Request Demo

Last update 01 Nov 2025

SIM-0278

Last update 01 Nov 2025

Overview

Basic Info

Drug Type Fc fusion protein |

Synonyms anti-IL2muFC(Simcere), ALM223, SIM 0278 + [1] |

Target |

Action agonists |

Mechanism IL-2R agonists(Interleukin-2 receptor agonists) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhasePhase 2 |

First Approval Date- |

Regulation- |

Login to view timeline

Related

2

Clinical Trials associated with SIM-0278NCT07175233

A Randomized, Double-blind, Placebo-Controlled Phase 2 Study to Evaluate the Efficacy, Safety, and Pharmacokinetics of SIM0278 in Subjects With Moderate to Severe Atopic Dermatitis

This is a randomized, double-blind, placebo-controlled multicenter clinical study to evaluate the efficacy, safety, and pharmacokinetics of SIM0278 in adult patients (18-75 years) with moderate to severe AD suitable for systemic therapy.

Approximately 184 subjects with moderate to severe AD are planned to be randomized in a 1: 1: 1: 1 ratio to SIM0278 low dose, SIM0278 medium dose, SIM0278 high dose, or placebo. Subjects were stratified at randomization by baseline disease severity (moderate [IGA = 3] VS severe [IGA = 4]).

The study consisted of 4 phases: screening, double-blind induction, open-label maintenance, and safety follow-up.

Approximately 184 subjects with moderate to severe AD are planned to be randomized in a 1: 1: 1: 1 ratio to SIM0278 low dose, SIM0278 medium dose, SIM0278 high dose, or placebo. Subjects were stratified at randomization by baseline disease severity (moderate [IGA = 3] VS severe [IGA = 4]).

The study consisted of 4 phases: screening, double-blind induction, open-label maintenance, and safety follow-up.

Start Date27 Oct 2025 |

Sponsor / Collaborator |

NCT06022354

A Single-center, Randomized, Double-blind, Sponsor Open, Placebo-controlled, Dose-escalation Phase I Study to Evaluate the Safety, Tolerability, Pharmacokinetics and Pharmacodynamics of SIM0278 After Single and Multiple Subcutaneous Injections in Chinese Healthy Subjects

This is a Phase 1, randomized, double-blind, placebo-controlled trial of SIM0278 in healthy subjects. The study will be conducted in 2 parts. Part 1 is single ascending dose study. Part 2 is multiple ascending dose study.

Start Date23 Aug 2023 |

Sponsor / Collaborator |

100 Clinical Results associated with SIM-0278

Login to view more data

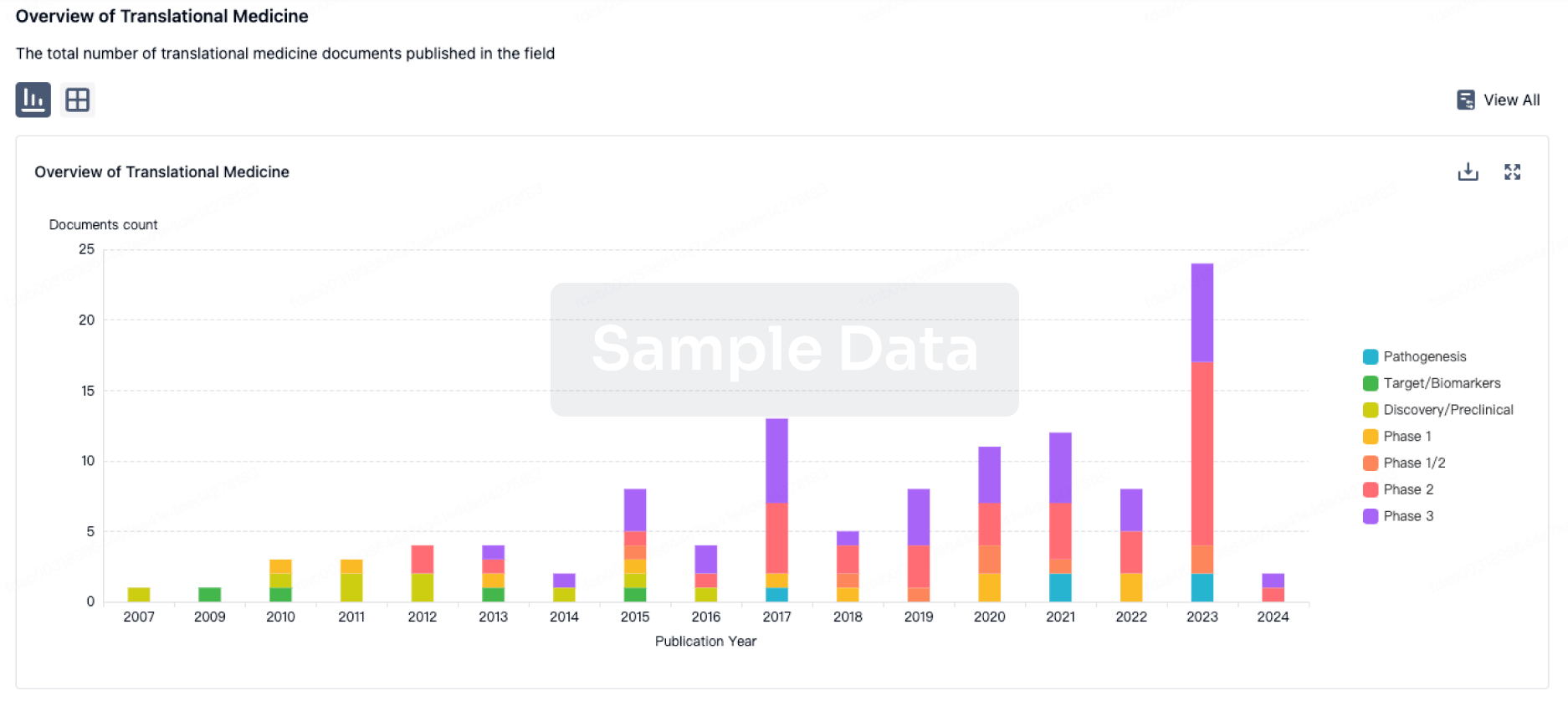

100 Translational Medicine associated with SIM-0278

Login to view more data

100 Patents (Medical) associated with SIM-0278

Login to view more data

8

News (Medical) associated with SIM-027824 Feb 2025

BARCELONA, Spain--(BUSINESS WIRE)--Almirall, S.A. (ALM):

Financial highlights (€ rounded million)

2024

2023

Variation

Total Revenue

990.6

898.8

10.2%

Net Sales

985.7

894.5

10.2%

Other Income

4.9

4.3

14.0%

Gross Profit

637.4

581.4

9.6%

% of sales

64.7%

65.0%

10.6%

Total EBITDA

192.6

174.1

Normalized Net Income

25.6

15.6

64.2%

Net Income

10.1

(38.5)

n.m

"2024 was an important year for Almirall as European leader in Medical Dermatology: we delivered impactful products to more patients and the medical community. Our double-digit sales growth and increased profitability demonstrate that our strategy is working and that our teams are delivering. In 2024 we achieved net sales growth of 10.2% and increased our total EBITDA by 10.6%, which was largely driven by our European dermatology business and our biologics. We continued to progress our exciting pipeline in medical dermatology by investing 12.6% of net sales in R&D and explore external opportunities for early and mid-stage assets.

We are very confident in our strategy, commercial success, and our R&D capabilities which are the foundation for entering an era of sustained double-digit growth and increased growth margins. Our focus, sustained financial performance, and dedication to innovation and patient care continue to grow our impact on people living with skin conditions, and the medical community.” Carlos Gallardo, Almirall Chairman and CEO

Almirall, S.A. (ALM) a global biopharmaceutical company based in Barcelona, today announced its full-year 2024 financial results.

Summary of results

Almirall surpassed guidance for 2024 achieving Net Sales of €985.7 MM – which represents a year-on-year growth of 10.6%. This growth was mainly driven by the strong performance of the European Dermatology business and the biologics portfolio.

Total EBITDA was €192.6 MM, increasing 10.6% year-on-year – above guidance. This was mainly driven by the strong sales growth achieved in 2024, which – in line with Almirall’s business strategy – is beginning to exceed investment growth, specifically SG&A.

Almirall finished 2024 at 0.2x Net Debt to EBITDA , which remains highly favorable despite the continued investment in expanding the biologics portfolio, especially the launch of Ebglyss ® across Europe.

Gross Margin of 64.7% was in line with expectations and impacted by increased royalties based on the sales growth of Ilumetri ® .

Sustained investment in Research & Development of €124.2 MM, at 12,6% of Net Sales 2024.

SG&A expenses were up 10% to €464.6 MM, due to the continued support for the launch of Ebglyss ® across Europe to further drive its anticipated growth trajectory.

Net Income was €10.1 MM - moderately impacted by smaller impairments.

Operating cash flow was €160.8 MM in 2024 which was mainly based on stabilized working capital and represents a significant improvement vs the previous year.

Leading medical dermatology in Europe

Dermatology continues to be a large, underpenetrated market with significant unmet needs and an estimated annual growth rate of +7.5% over the next five years, projected to reach €71 billion by 2030*. With significant increase in the scientific understanding of skin diseases and a resulting stream of new product launches in recent years, the dermatology market is forecasted to show significant growth potential in the foreseeable future. Almirall has successfully built a broad and relevant presence in dermatology based on a continuous stream of product launches broadening its dermatology portfolio, and strong commercial executions in its markets. Almirall sales of c. €485 million and its commercial efforts extend to covering 60% of office dermatologists and 90% of hospital dermatologists across Europe.

Almirall has become a recognized leader in medical dermatology in Europe thanks to its portfolio of more than 50 products in different modalities, predominantly topical, systemic and biologics. Almirall’s strategy is focused on its strong position in the area of immune-mediated inflammatory diseases, including atopic dermatitis and psoriasis, rare dermatological diseases, as well as non-melanoma skin cancer, and actinic keratosis. This has led to the company achieving a consistent 21% annual growth rate (CAGR) in Dermatology in Europe between 2020 and 2024.

Almirall’s continued investment in its R&D capabilities has resulted in a significant evolution of its medical dermatology pipeline. The company’s sustained focus on building leading innovation capabilities includes both, internal research and development, and in-licensing capabilities to achieve sustained pipeline growth, leveraging its highly flexible balance sheet. Almirall’s sustained financial strength and commercial excellence provide the foundation for continued growth, enabling Almirall to extend its impact within Europe and beyond to help patients and healthcare professionals.

* CARG. Source: Evaluate Pharma’s sales by indication. Accessed December 2024

Biologics

Atopic dermatitis and psoriasis are key indications within medical dermatology, and both – although at different stages of market maturity – represent significant opportunities for Almirall due to the forecasted increase of the numbers of people diagnosed and the transition of diagnosed patients to advanced treatment options.

Given these dynamics, Almirall can reach increasing numbers of patients with the psoriasis and atopic dermatitis biologics, and therefore the potential peak sales of the biologics portfolio was recently updated to above €800 MM by 2030. With the atopic dermatitis market emerging as a major field for advanced therapies, it is expected to grow through products with new mechanisms of action. It is anticipated that the atopic dermatitis market will mirror the trajectory seen in the psoriasis market in recent years, where Ilumetri® continues to show strong sustained growth supporting Almirall’s position as European leader in medical dermatology.

Atopic Dermatitis (AD)

After the approval of Ebglyss® (lebrikizumab) by the European Commission (EC), the Medicines and Healthcare products Regulatory Agency (MHRA) in the UK, and Switzerland, the product has now launched in 11 countries in Europe (in 2023: Germany, in 2024: Norway, UK, Spain, Denmark, the Czech Republik, the Netherlands, and in 2025: Italy, Switzerland, Austria, Belgium, and Sweden). The rollout in the remaining European countries is expected throughout 2025. In 2024, Almirall’s collaborator Lilly received US FDA approval for lebrikizumab and subsequently launched the product in the US.

Lebrikizumab is an anti-IL13 monoclonal antibody for the treatment of adult and adolescent patients (12 years and older with a body weight of at least 40 kg) with moderate-to-severe atopic dermatitis (AD), who are candidates for systemic therapy.

The AD market is in its early stages of development with limited availability of impactful treatments - especially considering that the disease requires a wide variety of options to provide optimal care for patients. The expected increase in prescription of advanced therapies for AD patients, combined with the forecasted increase of newly diagnosed patients represent a significant opportunity for growth. Lebrikizumab has the potential to become a best-in-class treatment for moderate-to-severe AD - it represents a significant step forward for patients due to its selective mechanism of action,1 proven short and long-term efficacy and safety - demonstrated up to 3 years2 with a monthly maintenance dosing for all patients.3

Lebrikizumab will continue to increase its contribution to the performance of European dermatology and the growth of Almirall over the coming years - together with the continued strong growth of the psoriasis biologic tildrakizumab.

Psoriasis

Ilumetri®, an anti-IL-23 high-affinity humanized monoclonal antibody indicated for the treatment of adult patients with moderate-to-severe plaque psoriasis, delivered very strong growth across all regions and achieved €209 MM in 2024, an impressive year-on-year growth of 26% after an already strong performance in 2023. This continued exceptional performance of the product is further supported by the recent launch of the 200mg dose option as an alternative to the 100mg dose. This gives dermatologists a unique opportunity to provide optimized treatment solutions for certain patient populations with tildrakizumab.

Almirall anticipates sustaining the momentum of Ilumetri® in the short to mid-term and therefore has recently updated its peak sales guidance to above €300 MM by 2030.

Other key dermatological products

Additionally, Wynzora® cream, a once-daily aqueous cream with a fixed combination of calcipotriene and betamethasone dipropionate (CAL/BDP), indicated for the topical treatment of mild to moderate psoriasis vulgaris in adults, including scalp, experienced a continued significant sales increase driven by a combination of in-market growth and recent country launches. Net Sales of €25.9 MM of the product were achieved in 2024, an impressive year-on-year increase of 53.3% after an already strong performance in 2023.

*Wynzora® is authorized with this name in Belgium, the Czech Republic, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Norway, Poland, Portugal, Spain, Sweden, Switzerland, the UK, and The Netherlands. In Austria, it is authorized under a different tradename: Winxory®

Klisyri® (tirbanibulin), a microtubule inhibitor for the topical treatment of actinic keratosis (AK) of the face or scalp, continued to grow significantly across major markets, generating total sales of €24.5 MM in Europe and the US. The company anticipates that the favorable growth trend for this product will continue in Europe and will be further fuelled by the recent approval of the large field application in the US which opens up opportunities for dermatologists to treat a wide range of patients.

Unlocking the value of Almirall’s innovative pipeline

Almirall’s R&D pipeline is solely focused on medical dermatology: in 2024 the company invested 12.6% of net sales in R&D which enables its R&D organisation to further advance the scientific understanding of skin diseases, and the development of innovative, novel, and impactful treatments across different modalities

The company has continuously invested in R&D over many years, laying the foundation for sustained growth and acceleration in the future. It has created and advanced a strong pipeline in key areas, both in clinical and preclinical stages. The company focuses on building collaborations with partners that have new platforms and technologies to further develop its innovative pipeline. Almirall accesses the latest available technologies, including small molecules, biologics, and other modalities such as mRNA/LNP. The company’s collaborative mindset has allowed to continue and expand the work with leading experts in dermatology around the globe to innovate and to initiate the development of novel technologies such as AI-based drug discovery, immunology, biological treatments, and others.

Late-stage pipeline and lifecycle management

In Almirall’s late-stage pipeline, it successfully completed the decentralized regulatory approval procedure for Efinaconazole in Europe and is expecting national marketing authorizations in Europe during the first half of 2025.

Sarecycline’s (Seysara®) regulatory review in China is ongoing with an anticipated approval in the second half of 2025.

To expand the label for Klisyri® to include large field application also in Europe, a current clinical study is aimed at enabling approval for an anticipated launch in 2026.

Almirall’s strategy on providing more value of the established biologic products - Ilumetri® and Ebglyss® - is focused on close collaborations with its partners. Sun Pharma is running two Phase III studies to assess the efficacy and safety of tildrakizumab in patients suffering from psoriatic arthritis. First results are expected in the second half of 2025.

Almirall, together with its collaborator Eli Lilly, are running a comprehensive program of clinical trials with the aim of further expanding the indications for Lebrikizumab. This includes a Phase III study run by Lilly which explores its safety and efficacy in patients from 6 months to under 18 years to make the benefits of lebrikizumab accessible to the pediatric population.

Almirall is currently conducting the ADTrust study, a 1200 patient pan-European, prospective observational 2-year study that aims to explore the physical, psychological and social impact of Atopic Dermatitis and the treatment with lebrikizumab on patient’s lives over 24 months in real-world clinical practice settings. The first patient was recruited into the study in January 2025, and its conclusion is forecasted for 2028.

Early-stage pipeline - autoimmune dermatological diseases

Almirall continues to make progress in its early-stage pipeline, which features a range of promising assets providing potentially great opportunity for patients across different important dermatological diseases. In the next 15 months, the start of four Proof of Concept (PoC) clinical studies across a spectrum of different diseases is planned.

The company is continuing to advance the asset ALM27134*, a first-in-class fully human, high-affinity monoclonal antibody that targets IL-1RAP (Interleukin-1 Receptor Accessory Protein) for the treatment of autoimmune dermatological diseases. This monoclonal antibody has the potential to address the unmet needs in several autoimmune dermatology indications. The phase I study of ALM27134 is ongoing with single and multiple ascending doses in healthy volunteers completed, and now advancing to explore the pharmacokinetics and safety of this novel treatment candidate. The start of a Phase II study is planned for later this year in patients suffering from Hidradenitis Suppurativa.

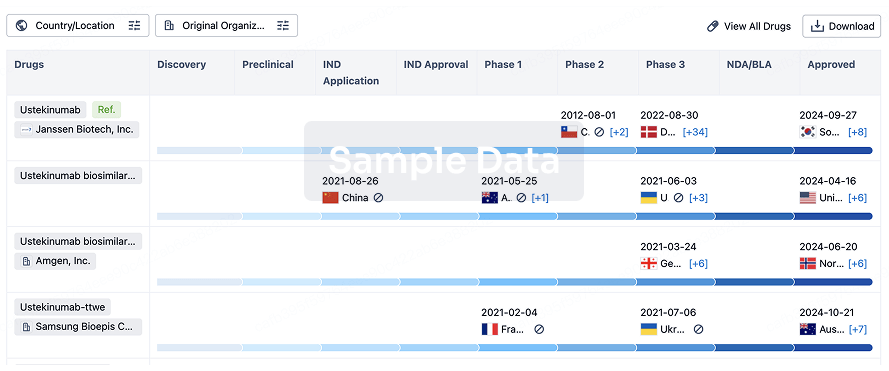

Phase I of ALM223**, an IL-2 mutant fusion protein (IL-2muFc) drug candidate developed in collaboration with Simcere is ongoing. This molecule is designed to activate regulatory T-cells and has the potential to rebalance the immune system in several autoimmune diseases4,5.

Clinical supply manufacturing of the company’s anti-IL-21 monoclonal antibody*** is ongoing to prepare for the launch of phase II testing. IL-21 is cytokine involved both in B- and T-cell biology and likely to be involved in several immune-mediated skin diseases.

ZKN-013**** is an oral readthrough inducer designed to overcome nonsense mutations that cause a premature stop codon. ZKN-013 has promising potential in several rare indications such as Dystrophic Epidermolysis Bullosa (RDEB), Junctional Epidermolysis Bullosa (JEB) and familial adenomatous polyposis (FAP). The phase I clinical study with ZKN-013 in healthy volunteers is currently ongoing.

*Previously referred to as ISB 880

** ALM223 in licensed from Simcere. Formally referred to as SIM-0278, worldwide ex-Greater China.

*** Licensed from Novo Nordisk

**** Licensed from Eloxx

New partnerships for progressing the future development of the pipeline

Throughout 2024, Almirall continued to build disruptive partnerships to advance science and technology with the goal of delivering meaningful and relevant innovation in medical dermatology.

In January 2024, Almirall announced a collaboration with Microsoft to advance its capabilities in the area of generative Artificial Intelligence (genAI) for the rapid analysis of extensive datasets creating a digital, agile, and patient-centric approach. Within Almirall R&D, the focus includes accelerating the discovery of new therapeutic targets, and to generate new product technologies for Almirall’s dermatology pipeline. Furthermore, Almirall will establish a new approach to technology-aided data management to optimize access to high quality data, including data governance, quality processes, and digital identity management, amongst others.

In February, the company announced a partnership with the Centre for Genomic Regulation (CRG) to identify biomarkers to build new disease models for atopic dermatitis which will lead to the development of new treatment options for AD. This new collaboration is complementary to the ongoing partnership with CRG aimed at developing and characterizing novel preclinical models as the basis for developing new treatment options for non-melanoma skin cancer (NMSC).

Conclusions

Almirall exceeded its guidance and further grew the outstanding performance of its European dermatology business in 2024. The strategic focus on medical dermatology has created a strong position for the company as it is entering an era of sustained growth and profitability. The impact Almirall has on patients and the medical community is significant, and set to grow based on the clear business strategy and the company’s ambition as leader in Medical Dermatology

Throughout 2024, the company achieved double-digit growth in all key growth drivers, specifically the successful launch and expansion of Ebglyss® across key markets in Europe, the continued strong sales growth of Ilumetri®, and the broader medical dermatology portfolio.

Almirall’s business strategy to continue maximizing the potential of the biologics portfolio, resulted in an upgrade of the peak sales forecast to above €800 MM. The positive momentum of the broad dermatology portfolio of products will deliver continued growth in the future - spearheaded by Klisyri® and Wynzora® in European markets.

The progress of Almirall’s pipeline is based on its sustained investment in advancing the scientific understanding of skin diseases and developing impactful products and technologies to effectively treat key diseases with remaining unmet medical needs. The company is entering an era of sustained double-digit growth (net sales CAGR 2023-2030) and profitability - enabling Almirall to reach more patients with relevant and impactful products. This growth trajectory is complemented by a strategic approach to add valuable assets to Almirall’s portfolio by new agreements based on scientific, strategic, and financial considerations.

Almirall’s unique dedication to medical dermatology and its long-term view on its contributions to patients, the medical community, and society are its foundation to leadership in medical dermatology, and to continued shareholder value creation.

2025 Full Year Guidance

Net Sales: Growth of 10-13%.

Total EBITDA: Between €220 MM and €240 MM

Investor Calendar 2025

Annual General Meeting – 9 th May 2025

Q1 2025 Financial Results – 13th May 2025

H1 2025 Financial Results – 22nd July 2025

9M 2025 Financial Results – 11th November 2025

About Almirall

Almirall is a global pharmaceutical company dedicated to medical dermatology. We closely collaborate with leading scientists, healthcare professionals, and patients to deliver our purpose: to transform the patients' world by helping them realize their hopes and dreams for a healthy life. We are at the forefront of science to deliver ground-breaking, differentiated medical dermatology innovations that address patients’ needs.

Almirall, founded in 1944 and headquartered in Barcelona, is publicly traded on the Spanish Stock Exchange (ticker: ALM, total revenue in 2024: €990 MM, over 2000 employees globally). Almirall products help to improve the lives of patients every day and are available in over 100 countries.

For more information, please visit almirall.com

Disclaimer

This document includes only summary information and does not intend to be comprehensive. Facts, figures and opinions contained herein, other than historical, are "forward-looking statements". These statements are based on currently available information and on best estimates and assumptions believed to be reasonable by the Company. These statements involve risks and uncertainties beyond the Company's control. Therefore, actual results may differ materially from those stated by such forward-looking statements. The Company expressly disclaims any obligation to review or update any forward-looking statements, targets or estimates contained in this document to reflect any change in the assumptions, events or circumstances on which such forward-looking statements are based unless so required by applicable law.

_____________________

1 Okragly A, et al. Binding, Neutralization and Internalization of the Interleukin-13 Antibody, Lebrikizumab. Dermatol Ther (Heidelb). 2023;13(7):1535-1547. doi:10.1007/s13555-023-00947-7

2 Silverberg JI et al ADvocate1 and ADvocate2 Investigators. Two Phase 3 Trials of Lebrikizumab for Moderate-to-Severe Atopic Dermatitis. N Engl J Med. 2023 Mar 23;388(12):1080-1091

3 Thaci E, et al. Efficacy and Safety of Lebrikizumab is Maintained up to Three Years in Patients with Moderate-to-Severe Atopic Dermatitis: ADvocate 1, ADvocate 2, and ADjoin Long Term Extension Trial. 2024 European Academy of Dermatology and Venereology Congress. September 25, 2024

4 Hernandez R, Põder J, LaPorte KM, Malek TR. Engineering IL-2 for immunotherapy of autoimmunity and cancer. Nat Rev Immunol. 2022 Oct;22(10):614-628. doi: 10.1038/s41577-022-00680-w. Epub 2022 Feb 25. PMID: 35217787.

5 Raeber ME, Sahin D, Karakus U, Boyman O. A systematic review of interleukin-2-based immunotherapies in clinical trials for cancer and autoimmune diseases. EBioMedicine. 2023 Apr;90:104539. doi: 10.1016/j.ebiom.2023.104539. Epub 2023 Mar 31. PMID: 37004361; PMCID: PMC10111960.

Phase 1Drug ApprovalPhase 2Phase 3Financial Statement

21 Dec 2023

BARCELONA, Spain I December 21, 2023 I

Almirall S.A. (BME: ALM), a global pharmaceutical company focused on medical dermatology, today announced the initiation of the phase I study evaluating the safety, pharmacokinetics, immunogenicity, and pharmacodynamics of ALM223, an interleukin 2 mutant fusion protein (IL-2 mu-Fc) for the potential treatment of a broad spectrum of immunological diseases.

ALM223

is a modified version of the protein IL-2 designed to selectively activate

Regulatory T cells

(Tregs). Tregs are important regulators of the immune system activity. Increasing their activity enables them to normalize the function of other immune cells, which could provide a therapeutic option in diseases characterized by an overactive immune system. In preclinical studies,

ALM223

selectively activates Tregs without directly interfering on other types of immune cells, such as Effector T cells or Natural Killer (NK) cells. It may therefore have potential to restore immune balance and prevent the immune cells from attacking the body’s own cells.

"We are very pleased about the initiation of the development in humans of this innovative IL-2 mutein, an important molecule that has the potential to treat a broad spectrum of immunological diseases. We look forward to further progress in clinical studies of this biologic that could improve the lives of people with immune-mediated skin diseases”,

said

Karl Ziegelbauer, Ph.D., Almirall’s Chief Scientific Officer.

ALM223

, previously referred to as SIM0278, had been developed by Simcere by utilizing their protein engineering platform. Almirall and Simcere Pharmaceutical signed an

exclusive license agreement

for the IL2-mu-Fc in September 2022, granting Almirall rights to develop and commercialize ALM223 for all indications outside of the Greater China region, while Simcere Pharmaceutical retained the rights within Greater China. Simcere also initiated the phase I development for the Chinese market in August 2023.

About Almirall

Almirall is a global pharmaceutical company focused on medical dermatology. We collaborate with scientists and healthcare professionals to address patients' needs through science to improve their lives. Our Noble Purpose is at the core of our work: "Transform the patients' world by helping them realize their hopes and dreams for a healthy life". We invest in differentiated and ground-breaking medical dermatology products to bring our innovative solutions to patients in need.

The company, founded in 1944 and headquartered in Barcelona, is publicly traded on the Spanish Stock Exchange (ticker: ALM). Throughout its 79-year history, Almirall has focused intensely on patients' needs. Almirall has a direct presence in 21 countries and strategic agreements in over 70, with about 1,800 employees. Total revenue in 2022 was €878.5 MM.

For more information, please visit almirall.com

1 Hernandez R, Põder J, LaPorte KM, Malek TR. Engineering IL-2 for immunotherapy of autoimmunity and cancer. Nat Rev Immunol. 2022 Oct;22(10):614-628. doi: 10.1038/s41577-022-00680-w. Epub 2022 Feb 25. PMID: 35217787.

2 Raeber ME, Sahin D, Karakus U, Boyman O. A systematic review of interleukin-2-based immunotherapies in clinical trials for cancer and autoimmune diseases. EBioMedicine. 2023 Apr;90:104539. doi: 10.1016/j.ebiom.2023.104539. Epub 2023 Mar 31. PMID: 37004361; PMCID: PMC10111960.

SOURCE:

Almirall

License out/inPhase 1Immunotherapy

09 Nov 2023

Almirall achieves Net Sales growth of 6.4%, driven by strong European dermatology performance

Almirall's European Dermatology business continued to be the driving force behind Almirall's strong performance in the first nine months of 2023, with a growth rate of 15.9% underpinned by the success of Ilumetri® and other recently launched products

Good performance of Key products in Europe: strong year-on-year growth of Ilumetri® (psoriasis) across geographies; Wynzora® (psoriasis) sales gaining traction, reinforced by recent country launches; and Klisyri® (actinic keratosis) rollout driving its favourable uptake

Lebrikizumab (EBGLYSS®) received positive CHMP opinion for marketing authorization in patients with moderate-to-severe atopic dermatitis; EU approval is usually expected within two months of the CHMP's positive opinion.

Pipeline development: based on the large field study data of tirbanibulin, the company submitted a supplementary New Drug Application (sNDA) in August 2023 and expects approval and a subsequent launch in H2 2024

The additional funds obtained from the capital increase executed in June allowed Almirall to take strategic steps to expand its capabilities. In the third quarter Almirall completed the acquisition of the rights of Prometax® in Spain, highly synergetic with Almirall’s existing neurology business in Spain. In parallel, the company continues to explore other opportunities for early and mid-stage assets

Almirall is on track to meet mid-single net sales digit growth (vs. initial low- to mid-single guidance) and continues to expect total EBITDA between €165 MM - €180 MM

BARCELONA, Spain--(BUSINESS WIRE)-- Almirall, S.A. (ALM), the global biopharmaceutical company based in Barcelona, has announced its 9M 2023.

Financial highlights (€ rounded million)

9M 2023

9M 2022

Variation

Net Sales

674.6

633.8

6.4%

Core EBITDA

137.1

134.0

2.3%

Total EBITDA

138.2

146.4

(5.6%)

Net Income

13.6

10.9

24.8%

Normalized Net Income

14.4

34.5

(58.3%)

Summary of results

Net Sales reached €674.6 MM, a +6.4% year-on-year increase driven by good performance of the dermatology portfolio in Europe.

Total EBITDA was €138.2 MM, consistent with expectations and reflecting the lower contribution from Other Income due to Astra Zeneca / Covis milestones compared to 9M 2022.

SG&A (Selling, General and Administrative) investment was €316.7 MM, 2.5% higher than last year, as expected. This increase reflects the company's ongoing investments in the premarketing ramp-up for lebrikizumab, as well as its investments in the recent launches of Wynzora® and Klisyri® in the US and EU, and the rollout of Ilumetri®.

Gross Margin of 64.9% was in line with expectations and reflects the impact of high input costs and inflation affecting some material purchases.

R&D investment was €78.4 MM, reaching 11.6% of Net Sales. R&D expenses are expected to normalize for the full year in the range of 12% of Net Sales.

Almirall finished the first 9 months of 2023 with a favourable balance sheet and solid liquidity position at 0.2x Net Debt to EBITDA.

“Almirall has delivered a consistently strong operational performance throughout the first nine months of 2023, and we are pleased to modestly upgrade our Net Sales guidance for the year. As we gear up for the lebrikizumab launch, we're embarking on a transformative journey for our company. The expected EMA approval, following the positive CHMP opinion, is just around the corner.

We maintain confidence in the positive trajectory of our growth drivers as we continue to support their success. Moreover, we have strategically utilized the additional capital from our recent capital increase to strengthen our portfolio, while we continue to explore other opportunities to enhance our R&D portfolio. This reflects our commitment to advancing innovation in dermatology and positions us favourably to realize our ambition of becoming a leading dermatology company, paving the way in medical dermatology by providing innovative solutions that profoundly impact patients' lives.”

Carlos Gallardo Piqué, Chairman and CEO

Growth Drivers Performance

Psoriasis

Ilumetri® (tildrakizumab), an anti-IL-23 biologic for moderate-to-severe plaque psoriasis, has continued its strong performance in 9M 2023, posting 38% growth compared to 9M 2022 and achieving Net Sales of €42 MM in Q3 in Europe. Almirall expects Q4 to resume growth momentum and anticipates that the absolute growth for 2023 will be comparable to that of 2022.

Penetration of the European market continues to be on track. Furthermore, Germany accounted for almost half of the sales, while other European countries contributed more than half, demonstrating the good traction of the product in other key markets.

Almirall unveiled new data at the European Association of Dermatology and Venereology Congress 2023 demonstrating for the first time that tildrakizumab improved patients’ wellbeing in moderate-to-severe psoriasis, achieving levels similar to the general population after 16 weeks and which was maintained up to week 28.1 Additionally, tildrakizumab demonstrated its effectiveness, improving patients’ health-related quality of life (HRQoL), with high rates of treatment satisfaction in patients with moderate-to-severe plaque psoriasis after 28 weeks in a real-world setting,2 with no new safety signals and a reassuring safety pro >3 consistent with previous randomized clinical trials (RCT) and real-world studies.4,5

The new evidence on the TRIBUTE study demonstrated that tildrakizumab improved other important patient-reported outcomes (PROs) such as sleep quality, which is highly correlated with itch, pain, quality of life, and work productivity and not with PASI.6,7 The results also revealed that tildrakizumab demonstrated similar efficacy and safety regardless of the baseline characteristics of the patients.8,9

Almirall also reported results from the TILOT study that demonstrated sustained efficacy and safety of tildrakizumab over 2 years in patients with moderate-to-severe plaque psoriasis in routine clinical practice including sensitive areas and improvements of itch.10 This was reflected in significant improvements in all measured parameters, including treatment satisfaction and quality of life.11

Additionally, Wynzora® cream, a once-daily aqueous cream with a fixed combination of calcipotriene and betamethasone diproprionate (CAL/BDP), indicated for the topical treatment of mild to moderate psoriasis vulgaris in adults, achieved sales of €11.8 MM in 9M 2023 vs €4.5 MM in 9M 2022. The growth of the product was primarily driven by recent country launches and the continuous expansion in key countries.

The cream has maintained strong performance throughout the year. Notably, both healthcare professionals and patients have expressed positive feedback about the product, emphasizing its efficacy, quick absorption, and non-sticky feel texture.

The company is confident that it has potential for significant growth in markets where the product has been already launched, such as Germany, Spain, the UK, Denmark, the Netherlands, Italy and Austria, as well as in additional EU countries in the upcoming quarters.

Wynzora® is commercialized in Austria under a different tradename: Winxory.

Actinic keratosis (AK)

Klisyri® (tirbanibulin) ointment for actinic keratosis (AK) on the face or scalp achieved net sales of €14.4 million in Europe and the United States during the first nine months of 2023, representing a 57% increase compared to the €9.2 MM recorded in the same period in 2022.

Klisyri® showed robust performance in key markets and its presence in the EU continues to grow. The product has experienced solid adoption in key countries where it has been launched. In the US, Almirall continues to focus on driving demand by differentiating Klisyri® from what is already available on the market based on efficacy, tolerability, and convenience. As a result, Klisyri® usage is associated with high overall patient satisfaction and a strong willingness to repeat treatment, as reported by dermatologists and patients.12

Prometax®

In September 2023, Almirall announced the acquisition of exclusive rights to Prometax® in Spain. The product is a transdermal patch with rivastigmine to treat Alzheimer’s Disease, increasing the level of the neurotransmitter acetylcholine which helps reduce the symptoms of Alzheimer’s. The product is highly synergetic with Almirall’s existing neurology business in Spain. The transaction was agreed based on an upfront payment of €45 MM and potential milestones of up to €15 MM.

Late-stage pipeline with promising potential

Atopic dermatitis (AD)

In the third quarter of 2023, the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) issued a positive opinion recommending the marketing authorization of lebrikizumab (EBGLYSS) for the treatment of adult and adolescent patients (12 years and older with a body weight of at least 40 kg) with moderate-to-severe atopic dermatitis (AD), who are candidates for systemic therapy.

The positive CHMP opinion is now being reviewed by the European Commission (EC). The approval in the European Union is expected in November and its launch in the first European country could take place soon after. The company expects regulatory decisions for lebrikizumab in moderate-to-severe AD in additional European markets. Regarding the UK, approval from the Medicines and Healthcare Products Regulatory Agency (MHRA) is expected by the end of the year, following the EC's Reliance Procedure. In Switzerland, Almirall submitted the MAA in June 2023 and approval is expected by the end of 2024.

In addition to the regulatory milestone, Almirall announced several positive clinical updates on lebrikizumab. At the European Academy of Dermatology and Venereology (EADV) Congress in October, lebrikizumab showed clinical improvements in combination with topical corticosteroids (TCS) in adult and adolescent patients with moderate-to-severe AD not adequately controlled with cyclosporine or for whom cyclosporine was not medically advisable, who were assessed over 16 weeks in the Phase III ADvantage study.13 The study met the primary endpoint at Week 16. At Week 16, lebrikizumab 250mg Q2W plus TCS significantly improved signs and symptoms of AD measured by EASI75* in 68.4% of patients, while only 40.8% of patients on placebo plus TCS achieved EASI75. Consistent benefit was also seen in additional endpoints such as EASI90, IGA, or Pruritus NRS*.

Additional data presented at the EADV Congress showed sustained depth of response in patients that participated in the Phase III monotherapy ADvocate 1 & 2 studies treated with lebrikizumab over 52 weeks. Deep responses, defined as total skin clearance (Investigator's Global Assessment (IGA), Eczema Area and Severity Index (EASI 100) and itch relief (NRS 0,1), were achieved in 20% and 31% of patients by Week 16 respectively and were maintained or increased through Week 52.14 These results suggest that lebrikizumab treatment can potentially allow patients and healthcare providers to elevate their expected treatment goals in AD beyond EASI75 and NRS 0/1 response.

New data on this biologic were also presented at the 43rd Annual Fall Clinical Dermatology Conference this quarter. The long-term extension study ADjoin showed patients with moderate-to-severe AD who continued treatment with lebrikizumab for up to two years experienced sustained skin clearance, itch relief and reduced disease severity with monthly maintenance dosing.15 Nearly 80% of patients with moderate-to-severe AD maintained clear or almost-clear skin with lebrikizumab monthly maintenance dosing at two years.

The data set makes Almirall confident that lebrikizumab has the potential to be a first-line biologic and may support less frequent dosing. The company is working with partner Eli Lilly on further clinical studies to maximize the value of lebrikizumab, which it believes is the best antibody targeting IL-13, the key pathogenic driver of AD. Almirall looks forward to its expected approval and launch by the end of the year, while steadily intensifying its internal efforts to be ready for a successful commercial launch.

*EASI=Eczema Area and Severity Index; EASI 75=at least 75% improvement from baseline in EASI; EASI 90=at least 90% improvement from baseline in EASI; IGA=Investigator’s Global Assessment; IGA (0,1)=IGA response of clear or almost clear; NRS=numeric rating scale; Q2W=every 2 weeks; Q4W=every 4 weeks (monthly)

Actinic keratosis (AK)

Almirall has completed the clinical study of tirbanibulin (Klisyri®) addressing the expansion to Large Field in the US. This phase III clinical study, multi-centre, open-label, single-arm study evaluated the safety and tolerability of tirbanibulin ointment 1% applied to a field of approximately 100 cm2 on the face or balding scalp in about 100 adult patients with actinic keratosis. The administration of Klisyri was well tolerated. Based on these data Almirall submitted a supplementary NDA in August 2023 and expects approval and subsequent launch in the US in H2 2024.

Autoimmune dermatological diseases

The company is also building an exciting early pipeline with promising recent in-licensed assets. The company is continuing its phase I study for the anti-IL-1RAP monoclonal antibody, which has potential utility across different autoimmune skin diseases. In September 2022, Almirall announced the initiation of the phase I study evaluating the safety, pharmacokinetics, pharmacodynamics, and clinical activity of ALM27134*, a potential first-in-class fully human, high-affinity monoclonal antibody that targets IL-1RAP (interleukin-1 receptor accessory protein). Almirall in-licensed exclusive global rights from Ichnos Science in 2021 to develop and commercialize ALM27134.

In addition, Almirall expects to initiate a phase I clinical study for IL-2muFc autoimmune drug candidate around the end of 2023. In 2022, Almirall entered into a licensing agreement with Simcere Pharmaceutical Group for Simcere’s IL-2 mutant fusion protein (IL-2muFc) autoimmune drug candidate, ALM223** (previously SIM0278). This molecule, developed utilising Simcere’s protein engineering platform, activates regulatory T-cells. Preclinically, ALM223 exhibits an improved PK pro the potential to restore immune balance. Under the agreement signed with Simcere Pharmaceutical Group, Almirall will be granted an exclusive right to develop and commercialise ALM223 for all indications outside the Greater China region (Mainland China, Hong Kong, Macau and Taiwan).

*Previously referred to as ISB 880

** ALM223 in licensed from Simcere. Formally referred to as SIM-0278, worldwide ex-Greater China.

Bispecific antibodies

In October, Almirall and EpimAb Biotherapeutics announced a license agreement for the development of bispecific antibodies for up to three undisclosed target pairs. Under the terms of this agreement, Almirall will gain a license to utilize EpimAb’s proprietary Fabs-In-Tandem Immunoglobulin (FITIg®) platform technology to generate, develop and commercialize bispecific antibodies, for which Almirall will have exclusive global rights. EpimAb Biotherapeutics shall retain all rights to the FITIg® Technology.

Other indications

Almirall has submitted regulatory filings under the European decentralized procedure in 2022 for efinaconazole, for the treatment of mild-to-moderate fungal infection of the nail in adults and children (aged 6 years and older). This product would reinforce Almirall’s onychomycosis franchise by complementing Ciclopoli®. The regulatory approval is expected in the second half of 2024.

As for the oral antibiotic Seysara® (sarecycline), the phase III clinical study conducted in China met primary and key secondary endpoints and Almirall has submitted a dossier with the Chinese National Medical Products Administration at the end of September 2023. The regulatory approval is expected in 2024.

2023 Full Year Guidance

Net sales guidance upgraded: mid-single digit net sales growth (vs. initial low- to mid-single guidance) and total EBITDA between €165 MM - €180 MM.

Investor Calendar 2024

Full year 2023 Financial Results – February 19th, 2024

Q1 2024 Financial Results – 13th May 2024

H1 2024 Financial Results – 22nd July 2024

9M 2024 Financial Results – 11th November 2024

About Almirall

Almirall is a global biopharmaceutical company focused on medical dermatology. We collaborate with scientists and healthcare professionals to address patients' needs through science to improve their lives. Our Noble Purpose is at the core of our work: "Transform the patients' world by helping them realize their hopes and dreams for a healthy life". We invest in differentiated and ground-breaking medical dermatology products to bring our innovative solutions to patients in need.

The company, founded in 1944 and headquartered in Barcelona, is publicly traded on the Spanish Stock Exchange (ticker: ALM). Throughout its 79-year history, Almirall has focused intensely on patients' needs. Almirall has a direct presence in 21 countries and strategic agreements in over 70, with about 1,800 employees. Total revenue in 2022 was €878.5 MM.

For more information, please visit almirall.com

Legal warning

This document includes only summary information and is not intended to be exhaustive. The facts, figures and opinions contained in this document, in addition to the historical ones, are "forward-looking statements". These statements are based on the information currently available and the best estimates and assumptions that the Company considers reasonable. These statements involve risks and uncertainties beyond the control of the Company. Therefore, actual results may differ materially from those declared by such forward-looking statements. The Company expressly waives any obligation to revise or update any forward-looking statements, goals or estimates contained in this document to reflect any changes in the assumptions, events or circumstances on which such forward-looking statements are based, unless required by the applicable law.

_______________________

1 Sommer R, et al. Patient-reported well-being using tildrakizumab in a real-world setting: 28-week interim data of the phase IV POSITIVE study. Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3490.

2 Augustin M, et al. Real-world effectiveness, quality of life, and treatment satisfaction with tildrakizumab in patients with moderate-to-severe psoriasis: 28-week interim data of the phase IV POSITIVE study. Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3492.

3 Mrowietz U, et al. Real-world safety of tildrakizumab in patients with moderate-to-severe psoriasis: 28-week interim data of the phase IV POSITIVE study. Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3491.

4 Thaçi D, et al. Five-year efficacy and safety of tildrakizumab in patients with moderate-to-severe psoriasis who respond at week 28: pooled analyses of two randomized phase III clinical trials (reSURFACE 1 and reSURFACE 2). Br J Dermatol. 2021 Aug;185(2):323–34. doi: 10.1111/bjd.19866.

5 Drerup KA, et al. Effective and Safe Treatment of Psoriatic Disease with the Anti-IL-23p19 Biologic Tildrakizumab: Results of a Real-World Prospective Cohort Study in Nonselected Patients. Dermatology. 2022;238:615–19. doi: 10.1159/000519924.

6 Costanzo A, et al. Tildrakizumab improves sleep quality and psoriasis-related pruritus and pain in patients with moderate-to-severe plaque psoriasis in conditions close to real clinical practice. Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3122.

7 Costanzo A, et al. Tildrakizumab improves sleep quality, quality of life and work productivity in patients with moderate-to-severe plaque psoriasis in conditions close to real clinical practice. Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3123.

8 Costanzo A, et al. Super responders to tildrakizumab treatment in moderate-to-severe chronic plaque psoriasis in conditions close to real clinical practice. Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3121.

9 Costanzo A, et al. Tildrakizumab demonstrates high efficacy regardless of baseline characteristics in patients with moderate-to-severe chronic plaque psoriasis in conditions close to real clinical practice. Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3120.

10 Tsianakas A, et al. Sustained efficacy and safety of tildrakizumab over 2 years in patients with moderate to severe plaque psoriasis in routine clinical practice: interim results in week 100 from the non-interventional, prospective, multicenter study TILOT. Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3110.

11 Tsianakas A, et al. Tildrakizumab improves signs and symptoms in patients with moderate to severe plaque psoriasis in a real-world setting: a holistic approach. Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3106.

12 PROAK: Patient-reported Outcomes for Tirbanibulin Effectiveness and Safety in Actinic Keratosis. SKIN The Journal of Cutaneous Medicine 2023.

13 Warren RB, et al. Efficacy and safety of lebrikizumab in combination with topical corticosteroids in patients with moderate-to-severe atopic dermatitis not adequately controlled or non-eligible for cyclosporine: a placebo-controlled, randomized Phase 3.

14 Simpson E, et al. Raising the bar of efficacy in atopic dermatitis: depth of response in patients treated with lebrikizumab over 52 weeks Presented at the 32nd European Academy of Dermatology and Venereology (EADV) Congress, 11 – 14 October 2023, Berlin, Germany. Abstract 3117.

15 Guttman-Yassky E, et al. Efficacy and Safety of Lebrikizumab Is Maintained to Two Years in Patients With Moderate-to-Severe Atopic Dermatitis. 2023 Fall Clinical Dermatology Conference. 20th October, 2023.

View source version on businesswire.com:

Contacts

Media contact Almirall

Tinkle

Laura Blázquez

lblazquez@tinkle.es

Phone: (+34) 600 430 581

Corporate Communications

Almirall

Mar Ramírez

mar.ramírez@almirall.com

Phone: (+34) 659 614 173

Investors’ Relations

Almirall

Pablo Divasson del Fraile

pablo.divasson@almirall.com

Phone: (+34) 93 291 3087

Source: Almirall S.A.

View this news release online at:

Clinical ResultPhase 3Drug ApprovalAcquisitionLicense out/in

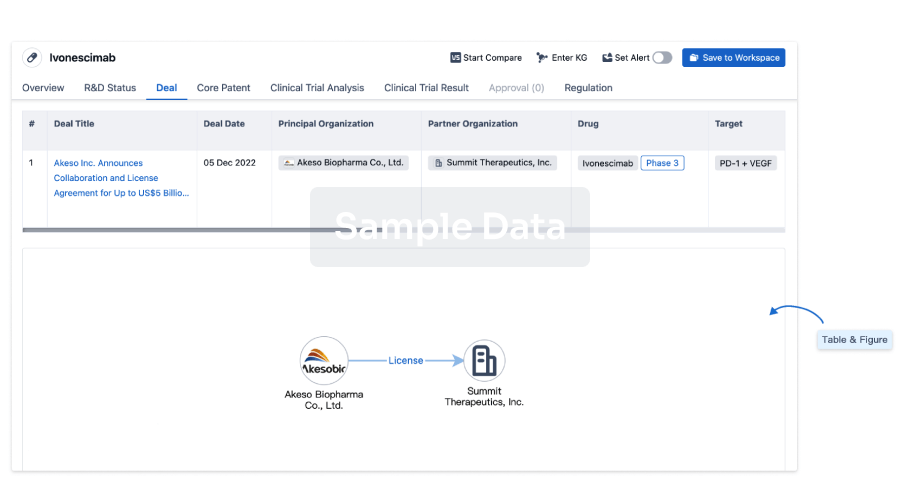

100 Deals associated with SIM-0278

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

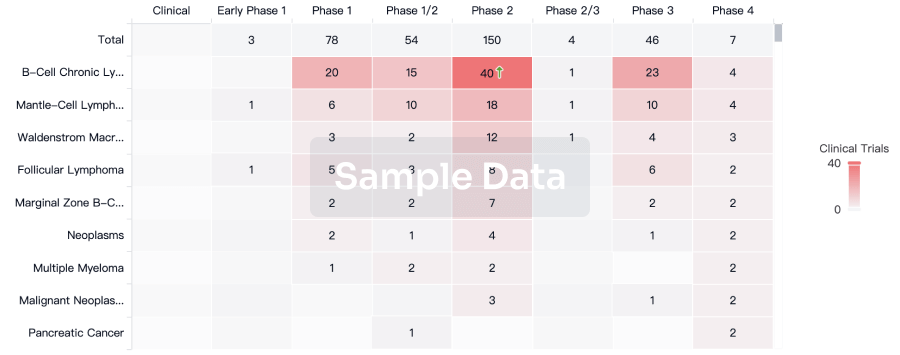

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Moderate Atopic Dermatitis | Phase 2 | China | 22 Sep 2025 | |

| Severe Atopic Dermatitis | Phase 2 | China | 22 Sep 2025 | |

| Autoimmune Diseases | Phase 1 | - | - | |

| inflammatory dermatosis | Phase 1 | Spain | - | |

| Systemic Lupus Erythematosus | Phase 1 | China | - |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

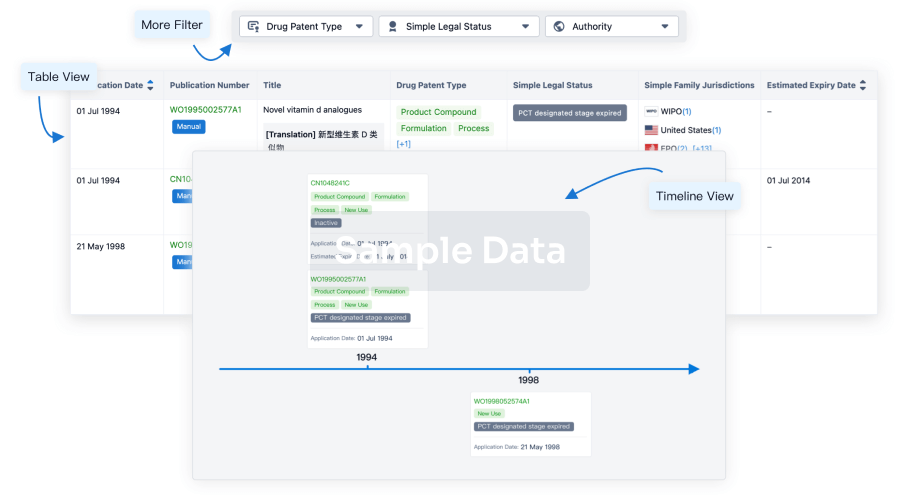

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free