Request Demo

Last update 29 Aug 2025

City Technology Ltd.

Last update 29 Aug 2025

Overview

Related

100 Clinical Results associated with City Technology Ltd.

Login to view more data

0 Patents (Medical) associated with City Technology Ltd.

Login to view more data

2

Literatures (Medical) associated with City Technology Ltd.01 May 2008·Journal of electroanalytical chemistry (Lausanne, Switzerland)Q3 · CHEMISTRY

Relaxation and Simplex mathematical algorithms applied to the study of steady-state electrochemical responses of immobilized enzyme biosensors: Comparison with experiments

Q3 · CHEMISTRY

Article

Author: Calvo, E J ; Garay, F ; Pratt, K F E ; Bartlett, P N ; Flexer, V

A description of the implementation of the relaxation method with automatic mesh point allocation for immobilized enzyme electrodes is presented. The advantages of this method for the solution of coupled reaction-diffusion problems are discussed. The relaxation numerical simulation technique is combined with the Simplex fitting algorithm to extract kinetic parameters from experimental data. The results of the simulations are compared to experimental data from self-assembled multilayered electrodes comprised of glucose oxidase (GOx) and an Os modified redox mediator and found to be in excellent agreement.

Sensors (Basel, Switzerland)Q3 · ENGINEERING & TECHNOLOGY

Oxygen Sensing for Industrial Safety — Evolution and New Approaches

Q3 · ENGINEERING & TECHNOLOGY

ReviewOA

Author: Willett, Martin

The requirement for the detection of oxygen in industrial safety applications has historically been met by electrochemical technologies based on the consumption of metal anodes. Products using this approach have been technically and commercially successful for more than three decades. However, a combination of new requirements is driving the development of alternative approaches offering fresh opportunities and challenges. This paper reviews some key aspects in the evolution of consumable anode products and highlights recent developments in alternative technologies aimed at meeting current and anticipated future needs in this important application.

2

News (Medical) associated with City Technology Ltd.15 Jul 2021

New York, July 15, 2021 (GLOBE NEWSWIRE) -- Reportlinker.com announces the release of the report "Global Gas Detection Equipment Industry" - Demand in the global market is set to be driven by increasing adoption of these safety devices in industrial, commercial and other industries for ensuring worker safety, minimizing risks and preventing fire breakouts. The market benefits from rising demand from end-use industries, focus on residential and workplace safety standards, and enforcement of tough environmental regulations. The oil & gas and chemicals industries are among the primary end-users of gas detectors owing to increasing emphasis on safety measures related to gas processing. Industry protocols and government laws that require gas facilities to use gas detectors are driving technical innovations such as infrared and photoionization technology. Growth is also anticipated to be influenced by penetration of the Internet of Everything and artificial neural network technologies over the next few years. Amid the COVID-19 crisis, the global market for Gas Detection Equipment estimated at US$2.6 Billion in the year 2020, is projected to reach a revised size of US$3.4 Billion by 2026, growing at a CAGR of 4.3% over the analysis period. Electrochemical, one of the segments analyzed in the report, is projected to grow at a 4% CAGR to reach US$1.1 Billion by the end of the analysis period. After a thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the Metal Oxide segment is readjusted to a revised 4.2% CAGR for the next 7-year period. This segment currently accounts for a 24.8% share of the global Gas Detection Equipment market. Electrochemical gas detectors find applications in a broad spectrum of environments that include refineries, chemical plants, gas turbines and underground gas storage facilities. The growing adoption of electrochemical sensors is attributed to their capability to detect harmful gas emission, detect landfill gases and improve indoor air quality. Metal Oxide Semiconductor (MOS) detectors are primarily used to detect a wide range of gases, commonly hydrogen sulphide and have a long life span even up to ten years. The U.S. Market is Estimated at $730.2 Million in 2021, While China is Forecast to Reach $671.9 Million by 2026 The Gas Detection Equipment market in the U.S. is estimated at US$730.2 Million in the year 2021. The country currently accounts for a 27.03% share in the global market. China, the world`s second largest economy, is forecast to reach an estimated market size of US$671.9 Million in the year 2026 trailing a CAGR of 6.8% over the analysis period. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 2.5% and 3.4% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 3.1% CAGR while Rest of European market (as defined in the study) will reach US$717.1 Million by the end of the analysis period. Developed markets such as US and Europe, the traditional regional markets for gas detection equipment, continue to generate a major portion of revenues for the global market. Stringent regulations and guidelines that govern the need and use of gas detection equipment, including gas sensors and other components, are well established in these markets than anywhere else across the globe. Demand for gas detection equipment in recent times has been relatively stronger in the Asia-Pacific market as compared to other markets, thanks to rapid industrialization in the region, and the subsequent increase in adoption of international safety standards and practices. Increased investments on new plants in steel, power, chemical/petrochemical and oil & gas sectors make Asia-Pacific a market laden with tremendous potential for gas detection equipment. Middle East & Africa, given the large concentration of oil & gas companies in the region, represents an equally strong regional market for gas detection equipment market. Infrared Segment to Reach $600.6 Million by 2026 Infrared gas sensors are intended to measure a diverse range of gases such as carbon dioxide, methane and VOCs like benzene, butane and acetylene. Infrared sensors works by passing radiation through a definite volume of gas, the absorption of energy from the sensor beam occurs at specific wavelengths, based on the properties of the particular gas. In the global Infrared segment, USA, Canada, Japan, China and Europe will drive the 4.8% CAGR estimated for this segment. These regional markets accounting for a combined market size of US$337 Million in the year 2020 will reach a projected size of US$466.8 Million by the close of the analysis period. China will remain among the fastest growing in this cluster of regional markets. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach US$81.6 Million by the year 2026, while Latin America will expand at a 5.4% CAGR through the analysis period. Select Competitors (Total 147 Featured)

Read the full report: I. METHODOLOGY II. EXECUTIVE SUMMARY 1. MARKET OVERVIEW Influencer Market Insights World Market Trajectories An Introduction to Gas Detection Equipment Evolution of Gas Detection Equipment An Overview of Gas Detection Sensing Technologies Common Gases Detected in Industries Common Gases and their Exposure Limits Pros and Cons of Select Gas Detection Technologies Gas Detection Equipment: Current Market Scenario and Outlook Fixed Gas Detection Equipment: Largest Product Segment Portable Gas Detection Equipment Exhibit Fastest Growth A Note on Evolution of Portable Gas Detectors Fixed Vs. Portable Gas Detection System: A Comparison While Developed Regions Remain Major Revenue Contributors, Developing Regions Emerge as Hot Spots for Future Growth EXHIBIT 1: World Gas Detection Equipment Market (2019 & 2025): Percentage Breakdown of Revenues for Developed and Developing Regions EXHIBIT 2: Global Gas Detection Equipment Market - Geographic Regions Ranked by Value CAGR for 2018-2025: China, Asia- Pacific, Latin America, Middle East, Africa, Canada, USA, Europe, and Japan Stable Economic Scenario Widens Business Prospects for Gas Detection Market EXHIBIT 3: Global Economic Outlook: Real GDP Growth Rates in % by Country/Region for the Years 2018 through 2021 COMPETITIVE SCENARIO Gas Detection Equipment: Fragmented Marketplace Leading Suppliers of Gas Detection Systems Low Cost Products Intensify Competition Recent Market Activity Impact of Covid-19 and a Looming Global Recession 2. FOCUS ON SELECT PLAYERS AirTest Technologies, Inc. (Canada) Bacharach, Inc. (USA) California Analytical Instruments, Inc. (USA) City Technology Ltd. (UK) Crowcon Detection Instruments, Ltd. (UK) Detector Electronics Corporation (USA) Drägerwerk AG & Co. KGaA (Germany) Emerson Electric Co. (USA) ENMET, LLC (USA) ESP Safety, Inc. (USA) Gastech Australia Pty Ltd. (Australia) GE Grid Solutions (USA) Honeywell International, Inc. (USA) Honeywell Analytics, Inc. (USA) RAE Systems, Inc. (USA) Industrial Scientific Corporation (USA) Johnson Controls International plc (USA) Mil-Ram Technology, Inc. (USA) MSA Safety Incorporated (USA) Sierra Monitor Corporation (USA) RKI Instruments, Inc. (USA) Sensidyne, LP (USA) Sensor Electronics (USA) Siemens AG (Germany) Status Scientific Controls Ltd. (UK) Teledyne Technologies, Inc. (USA) Thermo Fisher Scientific Inc. (USA) TQ Environmental Ltd. (UK) Trolex Ltd. (UK) Yokogawa Electric Corporation (Japan) 3. MARKET TRENDS & DRIVERS Persistent Need to Ensure Personnel & Plant Safety: Primary Demand Determinant for Gas Detection Equipment Market Increasingly Stringent Government Regulations Create Highly Conducive Environment A Peek into Regulatory Landscape Sophisticated Wireless Systems Step In to Spearhead Next Wave of Growth Ability to Address Diverse Needs and Wider Availability: Key Traits of Wireless Systems Market Rise of Sophisticated Sensor Technologies Instigates Progressive Momentum A Note on Sensor Technologies Used in Gas Detection Equipment Hydrogen Gas Detection Elicits Heightened Attention CO2 Sensing Gains Traction amid Rising Energy Costs & Stringent Environmental Mandates Oxygen Sensing Systems in Novel Designs Come to the Fore Natural Gas Detectors Grow in Popularity Rising Demand across End-Use Verticals Propels Market Expansion Oil & Gas: Major End-Use Sector Challenging Conditions of Exploration Call for More Robust and Reliable Detection Devices Newer Technologies Pervade H2S Detection Space in Oil & Gas Sector Limitations with Conventional Technologies Drive Use of Ultrasonic Devices in Oil & Gas Sector High Risks Drive Demand for Gas Detection Equipment in LNG Facilities Uptrend in Oil & Gas Sector Signals Bright Prospects for Gas Detection Equipment EXHIBIT 4: Worldwide E&P Capital Spending in $ Billion by Region and Type of Company for the Period 2017-2019 EXHIBIT 5: Global Crude Oil Demand in Billion Barrels for the Years 2010 through 2019 Chemical Industry Relies on Gas Detection Equipment for Regulatory Conformance Gas Detection Steps In to Curb Accidents in Chemical Plants Criticality of Real-Time Gas Detection in Mining Facilities Bodes Well Common Mine Gases: Properties & Health Effects From Canaries and Mice to Sensors: Gas Detection in Mining Improves Dramatically through History Multiple-Sensor Instruments Emerge as Norm for Gas Detection in Mining Power Sector: High-Risk Operational Environment Drives Demand for Gas Detection Equipment Rising Demand for Electricity Creates Opportunities for Gas Detection Equipment in the Power Sector Gas Detectors Play Indispensable Role in Personnel and Plant Safety in Water & Wastewater Treatment Industry Gas Detection in Water & Waste Water Treatment: A Peek into Various Gases and Hazard Locations Growing Demand for Semi-Fixed Detectors in Water & Wastewater Treatment Plants EXHIBIT 6: World Water and Wastewater Treatment Chemicals Market Revenues (in US$ Million) for the Years 2017, 2019 and 2021 EXHIBIT 7: World Water and Wastewater Treatment Chemicals Market Revenues (in %) by Region for the Year 2019 Offshore Infrastructure Applications Drive Demand for Gas Detection Equipment in Marine Industry Regulations for Ensuring Worker Safety in the Shipping Industry Customized Gas Detection Systems for SOLAS Compliance Ensuring Proper Maintenance and Care Gas Detection Equipment Gain Traction in Automotive Manufacturing Environment Increasing Automotive Production Augurs Well EXHIBIT 8: Global Passenger Car Production (In Million Units) for the Years 2010, 2016, 2020, and 2024 Rising Concerns of Indoor Air Quality Drive Demand for Gas Detection in HVAC Systems Hazards of Confined Spaces Drive Demand Enclosed Parking Spaces: Potential Application Zones Terrorist Attacks Drive Adoption of Gas Detection Equipment Technological Advancements & Innovations Maintain Growth Momentum in Gas Detection Equipment Market Integration of IoT, Cloud, Digital Communication and Mobile Device Connectivity Sensor Technology Advancements Widen Addressable Market Faster Response Time: Core Focus Area for Sensor Technology Enhancement Select Latest Gas Detection Equipment Models Pricing Pressures Continue to Dog the Market 4. GLOBAL MARKET PERSPECTIVE Table 1: World Current & Future Analysis for Gas Detection Equipment by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 2: World Historic Review for Gas Detection Equipment by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 3: World 15-Year Perspective for Gas Detection Equipment by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets for Years 2012, 2020 & 2027 Table 4: World Current & Future Analysis for Electrochemical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 5: World Historic Review for Electrochemical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 6: World 15-Year Perspective for Electrochemical by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 7: World Current & Future Analysis for Metal Oxide by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 8: World Historic Review for Metal Oxide by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 9: World 15-Year Perspective for Metal Oxide by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 10: World Current & Future Analysis for Infrared by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 11: World Historic Review for Infrared by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 12: World 15-Year Perspective for Infrared by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 13: World Current & Future Analysis for Catalytic by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 14: World Historic Review for Catalytic by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 15: World 15-Year Perspective for Catalytic by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 16: World Current & Future Analysis for Zirconia by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 17: World Historic Review for Zirconia by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 18: World 15-Year Perspective for Zirconia by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 19: World Current & Future Analysis for Other Sensor Types by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 20: World Historic Review for Other Sensor Types by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 21: World 15-Year Perspective for Other Sensor Types by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 22: World Current & Future Analysis for Single Gas Detection by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 23: World Historic Review for Single Gas Detection by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 24: World 15-Year Perspective for Single Gas Detection by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 25: World Current & Future Analysis for Multi Gas Detection by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 26: World Historic Review for Multi Gas Detection by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 27: World 15-Year Perspective for Multi Gas Detection by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 28: World Current & Future Analysis for Fixed by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 29: World Historic Review for Fixed by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 30: World 15-Year Perspective for Fixed by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 31: World Current & Future Analysis for Portable by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 32: World Historic Review for Portable by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 33: World 15-Year Perspective for Portable by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 34: World Current & Future Analysis for Oil & Gas by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 35: World Historic Review for Oil & Gas by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 36: World 15-Year Perspective for Oil & Gas by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 37: World Current & Future Analysis for Chemical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 38: World Historic Review for Chemical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 39: World 15-Year Perspective for Chemical by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 40: World Current & Future Analysis for Mining & Metals by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 41: World Historic Review for Mining & Metals by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 42: World 15-Year Perspective for Mining & Metals by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 43: World Current & Future Analysis for Water & Wastewater Treatment by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 44: World Historic Review for Water & Wastewater Treatment by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 45: World 15-Year Perspective for Water & Wastewater Treatment by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 46: World Current & Future Analysis for Power by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 47: World Historic Review for Power by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 48: World 15-Year Perspective for Power by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 Table 49: World Current & Future Analysis for Other End-Uses by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 50: World Historic Review for Other End-Uses by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 51: World 15-Year Perspective for Other End-Uses by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2012, 2020 & 2027 III. MARKET ANALYSIS UNITED STATES Market Dynamics Gas Detectors - Critical for Homeland Security An Overview of Key Product Segments Fixed Gas Detection Equipment Handheld/Portable Gas Detection Equipment Table 52: USA Current & Future Analysis for Gas Detection Equipment by Sensor Type - Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 53: USA Historic Review for Gas Detection Equipment by Sensor Type - Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 54: USA 15-Year Perspective for Gas Detection Equipment by Sensor Type - Percentage Breakdown of Value Sales for Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types for the Years 2012, 2020 & 2027 Table 55: USA Current & Future Analysis for Gas Detection Equipment by Technology - Single Gas Detection and Multi Gas Detection - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 56: USA Historic Review for Gas Detection Equipment by Technology - Single Gas Detection and Multi Gas Detection Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 57: USA 15-Year Perspective for Gas Detection Equipment by Technology - Percentage Breakdown of Value Sales for Single Gas Detection and Multi Gas Detection for the Years 2012, 2020 & 2027 Table 58: USA Current & Future Analysis for Gas Detection Equipment by Product Type - Fixed and Portable - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 59: USA Historic Review for Gas Detection Equipment by Product Type - Fixed and Portable Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 60: USA 15-Year Perspective for Gas Detection Equipment by Product Type - Percentage Breakdown of Value Sales for Fixed and Portable for the Years 2012, 2020 & 2027 Table 61: USA Current & Future Analysis for Gas Detection Equipment by End-Use - Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 62: USA Historic Review for Gas Detection Equipment by End-Use - Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 63: USA 15-Year Perspective for Gas Detection Equipment by End-Use - Percentage Breakdown of Value Sales for Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses for the Years 2012, 2020 & 2027 CANADA Table 64: Canada Current & Future Analysis for Gas Detection Equipment by Sensor Type - Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 65: Canada Historic Review for Gas Detection Equipment by Sensor Type - Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 66: Canada 15-Year Perspective for Gas Detection Equipment by Sensor Type - Percentage Breakdown of Value Sales for Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types for the Years 2012, 2020 & 2027 Table 67: Canada Current & Future Analysis for Gas Detection Equipment by Technology - Single Gas Detection and Multi Gas Detection - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 68: Canada Historic Review for Gas Detection Equipment by Technology - Single Gas Detection and Multi Gas Detection Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 69: Canada 15-Year Perspective for Gas Detection Equipment by Technology - Percentage Breakdown of Value Sales for Single Gas Detection and Multi Gas Detection for the Years 2012, 2020 & 2027 Table 70: Canada Current & Future Analysis for Gas Detection Equipment by Product Type - Fixed and Portable - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 71: Canada Historic Review for Gas Detection Equipment by Product Type - Fixed and Portable Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 72: Canada 15-Year Perspective for Gas Detection Equipment by Product Type - Percentage Breakdown of Value Sales for Fixed and Portable for the Years 2012, 2020 & 2027 Table 73: Canada Current & Future Analysis for Gas Detection Equipment by End-Use - Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 74: Canada Historic Review for Gas Detection Equipment by End-Use - Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 75: Canada 15-Year Perspective for Gas Detection Equipment by End-Use - Percentage Breakdown of Value Sales for Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses for the Years 2012, 2020 & 2027 JAPAN Table 76: Japan Current & Future Analysis for Gas Detection Equipment by Sensor Type - Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 77: Japan Historic Review for Gas Detection Equipment by Sensor Type - Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 78: Japan 15-Year Perspective for Gas Detection Equipment by Sensor Type - Percentage Breakdown of Value Sales for Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types for the Years 2012, 2020 & 2027 Table 79: Japan Current & Future Analysis for Gas Detection Equipment by Technology - Single Gas Detection and Multi Gas Detection - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 80: Japan Historic Review for Gas Detection Equipment by Technology - Single Gas Detection and Multi Gas Detection Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 81: Japan 15-Year Perspective for Gas Detection Equipment by Technology - Percentage Breakdown of Value Sales for Single Gas Detection and Multi Gas Detection for the Years 2012, 2020 & 2027 Table 82: Japan Current & Future Analysis for Gas Detection Equipment by Product Type - Fixed and Portable - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 83: Japan Historic Review for Gas Detection Equipment by Product Type - Fixed and Portable Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 84: Japan 15-Year Perspective for Gas Detection Equipment by Product Type - Percentage Breakdown of Value Sales for Fixed and Portable for the Years 2012, 2020 & 2027 Table 85: Japan Current & Future Analysis for Gas Detection Equipment by End-Use - Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 86: Japan Historic Review for Gas Detection Equipment by End-Use - Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 87: Japan 15-Year Perspective for Gas Detection Equipment by End-Use - Percentage Breakdown of Value Sales for Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses for the Years 2012, 2020 & 2027 CHINA Table 88: China Current & Future Analysis for Gas Detection Equipment by Sensor Type - Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 89: China Historic Review for Gas Detection Equipment by Sensor Type - Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 90: China 15-Year Perspective for Gas Detection Equipment by Sensor Type - Percentage Breakdown of Value Sales for Electrochemical, Metal Oxide, Infrared, Catalytic, Zirconia and Other Sensor Types for the Years 2012, 2020 & 2027 Table 91: China Current & Future Analysis for Gas Detection Equipment by Technology - Single Gas Detection and Multi Gas Detection - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 92: China Historic Review for Gas Detection Equipment by Technology - Single Gas Detection and Multi Gas Detection Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 93: China 15-Year Perspective for Gas Detection Equipment by Technology - Percentage Breakdown of Value Sales for Single Gas Detection and Multi Gas Detection for the Years 2012, 2020 & 2027 Table 94: China Current & Future Analysis for Gas Detection Equipment by Product Type - Fixed and Portable - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 95: China Historic Review for Gas Detection Equipment by Product Type - Fixed and Portable Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 96: China 15-Year Perspective for Gas Detection Equipment by Product Type - Percentage Breakdown of Value Sales for Fixed and Portable for the Years 2012, 2020 & 2027 Table 97: China Current & Future Analysis for Gas Detection Equipment by End-Use - Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses - Independent Analysis of Annual Sales in US$ Billion for the Years 2020 through 2027 and % CAGR Table 98: China Historic Review for Gas Detection Equipment by End-Use - Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 99: China 15-Year Perspective for Gas Detection Equipment by End-Use - Percentage Breakdown of Value Sales for Oil & Gas, Chemical, Mining & Metals, Water & Wastewater Treatment, Power and Other End-Uses for the Years 2012, 2020 & 2027 EUROPE Safety Gas Detectors Market EXHIBIT 9: Portable Gas Detectors Market in Europe (2019): Percentage Breakdown of Revenues by Type Regulatory Framework & ATEX Standards Table 100: Europe Current & Future Analysis for Gas Detection Equipment by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2020 through 2027 and % CAGR Table 101: Europe Historic Review for Gas Detection Equipment by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Billion for Years 2012 through 2019 and % CAGR Table 102: Europe 15-Year Perspective for Gas Detection Equipment by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets for Years 2012, 2020 & 2027 Table 103: Europe Current & Future Analysis for Gas Detection Equipment by Sensor Type - Electrochemical, Metal Oxide, Please contact our Customer Support Center to get the complete Table of ContentsRead the full report: ReportlinkerReportLinker is an award-winning market research solution. Reportlinker finds and organizes the latest industry data so you get all the market research you need - instantly, in one place.__________________________

19 May 2021

LOS ANGELES, May 19, 2021 (GLOBE NEWSWIRE) -- The Global Pressure Sensor Market is expected to grow at a CAGR of around 8.8% from 2020 to 2027 and reach the market value of over US$ 24.5 Bn by 2027.

A pressure sensor is a device used to sense pressure and convert it into an electric signal. These pressure sensors can alternatively be called pressure transmitters, pressure transducers, pressure indicators, pressure senders, piezometers, and manometers, among others. These are available in various designs, technology, performance, application suitability, and cost.

The global pressure sensor market is segmented on the basis of product type, function, technology, application, end-user industry, and geography. On the basis of product type, the market is divided into absolute pressure sensors, gauge pressure sensors, differential pressure sensors, sealed pressure sensors, and vacuum pressure sensors. Based on the function, the pressure sensor is studied across pressure sensing, altitude sensing, flow sensing, and depth sensing.

DOWNLOAD SAMPLE PAGES OF THIS REPORT@

By technology, the market is divided across piezoresistive, capacitive, resonant, electromagnetic, optical, others. Additionally, pressure sensors have applications across automotive on-vehicle, medical devices, HVAC, process controls, test & measurement, and others. The end-user industry includes automotive, medical, industrial, utility, aviation, oil & gas, marine, consumer electronics, and others.

Based on the application, the automotive on-vehicle segment is leading the market with maximum revenue share and the segment is also projected to maintain its dominance throughout the forecast period from 2020 to 2027. The segment is accounted for the maximum revenue share owing to its high demand and usage across the globe.

Asia Pacific dominated the pressure sensor market in 2019 and the region is also projected to maintain its dominance throughout the forecast period from 2020 to 2027. The dominance of the automotive market in the region due to expanding manufacturing units and demand across the developing economies is contributing to the maximum revenue share in the pressure sensor market.

VIEW TABLE OF CONTENT OF THIS REPORT@

North America is projected to experience the fastest growth over the forecast period from 2020 to 2027 in the pressure sensors market. The increasing demand for pressure sensors in industry verticals like oil & gas, petrochemical, and medical is further accelerating the regional market growth. The US contributes to the maximum revenue share in the regional market.

Some of the leading competitors are ABB Ltd., AlphaSense, City Technology Ltd., Dynament Ltd., Figaro Engineering Inc., GfG Europe Ltd, Membrapor AG., Nemoto & Co., Ltd., Robert Bosch LLC., Siemens AG., and others. The major players are continuously making possible efforts for the development of advanced products that can serve the end-user better by meeting the regulations and requirements.

Browse Upcoming Market Research Reports@

Some of the key observations regarding the pressure sensor industry include:

INQUIRY BEFORE BUYING@

BUY THIS PREMIUM RESEARCH REPORT -

Would like to place an order or any question, please feel free to contact at sales@acumenresearchandconsulting.com | +1 407 915 4157

For Latest Update Follow Us:

100 Deals associated with City Technology Ltd.

Login to view more data

100 Translational Medicine associated with City Technology Ltd.

Login to view more data

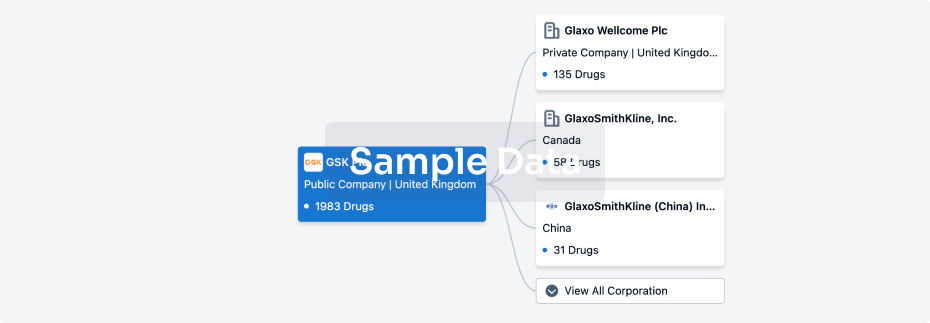

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 13 Dec 2025

No data posted

Login to keep update

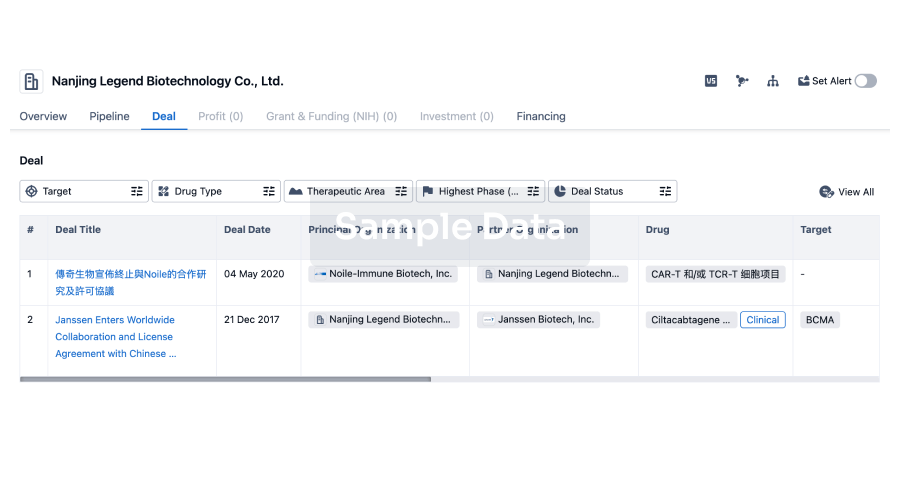

Deal

Boost your decision using our deal data.

login

or

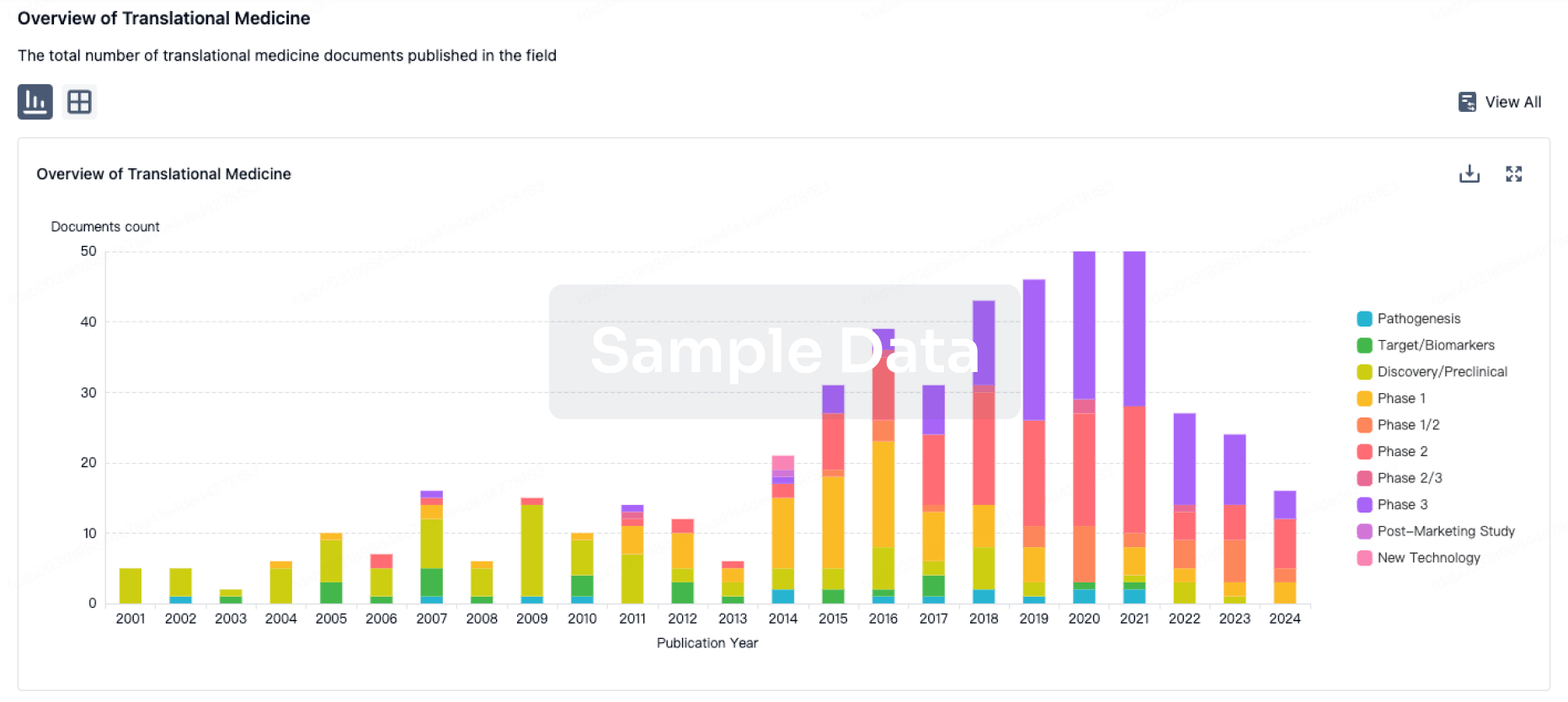

Translational Medicine

Boost your research with our translational medicine data.

login

or

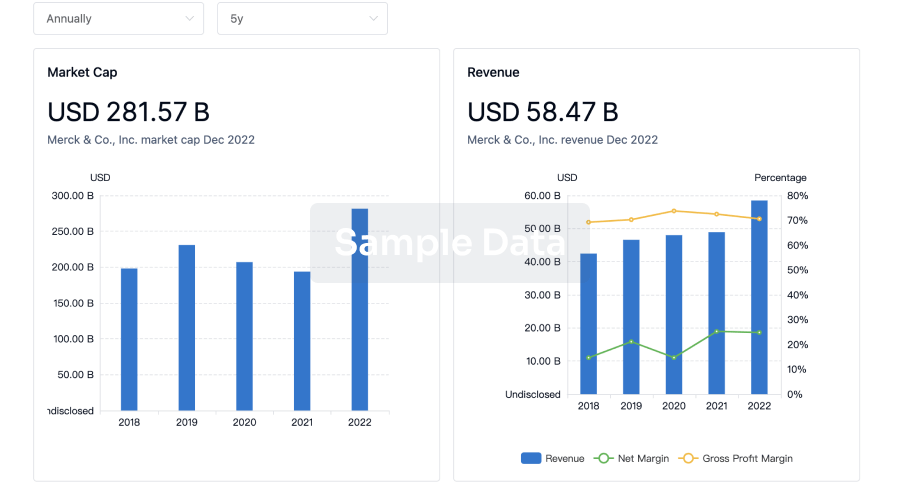

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

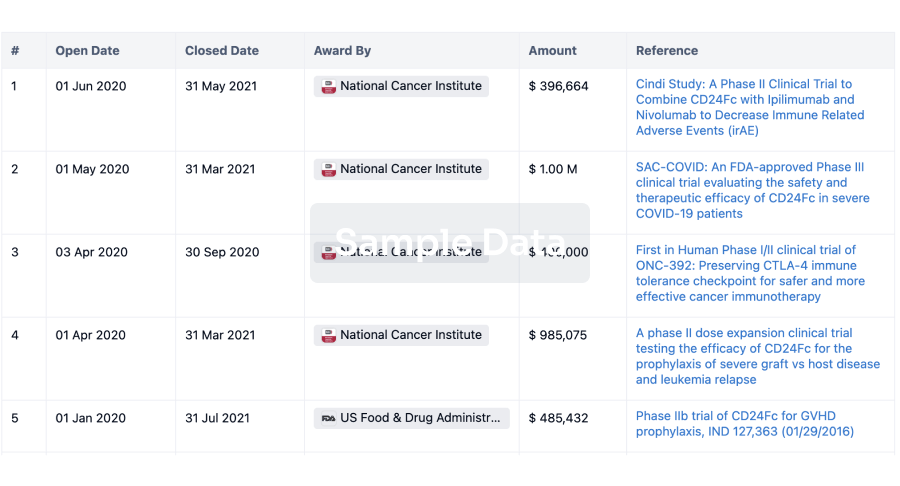

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

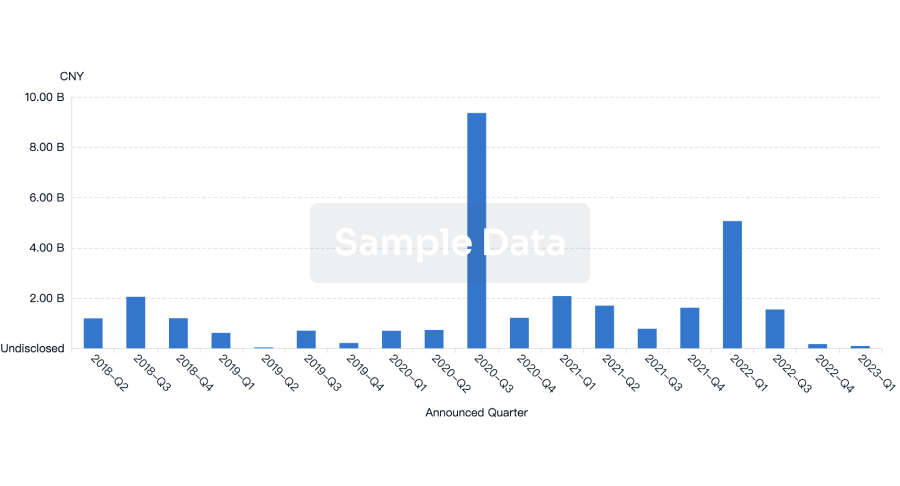

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

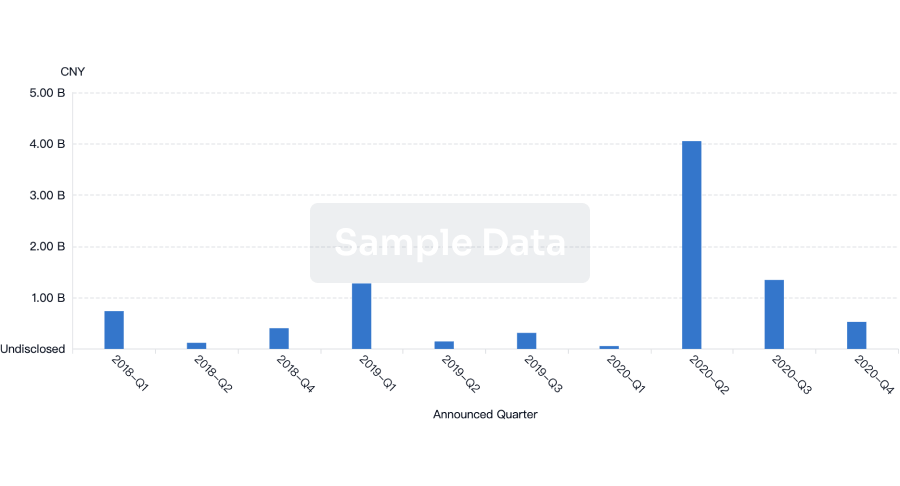

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free