Request Demo

Last update 09 Mar 2026

177Lu-PNT2003

Last update 09 Mar 2026

Overview

Basic Info

Drug Type Peptide Conjugate Radionuclide, Therapeutic radiopharmaceuticals |

Synonyms 177Lu PNT2003, LU-PNT 2003, LU-PNT2003 + [3] |

Target |

Action antagonists |

Mechanism SSTR2 antagonists(Somatostatin receptor 2 antagonists) |

Therapeutic Areas |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhaseApproved |

First Approval Date United States (02 Mar 2026), |

Regulation- |

Login to view timeline

Structure/Sequence

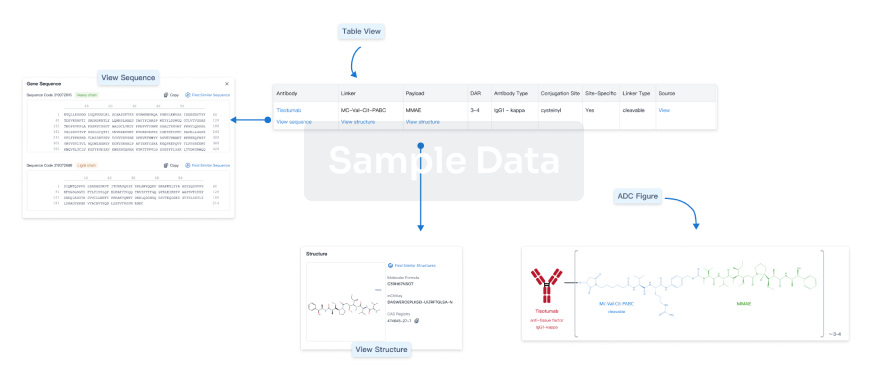

Boost your research with our ADC technology data.

login

or

Related

1

Clinical Trials associated with 177Lu-PNT2003NCT06441331

A Multicenter, Open-label, Interventional Phase I Trial to Determine the Dose and Evaluate the Pharmacokinetics (PK) and Safety of Lutetium Lu 177 Edotreotide Targeted Radiopharmaceutical Therapy (RPT) as Monotherapy or Following Standard of Care (SoC) for the Treatment of Somatostatin Receptor-positive Tumors in the Pediatric Population (KinLET).

The purpose of the study is to determine the appropriate pediatric dosage and evaluate the pharmacokinetics (PK) and safety of Lutetium Lu 177 Edotreotide Targeted Radiopharmaceutical Therapy (RPT) as a monotherapy or following standard of care (SoC) in participants ≥2 to <18 years of age with somatostatin receptor (SSTR)-positive tumors.

Start Date26 Sep 2025 |

Sponsor / Collaborator |

100 Clinical Results associated with 177Lu-PNT2003

Login to view more data

100 Translational Medicine associated with 177Lu-PNT2003

Login to view more data

100 Patents (Medical) associated with 177Lu-PNT2003

Login to view more data

34

News (Medical) associated with 177Lu-PNT200302 Mar 2026

BEDFORD, Mass., March 02, 2026 (GLOBE NEWSWIRE) -- Lantheus Holdings, Inc. (“Lantheus” or the “Company”) (NASDAQ: LNTH), the leading radiopharmaceutical-focused company committed to enabling clinicians to Find, Fight and Follow disease to deliver better patient outcomes, today announced that it has received U.S. Food and Drug Administration (FDA) tentative approval for the Abbreviated New Drug Application (ANDA) for Lutetium Lu 177 Dotatate (PNT2003), a radioequivalent

1

version of LUTATHERA

®

(lutetium Lu 177 dotatate). LUTATHERA

®

is indicated for the treatment of somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors (GEP-NETs), including foregut, midgut, and hindgut neuroendocrine tumors.

“As the first radioequivalent to LUTATHERA to receive FDA tentative approval, PNT2003 marks an important step forward in Lantheus’ work to advance treatment options for patients with GEP-NETs. This milestone comes at a time when advances in imaging and evolving clinical guidelines are enabling the identification of more patients who stand to benefit from targeted radiopharmaceutical therapies. As the leading radiopharmaceutical-focused company, we remain committed to meeting this growing demand and look forward to making PNT2003 available to patients pending final FDA approval,” said Mary Anne Heino, Chief Executive Officer of Lantheus.

The FDA tentative approval indicates that the FDA has completed its review of the ANDA and that it meets the requirements for approval under the Federal Food, Drug and Cosmetics Act. Full approval of the ANDA is subject to the expiration of the 30-month stay in June 2026, triggered in connection with a Hatch-Waxman patent litigation.

Lantheus licensed exclusive worldwide rights (excluding certain territories) to PNT2003 from POINT Biopharma Global, Inc. in December 2022. To read the press release announcing that licensing transaction, please click

here

. POINT was acquired by Eli Lilly and Company in December 2023.

About GEP-NETs

Neuroendocrine tumors (NETs) are rare, often slow-growing cancers that can develop throughout the body. A subset known as gastroenteropancreatic NETs (GEP-NETs) affects the digestive system and pancreas and may be functional or non-functional depending on hormone activity.

2

Over the last few decades, the incidence of GEP-NETs has increased significantly, with the prevalence in the U.S. estimated to be approximately 200,000 patients.

3

Because GEP-NETs often grow slowly and cause non-specific symptoms, up to 50% are initially misdiagnosed, with patients waiting an average of 4.3 years from symptom onset to diagnosis.

4,5

About Lantheus

Lantheus is the leading radiopharmaceutical-focused company, delivering life-changing science to enable clinicians to Find, Fight and Follow disease to deliver better patient outcomes. Headquartered in Massachusetts with offices in New Jersey, Canada, Germany, Sweden, Switzerland and the United Kingdom, Lantheus has been providing radiopharmaceutical solutions for more than 70 years. For more information, visit

.

Safe Harbor for Forward-Looking and Cautionary Statements

This press release contains “forward-looking statements” that are subject to risks and uncertainties. Forward-looking statements include, but are not limited to, statements relating to the potential FDA full approval of PNT2003 and statements regarding Lantheus’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by their use of terms such as “forward,” “look” and other similar terms. Such forward-looking statements are based upon current plans, estimates and expectations that are subject to risks and uncertainties that could cause actual results to materially differ from those described in the forward-looking statements.

1

The term radioequivalent is used to describe a radiopharmaceutical whose mechanism of action is determined to be equivalent to that of the reference product approved by the FDA, or a similar regulator outside of the US.

2

Neuroendocrine Tumors. Cleveland Clinic. Published June 26, 2024. Accessed May 22, 2025.

3

Dasari A, Shen C, Halperin D, Zhao B, Zhou S, Xu Y, Shih T, Yao JC. Trends in the Incidence, Prevalence, and Survival Outcomes in Patients With Neuroendocrine Tumors in the United States. JAMA Oncol. 2017 Oct 1;3(10):1335-1342. doi: 10.1001/jamaoncol.2017.0589. PMID: 28448665; PMCID: PMC5824320.

4

Kolarova T, et.al. P-136 Survey of challenges in access to diagnostics and treatment for neuroendocrine tumor patients (SCAN): Early diagnosis and treatment availability. Annals of Oncology, Volume 31, S134.

5

Raphael MJ, Chan DL, Law C, Singh S. Principles of diagnosis and management of neuroendocrine tumours. CMAJ. 2017 Mar 13;189(10):E398-E404. doi: 10.1503/cmaj.160771. PMID: 28385820; PMCID: PMC5359105.

LUTATHERA

®

is a registered trademark of Novartis AG and/or its affiliates.

Contacts:

Mark Kinarney

Vice President, Investor Relations

978-671-8842

ir@lantheus.com

Melissa Downs

Executive Director, External Communications

646-975-2533

media@lantheus.com

Drug ApprovalAcquisition

30 Oct 2025

BEDFORD, Mass., Oct. 30, 2025 (GLOBE NEWSWIRE) -- Lantheus Holdings, Inc. (“Lantheus”) (NASDAQ: LNTH), the leading radiopharmaceutical-focused company committed to enabling clinicians to Find, Fight and Follow disease to deliver better patient outcomes, today announced that the U.S. Food and Drug Administration (FDA) has established a Prescription Drug User Fee Act (PDUFA) date for LNTH-2501 (Gallium-68 edotreotide). LNTH-2501 is a diagnostic kit for the preparation of Ga 68 edotreotide Injection, indicated for use with positron emission tomography (PET) imaging for localization of somatostatin receptor-positive (SSTR+) neuroendocrine tumors (NETs) in adult and pediatric patients.

The FDA has set a PDUFA target action date of March 29, 2026.

“The development of LNTH-2501 underscores our commitment to expanding access to high-quality diagnostic solutions in oncology,” said Brian Markison, CEO, Lantheus. “LNTH-2501 has the potential to provide clinicians a reliable and accessible option for identifying and managing somatostatin receptor-positive neuroendocrine tumors, ultimately supporting more informed treatment decisions and improved patient care.”

LNTH-2501 (Ga-68 edotreotide Injection) further expands Lantheus’ oncology diagnostic portfolio with a PET imaging kit for SSTR+ NETs. Submitted under the FDA’s 505(b)(2) pathway, the filing builds on an extensive evidence base for Ga-68 edotreotide, including multiple published studies. LNTH-2501 is designed to deliver high-quality, reliable and accessible SSTR+ NET imaging.

About Neuroendocrine Tumors (NETs) Neuroendocrine tumors (NETs) are rare, often slow-growing cancers that can develop throughout the body.1 A subset known as gastroenteropancreatic NETs (GEP-NETs) affects the digestive system and pancreas and may be functional or non-functional depending on hormone activity. In the U.S., it is estimated that there are over 170,000 people living with NETs, with gastroenteropancreatic NETs (GEP-NETs), which are those NETs arising in the pancreas and digestive system, accounting for 55–70% of cases.2 Because NETs often grow slowly and cause non-specific symptoms, up to 50% are initially misdiagnosed, leading to delayed detection and treatment.3

About LNTH-2501 (Ga 68 edotreotide) LNTH-2501 (Kit for Preparation of Ga 68 edotreotide Injection), is currently under evaluation by the FDA as a radioactive diagnostic kit indicated for use with positron emission tomography (PET) for localization of somatostatin receptor positive neuroendocrine tumors (NETs) in adult and pediatric patients. LNTH-2501 is supplied as a 2-vial kit to radiopharmacies which allows for direct preparation of Ga 68 edotreotide injection with the eluate of Gallium from an on-site generator at the radiopharmacy. LNTH-2501 is not currently approved by the FDA and is not yet available for sale in the United States. If approved, LNTH-2501 may complement Lantheus’ therapeutic candidate PNT2003 as part of a theranostic approach, advancing the company’s strategy to deliver integrated diagnostic and therapeutic solutions for patients with cancer.

About Lantheus Lantheus is the leading radiopharmaceutical-focused company, delivering life-changing science to enable clinicians to Find, Fight and Follow disease to deliver better patient outcomes. Headquartered in Massachusetts with offices in New Jersey, Canada, Germany, Sweden, Switzerland and the United Kingdom, Lantheus has been providing radiopharmaceutical solutions for nearly 70 years. For more information, visit www.lantheus.com.

Safe Harbor for Forward-Looking and Cautionary Statements This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by their use of terms such as "designed,” “growing,” “potential,” “would,” and other similar terms. Such forward-looking statements are based upon current plans, estimates and expectations that are subject to risks and uncertainties that could cause actual results to materially differ from those described in the forward-looking statements. The inclusion of forward-looking statements should not be regarded as a representation that such plans, estimates and expectations will be achieved. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which speak only as of the date hereof. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Risks and uncertainties that could cause our actual results to materially differ from those described in the forward-looking statements include: (i) a delay in obtaining, or failure to obtain, a positive regulatory outcome from the FDA for LNTH-2501; (ii) our ability to launch LNTH-2501 as a commercial product; (iii) the market receptivity to LNTH-2501 as a radiopharmaceutical diagnostic; (iv) the existence, availability and profile of competing products; (v) the potential of LNTH-2501 to complement Lantheus’ therapeutic candidate PNT2003 as part of a theranostic approach; and (ix) the risks and uncertainties discussed in our filings with the Securities and Exchange Commission (including those described in the Risk Factors section in our most recently filed Annual Report on Form 10-K and Quarterly Reports on Form 10-Q).

Contacts:

Lantheus Mark Kinarney Vice President, Investor Relations 978-671-8842 ir@lantheus.com

Melissa Downs Executive Director, External Communications 646-975-2533 media@lantheus.com

_____________________________ REFERENCES: 1 Neuroendocrine Tumors. Cleveland Clinic. Published June 26, 2024. Accessed May 22, 2025. https://my.clevelandclinic.org/health/diseases/22006-neuroendocrine-tumors-net 2 Principles of Diagnosis and Management of Neuroendocrine Tumours. National Library of Medicine. Published March 13, 2017. Accessed May 22, 2025. https://pmc.ncbi.nlm.nih.gov/articles/PMC5359105/ 3 P-136 Survey of Challenges in Access to Diagnostics and Treatment for Neuroendocrine Tumor Patients (SCAN): Early Diagnosis and Treatment Availability. Annals of Oncology. Published July 2020. Accessed May 22, 2025. https://www.annalsofoncology.org/article/S0923-7534(20)39517-X/fulltext

Source: Lantheus Holdings, Inc.

Oligonucleotide

06 Aug 2025

Recorded second quarter 2025 worldwide revenue of $378.0 million , GAAP fully diluted earnings per share of $1.12 , adjusted fully diluted earnings per share of $1.57 and free cash flow of $79.1 million Announced FDA acceptance of NDA for new formulation for piflufolastat F 18 PSMA PET imaging agent with a PDUFA date of March 6, 2026 Closed acquisition of Life Molecular Imaging in July, immediately expanding near- and long-term growth profile and commercial portfolio with Neuraceq® (florbetaben F 18 injection), a globally approved beta-amyloid targeted radiodiagnostic for Alzheimer's disease; FDA label expansion for Neuraceq in June Board of Directors authorized a program to repurchase up to $400 million of Lantheus common stock, replacing the 12-month program announced in November 2024 Provided updated corporate guidance for full year 2025 revenue and adjusted fully diluted earnings per share, reflecting the Life Molecular Imaging acquisition and current business outlook

BEDFORD, Mass. , Aug. 06, 2025 (GLOBE NEWSWIRE) -- Lantheus Holdings, Inc. ( Lantheus or the Company) (NASDAQ: LNTH), the leading radiopharmaceutical-focused company committed to enabling clinicians to Find, Fight and Follow disease to deliver better patient outcomes, today reported financial results for its second quarter ended June 30, 2025 .

“In the second quarter and the month thereafter, we completed the acquisitions of both Evergreen Theragnostics and Life Molecular Imaging – key steps in executing our strategy to expand capabilities across the radiopharmaceutical value chain, diversify revenue, including with Neuraceq, and drive future growth. At the same time, we navigated increased competition in the PSMA PET landscape, which impacted PYLARIFY performance. We are taking actions to reinforce PYLARIFY’s clinical differentiation and support the value of our PSMA PET franchise,” said Brian Markison , CEO. “Today, we announced the FDA has accepted our NDA for a new PSMA PET formulation and the Board authorized a new $400 million stock repurchase program, which reflects our confidence in our long-term strategy to deliver value for our business, patients, and shareholders.”

Summary Financial Results

Second Quarter 2025

Sales of PYLARIFY were $250.6 million , a decrease of 8.3%. Sales of DEFINITY were $83.9 million , an increase of 7.5%. Operating income decreased 14.4% to $88.0 million . Adjusted operating income (non-GAAP) decreased 10.8% to $152.6 million . Fully diluted earnings per share increased 27.3% to $1.12 , compared to $0.88 in the prior year period. Adjusted fully diluted earnings per share (non-GAAP) decreased 12.8% to $1.57 , compared to $1.80 in the prior year period. Net cash provided by operating activities and free cash flow were $87.1 million and $79.1 million , respectively.

Balance Sheet

At June 30, 2025 , the Company's cash and cash equivalents were $695.6 million , after payment of $276.4 million for the Evergreen Theragnostics, Inc. (“Evergreen”) acquisition, which closed early in the second quarter of 2025, compared to $912.8 million at December 31, 2024 . The Company currently has access to up to $750.0 million from a revolving line of credit.

Recent Business Highlights

Business Development Updates

In July, the Company announced the completion of the acquisition of Life Molecular Imaging, a global radiopharmaceutical company dedicated to developing and offering novel cutting-edge radiopharmaceuticals that improve early detection and characterization of chronic and life-threatening diseases. Through the transaction, Lantheus acquired Neuraceq, a globally approved beta-amyloid targeted radiodiagnostic for Alzheimer’s disease, as well as an international commercial footprint and infrastructure. In June, the FDA approved an updated label for Neuraceq, expanding the clinical indication to include the use in both diagnostic assessment and identification of appropriate candidates for FDA-approved amyloid-targeting therapies. The expanded label also includes the utilization of quantitative amyloid plaque metrics in conjunction with visual image interpretation and broader use for monitoring of therapy and following progression to Alzheimer's disease. In May, the Company announced an agreement to sell its SPECT business to Illuminated Holdings, Inc. , the parent company of SHINE Technologies, LLC (“SHINE”). The transaction allows Lantheus to focus on growing its commercial portfolio of innovative PET radiodiagnostics and microbubbles, while advancing its pipeline of radiopharmaceuticals. The transaction is expected to close by the end of the year, subject to customary closing conditions. In April, the Company announced the completion of the acquisition of Evergreen, a clinical-stage radiopharmaceutical company based in New Jersey . Through the transaction, Lantheus acquired OCTEVY™, a registrational-stage PET imaging agent targeting neuroendocrine tumors, which complements Lantheus’ therapeutic candidate PNT2003, and also acquired a portfolio of clinical and pre-clinical theranostic pairs. The acquisition also advances Lantheus’ capabilities with the addition of Evergreen’s radioligand therapy manufacturing infrastructure, including a revenue-generating CDMO business.

Radiopharmaceutical Pipeline Updates

This morning, the Company announced FDA acceptance of a new drug application (“NDA”) for a new formulation of piflufolastat F 18 PSMA PET imaging agent. The new formulation will increase batch size by ~50%, which would allow Lantheus to serve significantly more patients while maintaining the same high standards that has made PYLARIFY the trusted choice for providers. In April, the Company announced that MK-6240, its next-generation tau imaging agent, met its primary endpoints in two pivotal clinical studies assessing the investigational asset’s sensitivity and specificity. The Company plans to submit an NDA to the FDA in the third quarter of 2025.

Other Key Updates

Full Year 2025 Updated Corporate Financial Guidance

On a forward-looking basis, the Company does not provide GAAP income per common share guidance or a reconciliation of GAAP income per common share to adjusted fully diluted EPS because the Company is unable to predict with reasonable certainty business development and acquisition related expenses, purchase accounting fair value adjustments, and any one-time, non-recurring charges. These items are uncertain, depend on various factors, and could be material to results computed in accordance with GAAP. As a result, it is the Company’s view that a quantitative reconciliation of adjusted fully diluted EPS on a forward-looking basis is not available without unreasonable effort.

Conference Call and Webcast

As previously announced, the Company will host a conference call and webcast on Wednesday, August 6, 2025 , at 8:00 a.m. ET . To access the conference call or webcast, participants should register online at https://investor.lantheus.com/news-events/calendar-of-events.

A replay will be available approximately two hours after completion of the webcast and will be archived on the same web page for at least 30 days.

The conference call will include a discussion of non-GAAP financial measures. Reference is made to the most directly comparable GAAP financial measures, the reconciliation of the differences between the two financial measures, and the other information included in this press release, our Form 8-K filed with the SEC today, or otherwise available in the Investor Relations section of our website located at www.lantheus.com.

The conference call may include forward-looking statements. See the cautionary information about forward-looking statements in the safe-harbor section of this press release.

About Lantheus

Lantheus is the leading radiopharmaceutical-focused company, delivering life-changing science to enable clinicians to Find, Fight and Follow disease to deliver better patient outcomes. Headquartered in Massachusetts with offices in New Jersey , Canada , Germany , Sweden and Switzerland , Lantheus has been providing radiopharmaceutical solutions for nearly 70 years. For more information, visit www.lantheus.com.

Internet Posting of Information

The Company routinely posts information that may be important to investors in the “Investors” section of its website at www.lantheus.com. The Company encourages investors and potential investors to consult its website regularly for important information about the Company.

Non-GAAP Financial Measures

The Company uses non-GAAP financial measures, such as adjusted net income and its line components; adjusted net income per share - fully diluted; adjusted operating income, and free cash flow. The Company’s management believes that the presentation of these measures provides useful information to investors. These measures may assist investors in evaluating the Company’s operations, period over period. However, these measures may exclude items that may be highly variable, difficult to predict and of a size that could have a substantial impact on the Company’s reported results of operations for a particular period. Management uses these and other non-GAAP measures internally for evaluation of the performance of the business, including the evaluation of results relative to employee performance compensation targets. Investors should consider these non-GAAP measures only as a supplement to, not as a substitute for or as superior to, measures of financial performance prepared in accordance with GAAP.

Safe Harbor for Forward-Looking and Cautionary Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by their use of terms such as “advance,” “believe,” “continue,” “could,” “driving,” “expect,” “guidance,” “maintain,” “may,” “on track,” “plan,” “potential,” “predict,” “progress,” “should,” “target,” “will,” “would” and other similar terms. Such forward-looking statements include our guidance for the fiscal year 2025 and our plans to expand our portfolio of late-stage assets and high potential early-stage candidates, our acquisitions of Evergreen and Life Molecular and our plans to divest our SPECT business to SHINE, and are based upon current plans, estimates and expectations that are subject to risks and uncertainties that could cause actual results to materially differ from those described in the forward-looking statements. The inclusion of forward-looking statements should not be regarded as a representation that such plans, estimates and expectations will be achieved. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which speak only as of the date hereof. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Risks and uncertainties that could cause our actual results to materially differ from those described in the forward-looking statements include: (i) continued market expansion and penetration for our established commercial products, particularly PYLARIFY and DEFINITY, in a competitive environment and our ability to clinically and commercially differentiate our products; (ii) our ability to have third parties manufacture our products and our ability to manufacture DEFINITY in our in-house manufacturing facility, in amounts and at the times needed; (iii) the availability of raw materials, key components, and equipment, either used in the production of our products and product candidates, or in the use by healthcare professionals (“HCPs”) of our products and product candidates, including, but not limited to positron emission tomography (“PET”) scanners for PYLARIFY, MK-6240 and NAV-4694; (iv) our ability to satisfy our obligations under our existing clinical development partnerships using MK-6240 or NAV-4694 as a research tool and under the license agreements through which we have rights to MK-6240 and NAV-4694, and to further develop and commercialize MK-6240 and NAV-4694 as approved products, including the timing for any potential regulatory submissions for these investigational assets; (v) our ability to successfully integrate acquisitions, including of Life Molecular and Evergreen, including the potential for unforeseen expenses related to integration activities, the accuracy of our financial models, the potential for unforeseen liabilities within those businesses, the ability to integrate disparate information technology systems, retain key talent and create a merged corporate culture that successfully realizes the full potential of the combined organization; (vi) our ability to obtain U.S. Food and Drug Administration ("FDA") approval for our new F-18 PSMA PET product candidate, to complete the technology transfer across our PET manufacturing facilities network for such new product candidate, and to obtain adequate coding, coverage and payment, including transitional pass-through payment status, for such new product candidate; (vii) our ability to complete the sale of our single-photon emission computerized tomography ("SPECT") business to SHINE on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary regulatory approvals and satisfaction of other closing conditions to consummate the transaction, unforeseen expenses related to the divestiture, and failure to realize the expected benefits of the transaction; (viii) our ability to obtain FDA approval for LNTH-2501, our investigational kit for the preparation of Gallium-68 DOTATOC, which may be used in conjunction with a PET scan to stage and localize gastroenteropancreatic neuroendocrine tumors in adults and children, and approval for PNT2003, and to be successful in the patent litigation associated with PNT2003; (ix) the cost, efforts and timing for clinical development, regulatory approval, adequate coding, coverage and payment and successful commercialization of our product candidates and new clinical applications and territories for our products, in each case, that we or our strategic partners may undertake; (x) our ability to identify opportunities to collaborate with strategic partners and to acquire or in-license additional diagnostic and therapeutic product opportunities in oncology, neurology and other strategic areas and continue to grow and advance our pipeline of products; and (xi) the risk and uncertainties discussed in our filings with the Securities and Exchange Commission (including those described in the Risk Factors section in our Annual Reports on Form 10-K and our Quarterly Reports on Form 10-Q).

- Tables Follow -

(a) Non-GAAP amount excludes a gain of $42 from the change in value of other assets for the three and six months ended June 30, 2025 .

(b) The income tax effect of the adjustments between GAAP net income and adjusted net income (non-GAAP) takes into account the tax treatment and related tax rate that apply to each adjustment in the applicable tax jurisdiction.

(c) Amounts may not add due to rounding.

Contacts: Mark Kinarney Vice President, Investor Relations978-671-8842ir@lantheus.com

Melissa Downs Executive Director, External Communications 646-975-2533media@lantheus.com

Source: Lantheus Holdings, Inc.

AcquisitionDrug ApprovalNDALicense out/inFinancial Statement

100 Deals associated with 177Lu-PNT2003

Login to view more data

R&D Status

Approved

10 top approved records. to view more data

Login

| Indication | Country/Location | Organization | Date |

|---|---|---|---|

| Somatostatin Receptor-Positive Neuroendocrine Tumor | United States | 02 Mar 2026 |

Developing

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Gastro-Enteropancreatic Neuroendocrine Tumor | NDA/BLA | United States | 12 Jan 2024 | |

| Gastro-Enteropancreatic Neuroendocrine Tumor | NDA/BLA | United States | 12 Jan 2024 | |

| Neuroendocrine Tumors | Phase 3 | Canada | 31 Dec 2021 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free