Request Demo

Last update 22 Nov 2025

LY-3463251

Last update 22 Nov 2025

Overview

Basic Info

Drug Type Antibody fusion proteins |

Synonyms LY 3463251, LY3463251 |

Target |

Action agonists |

Mechanism GFRAL agonists(GDNF family receptor alpha like agonists), RET agonists(Tyrosine-protein kinase receptor RET agonists) |

Therapeutic Areas |

Active Indication- |

Inactive Indication |

Originator Organization |

Active Organization- |

Inactive Organization |

License Organization- |

Drug Highest PhaseDiscontinuedPhase 1 |

First Approval Date- |

Regulation- |

Login to view timeline

Related

1

Clinical Trials associated with LY-3463251NCT03764774

A Randomized, Placebo-Controlled, Subject- and Investigator-Blind, Single and Multiple Dose, Safety, Tolerability, and Pharmacokinetics Study of LY3463251 in Healthy and Overweight Healthy Subjects

The purpose of this study is to evaluate the safety and tolerability (side effects) of single (Part A) and multiple (Part B) doses of the study drug when it is administered subcutaneously (under the skin) into the abdomen.

This is a two-part study. Participants will enroll in only one part. For each participant, Part A will last about 10 weeks and Part B will last about 23 weeks, including screening.

This is a two-part study. Participants will enroll in only one part. For each participant, Part A will last about 10 weeks and Part B will last about 23 weeks, including screening.

Start Date06 Dec 2018 |

Sponsor / Collaborator |

100 Clinical Results associated with LY-3463251

Login to view more data

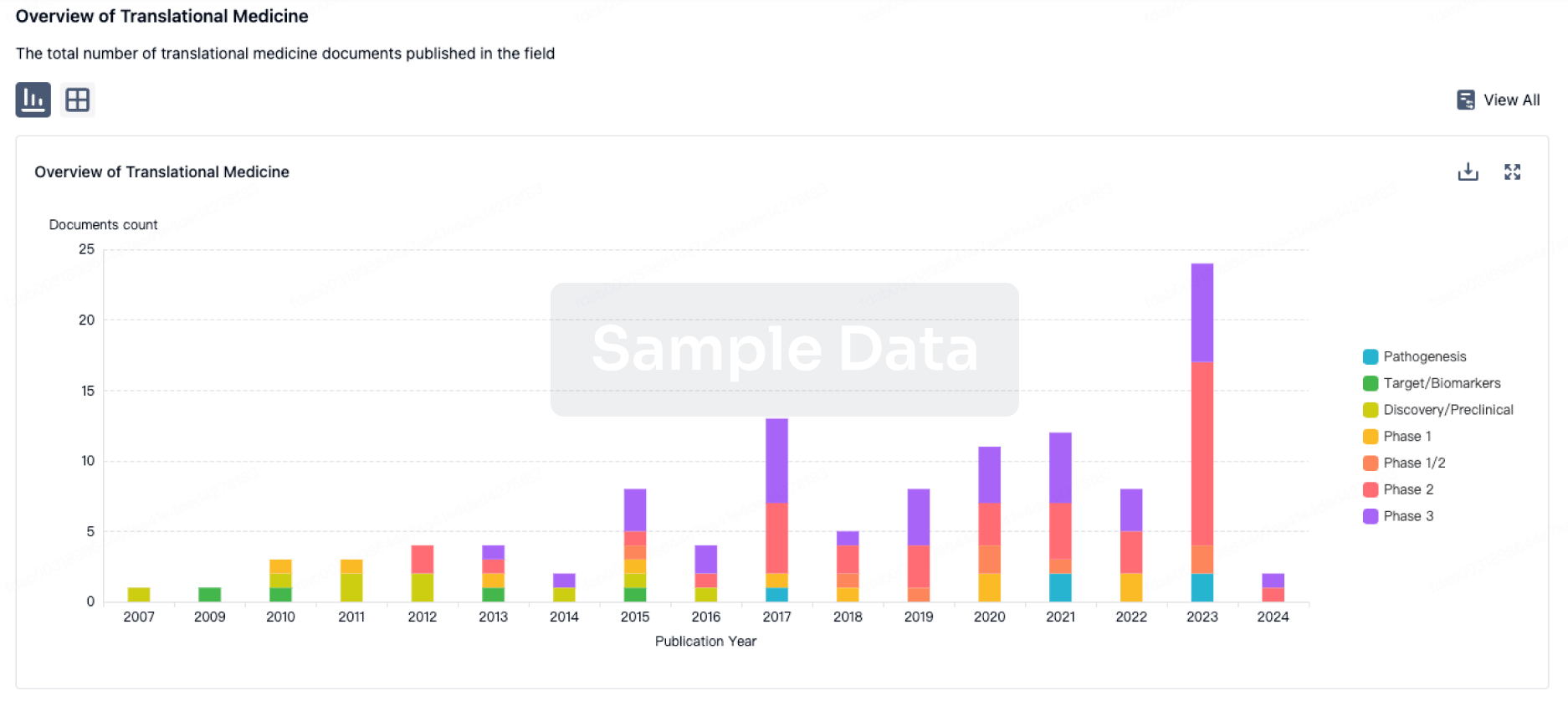

100 Translational Medicine associated with LY-3463251

Login to view more data

100 Patents (Medical) associated with LY-3463251

Login to view more data

1

Literatures (Medical) associated with LY-346325101 Feb 2023·Cell metabolism

Discovery, development, and clinical proof of mechanism of LY3463251, a long-acting GDF15 receptor agonist

Article

Author: Benichou, Olivier ; Coskun, Tamer ; Emmerson, Paul J ; Martin, Jennifer A ; Robins, Deborah A ; Mather, Kieren J ; Zvada, Simbarashe P ; Garhyan, Parag ; Gonciarz, Malgorzata D ; Adams, Andrew C ; Pickard, Richard T ; Reynolds, Vincent L ; Dunbar, James D ; Du, Yu

GDF15 and its receptor GFRAL/RET form a non-homeostatic system that regulates food intake and body weight in preclinical species. Here, we describe a GDF15 analog, LY3463251, a potent agonist at the GFRAL/RET receptor with prolonged pharmacokinetics. In rodents and obese non-human primates, LY3463251 decreased food intake and body weight with no signs of malaise or emesis. In a first-in-human study in healthy participants, single subcutaneous LY3463251 injections showed a safety and pharmacokinetic profile supporting further clinical development with dose-dependent nausea and emesis in a subset of individuals. A subsequent 12-week multiple ascending dose study in overweight and obese participants showed that LY3463251 induced significant decreases in food intake and appetite scores associated with modest body weight reduction independent of nausea and emesis (clinicaltrials.gov: NCT03764774). These observations demonstrate that agonism of the GFRAL/RET system can modulate energy balance in humans, though the decrease in body weight is surprisingly modest, suggesting challenges in leveraging the GDF15 system for clinical weight-loss applications.

1

News (Medical) associated with LY-346325107 Mar 2024

In February, researchers from the University of Leicester and the Leicester Diabetes Centre published a review article on obesity in the "International Journal of Obesity," introducing the current and future drug development pipeline for the treatment of obesity, with special attention given to novel therapies based on the mechanisms of gut incretin hormones.

A deep understanding of the weight regulation mechanism and the impact of the gut-brain axis on appetite has spurred the development of incretin-based medications, such as GLP-1 receptor agonists. For instance, the subcutaneously injected drug Semaglutide 2.4 mg, approved in 2021 and administered once a week, has been shown to achieve an average weight reduction of 15%-17% and also offers cardiovascular protective effects. Oral GLP-1 receptor agonists are also in the development phase, with preliminary data showing efficacy similar to that of Semaglutide.

In pursuit of more effective obesity treatments, researchers are studying the combined use of GLP-1 with other incretin hormones (such as GIP, glucagon, and amylin) to enhance weight reduction and cardiovascular metabolic improvements. A dual GIP and GLP-1 receptor agonist developed by Eli Lilly, Tirzepatide, has demonstrated weight loss results up to 22.5% in diabetes and obesity management. Additionally, various combinations of incretin-based therapies such as Cagrisema and Retatrutide have entered phase III clinical trials, with early data suggesting they may offer an even greater degree of weight reduction benefits.

At present, the effects of incretin combination therapies on weight loss are approaching those of bariatric surgery, marking the advent of a new era in pharmacological treatment for obesity. This article briefly outlines the efficacy and safety data of the drug treatment pipeline for obesity, with a focus on incretin-based medications, and discusses the clinical challenges and significance brought about by this new era.

Main Gastrointestinal Hormone Targets and Their Roles in the Obesity Treatment PipelineObesity, as a global chronic disease characterized by excessive fat accumulation, affects the health of approximately 650 million people and is associated with an increased risk of multiple metabolic complications, such as Type 2 diabetes and non-alcoholic fatty liver disease, as well as cardiovascular diseases and mechanical issues, including osteoarthritis and obstructive sleep apnea. Although lifestyle interventions—including dietary modifications, exercise, and behavioral changes—are the foundational approaches for treating obesity and offer various benefits, even the most rigorous intervention programs achieve only an average weight loss of about 10%; maintaining these weight loss results presents significant challenges, as the majority of patients are expected to experience an 80% rebound in lost weight within five years.

GLP-1 (Glucagon-like peptide-1): GLP-1 is a peptide hormone secreted by intestinal L cells after food intake, exhibiting multiple physiological effects. It mainly stimulates insulin secretion and inhibits the release of glucagon by binding to receptors on pancreatic beta cells, thus helping to lower blood glucose levels. Additionally, GLP-1 also demonstrates significant appetite suppression and delays gastric emptying, making it an effective candidate drug for the treatment of type 2 diabetes and obesity.

GIP (Glucose-dependent insulinotropic polypeptide): GIP is another intestinal hormone secreted by K cells of the ileum after food intake. Its primary physiological functions include promoting glucose-dependent insulin secretion, enhancing hepatic glycogen synthesis, and increasing the buffering capacity of adipose tissue for lipids. Although the insulinotropic effect of GIP is diminished in patients with type 2 diabetes, studies have found that GIP receptor agonists can induce a degree of weight loss and, when used in combination with GLP-1, can produce synergistic effects, enhancing blood glucose reduction and weight loss.

Glucagon: Glucagon is a hormone secreted by pancreatic alpha cells, which has the opposite effect of insulin in blood sugar regulation. It promotes the conversion of liver glycogen to glucose and increases gluconeogenesis, as well as enhancing fat breakdown to provide energy. Although the use of glucagon alone may not be favorable for weight management, combining it with other gut-pancreatic hormones (such as GLP-1) might represent a new direction in the development of drugs for obesity, aiming to balance blood sugar regulation with weight reduction.

Amylin: Amylin is a polypeptide hormone co-secreted with insulin by the pancreatic β-cells. Postprandially, it has the ability to suppress gastrointestinal motility, delay gastric emptying, reduce appetite, and is also involved in regulating glucose homeostasis. Combination formulations that include amylin analogs with other incretins like GLP-1, such as cagrisema, are currently being assessed for the treatment of obesity and metabolic disorders.

PYY (Peptide YY): PYY is a satiety hormone produced by L cells in the intestines, which, similar to GLP-1, increases in concentration after meals and can reduce food intake, thereby potentially aiding in combating obesity. As a significant gut hormone, PYY is receiving attention in the treatment strategies of obesity and other metabolic disorders, particularly in combination therapies with other incretins.

GLP-1R agonistInjectable Semaglutide: Subcutaneous injections of liraglutide 3mg (once daily) and semaglutide 2.4mg (once weekly) have been approved for the management of obesity. Currently, higher doses of subcutaneous semaglutide (once weekly at 7.2mg) are being evaluated in phase III clinical trials. However, due to aversion to injection therapy, an oral formulation of semaglutide that includes an absorption enhancer has been developed to solve this issue. This formulation improves the drug's bioavailability by enhancing gastric mucosal absorption.

Oral Semaglutide should be taken in the morning along with 120 ml of water, 30 minutes before any meal, to ensure full absorption. Based on results from the PIONEER project, oral semaglutide has been approved for treatment in patients with type 2 diabetes, where a 14 mg dose can reduce hemoglobin A1c (HbA1c) levels by up to −1.4% and lead to a weight loss of up to 4.4 kg. This not only indicates that oral semaglutide has similar efficacy in the treatment of obesity compared to the injectable form but also that its oral route of administration may help overcome psychological barriers to injection therapy for some patients, thus improving compliance and acceptance.

In a phase III clinical trial for a non-type 2 diabetic obese population (OASIS-1), researchers evaluated the safety and effectiveness of daily oral semaglutide 50mg combined with placebo and moderate-intensity lifestyle interventions. The trial results showed that after a 68-week treatment period, the oral semaglutide group achieved a significant weight reduction compared to the placebo group, with a 17.4% decrease in body weight versus 1.8% in the placebo group. Additionally, patients taking oral semaglutide also showed improvements in multiple cardiovascular metabolic risk factors.

In the PIONEER PLUS trial, for individuals with type 2 diabetes, a daily dose of 50 mg oral semaglutide achieved a weight loss of 9.8% over a continuous 68-week study period compared to 5.4% weight loss with a daily dose of 14 mg semaglutide. Moreover, in terms of reduction in hemoglobin A1c (HbA1c) levels, the 50 mg dose of oral semaglutide outperformed the 14 mg dose, with reductions of 2.1% and 1.3%, respectively, at 68 weeks.

Orforglipron is a once-daily, orally administered, non-peptide GLP-1 receptor agonist that operates in a slightly different manner from natural GLP-1. Orforglipron is a selective and potent partial agonist that biases the activation of GLP-1 receptors towards the G-protein signaling pathway and exhibits a lesser ability to recruit β-arrestin.

In a 36-week phase II trial conducted among obese individuals, orforglipron dosages varied from 12 to 45 mg. The results demonstrated a dose-dependent effect on weight loss, with the maximum reduction reaching −14.7%, compared to only −2.3% in the placebo group. Moreover, orforglipron simultaneously improved cardiovascular metabolic risk factors.

For patients with type 2 diabetes, a 26-week phase II trial showed that 48% of participants achieved at least 10% weight reduction after treatment with orforglipron 45 mg. In this trial, the average HbA1c level dropped by up to −2.1% with a 45 mg dose of orforglipron, while the placebo group showed a decrease of only −0.4%.

Danuglipron is an oral, non-peptide GLP-1 receptor agonist with a pharmacological mechanism that predominantly activates the G protein rather than β-arrestin. In a Phase II clinical trial targeting patients with obesity, Danuglipron showcased significant weight loss effects over a 32-week treatment period. At doses ranging from 40 to 200 mg taken twice daily, the highest weight reduction achieved was up to 11.7% compared to a 1.4% weight increase in the placebo group. However, the discontinuation rates for Danuglipron across different doses were over 50%, significantly higher than the approximately 40% observed in the placebo group, indicating poor tolerability in some patients. The primary adverse events were gastrointestinal in nature and mostly mild to moderate.

In trials with patients with type 2 diabetes and overweight/obesity, after 16 weeks of treatment with Danuglipron, the high-dose (120 mg twice daily) group showed an average weight loss of 4.2 kg and a reduction in HbA1c levels by 1.2% compared to the placebo group. Due to the high discontinuation rates observed in early trial phases, especially for the twice-daily formulation, the development team decided not to advance this dosing regimen into Phase III research. Instead, efforts were redirected to develop and assess an improved once-daily formulation aimed at enhancing the drug's tolerability and patient acceptance.

Lotiglipron is an oral, non-peptide GLP-1 receptor agonist that showed therapeutic potential in early clinical trials. However, patients using Lotiglipron exhibited increased liver enzyme levels, a possible indication of hepatic toxicity. In light of this potential significant safety issue, the development of Lotiglipron has been discontinued, meaning the drug did not progress to further clinical trial stages to evaluate its efficacy and safety.

GIPR/GLP‐1R dual agonistsTirzepatide is a dual agonist for the glucagon-like peptide-1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors. This medication has been developed for the treatment of type 2 diabetes due to its comprehensive effects in regulating appetite, reducing food intake, and improving glycemic control. In clinical studies targeting obesity, particularly in the phase 3 trials based on the SURPASS program, tirzepatide demonstrated outstanding weight reduction benefits, with some patients achieving a weight loss of up to 22.5%. These significant results have prompted further in-depth research on tirzepatide, such as the SURMOUNT initiative, to evaluate its potential as a therapeutic agent for obesity.

Additionally, besides its effective role in weight reduction, tirzepatide has demonstrated improvements in cardiovascular metabolic risk factors. For obese populations with comorbidities such as type 2 diabetes, heart failure, and obstructive sleep apnea, it holds extensive therapeutic value. Owing to its unique dual-target mechanism, tirzepatide has the potential to become a more comprehensive and efficient next-generation medication for the management of obesity and its related complications, having already received the necessary regulatory approvals.

CT-388 is an orally or injectably administered dual GLP-1R and GIPR agonist that is in the early stages of development. In a Phase I clinical trial, the drug demonstrated positive preliminary effects, achieving an average weight reduction of over 8% after four weeks of treatment in an overweight or obese population, indicating its strong potential for weight loss.

GIPR antagonists/GLP-1R agonistsAMG133 is a monoclonal antibody drug designed to block the glucose-dependent insulinotropic polypeptide (GIP) receptor and simultaneously bind to two modified GLP-1 peptide segments to activate the GLP-1 receptor. In a Phase 1 clinical trial, AMG133 demonstrated significant dose-dependent weight loss effects, achieving up to a 14.5% reduction in body weight compared to a 1.5% reduction for the placebo group on day 85. Notably, patients participating in the trial maintained the weight loss for several months after the last injection. The main adverse events were transient nausea and vomiting.

Additionally, AMG133 explores a new strategy for treating obesity by targeting the GIP receptor and combining GLP-1 activity. Its mechanism of action may include improving metabolic status and reducing food intake through balancing the action of gut-pancreatic axis hormones, and potentially increasing energy expenditure by modulating internal amino acid cycling, thereby aiding in weight management. Currently, a 52-week Phase 2 clinical trial (NCT05669599) is underway for the overweight and obese population to further evaluate the safety and long-term efficacy of AMG133.

GLP-1R/GCGR dual agonistsSurvodutide is a candidate drug in the obesity treatment pipeline, belonging to a class of dual GLP-1 and GCGR agonists. In clinical trials targeting obese populations, Survodutide demonstrated varying degrees of weight loss across dosages ranging from 0.6 to 4.8 milligrams. In Phase II studies, Survodutide showed a statistically significant advantage over placebo, with a higher proportion of patients achieving at least a 10% and 15% reduction in body weight compared to the placebo group. Additionally, as a therapeutic, Survodutide has been granted Fast Track designation by the U.S. FDA for the adult MASH patient population.

During clinical trials, the proportion of participants who discontinued a medication due to adverse events associated with Survodutide ranged between 20% and 29%. The majority of these discontinuations were due to gastrointestinal-related adverse events, primarily occurring during the rapid dose-escalation phase. To minimize treatment interruptions due to adverse reactions, subsequent Phase III clinical trials may adopt a more gradual dose-escalation strategy to reduce the incidence and severity of gastrointestinal discomfort and other adverse events, thereby enhancing patient tolerance and adherence to the medication.

Mazdutide is another GLP-1R and GCGR dual agonist undergoing clinical research, holding a place in the developmental pipeline for obesity treatment drugs. Clinical trials have shown significant weight reduction effects at varying dosage levels (3 to 9 milligrams) for Mazdutide. In a Phase II trial, patients in the Mazdutide group saw a weight decrease between 5% and 22.5%, with a notable proportion of patients across different dosage groups achieving at least a 10% or even higher degree of weight reduction. Moreover, Mazdutide also exhibited beneficial effects on cardiovascular metabolic risk factors, including improvements in HbA1c levels, waist circumference changes, and blood pressure metrics.

Given the promising preliminary efficacy and safety data, Mazdutide continues to be evaluated in Phase III clinical trials to further verify its long-term safety and effectiveness, and it is anticipated to become a significant treatment option for obesity and patients with type 2 diabetes in the future. However, as with other novel obesity drugs, Mazdutide must overcome certain challenges, such as optimizing dose-escalation strategies to reduce dropout rates due to adverse events, and ensuring consistent and sustained efficacy in larger scale clinical studies.

Pemvidutide is another dual agonist of GLP-1R and GCGR that is currently under clinical investigation. It is now in Phase II clinical trials to assess its effectiveness as a therapeutic option for obesity treatment. In Phase I clinical trials, the drug demonstrated significant weight loss potential with reductions up to 10.3% over 12 weeks. In the Phase II obesity clinical trial MOMENTUM-1, a 2.4 mg dose of pemvidutide resulted in an average weight loss of 15.6% after 48 weeks, with the placebo-corrected figure being 13.4%.

However, it is noteworthy that 20% of patients treated with the 2.4 mg dose of pemvidutide discontinued treatment due to adverse events, with nausea and vomiting being the most common AEs. The discontinuation rate decreased with lower doses, ranging between 5% to 19%.

In a Phase Ib study for patients with Type 2 Diabetes (T2D), although no significant improvement in HbA1c levels was observed, pemvidutide still achieved a weight reduction of 8.5% at the end of a 12-week course compared to placebo.

Additionally, in a Phase II clinical trial targeting a population with Metabolism-Associated Steatohepatitis (MASLD), treatment with 2.4 mg of pemvidutide for 24 weeks resulted in a relative liver fat content reduction of up to 76% as opposed to the placebo group's 14%. Furthermore, pemvidutide is currently undergoing Phase II studies for various Metabolic Syndrome Hybrid Disorders (MASH).

Efinopegdutide is another GLP-1R and GCGR dual agonist currently under clinical investigation, which is being explored in studies for patients with obesity, type 2 diabetes (T2D), and metabolically associated fatty liver disease/multiple acyl-CoA dehydrogenase deficiency syndrome (MASLD/MASH). In a phase 2 clinical trial conducted on an obese population, over a 26-week period, patients who were administered a dose range of efinopegdutide from 5 mg to 10 mg experienced a weight reduction of up to 11.8%. In comparison, patients treated with 3 mg of liraglutide observed a weight loss of 7.5%, while the placebo group saw only a 1.8% reduction.

In individuals with type 2 diabetes, another phase 2 clinical study demonstrated that after 12 weeks of efinopegdutide treatment, although no significant improvement in glycated hemoglobin (HbA1c) levels was observed, the effect on weight loss reached a high of 7.9%, well above the 0.7% weight reduction rate in the placebo group.

Particularly noteworthy is that in patients with both type 2 diabetes and MASLD, after 24 weeks of treatment with a 10 mg dose of efinopegdutide, liver fat content reduced by 72.7%, a result that is superior to the 42.3% reduction achieved with a 1 mg dose of semaglutide, despite a similar overall weight loss being observed with the two interventions.

AZD9550 and LY3305677 are GLP-1R and GCGR dual agonists in the early stages of clinical trials, being investigated as novel therapeutic options for the treatment of obesity.

GLP-1R/GIPR/GCGR Triple AgonistRetatrutide is a novel once-weekly triple agonist for the GLP-1R, GIPR, and GCGR receptors, showing a stronger action on the human GIP receptor, and exerting weaker effects on the GLP-1 and glucagon receptors. In a phase 2 clinical trial targeting obese individuals without type 2 diabetes (T2D), retatrutide dosed at 1 to 12 mg resulted in up to 24.2% weight loss over a 48-week treatment period, compared to 2.1% in the placebo group, and demonstrated a dose-dependent effect. After 48 weeks, 36%-48% of subjects receiving 8 mg and 12 mg doses achieved ≥25% weight reduction, with no participants in the placebo group reaching this level. Participants with a BMI ≥35 kg/m² and female participants experienced a higher percentage of weight loss following retatrutide treatment. Additionally, retatrutide significantly improved blood lipids and blood pressure compared to placebo.

In patients with T2D in a phase 2 clinical trial, retatrutide (0.5 to 12 mg) significantly reduced body weight and HbA1c levels compared to placebo and 1.5 mg dulaglutide. At 36 weeks, retatrutide led to a maximum HbA1c reduction of 2.2%, while dulaglutide reduced it by 1.4%, and the placebo group by 0.3%; regarding weight, retatrutide achieved a maximum reduction of 16.9%, dulaglutide 2%, and the placebo group 3%. The advantages of the triple agonist were also reflected in the MASLD (magnetic resonance-observed substantial loss of liver fat): approximately 90% of high-dose retatrutide subjects in a subgroup of 98 people had a normal fat content restoration.

The safety profile of retatrutide is similar to other incretin-based therapies, with the most commonly reported adverse events being transient and mostly mild to moderate gastrointestinal symptoms, with the 4 mg starting dose group having a higher incidence than the 2 mg starting dose group. In the 12 mg dose group, 16% of subjects discontinued due to adverse events (AEs), but the overall incidence of severe adverse events (SAEs) was low, about 6%-8%.

Currently, a phase 3 clinical trial program for retatrutide (TRIUMPH) is underway to assess its safety and efficacy in different obese patient populations, including those with obstructive sleep apnea (OSA), T2D, diagnosed cardiovascular disease, osteoarthritis, and others.

Amylin AgonistsPramlintide is the first FDA-approved synthetic insulin analog for the management of diabetes and can lead to a weight reduction of up to 7.9% in clinical use. This medication works by mimicking the action mechanism of natural insulin, contributing to appetite regulation, slowing gastric emptying, and improving glycemic control.

Cagrilintide is a new long-acting insulin analog that has shown dose-dependent weight reduction effects in phase II clinical trials, with outcomes ranging from 6% to 10.8% under a once-weekly dosing regimen. By comparison, a 3 mg dose of liraglutide, another medication, resulted in a 9% weight loss, while the placebo group only experienced a 3% reduction.

Besides Cagrilintide, there are other insulin-based molecules in early clinical trial phases, including long-acting insulin agonists and a dual receptor agonist that binds both insulin and calcitonin activities.

GLP‐1R/Amylin dual agonistsCagrisema is a dual therapy that combines semaglutide, a GLP-1 receptor agonist, with cagrilintide, a long-acting insulin analog. In studies targeting patients with obesity, cagrisema has demonstrated significant weight loss effects. Results from a 20-week phase 1b clinical trial showed that a once-weekly dose of 2.4 mg cagrilintide in combination with an equal dose of semaglutide, collectively termed cagrisema, achieved up to 17.1% weight reduction in the obese population. In contrast, patients treated with semaglutide 2.4 mg plus placebo alone experienced a 9.5% weight loss. Furthermore, in a phase 2 clinical trial addressing a patient group with type 2 diabetes and overweight/obesity, after 32 weeks of treatment, the cagrisema 2.4 mg group exhibited a more significant average weight loss compared to the cagrilintide 2.4 mg group or the group using semaglutide 2.4 mg alone, with reductions of 15.6%, 8.1%, and 5.1%, respectively. Additionally, the cagrisema treatment group's glycosylated hemoglobin (HbA1c) levels decreased more than those treated solely with semaglutide 2.4 mg or cagrilintide 2.4 mg alone, with reductions of -2.2%, -1.8%, and -0.9% respectively.

PEPTIDE YY (PYY)PYY 1875 is an agonist targeting the neuropeptide Y receptor 2 (Y2R). Clinical studies and trials have indicated that therapies addressing the PYY system have the potential to reduce food intake, increase satiety, and promote weight loss. Despite lower efficacy and tolerability shown by nasally administered PYY agonists in early studies, long-acting subcutaneous PYY receptor agonists such as PYY 1875 are undergoing early-phase clinical trials to evaluate their safety and effectiveness as monotherapy or in combination with GLP-1 receptor agonists for the treatment of obesity.

In a Phase I clinical trial, a PYY analog named Y14 peptide was administered subcutaneously every 7 to 14 days. The results demonstrated good safety and potential significant efficacy of the drug. Over a trial period of 31 days, participants treated with Y14 peptide experienced a weight reduction of 2.9 to 3.6 kilograms, with a 38% to 55% reduction in food intake compared to the placebo group. This further substantiates the potential of therapies targeting the PYY system in the treatment of obesity.

Other novel drugsBimagrumab is a human monoclonal antibody drug, whose mechanism of action stimulates the growth of skeletal muscle by blocking the activin type II receptor (ActRII). The drug is administered via intravenous infusion every four weeks.

In a 48-week phase II clinical trial conducted on patients with type 2 diabetes and obesity, treatment with a dose of 10 mg/kg of bimagrumab resulted in a significant reduction in fat mass by 20.5% (compared to 0.5% in the placebo group), while lean body mass increased by 3.6% (as opposed to a decrease of 0.8% in the placebo group), leading to an overall body weight reduction of -6.5%, which was substantially better than the -0.8% observed in the placebo group. Additionally, compared to the placebo, there was an adjusted improvement of 0.8% in the glycated hemoglobin (HbA1c) levels.

Although the incidence of adverse events (AEs) between bimagrumab and placebo was similar, there was a transient increase in pancreatic and liver enzyme levels observed with the use of bimagrumab [97]. Due to its potential in preserving lean mass and promoting high-quality weight loss, bimagrumab could be an attractive treatment option for obesity with muscle wasting.

An ongoing phase II clinical trial is evaluating the effects of different doses of bimagrumab (up to 30 mg/kg) in combination with semaglutide for the treatment of obesity. This study aims to further validate the effectiveness of bimagrumab in maintaining lean body mass while optimizing weight loss and to explore the safety and efficacy of its combined use with the GLP-1 receptor agonist semaglutide.

Growth/differentiation factor-15 (GDF-15) is a stress-induced cytokine expressed in multiple cell types, including cardiomyocytes, adipocytes, and macrophages. As a potential therapeutic approach for obesity, studies have found a correlation between increased tumor-secreted GDF-15 and weight loss. In animal experiments, particularly in mouse models, GDF-15 enhances satiety and reduces food intake through its action on the central nervous system.

LY3463251 is the first GDF-15 receptor agonist to complete a Phase I clinical trial, with results showing an average weight reduction of 3% in patients after 12 weeks of treatment. Currently, in addition to LY3463251, several other GDF-15 agonists are being assessed in early-stage clinical trials, including NNC0247-0829 and JNJ-9090/CIN-109, among others. These studies aim to further explore the potential of GDF-15 as a novel anti-obesity drug and its effects on the metabolic regulation in the human body.

Reference:

https://www.nature.com/articles/s41366-024-01473-y

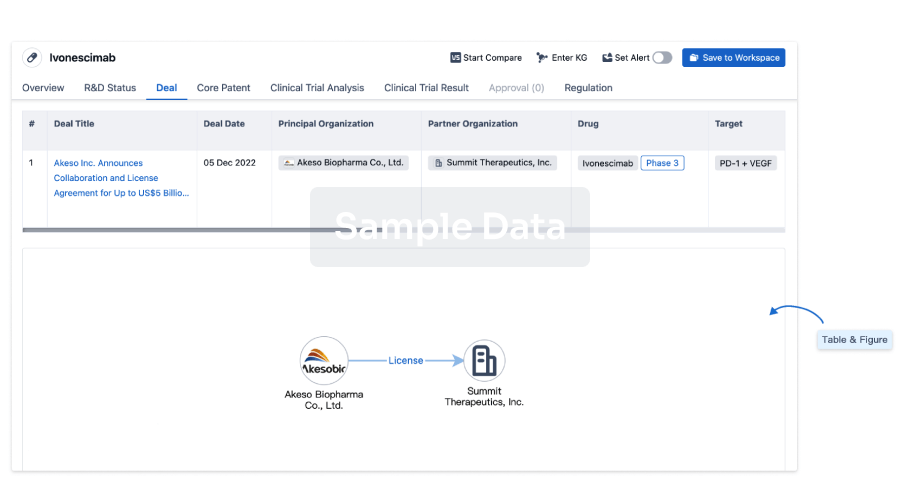

100 Deals associated with LY-3463251

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Overweight | Phase 1 | United States | 06 Dec 2018 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

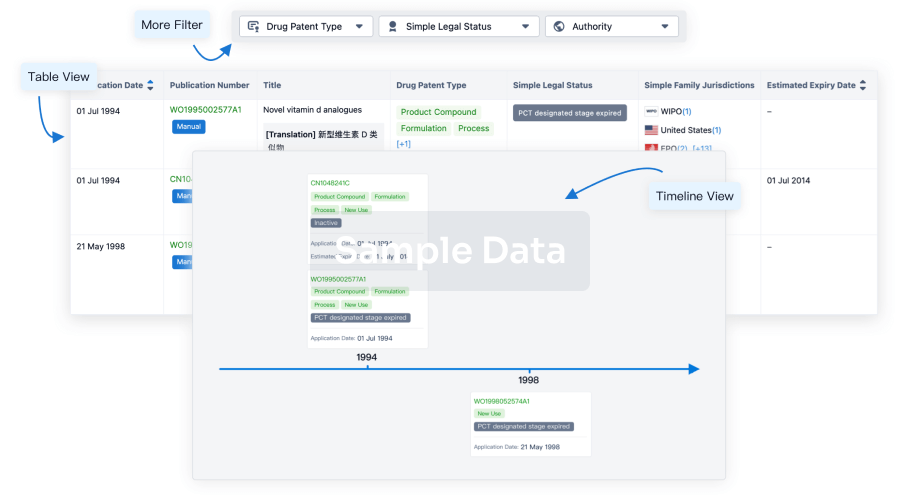

Core Patent

Boost your research with our Core Patent data.

login

or

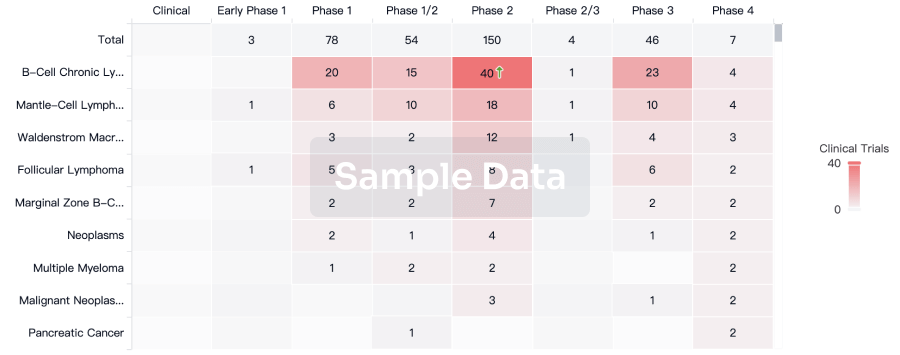

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

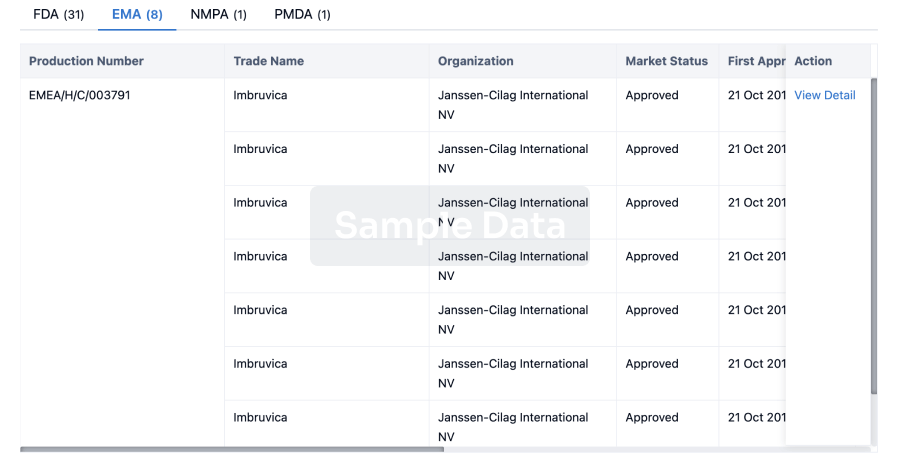

Approval

Accelerate your research with the latest regulatory approval information.

login

or

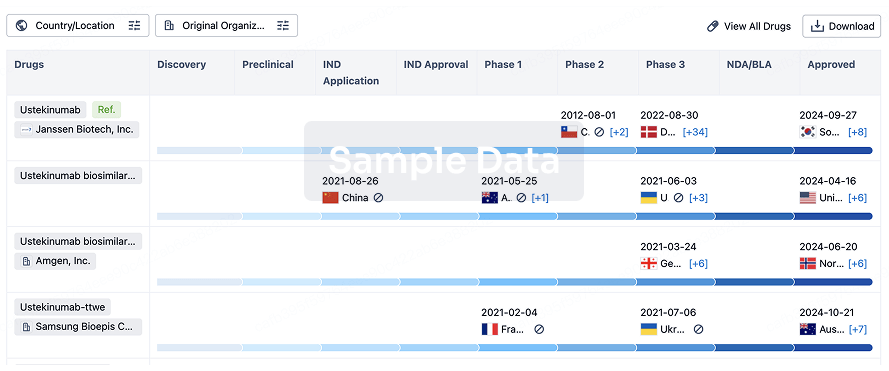

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

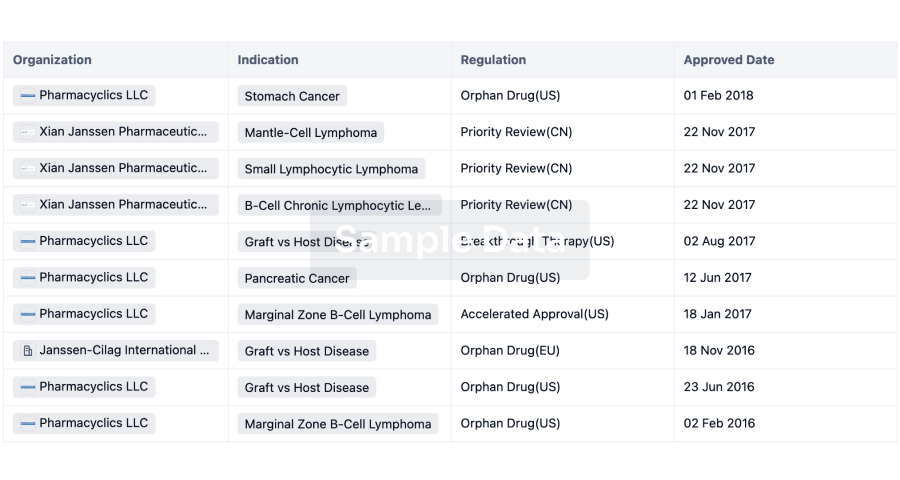

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free