Baxter weighs potential private equity sale in lieu of planned Vantive kidney care spinout

04 Mar 2024

AcquisitionExecutive ChangeIPO

Preview

Source: FierceBiotech

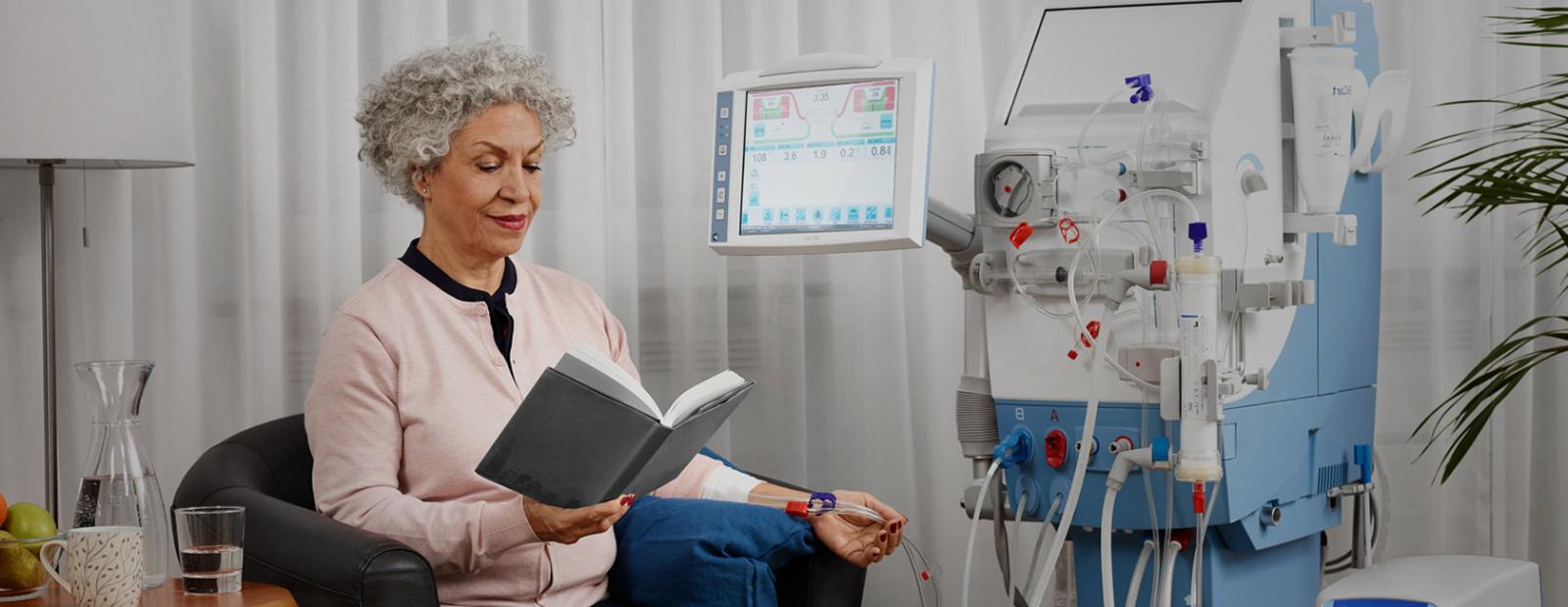

Whether bought or spun out, the renal care company's offerings will include hardware for intensive care units and dialysis clinics as well as at-home devices.

Vantive might pose an advantage for an interested buyer.

Baxter disclosed that its long-gestating plans to spin out its kidney care operations into an independent company may be dropped, in favor of a sale later this year.

In a Monday filing with the Securities and Exchange Commission, the medtech said it “has been in recent discussions with select private equity investors” for a potential acquisition deal—but also that “[n]o final decision on the separation structure has been made.”

Additionally, Baxter said that no matter the path its Vantive-in-waiting takes, the company aims to make the split official in the latter half of this year, pushing back its launch date somewhat compared to its original plans.

The spinout plans were first announced in January 2023, with President and CEO Jose Almeida describing the move at the time as a “major inflection point” in Baxter’s history. The renal care division boasts a 70-year history and maintains an international portfolio of dialysis machines, supplies and services, as well as organ-support hardware—with a catalog that brought in about $4.4 billion in sales during 2023 (PDF) and reached 1 million patients in 70 countries.

That company transformation also included the $4.25 billion sale of Baxter’s biopharma solutions business, to the private equity firms Warburg Pincus and Advent International, in a deal that closed last October.

The remaining Baxter, to be headed up by Almeida, will include its drug delivery division, frontline care monitors and ventilators, smart patient beds and motorized tables, advanced surgery devices and clinical nutrition support products—while the proceeds will be used to help pay down debts following its $10.5 billion acquisition of Hillrom in December 2021.

Vantive, meanwhile, received its name last July, alongside an initial goal to strike out on its own in the first half of this year. The company’s offerings will span the hospital, clinic and home, with hardware for intensive care units as well as self-performed peritoneal dialysis. It will also support digital platforms for in-center and remote patient monitoring.

Tapped to lead the outfit is Chris Toth, Baxter’s current group president for kidney care. Included in the company’s full-year 2023 earnings release in early February was word that Toth was continuing to build out Vantive’s senior management: Matt Harbaugh, former chief financial officer of NuVasive, was named CFO-designate of Vantive.

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

-Targets

-Drugs

-Chat with Hiro

Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.