Request Demo

Last update 08 Mar 2025

Manali Petrochemicals Ltd.

Last update 08 Mar 2025

Overview

Related

100 Clinical Results associated with Manali Petrochemicals Ltd.

Login to view more data

0 Patents (Medical) associated with Manali Petrochemicals Ltd.

Login to view more data

1

Literatures (Medical) associated with Manali Petrochemicals Ltd.01 Jan 2011·CELLULAR POLYMERS

Preparation of Molded Viscoelastic Polyurethane Foam for Pillow Applications

Author: Veena, N.R. ; Dhilipraj, D. Bernard ; Rajan, Krishna Prasad ; Manikandan, R.

There is a growing interest in developing and commercializing viscoelastic polyurethane foam suitable for pillow and mattress applications. In the present investigation, a novel combination of polyols with different molecular weights and hydroxyl values along with other ingredients were used for the preparation of viscoelastic polyurethane foam. The optimum polyol:isocyanate ratio was found to be 100:45 to yield a good quality foam. The physico-mechanical properties of the foam were measured as per standard procedures and compared with those of a commercially available viscoelastic foam sample. It was observed that the properties of the foam from this investigation were almost similar and in some aspects better than the properties of commercially available pillow foam. The foam can be further developed to make it suitable for hospital pillows and mattress applications.

1

News (Medical) associated with Manali Petrochemicals Ltd.24 May 2021

Dublin, May 24, 2021 (GLOBE NEWSWIRE) -- The "Global MDI, TDI, and Polyurethane Market by Application (Flexible Foams, Rigid Foams, Paints & Coatings, Elastomers, Adhesives & Sealants), End-use (Construction, Furniture & Interiors, Electronics & Appliances, Automotive, Footwear), and Region - Forecast to 2026" report has been added to ResearchAndMarkets.com's offering.

The global MDI, TDI & Polyurethane market is estimated to be USD 77.9 billion in 2021 and is projected to reach USD 105.3 billion by 2026, at a CAGR of 6.2% between 2021 and 2026.

Factors such as compliance with energy regulation, environmental sustainability need, and versatility & unique properties will drive the MDI, TDI & polyurethane market. The major restraint for the market will be toxicity and environmental concern and eco-friendly substitutes. However, increasing demand for bio-based polyurethane will act as an opportunity for the market.

Flexible foam is the largest application for MDI, TDI & polyurethane market in 2020

With flexible polyurethane foams, manufacturers of furniture, bedding, and automotive sectors can address the issues of sustainability and energy conservation more efficiently. Flexible foam is one of the most widely used materials in the bedding & furniture industry. It is mainly used in home & office furniture, bedding, mattresses, pillows, seating, and carpet underlay. Packaging and automotive are other growing end-use industries for flexible foams.

Flexible polyurethane foams help automobile manufacturers with weight reduction, vibration absorption, fuel efficiency, and durability of vehicles. As cushioning materials, flexible polyurethane foams provide support, resiliency, comfort, durability, and handling strength. All of these benefits result in better gas mileage and a more comfortable ride. The demand growth of flexible polyurethane foams is expected to be driven by increasing energy efficiency requirements globally, as the governments and organizations have to comply with international norms and regulations.

Construction is estimated to be the largest end-use industry of Polyurethane market between 2021 and 2026

Polyurethane finds multiple applications in the construction industry. Flexible and semi-rigid foams are used in paints, coatings, and adhesives. These products are extensively used in construction. Rigid foams are widely used as structural and insulation foams in buildings. Construction has the largest share in the polyurethane market. Polyurethane finds high demand for building or remodeling homes, offices, and other buildings. The high demand is backed by its lightweight, ease of installation, durability, reliability, and versatile nature.

The most important application of polyurethane in buildings is insulation. The rigid foam has unique insulating properties that make it ideal for walls and roofs of new homes and remodeling of existing homes. Insulation is usually required in cavity walls, roofs, floors, around pipes, and boilers. Polyurethane is an affordable, durable, and safe method of reducing carbon emissions that lead to global warming. Polyurethane can dramatically reduce heat loss in homes and offices in cold weather. During summer, they play an important role in keeping buildings cool, reducing the need for air conditioning.

APAC is estimated to be the largest MDI, TDI & Polyurethane market during the forecast period, in terms of value and volume

Asia-Pacific is one of the most crucial markets of MDI, TDI, and Polyurethane. In terms of global plastic consumption. Owing to the current economic conditions in mature markets such as the U.S. and Western Europe and rapidly increasing domestic consumption, Asia-Pacific has emerged as the leading produces as well as consumer of MDI, TDI, and polyurethane.

The construction and bedding & furniture sectors of the region have a leading share in the polyurethane market. Transportation, automotive, and footwear manufacturers are setting up or expanding their manufacturing bases in this region to leverage from the low manufacturing cost. China dominates the MDI, TDI, and polyurethane market in Asia-Pacific. The growing construction industry in the country as well as rebound in construction activities are the main drivers for the MDI, TDI, and polyurethane market.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights4.1 Attractive Opportunities in the MDI, TDI, and Polyurethane Market4.2 APAC: MDI, TDI, and Polyurethane Market, by Application and Country4.3 MDI, TDI, and Polyurethane Market, by Region4.4 MDI, TDI, and Polyurethane Market, Region vs. Application4.5 MDI, TDI, and Polyurethane Market Attractiveness

5 Market Overview5.1 Introduction5.2 Market Dynamics of MDI, TDI, and Polyurethane Market5.2.1 Drivers5.2.1.1 Growth in End-use Industries5.2.1.2 Compliance with Energy Regulations5.2.1.3 Environment Sustainability Needs5.2.1.4 Versatility and Unique Properties5.2.2 Restraints5.2.2.1 Toxicity and Environmental Concerns5.2.2.2 Stringent Regulations by the Governing Bodies5.2.2.3 Eco-Friendly Substitutes5.2.3 Opportunities5.2.3.1 Phosgene-Free MDI Production5.2.3.2 Increasing Demand for Bio-Based Polyurethane5.2.4 Challenges5.2.4.1 Fluctuation in the Prices due to High Cost of Raw Materials and Logistics5.3 Porter's Five Forces Analysis5.4 Macroeconomic Indicators5.5 COVID-19 Impact5.6 Impact of COVID-19: Customer Analysis

6 Industry Trends

7 MDI, TDI, and Polyurethane Market, by Application

8 Polyurethane Market, by End-use Industry

9 MDI, TDI & Polyurethane Market, by Region

10 Competitive Landscape

11 Company Profiles11.1 Major Players11.1.1 BASF SE11.1.1.1 Business Overview11.1.1.2 BASF SE: Company Overview11.1.1.3 Products Offered11.1.1.4 BASF SE: Recent Developments11.1.1.5 BASF SE: New Product Launch11.1.1.6 Winning Imperatives11.1.1.7 Current Focus and Strategies11.1.1.8 Threat from Competitors11.1.1.9 Right to Win11.1.2 The Dow Chemical Company11.1.2.1 Business Overview11.1.2.2 The Dow Chemical Company: Company Overview11.1.2.3 Products Offered11.1.2.4 The Dow Chemical Company: Recent Developments11.1.2.5 Winning Imperatives11.1.2.6 Current Focus and Strategies11.1.2.7 Threat from Competitors11.1.2.8 Right to Win11.1.3 DuPont De Nemours, Inc.11.1.3.1 Business Overview11.1.3.2 DuPont De Nemours, Inc.: Company Overview11.1.3.3 Products Offered11.1.3.4 DuPont De Nemours, Inc.: Recent Developments11.1.3.5 Winning Imperatives11.1.3.6 Current Focus and Strategies11.1.3.7 Threat from Competitors11.1.3.8 Right to Win11.1.4 Huntsman Corporation11.1.4.1 Business Overview11.1.4.2 Huntsman Corporation: Company Overview11.1.4.3 Products Offered11.1.4.4 Huntsman Corporation: Recent Developments11.1.4.5 Winning Imperatives11.1.4.6 Current Focus and Strategies11.1.4.7 Threat from Competitors11.1.4.8 Right to Win11.1.5 Covestro AG11.1.5.1 Business Overview11.1.5.2 Covestro AG: Company Overview11.1.5.3 Products Offered11.1.5.4 Covestro AG: Recent Developments11.1.5.5 Winning Imperatives11.1.5.6 Current Focus and Strategies11.1.5.7 Threat from Competitors11.1.5.8 Right to Win11.1.6 Lanxess AG11.1.6.1 Business Overview11.1.6.2 Lanxess AG: Business Overview11.1.6.3 Products Offered11.1.6.4 Lanxess AG: Recent Developments11.1.6.5 Winning Imperatives11.1.6.6 Current Focus and Strategies11.1.6.7 Threat from Competitors11.1.6.8 Right to Win11.1.7 Mitsui Chemicals Inc.11.1.7.1 Business Overview11.1.7.2 Mitsui Chemicals Inc.: Company Overview11.1.7.2.1 Products Offered11.1.7.3 Mitsui Chemicals Inc.: Recent Developments11.1.7.4 Winning Imperatives11.1.7.5 Current Focus and Strategies11.1.7.6 Threat from Competitors11.1.7.7 Right to Win11.1.8 Wanhua Chemicals Group Co. Ltd.11.1.8.1 Business Overview11.1.8.2 Wanhua Chemicals Group Co. Ltd.: Company Overview11.1.8.3 Products Offered11.1.8.4 Wanhua Chemicals Group Co. Ltd.: Recent Developments11.1.8.5 Winning Imperatives11.1.8.6 Current Focus and Strategies11.1.8.7 Threat from Competitors11.1.8.8 Right to Win11.1.9 Woodbridge Foam Corporation11.1.9.1 Business Overview11.1.9.2 Woodbridge Foam Corporation: Company Overview11.1.9.3 Products Offered11.1.9.4 Woodbridge Foam Corporation: Recent Developments11.1.9.5 Right to Win11.1.10 Chematur Engineering AB11.1.10.1 Business Overview11.1.10.2 Chematur Engineering AB: Company Overview11.1.10.3 Products Offered11.2 Start-Up/SMEs Players11.2.1 Coim S.p.A.11.2.2 Fix Holdings Inc.11.2.3 Cangzhou Dahua Group Co. Ltd11.2.4 Kumho Mitsui Chemicals Inc.11.2.5 ITWC Inc.11.2.6 Tosoh Corporation11.2.7 Recticel11.2.8 Shandong Inov Polyurethane Co. Ltd.11.2.9 Trelleborg AB11.2.10 Manali Petrochemicals Ltd.11.2.11 Kuwait Polyurethane Industries Co.11.2.12 Springfeel Polyurethane Foams Private Limited11.2.13 Ningbo Best Polyurethane Co. Ltd.11.2.14 Arian Polyurethane JSC

12 Adjacent & Related Markets12.1 Introduction12.2 Limitations12.3 Plastic Antioxidants Market12.3.1 Market Definition12.3.2 Market Overview12.4 Polyurethane Dispersions Market, by Region12.4.1 APAC12.4.2 Europe12.4.3 North America12.4.4 Middle East & Africa12.4.5 South America

13 Appendix

For more information about this report visit

100 Deals associated with Manali Petrochemicals Ltd.

Login to view more data

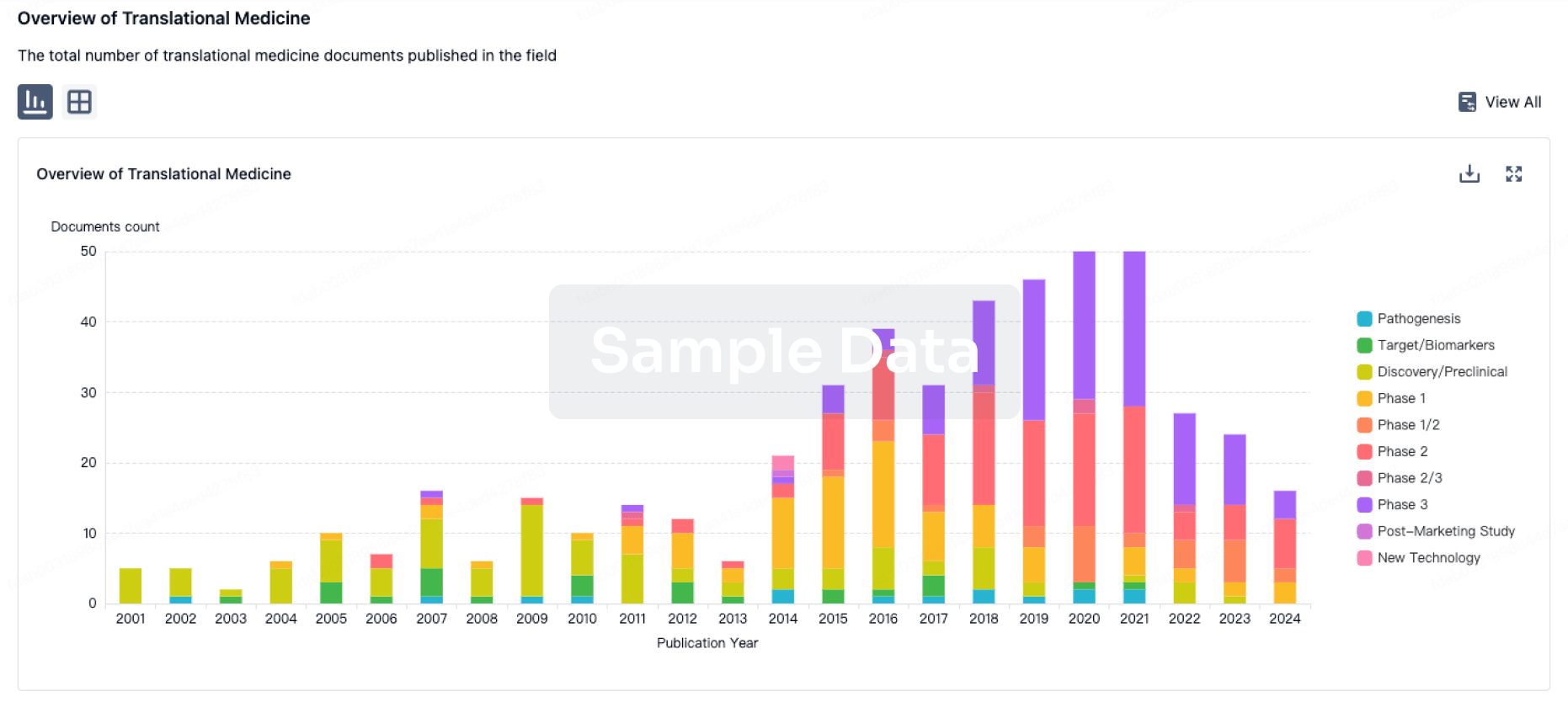

100 Translational Medicine associated with Manali Petrochemicals Ltd.

Login to view more data

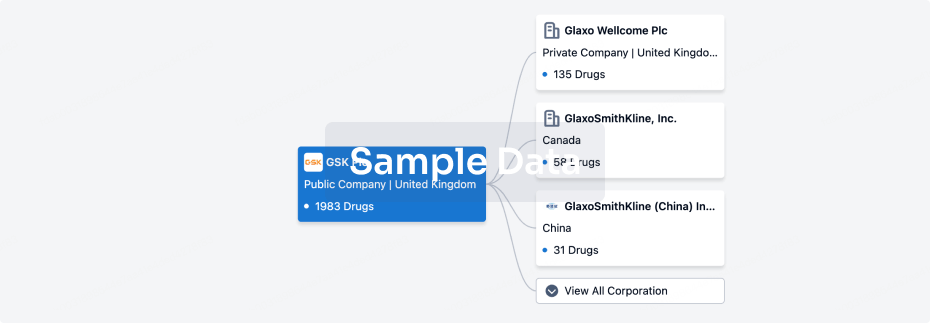

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 01 May 2025

No data posted

Login to keep update

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

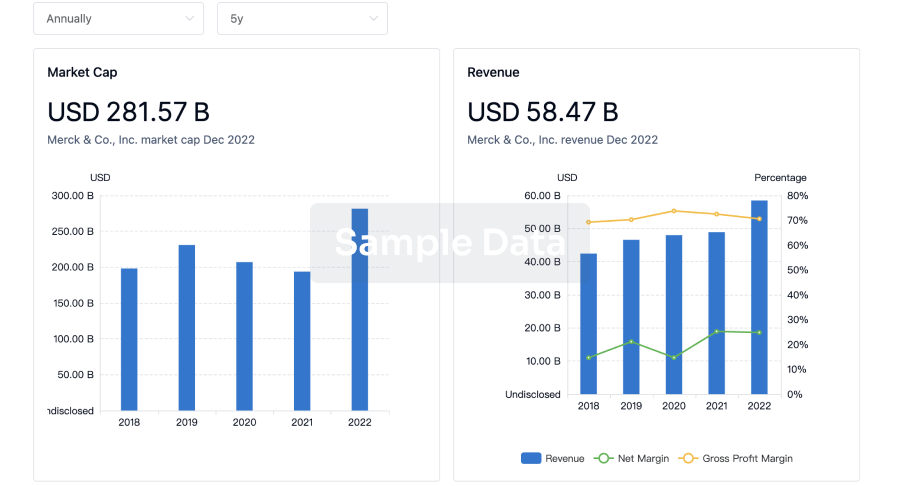

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

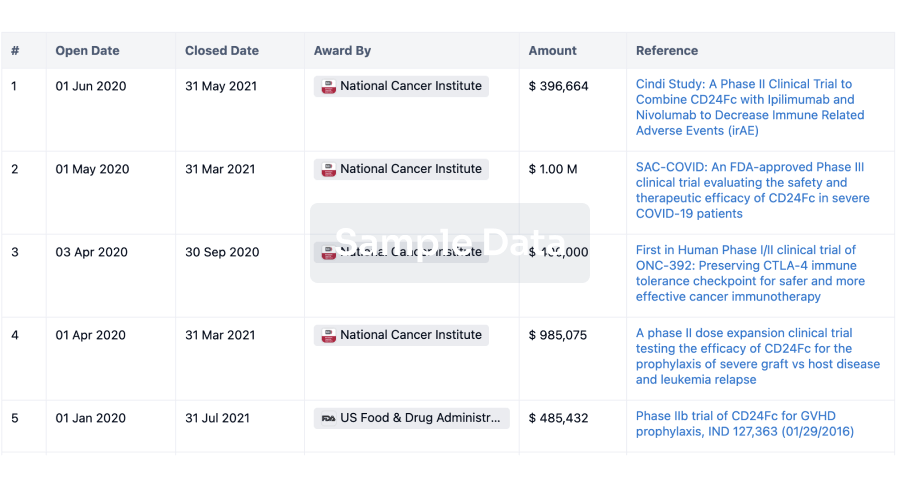

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

Chat with Hiro

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free