Request Demo

Last update 14 Aug 2025

UpScriptHealth

Last update 14 Aug 2025

Overview

Related

100 Clinical Results associated with UpScriptHealth

Login to view more data

0 Patents (Medical) associated with UpScriptHealth

Login to view more data

16

News (Medical) associated with UpScriptHealth17 Jul 2025

Eli Lilly and Pfizer launched new services last year meant to give patients easier access to clinicians who can prescribe their drugs.

The direct-to-consumer sites, called LillyDirect and PfizerForAll, quickly

attracted scrutiny

from lawmakers who questioned whether the pharmaceutical giants’ relationships with telehealth startups influenced doctors to prescribe certain treatments and led to inappropriate prescribing.

A report out Thursday from a group of US senators sheds light on those relationships, including some of the first details on the payments passed between the pharma and telehealth companies. The report is based on a nine-month investigation by Sens. Dick Durbin (D-IL), Bernie Sanders (I-VT), Elizabeth Warren (D-MA) and Peter Welch (D-VT).

“At best, these relationships raise questions about conflicts of interest. At worst, they create the potential for inappropriate prescribing that can unnecessarily increase spending for federal health care programs,” the report found.

LillyDirect launched in January 2024, connecting patients to obesity startups Form Health and 9amHealth, along with Cove Health for migraine treatment. The

senators sent

each of these telehealth companies letters in March inquiring about the partnerships, after first

probing

the pharma companies. Lilly has since added more

partners

treating weight, Alzheimer’s disease and sleep apnea.

PfizerForAll, started in August,

links patients to treatment

for migraine, flu, Covid-19 and menopause from telehealth company UpScriptHealth. The senators also sent letters to Upscript and Populus, another Pfizer partner that connects patients to independent providers, in March.

Pharma and telehealth companies took issue with the report’s findings. A Lilly spokesperson said the company is “disappointed that the Senators’ report mischaracterizes Lilly’s intent in offering patient-focused resources on LillyDirect.”

Representatives for Lilly and Pfizer said the telehealth providers they link to use their own clinical judgement and aren’t paid to write prescriptions.

Here are the biggest takeaways from the senators’ report, from how much pharma companies pay their telehealth partners, to how many patients and prescriptions are flowing through the relationships.

Though all the telehealth companies denied receiving incentives or bonuses from the pharma companies to write prescriptions, there is money changing hands.

Lilly’s contract payments to three telehealth companies totaled $942,500, according to the report. The pharma companies generally strike up three-year contracts with the telehealth partners, the report said.

A telehealth company working with Pfizer charges its customers from $510,000 to $2.45 million over the contract term, according to the report. The other Pfizer partner did not share financial information.

In addition to payments, pharma companies collect patient data from their telehealth partners. The report noted that while Lilly doesn’t collect data on which patients are prescribed one of its drugs, it does receive details from telehealth partners about the patients connected through LillyDirect. Those details include how many patients ultimately receive some kind of prescription. For Pfizer’s part, it can access patient contact information if they consented, and the name of the treating clinician.

Most patients who sought care through a pharma company’s telehealth partner received a prescription, often for that pharma company’s drug, according to the report.

The report said 74% of patients who visited a telehealth company through LillyDirect got a prescription. Meanwhile, 85% of patients who sought care from UpScriptHealth through PfizerForAll received a prescription.

According to the report, 66% of all prescriptions from Lilly’s partner Form Health were for Lilly medications. The report also noted that 9amHealth said its patients were more likely to receive a Lilly drug over another brand.

Frank Westermann, co-CEO of 9amHealth, said in an emailed statement that the report misrepresents how it practices medicine. He said 9am providers prescribe based on medical necessity, have access to patients’ medical histories, and require labs and diagnostics. More patients receive Lilly medications because the company doesn’t prescribe compounded medications, and Lilly’s cash-pay option for its GLP-1 drugs was the most affordable alternative, he said.

“The placement of 9amHealth in a context of ‘virtual pill mills’ is not only inaccurate, it also undermines the work of dedicated medical professionals who follow strict clinical protocols and set their life’s purpose to provide empathetic yet comprehensive medical care,” Westermann said.

According to the report, 95% of patients getting a medical consult through Populus received a prescription, though that figure isn’t specific to its relationship with Pfizer.

“We do not steer anyone to any particular drug; however, since the consumer has initiated this process specifically to inquire about a specific drug, the providers of course consider whether that drug is right for the consumer,” Howard Seidman, Populus’ chief operating officer, said in an email.

At least in 2024, telehealth companies weren’t attracting a ton of customers through their pharma partnerships.

Almost 4,400 patients had a telehealth visit through LillyDirect between July and December 2024, according to the report. Most of those visits (86%) were with Form Health, while 9am saw 620 patients from LillyDirect, and Cove saw 15 patients, the report said.

Between late August 2024 and early January 2025, 325 people conducted a telehealth visit with UpScriptHealth via Pfizer’s site, according to the report.

Form Health, Cove and UpScriptHealth did not respond to requests for comment.

30 Jun 2025

Escala Medical, a technology company specializing in the treatment of pelvic organ prolapse, has secured $4.5 million in funding.

EIC Fund led the round, which follows a $2.9 million (€2.5 million) grant awarded to Escala in 2023 via the EIC Accelerator program.

WHAT IT DOES

Escala's product Mendit works to restore pelvic organ function using a technique that removes the need for tissue incision or dissection to connect the sacrospinous ligament to the vaginal wall.

The device features a navigation, anchoring and deployment mechanism. The applicator tip is guided to the ligament using the finger, where it then securely anchors the vaginal wall in its proper anatomical position.

According to the company, the procedure can be done in an outpatient setting.

Escala will utilize the funds to expand its commercial operations in the U.S. and support its entry into the European market. The company will also use the money to further international growth through a signed distribution agreement with a partner based in Singapore.

"This funding marks an important milestone as we continue to scale our operations and bring our breakthrough technology to more women worldwide," Edit Goldberg, CEO of Escala, said in a statement.

"We're proud to have the support of the EIB and our private investors and we remain committed to advancing the next generation of our Mendit device to improve outcomes and expand access to millions of women worldwide who suffer from organ prolapse."

MARKET SNAPSHOT

Other companies in the pelvic health space include Origin, which entered into a partnership in March with women's telehealth company Wisp to allow their members to access each other's services.

Hybrid care provider Origin provides physical therapy for the pelvic floor and the whole body to improve sexual health during pregnancy, postpartum and menopause.

Wisp offers same-day appointments for women seeking treatment for sexual and reproductive health tools. Patients can connect with a licensed medical provider and, if needed, obtain a prescription for same-day in-person pickup or home delivery.

The company offers treatments for reproductive health, vaginal health, weight care, hormonal health and more.

Earlier this month, Sword Health raised $40 million, bringing its total funding to $380 million and its valuation to $4 billion. Sword used the funds to support its global expansion, further develop its AI models across various areas of care and accelerate its momentum in mergers and acquisitions.

In 2024, Axena Health, which develops a digital therapeutic for women's pelvic health, partnered with the direct-to-consumer telehealth company UpScriptHealth to offer consultations and treatment to women experiencing urinary incontinence symptoms.

Axena's Leva Pelvic Health System helps women with pelvic floor muscle training (PFMT), a first-line treatment that can be completed at home.

In 2023, Axena Health raised a $25 million Series A investment from XA IM Alts.

Axena offers the Leva Pelvic Health System, a prescription digital therapeutic aimed at treating urinary incontinence and chronic fecal incontinence in women.

The system, which has received FDA 510(k) clearance, includes a vaginal motion sensor that connects to an app, guiding users through pelvic floor muscle training.

According to an Axena spokesperson, the company acquired the system from Renovia, which developed and commercialized Leva before it shut down in 2022. last year. Renovia had previously raised $17 million in Series C-1 financing in 2021 and a $32.3 million Series B in 2018.

In 2022, Digital musculoskeletal care company SWORD Health launched a women's physical therapy product focused on pelvic health and pain.

The product, Bloom, includes a sensor that measures the pressure and stamina of the pelvic floor and connects to an app, allowing users to receive feedback on their exercises.

Members are paired with a pelvic health specialist who guides them through exercises and makes changes to their program based on their needs and results.

That same year, Hinge Health launched a women's pelvic health program. Hinge's program, available within the same platform as the rest of its musculoskeletal tools, offers educational content and access to a care team comprising physical therapists, women's health coaches and urogynecologists.

Hinge went public in May, raising $437.3 million in its initial public offering. which sold 9.14 million shares. Hinge opened on the NYSE at a stock price of $39.25 per share, 23% higher than its originally expected IPO price of $32.

The company's stock is now trading at $51.80 per share.

IPO

14 Mar 2025

The telehealth companies have been given until April 15 to respond to the senators' questions.

Several months after a group of senators sent letters to Pfizer and Eli Lilly investigating their respective direct-to-consumer telehealth platforms, the lawmakers are now directing similar queries toward several of the platforms’ partners.PfizerForAll and LillyDirect both went live in 2024 and offer access to virtual and in-person care and prescription medications and other health products delivered right to a user’s doorstep.In October, Democratic Sens. Dick Durbin of Illinois, Peter Welch of Vermont and Elizabeth Warren of Massachusetts and Independent Sen. Bernie Sanders of Vermont sent near-identical letters to the two Big Pharmas. The missives each included a list of 13 questions, all aimed at digging into “the nature of [each company’s] relationship with contracted telehealth prescribers.”According to the senators, despite the drugmakers’ assurances that the doctors employed by their telehealth provider partners are free to prescribe any appropriate medication, regardless of its maker, the fact that the service is coming from a company-branded platform “appears intended to steer patients toward particular medications and creates the potential for inappropriate prescribing that can increase spending for federal health care programs.”The legislators picked up their pens again this week to send similar queries to five telehealth companies that have held contracts with Lilly or Pfizer: 9amHealth, Thirty Madison, Form Health, Populus Health Technologies and UpScriptHealth.The new set of letters largely echo those sent to the drugmakers, including a verbatim reiteration of the senators’ belief that the inherent nature of the platforms creates the potential for fraud.“Unsurprisingly, a patient coming straight from Pfizer’s website to a telehealth appointment with a prescriber chosen by Pfizer is overwhelmingly more likely to ask for Pfizer’s medication,” they wrote in one version of the letter. “Further, that prescriber may have an incentive to prescribe such medication, whether or not it is medically necessary or clinically appropriate. Payments by Pfizer hold the potential to induce specific actions of the prescribing pen.” Once again, each letter concludes with a list of 13 questions, again featuring some overlaps with those sent to Pfizer and Lilly. The questions probe, for example, whether the pharmas “direct, encourage, or educate” the telehealth providers to prescribe their own medications; if the contracted providers are restricted from or rewarded for prescribing any specific drugs; and what the financial terms of their contracts look like.The telehealth companies have been given until April 15 to respond to the questions.In their own responses to the senators’ inquiries last fall, both Pfizer and Lilly emphasized the independence of their contracted telehealth partners, claiming that they do not incentivize the doctors in any way to prescribe their own drugs, Endpoints reported at the time.Lilly also reportedly seized the opportunity to direct the senators’ attention to another issue then top of mind for the company: telehealth companies that sell compounded versions of drugs like Lilly’s GLP-1 tirzepatide, with the drugmaker labeling such knockoffs as “unsafe and untested.”The spat between GLP-1 kingpins Lilly and Novo Nordisk and sellers of compounded drugs reached a fever pitch last month, as telehealth giant Hims & Hers released a Super Bowl ad nodding to their own compounded versions of obesity meds, prompting pointed responses from both companies. The conflict has since been rendered largely moot for Lilly, however—at least on the GLP-1 front—as a court ruled this month that compounders must stop producing their versions of tirzepatide.

100 Deals associated with UpScriptHealth

Login to view more data

100 Translational Medicine associated with UpScriptHealth

Login to view more data

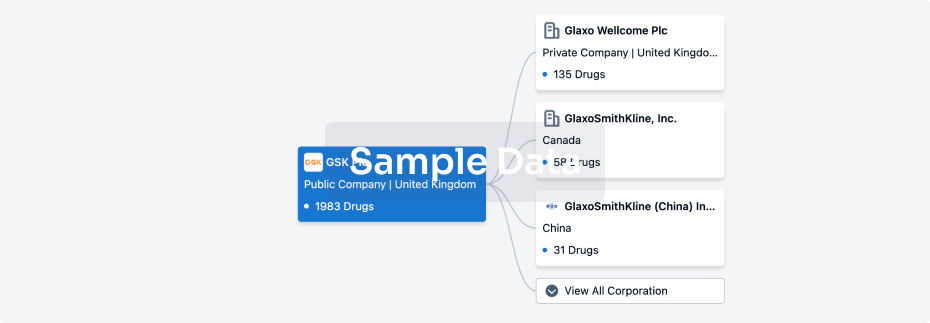

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 15 Dec 2025

No data posted

Login to keep update

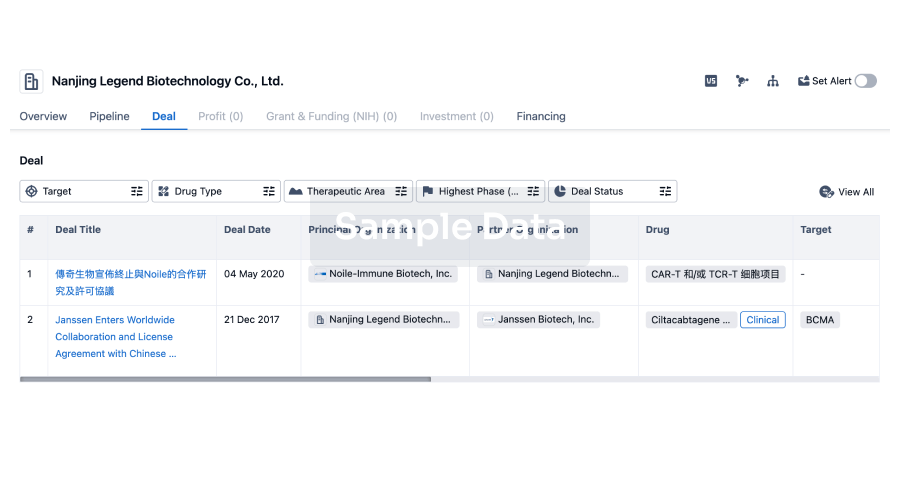

Deal

Boost your decision using our deal data.

login

or

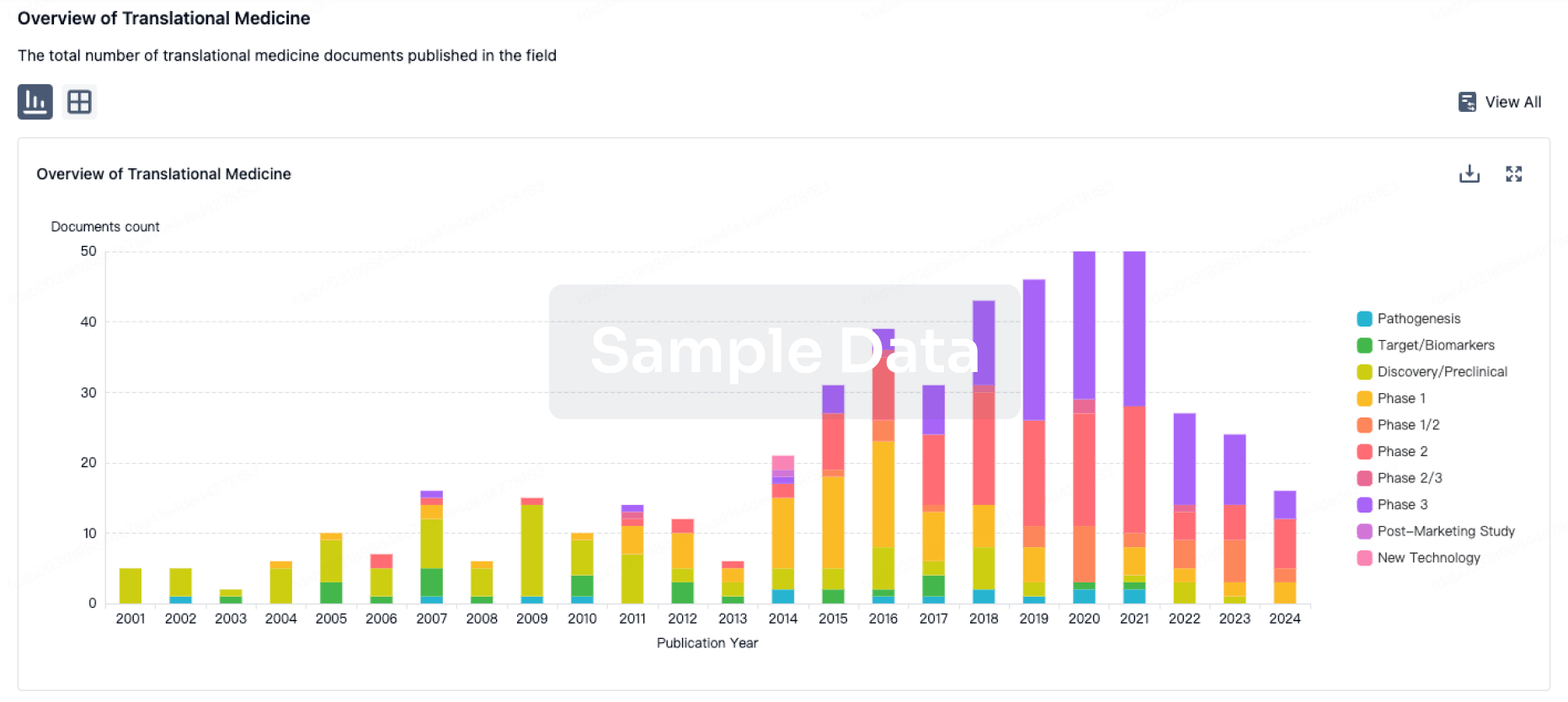

Translational Medicine

Boost your research with our translational medicine data.

login

or

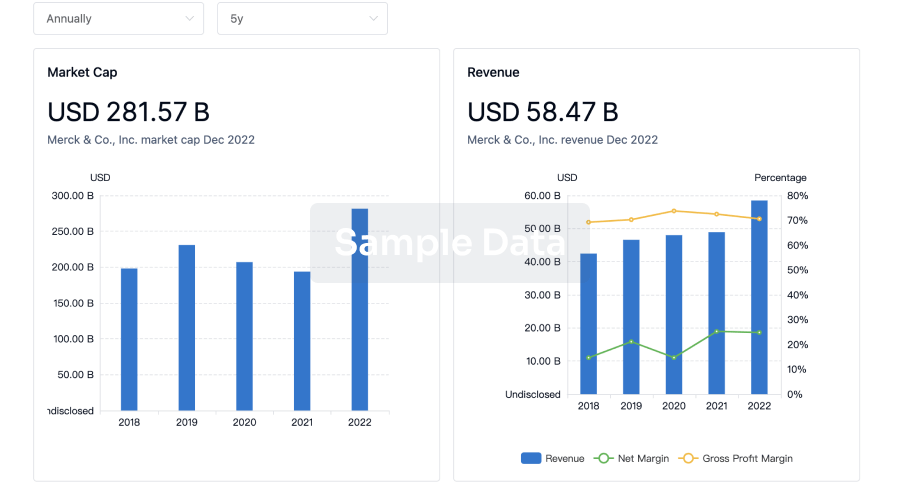

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

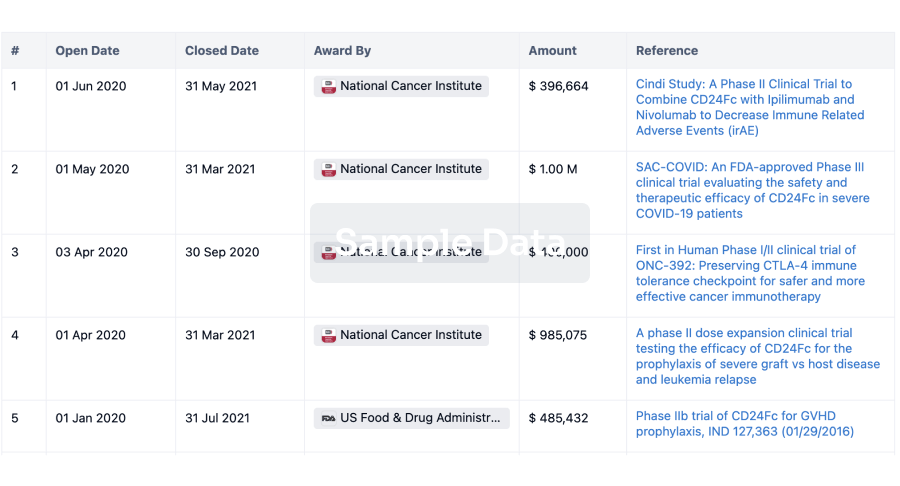

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

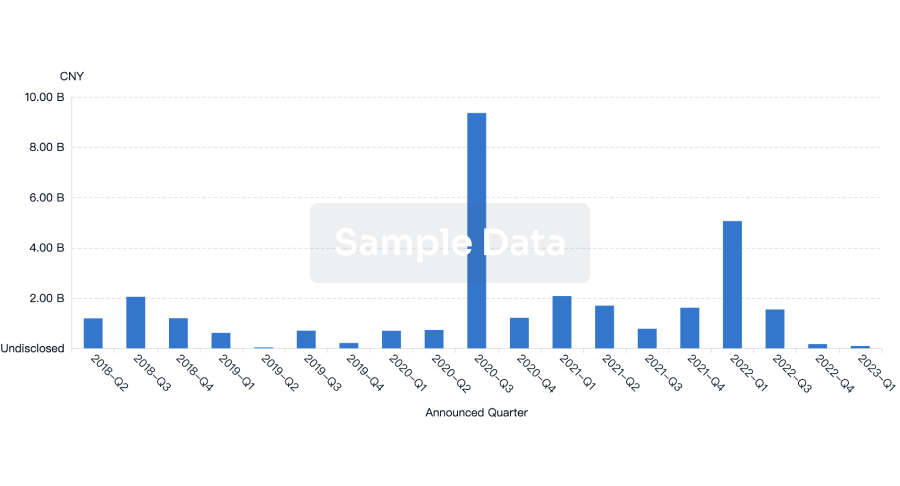

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

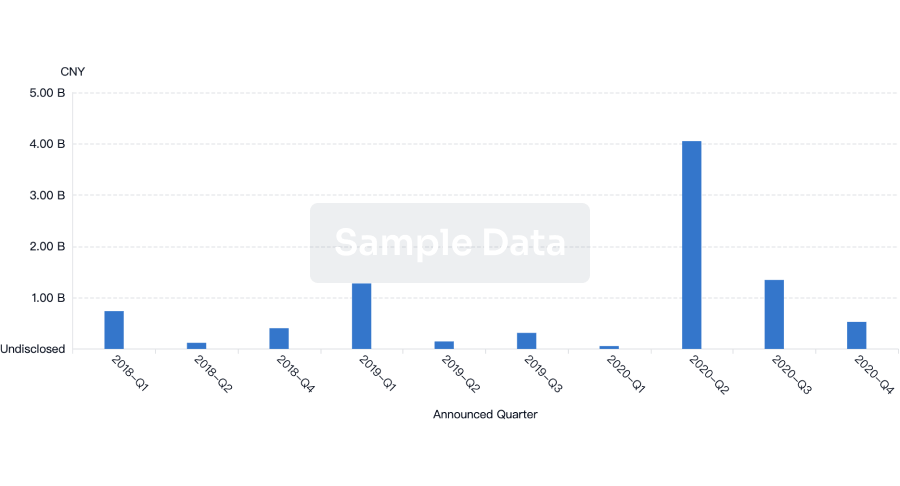

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free