I-Mab Biopharma announced a slew of changes after the US market closed on Thursday, including acquiring a retinal disease drug, naming a new CFO, and planning a dual listing in Hong Kong.

The Rockville, MD-based biotech also said it plans to change its name to NovaBridge Biosciences later this month.

I-Mab is preparing to trade on the Hong Kong Stock Exchange by the end of the year, executive chair Wei Fu told

Endpoints News

. Fu is CEO of CBC Group, one of the leading healthcare asset management firms in Asia and a key backer of I-Mab. He was named I-Mab executive chair last month.

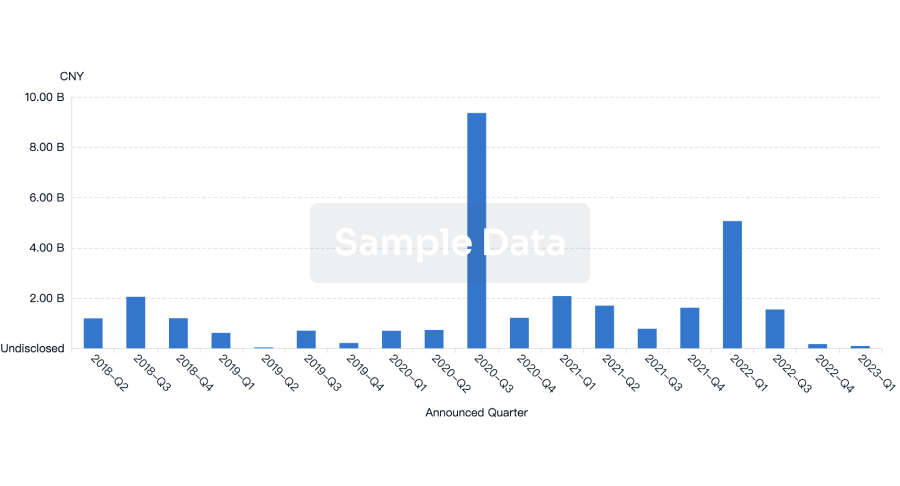

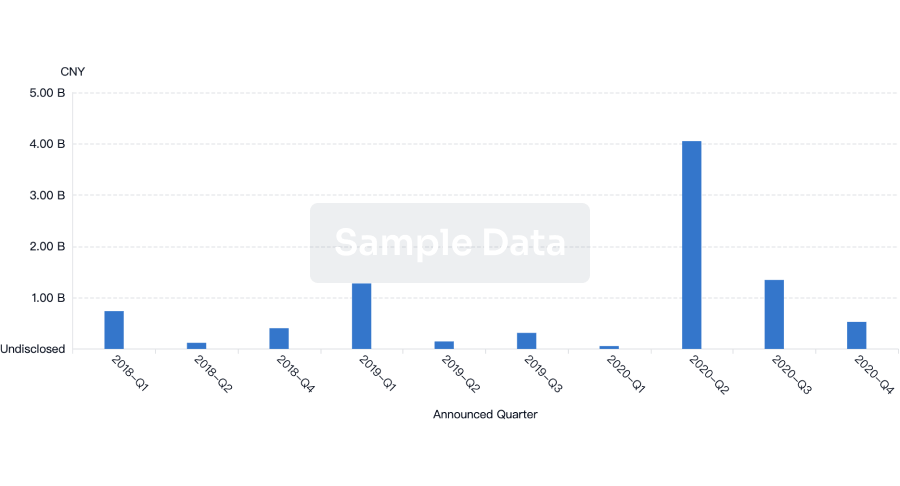

The HKEX has become the go-to IPO market for biotech companies, with

more than 40 Chinese biotechs

submitting their pitches so far this year.

To help with the listing, I-Mab brought on a CFO with HKEX expertise. Kyler Lei was previously head of capital markets at Sino Biopharmaceutical. Sino, which is listed on the HKEX, acquired

LaNova Medicines

earlier this year.

I-Mab’s decision to pursue an HKEX listing comes about a year and a half after the company

split

its US and China businesses,

citing R&D and operating expenses

, among other reasons. Multiple

executives departed

shortly thereafter.

With China’s biotech ecosystem attracting global attention, Fu believes that I-Mab can benefit from that interest, describing the drug development environment there as a “sustainable opportunity.”

“Therefore, we try to repurpose I-Mab to service this need to bring the innovation out of that market, China, to serve the global patients,” he said.

The biotech is also adopting a hub-and-spoke model, in which assets are housed in individual units to facilitate simpler dealmaking with pharma companies. The model has become more common following successful experiments at companies like Roivant Sciences and BridgeBio. The company said the spokes allow it to “maintain operational focus and agility.”

In an interview, I-Mab CEO Sean Fu said the company will continue working on its internal pipeline, which includes three clinical-stage cancer drugs:

“What we are providing is a commitment to continue to deliver on giva and the rest of the innovative assets in the I-O space,” he said.

As part of the model, I-Mab created a subsidiary called Visara, and it pumped $37 million into the unit, which will serve as the basis for its foray into ophthalmology. The company plans to look for additional ophthalmology assets in China, Korea, the US and elsewhere, Wei Fu said.

Visara acquired an experimental retinal disease drug from AffaMed Therapeutics and its partner AskGene Pharma for undisclosed terms.

Known as VIS-101 (formerly AM712), the bifunctional biologic targets VEGF-A and ANG2. The experimental medicine has been through Phase 1 in patients with

diabetic macular edema

and

neovascular age-related macular degeneration

. It’s currently in a Phase 2 in China, I-Mab said.

Another Western biotech recently licensed a VEGF and ANG2 candidate from a Chinese drug developer. Ollin Biosciences

launched last month with $100 million

to develop a bispecific from Innovent Biologics and another ophthalmology asset from VelaVigo. I-Mab and Ollin are both trying to develop therapies that can compete with Roche’s Vabysmo.

Heading up the board at Visara is Emmett Cunningham, who is also on the boards of other ophthalmology companies like Aviceda Therapeutics and Eyconis, the Ascendis Pharma spinout.