Request Demo

Last update 08 May 2025

MEDACorp, Inc.

Dissolved

| Private Company|Massachusetts, United StatesDissolved

| Private Company|Massachusetts, United StatesLast update 08 May 2025

Overview

Related

100 Clinical Results associated with MEDACorp, Inc.

Login to view more data

0 Patents (Medical) associated with MEDACorp, Inc.

Login to view more data

5

News (Medical) associated with MEDACorp, Inc.22 Oct 2024

Appoints Dr. Melanie Whittington as Managing Director and Head of the Center for Pharmacoeconomics

BOSTON, Oct. 22, 2024 /PRNewswire/ -- Leerink Partners' affiliate, MEDACorp, announced today the launch of a new division, the Center for Pharmacoeconomics (CPE), which will be dedicated to advancing the understanding of the societal benefits of healthcare treatments in the United States. Dr. Melanie Whittington, PhD, a recognized leader in pharmacoeconomics, will serve as Managing Director and Head of the CPE division of MEDACorp.

CPE's mission is to be the storyteller of healthcare innovation. CPE will provide commentaries, analyses, and resources to help the industry understand the long-term societal impact of pharmaceuticals and how innovation occurs. CPE was launched in response to academic experts and professional health economic societies calling for a broader view of value for healthcare treatments. The center's approach will examine not only the healthcare costs and health benefits of a treatment, but also its impact on outcomes such as patient productivity, caregiver time, and equity to provide a broad and patient-centered view of value. CPE is dedicated to being a catalyst for change in economic evaluation to foster healthcare innovation and improve societal outcomes.

"With Mel's distinguished expertise in health economics and her leadership in value assessment, the Center for Pharmacoeconomics is positioned to become a key authority in economic evaluation," said Jim Kelly, President of MEDACorp. "The evaluations, insights, and resources provided by CPE will be invaluable for stakeholders navigating the value demonstration landscape, promoting healthcare innovation, and fostering meaningful advancements in patient-centered economic evaluation."

Dr. Whittington is internationally known for applying and developing economic evaluation methods to assess the value of pharmaceuticals. She is also a Senior Fellow within the Center for the Evaluation of Value and Risk in Health at Tufts Medical Center. Prior to joining CPE, she founded a health economics consultancy committed to developing and testing novel methods for economic evaluation. Before that, she served as Director of Health Economics at the Institute for Clinical and Economic Review (ICER).

"During a time of increased scrutiny over pharmaceutical prices, understanding and appreciating the value that healthcare interventions provide has never been more important," said Dr. Whittington. "CPE is committed to providing the U.S. healthcare industry with evaluations and insights that account for the broader societal impacts of healthcare interventions. By doing so, we aim to shape a future where the value of healthcare innovations is celebrated, and societal outcomes are prioritized."

To learn more, visit: .

About MEDACorp

MEDACorp LLC is an affiliate of Leerink Partners LLC. MEDACorp maintains both a global network of independent healthcare professionals providing industry and market insights to its clients and the Center for Pharmacoeconomics to evaluate the societal impacts of healthcare innovations. Through its global network and its Center for Pharmacoeconomics, MEDACorp supports Leerink Partners and its clients by providing unique perspectives on industry trends, market developments, emerging opportunities within the healthcare sector, and health economics.

About The Center for Pharmacoeconomics

The Center for Pharmacoeconomics ("CPE") is a division of MEDACorp. CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes.

About Leerink Partners

Leerink Partners is a highly specialized healthcare investment bank with a legacy of excellence in the financial industry. The firm's experienced team delivers innovative advisory solutions, capital raising expertise, and unique insights to empower clients to achieve their strategic objectives. Since inception the firm has advised on $60 billion of M&A, helped clients raise over $165 billion in capital, and has established itself as a trusted partner to healthcare companies and their investors. The firm is a broker-dealer registered with the United States Securities and Exchange Commission and a member of the Financial Industry Regulatory Authority.

Leerink Partners for the Center for Pharmacoeconomics

Contact: Diane Vieira

(617) 918-4097

Prosek Partners for the Center for Pharmacoeconomics

Contact: Michael Schutsky

(646) 818-9251

SOURCE Leerink Partners

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

Executive Change

17 Jul 2023

Pfizer's $43 billion acquisition of Seagen is under review by the Federal Trade Commission. The antitrust regulator is asking the companies for a second round of information, Seagen said in a regulatory filing Friday.

The Federal Trade Commission (FTC) has asked Pfizer and Seagen for more information on their proposed $43 billion merger, the Seattle biotech revealed (PDF) in a Securities and Exchange Comission (SEC) filing Friday.

This is the second round of documentation the antitrust regulator has requested from the companies since their deal was announced in March.

"Second requests require both parties to provide additional information to assess the legality of the transaction, though they can be broad in nature, investigating issues such as existing or potential competition, drug pricing or off-label usage of certain products," SVB Securities wrote in a note to investors.

Second requests from the FTC come in roughly 25% of merger and acquisition deals, with the regulator challenging a transaction 5% to 10% of the time, MEDACorp told SVB, adding that a second request can extend the timeline for review by six to nine months.

Seagen added in the filing that it still expects the acquisition to be complete “by late 2023 or early 2024.”

Scrutiny of the deal comes as no surprise considering the FTC filed a lawsuit in May to block Amgen’s proposed $27.8 billion buyout of Horizon. That case that will be heard in September.

Last month, Goldman Sachs analyst Chris Shibutani, M.D.—based on a conversation with Pfizer Chief Financial Officer Dave Denton—wrote that the company expected the request, even though “no red flags have cropped up,” on the acquisition.

A month ago, Pfizer revealed in an SEC filing that it had withdrawn its notification for the buyout of Seagen and would refile it later in the day. The move extended the FTC’s review of the deal by 30 days to Friday of last week.

Seagen also said in its filing that it referred the merger with Pfizer to the European Commission for review June 1, and that approval is necessary for the deal to close.

SVB mentioned that undergoing a European review is standard procedure for larger mergers, although the bloc is also scrutinizing biopharma M&A more rigorously. Last week, the EU fined Illumina a record 432 million euros ($476 million) for hastening its $7 billion acquisition of Grail without gaining regulatory approval. The EU is expected to follow the FTC in ordering Illumina to fully divest Grail.

The Pfizer-Seagen merger is the largest M&A deal in biopharma since AbbVie acquired Allergan for $63 billion in June of 2019. It would give Pfizer four approved products and a deep pipeline of antibody-drug conjugate candidates. Pfizer said it expects the products brought by Seagen to bring $10 billion in additional annual revenues by 2030.

Pfizer had two of the three largest deals in the industry last year. In May, Pfizer executed an $11.6 billion buyout of migraine pioneer Biohaven. Three months later, the New York giant paid $5.4 billion, outbidding Johnson & Johnson, for sickle cell specialist Global Blood Therapeutics.

While the FTC's attempt to block the Amgen-Horizon deal—it's first such move against a biopharma company in more than a decade—raises concern for Pfizer's buyout of Seagen, some analysts believe there is little overlap between the companies that would justify a similar lawsuit.

In its suit, the FTC has cited Amgen’s history of enhancing the monopoly positions of its drugs through product bundling and rebate schemes. This ability to exploit the market could be enhanced with therapies that Amgen would gain through an acquisition of Horizon, the FTC has argued.

AcquisitionADC

30 Mar 2020

Four months after Merck announced a surprise Phase III

success

on the heart drug they gave Bayer $1 billion for, the full data is out — and cardiologists, investors and payers are left wondering just how effective the drug really is.

The data, published in the

New England Journal of Medicine

and announced in the virtual American College of Cardiology meeting, showed that across 5,050 patients, vericiguat led to a 10% reduction in hospitalizations for heart failure. Although that met the primary endpoint — the composite of time until first death or hospitalization for heart failure — it underwhelmed, particularly as the drug did not lead to a statistically significant reduction in death.

The November announcement had left it up in the air if the composite success had been fueled by reductions in hospitalizations, or reductions in death, or both. That announcement had surprised some, given that the drug failed Phase II trials.

“Our KOLs’ modest expectations were met if not missed and investor expectations were definitely missed,” Cowen’s Steve Scala wrote in a note, citing a survey they had done at their investor conference earlier this month. He projected $500 million in peak sales in 2025.

In advance of the virtual conference, SVB Leerink’s Daina Graybosch noted that the cardiovascular market had become murky in recent years. She cited Novartis’s Entresto, a drug that’s been slow to reach patients despite being hailed as a major advance in cardiovascular therapy, and pointed to an obstacle course of reluctant payers, unfamiliar physicians, out-of-pocket costs for patients and looming questions about real-world benefits. Still, with the potential for real-world data, she said the data could Merck might get “a leg up” on the market.

Instead, on Monday, she wrote the data reduced vericiguat’s potential to a “niche” market in those who can’t tolerate parts of the current standard-of-care. Even that, though, was based on data not yet released, including quality of life metrics in a larger set of patients also treated with Entresto.

“MEDACorp cardiologists we spoke with were pleased to have an additional therapeutic option at their disposal, with positive (but not enthusiastic) commentary provided on vericiguat’s incremental benefit,” Graybosch wrote, citing Leerink’s expert network.

Cardiologists who have may have ordinarily debated the results in the hallways of a Chicago hotel instead discussed them on Twitter, with some praising the hospitalization benefit and noting that, while not statistically significant, the trial did see an absolute decline in deaths. Others described the composite win as “ambiguous.”

In a webcast for the

American Journal of Managed Care

, University of Mississippi College of Medicine chair Javed Butler said the results looked more promising when you considered how short the follow-up was and the particularly high-risk patient population.

“So, if you actually look at the absolute risk reduction, there was about a 4% absolute risk reduction,” he said, “which is the same or better than some of the recent trials that we’ve seen.”

It’s not clear when Merck will file for an NDA, although analysts agreed a submission was likely coming and likely to succeed. Still, with low projected sales and with gefapixant

results

they Leerink viewed as disappointing earlier this month, Scala wrote that Merck might be in need of some changes.

“MRK’s current strength — thanks to Keytruda and Vaccines — is clear,” he wrote, “but the oxygen for drug manufacturers are pipelines, and MRK’s appears insufficient, raising potential for significant M&A.”

Vaccine

100 Deals associated with MEDACorp, Inc.

Login to view more data

100 Translational Medicine associated with MEDACorp, Inc.

Login to view more data

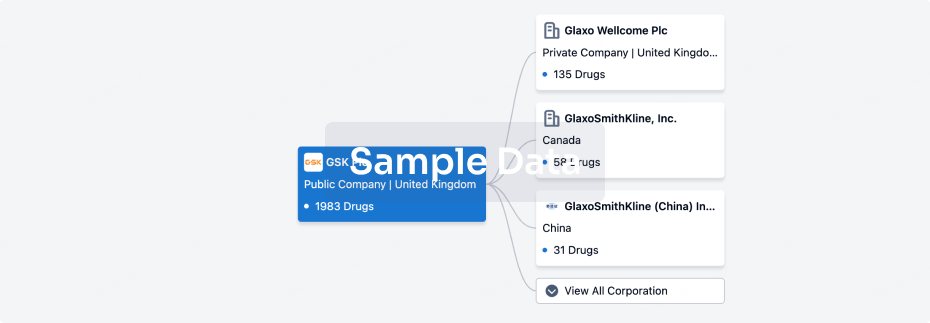

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 02 Aug 2025

No data posted

Login to keep update

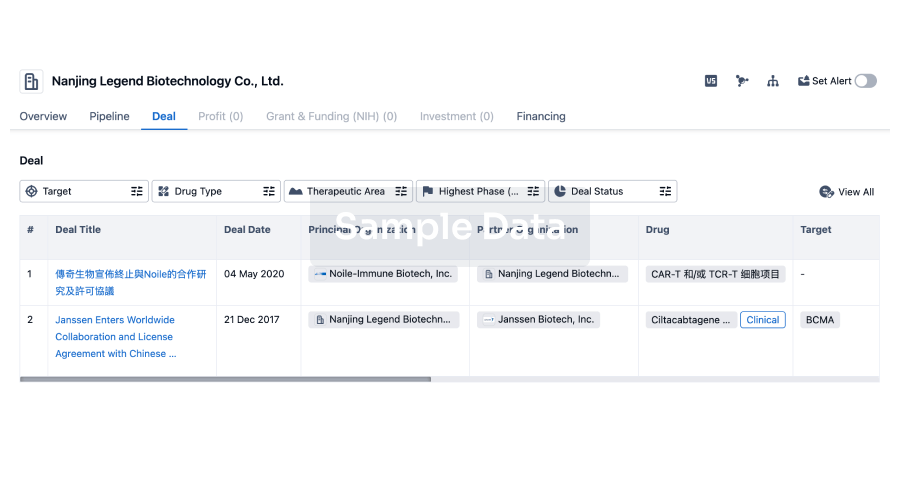

Deal

Boost your decision using our deal data.

login

or

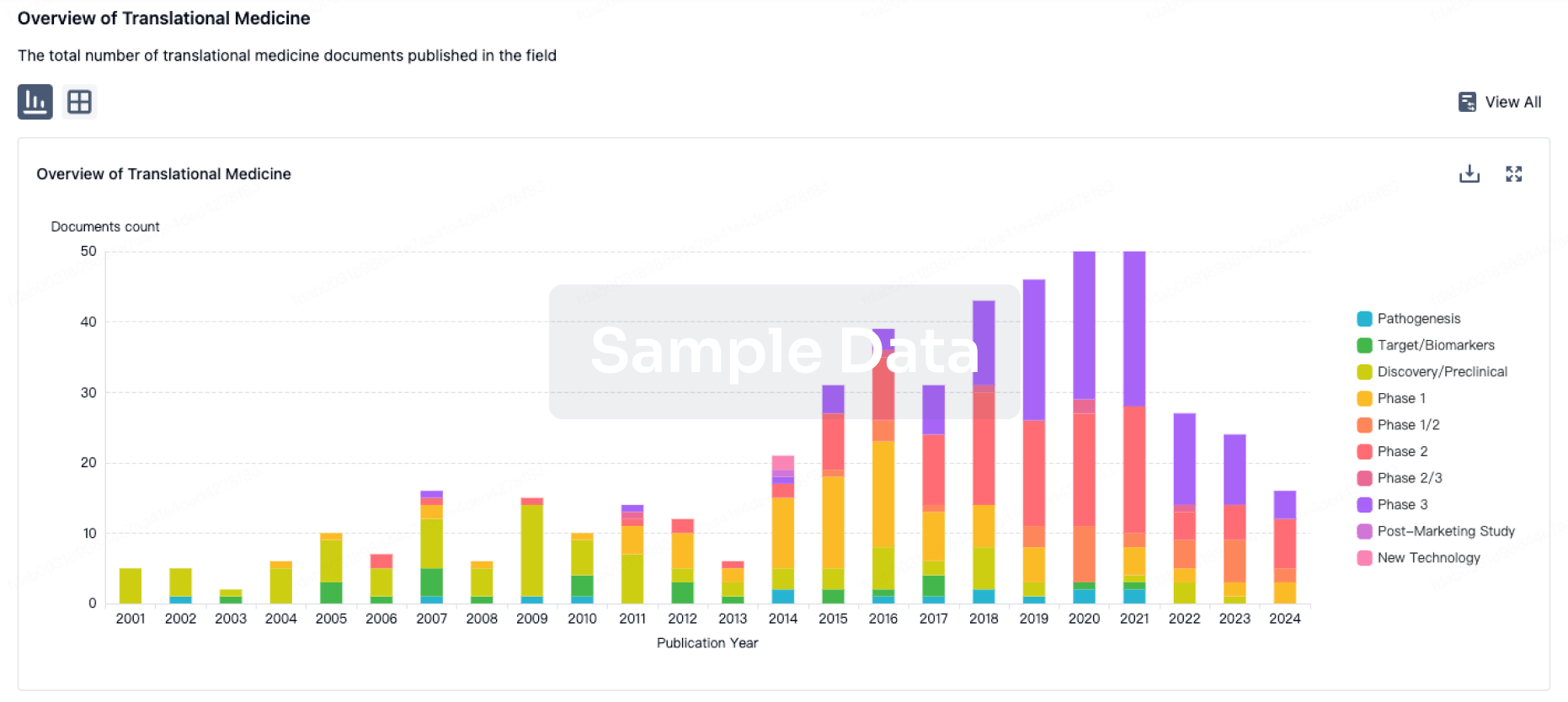

Translational Medicine

Boost your research with our translational medicine data.

login

or

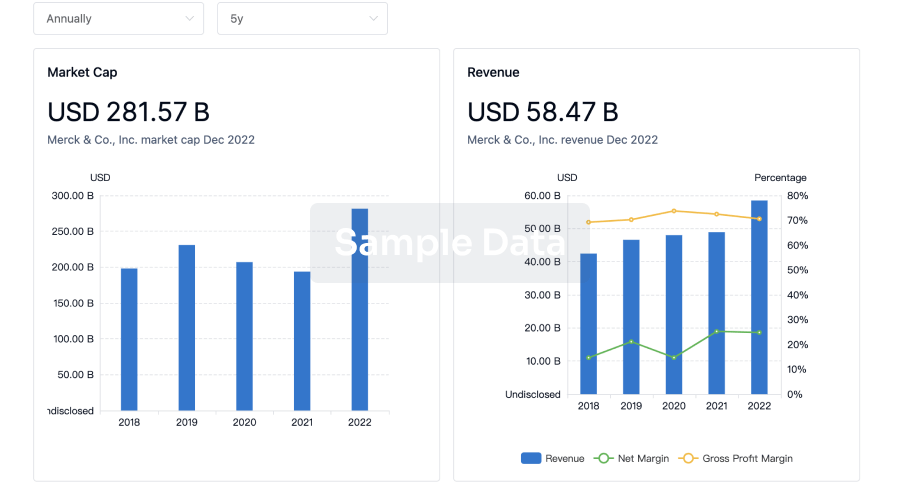

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

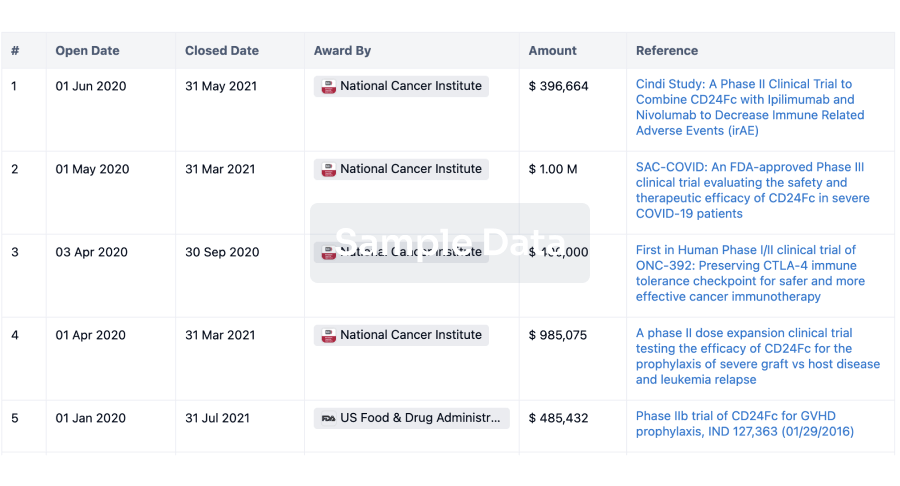

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

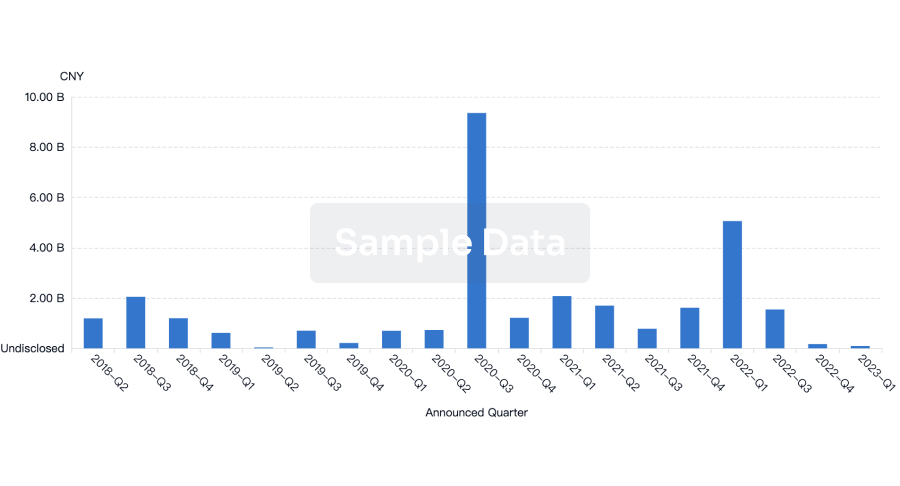

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

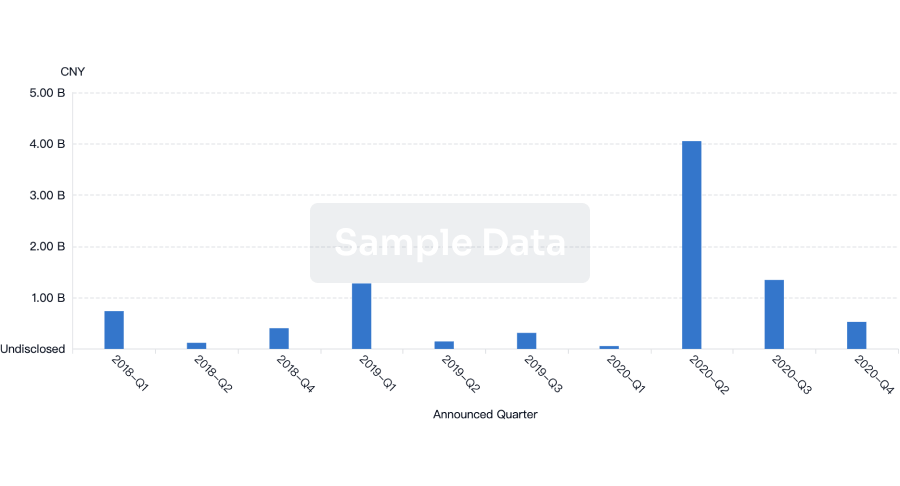

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free