In boost to Amgen, analysts predict osteoporosis market share shift

28 Jun 2024

Drug ApprovalBiosimilar

Preview

Source: FiercePharma

GlobalData predicts osteoporosis sales across seven major markets will hit $17.9 billion in 2033.

Change is coming to the osteoporosis market. GlobalData analysts have tipped the market to shift from bisphosphonates to anabolics, putting Amgen and its rivals in line to capture the additional $7 billion in annual sales that are forecast by 2033.

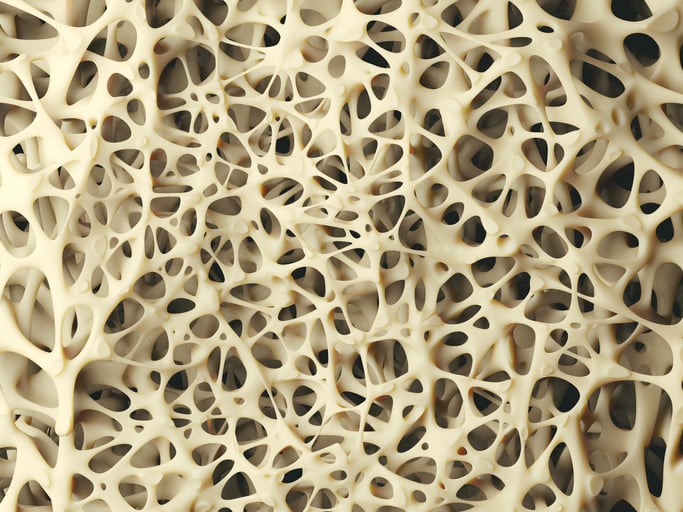

Bisphosphonates treat osteoporosis by slowing the rate that bone is broken down, thereby maintaining bone density. Anabolic drugs promote new bone formation by activating osteoblasts. Bisphosphonates are the go-to treatment option, with the American College of Physicians recommending them as first-line therapy in most patients, but GlobalData analyst Sulayman Patel expects anabolics to gain ground.

“Despite their higher cost over traditional bisphosphonates, [anabolics’] effectiveness in enhancing bone density justifies their increasing adoption,” Patel said. “This shift reflects a broader trend in healthcare towards prioritizing outcomes over initial costs. However, balancing affordability and accessibility with clinical efficacy remains a challenge that pharmaceutical companies must continue to navigate.”

GlobalData predicts osteoporosis sales across the U.S., France, Germany, Italy, Spain, the U.K. and Japan will hit $17.9 billion in 2033, up from $10.5 billion last year. The analysts expect anabolics, including Eli Lilly’s Forteo and Amgen’s Evenity, to gain market share.

Forteo lost its blockbuster status in 2021 and fell off the list of Lilly’s bestselling products altogether in 2023. Evenity rose as Forteo fell, with sales of the newer drug climbing 47% to almost $1.2 billion in 2023. Radius Health sells another anabolic osteoporosis drug, Tymlos. Sales of the medicine hit $219 million in 2021. Two investment groups took Radius private the following year.

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

Targets

-Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Leverages most recent intelligence information, enabling fullest potential.