizer.com/apls to access the summaries starting May 22, 2025.

COLORECTAL CANCERS

Oral Presentation (Abstract LBA3500)

Friday, May 30, 2:45-5:45 PM CDT

First-line encorafenib + cetuximab + mFOLFOX6 in BRAF V600E-mutant metastatic colorectal cancer (BREAKWATER): progression-free survival and updated overall survival analyses

Elez et al

BREAST CANCER

Rapid Oral Presentation (Abstract 1020)

Friday, May 30, 2:45-4:15 PM CDT

Dose optimization of PF-07248144, a first-in-class KAT6 inhibitor, in patients (pts) with ER+/HER2− metastatic breast cancer (mBC): Results from phase 1 study to support the recommended phase 3 dose (RP3D)

LoRusso et al

Oral Presentation (Abstract LBA1000)

Saturday, May 31, 1:15-4:15 PM CDT

Vepdegestrant, a PROTAC estrogen receptor (ER) degrader, vs fulvestrant in ER-positive/human epidermal growth factor receptor 2 (HER2)–negative advanced breast cancer: Results of the global, randomized, phase 3 VERITAC-2 study

Hamilton et al

GENITOURINARY CANCERS

Oral Presentation (Abstract 4502)

Sunday, June 1, 9:45 AM-12:45 PM CDT

Exploratory analysis of responders from the phase 3 EV-302 trial of enfortumab vedotin plus pembrolizumab (EV+P) vs chemotherapy (chemo) in previously untreated locally advanced or metastatic urothelial carcinoma (la/mUC)

Gupta et al

Oral Presentation (Abstract 5005)

Tuesday, June 3, 9:45 AM-12:45 PM CDT

ARCHES 5-year follow-up overall survival (OS) analysis of enzalutamide (ENZA) plus androgen deprivation therapy (ADT) in patients (pts) with metastatic hormone-sensitive prostate cancer (mHSPC)

Armstrong et al

Poster Presentation (Abstract 4571)

Monday, June 2, 9:00 AM-12:00 PM CDT

EV-302: Long-term subgroup analysis from the phase 3 global study of enfortumab vedotin in combination with pembrolizumab (EV+P) vs chemotherapy (chemo) in previously untreated locally advanced or metastatic urothelial carcinoma (la/mUC)

Bedke et al

Poster Presentation (Abstract 5046)

Monday, June 2, 9:00 AM-12:00 PM CDT

Safety and pharmacokinetics of mevrometostat (M) in combination with enzalutamide (E) in patients with metastatic castration-resistant prostate cancer (mCRPC)

Matsubara et al

HEMATOLOGIC CANCERS

Oral Presentation (Abstract 7504)

Tuesday, June 3, 9:45 AM-12:45 PM CDT

Elranatamab in combination with daratumumab and lenalidomide (EDR) in patients with newly diagnosed multiple myeloma (NDMM) not eligible for transplant: Initial results from MagnetisMM-6 part 1

Quach et al

THORACIC CANCERS

Rapid Oral Presentation (Abstract 3010)

Monday, June 2, 8:00-9:30 AM CDT

Sigvotatug vedotin (SV), an investigational integrin beta-6 (IB6)–directed antibody‒drug conjugate (ADC), and pembrolizumab combination therapy: Initial results from an ongoing phase 1 study (SGNB6A-001)

Sehgal et al

Poster Presentation (Abstract 6033)

Monday, June 2, 9:00 AM-12:00 PM CDT

Initial safety and efficacy of PDL1V (PF-08046054), a vedotin-based ADC targeting PD-L1, in combination with pembrolizumab in patients with recurrent or metastatic (R/M) HNSCC

Gillison et al

Poster Presentation (Abstract 8611)

Saturday, May 31, 1:30-4:30 PM CDT

Interim results of PDL1V (PF-08046054), a vedotin-based ADC targeting PD-L1, in patients with NSCLC in a phase 1 trial

Fontana et al

*The BREAKWATER trial was conducted with support from ONO Pharmaceutical, Merck KGaA, Darmstadt, Germany and Eli Lilly and Company.

**Pfizer and Arvinas have a global collaboration for the co-development and co-commercialization of vepdegestrant.

***XTANDI® is jointly developed and commercialized by Pfizer and Astellas in the United States.

****Pfizer and Astellas have a clinical collaboration agreement with Merck to evaluate the combination of PADCEV® and KEYTRUDA® in patients with previously untreated metastatic urothelial cancer.

Prescribing Information for Pfizer Medicines

Please see full Prescribing Information for BRAFTOVI®.

Please see full Prescribing Information, including BOXED WARNING, for ELREXFIO™ (elranatamab-bcmm).

Please see full Prescribing Information for IBRANCE® (palbociclib) tablets and IBRANCE® (palbociclib) capsules.

Please see full Prescribing Information, including BOXED WARNING, for PADCEV® (enfortumab vedotin).

Please see full Prescribing Information for XTANDI® (enzalutamide).

About Pfizer Oncology

At Pfizer Oncology, we are at the forefront of a new era in cancer care. Our industry-leading portfolio and extensive pipeline includes three core mechanisms of action to attack cancer from multiple angles, including small molecules, antibody-drug conjugates (ADCs), and bispecific antibodies, including other immune-oncology biologics. We are focused on delivering transformative therapies in some of the world’s most common cancers, including breast cancer, genitourinary cancer, hematology-oncology, and thoracic cancers, which includes lung cancer. Driven by science, we are committed to accelerating breakthroughs to help people with cancer live better and longer lives.

About Pfizer: Breakthroughs That Change Patients’ Lives

At Pfizer, we apply science and our global resources to bring therapies to people that extend and significantly improve their lives. We strive to set the standard for quality, safety and value in the discovery, development and manufacture of health care products, including innovative medicines and vaccines. Every day, Pfizer colleagues work across developed and emerging markets to advance wellness, prevention, treatments and cures that challenge the most feared diseases of our time. Consistent with our responsibility as one of the world's premier innovative biopharmaceutical companies, we collaborate with health care providers, governments and local communities to support and expand access to reliable, affordable health care around the world. For 175 years, we have worked to make a difference for all who rely on us. We routinely post information that may be important to investors on our website at www.pfizer.com. In addition, to learn more, please visit us on www.pfizer.com and follow us on X at @Pfizer and @Pfizer_News, LinkedIn, YouTube and like us on Facebook at Facebook.com/Pfizer.

Disclosure Notice

The information contained in this release is as of April 23, 2025. Pfizer assumes no obligation to update forward-looking statements contained in this release as the result of new information or future events or developments.

This release contains forward-looking information about Pfizer Oncology and Pfizer’s oncology portfolio of marketed and investigational therapies, including their potential benefits; expectations for our product pipeline, in-line products and product candidates, including anticipated regulatory submissions, data read-outs, study starts, approvals, launches, clinical trial results and other developing data; the development or commercial potential of our product pipeline, in-line products, product candidates and additional indications or combinations, including expected clinical trial protocols, the potential and timing for the initiation and progress of clinical trials and data read-outs from trials; the timing and potential for the submission of applications for and receipt of regulatory approvals; the timing and potential for product launches and commercialization; expected breakthrough, best- or first-in-class or blockbuster status or expected market entry of our medicines; potential patients reached; the regulatory landscape; the competitive landscape; and other statements about our business, operations and financial results that involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Risk and uncertainties include, among other things, uncertainties regarding the commercial success of Pfizer’s oncology portfolio; the uncertainties inherent in research and development, including the ability to meet anticipated clinical endpoints, commencement and/or completion dates for our clinical trials, regulatory submission dates, regulatory approval dates and/or launch dates, as well as the possibility of unfavorable new clinical data and further analyses of existing clinical data; risks associated with interim and preliminary data; the risk that clinical trial data are subject to differing interpretations and assessments by regulatory authorities; whether regulatory authorities will be satisfied with the design of and results from our clinical studies; whether and when any drug applications, biologics license applications and/or emergency use authorization applications may be filed in any jurisdictions for any potential indication for Pfizer’s product candidates; whether and when any such applications that may be filed for any of Pfizer’s product candidates may be approved by regulatory authorities, which will depend on myriad factors, including making a determination as to whether the product's benefits outweigh its known risks and determination of the product's efficacy and, if approved, whether any such product candidates will be commercially successful; decisions by regulatory authorities impacting labeling, manufacturing processes, safety and/or other matters that could affect the availability or commercial potential of Pfizer’s products or product candidates, including development of products or therapies by other companies; manufacturing capabilities or capacity; uncertainties regarding the impact of COVID-19 on Pfizer’s business, operations and financial results; and competitive developments.

A further description of risks and uncertainties can be found in Pfizer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and in its subsequent reports on Form 10-Q, including in the sections thereof captioned “Risk Factors” and “Forward-Looking Information and Factors That May Affect Future Results”, as well as in its subsequent reports on Form 8-K, all of which are filed with the U.S. Securities and Exchange Commission and available at www.sec.gov and www.pfizer.com.

Phase 3ASCOPhase 1Clinical ResultImmunotherapy

03 Jan 2025

SAN FRANCISCO, Jan. 03, 2025 (GLOBE NEWSWIRE) -- Olema Pharmaceuticals, Inc. (“Olema” or “Olema Oncology”, Nasdaq: OLMA), a clinical-stage biopharmaceutical company focused on the discovery, development, and commercialization of targeted therapies for breast cancer and beyond, today announced that the Company granted stock options to three new employees to purchase an aggregate of 26,200 shares of the Company's common stock, effective as of January 2, 2025. These awards were approved by the Compensation Committee of Olema’s Board of Directors and granted under the Company's 2022 Inducement Plan as an inducement material to the new employees entering into employment with Olema, in accordance with Nasdaq Listing Rule 5635(c)(4). The stock options vest over four years, with 25 percent vesting on the first anniversary of the vesting commencement date for such employee and the remainder vesting in 36 equal monthly installments over the following three years, subject to the employee being continuously employed by Olema as of such vesting dates. The stock options have a 10-year term and an exercise price of $5.57 per share, equal to the last reported sale price of the Company's common stock as reported by Nasdaq on January 2, 2025. The stock options are subject to the terms of the Olema Pharmaceuticals, Inc., 2022 Inducement Plan. Olema is providing this information in accordance with Nasdaq Listing Rule 5635(c)(4). About Olema OncologyOlema Oncology is a clinical-stage biopharmaceutical company committed to transforming the standard of care and improving outcomes for patients living with breast cancer and beyond. Olema is advancing a pipeline of novel therapies by leveraging our deep understanding of endocrine-driven cancers, nuclear receptors, and mechanisms of acquired resistance. Our lead product candidate, palazestrant (OP-1250), is a proprietary, orally available complete estrogen receptor (ER) antagonist (CERAN) and a selective ER degrader (SERD), currently in a Phase 3 clinical trial called OPERA-01. In addition, Olema is developing a potent KAT6 inhibitor (OP-3136). Olema is headquartered in San Francisco and has operations in Cambridge, Massachusetts. For more information, please visit us at www.olema.com. Media and Investor Relations ContactCourtney O’KonekVice President, Corporate CommunicationsOlema Oncologymedia@olema.com

Phase 3

10 Dec 2024

Palazestrant, in combination with ribociclib, demonstrated promising clinical activity, a safety profile consistent with ribociclib and endocrine therapy, and favorable tolerability in patients with ER+/HER2- advanced or metastatic breast cancer With a median follow-up of 12 months, median progression-free survival (PFS) has not been reached6-month PFS rate was 73% in all patients, 81% in patients with ESR1 mutations, 70% in ESR1 wild-type patients, and 68% in patients with prior CDK4/6 inhibitor treatment; data continue to mature Conference call today at 8:00 a.m. ET SAN FRANCISCO, Dec. 10, 2024 (GLOBE NEWSWIRE) -- Olema Pharmaceuticals, Inc. (“Olema” or “Olema Oncology”, Nasdaq: OLMA), a clinical-stage biopharmaceutical company focused on the discovery, development, and commercialization of targeted therapies for breast cancer and beyond, today announced updated clinical results from the ongoing Phase 1b/2 study of palazestrant in combination with CDK4/6 inhibitor, ribociclib, in patients with estrogen receptor-positive, human epidermal growth factor receptor 2-negative (ER+/HER2-) advanced or metastatic breast cancer. Results as of September 25, 2024, will be presented in a poster session at the San Antonio Breast Cancer Symposium (SABCS 2024) being held December 10-13 at the Henry B. Gonzalez Convention Center in San Antonio, Texas. Updated results as of November 11, 2024, are detailed below. “We believe these data, while still maturing, are compelling and highly differentiated, with robust clinical activity shown across both ESR1 wild-type and mutant patient populations after prior treatment with a CDK4/6 inhibitor in combination with endocrine therapy. Mutations in the ESR1 gene are one of the most common resistance mechanisms arising during current front-line standard of care treatment, leading to progression. Palazestrant has demonstrated its potential to work in combination with ribociclib by completely blocking estrogen receptor signaling and suppressing tumor growth to extend progression-free survival after prior progression on the current standard of care, regardless of ESR1 status,” said Sean P. Bohen, M.D., Ph.D., President and Chief Executive Officer of Olema Oncology. “These data provide the foundation to initiate OPERA-02, our planned pivotal Phase 3 trial of palazestrant in combination with ribociclib in front-line metastatic breast cancer next year. We look forward to sharing mature data from this combination in 2025 and continuing the development of palazestrant as we work to advance our goal of creating innovative therapies to improve the lives of breast cancer patients.” Interim Results from the Phase 1b/2 Study of Palazestrant in Combination with RibociclibEnrollment62 patients with advanced or metastatic ER+/HER2- breast cancer were treated with palazestrant (n=56 at the recommended Phase 2 dose (RP2D) of 120 mg once daily) plus ribociclib (600 mg once daily; three weeks on treatment followed by one week off treatment). The majority of participants (48 (77%)) were 2/3+ line patients; 48 (77%) patients received prior endocrine therapy for metastatic breast cancer, 46 (74%) patients received prior treatment of endocrine therapy with CDK4/6 inhibitors (CDK4/6i), 12 (19%) received two prior lines of treatment with CDK4/6i, and 11 (18%) patients received chemotherapy for metastatic breast cancer.36 (58%) patients had visceral disease; 42 (68%) patients had measurable disease at baseline. Of 60 patients whose circulating tumor DNA (ctDNA) was assessed, 28% had activating mutations in ESR1 at baseline. EfficacyPalazestrant combined with ribociclib showed promising clinical activity including tumor responses, prolonged disease stabilization, and progression-free survival in patients with ESR1 wild-type and ESR1 activating mutations at baseline and in those previously treated with one or two lines of CDK4/6i. Efficacy data continue to mature; 30 (48%) patients remain on treatment, and the longest duration on treatment is approximately 18 months (79 weeks) and was ongoing as of the data cutoff date of November 11, 2024. With a median follow-up of 12 months, the median PFS was not reached as of the data cutoff date. Across all patients, the 6-month PFS rate was 73%. In those who received prior treatment with a CDK4/6i plus an endocrine therapy, the 6-month PFS rate was 68%. The 6-month PFS rate in ESR1 mutant patients was 81% and in ESR1 wild-type patients it was 70%.In those who were clinical benefit rate (CBR)1-eligible, the CBR was 76% (37/49) in all patients, 81% (13/16) in patients with ESR1 mutations, and 74% (23/31) in ESR1 wild-type patients. In patients with prior CDK4/6i treatment, the CBR was 71% (25/35), 81% (12/16) in patients with ESR1 mutations, and 65% (11/17) in ESR1 wild-type patients.As of the data cutoff date, there were 11 responses (two confirmed complete responses, eight confirmed partial responses, and one unconfirmed partial response). Among 37 response-evaluable patients with measurable disease, the ORR was 27% (10/37). 60% of the 37 had a reduction in target lesion size. Safety and TolerabilityAcross 62 treated patients, the combination of up to 120 mg of palazestrant with the approved dose for metastatic disease of 600 mg of ribociclib daily was well tolerated with no new safety signals or increase in toxicity. The overall safety profile was consistent with the established safety profile of ribociclib 600 mg plus an endocrine therapy. Treatment with palazestrant up to 120 mg combined with ribociclib (600 mg) was well tolerated with no dose-limiting toxicities.The majority of treatment-emergent adverse events (TEAEs) were Grade 1 or 2, and the severity and incidence of adverse events were consistent with the expected safety profile of ribociclib plus endocrine therapy. PharmacokineticsPalazestrant did not affect ribociclib drug exposure when compared with published exposure data for single-agent ribociclib. Steady-state trough values showed no clinically significant difference between the combination and single-agent palazestrant. ConclusionsFindings from this study support the advancement of palazestrant in combination with ribociclib into clinical development for the first-line treatment of ER+/HER2- advanced or metastatic breast cancer. “Palazestrant is not an endocrine therapy where you need to wait six months to see a patient derive benefit. We have seen impressive responses quickly and a significant reduction of disease burden. The patients I have seen feel much better than they have on other treatments available in the armamentarium today,” said Virginia Borges, M.D., Professor, Medicine-Medical Oncology at the University of Colorado, and Principal Investigator for the palazestrant plus ribociclib combination study. “The findings presented at SABCS show that the combination of palazestrant and ribociclib is well-tolerated with meaningful preliminary efficacy that I believe has the potential to outperform the current standard of care and change how metastatic breast cancer is treated. I look forward to the continued development of palazestrant.” A copy of the poster presented at SABCS reflecting a September 25, 2024 data cutoff date will be made available on the Publications page of Olema’s website in alignment with the Symposium’s embargo policy. 1CBR is the proportion of patients who remained on treatment through at least 24 weeks with a confirmed complete response or partial response, or stable disease. Conference Call InformationOlema will hold a conference call to discuss these results today with the investment community at 8:00 a.m. ET (7:00 a.m. CT). Register to join the webcast by visiting the Events and Presentations page on the Investors section of Olema’s website. About Palazestrant (OP-1250)Palazestrant (OP-1250) is a novel, orally available small molecule with dual activity as both a complete estrogen receptor (ER) antagonist (CERAN) and selective ER degrader (SERD). It is currently being investigated in patients with recurrent, locally advanced or metastatic ER-positive (ER+), human epidermal growth factor receptor 2-negative (HER2-) breast cancer. In preclinical studies, palazestrant completely blocks ER-driven transcriptional activity in both ESR1 wild-type and mutant forms of breast cancer. In Olema’s ongoing clinical trials for advanced or metastatic ER+/HER2- breast cancer, palazestrant has demonstrated anti-tumor activity along with attractive pharmacokinetics and exposure, favorable tolerability, and combinability with CDK4/6 inhibitors. Palazestrant has been granted U.S. Food and Drug Administration (FDA) Fast Track designation for the treatment of ER+/HER2- metastatic breast cancer that has progressed following one or more lines of endocrine therapy with at least one line given in combination with a CDK4/6 inhibitor. It is being evaluated both as a single agent in an ongoing Phase 3 clinical trial, OPERA-01, and in Phase 1/2 combination studies with CDK4/6 inhibitors (palbociclib and ribociclib), a PI3Ka inhibitor (alpelisib), and an mTOR inhibitor (everolimus). For more information on OPERA-01, please visit www.opera01study.com. About Olema OncologyOlema Oncology is a clinical-stage biopharmaceutical company committed to transforming the standard of care and improving outcomes for patients living with breast cancer and beyond. Olema is advancing a pipeline of novel therapies by leveraging our deep understanding of endocrine-driven cancers, nuclear receptors, and mechanisms of acquired resistance. Our lead product candidate, palazestrant (OP-1250), is a proprietary, orally available complete estrogen receptor (ER) antagonist (CERAN) and a selective ER degrader (SERD), currently in a Phase 3 clinical trial called OPERA-01. In addition, Olema is developing a potent KAT6 inhibitor (OP-3136). Olema is headquartered in San Francisco and has operations in Cambridge, Massachusetts. For more information, please visit us at www.olema.com. Forward Looking StatementsStatements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Words such as “anticipate,” “believe,” “could,” “expect,” “goal,” “may,” “potential,” “upcoming,” “will,” and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These statements include those related to the potential beneficial characteristics, safety, tolerability, efficacy, and therapeutic effects of palazestrant and the development of palazestrant, in each case, including in combination with other drugs, the potential of palazestrant to work in combination with ribociclib to suppress tumor growth or extend progression-free survival, the initiation and timing of clinical trials, and Olema’s potential to transform the endocrine therapy standard of care treatments for patients living with ER+/HER2- metastatic breast cancer. Because such statements deal with future events and are based on Olema’s current expectations, they are subject to various risks and uncertainties, and actual results, performance or achievements of Olema could differ materially from those described in or implied by the statements in this press release. These forward-looking statements are subject to risks and uncertainties, including, without limitation, those discussed in the section titled “Risk Factors” in Olema’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, and other filings and reports that Olema makes from time to time with the U.S. Securities and Exchange Commission. Except as required by law, Olema assumes no obligation to update these forward-looking statements, including in the event that actual results differ materially from those anticipated in the forward-looking statements. Media and Investor Relations ContactCourtney O’KonekVice President, Corporate CommunicationsOlema Oncologymedia@olema.com

Clinical ResultPhase 3Fast TrackPhase 2

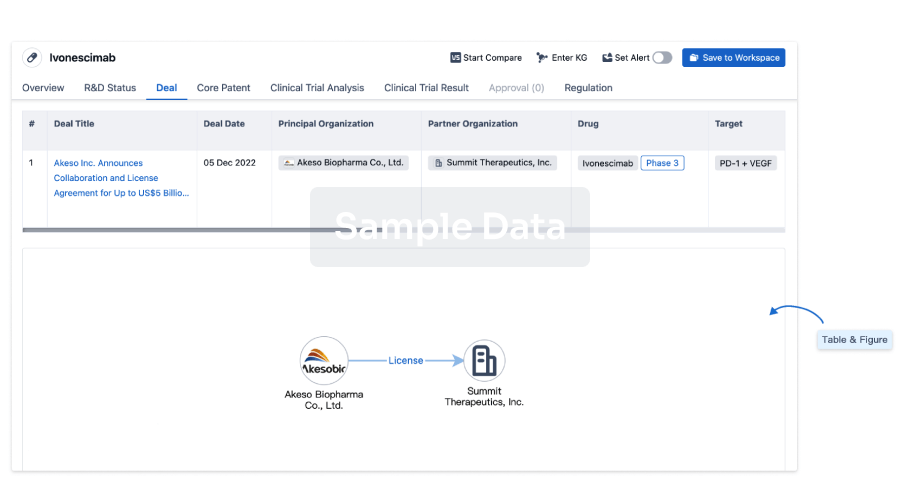

100 Deals associated with KAT6 Inhibitor (JiangSu Hengrui)

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Neoplasms | Preclinical | China | - |

Login to view more data

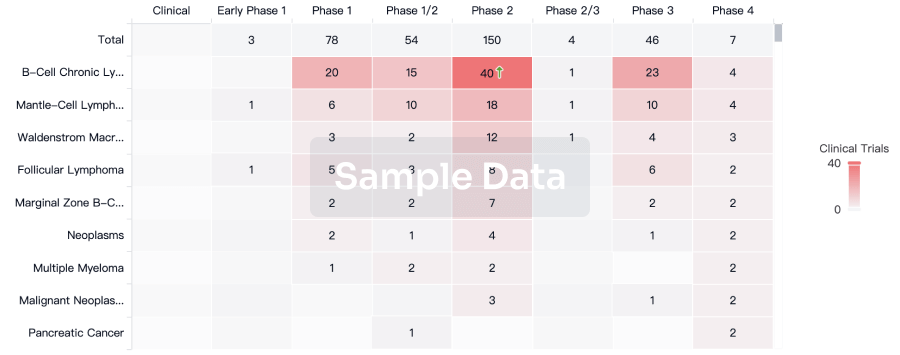

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free