Clinical Nutrition - A Lucrative Market in the US. The Demand is Increasing Across All Age Groups, The Sale of Clinical Nutrition is Expected to Reach USD 16.6 Billion by 2027 - Arizton

15 Dec 2022

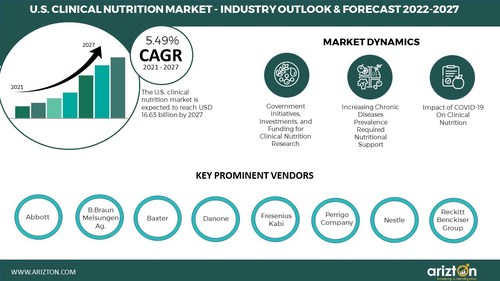

CHICAGO, Dec. 15, 2022 /PRNewswire/ -- According to Arizton's latest research report, the U.S. clinical nutrition market to grow at a CAGR of 5.5% during 2021-2027. Innovation in personalization and targeted solutions, increasing demand for infant nutrition, advancement in nutritional therapies, and shift towards home nutritional care are the significant trends in the market.

Continue Reading

Preview

Source: PRNewswire

U.S. Clinical Nutrition Market

The major market players in the U.S. are offering home enteral nutrition and parenteral nutrition services. According to Baxter, 2022, around two million U.S. hospitals stay involved in malnutrition cases. On the other hand, within 30 days of discharge, 23% of U.S. patients with malnutrition-related disorders were readmitted to hospitals. Therefore, home nutritional care is increasing in recent years across the U.S. to treat or prevent malnutrition, intestinal failure, and supportive care. In the U.S., home parenteral nutrition demand is consistently rising compared to enteral nutrition. The major factor that increases access to home nutritional care is the rising patient population from 65-74, 75, and above. The increasing prevalence of malnutrition among those age group patient populations is a leading factor driving the high demand for clinical nutrition services.

The U.S. Clinical Nutrition Market Report Scope

Click Here to Download the Free Sample Report

The U.S. government implements a tremendous breadth and depth of initiatives relevant to the country's nutrition level. So, the increasing government initiatives to improve the country's nutritional health and the rising concern about food insecurity across U.S. families are expected to drive significant U.S. clinical nutrition market growth. In addition, the increasing geriatric population and chronic disease prevalence are constantly fueling industry growth. Obesity, hypertension, gastrointestinal disorders, CVD, and other primary health conditions primely accelerate the country's malnutrition rate, creating a high demand for clinical nutrition. However, there are some limitations to the industry growth, like potential side-effects associated with clinical nutrition and challenges in enteral nutrition deliveries, pediatric ICU patients, and more, hampering the industry growth.

In the U.S., the COVID-19 infection spread significantly and severely impacted the overall age group population. People over 65 were severely affected, responsible for around 80% of hospitalization. It led to mental and physical health consequences for the senior population. The major factors are muscle wasting, isolation, reduced food intake, and increased malnutrition. In this context, clinical nutrition plays a major role in covering the body's required nutritional support.

Why Should You Buy this Research Report?

In-depth data and analysis of the U.S. clinical nutrition market's growth over the ensuing six years.

U.S. clinical nutrition market size estimation and contribution in the market.

Predictions on upcoming trends and changes in consumer behavior.

Analysis of the market's competitive environment and exhaustive vendor information.

Detailed information on the variables posing challenges to vendors in the U.S. clinical nutrition market.

Competition Among the Major Industry Players

Abbott's Ensure is one of the leading clinical nutrition products used in the U.S. clinical nutrition market. This product significantly drives the company's high customer base and delivers higher revenue yearly.

Danone is a leading industry player offering specialized nutrition comprising Advanced Medical Nutrition (AMN) and Early Life Nutrition solutions.

Perrigo Company is one of the leading companies offering store-brand self-care products, including toddler and infant formulas and pediatric and adult nutrition drinks.

Key Vendors

Abbott

B. Braun Melsungen Ag.

Baxter

Danone

Fresenius Kabi

Nestle

DSM

Envara Health

Hero Nutritionals

Hum Nutrition

Kendal Nutricare

Lonza

Lactalis Nutrition Santé

MEND

MediFood International SA

SternLife GmbH & Co. KG

Market Segmentation

Products

Powder

Liquid

Semi-solid

Route of Administration

Oral

Enteral nutrition

Parenteral Nutrition

Age Group

Infant & Toddler

Children and teenagers

Adult

Geriatric

Application

Malnutrition

Gastrointestinal disorders (G.I.)

Cancer

Others

Distribution Channels

Institutional Sales Channels

Supermarkets and Hypermarkets

Pharmacies and Drug Stores

Specialty Stores

Online Channels

Others

End-Users

Hospitals

Individuals

Home care

Long-term care facilities

Check Out Some of the Top-Selling Related Research Reports:

Personalized Nutrition Market - Global Outlook and Forecast 2021-2026: The global personalized nutrition market size is to reach around USD 16.70 billion by 2026.

Infant Nutrition Market - Global Outlook & Forecast 2021-2026: The global infant nutrition market size was valued at USD 68.44 billion in 2020 and is estimated to reach USD 106.84 billion by 2026.

Parenteral Nutrition Market - Global Outlook and Forecast 2022-2027: The global parenteral nutrition market is expected to grow at a CAGR of 4% from 2021 to 2027.

Clinical Nutrition Market - Global Outlook and Forecast 2021-2026: The global clinical nutrition market size is expected to reach USD 89.98 billion by 2026, growing at a CAGR of 9%.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.3.1 MARKET SEGMENTATION BY PRODUCTS

4.3.2 MARKET SEGMENTATION BY ROUTE OF ADMINISTRATION

4.3.3 MARKET SEGMENTATION BY AGE GROUP

4.3.4 MARKET SEGMENTATION BY APPLICATION

4.3.5 MARKET SEGMENTATION BY DISTRIBUTION CHANNELS

4.3.6 MARKET SEGMENTATION BY END-USERS

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 INTRODUCTION

7.1 OVERVIEW

8 PREMIUM INSIGHTS

9 MARKET OPPORTUNITIES & TRENDS

9.1 INNOVATION IN PERSONALIZATION AND TARGETED SOLUTIONS

9.2 INCREASING DEMAND FOR INFANT NUTRITION

9.3 ADVANCES IN NUTRITIONAL THERAPIES

9.4 SHIFT TOWARD HOME NUTRITIONAL CARE

10 MARKET GROWTH ENABLERS

10.1 GOVERNMENT INITIATIVES, INVESTMENTS, AND FUNDING FOR CLINICAL NUTRITION RESEARCH

10.2 INCREASING CHRONIC DISEASE PREVALENCE REQUIRES NUTRITIONAL SUPPORT

10.3 IMPACT OF COVID-19 ON CLINICAL NUTRITION

11 MARKET RESTRAINTS

11.1 SIDE EFFECTS AND COMPLICATIONS DUE TO CLINICAL NUTRITION

11.2 BARRIERS TO DELIVERING ENTERAL NUTRITION IN PEDIATRIC ICU

11.3 HIGH COST OF CLINICAL NUTRITION

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.1.1 CLINICAL NUTRITION MARKET IN US: PRODUCT SEGMENTATION INSIGHTS

12.1.2 CLINICAL NUTRITION MARKET IN US: PRODUCT SEGMENTATION INSIGHTS

12.1.3 CLINICAL NUTRITION MARKET IN US BY APPLICATION

12.1.4 CLINICAL NUTRITION MARKET IN THE US BY AGE GROUP

12.1.5 CLINICAL NUTRITION MARKET IN THE US BY DISTRIBUTION CHANNEL

12.1.6 CLINICAL NUTRITION MARKET IN THE US BY END-USER

12.2 MARKET SIZE & FORECAST

12.3 FIVE FORCES ANALYSIS

12.3.1 THREAT OF NEW ENTRANTS

12.3.2 BARGAINING POWER OF SUPPLIERS

12.3.3 BARGAINING POWER OF BUYERS

12.3.4 THREAT OF SUBSTITUTES

12.3.5 COMPETITIVE RIVALRY

13 ROUTE OF ADMINISTRATION

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 ORAL

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 ORAL PRODUCT MARKET BY ROUTE OF ADMINISTRATION

13.4 ENTERAL

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 ENTERAL PRODUCT MARKET BY AGE GROUP

13.5 PARENTERAL

13.5.1 MARKET OVERVIEW

13.5.2 MARKET SIZE & FORECAST

13.5.3 PARENTERAL PRODUCT MARKET BY AGE GROUP

14 PRODUCT

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 POWDER

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.4 LIQUID

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.5 SEMI-SOLID

14.5.1 MARKET OVERVIEW

14.5.2 MARKET SIZE & FORECAST

15 AGE GROUP

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 MARKET OVERVIEW

15.3 CHILD AND TEENAGER

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.4 ADULT

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

15.5 INFANT & TODDLER

15.5.1 MARKET OVERVIEW

15.5.2 MARKET SIZE & FORECAST

15.6 GERIATRIC

15.6.1 MARKET OVERVIEW

15.6.2 MARKET SIZE & FORECAST

16 APPLICATION

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 MARKET OVERVIEW

16.3 MALNUTRITION

16.3.1 MARKET OVERVIEW

16.3.2 MARKET SIZE & FORECAST

16.4 METABOLIC DISORDERS

16.4.1 MARKET OVERVIEW

16.4.2 MARKET SIZE & FORECAST

16.5.1 MARKET OVERVIEW

16.5.2 MARKET SIZE & FORECAST

16.6 CANCER

16.6.1 MARKET OVERVIEW

16.6.2 MARKET SIZE & FORECAST

16.7 OTHERS

16.7.1 MARKET OVERVIEW

16.7.2 MARKET SIZE & FORECAST

17 DISTRIBUTION CHANNEL

17.1 MARKET SNAPSHOT & GROWTH ENGINE

17.2 MARKET OVERVIEW

17.3 INSTITUTIONAL SALES

17.3.1 MARKET OVERVIEW

17.3.2 MARKET SIZE & FORECAST

17.4 SUPERMARKET & HYPERMARKET

17.4.1 MARKET OVERVIEW

17.4.2 MARKET SIZE & FORECAST

17.5 ONLINE CHANNELS

17.5.1 MARKET OVERVIEW

17.5.2 MARKET SIZE & FORECAST

17.6 PHARMACIES & DRUG STORES

17.6.1 MARKET OVERVIEW

17.6.2 MARKET SIZE & FORECAST

17.7 SPECIALTY STORES

17.7.1 MARKET OVERVIEW

17.7.2 MARKET SIZE & FORECAST

17.8 OTHERS

17.8.1 MARKET OVERVIEW

17.8.2 MARKET SIZE & FORECAST

18 END-USER

18.1 MARKET SNAPSHOT & GROWTH ENGINE

18.2 MARKET OVERVIEW

18.3 HOSPITALS

18.3.1 MARKET OVERVIEW

18.3.2 MARKET SIZE & FORECAST

18.4 INDIVIDUAL

18.4.1 MARKET OVERVIEW

18.4.2 MARKET SIZE & FORECAST

18.5 HOMECARE

18.5.1 MARKET OVERVIEW

18.5.2 MARKET SIZE & FORECAST

18.6 LONG-TERM CARE CENTERS

18.6.1 MARKET OVERVIEW

18.6.2 MARKET SIZE & FORECAST

19 COMPETITIVE LANDSCAPE

19.1 COMPETITION OVERVIEW

19.2 MARKET SHARE ANALYSIS

19.2.1 ABBOTT

19.2.2 B. BRAUN MELSUNGEN AG

19.2.3 BAXTER

19.2.4 DANONE

19.2.5 FRESENIUS KABI

19.2.6 NESTLE

19.2.7 PERRIGO COMPANY

19.2.8 RECKITT BENCKISER

20 KEY COMPANY PROFILES

20.1 ABBOTT

20.1.1 BUSINESS OVERVIEW

20.1.2 PRODUCT OFFERINGS

20.1.3 KEY STRATEGIES

20.1.4 KEY STRENGTHS

20.1.5 KEY OPPORTUNITIES

20.2 B. BRAUN MELSUNGEN AG

20.3 BAXTER

20.4 DANONE

20.5 FRESENIUS KABI

20.6 NESTLE

20.7 PERRIGO COMPANY

20.8 RECKITT BENCKISER GROUP

21 OTHER PROMINENT VENDORS

21.1 ADM

21.1.1 BUSINESS OVERVIEW

21.1.2 PRODUCT OFFERINGS

21.2 AJINOMOTO CO

21.3 BASF SE

21.4 DSM

21.5 ENVARA HEALTH

21.6 GLANBIA PLC

21.7 HERO NUTRITIONALS

21.8 HUM NUTRITION

21.9 KENDAL NUTRICARE

21.10 LONZA

21.11 LACTALIS NUTRITION SANTÉ

21.12 MEND

21.13 MEDIFOOD INTERNATIONAL SA

21.14 PRIMUS PHARMACEUTICALS

21.15 STERNLIFE GMBH & CO. KG

21.16 THE CRAFT HEAINZ COMPANY

21.17 VIVANTE HEALTH

22 REPORT SUMMARY

22.1 KEY TAKEAWAYS

22.2 STRATEGIC RECOMMENDATIONS

23 QUANTITATIVE SUMMARY

23.1 MARKET BY PRODUCT

23.2 MARKET BY ROUTE OF ADMINISTRATION

23.3 MARKET BY AGE GROUP

23.4 MARKET BY APPLICATION

23.5 MARKET BY DISTRIBUTION CHANNEL

23.6 MARKET BY END-USERS

23.7 ROUTE OF ADMINISTRATION MARKET BY AGE GROUP

23.7.1 ORAL CLINICAL NUTRITION MARKET IN THE US BY AGE GROUP

23.7.2 ENTERAL CLINICAL NUTRITION MARKET IN THE US BY AGE GROUP

23.7.3 PARENTERAL CLINICAL NUTRITION MARKET IN THE US BY AGE GROUP

24 APPENDIX

24.1 ABBREVIATIONS

About

Us

:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Click Here to Contact Us

Call: +1-312-235-2040

+1 302 469 0707

Mail: [email protected]

Photo: https://mma.prnewswire.com/media/1969443/US_Clinical_Nutrition_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

SOURCE Arizton Advisory & Intelligence

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

Targets

-Drugs

-Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Leverages most recent intelligence information, enabling fullest potential.