Corporate Wellness Market Size to Grow by USD 24.44 Billion | Central Wellness, ComPsych Corp., EXOS, and Sodexo Group among Dominant Vendors | Technavio

22 Jun 2022

NEW YORK, June 22, 2022 /PRNewswire/ -- The "Corporate Wellness Market by Application and Geography - Forecast and Analysis 2021-2025" report has been added to Technavio's offering. With ISO 9001:2015 certification, Technavio is proudly partnering with more than 100 Fortune 500 companies for over 16 years.

Preview

Source: PRNewswire

Technavio has announced its latest market research report titled Corporate Wellness Market by Application and Geography - Forecast and Analysis 2021-2025

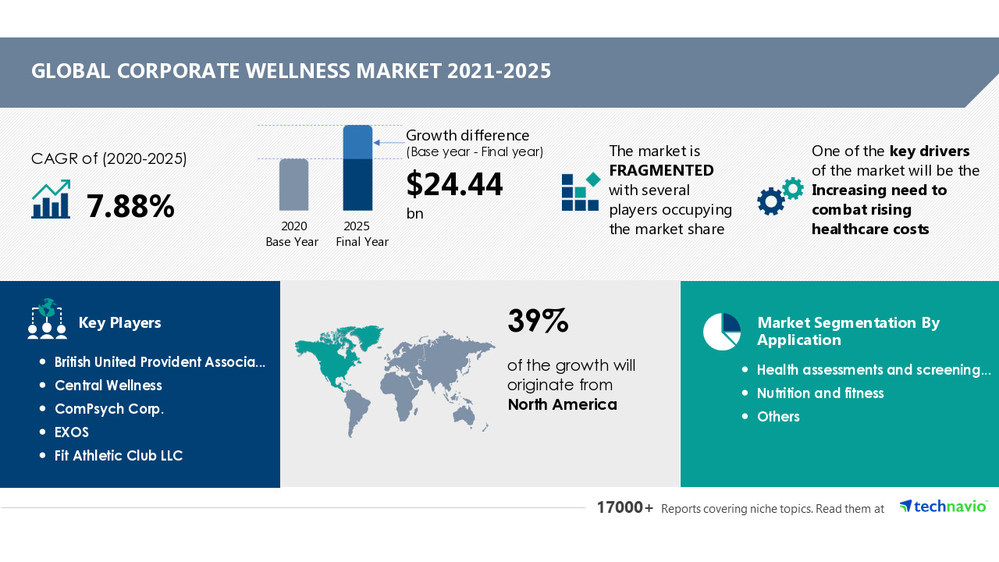

The potential growth difference for the corporate wellness market between 2020 and 2025 is USD 24.44 billion, as per the latest market analysis report by Technavio. The report projects the market to witness an accelerating growth momentum at a CAGR of 7.88% during the forecast period. The increasing need to combat rising healthcare costs will influence the market positively. However, the poor engagement level of employees will emerge as a major challenge for global corporate wellness market growth.

To get the exact yearly growth variance and the Y-O-Y growth rate, Download Sample Report.

Competitive Landscape

The corporate wellness market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The corporate wellness market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Some Companies Mentioned with their Offerings

British United Provident Association Ltd.: The company offers corporate wellness such as health. insurance, health assessments, dental insurance, mind matters, cash plan, private GP and nurse services, occupational health.

Central Wellness: The company offers corporate wellness such as health and wellness events, health and wellness coaching, health assessment.

ComPsych Corp.: The company offers corporate wellness such as Health assessment, Tobacco cessation, Weight management, Lifestyle coaching, Worksite wellness, challenges, Mobile and online tools and incentive tracking, Ongoing education and communications.

EXOS: The company offers corporate wellness such as corporate wellness programs which are the combination of wellness services, technology, fitness facilities.

Sodexo Group: The company offers corporate wellness such as corporate wellness programs.

Some other companies covered in this report are:

Fit Athletic Club LLC

Laboratory Corp. of America Holdings

WorkStride

To gain access to more vendor profiles with their key offerings available with Technavio, Click Here

Key Revenue-generating Segment Highlights

The corporate wellness market report is segmented by Application (health assessments and screenings, nutrition and fitness, and others) and Geography (North America, Europe, APAC, South America, and MEA).

The health assessments and screenings application segment held the largest corporate wellness market share in 2020. The segment will continue to account for the highest revenue throughout the forecast period. The growth of this segment can be attributed to the increasing adoption of workplace health assessment involving the assessment of current workplace wellness programs, physical environment, policies of the organization, and an employee survey followed by a questionnaire to identify behaviors, health concerns, and interests of employees.

39% of the market's growth will originate from North America during the forecast period. The US and Canada are the key markets for corporate wellness market in North America. Market growth in this region will be faster than the growth of the market in regions. The increasing need to combat rising healthcare costs will facilitate the corporate wellness market growth in North America over the forecast period.

View sample report

for insights into the contribution of all the segments and regional opportunities in the report.

Related Reports:

Wellness Tourism Market by Type, Application, and Geography - Forecast and Analysis 2022-2026

Health and Wellness Market by Product and Geography - Forecast and Analysis 2021-2025

Key Topics Covered:

1 Executive Summary

2 Market Landscape

2.1 Market ecosystem

Exhibit 01: Parent market

Exhibit 02: Market characteristics

2.2 Value chain analysis

Exhibit 03: Value Chain Analysis: Leisure facilities

3 Market Sizing

3.1 Market definition

Exhibit 04: Offerings of vendors included in the market definition

3.2 Market segment analysis

Exhibit 05: Market segments

3.3 Market size 2020

3.4 Market outlook: Forecast for 2020 - 2025

Exhibit 06: Global - Market size and forecast 2020 - 2025 ($ billion)

Exhibit 07: Global market: Year-over-year growth 2020 - 2025 (%)

4 Five Forces Analysis

4.1 Five forces summary

Exhibit 08: Five forces analysis 2020 & 2025

4.2 Bargaining power of buyers

Exhibit 09: Bargaining power of buyers

4.3 Bargaining power of suppliers

Exhibit 10: Bargaining power of suppliers

4.4 Threat of new entrants

Exhibit 11: Threat of new entrants

4.5 Threat of substitutes

Exhibit 12: Threat of substitutes

4.6 Threat of rivalry

Exhibit 13: Threat of rivalry

4.7 Market condition

Exhibit 14: Market condition - Five forces 2020

5 Market Segmentation by Application

5.1 Market segments

Exhibit 15: Application - Market share 2020-2025 (%)

5.2 Comparison by Application

Exhibit 16: Comparison by Application

5.3 Health assessments and screenings - Market size and forecast 2020-2025

Exhibit 17: Health assessments and screenings - Market size and forecast 2020-2025 ($ billion)

Exhibit 18: Health assessments and screenings - Year-over-year growth 2020-2025 (%)

5.4 Nutrition and fitness - Market size and forecast 2020-2025

Exhibit 19: Nutrition and fitness - Market size and forecast 2020-2025 ($ billion)

Exhibit 20: Nutrition and fitness - Year-over-year growth 2020-2025 (%)

5.5 Others - Market size and forecast 2020-2025

Exhibit 21: Others - Market size and forecast 2020-2025 ($ billion)

Exhibit 22: Others - Year-over-year growth 2020-2025 (%)

5.6 Market opportunity by Application

Exhibit 23: Market opportunity by Application

6 Customer landscape

7 Geographic Landscape

7.1 Geographic segmentation

Exhibit 25: Market share by geography 2020-2025 (%)

7.2 Geographic comparison

Exhibit 26: Geographic comparison

7.3 North America - Market size and forecast 2020-2025

Exhibit 27: North America - Market size and forecast 2020-2025 ($ billion)

Exhibit 28: North America - Year-over-year growth 2020-2025 (%)

7.4 Europe - Market size and forecast 2020-2025

Exhibit 29: Europe - Market size and forecast 2020-2025 ($ billion)

Exhibit 30: Europe - Year-over-year growth 2020-2025 (%)

7.5 APAC - Market size and forecast 2020-2025

Exhibit 31: APAC - Market size and forecast 2020-2025 ($ billion)

Exhibit 32: APAC - Year-over-year growth 2020-2025 (%)

7.6 South America - Market size and forecast 2020-2025

Exhibit 33: South America - Market size and forecast 2020-2025 ($ billion)

Exhibit 34: South America - Year-over-year growth 2020-2025 (%)

7.7 MEA - Market size and forecast 2020-2025

Exhibit 35: MEA - Market size and forecast 2020-2025 ($ billion)

Exhibit 36: MEA - Year-over-year growth 2020-2025 (%)

7.8 Key leading countries

Exhibit 37: Key leading countries

7.9 Market opportunity by geography

Exhibit 38: Market opportunity by geography ($ billion)

8 Drivers, Challenges, and Trends

8.1 Market drivers

8.2 Market challenges

Exhibit 39: Impact of drivers and challenges

8.3 Market trends

9 Vendor Landscape

9.1 Vendor landscape

Exhibit 40: Vendor landscape

9.2 Landscape disruption

Exhibit 41: Landscape disruption

Exhibit 42: Industry risks

9.3 Competitive scenario

10 Vendor Analysis

10.1 Vendors covered

10.2 Market positioning of vendors

Exhibit 44: Market positioning of vendors

Exhibit 45: British United Provident Association Ltd. - Overview

Exhibit 46: British United Provident Association Ltd. - Business segments

Exhibit 47: British United Provident Association Ltd. – Key news

Exhibit 48: British United Provident Association Ltd. - Key offerings

Exhibit 49: British United Provident Association Ltd. - Segment focus

10.4 Central Wellness

Exhibit 50: Central Wellness - Overview

Exhibit 51: Central Wellness - Product and service

Exhibit 52: Central Wellness - Key offerings

Exhibit 53: Central Wellness - Segment focus

10.5 ComPsych Corp.

Exhibit 54: ComPsych Corp. - Overview

Exhibit 55: ComPsych Corp. - Product and service

Exhibit 56: ComPsych Corp. - Key offerings

10.6 EXOS

Exhibit 57: EXOS - Overview

Exhibit 58: EXOS - Product and service

Exhibit 59: EXOS - Key offerings

10.7 Fit Athletic Club LLC

Exhibit 60: Fit Athletic Club LLC - Overview

Exhibit 61: Fit Athletic Club LLC - Product and service

Exhibit 62: Fit Athletic Club LLC - Key offerings

10.8 Laboratory Corp. of America Holdings

Exhibit 63: Laboratory Corp. of America Holdings - Overview

Exhibit 64: Laboratory Corp. of America Holdings - Business segments

Exhibit 65: Laboratory Corp. of America Holdings – Key news

Exhibit 66: Laboratory Corp. of America Holdings - Key offerings

Exhibit 67: Laboratory Corp. of America Holdings - Segment focus

10.9 Sodexo Group

Exhibit 68: Sodexo Group - Overview

Exhibit 69: Sodexo Group - Business segments

Exhibit 70: Sodexo Group – Key news

Exhibit 71: Sodexo Group - Key offerings

Exhibit 72: Sodexo Group - Segment focus

10.10 Vitality Group LLC

Exhibit 73: Vitality Group LLC - Overview

Exhibit 74: Vitality Group LLC - Product and service

Exhibit 75: Vitality Group LLC – Key news

Exhibit 76: Vitality Group LLC - Key offerings

Exhibit 77: WebMD Health Services Group Inc. - Overview

Exhibit 78: WebMD Health Services Group Inc. - Product and service

Exhibit 79: WebMD Health Services Group Inc. - Key offerings

10.12 WorkStride

Exhibit 80: WorkStride - Overview

Exhibit 81: WorkStride - Product and service

Exhibit 82: WorkStride - Key offerings

11.1 Scope of the report

11.2 Currency conversion rates for US$

Exhibit 83: Currency conversion rates for US$

11.3 Research methodology

Exhibit 84: Research Methodology

Exhibit 85: Validation techniques employed for market sizing

Exhibit 86: Information sources

11.4 List of abbreviations

Exhibit 87: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

US: +1 844 364 1100

UK: +44 203 893 3200

Email:[email protected]

Website: www.technavio.com/

SOURCE Technavio

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

Targets

-Drugs

-Chat with Hiro

Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.