AbbVie, already a leader in the T cell engager field with Epkinly and a Phase 3 program, is further digging into the field with a new discovery collaboration with EvolveImmune Therapeutics.

The Chicago pharmaceutical company will pay EvolveImmune $65 million in upfront payments and equity, and it could dish out up to $1.4 billion in biobucks and fees if it elects to license the programs. The tie-up will focus on solid tumors and hematologic malignancies.

The partnership is further validation of the R&D at EvolveImmune, which has raised about $72 million to date from VC investors as well as

Bristol Myers Squibb

and the corporate venture arms of Pfizer and Takeda.

“There’s a next generation of T cell engagers, which we’re part of, that can bend the curve on treating patients,” EvolveImmune CEO Stephen Bloch told

Endpoints News

. He said the industry is “just at the beginning of that wave.”

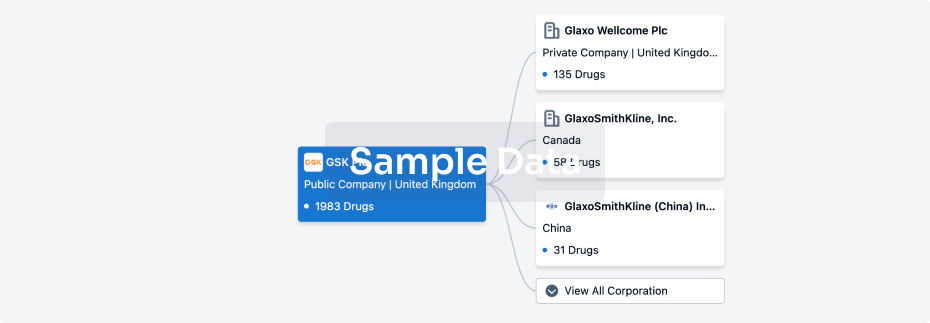

The deal arrives amid a week stacked with TCE-related deals and partnerships. GSK announced it’s

paying $300 million upfront

to buy an oncology T cell engager from Chimagen that it plans to study in lupus next year, and Genmab

lined up

a partnership with Revitope Oncology in solid tumors.

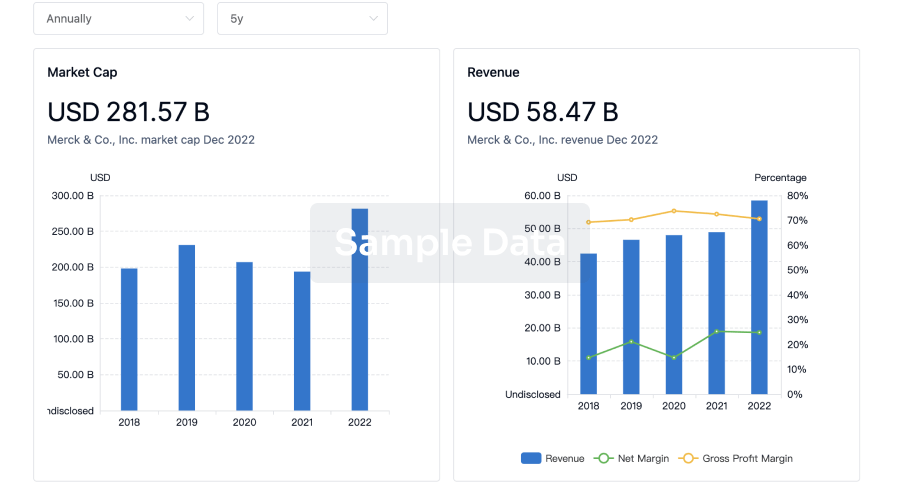

Earlier this year, Merck

paid $700 million for a Curon asset

,

Candid Therapeutics

raised $370 million and

Clasp Therapeutics

nabbed $150 million.

AbbVie is no stranger to T cell engagers. With Genmab, it markets the lymphoma treatment Epkinly. And in June, it also

entered

Phase 3 with another TCE, named ABBV-383.

The money from AbbVie will help EvolveImmune get its lead internal program, named EVOLVE-104, into the clinic by the middle of next year, according to Bloch. The company likely won’t raise another private funding round before that Phase 1 but is open to additional financing in the future, he said.

EvolveImmune has built a co-stimulatory molecule into its programs, which activates CD2, to improve durability. Bloch said T cell engagement through CD3 alone is “not enough” and leads to exhaustion and dysfunction of the T cells.

“It’s a system, rather than folks who are thinking about multiple therapies or exogenous or multiple antibodies, to try to get to the same place,” Bloch said.

Putting T cell engagers in studies for patients with autoimmune diseases has also become a focus in recent deals. Bloch said the company has a CD20 program that could be applied in autoimmune indications but will likely wait to see how other autoimmune TCEs read out in 2025. He’s not ruling out partnerships on the autoimmune front, though.

“There’s a lot of competition,” he said, “and there’s also a lot of watching and seeing.”

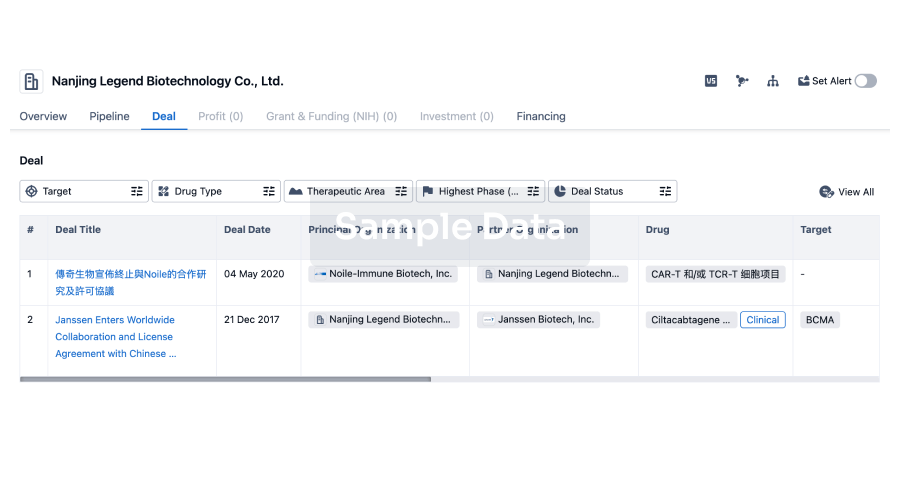

The startup, which has nearly 40 employees, previously did CRISPR/Cas9 discovery work in the CAR-T space.

“The CAR-Ts obviously are incredibly important, but the T cell engagers open up cancer therapies to a much broader set of patients who may not be at academic medical centers,” Bloch said. He also pointed to the “very, very high” costs of administering CAR-Ts to patients.