Request Demo

Last update 08 May 2025

BeiGene Biologics Co. Ltd.

Subsidiary Company|2017|Guangdong Sheng, China

Subsidiary Company|2017|Guangdong Sheng, China

Last update 08 May 2025

Overview

Tags

Neoplasms

Respiratory Diseases

Digestive System Disorders

Monoclonal antibody

Small molecule drug

Antibody drug conjugate (ADC)

Disease domain score

A glimpse into the focused therapeutic areas

No Data

Technology Platform

Most used technologies in drug development

No Data

Targets

Most frequently developed targets

No Data

| Top 5 Drug Type | Count |

|---|---|

| Monoclonal antibody | 4 |

| Antibody drug conjugate (ADC) | 2 |

| Small molecule drug | 2 |

| Trispecific antibody | 1 |

| Bispecific antibody | 1 |

Related

14

Drugs associated with BeiGene Biologics Co. Ltd.Target |

Mechanism PD-1 inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication |

Drug Highest PhaseApproved |

First Approval Ctry. / Loc. China |

First Approval Date26 Dec 2019 |

Target |

Mechanism BTK inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Drug Highest PhaseApproved |

First Approval Ctry. / Loc. United States |

First Approval Date14 Nov 2019 |

Target |

Mechanism TIM3 inhibitors |

Active Org. |

Originator Org. |

Inactive Indication- |

Drug Highest PhasePhase 3 |

First Approval Ctry. / Loc.- |

First Approval Date- |

13

Clinical Trials associated with BeiGene Biologics Co. Ltd.CTR20244835

一项在晚期实体瘤患者中评价靶向FGFR2b 的抗体偶联药物BG-C137 的安全性、耐受性、药代动力学、药效学和初步抗肿瘤活性的1a/b 期、开放性、多中心研究

[Translation] A Phase 1a/b, open-label, multicenter study evaluating the safety, tolerability, pharmacokinetics, pharmacodynamics, and preliminary antitumor activity of BG-C137, an antibody-drug conjugate targeting FGFR2b, in patients with advanced solid tumors

本研究旨在晚期实体瘤患者中评价BG-C137 的安全性、耐受性、药代动力学(PK)、药效学和初步抗肿瘤活性。

[Translation]

This study aimed to evaluate the safety, tolerability, pharmacokinetics (PK), pharmacodynamics, and preliminary antitumor activity of BG-C137 in patients with advanced solid tumors.

Start Date09 Jan 2025 |

Sponsor / Collaborator |

CTR20243757

一项评估靶向B7H3的抗体偶联药物BGB-C354单药以及联合抗PD-1单克隆抗体替雷利珠单抗治疗晚期实体瘤患者的安全性、耐受性、药代动力学和初步抗肿瘤活性的 1 期研究

[Translation] A Phase 1 Study Evaluating the Safety, Tolerability, Pharmacokinetics, and Preliminary Antitumor Activity of B7H3-Targeting Antibody-Drug Conjugate BGB-C354, Alone and in Combination with the Anti-PD-1 Monoclonal Antibody Tislelizumab in Patients with Advanced Solid Tumors

评估BGB-C354 单药以及联合抗 PD-1 单克隆抗体替雷利珠单抗治疗晚期实体瘤患者的安全性、耐受性、药代动力学和初步抗肿瘤活性。

[Translation]

To evaluate the safety, tolerability, pharmacokinetics, and preliminary antitumor activity of BGB-C354 alone and in combination with the anti-PD-1 monoclonal antibody tislelizumab in patients with advanced solid tumors.

Start Date01 Nov 2024 |

Sponsor / Collaborator |

CTR20242829

靶向B7H4 的抗体偶联药物 BG-C9074 单药治疗及其与替雷利珠单抗联合用药治疗晚期实体瘤患者的1a/1b 期研究

[Translation] Phase 1a/1b study of BG-C9074, an antibody-drug conjugate targeting B7H4, as monotherapy and in combination with tislelizumab in patients with advanced solid tumors

评估BG-C9074单药治疗及其与替雷利珠单抗联合治疗在晚期实体瘤患者中的安全性和耐受性。确定BG-C9074单药治疗及其与替雷利珠单抗联合治疗的最大耐受剂量(MTD)或最大给药剂量(MAD)以及扩展期推荐剂量(RDFE)。初步评估BG-C9074单药治疗在晚期实体瘤患者中的抗肿瘤活性。

[Translation]

To evaluate the safety and tolerability of BG-C9074 monotherapy and its combination with tislelizumab in patients with advanced solid tumors. To determine the maximum tolerated dose (MTD) or maximum administered dose (MAD) and the recommended dose for extension (RDFE) of BG-C9074 monotherapy and its combination with tislelizumab. To preliminarily evaluate the anti-tumor activity of BG-C9074 monotherapy in patients with advanced solid tumors.

Start Date05 Sep 2024 |

Sponsor / Collaborator |

100 Clinical Results associated with BeiGene Biologics Co. Ltd.

Login to view more data

0 Patents (Medical) associated with BeiGene Biologics Co. Ltd.

Login to view more data

113

Literatures (Medical) associated with BeiGene Biologics Co. Ltd.22 Apr 2025·Blood Advances

Acquired mutations in patients with relapsed/refractory CLL who progressed in the ALPINE study

Article

Author: Cohen, Aileen Cleary ; Huang, Ruiqi ; Eichhorst, Barbara F. ; Shadman, Mazyar ; Idoine, Adam ; O’Brien, Susan M. ; Shi, Yang ; Li, Jessica ; Salmi, Tommi ; Lamanna, Nicole ; Brown, Jennifer R. ; Tam, Constantine S. ; Qiu, Lugui

21 Apr 2025·Cancer Research

Abstract 2090: Integrative spatial and single-cell analysis elucidates tumor microenvironment heterogeneity in NSCLC

Author: Yan, Han ; Zhang, Pei ; Wang, Beixi ; Zhou, Jiadong ; Zhou, Qiming ; Shen, Zhirong ; Shi, Jingwen ; Zhang, Yun

21 Apr 2025·Cancer Research

Abstract 4558: Comparative analysis of blood- and tissue-informed MRD studies in SCLC

Author: Zhang, Yue ; Xie, Feng ; Shi, Yang ; Sun, Pu ; Tan, Wei ; Luo, Qin ; Tang, Haoran ; Jia, Cancan

1

News (Medical) associated with BeiGene Biologics Co. Ltd.04 Oct 2020

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

# BeiGene, Ltd.

> (incorporated in the Cayman Islands with limited liability)

(Stock Code: 06160) VOLUNTARY ANNOUNCEMENT – UPDATE REGARDING RECENT BUSINESS DEVELOPMENTS

As previously disclosed in the prospectus dated July 30, 2018 of BeiGene, Ltd. (the “ Company ”), in March 2017, BeiGene (Hong Kong) Co., Limited (“ BeiGene HK ”), a wholly-owned subsidiary of Company, formed a joint venture with Guangzhou High-tech Zone Technology Holding Group Co., Ltd. (formerly Guangzhou GET Technology Development Co., Ltd.) (“ GET ”), an affiliate of Guangzhou Development District, to build a commercial-scale biologics manufacturing facility in Guangzhou, China. Under the terms of the joint venture agreement, BeiGene HK held a 95% equity interest and GET held a 5% equity interest in the joint venture, BeiGene Biologics Co., Ltd. (“ BeiGene Biologics ”). Additionally, GET provided a RMB900 million loan at a fixed interest rate of 8% per year due in April 2023 (the “ Shareholder Loan ”) to BeiGene Biologics to support construction of the manufacturing facility. On September 28, 2020, BeiGene HK entered into a share purchase agreement with GET to (i) acquire the 5% equity interest held by GET in BeiGene Biologics for a total purchase price of approximately RMB195 million, and (ii) cause BeiGene Biologics to repay the Shareholder Loan in full, together with interest, in a total amount of approximately RMB1.15 billion. As a result of this transaction, (i) the Company, through its wholly-owned subsidiary BeiGene HK, will hold 100% of the equity interest in BeiGene Biologics, subject to approval of the transaction by the local State Administration for Market Regulation, which is expected in the fourth quarter of 2020 (the “ Regulatory Approval Date ”), (ii) the Shareholder Loan has been repaid in full and has terminated, and (iii) the Amended Equity Joint Venture Contract of BeiGene Biologics dated April 11, 2017 between BeiGene HK and GET will terminate on the Regulatory Approval Date. In order to fund the purchase of the 5% equity interest and repayment of the Shareholder Loan, the Company entered into a one-year term loan, renewable for up to three years, with China Minsheng Banking Corp., Ltd., Shanghai Pilot Free Trade Zone Branch to borrow US$118,320,000 through an acquisition facility, together with up to an additional US$80,000,000 through a working capital facility (collectively, the “ CMBC Loan ”). In addition, as a credit enhancement measure for the CMBC Loan, BeiGene Biologics entered into an up to 37-month term loan with an affiliate of Hillhouse Capital Advisors, Ltd. (“ Hillhouse ”), a substantial shareholder of the Company, to borrow up to (i) RMB100 million through a general corporate facility, and (ii) RMB400 million through a credit enhancement facility that can only be used for repayment of the CMBC Loan if needed (collectively, the “ Hillhouse Loan ”). One of the Company’s directors, Qingqing Yi, is affiliated with Hillhouse. The aggregate interest and fees payable under both the CMBC Loan and 2Hillhouse Loan is 5.75% per year. The Company plans to draw down all of the US$198,320,000 available under the CMBC Loan in the fourth quarter of 2020, and BeiGene Biologics has drawn down the RMB100 million general corporate facility under the Hillhouse Loan as required by the terms of the CMBC Loan agreement. The remaining RMB400 million credit enhancement facility under the Hillhouse Loan will not be drawn down unless the Company and BeiGene Biologics decide to use that to repay a portion of the CMBC Loan in the future. The Hillhouse Loan represents financial assistance received by the Company from a connected person, but is conducted on normal commercial terms or better and is not secured by any assets of the Company, and is therefore exempt from the connected transactions requirements of the Hong Kong listing rules.

Forward-Looking Statements

This announcement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including statements regarding the expected regulatory approval of the transaction and the plan to draw down the CMBC Loan. Actual results may differ materially from those indicated in the forward-looking statements as a result of various important factors more fully discussed in the section entitled “Risk Factors” in the Company’s most recent quarterly report on Form 10-Q, as well as discussions of potential risks, uncertainties, and other important factors in the Company’s subsequent filings with the U.S. Securities and Exchange Commission and The Stock Exchange of Hong Kong Limited. The Company undertakes no duty to update such information unless required by law. By order of the Board

BeiGene, Ltd. Mr. John V. Oyler

Chairman Hong Kong, October 5, 2020 As at the date of this announcement, the Board of Directors of the Company comprises Mr. John V. Oyler as Chairman and Executive Director, Dr. Xiaodong Wang and Mr. Anthony C. Hooper as Non-executive Directors, and Mr. Timothy Chen, Mr. Donald W. Glazer, Mr. Michael Goller, Mr. Ranjeev Krishana, Mr. Thomas Malley, Dr. Corazon (Corsee) D. Sanders, Mr. Jing-Shyh (Sam) Su and Mr. Qingqing Yi as Independent Non-executive Directors.

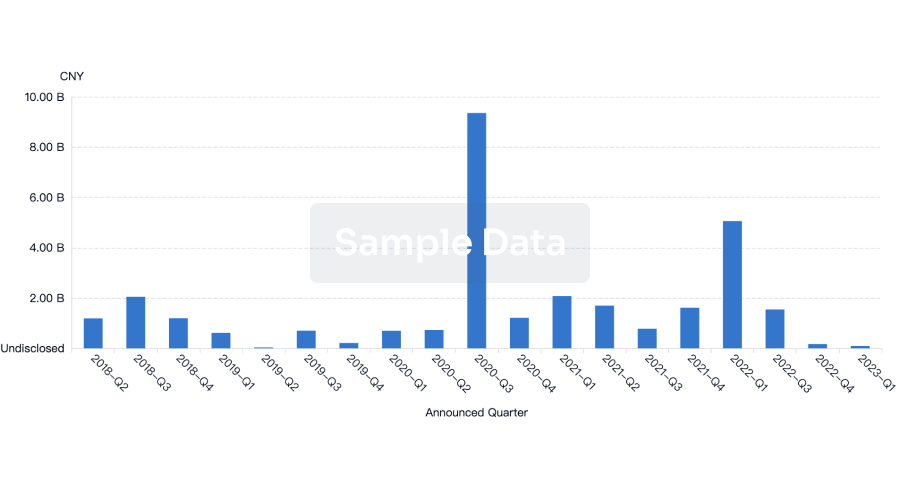

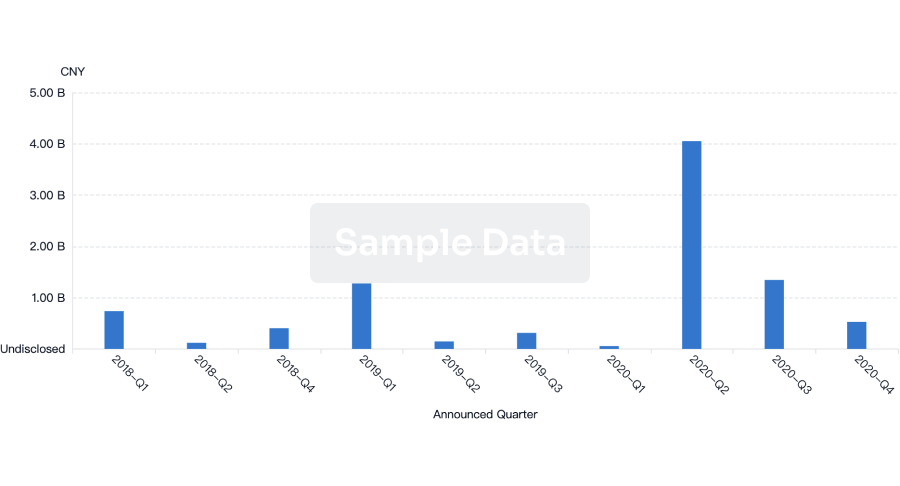

Acquisition

100 Deals associated with BeiGene Biologics Co. Ltd.

Login to view more data

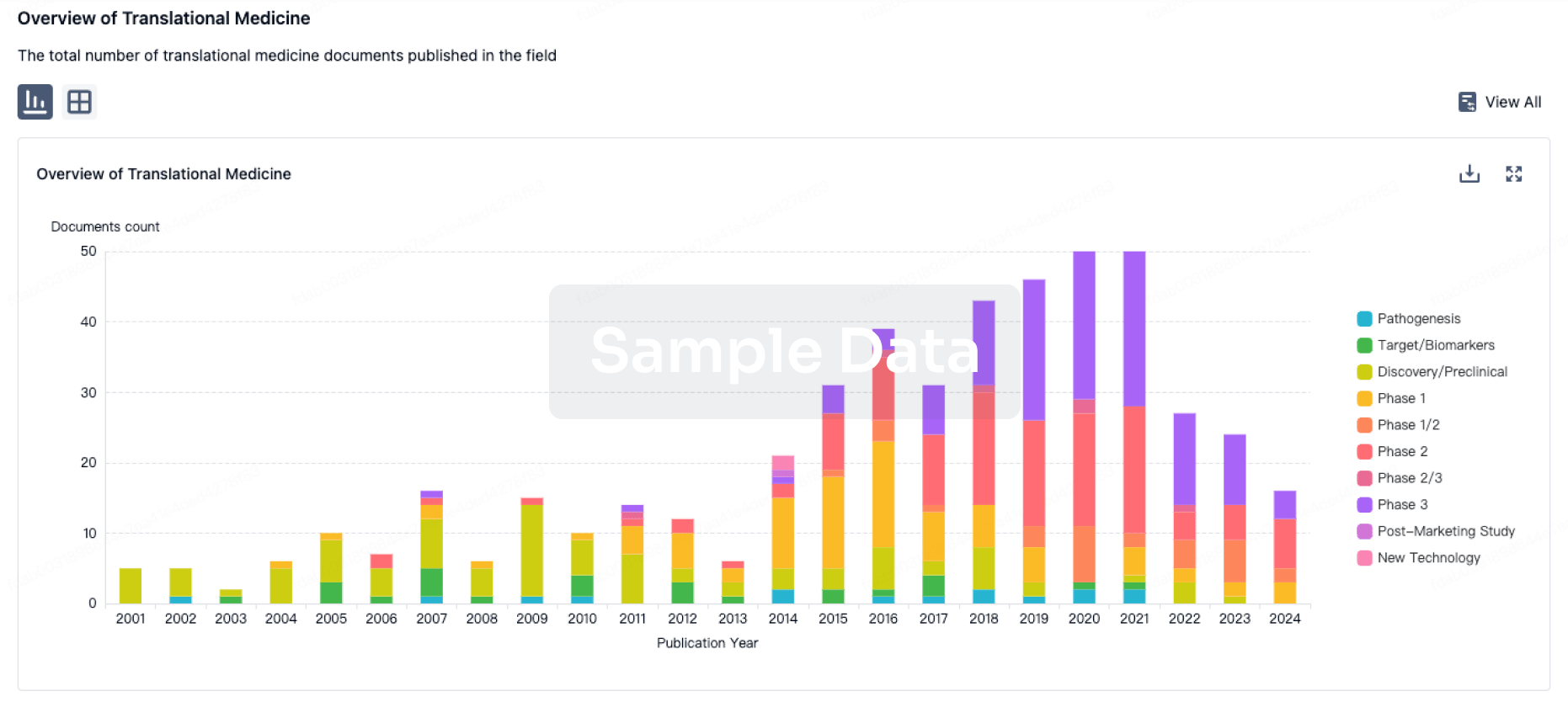

100 Translational Medicine associated with BeiGene Biologics Co. Ltd.

Login to view more data

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 13 May 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Preclinical

1

1

IND Application

IND Approval

2

4

Phase 1 Clinical

Phase 2 Clinical

3

2

Approved

Other

1

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

Tislelizumab ( PD-1 ) | Resectable Lung Non-Small Cell Carcinoma More | Approved |

Zanubrutinib ( BTK ) | Mantle-Cell Lymphoma More | Approved |

BGB-15025 ( HPK1 ) | Non-Small Cell Lung Cancer More | Phase 2 |

Alcestobart ( LAG3 ) | Esophageal Squamous Cell Carcinoma More | Phase 2 |

BGB-A445 ( OX40 ) | Non-Small Cell Lung Cancer More | Phase 2 |

Login to view more data

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

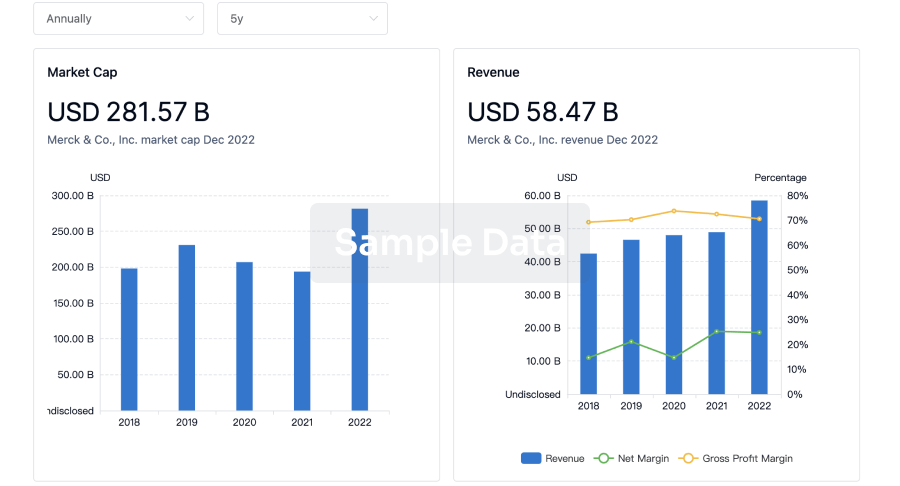

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

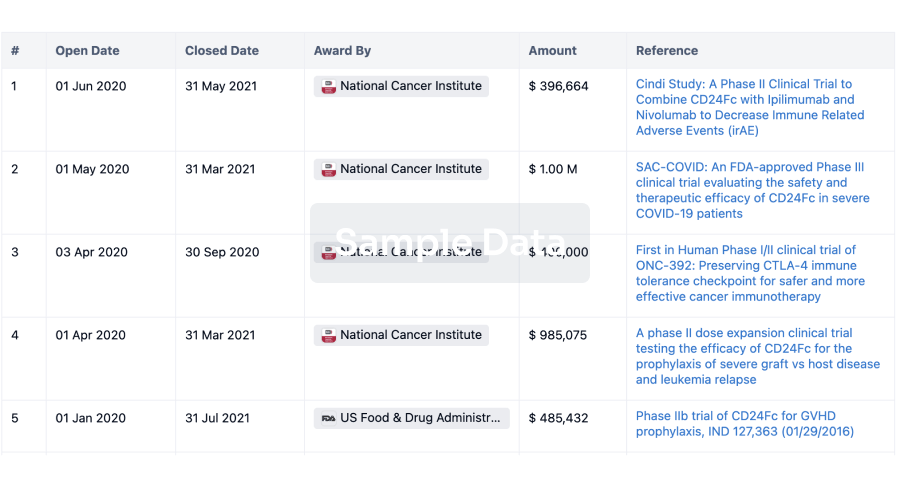

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

Chat with Hiro

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free