A New-Era of Digital Health in Cardiac Monitoring has Begun Post Pandemic; Smart Wearables, AI-based ECG Becoming Integral Part of Ambulatory Cardiovascular Medical Practices; The Global Wearable ECG Devices Market to Witness Sales of $35 Billion by 2027 - Arizton

17 Jan 2023

Acquisition

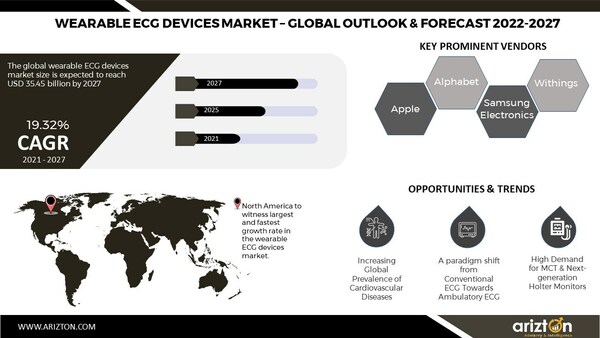

CHICAGO, Jan. 17, 2023 /PRNewswire/ -- According to Arizton's latest research report, the global wearable ECG devices market will grow at a CAGR of 19.32% during 2021-2027. The growth of the global wearable ECG devices market is anticipated to be driven by the growing adoption of cutting-edge sensors and AI-based wearable ECG devices with widely accessible clinical data. Additionally, vendors' increased emphasis on inorganic growth strategies is probably going to lead to significant product innovations, which will favorably impact the market development of wearable ECG devices globally.

Continue Reading

Preview

Source: PRNewswire

Wearable ECG Devices Market

The global wearable ECG devices market is expected to grow significantly during the forecast period due to growing technological advancements, new product launches & approvals, and the rising adoption of smart wearables by the young generation. An increase in the incidence of CVDs has led to a growing volume of diagnosis across the globe. As the demand for continuous monitoring among patients is increasing, vendors are coming up with new technologically advanced devices with higher diagnostic yields and user-friendly devices.

Innovations are firmly rooted in everyday life, and consumers are beginning to use software and hardware to manage their health. The recent trend of smart wearable devices is gaining popularity across the globe. The adoption of the smart wearable is highly boosted due to the impact of COVID-19. A new era of consumer-centric health has begun, bringing great future benefits to preventing, diagnosing, and treating cardiovascular diseases. Currently, several challenges are hampering the spread of wearable technology in clinical practice. With further sensor and computer technology development, wearables will process more complex functions and become an integral part of cardiovascular medical practices.

Global Wearable ECG Devices Market Report Scope

Click Here to Download the Free Download Report

Geographical Insights

North America is a major revenue contributor and accounts for 34.08% share of the global wearable ECG devices market. The region is the fastest-growing market for wearable ECG devices. North America offers tremendous opportunities for the players to boom in the market. The presence of a large pool of patients with atrial fibrillation requiring cardiac monitoring devices, higher acceptance of advanced and innovative wearable ECG devices, and high awareness toward the availability of advanced treatment options using devices for AF and stroke have collectively supported North America's dominance in the global market. Moreover, the region is the single largest market for wearable ECG devices, thus becoming strategically important to many prominent market players such as GE Healthcare, Koninklijke Philips, and others. For instance, GE Healthcare offers SEER 1000, SEER 12 Digital Holter ECG Recorder. Koninklijke Philips offers Holter Monitoring DigiTrak XT Holter System and Holter Monitoring Software. The Holter Monitoring DigiTrak XT Holter System is a sleek, streamlined recorder that is intended for patient comfort and streamlined workflows for all users. In addition, the Holter Monitoring Software can record, analyze, diagnose, and communicate ECG data quickly and accurately.

Vendor Insights

There are many emerging companies trying to compete in the patch-based wearable ECG devices market segment. Large medical device companies are adopting an acquisition strategy to invest or partner with many emerging vendors to diversify their product portfolio and strengthen their presence in the overall wearable ECG devices market. For instance, Philips acquired BioTelemetry, a leading vendor in the mobile cardiac telemetry segment, in February 2021. Similarly, Boston Scientific acquired Preventice Solutions in January 2021. This acquisition is likely to strengthen Boston Scientific, especially in the ambulatory wearable ECG device segment. Baxter International acquired Hill-Rom Services in December 2021. In May 2014, Medtronic acquired Corventis, focusing on the development of wireless cardiac monitoring patches.

ECG-Based Smartwatches: Key Company Profiles

Apple

Alphabet

Withings

Other Wearable ECG Devices: Key Company Profiles

Hill-Rom

Koninklijke Philips

Other Prominent Vendors

FUKUDA DENSHI

Masimo

Medicalgorithmics

Advanced Instrumentations

AMEDTEC MEDIZINTECHNIK AUE

ASPEL

Hangzhou Beneware Medical Equipment

Biotricity

Borsam Biomedical Instruments

BTL

Custo Med

Oy Diagnostic Devices Development – DDD

DMS-Service

Forest Medical

Holter Supplies

LPU Medical

LIVEWELL

Lumed

medical ECONET

Meditech Equipment

Midmark

Monitor

Neurosoft

Northeast Monitoring

Recorders & Medicare Systems

Schiller

Trimpeks

UPOLife

Market Segmentation

Product

Smartwatch-Based ECG

Mobile Cardiac Telemetry

Holter Monitoring

Cardiac Event Monitoring

Frequency

Episodic & Adhoc

Continuous

Geography

APAC

China

India

Japan

South Korea

Australia

Europe

Germany

Italy

Spain

France

UK

North America

US

Canada

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

Turkey

South Africa

South Arabia

Check Out Some of the Top-Selling Related Research Reports:

Remote Patient Monitoring Market - The global remote patient monitoring market is expected to reach USD 62 billion by 2027.

Cardiac Monitoring Market - The global cardiac monitoring market is expected to reach USD 11.91 billion by 2027.

Vital Signs Monitoring Devices Market - The global vital signs monitoring devices market size to cross USD 15 billion by 2025.

Cardiac Assist Devices Market - The cardiac assist devices market size to reach USD 2.4 billion by 2025.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.3.1 MARKET SEGMENTATION BY GEOGRAPHY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 INTRODUCTION

7.1 OVERVIEW

7.1.1 WEARABLE ECG DEVICES

8 PREMIUM INSIGHTS

8.1 MARKET SCENARIO

8.1.1 OVERVIEW

8.1.2 MARKET SEGMENTATION

9 MARKET OPPORTUNITIES & TRENDS

9.1 INCREASING USE OF ADVANCED SENSORS & AI IN WEARABLE ECG DEVICES

9.2 EMERGENCE OF SMARTWATCHES EQUIPPED WITH ECG

9.3 NEW PRODUCT APPROVALS & LAUNCHES IN WEARABLE ECG DEVICES

9.4 GROWING POPULARITY OF SMART WEARABLE TECHNOLOGY IN ECG

10 MARKET GROWTH ENABLERS

10.1 INCREASING GLOBAL PREVALENCE OF CARDIOVASCULAR DISEASES

10.2 PARADIGM SHIFT FROM CONVENTIONAL ECG TOWARD AMBULATORY ECG

10.3 HIGH DEMAND FOR MCT & NEXT-GENERATION HOLTER MONITORS

11 MARKET GROWTH RESTRAINTS

11.1 LIMITATIONS & RISKS ASSOCIATED WITH WEARABLE ECG DEVICES

11.2 HIGH COST OF WEARABLE ECG DEVICES

11.3 AVAILABILITY OF ALTERNATE CARDIAC MONITORING DEVICES

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 MARKET SIZE & FORECAST

12.2.1 GEOGRAPHY INSIGHTS

12.2.2 PRODUCT INSIGHTS

12.2.3 FREQUENCY INSIGHTS

12.3 FIVE FORCES ANALYSIS

12.3.1 THREAT OF NEW ENTRANTS

12.3.2 BARGAINING POWER OF SUPPLIERS

12.3.3 BARGAINING POWER OF BUYERS

12.3.4 THREAT OF SUBSTITUTES

12.3.5 COMPETITIVE RIVALRY

13 PRODUCT

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 SMARTWATCH-BASED ECG

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY GEOGRAPHY

13.4 MOBILE CARDIAC TELEMETRY

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY GEOGRAPHY

13.5 HOLTER MONITORING

13.5.1 MARKET OVERVIEW

13.5.2 MARKET SIZE & FORECAST

13.5.3 MARKET BY GEOGRAPHY

13.6 CARDIAC EVENT MONITORING

13.6.1 MARKET OVERVIEW

13.6.2 MARKET SIZE & FORECAST

13.6.3 MARKET BY GEOGRAPHY

14 FREQUENCY

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 EPISODIC & ADHOC

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 MARKET BY GEOGRAPHY

14.4 CONTINUOUS

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 MARKET BY GEOGRAPHY

15 GEOGRAPHY

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 GEOGRAPHIC OVERVIEW

16 NORTH AMERICA

16.1 MARKET OVERVIEW

16.1.1 MARKET SIZE & FORECAST

16.1.2 NORTH AMERICA: PRODUCT SEGMENTATION

16.1.3 NORTH AMERICA: FREQUENCY SEGMENTATION

16.2 KEY COUNTRIES

16.2.1 US: MARKET SIZE & FORECAST

16.2.2 CANADA: MARKET SIZE & FORECAST

17 EUROPE

17.1 MARKET OVERVIEW

17.1.1 MARKET SIZE & FORECAST

17.1.2 EUROPE: PRODUCT SEGMENTATION

17.1.3 EUROPE: FREQUENCY SEGMENTATION

17.2 KEY COUNTRIES

17.2.1 GERMANY: MARKET SIZE & FORECAST

17.2.2 FRANCE: MARKET SIZE & FORECAST

17.2.3 UK: MARKET SIZE & FORECAST

17.2.4 ITALY: MARKET SIZE & FORECAST

17.2.5 SPAIN: MARKET SIZE & FORECAST

18 APAC

18.1 MARKET OVERVIEW

18.1.1 MARKET SIZE & FORECAST

18.1.2 APAC: PRODUCT SEGMENTATION

18.1.3 APAC: FREQUENCY SEGMENTATION

18.2 KEY COUNTRIES

18.2.1 JAPAN: MARKET SIZE & FORECAST

18.2.2 CHINA: MARKET SIZE & FORECAST

18.2.3 INDIA: MARKET SIZE & FORECAST

18.2.4 SOUTH KOREA: MARKET SIZE & FORECAST

18.2.5 AUSTRALIA: MARKET SIZE & FORECAST

19 LATIN AMERICA

19.1 MARKET OVERVIEW

19.1.1 MARKET SIZE & FORECAST

19.1.2 LATIN AMERICA: PRODUCT SEGMENTATION

19.1.3 LATIN AMERICA: FREQUENCY SEGMENTATION

19.2 KEY COUNTRIES

19.2.1 BRAZIL: MARKET SIZE & FORECAST

19.2.2 MEXICO: MARKET SIZE & FORECAST

19.2.3 ARGENTINA: MARKET SIZE & FORECAST

20 MIDDLE EAST & AFRICA

20.1 MARKET OVERVIEW

20.1.1 MARKET SIZE & FORECAST

20.1.2 MIDDLE EAST & AFRICA: PRODUCT SEGMENTATION

20.1.3 MIDDLE EAST & AFRICA: FREQUENCY SEGMENTATION

20.2 KEY COUNTRIES

20.2.1 TURKEY: MARKET SIZE & FORECAST

20.2.2 SAUDI ARABIA: MARKET SIZE & FORECAST

20.2.3 SOUTH AFRICA: MARKET SIZE & FORECAST

21 COMPETITIVE LANDSCAPE

21.1 COMPETITION OVERVIEW

21.2 MARKET SHARE ANALYSIS

22 ECG-BASED SMARTWATCHES: KEY COMPANY PROFILES

22.1 APPLE

22.1.1 BUSINESS OVERVIEW

22.1.2 APPLE IN WEARABLE ECG DEVICES MARKET

22.1.3 PRODUCT OFFERINGS

22.1.4 KEY STRATEGIES

22.1.5 KEY STRENGTHS

22.1.6 KEY OPPORTUNITIES

22.2 ALPHABET

22.2.1 BUSINESS OVERVIEW

22.2.2 ALPHABET IN WEARABLE ECG DEVICES MARKET

22.2.3 PRODUCT OFFERINGS

22.2.4 KEY STRATEGIES

22.2.5 KEY STRENGTHS

22.2.6 KEY OPPORTUNITIES

22.3 SAMSUNG ELECTRONICS

22.3.1 BUSINESS OVERVIEW

22.3.2 SAMSUNG ELECTRONICS IN WEARABLE ECG DEVICES MARKET

22.3.3 PRODUCT OFFERINGS

22.3.4 KEY STRATEGIES

22.3.5 KEY STRENGTHS

22.3.6 KEY OPPORTUNITIES

22.4 WITHINGS

22.4.1 BUSINESS OVERVIEW

22.4.2 WITHINGS IN WEARABLE ECG DEVICES MARKET

22.4.3 PRODUCT OFFERINGS

22.4.4 KEY STRATEGIES

22.4.5 KEY STRENGTHS

22.4.6 KEY OPPORTUNITIES

23 OTHER WEARABLE ECG DEVICES: KEY COMPANY PROFILES

23.1 BOSTON SCIENTIFIC

23.1.1 BUSINESS OVERVIEW

23.1.2 BOSTON SCIENTIFIC IN WEARABLE ECG DEVICES MARKET

23.1.3 PRODUCT OFFERINGS

23.1.4 KEY STRATEGIES

23.1.5 KEY STRENGTHS

23.1.6 KEY OPPORTUNITIES

23.2 GE HEALTHCARE

23.2.1 BUSINESS OVERVIEW

23.2.2 GE HEALTHCARE IN WEARABLE ECG DEVICES MARKET

23.2.3 PRODUCT OFFERINGS

23.2.4 KEY STRATEGIES

23.2.5 KEY STRENGTHS

23.2.6 KEY OPPORTUNITIES

23.3 IRHYTHM TECHNOLOGIES

23.3.1 BUSINESS OVERVIEW

23.3.2 IRHYTHM TECHNOLOGIES IN WEARABLE ECG DEVICES MARKET

23.3.3 PRODUCT OFFERINGS

23.3.4 KEY STRATEGIES

23.3.5 KEY STRENGTHS

23.3.6 KEY OPPORTUNITIES

23.4 HILL-ROM

23.4.1 BUSINESS OVERVIEW

23.4.2 HILL-ROM IN WEARABLE ECG DEVICES MARKET

23.4.3 PRODUCT OFFERINGS

23.4.4 KEY STRATEGIES

23.4.5 KEY STRENGTHS

23.4.6 KEY OPPORTUNITIES

23.5 KONINKLIJKE PHILIPS

23.5.1 BUSINESS OVERVIEW

23.5.2 KONINKLIJKE PHILIPS IN WEARABLE ECG DEVICES MARKET

23.5.3 PRODUCT OFFERINGS

23.5.4 KEY STRATEGIES

23.5.5 KEY STRENGTHS

23.5.6 KEY OPPORTUNITIES

23.6 OSI SYSTEMS

23.6.1 BUSINESS OVERVIEW

23.6.2 OSI SYSTEMS IN WEARABLE ECG DEVICES MARKET

23.6.3 PRODUCT OFFERINGS

23.6.4 KEY STRATEGIES

23.6.5 KEY STRENGTHS

23.6.6 KEY OPPORTUNITIES

24 OTHER PROMINENT VENDORS

24.1 AEROTEL MEDICAL SYSTEMS

24.1.1 BUSINESS OVERVIEW

24.1.2 PRODUCT OFFERINGS

24.2 ADVANCED INSTRUMENTATIONS

24.2.1 BUSINESS OVERVIEW

24.2.2 PRODUCT OFFERINGS

24.3 AMEDTEC MEDIZINTECHNIK AUE

24.3.1 BUSINESS OVERVIEW

24.3.2 PRODUCT OFFERINGS

24.4 ASPEL

24.4.1 BUSINESS OVERVIEW

24.4.2 PRODUCT OFFERINGS

24.5 BPL MEDICAL TECHNOLOGIES

24.5.1 BUSINESS OVERVIEW

24.5.2 PRODUCT OFFERINGS

24.6 BARDY DIAGNOSTICS

24.6.1 BUSINESS OVERVIEW

24.6.2 PRODUCT OFFERINGS

24.7 BITTIUM

24.7.1 BUSINESS OVERVIEW

24.7.2 PRODUCT OFFERINGS

24.8 BIOTRICITY

24.8.1 BUSINESS OVERVIEW

24.8.2 PRODUCT OFFERINGS

24.9 BORSAM BIOMEDICAL INSTRUMENTS

24.9.1 BUSINESS OVERVIEW

24.9.2 PRODUCT OFFERINGS

24.10 BTL

24.10.1 BUSINESS OVERVIEW

24.10.2 PRODUCT OFFERINGS

24.11 CARDIACSENSE

24.11.1 BUSINESS OVERVIEW

24.11.2 PRODUCT OFFERINGS

24.12 CORTRIUM

24.12.1 BUSINESS OVERVIEW

24.12.2 PRODUCT OFFERINGS

24.13 CONTEC MEDICAL SYSTEMS

24.13.1 BUSINESS OVERVIEW

24.13.2 PRODUCT OFFERINGS

24.14 CUSTO MED

24.14.1 BUSINESS OVERVIEW

24.14.2 PRODUCT OFFERINGS

24.15 DMS-SERVICE

24.15.1 BUSINESS OVERVIEW

24.15.2 PRODUCT OFFERINGS

24.16 EB NEURO

24.16.1 BUSINESS OVERVIEW

24.16.2 PRODUCT OFFERINGS

24.17 EDAN INSTRUMENTS

24.17.1 BUSINESS OVERVIEW

24.17.2 PRODUCT OFFERINGS

24.18 FUKUDA DENSHI

24.18.1 BUSINESS OVERVIEW

24.18.2 PRODUCT OFFERINGS

24.19 FOREST MEDICAL

24.19.1 BUSINESS OVERVIEW

24.19.2 PRODUCT OFFERINGS

24.20 HANGZHOU BENEWARE MEDICAL EQUIPMENT

24.20.1 BUSINESS OVERVIEW

24.20.2 PRODUCT OFFERINGS

24.21 HOLTER SUPPLIES

24.21.1 BUSINESS OVERVIEW

24.21.2 PRODUCT OFFERINGS

24.22 LABTECH

24.22.1 BUSINESS OVERVIEW

24.22.2 PRODUCT OFFERINGS

24.23 LEPU MEDICAL TECHNOLOGY

24.23.1 PRODUCT OFFERINGS

24.24 LIVEWELL

24.24.1 BUSINESS OVERVIEW

24.24.2 PRODUCT OFFERINGS

24.25 LUMED

24.25.1 BUSINESS OVERVIEW

24.25.2 PRODUCT OFFERINGS

24.26 MASIMO

24.26.1 BUSINESS OVERVIEW

24.26.2 PRODUCT OFFERINGS

24.27 MEDICALGORITHMICS

24.27.1 BUSINESS OVERVIEW

24.27.2 PRODUCT OFFERINGS

24.28 MEDICAL ECONET

24.28.1 BUSINESS OVERVIEW

24.28.2 PRODUCT OFFERINGS

24.29 MEDICOMP

24.29.1 BUSINESS OVERVIEW

24.29.2 PRODUCT OFFERINGS

24.30 MEDITECH KFT

24.30.1 BUSINESS OVERVIEW

24.30.2 PRODUCT OFFERINGS

24.31 MEDITECH EQUIPMENT

24.31.1 BUSINESS OVERVIEW

24.31.2 PRODUCT OFFERINGS

24.32 MIDMARK

24.32.1 BUSINESS OVERVIEW

24.32.2 PRODUCT OFFERINGS

24.33 MONITOR

24.33.1 BUSINESS OVERVIEW

24.33.2 PRODUCT OFFERINGS

24.34 NASAN MEDICAL ELECTRONICS

24.34.1 BUSINESS OVERVIEW

24.34.2 PRODUCT OFFERINGS

24.35 NASIFF ASSOCIATES

24.35.1 BUSINESS OVERVIEW

24.35.2 PRODUCT OFFERINGS

24.36 NEUROSOFT

24.36.1 BUSINESS OVERVIEW

24.36.2 PRODUCT OFFERINGS

24.37 NORAV MEDICAL

24.37.1 BUSINESS OVERVIEW

24.37.2 PRODUCT OFFERINGS

24.38 NORTHEAST MONITORING

24.38.1 BUSINESS OVERVIEW

24.38.2 PRODUCT OFFERINGS

24.39 OY DIAGNOSTIC DEVICES DEVELOPMENT – DDD

24.39.1 BUSINESS OVERVIEW

24.39.2 PRODUCT OFFERINGS

24.40 RECORDERS & MEDICARE SYSTEMS

24.40.1 BUSINESS OVERVIEW

24.40.2 PRODUCT OFFERINGS

24.41 SCOTTCARE CARDIOVASCULAR SOLUTIONS

24.41.1 BUSINESS OVERVIEW

24.41.2 PRODUCT OFFERINGS

24.42 SCHILLER

24.42.1 BUSINESS OVERVIEW

24.42.2 PRODUCT OFFERINGS

24.43 SHENZHEN BIOCARE BIO-MEDICAL EQUIPMENT

24.43.1 BUSINESS OVERVIEW

24.43.2 PRODUCT OFFERINGS

24.44 SUZUKEN COMPANY

24.44.1 BUSINESS OVERVIEW

24.44.2 PRODUCT OFFERINGS

24.45 TRIMPEKS

24.45.1 BUSINESS OVERVIEW

24.45.2 PRODUCT OFFERINGS

24.46 UPOLIFE

24.46.1 BUSINESS OVERVIEW

24.46.2 PRODUCT OFFERINGS

24.47 VIVALNK

24.47.1 BUSINESS OVERVIEW

24.47.2 PRODUCT OFFERINGS

25 REPORT SUMMARY

25.1 KEY TAKEAWAYS

25.2 STRATEGIC RECOMMENDATIONS

26 QUANTITATIVE SUMMARY

26.1 MARKET BY PRODUCT

26.1.1 NORTH AMERICA: PRODUCT SEGMENTATION

26.1.2 EUROPE: PRODUCT SEGMENTATION

26.1.3 APAC: PRODUCT SEGMENTATION

26.1.4 LATIN AMERICA: PRODUCT SEGMENTATION

26.1.5 MIDDLE EAST & AFRICA: PRODUCT SEGMENTATION

26.2 MARKET BY FREQUENCY

26.2.1 NORTH AMERICA: FREQUENCY SEGMENTATION

26.2.2 EUROPE: FREQUENCY SEGMENTATION

26.2.3 APAC: FREQUENCY SEGMENTATION

26.2.4 LATIN AMERICA: FREQUENCY SEGMENTATION

26.2.5 MIDDLE EAST & AFRICA: FREQUENCY SEGMENTATION

26.3 MARKET BY GEOGRAPHY

26.3.1 SMARTWATCH-BASED ECG: GEOGRAPHY SEGMENTATION

26.3.2 MOBILE CARDIAC TELEMETRY: GEOGRAPHY SEGMENTATION

26.3.3 HOLTER MONITORING: GEOGRAPHY SEGMENTATION

26.3.4 CARDIAC EVENT MONITORING: GEOGRAPHY SEGMENTATION

26.3.5 EPISODIC & ADHOC: GEOGRAPHY SEGMENTATION

26.3.6 CONTINUOUS: GEOGRAPHY SEGMENTATION

27 APPENDIX

27.1 ABBREVIATIONS

About

Us

:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Click Here to Contact Us

Call: +1-312-235-2040

+1 302 469 0707

Mail: [email protected]

Photo - https://mma.prnewswire.com/media/1985019/Arizton_1.jpg

Logo - https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

SOURCE Arizton Advisory & Intelligence

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

Targets

-Drugs

-Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Leverages most recent intelligence information, enabling fullest potential.