Healthcare Equipment Leasing Market to Reach USD 71.7 Billion by 2027 - Arizton

21 Nov 2022

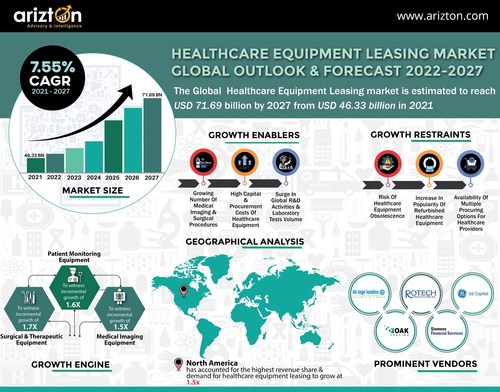

CHICAGO, Nov. 21, 2022 /PRNewswire/ -- According to Arizton's latest research report, healthcare equipment leasing market is expected to grow at a CAGR of around 7.6% during 2022-2027. Growing number of medical imaging & surgical procedures, high capital & procurement costs of healthcare equipment, and increase in the number of diagnostic centers & hospitals are the major drivers of the healthcare equipment leasing market.

Continue Reading

Preview

Source: PRNewswire

HEALTHCARE EQUIPMENT LEASING

With the rise in imaging and diagnostic procedures, especially during the COVID-19 pandemic, the demand for leasing healthcare equipment increased drastically. However, patient monitoring equipment is likely to witness the highest CAGR of 8% during the forecast period. Leasing healthcare equipment has become more advantageous to healthcare providers by avoiding putting up the required capital. Healthcare equipment, such as diagnostic and surgical devices, is constantly improving, making past models obsolete quickly. With leasing, there is more control over the imaging equipment by the procurer at the end of the lease. In addition, upgrading the healthcare equipment can also be scheduled by the procurer. Most healthcare practices, from small to large, prefer to lease healthcare equipment, which will continue the market growth. growth.

Healthcare Equipment Leasing Market Report Scope

Learn more about the additional trends impacting the future of the market and the positive and negative consequences on the businesses, click to get free sample report now.

Healthcare equipment leasing has become an emerging phenomenon for small to medium-sized companies. For start-ups, leasing has been the only way to get the doors opened before the funding runs out, especially in a case where many expensive items are required to run the company. Healthcare equipment leasing for new and used ones can be one of the most cost-effective ways of procuring required items. With leasing, sometimes equipment can be upgraded after each term to the newest and best without having to figure out what to do with the old healthcare equipment.

Market Segmentation

Medical Imaging Equipment

Surgical & Therapeutic Equipment

Patient Monitoring Equipment

Durable Medical & Storage/Transport

Lease

End-User

Hospitals

Radiology/Medical Imaging Centers

Clinics & Physician Offices

Others

Geography

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

China

Japan

India

South Korea

Australia

The Philippines

Malaysia

Vietnam

Indonesia

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

Turkey

UAE

Established players are forming strategic alliances and entering co-marketing agreements to increase their competitiveness and market penetration of medical device contract manufacturing. Vendors also focus on establishing long-term relationships with suppliers and distributors to develop their portfolio and the geographical reach of their leasing services.

Significant competition among the leading vendors is expected to increase in the future due to the emergence of new entrants. The healthcare equipment leasing market in North America comprises several large vendors with emerging medium-sized and small companies. Europe and APAC have few large players and many small and mid-sized companies. Emerging economies, such as China, India, and Brazil, offer significant growth opportunities for players in this market.

Companies Profiled in the Report

Koninklijke Philips N.V.

Siemens Financial Services

De Lage Landen International B.V.

Advantage+

BNP Paribas Leasing Solutions

C Cube Advance Technologies

Excedr

First American Healthcare Finance

First-Citizens Bank & Trust Company

GreatAmerica Financial Services

GRENKE

JA Mitsui Leasing

Madison Capital

Med One Group

National Equipment Leasing Company

National Funding North Star Leasing

Societe Generale Equipment Finance (SGEF)

TimePayment

TD Bank

Trust Capital

Read 313-page market research report, which is segmentation by "Equipment (Medical Imaging Equipment, Surgical & Therapeutic Equipment, Patient Monitoring Equipment, Laboratory Equipment, and Durable Medical & Storage/Transport), Lease (New Equipment Lease and Used Equipment Lease), End-user (Hospitals, Radiology/Medical Imaging Centers, Clinics & Physician Offices, Clinical & Research Laboratories, and Others), and Geography (North America, Europe, APAC, Latin America, and Middle East & Africa)" by Arizton

Read some of the top-selling Related reports:

Biopharmaceutical Contract Manufacturing Market – Global Outlook & Forecast 2022-2027: The global biopharmaceutical contract manufacturing market is expected to grow at a CAGR of 14.37% from 2022 to 2027. Increasing expenditure on regenerative medicine development and clinical trials gives new hope for growth in cell and gene therapy drugs. Also, increasing clinical trials of stem cell therapies and gene therapies drive the growth of manufacturing companies, which will trigger the development of the biopharmaceutical contract manufacturing market in Latin America.

3D Medical Imaging Market - Global Outlook & Forecast 2022-2027: The global 3D medical imaging market is expected to grow at a CAGR of 6.41% and is expected to reach USD 5.4 billion by 2027 from USD 3.7 billion in 2021. 3D medical imaging is a burgeoning market transforming radiological diagnosis and surgical planning. It provides clear and accurate views that can quickly summarize the relationship between anatomic structures for planning surgical procedures before and during the operating room. Vendors focus more on developing advanced technologies to cater to the growing demand for 3D medical imaging technologies to meet the current unmet medical imaging needs. As a result, several companies are focused on implementing AI implementation to generate 3D images faster with better accuracy.

Ventilators Market - Global Outlook and Forecast 2022-2027: The global ventilators market is valued at USD 1.86 billion in 2022 and is expected to reach USD 1.96 billion by 2027. The changing healthcare services in the emerging industry and significant development in developed countries consistently drive the market growth. The change can also be attributed to the growing awareness of respiratory diseases and the increase in various treatment options. The government and other vendors have taken multiple steps to raise awareness among patients and the public. The increasing life expectancy across the world and the high prevalence of patients with chronic conditions drive the increased demand for intensive care ventilators demand across the globe.

Refurbished Medical Equipment Market - Global Outlook & Forecast 2022-2027: The global refurbished medical equipment market is growing at a CAGR of 11.8% and is expected to reach USD 29.7 billion by 2027. Medical equipment inventory is an accepted cost of doing business for manufacturers and is often the most significant cost category. Since medical equipment is typically a high-value product, any efficiencies or cost reductions can quickly contribute to the bottom line. Older equipment does not last forever, and this equipment eventually will need to be replaced and refurbished. It is expected that many facilities will be eager to replace their older systems with the resolution of global supply chain problems. These factors are contributing to the rising sales of medical devices, which reflects a large inventory of used medical equipment in the refurbished medical equipment market.

Table of Content

1 RESEARCH METHODOLOGY

3 RESEARCH PROCESS

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7.1 MARKET SYNOPSIS

7.1.1 MARKET SEGMENTATIONS

7.1.2 COMPETITIVE LANDSCAPE

8 INTRODUCTION

8.1 OVERVIEW

9 MARKET OPPORTUNITIES & TRENDS

9.1 RAPID TECHNOLOGICAL ADVANCES IN HEALTHCARE SETTINGS

9.2 GROWING EASE OF LEASING HEALTHCARE EQUIPMENT IN LMICS

9.3 SURGE IN GLOBAL R&D ACTIVITIES & LABORATORY TESTS VOLUME

10 MARKET GROWTH ENABLERS

10.1 GROWING NUMBER OF MEDICAL IMAGING & SURGICAL PROCEDURES

10.2 HIGH CAPITAL & PROCUREMENT COSTS OF HEALTHCARE EQUIPMENT

10.3 INCREASE IN NUMBER OF DIAGNOSTIC CENTERS & HOSPITALS

11 MARKET RESTRAINTS

11.1 RISK OF HEALTHCARE EQUIPMENT OBSOLESCENCE

11.2 INCREASE IN POPULARITY OF REFURBISHED HEALTHCARE EQUIPMENT

11.3 AVAILABILITY OF MULTIPLE PROCURING OPTIONS FOR HEALTHCARE PROVIDERS

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 MARKET SIZE & FORECAST

12.3 FIVE FORCES ANALYSIS

12.3.1 THREAT OF NEW ENTRANTS

12.3.2 BARGAINING POWER OF SUPPLIERS

12.3.3 BARGAINING POWER OF BUYERS

12.3.4 THREAT OF SUBSTITUTES

12.3.5 COMPETITIVE RIVALRY

13 EQUIPMENT

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 MEDICAL IMAGING EQUIPMENT

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MEDICAL IMAGING EQUIPMENT: GEOGRAPHY SEGMENTATION

13.4 SURGICAL & THERAPEUTIC EQUIPMENT

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 SURGICAL & THERAPEUTIC EQUIPMENT: GEOGRAPHY SEGMENTATION

13.5 PATIENT MONITORING EQUIPMENT

13.5.1 MARKET OVERVIEW

13.5.2 MARKET SIZE & FORECAST

13.5.3 PATIENT MONITORING EQUIPMENT: GEOGRAPHY SEGMENTATION

13.6 LABORATORY EQUIPMENT

13.6.1 MARKET OVERVIEW

13.6.2 MARKET SIZE & FORECAST

13.6.3 LABORATORY EQUIPMENT: GEOGRAPHY SEGMENTATION

13.7 DURABLE MEDICAL & STORAGE/TRANSPORT EQUIPMENT

13.7.1 MARKET OVERVIEW

13.7.2 MARKET SIZE & FORECAST

13.7.3 DURABLE MEDICAL & STORAGE/TRANSPORT EQUIPMENT: GEOGRAPHY SEGMENTATION

14 LEASE TYPE

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 NEW EQUIPMENT LEASE

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 NEW EQUIPMENT LEASE: GEOGRAPHY SEGMENTATION

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 USED EQUIPMENT LEASE: GEOGRAPHY SEGMENTATION

15 END-USER

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 MARKET OVERVIEW

15.3 HOSPITALS

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.3.3 HOSPITALS: GEOGRAPHY SEGMENTATION

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

15.4.3 RADIOLOGY/IMAGING CENTERS: GEOGRAPHY SEGMENTATION

15.5 CLINICS & PHYSICIAN OFFICES

15.5.1 MARKET OVERVIEW

15.5.2 MARKET SIZE & FORECAST

15.5.3 CLINICS & PHYSICIAN OFFICES: GEOGRAPHY SEGMENTATION

15.6 CLINICAL & RESEARCH LABORATORIES

15.6.1 MARKET OVERVIEW

15.6.2 MARKET SIZE & FORECAST

15.6.3 CLINICAL & RESEARCH LABORATORIES: GEOGRAPHY SEGMENTATION

15.7 OTHERS

15.7.1 MARKET OVERVIEW

15.7.2 MARKET SIZE & FORECAST

15.7.3 OTHERS: GEOGRAPHY SEGMENTATION

16 GEOGRAPHY

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 GEOGRAPHIC OVERVIEW

17.3 KEY COUNTRIES

17.3.1 US: MARKET SIZE & FORECAST

17.3.2 CANADA: MARKET SIZE & FORECAST

18 EUROPE

18.3 KEY COUNTRIES

18.3.1 GERMANY: MARKET SIZE & FORECAST

18.3.2 FRANCE: MARKET SIZE & FORECAST

18.3.3 ITALY: MARKET SIZE & FORECAST

18.3.4 SPAIN: MARKET SIZE & FORECAST

18.3.5 UK: MARKET SIZE & FORECAST

19 APAC

19.3 KEY COUNTRIES

19.3.1 CHINA: MARKET SIZE & FORECAST

19.3.2 JAPAN: MARKET SIZE & FORECAST

19.3.3 INDIA: MARKET SIZE & FORECAST

19.3.4 SOUTH KOREA: MARKET SIZE & FORECAST

19.3.5 AUSTRALIA: MARKET SIZE & FORECAST

19.3.6 PHILIPPINES: MARKET SIZE & FORECAST

19.3.7 VIETNAM: MARKET SIZE & FORECAST

19.3.8 INDONESIA: MARKET SIZE & FORECAST

19.3.9 THAILAND: MARKET SIZE & FORECAST

19.3.10 MALAYSIA: MARKET SIZE & FORECAST

20 LATIN AMERICA

20.3 KEY COUNTRIES

20.3.1 BRAZIL: MARKET SIZE & FORECAST

20.3.2 MEXICO: MARKET SIZE & FORECAST

20.3.3 ARGENTINA: MARKET SIZE & FORECAST

21 MIDDLE EAST & AFRICA

21.3 KEY COUNTRIES

21.3.1 TURKEY: MARKET SIZE & FORECAST

21.3.2 SOUTH AFRICA: MARKET SIZE & FORECAST

21.3.3 SAUDI ARABIA: MARKET SIZE & FORECAST

21.3.4 UAE: MARKET SIZE & FORECAST

22 COMPETITIVE LANDSCAPE

22.1 COMPETITION OVERVIEW

22.2 MARKET SHARE ANALYSIS

22.2.1 GENERAL ELECTRIC COMPANY IN HEALTHCARE EQUIPMENT LEASING MARKET

22.2.2 KONINKLIJKE PHILIPS N.V. IN HEALTHCARE EQUIPMENT LEASING MARKET

22.2.3 SIEMENS FINANCIAL SERVICES IN HEALTHCARE EQUIPMENT LEASING MARKET

22.2.4 DLL IN HEALTHCARE EQUIPMENT LEASING MARKET

22.2.5 OAK LEASING IN HEALTHCARE EQUIPMENT LEASING MARKET

22.2.6 ROTECH HEALTHCARE IN HEALTHCARE EQUIPMENT LEASING MARKET

23 KEY COMPANY PROFILES

23.1.1 BUSINESS OVERVIEW

23.1.2 GENERAL ELECTRIC COMPANY IN HEALTHCARE EQUIPMENT LEASING MARKET

23.1.3 SERVICE OFFERINGS

23.1.4 KEY STRATEGIES

23.1.5 KEY STRENGTHS

23.1.6 KEY OPPORTUNITIES

23.2 KONINKLIJKE PHILIPS N.V.

23.3 SIEMENS

23.4 DLL

23.5 OAK LEASING

23.6 ROTECH HEALTHCARE

24 OTHER PROMINENT VENDORS

24.1 ADVANTAGE+

24.1.1 BUSINESS OVERVIEW

24.1.2 SERVICE OFFERINGS

24.2 BNP PARIBAS LEASING SOLUTIONS

24.3 C CUBE ADVANCED TECHNOLOGIES

24.4 CMS FUNDING

24.6 CSI LEASING

24.7 EXCEDR

24.8 FIRST AMERICAN EQUIPMENT FINANCE

24.9 FIRST-CITIZENS BANK & TRUST COMPANY

24.10 GREATAMERICA FINANCIAL SERVICES

24.11 GRENKE

24.12 HENRY SCHEIN

24.13 INSIGHT FINANCIAL SERVICES

24.14 INTUITIVE SURGICAL

24.15 JA MITSUI LEASING

24.16 MADISON CAPITAL

24.17 MCKESSON

24.18 MED ONE GROUP

24.20 MRI DEPOT

24.21 NATIONAL EQUIPMENT LEASING COMPANY

24.22 NATIONAL FUNDING

24.23 NORTH STAR LEASING

24.24 OLYMPUS

24.25 ORIX

24.26 PRUDENTIAL LEASING

24.27 SLR INVESTMENT

24.28 SOCIETE GENERALE EQUIPMENT FINANCE

24.29 STRYKER

24.30 TIMEPAYMENT

24.31 TD BANK

24.32 TRUST CAPITAL

24.33 UNIVEST

24.34 WELLS FARGO

25 REPORT SUMMARY

25.1 KEY TAKEAWAYS

25.2 STRATEGIC RECOMMENDATIONS

26 APPENDIX

26.1 ABBREVIATIONS

About Arizton:

Arizton Advisory and Intelligence is an innovation and quality-driven firm, which offers cutting-edge research solutions to clients across the world. We excel in providing comprehensive market intelligence reports and advisory and consulting services. We offer comprehensive market research reports on industries such as consumer goods & retail technology, automotive and mobility, smart tech, healthcare, and life sciences, industrial machinery, chemicals, and materials, IT and media, logistics and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered in generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Click Here to Contact Us

Call: +1-312-235-2040

+1 302 469 0707

Mail: [email protected]

Photo: https://mma.prnewswire.com/media/1952502/HEALTHCARE_EQUIPMENT_LEASING.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

SOURCE Arizton Advisory & Intelligence

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

Targets

-Drugs

-Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Leverages most recent intelligence information, enabling fullest potential.