Request Demo

Last update 08 May 2025

SeaChange Pharmaceuticals, Inc.

Last update 08 May 2025

Overview

Related

100 Clinical Results associated with SeaChange Pharmaceuticals, Inc.

Login to view more data

0 Patents (Medical) associated with SeaChange Pharmaceuticals, Inc.

Login to view more data

1

Literatures (Medical) associated with SeaChange Pharmaceuticals, Inc.Predicting drug secondary pharmacology and mechanistic targets

Author: Shoichet, Brian K. ; Keiser, Michael J. ; Irwin, John J. ; Roth, Bryan L.

3

News (Medical) associated with SeaChange Pharmaceuticals, Inc.01 Nov 2023

Acquisition of Kildare-based firm continues NFP's expansion in Europe, adds leading safety management solutions provider

DUBLIN, Nov. 1, 2023 /PRNewswire/ -- NFP, a market-leading international specialty insurance broking and consulting firm, today announced it has acquired SeaChange Limited, a health and safety consultancy based in Naas, County Kildare. This acquisition expands NFP's European health and safety capabilities and solutions for the company's Irish, UK and mainland European clients. The acquisition closed effective October 1.

"Acquiring SeaChange provides an exciting opportunity to support our clients in new ways, offering them access to an in-house health and safety consultancy as another way to mitigate overall business risk," said Matt Pawley, president, NFP in Europe. "This strategic move gives NFP another competitive edge and an exciting progression into health and safety consulting in Ireland."

Founded in 2005 by Ger Cummins as a family-run business, SeaChange delivers sustainable safety management solutions to its clients, empowering businesses to fully engage their workforce and become leaders in health and safety best practices. SeaChange employs 25 people and partners with their 300 clients across Ireland, Europe and the United States.

"Joining NFP represents a new era for SeaChange and a very proud moment for our business and family," said Dr. Paul Cummins, CEO, SeaChange. "NFP has a very successful business in Ireland, and we believe this next step will offer NFP and SeaChange clients a wider breadth of corporate services to help manage risk and support a more competitive insurance offering. I look forward to leading our company on the next chapter of its business journey."

About NFP

NFP is a leading property and casualty broker, benefits consultant, wealth manager, HR services consultant, and retirement plan advisor that provides solutions through its licensed subsidiaries and affiliates. NFP in Europe focuses on business and people risk solutions across commercial insurance, health and safety consultancy, employee benefits, human resources, private and personal solutions, and wealth management. NFP enables client success through the expertise of over 8,000 global employees, investments in innovative technologies, and enduring relationships with highly rated insurers, providers, and financial institutions. NFP is the 9th best place to work for large employers in insurance, 7th largest privately-owned broker, 7th largest benefits broker by global revenue and 13th largest broker of US business (all rankings according to Business Insurance).

Visit nfpireland.ie to discover how NFP empowers clients to meet their goals.

About SeaChange

SeaChange Ltd. is a health and safety consultancy that provides organisations across multiple business sectors with transformative safety management solutions, engaging the workforce in preventing incidents and achieving a positive, sustainable safety culture.

Visit SeaChange for more on leading a proactive safety culture in your organisation.

SOURCE NFP Corp.

Acquisition

04 Nov 2022

A new pharmacy benefit offering called Transcarent Pharmacy Care is designed to give employers and health systems maximum control over their formulary, benefit designs and data, according to Transcarent and Prescryptive Health.

Employer health startup Transcarent announced in September plans to launch a new pharmacy program for self-funded employers and health systems.

The company revealed that it is teaming up with healthcare technology company Prescryptive Health to power its new pharmacy benefit offering. Prescryptive’s mobile patient engagement platform, MyRx.io, enables users to find and pay for clinical services at pharmacies, including COVID-19 tests and vaccines, and see what pharmacies in a given area charge for medications.

The new pharmacy benefit offering, called Transcarent Pharmacy Care, is designed to give employers and health systems maximum control over their formulary, benefit designs and data, according to the companies.

"This new-to-market solution will address the confusing, complex, and costly process that exists today for members by offering easy-to-understand price transparency tools, 24/7 clinical support, and guidance while addressing virtually all of their other health and care needs," Transcarent executives said in a press release.

“The current fragmented healthcare system is not designed for consumers’ needs to get transparent information, trusted guidance and easy access to care on their terms,” said Glen Tullman, CEO of Transcarent, in a statement. “The push for transparency and accessibility must extend to the pharmacy. Transcarent is partnering with Prescryptive to create a transparent, connected care experience that aligns with our mission to break down healthcare silos and empower our Members on their health and care journey.”

Prescryptive, founded in 2017, acts as a PBM, negotiating prices directly with pharmacies. That allows the company to maintain fair rates and to be transparent about them with consumers, co-founder and CEO Chris Blackley told Fierce Healthcare back in October 2021.

Prescryptive says it developed a "prescription intelligence platform" that offers members transparent pricing, 100% pass-through of manufacturer rebates and no spread pricing.

The company works with a national network of more than 60,000 retail, home delivery and specialty pharmacies.

Some of the startup’s partners include major pharmaceutical companies, independent pharmacy groups and chains like Walmart and Walgreens.

Through the partnership, Transcarent Pharmacy Care members will be able to shop for their own prescriptions with a digital prescription, the companies said. Consumers can view real-time price data, select a pharmacy to fill their medication or a home delivery option, know the price they will pay and make more informed decisions.

In a recent pharmacy study by Prescryptive, 90% of consumers said they would appreciate knowing the price of medication before they arrive at the pharmacy, and 73% said they would be more likely to talk to their doctor about lower-cost alternatives if they knew the price in advance.

Transcarent launched from stealth in March 2021 and has raised $298 million to power its premium-free approach to employer-sponsored healthcare.

The Pharmacy Care tool builds in previous launches from Transcarent, including solutions for behavioral health care and oncology care. The company has also secured partnerships with big names in the industry, including retail giant Walmart.

Prescryptive has raised $26 million in funding from investors that include SeaChange and Pallasite Ventures.

Several startups have launched in the past few years aiming to disrupt skyrocketing prescription drug prices in the U.S. Mark Cuban Cost Plus Drug Company launched its own PBM and an online pharmacy as part of an ongoing effort to provide consumers with low drug prices.

Amazon acquired PillPack in 2018 and rolled out Amazon Pharmacy in 2020. At the ViVE 2022 digital health conference in March, Amazon Pharmacy announced it was partnering with Blues plans in five states and Prime Therapeutics to launch a prescription discount savings card for some Blue Plans members. The company recently inked a deal with Florida Blue to serve as its exclusive home delivery service provider.

CollaborateVaccine

13 Sep 2021

- Execution of Growth Strategy Drives 29% Sequential Increase in Revenue; Gross Margin Expands to 63%, Up 700 Basis Points Compared to the Prior Quarter

- SeaChange Positioned to Capitalize on Convergence of Streaming and Ad Tech with Leading Cloud-Based OTT and Advanced Advertising Platform

BOSTON, Sept. 13, 2021 (GLOBE NEWSWIRE) -- SeaChange International, Inc. (NASDAQ: SEAC), a leading provider of video delivery platforms, today reported financial and operational results for the fiscal second quarter ended July 31, 2021.

Fiscal Second Quarter 2022 and Recent Highlights

Management Commentary

“As our results for the second quarter demonstrate, SeaChange’s growth strategy focused on the video streaming and Ad Tech markets is gaining traction,” said Executive Chairman Robert Pons. “In particular, we are capitalizing on the explosive growth in streaming, which was exemplified by the 29% sequential revenue growth we delivered in Q2, along with robust gross profit margins and improved profitability. Our increasing financial momentum reveals the traction we’re achieving on our key sales initiatives, including enhancing our product portfolio, securing new streaming customers, extending our footprint as a video Ad Tech provider, and driving more predictable growth. Today, SeaChange enables content owners and cable companies to deliver profitable TV and streaming services to more than 100 million subscribers across 35,000 linear channels and serving up over 100 million ads monthly.”

Chris Klimmer, senior vice president of global sales and marketing at SeaChange, commented: “SeaChange is well-positioned to capitalize on the intersection of the explosive growth in all things Ad Tech and streaming. Our enhanced product positioning and recent customer wins serve as proof points that we are poised to take advantage of the major trends within the broadcast industry. SeaChange has the technology assets and expertise to provide cable operators and streaming content owners globally with advanced advertising technology, and a turn-key managed services streaming enablement platform. We do this by helping them to unlock additional revenue streams, maximize the ROI of user and content acquisition costs and streamline operational costs while enhancing operational efficiencies.”

Pons added: “We have entered the third quarter with significant momentum and a robust pipeline of sales opportunities. We believe we are just starting to scratch the surface of streaming and Ad Tech opportunities. Longer term, we believe our continued execution on our strategic plan will drive scale, capture market share, and create even greater value for both our customers and shareholders.”

Fiscal Second Quarter 2022 Financial Results

Conference CallSeaChange will host a conference call today (September 13, 2021) at 5:00 p.m. Eastern time (2:00 p.m. Pacific time) to discuss these results.

SeaChange executive management will host the call, followed by a question-and-answer period.

U.S. dial-in number: 877-407-8037International number: 201-689-8037Meeting Number: 13722323

Please call the conference telephone number approximately 10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of SeaChange’s website.

About SeaChange International, Inc.SeaChange International (NASDAQ: SEAC) is a trusted provider of streaming video services, cable TV broadcast platforms and advanced advertising insertion technology. The company partners with operators, broadcasters and content owners worldwide to help them deliver the highest quality video experience to consumers. Its StreamVid premium streaming platform enables operators and content owners to cost-effectively launch and grow a direct-to-consumer service to manage, curate and monetize their content as well as form a direct relationship with their subscribers. SeaChange enjoys a rich heritage of nearly three decades of video hardware, software and advertising technology.

Safe Harbor ProvisionCertain statements in this press release may constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended to date. Forward-looking statements can be identified by words such as "may," "might," "will," "should," "could," "expects," "plans," "anticipates," "believes," "seeks," "intends," "estimates," "predicts," "potential" or "continue," the negative of these terms and other comparable terminology. Examples of forward-looking statements include, among others, statements we make regarding the Company’s ability to execute its strategic roadmap, capture additional market share and capitalize on the growing demand for over-the-top video streaming services globally; the Company’s ability to effectively monetize the value of its software and services; the Company’s ability to accelerate key initiatives and execute on its strategic plan in a manner that translates to sustainable growth and consistent profitability in the years ahead;; and other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations, and assumptions of the management of the Company and are subject to a number of known and unknown risks and significant business, economic and competitive uncertainties that could cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. Risks that could cause actual results to differ include, but are not limited to: the impact of COVID-19 on our business and the economies in which we operate; the continued spending by the Company's customers on video solutions and services and expenses we may incur in fulfilling customer arrangements; the manner in which the multiscreen video and over-the-top markets develop; the Company's ability to compete in the software marketplace; the loss of or reduction in demand, or the return of product, by one of the Company's large customers or the failure of revenue acceptance criteria in a given fiscal quarter; the cancellation or deferral of purchases of the Company's products; any decline in demand or average selling prices for our products and services; failure to achieve our financial forecasts due to inaccurate sales forecasts or other factors, including due to expenses we may incur in fulfilling customer arrangements; the impact of our cost-savings and restructuring programs; the Company's ability to manage its growth; the risks associated with international operations; the ability of the Company to use its net operating losses, including the potential impact on these losses resulting from the Coronavirus Aid, Relief, and Economic Security (CARES) Act; the impact of changes in the market on the value of our investments; changes in the regulatory environment; and other risks that are described in further detail in the Company’s reports filed from time to time with the Securities and Exchange Commission (SEC), which are available at , including but not limited to, such information appearing under the caption "Risk Factors" in the Company's Annual Report on Form 10-K. Any forward-looking statements should be considered in light of those risk factors. The Company cautions readers that such forward-looking statements speak only as of the date they are made. The Company disclaims any intent or obligation to publicly update or revise any such forward-looking statements to reflect any change in Company expectations or future events, conditions or circumstances on which any such forward-looking statements may be based, or that may affect the likelihood that actual results may differ from those set forth in such forward-looking statements.

SeaChange Contact:Matt GloverGateway Group, Inc.949-574-3860SEAC@gatewayir.com

Condensed Consolidated Balance Sheets(Unaudited, amounts in thousands)

SeaChange International, Inc.Consolidated Statements of Operations(Unaudited, amounts in thousands, except per share data)

SeaChange International, Inc.Consolidated Statements of Cash Flows(Unaudited, amounts in thousands)

Non-GAAP MeasuresWe define non-GAAP loss from operations as U.S. GAAP net income (loss) plus stock-based compensation expenses, amortization of intangible assets, severance and restructuring costs, gain on extinguishment of debt, other income (expense), net, and income tax benefit. We discuss non-GAAP loss from operations, including on a per share basis, in our quarterly earnings releases and certain other communications, as we believe non-GAAP operating loss from operations is an important measure that is not calculated according to U.S. GAAP. We use non-GAAP loss from operations in internal forecasts and models when establishing internal operating budgets, supplementing the financial results and forecasts reported to our Board of Directors, determining a component of bonus compensation for executive officers and other key employees based on operating performance, and evaluating short-term and long-term operating trends in our operations. We believe that the non-GAAP loss from operations financial measure assists in providing an enhanced understanding of our underlying operational measures to manage the business, to evaluate performance compared to prior periods and the marketplace, and to establish operational goals. We believe that the non-GAAP financial adjustments are useful to investors because they allow investors to evaluate the effectiveness of the methodology and information used by management in our financial and operational decision-making.

Non-GAAP loss from operations is a non-GAAP financial measure and should not be considered in isolation or as a substitute for financial information provided in accordance with U.S. GAAP. This non-GAAP financial measure may not be computed in the same manner as similarly titled measures used by other companies. We expect to continue to incur expenses similar to the financial adjustments described above in arriving at non-GAAP loss from operations and investors should not infer from our presentation of this non-GAAP financial measure that these costs are unusual, infrequent or non-recurring. The following table includes the reconciliations of our U.S. GAAP loss from operations, the most directly comparable U.S. GAAP financial measure, to our non-GAAP loss from operations for the three and six months ended July 31, 2021.

SeaChange International, Inc.Fiscal Year Reconciliation of GAAP to Non-GAAP(Unaudited, amounts in thousands, except per share data)

SeaChange International, Inc.Supplemental Schedule - Revenue Breakout(Unaudited, amounts in thousands)

Financial StatementAcquisition

100 Deals associated with SeaChange Pharmaceuticals, Inc.

Login to view more data

100 Translational Medicine associated with SeaChange Pharmaceuticals, Inc.

Login to view more data

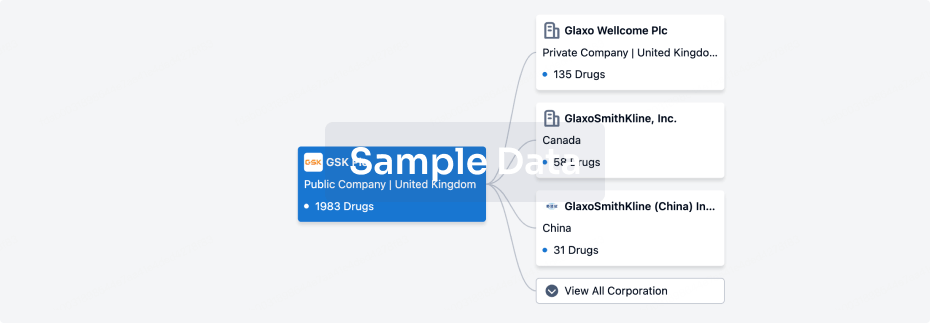

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 22 May 2025

No data posted

Login to keep update

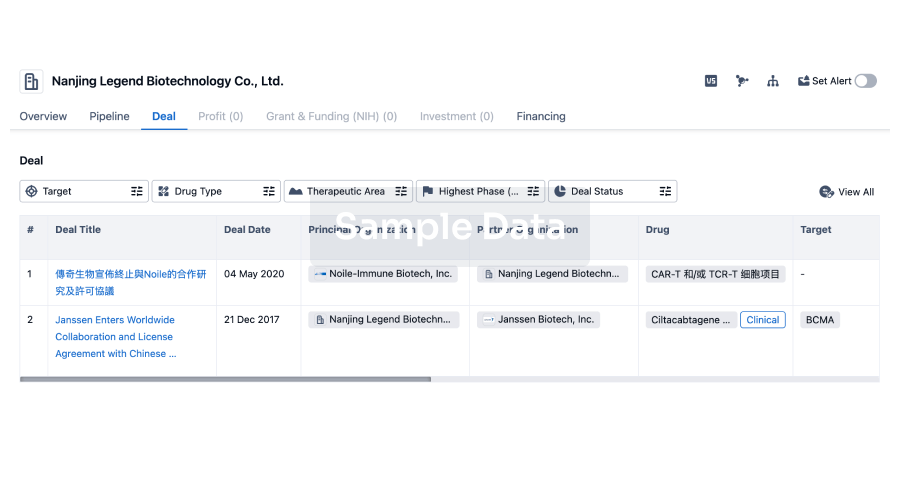

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

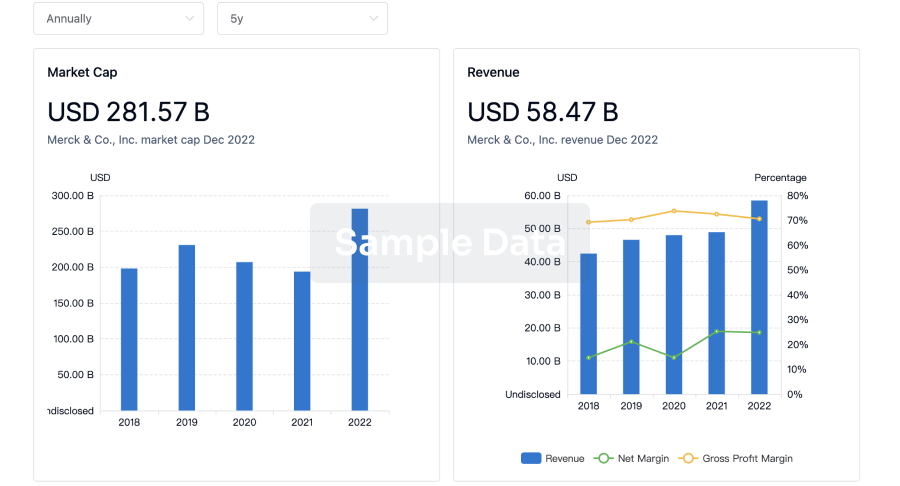

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

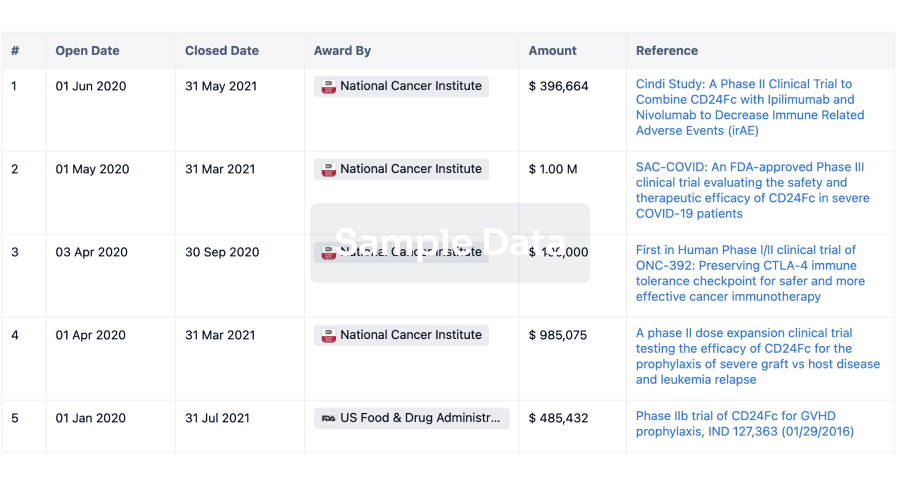

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free