Single-use Bioprocessing System Market - 37% of growth to Originate from North America| Driven by Increasing Use of Single-use Technologies to Minimize the Risk of Contamination |Technavio

07 Jun 2022

Vaccine

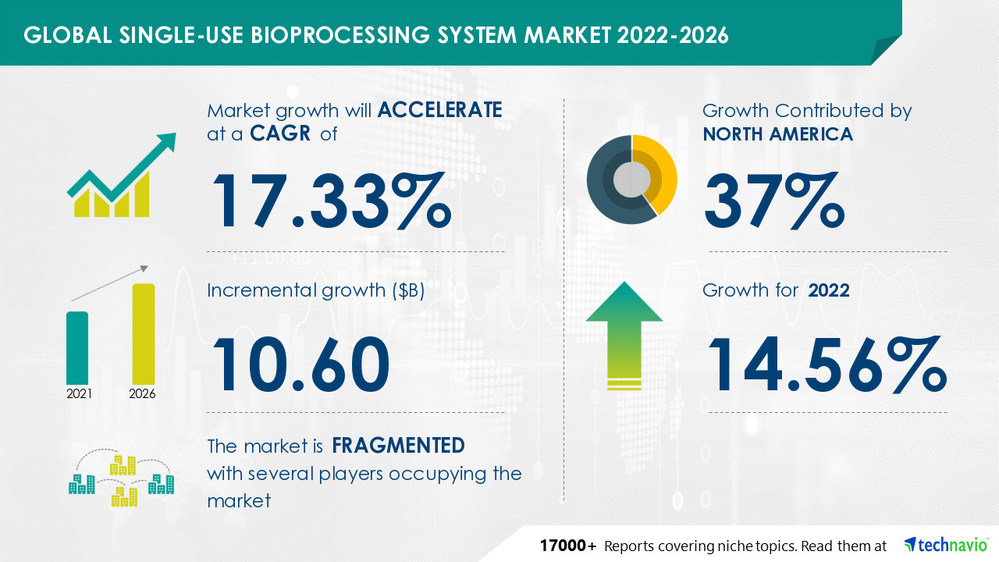

NEW YORK, June 7, 2022 /PRNewswire/ -- The "Single-use Bioprocessing System Market by Application, End-user, Product and Geography, Forecast and Analysis 2022-2026" report has been added to Technavio's offering. With ISO 9001:2015 certification, Technavio is proudly partnering with more than 100 Fortune 500 companies for over 16 years. 37% of the market's growth will originate from

North America during the forecast period.

Preview

Source: PRNewswire

Technavio has announced its latest market research report titled Single-use Bioprocessing System Market by Product, Application, End-user, and Geography - Forecast and Analysis 2022-2026

The US is the key market for single-use bioprocessing systems in North America. The significant increase in the adoption of SUB systems among pharmaceutical companies to achieve lower costs and higher productivity, as well as strategic enhancements in the therapeutic approval process and the presence of key players will facilitate the single-use bioprocessing system market growth in North America over the forecast period.

The potential growth difference for the single-use bioprocessing system market between 2021 and 2026 is

USD 10.60 billion. To get the exact yearly growth variance and the Y-O-Y growth rate,

Talk to our analyst

.

Key Market Dynamics:

Market Driver - The key factor driving the global single-use bioprocessing system industry growth is the

increasing use of single-use technologies to minimize the risk of contamination. Contamination among batches reduces the production yield and increases the cost and time-to-market by making it necessary to undertake additional steps for purification. In addition, the detection of impurities in the post commercial stages by regulatory bodies can make end-users liable for product recalls and legal actions.

Market Challenge - The key challenges to the global SUB system industry growth are the

issues related to extractables and leachable in polymeric systems. Leachables can have a toxic effect on patients who consume these drugs and can also have an adverse impact on the properties of drugs, thereby reducing their efficacy. Due to contamination concerns, the US FDA has mandated that pharmaceutical companies must demonstrate the safety of the materials used in container production systems, closure systems, and drug delivery devices.

To learn about additional key drivers, trends, and challenges -

Download our Sample Report right now!

Segmentation Analysis:

The single-use bioprocessing system market report is segmented by

Application (mAb production, Vaccine production, Plant cell cultivation, PSCTs, and Others),

End-user (Pharmaceutical companies, CROs and CMOs, Biotechnology companies, and Academic and research institutions),

Product (Bags and mixers, Bioreactors and fermenters, Filtration devices and sampling systems, Bioprocess containers, and Others), and

Geography (North America, Europe, Asia, and Rest of World (ROW)).

The single-use bioprocessing system market share growth in the application segment by the

mAb production will be significant for revenue generation. SUB systems eradicate the chances of cross-contamination and reduce the time involved in the preparation of new equipment between mAb production batches.

Download our sample report

for additional insights into the contribution of all the segments

Some Companies Mentioned

The single-use bioprocessing system market is

fragmented and the vendors are deploying growth strategies such as investment in R and D and strategic partnerships to compete in the market.

Adolf Kuhner AG

Advanced Microdevices Pvt. Ltd.

Celltainer

Merck KGaA

SENTINEL PROCESS SYSTEMS INC.

To gain access to more vendor profiles with their key offerings available with Technavio,

Related Reports:

Automated Microscopy Market by Type and Geography - Forecast and Analysis 2022-2026

Preclinical Animal Behavior Market by End-user, Application, and Geography - Forecast and Analysis 2022-2026

Table of Contents:

1 Executive Summary

1.1 Market overview

Exhibit 01: Executive Summary – Chart on Market Overview

Exhibit 02: Executive Summary – Data Table on Market Overview

Exhibit 03: Executive Summary – Chart on Global Market Characteristics

Exhibit 04: Executive Summary – Chart on Market by Geography

Exhibit 05: Executive Summary – Chart on Market Segmentation by Application

Exhibit 06: Executive Summary – Chart on Market Segmentation by End-user

Exhibit 07: Executive Summary – Chart on Market Segmentation by Product

Exhibit 08: Executive Summary – Chart on Incremental Growth

Exhibit 09: Executive Summary – Data Table on Incremental Growth

Exhibit 10: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

2.1 Market ecosystem

Exhibit 11: Parent market

Exhibit 12: Market Characteristics

3 Market Sizing

3.1 Market definition

Exhibit 13: Offerings of vendors included in the market definition

3.2 Market segment analysis

Exhibit 14: Market segments

3.3 Market size 2021

3.4 Market outlook: Forecast for 2021-2026

Exhibit 15: Chart on Global - Market size and forecast 2021-2026 ($ million)

Exhibit 16: Data Table on Global - Market size and forecast 2021-2026 ($ million)

Exhibit 17: Chart on Global Market: Year-over-year growth 2021-2026 (%)

Exhibit 18: Data Table on Global Market: Year-over-year growth 2021-2026 (%)

4 Five Forces Analysis

4.1 Five forces summary

Exhibit 19: Five forces analysis - Comparison between2021 and 2026

4.2 Bargaining power of buyers

Exhibit 20: Chart on Bargaining power of buyers – Impact of key factors 2021 and 2026

4.3 Bargaining power of suppliers

Exhibit 21: Bargaining power of suppliers – Impact of key factors in 2021 and 2026

4.4 Threat of new entrants

Exhibit 22: Threat of new entrants – Impact of key factors in 2021 and 2026

4.5 Threat of substitutes

Exhibit 23: Threat of substitutes – Impact of key factors in 2021 and 2026

4.6 Threat of rivalry

Exhibit 24: Threat of rivalry – Impact of key factors in 2021 and 2026

4.7 Market condition

Exhibit 25: Chart on Market condition - Five forces 2021 and 2026

5 Market Segmentation by Application

5.1 Market segments

Exhibit 26: Chart on Application - Market share 2021-2026 (%)

Exhibit 27: Data Table on Application - Market share 2021-2026 (%)

5.2 Comparison by Application

Exhibit 28: Chart on Comparison by Application

Exhibit 29: Data Table on Comparison by Application

5.3 mAb production - Market size and forecast 2021-2026

Exhibit 30: Chart on mAb production - Market size and forecast 2021-2026 ($ million)

Exhibit 31: Data Table on mAb production - Market size and forecast 2021-2026 ($ million)

Exhibit 32: Chart on mAb production - Year-over-year growth 2021-2026 (%)

Exhibit 33: Data Table on mAb production - Year-over-year growth 2021-2026 (%)

5.4 Vaccine production - Market size and forecast 2021-2026

Exhibit 34: Chart on Vaccine production - Market size and forecast 2021-2026 ($ million)

Exhibit 35: Data Table on Vaccine production - Market size and forecast 2021-2026 ($ million)

Exhibit 36: Chart on Vaccine production - Year-over-year growth 2021-2026 (%)

Exhibit 37: Data Table on Vaccine production - Year-over-year growth 2021-2026 (%)

5.5 Plant cell cultivation - Market size and forecast 2021-2026

Exhibit 38: Chart on Plant cell cultivation - Market size and forecast 2021-2026 ($ million)

Exhibit 39: Data Table on Plant cell cultivation - Market size and forecast 2021-2026 ($ million)

Exhibit 40: Chart on Plant cell cultivation - Year-over-year growth 2021-2026 (%)

Exhibit 41: Data Table on Plant cell cultivation - Year-over-year growth 2021-2026 (%)

5.6 PSCTs - Market size and forecast 2021-2026

Exhibit 42: Chart on PSCTs - Market size and forecast 2021-2026 ($ million)

Exhibit 43: Data Table on PSCTs - Market size and forecast 2021-2026 ($ million)

Exhibit 44: Chart on PSCTs - Year-over-year growth 2021-2026 (%)

Exhibit 45: Data Table on PSCTs - Year-over-year growth 2021-2026 (%)

5.7 Others - Market size and forecast 2021-2026

Exhibit 46: Chart on Others - Market size and forecast 2021-2026 ($ million)

Exhibit 47: Data Table on Others - Market size and forecast 2021-2026 ($ million)

Exhibit 48: Chart on Others - Year-over-year growth 2021-2026 (%)

Exhibit 49: Data Table on Others - Year-over-year growth 2021-2026 (%)

5.8 Market opportunity by Application

Exhibit 50: Market opportunity by Application ($ million)

6 Market Segmentation by End-user

6.1 Market segments

Exhibit 51: Chart on End-user - Market share 2021-2026 (%)

Exhibit 52: Data Table on End-user - Market share 2021-2026 (%)

6.2 Comparison by End-user

Exhibit 53: Chart on Comparison by End-user

Exhibit 54: Data Table on Comparison by End-user

6.3 Pharmaceutical companies - Market size and forecast 2021-2026

Exhibit 55: Chart on Pharmaceutical companies - Market size and forecast 2021-2026 ($ million)

Exhibit 56: Data Table on Pharmaceutical companies - Market size and forecast 2021-2026 ($ million)

Exhibit 57: Chart on Pharmaceutical companies - Year-over-year growth 2021-2026 (%)

Exhibit 58: Data Table on Pharmaceutical companies - Year-over-year growth 2021-2026 (%)

6.4 CROs and CMOs - Market size and forecast 2021-2026

Exhibit 59: Chart on CROs and CMOs - Market size and forecast 2021-2026 ($ million)

Exhibit 60: Data Table on CROs and CMOs - Market size and forecast 2021-2026 ($ million)

Exhibit 61: Chart on CROs and CMOs - Year-over-year growth 2021-2026 (%)

Exhibit 62: Data Table on CROs and CMOs - Year-over-year growth 2021-2026 (%)

6.5 Biotechnology companies - Market size and forecast 2021-2026

Exhibit 63: Chart on Biotechnology companies - Market size and forecast 2021-2026 ($ million)

Exhibit 64: Data Table on Biotechnology companies - Market size and forecast 2021-2026 ($ million)

Exhibit 65: Chart on Biotechnology companies - Year-over-year growth 2021-2026 (%)

Exhibit 66: Data Table on Biotechnology companies - Year-over-year growth 2021-2026 (%)

6.6 Academic and research institutions - Market size and forecast 2021-2026

Exhibit 67: Chart on Academic and research institutions - Market size and forecast 2021-2026 ($ million)

Exhibit 68: Data Table on Academic and research institutions - Market size and forecast 2021-2026 ($ million)

Exhibit 69: Chart on Academic and research institutions - Year-over-year growth 2021-2026 (%)

Exhibit 70: Data Table on Academic and research institutions - Year-over-year growth 2021-2026 (%)

6.7 Market opportunity by End-user

Exhibit 71: Market opportunity by End-user ($ million)

7 Market Segmentation by Product

7.1 Market segments

Exhibit 72: Chart on Product - Market share 2021-2026 (%)

Exhibit 73: Data Table on Product - Market share 2021-2026 (%)

7.2 Comparison by Product

Exhibit 74: Chart on Comparison by Product

Exhibit 75: Data Table on Comparison by Product

7.3 Bags and mixers - Market size and forecast 2021-2026

Exhibit 76: Chart on Bags and mixers - Market size and forecast 2021-2026 ($ million)

Exhibit 77: Data Table on Bags and mixers - Market size and forecast 2021-2026 ($ million)

Exhibit 78: Chart on Bags and mixers - Year-over-year growth 2021-2026 (%)

Exhibit 79: Data Table on Bags and mixers - Year-over-year growth 2021-2026 (%)

7.4 Bioreactors and fermenters - Market size and forecast 2021-2026

Exhibit 80: Chart on Bioreactors and fermenters - Market size and forecast 2021-2026 ($ million)

Exhibit 81: Data Table on Bioreactors and fermenters - Market size and forecast 2021-2026 ($ million)

Exhibit 82: Chart on Bioreactors and fermenters - Year-over-year growth 2021-2026 (%)

Exhibit 83: Data Table on Bioreactors and fermenters - Year-over-year growth 2021-2026 (%)

7.5 Filtration devices and sampling systems - Market size and forecast 2021-2026

Exhibit 84: Chart on Filtration devices and sampling systems - Market size and forecast 2021-2026 ($ million)

Exhibit 85: Data Table on Filtration devices and sampling systems - Market size and forecast 2021-2026 ($ million)

Exhibit 86: Chart on Filtration devices and sampling systems - Year-over-year growth 2021-2026 (%)

Exhibit 87: Data Table on Filtration devices and sampling systems - Year-over-year growth 2021-2026 (%)

7.6 Bioprocess containers - Market size and forecast 2021-2026

Exhibit 88: Chart on Bioprocess containers - Market size and forecast 2021-2026 ($ million)

Exhibit 89: Data Table on Bioprocess containers - Market size and forecast 2021-2026 ($ million)

Exhibit 90: Chart on Bioprocess containers - Year-over-year growth 2021-2026 (%)

Exhibit 91: Data Table on Bioprocess containers - Year-over-year growth 2021-2026 (%)

7.7 Others - Market size and forecast 2021-2026

Exhibit 92: Chart on Others - Market size and forecast 2021-2026 ($ million)

Exhibit 93: Data Table on Others - Market size and forecast 2021-2026 ($ million)

Exhibit 94: Chart on Others - Year-over-year growth 2021-2026 (%)

Exhibit 95: Data Table on Others - Year-over-year growth 2021-2026 (%)

7.8 Market opportunity by Product

Exhibit 96: Market opportunity by Product ($ million)

8 Customer Landscape

8.1 Customer landscape overview

Exhibit 97: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

9.1 Geographic segmentation

Exhibit 98: Chart on Market share by geography 2021-2026 (%)

Exhibit 99: Data Table on Market share by geography 2021-2026 (%)

9.2 Geographic comparison

Exhibit 100: Chart on Geographic comparison

Exhibit 101: Data Table on Geographic comparison

9.3 North America - Market size and forecast 2021-2026

Exhibit 102: Chart on North America - Market size and forecast 2021-2026 ($ million)

Exhibit 103: Data Table on North America - Market size and forecast 2021-2026 ($ million)

Exhibit 104: Chart on North America - Year-over-year growth 2021-2026 (%)

Exhibit 105: Data Table on North America - Year-over-year growth 2021-2026 (%)

9.4 Europe - Market size and forecast 2021-2026

Exhibit 106: Chart on Europe - Market size and forecast 2021-2026 ($ million)

Exhibit 107: Data Table on Europe - Market size and forecast 2021-2026 ($ million)

Exhibit 108: Chart on Europe - Year-over-year growth 2021-2026 (%)

Exhibit 109: Data Table on Europe - Year-over-year growth 2021-2026 (%)

9.5 Asia - Market size and forecast 2021-2026

Exhibit 110: Chart on Asia - Market size and forecast 2021-2026 ($ million)

Exhibit 111: Data Table on Asia - Market size and forecast 2021-2026 ($ million)

Exhibit 112: Chart on Asia - Year-over-year growth 2021-2026 (%)

Exhibit 113: Data Table on Asia - Year-over-year growth 2021-2026 (%)

9.6 Rest of World (ROW) - Market size and forecast 2021-2026

Exhibit 114: Chart on Rest of World (ROW) - Market size and forecast 2021-2026 ($ million)

Exhibit 115: Data Table on Rest of World (ROW) - Market size and forecast 2021-2026 ($ million)

Exhibit 116: Chart on Rest of World (ROW) - Year-over-year growth 2021-2026 (%)

Exhibit 117: Data Table on Rest of World (ROW) - Year-over-year growth 2021-2026 (%)

9.7 US - Market size and forecast 2021-2026

Exhibit 118: Chart on US - Market size and forecast 2021-2026 ($ million)

Exhibit 119: Data Table on US - Market size and forecast 2021-2026 ($ million)

Exhibit 120: Chart on US - Year-over-year growth 2021-2026 (%)

Exhibit 121: Data Table on US - Year-over-year growth 2021-2026 (%)

9.8 Germany - Market size and forecast 2021-2026

Exhibit 122: Chart on Germany - Market size and forecast 2021-2026 ($ million)

Exhibit 123: Data Table on Germany - Market size and forecast 2021-2026 ($ million)

Exhibit 124: Chart on Germany - Year-over-year growth 2021-2026 (%)

Exhibit 125: Data Table on Germany - Year-over-year growth 2021-2026 (%)

9.9 China - Market size and forecast 2021-2026

Exhibit 126: Chart on China - Market size and forecast 2021-2026 ($ million)

Exhibit 127: Data Table on China - Market size and forecast 2021-2026 ($ million)

Exhibit 128: Chart on China - Year-over-year growth 2021-2026 (%)

Exhibit 129: Data Table on China - Year-over-year growth 2021-2026 (%)

9.10 France - Market size and forecast 2021-2026

Exhibit 130: Chart on France - Market size and forecast 2021-2026 ($ million)

Exhibit 131: Data Table on France - Market size and forecast 2021-2026 ($ million)

Exhibit 132: Chart on France - Year-over-year growth 2021-2026 (%)

Exhibit 133: Data Table on France - Year-over-year growth 2021-2026 (%)

9.11 Japan - Market size and forecast 2021-2026

Exhibit 134: Chart on Japan - Market size and forecast 2021-2026 ($ million)

Exhibit 135: Data Table on Japan - Market size and forecast 2021-2026 ($ million)

Exhibit 136: Chart on Japan - Year-over-year growth 2021-2026 (%)

Exhibit 137: Data Table on Japan - Year-over-year growth 2021-2026 (%)

9.12 Market opportunity by geography

Exhibit 138: Market opportunity by geography ($ million)

10 Drivers, Challenges, and Trends

10.1 Market drivers

10.2 Market challenges

10.3 Impact of drivers and challenges

Exhibit 139: Impact of drivers and challenges in 2021 and 2026

10.4 Market trends

11 Vendor Landscape

11.1 Overview

11.2 Vendor landscape

Exhibit 140: Overview on Criticality of inputs and Factors of differentiation

11.3 Landscape disruption

Exhibit 141: Overview on factors of disruption

11.4 Industry risks

Exhibit 142: Impact of key risks on business

12 Vendor Analysis

12.1 Vendors covered

Exhibit 143: Vendors covered

12.2 Market positioning of vendors

Exhibit 144: Matrix on vendor position and classification

12.3 3M Corp.

Exhibit 145: 3M Corp. - Overview

Exhibit 146: 3M Corp. - Business segments

Exhibit 147: 3M Corp. - Key news

Exhibit 148: 3M Corp. - Key offerings

Exhibit 149: 3M Corp. - Segment focus

12.4 Adolf Kuhner AG

Exhibit 150: Adolf Kuhner AG - Overview

Exhibit 151: Adolf Kuhner AG - Product / Service

Exhibit 152: Adolf Kuhner AG - Key offerings

12.5 Avantor Inc.

Exhibit 153: Avantor Inc. - Overview

Exhibit 154: Avantor Inc. - Business segments

Exhibit 155: Avantor Inc. - Key news

Exhibit 156: Avantor Inc. - Key offerings

Exhibit 157: Avantor Inc. - Segment focus

Exhibit 158: Compagnie de Saint Gobain SA - Overview

Exhibit 159: Compagnie de Saint Gobain SA - Business segments

Exhibit 160: Compagnie de Saint Gobain SA - Key news

Exhibit 161: Compagnie de Saint Gobain SA - Key offerings

Exhibit 162: Compagnie de Saint Gobain SA - Segment focus

12.7 Danaher Corp.

Exhibit 163: Danaher Corp. - Overview

Exhibit 164: Danaher Corp. - Business segments

Exhibit 165: Danaher Corp. - Key news

Exhibit 166: Danaher Corp. - Key offerings

Exhibit 167: Danaher Corp. - Segment focus

12.8 Eppendorf AG

Exhibit 168: Eppendorf AG - Overview

Exhibit 169: Eppendorf AG - Product / Service

Exhibit 170: Eppendorf AG - Key news

Exhibit 171: Eppendorf AG - Key offerings

12.9 Merck KGaA

Exhibit 172: Merck KGaA - Overview

Exhibit 173: Merck KGaA - Business segments

Exhibit 174: Merck KGaA - Key news

Exhibit 175: Merck KGaA - Key offerings

Exhibit 176: Merck KGaA - Segment focus

12.10 Sartorius AG

Exhibit 177: Sartorius AG - Overview

Exhibit 178: Sartorius AG - Business segments

Exhibit 179: Sartorius AG - Key news

Exhibit 180: Sartorius AG - Key offerings

Exhibit 181: Sartorius AG - Segment focus

Exhibit 182: Solaris Biotechnology Srl - Overview

Exhibit 183: Solaris Biotechnology Srl - Product / Service

Exhibit 184: Solaris Biotechnology Srl - Key offerings

Exhibit 185: Thermo Fisher Scientific Inc. - Overview

Exhibit 186: Thermo Fisher Scientific Inc. - Business segments

Exhibit 187: Thermo Fisher Scientific Inc. - Key news

Exhibit 188: Thermo Fisher Scientific Inc. - Key offerings

Exhibit 189: Thermo Fisher Scientific Inc. - Segment focus

13 Appendix

13.1 Scope of the report

13.2 Inclusions and exclusions checklist

Exhibit 190: Inclusions checklist

Exhibit 191: Exclusions checklist

13.3 Currency conversion rates for US$

Exhibit 192: Currency conversion rates for US$

13.4 Research methodology

Exhibit 193: Research methodology

Exhibit 194: Validation techniques employed for market sizing

Exhibit 195: Information sources

13.5 List of abbreviations

Exhibit 196: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

US: +1 844 364 1100

UK: +44 203 893 3200

Email:[email protected]

Website: www.technavio.com/

SOURCE Technavio

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Indications

-Targets

-Drugs

-Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Leverages most recent intelligence information, enabling fullest potential.