Request Demo

Last update 08 May 2025

Terremoto Biosciences, Inc.

Last update 08 May 2025

Overview

Related

100 Clinical Results associated with Terremoto Biosciences, Inc.

Login to view more data

0 Patents (Medical) associated with Terremoto Biosciences, Inc.

Login to view more data

9

News (Medical) associated with Terremoto Biosciences, Inc.26 Jul 2024

Today, a brief rundown of news from AbbVie and AstraZeneca as well as updates from Glycomimetics, Cue Biopharma and Confo Therapeutics that you may have missed.AbbVie on Thursday reported second quarter results indicating it is weathering growing biosimilar competition& to its flagship autoimmune disease drug Humira. According to analysts with the investment bank Piper Sandler, the companys immunology business beat handily consensus revenue estimates, as two of its other drugs, Skyrizi and Rinvoq, generated more than $4 billion combined. Humira sales, at about $2.8 billion, also surpassed expectations. We think investor concerns have subsided, wrote analyst Christopher Raymond, noting that it appears Skyrizi and Rinvoq will more than make up for Humiras loss of patent exclusivity. AbbVie shares climbed 3%. Ben FidlerA Food and Drug Administration advisory panel appeared open to the agency approving a regimen of AstraZenecas immunotherapy Imfinzi that begins before surgery to remove a type of lung tumor and continues afterwards. The positive view came despite concerns from the FDA about over-treatment and difficult to decipher which part of the regimen is more beneficial. Still, FDA panelists unanimously voted Thursday to change trial protocols in the so-called perioperative setting in lung cancer going forward, meaning future clearances will require additional monetary and time investment, wrote Leerink Partners analyst Daina Graybosch. Drugmakers, as a result, will likely be more reluctant to test therapies in earlier settings, and when they do, shy away from a perioperative approach even if its whats best for patients, she wrote. Ben FidlerBelgian biotech startup Confo Therapeutics announced Friday it raised 60 million euros in a Series B financing that will help it bring two drug prospects into clinical trials. Confo is one of a number of companies developing antibodies targeting proteins known as GPCRs. The companys pipeline includes drugs for obesity and pain, one of which is partnered with Eli Lilly and already in early-stage testing. Its funding round was led by investment firm Ackermans & van Haaren, and involved other backers such as Perceptive Advisors and Wellington Partners. Gwendolyn WuGlycomimetics and Cue Biopharma both announced plans Thursday to restructure and cut jobs. Glycomimetics intends to lay off 80% of its workforce and begin a strategic review after learning the FDA will require an additional trial of its leukemia drug uproleselan before considering an approval. Cue, meanwhile, will reduce staff by 25% and seek partners for its cancer drug prospects so it can focus resources on autoimmune disease research. Ben FidlerNine months after selling Mirati Therapeutics to Bristol Myers Squibb, Charles Baum has reemerged as the CEO of a biotechnology startup. Baum on Thursday was named the head of Terremoto Biosciences, which is developing covalent medicines aimed at targets previously thought to be undruggable. The startup has raised $250 million since its inception, most recently a $175 million Series B round from Third Rock Ventures, Novo Holdings and a few other firms last November. Ben Fidler '

Executive ChangeIPO

25 Jul 2024

Before Mirati, Charles Baum, M.D., Ph.D., helped develop oncology drugs at Pfizer and Schering-Plough.

Charles Baum, M.D., Ph.D., who oversaw Mirati Therapeutics' $5.8 billion sale to Bristol Myers Squibb last year, is taking the helm of young biotech Terremoto Biosciences.

Baum’s “extensive experience in drug development, and proven track record in advancing high-impact medicines, will be instrumental," outgoing CEO Peter Thompson, M.D., said in a July 25 release. Thompson will retain his seat as board chairperson.

Baum, a trained physician-scientist, was the founder, president and CEO of oncology-focused Mirati. Before that, he helped develop cancer drugs at Pfizer and Schering-Plough.

Now, Baum will serve as CEO at Terremoto, a company developing small molecules to target disease-causing proteins—like those found in cancerous tumor cells—using covalent bonds. Existing therapies that use covalent bonds primarily target the amino acid cysteine. However, of the 20 amino acids that make up proteins, cysteine is the least common. Terremoto is instead targeting one of the essential amino acids, lysine, which is found in almost all proteins.

By targeting lysine and other amino acids, Terremoto hopes to treat previously undruggable diseases and create first-in-class medicines.

The biotech, based in South San Francisco, raised $75 million in series A funding in 2022. A little more than a year later, the biotech more than doubled that number in a $175 million series B.

Executive Change

24 Mar 2024

What's the best name in biotech? You tell us. Vote now in #FierceMadness: The best biotech name tournament.

March 24: I’m still reeling from the loss of Tentarix in round 1 but the show must go on. I should, however, note that I saw some (absolutely correct) criticism that NightHawk should have been a higher seed and admittedly yes, they should have.

I got a little carried away with the long gangly birds, which I identify with as a tall person, and seeded them according to my personal bird preference. That’s what you get when you ask a Canadian who’s never watched a single game of professional basketball in her life to run a joke March Madness bracket.

Anyway, moving on. We’ve got plenty of excitement for the Round of 32, with some strong names taking to the bench: Arrakis, Nutcracker, Pretzel and Tyra. Obsidian, HiFiBio and Werewolf. All great.

Members of the samesies bracket have dispatched with their doppelgangers and can now move forward on the strength of their names. We have always liked HiFiBio around here. Something about those capitals makes it seem like the company is yelling at you.

So let’s get on with it. Voting is now open for the Round of 32. Here's your bracket:

The fine print: To vote, click on the Crowd Signal survey below. You don't have to share any details, just vote. You will get one vote in each poll. Voting for the rounds will be open for two days, closing at 12:01 a.m. ET on March 27.

In the Round of 32, we’re asking you to write in what you would name your own biotech and why. We can’t wait to see your responses and will share the best ones (we will not post any identifying details, so go crazy!).

We will post the final results here on this page before noon after each poll closes. Keep track of the tournament across Fierce Biotech's socials with the hashtag #BiotechBracket. — Annalee Armstrong

https://mollywalker8418.survey.fm/fiercemadness-best-biotech-name-tournament-round-of-32

March 22: The Round of 64 results are in. We've crunched the numbers. We've done the analysis. Consulted a team of esteemed and not real judges. Here are your winners:

Click here to view the bracket

Now I know that the seeding in this tournament was 100% made up but I had Tentarix going far, only to be taken down by Ocelot Bio, which is my pick for the championship.

But you, dear readers, had other ideas. You defeated the #1 seed Tentarix in favor of NightHawk Biosciences with 60% of the vote in the first round. How dare you? I’m reporting of course from Charlottesville, Virginia, where we understand the sting of a #1 seed going down in the first round.

And Red Queen beating Renaissance by 59 votes? I thought for sure the Venn diagram of Beyoncé listeners and biotech was just a circle.

Max Bayer will also be sad to hear that his namesake company, Bayer, has been defeated in the first round. He defied reason, all of his colleagues and even the very official and important rules of the tournament itself to sponsor the German maker of Advil. In the end, Fierce Biotech’s unofficial biotech Tyra Biosciences—which has had us on more than one occasion ask our web development team why we can’t use a GIF of Tyra Banks as a headline image for an article—has taken down the storied 100-year-old pharmaceutical giant 574-411.

Now that is #Fierce.

https://media3.giphy.com/media/v1.Y2lkPTc5MGI3NjExYWdvaG9xb2R6cTRteXh4eHg4eGI1Z3Mxcm9zMjJkamV1OGd6NmQ3NyZlcD12MV9pbnRlcm5hbF9naWZfYnlfaWQmY3Q9Zw/3oEjHFikABzglp1HRm/giphy.gif

Kite Pharma had the largest win spread, beating out Vir Biotechnology by 595 votes to take the first round in the Daily Life bracket. Kite also had the highest number of votes in the entire competition with 788. Kapoose Creek got the lowest with just 245. The Fierce team loved that biotech name and saw it going far. Bummer.

We had a near tie in the Nature bracket with Chrysalis Biotherapeutics edging out Heron Therapeutics by just five votes. Galapagos had a pretty resounding win over Terremoto Biosciences, taking the match up 735 to 249.

Here's the full list of winners:

https://public.flourish.studio/visualisation/17265076/

We also had some incredible biotech names written in for the open-ended question. Honestly, Skunkworx Bio? Can’t believe I forgot that one. Foghorn, Caribou, Viking, Rhino and Hookipa? All great. We had many—and I mean MANY—suggestions of Zevra Therapeutics. Not sure if the entire staff over there is campaigning but we're here for it.

One odd suggestion that sent me down a Google rabbit hole was Potato Peelers From Pluto. That does not appear to be an actual biotech, which means that it’s available. So to the venture firms out there (and this is especially for you, Flagship Pioneering), I know you’re always in need of new company names. I better see a release for Potato Peelers From Pluto Biosciences in my inbox ASAP. I’ve got tens of cents to pitch toward that series A.

The second round of voting will open on Monday, March 25. Check back on this page to get your votes in. Keep track of the tournament across Fierce Biotech's socials with the hashtag #BiotechBracket.

A reminder of the schedule:

First Round (64): March 20-21

Second Round (32): March 25-26

Sweet 16: March 27-28

Elite 8: April 1-2

Final 4: April 3-4

Championship: April 5-9

And a reminder to vote in our sister publication tournaments as well: Fierce Pharma's drug name tournament is here and Fierce Healthcare's buzzwords tournament is here. — Annalee Armstrong

Click here to download your own Biotech Name bracket

Mar 20: We were making puns out of the many biotech names we come across every day on our Fierce Biotech chat when, suddenly, we realized we should take the discussion public.

And, with no seconds to lose, we launched into Fierce Madness: The Best Biotech Name Tournament, piggybacking, of course, on the annual March Madness basketball tournament. Coming up with a list of 64 names was insanely easy—from Tentarix to Biomissle to Arrakis, this industry has some of the most creative ideas and branding out there. But which one is the best?

We now turn to you, dear readers, to settle the debate for us. Is it Ocelot? HiFiBio? Lava or Intergalactic? How about Ampersand? Red Queen or Glox?

Within our bracket is another important debate to be had: Which biotechs with nearly the exact same name are the best? In one of our six brackets we have the battle of the Samesies, biotechs that have confused us from the day they launched out of stealth.

Picture this: You’re searching for news on Generation Bio. You type it into the search box at FierceBiotech.com. What follows is this: Deep in a server room, somewhere in America, the little robots that run the search receive a jolt of electricity. They wake up. Generation Bio, you say? Are you sure you don’t mean Generate:Biomedicines? One of their little metal heads twitches. It can’t even. Another keels over. Paw twitching (I picture them as little metal rats for some reason). A third blows up entirely.

The first one, with a little smoke coming out its ears, returns the result: Generate:Biomedicines and also … Generation Bio.

So this bracket is going to settle that debate once and for all. Is it ProfoundBio or ProFound Therapeutics? Which Bridge is the best bio? You get to decide.

Our remaining categories, save for one, are a bit more self-explanatory: Folklore, Animals, The Arts, Deep Space, Daily Life and Nature. And the last one, What’s in a Name?, combines a few more traditional—shall we say biotech-y—names with some inside jokes from the Fierce Biotech team.

We kick things off today with our Round of 64.

https://public.flourish.studio/visualisation/17038324/

The fine print: To vote, click on the Crowd Signal survey below. You don't have to share any details, just vote. You will get one vote in each poll. Voting for the rounds will be open for two days, closing at 12:01 a.m. ET the following day. You’ll get a few extra days to vote and rally support for the Championship game.

In the Round of 64, we've opened it up to you, readers, to suggest some companies we may have forgotten. If we get some good ones, we'll play 'em in as Wild Cards.

We will post the results here on this page before noon after each poll closes. Keep track of the tournament across Fierce Biotech's socials with the hashtag #BiotechBracket.

First Round (64): March 20-21

Second Round (32): March 25-26

Sweet 16: March 27-28

Elite 8: April 1-2

Final 4: April 3-4

Championship: April 5-9

Oh, and our sister publications are also getting in on the #FierceMadness, too. Check out Fierce Pharma's drug name tournament here and Fierce Healthcare's buzzwords tournament here. — Annalee Armstrong

100 Deals associated with Terremoto Biosciences, Inc.

Login to view more data

100 Translational Medicine associated with Terremoto Biosciences, Inc.

Login to view more data

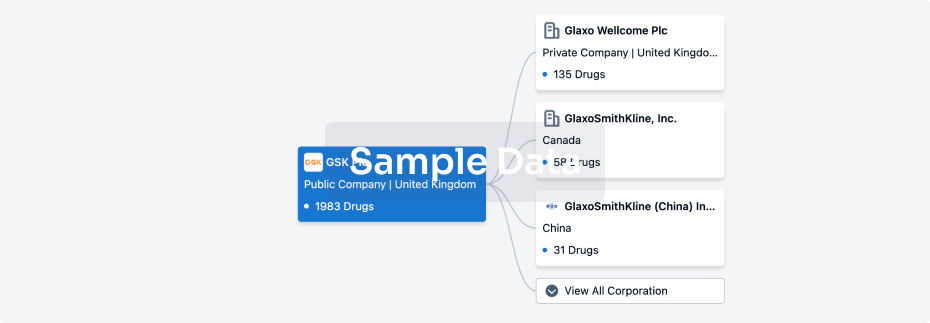

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 11 Nov 2025

No data posted

Login to keep update

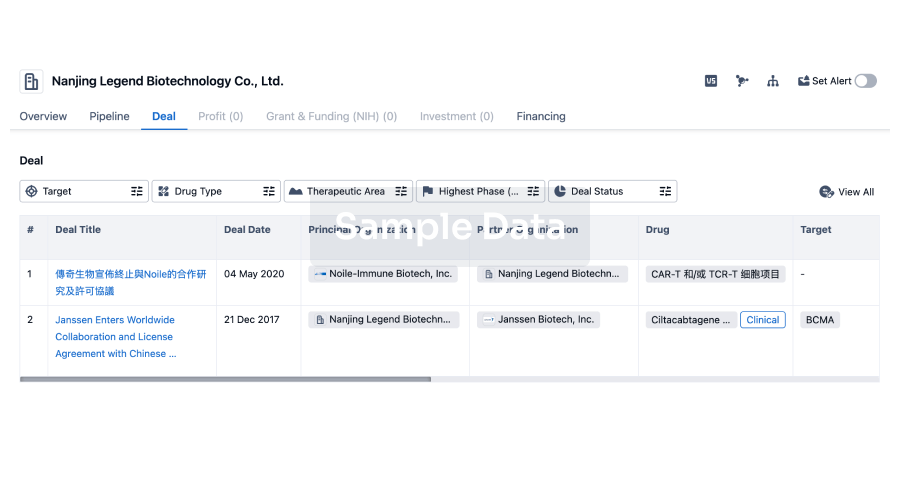

Deal

Boost your decision using our deal data.

login

or

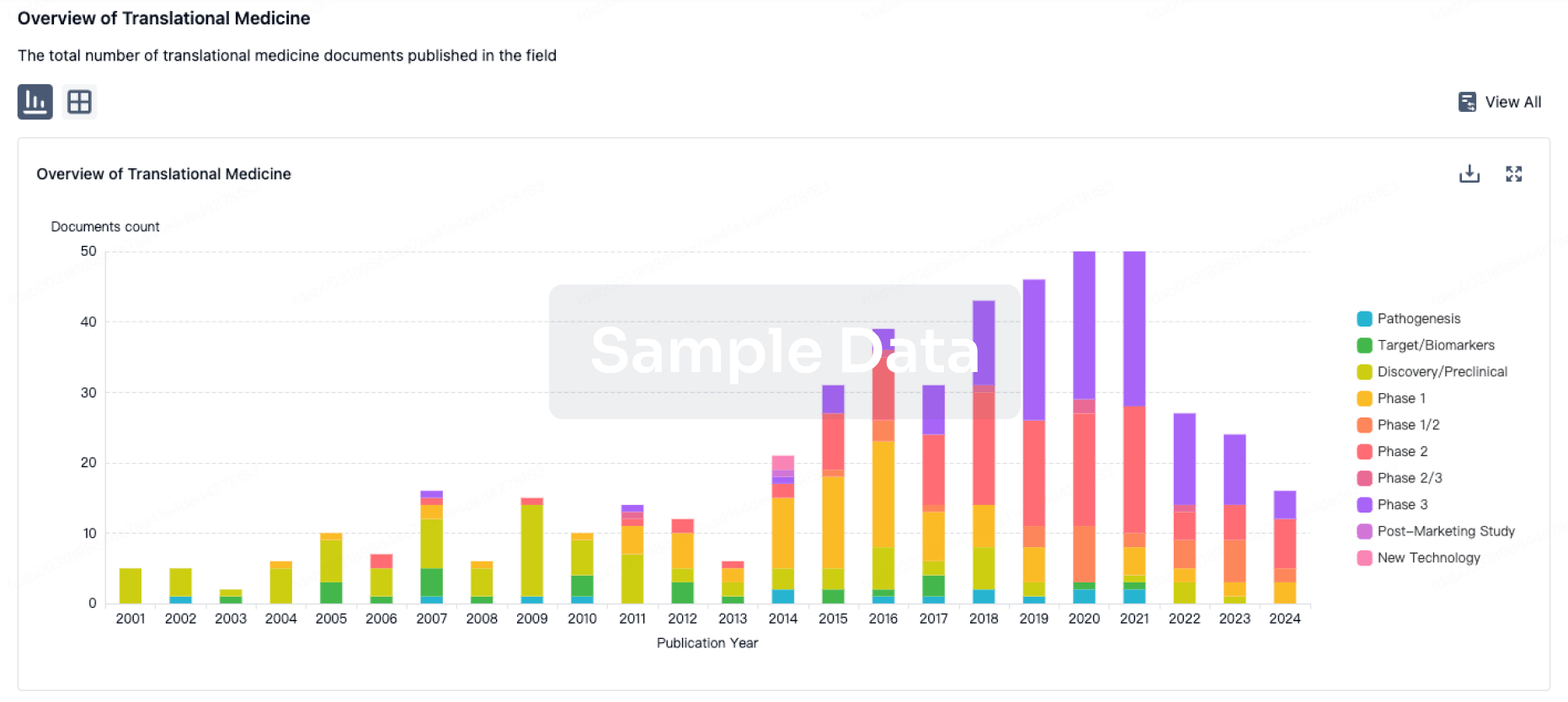

Translational Medicine

Boost your research with our translational medicine data.

login

or

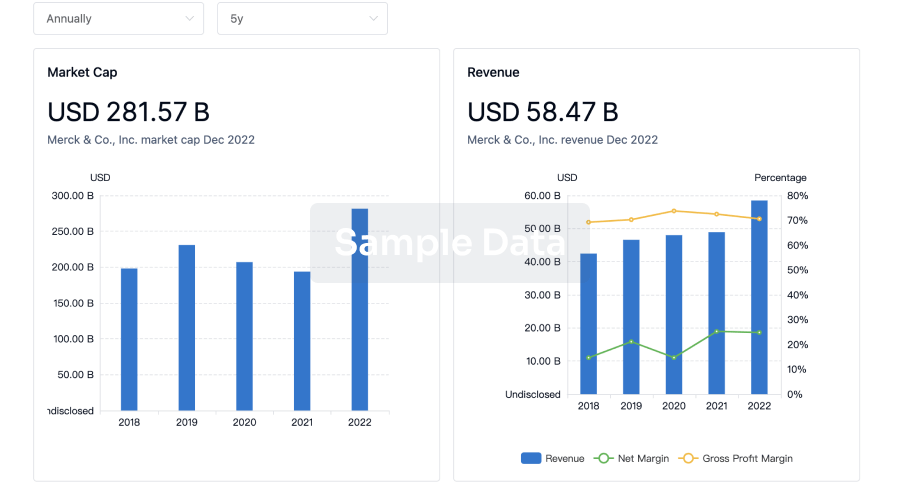

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

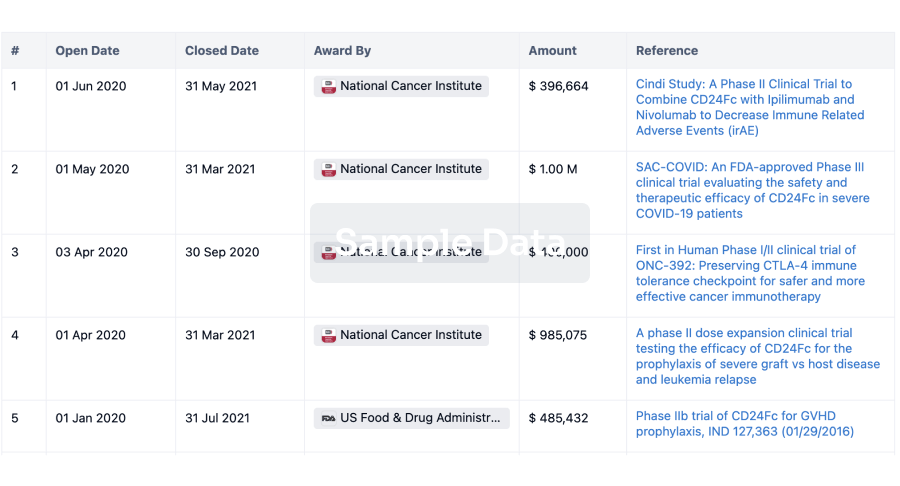

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

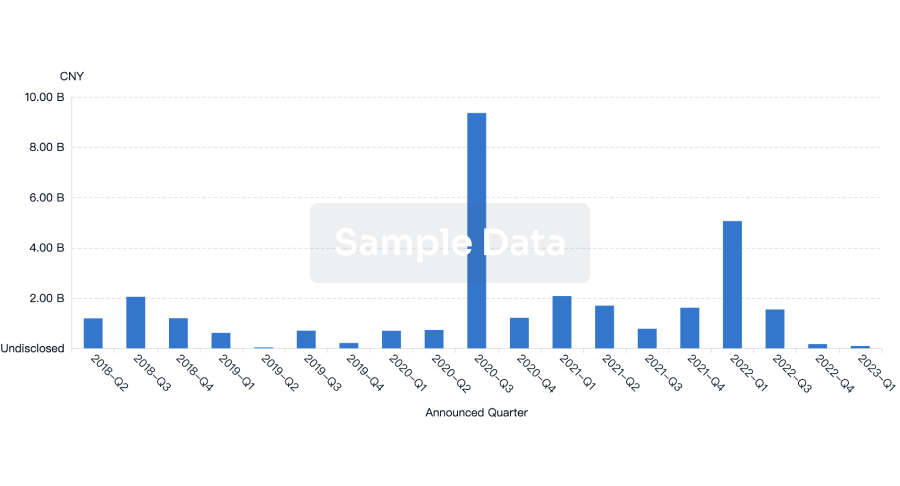

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

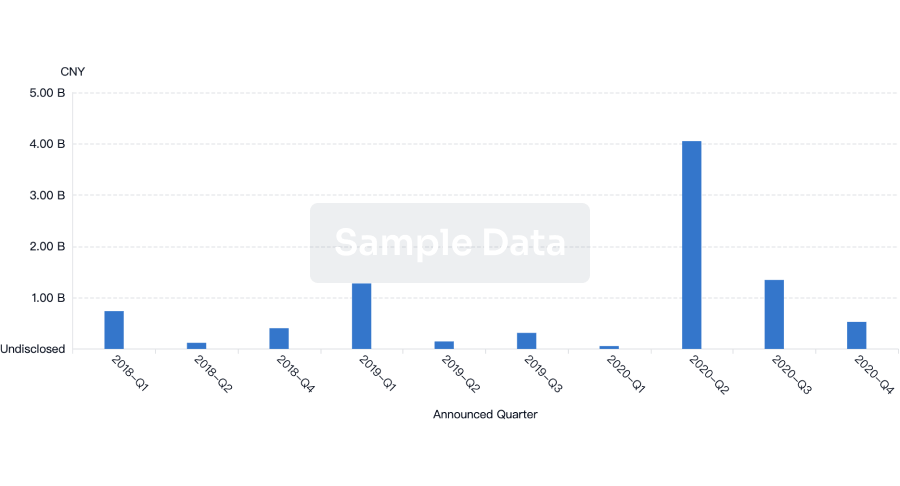

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free