Request Demo

Last update 08 May 2025

altona Diagnostics GmbH

Last update 08 May 2025

Overview

Related

100 Clinical Results associated with altona Diagnostics GmbH

Login to view more data

0 Patents (Medical) associated with altona Diagnostics GmbH

Login to view more data

11

Literatures (Medical) associated with altona Diagnostics GmbH01 Mar 2025·Nature Medicine

Rapid brain tumor classification from sparse epigenomic data

Article

Author: Schüller, Ulrich ; Vik-Mo, Einar O ; Ammerpohl, Ole ; Rohrandt, Christian ; Wong, Derek ; Lum, Amy ; Zadeh, Gelareh ; Synowitz, Michael ; Zhu, Zhihan ; Leske, Henning ; Halldorsson, Skarphedinn ; Brändl, Björn ; Djirackor, Luna ; Yip, Stephen ; Smičius, Romualdas ; Steiger, Mara ; Kretzmer, Helene ; Quedenau, Claudia ; Schuldt, Bernhard ; Afflerbach, Ann-Kristin ; Riemenschneider, Markus J ; Müller, Franz-Josef ; Evers, Maximilian ; van Bömmel, Alena ; Proescholdt, Martin ; Schmidt, Nils O ; Kubelt, Carolin ; Magadeeva, Svetlana ; Wang, Gaojianyong

01 Dec 2024·Computational and Structural Biotechnology Journal

Rapid intraoperative amplicon sequencing of CNS tumor markers

Article

Author: Rohrandt, Christian ; Evers, Maximilian ; Danso, Dominik ; Friedrichsen, Sönke ; Maicher, André ; Wang, Gaojianyong ; Kubelt-Kwamin, Carolin ; Müller, Franz-Josef ; Kubelt, Carolin ; Kolkenbrock, Stephan ; Brändl, Björn

01 Dec 2022·Biomedical Optics Express

Detection of fluorescence-labeled DNA with in-plane organic optoelectronic devices

Article

Author: Kraft, Fabio A ; Nebling, Eric ; Köpke, Markus ; Gerken, Martina ; Rutschke, Nils ; Titov, Igor

9

News (Medical) associated with altona Diagnostics GmbH09 Jan 2025

DUBLIN--(

BUSINESS WIRE

)--The

"Clinical Laboratory Molecular Diagnostics for Infectious Disease Market: Forecasts by Application by Place and by Country, with Market Analysis & Executive Guides"

report has been added to

ResearchAndMarkets.com's

offering.

The report has hundreds of pages of information including a complete list of Current United States Medicare Fee Payment Schedules to help sharpen your pricing along with the most frequently used and billed tests. Again, assistance in using the information is normally provided without additional charges. The report includes detailed breakouts for 15 Countries and 4 Regions. A detailed breakout for any country in the world is available to purchasers of the report.

The Molecular Diagnostics - Infectious Disease sector of the clinical diagnostics industry is poised for further growth. A market that just keeps on growing but is becoming more complex and segmented. Find out what's happening in this informative report. Find out about the impact of multiplex assays which threaten to change diagnosis and treatment forever.

Exciting technical developments especially in the seesaw between nucleic acid testing and immunoassay, hold the promise of a dynamic, growing and evolving world market that holds the promise of diagnostics taking the lead in infectious disease eradication. This research makes you the expert in your organization. The report includes five year market forecasts.

The section on the Clinical Laboratory Market Segments and Industry Structure provides an analysis of the laboratory market, detailing traditional segmentation and focusing on specific areas like syndromic testing. It explores how different types of labs, including hospital labs, central labs, and physician office labs (POLs), segment their services based on testing needs.

The industry structure section discusses the distribution of testing among hospitals, the economies of scale achieved by larger lab networks, and the competition between hospital-based labs and centralized laboratories. It also highlights the role of physician offices and the growing relevance of Point-of-Care Testing (POCT), reflecting the shifting dynamics in where and how diagnostic testing is conducted. This summary encapsulates the key market dynamics and structural elements of the clinical laboratory industry.

Infectious disease testing directly benefits from the explosion in biotechnology, especially genomics. Learn all about it in this new report. A range of dynamic trends are pushing market growth and company valuations. Trends like

Multiplex testing

Pathogen evolution and pandemics

Biotechnology advances in genetics

Climate change

Globalization

The rise of rapid testing

Key Topics Covered:

1 Market Guides

1.1 Situation Analysis

2 Introduction and Market Definition

2.1 Market Definition

2.2 Methodology

2.3 Perspective: Healthcare and the IVD Industry

2.3.1 Global Healthcare Spending

2.3.2 Spending on Diagnostics

2.3.3 Important Role of Insurance for Diagnostics

2.4 The Nature of the IVD Product

2.4.1 Features Overview

2.4.2 The Misunderstood Feature

2.4.3 Regulation

2.4.4 The Newest Feature

2.4.5 The Oldest Feature

2.4.6 All About Scope

2.4.7 Why Turnaround is Becoming More Important

2.4.8 The Role of Trust

2.5 The IVD Product of the Future

3 Infectious Diseases - Guide to the Pathogens

3.1 Infectious Disease Pathogens - The Big Picture

3.1.1 Viruses

3.1.2 Bacteria

3.1.3 Fungi

3.1.4 Parasites

3.1.5 Prions

3.1.6 Virulence

3.1.7 Transmission

3.2 The Coronavirus

3.2.1 Severe acute respiratory syndrome (SARS)

3.2.2 Middle East respiratory syndrome (MERS)

3.2.3 COVID-19. The SARS CoV 2 Virus.

4 Industry Overview

4.1 Players in a Dynamic Market

4.1.1 Academic Research Lab

4.1.2 Diagnostic Test Developer

4.1.3 Instrumentation Supplier

4.1.4 Chemical/Reagent Supplier

4.1.5 Pathology Supplier

4.1.6 Independent Clinical Laboratory

4.1.7 Public National/regional Laboratory

4.1.8 Hospital Laboratory

4.1.9 Physicians Office Lab (POLS)

4.1.10 Audit Body

4.1.11 Certification Body

4.2 The Clinical Laboratory Market Segments

4.2.1 Traditional Market Segmentation

4.2.2 Laboratory Focus and Segmentation

4.2.3 Segmenting the Syndromic Testing Market

4.3 Industry Structure

4.3.1 Hospital Testing Share

4.3.2 Economies of Scale

4.3.3 Hospital vs. Central Lab

4.3.4 Physician Office Labs

4.3.5 Physicians and POCT

5 Market Trends

5.1 Factors Driving Growth

5.1.1 The Nucleic Acid Impact

5.1.2 Population Dynamics

5.1.3 The Developing World

5.1.4 Decentralization

5.1.5 Self Testing

5.1.6 The Need for Speed

5.2 Factors Limiting Growth

5.2.1 Costs and Experience Curve Effects

5.2.2 The Role of ID Prevalence

5.2.3 Wellness

5.2.4 The Impact of Living Standards

5.3 Instrumentation, Automation and Diagnostic Trends

5.3.1 Traditional Automation and Centralization

5.3.2 The New Automation, Decentralization and Point Of Care

5.3.3 Instruments Key to Market Share

5.3.4 Bioinformatics Plays a Role

5.3.5 PCR Takes Command

5.3.6 Next Generation Sequencing Fuels a Revolution

5.3.7 NGS Impact on Pricing

5.3.8 Whole Genome Sequencing, A Brave New World

5.3.9 Companion Diagnostics Blurs Diagnosis and Treatment

6 Clinical Laboratory MDx Infectious Disease Recent Developments

6.1 Recent Developments - Importance and How to Use This Section

6.1.1 Importance of These Developments

6.1.2 How to Use This Section

6.2 Roche Respiratory Panel Receives FDA EUA

6.3 Genetic Signatures Gets Approval for GI Parasite Panel

6.4 Diasorin Expands Respiratory Panel

6.5 BioMerieux Outlines MDx-Driven Growth

6.6 T2 Biosystems Gets Extended T2Bacteria Panel

6.7 Diasorin Aims to Deliver Updated Instruments, New Assays

6.8 Oxford Nanopore Nabs Investment From BioMerieux

6.9 Day Zero Diagnostics Closes Financing Round

6.10 Spindiag Seeks Investors for Rapid PCR System

6.11 Sorrento Therapeutics Nabs Contract for Dx Platform

6.12 Kephera Planning Menu of Infectious Disease Tests

6.13 Oxford Nanopore and BioMerieux to Develop IDDx

6.14 SD Biosensor Eyes Global Expansion

6.15 Selux Dx Next Gen Phenotyping Gets FDA Clearance

6.16 Takara Developing High-Throughput Multiplex Panels

6.17 BioGX Debuts New Point-of-Care Molecular Testing System

6.18 Nanopath MDx Platform Providing 15-Minute Results

6.19 ProtonDx Commercializing Rapid MDx Instrument

6.20 Siemens Healthineers to Develop Next-Gen, High-Throughput MDx Platform

6.21 Hologic Obtains CE Mark for MDx Epstein-Barr, BK Virus Assays

6.22 Pathogenomix Infectious Disease Platform Uses Cloud-Based Analytics, NGS

6.23 Accelerate Diagnostics Anticipates Growth

6.24 Growth of Decentralized Testing Expected to Continue

6.25 Lumos Diagnostics Expanding Test Portfolio

6.26 Study Validates Karius Cell-Free DNA to Detect Hundreds of Pathogens

6.27 CareDx, IDbyDNA Develop Infectious Disease Dx for Transplant Patients

7 Key Companies

7.1 Abbott Laboratories

7.2 Agilent

7.3 Altona Diagnostics

7.4 Anitoa

7.5 Autonomous Medical Devices

7.6 Beckman Coulter Diagnostics (Danaher)

7.7 Becton, Dickinson and Company

7.8 BioGX

7.9 Biomatik

7.10 bioMerieux Diagnostics

7.11 Bio-Rad Laboratories, Inc

7.12 Cepheid (Danaher)

7.13 Diasorin S.p.A.

7.14 DNAe

7.15 Flow Health

7.16 Global Access Diagnostics

7.17 Great Basin Scientific, Inc

7.18 Hologic

7.19 Novacyt

7.20 Novus Diagnostics

7.21 Oncimmune

7.22 One Codex

7.23 OraSure Technologies

7.24 Proof Diagnostics

7.25 Qiagen

7.26 QuidelOrtho

7.27 R-Biopharm AG

7.28 Response Biomedical

7.29 Revvity

7.30 Roche Diagnostics

7.31 Siemens Healthineers

7.32 Thermo Fisher Scientific

7.33 Vela Diagnostics

7.34 Veredus Laboratories

7.35 YD Diagnostics

7.36 Zhejiang Orient Gene Biotech

8 The Global Market for Clinical Laboratory MDx Infectious Disease

8.1 Global Market Overview by Country

8.2 Global Market by Application - Overview

8.3 Global Market by Place - Overview

9 Global Clinical Laboratory MDx Infectious Disease Markets - By Application

9.1 Respiratory

9.2 Blood Borne Virus

9.3 Transplant

9.4 Hospital Acquired Infections

9.5 Reproductive Health

9.6 C19 Singleplex

9.7 Meningitis

9.8 Gastrointestinal

9.9 Tropical

10 Global Clinical Laboratory MDx Infectious Disease Markets - By Place

10.1 Hospital Lab

10.2 Outpatient Lab

10.3 Point of Care

10.4 Other Place

11 Appendices

11.1 Growth of Approved IVD Test Menu

11.2 Growth of Approved Average IVD Test Fee

11.3 The Most Used IVD Assays

11.4 The Highest Grossing Assays

11.5 Laboratory Fees Schedule

For more information about this report visit

https://www.researchandmarkets.com/r/fte25m

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

11 Nov 2024

DUBLIN--(

BUSINESS WIRE

)--The

"European Life Science Tools and Reagents Market"

report has been added to

ResearchAndMarkets.com's

offering.

The European market for life science tools and reagents and COVID-19 diagnostics products was valued at $14.7 billion in 2023. The market is expected to grow from $13.0 billion in 2024 to $15.4 billion by the end of 2029, at a compound annual growth rate (CAGR) of 3.4% from 2024 through 2029.

This report provides a comprehensive analysis of the European market for life science tools and reagents, including the leading companies, their revenues, product portfolios and recent activities. It looks at the competitive landscape, trends and market dynamics, such as drivers, restraints and opportunities. It also analyzes the current and future markets.

The reagents studied are antibodies, enzyme-linked immunosorbent assay (ELISA) kits, protein reagents and probes. The life science tools included are hybridization systems, PCR, Western blotting instruments and ELISA instruments. The countries whose markets are analyzed are Germany, France, the U.K., Italy, Spain, Switzerland and the Rest of Europe. Markets are also analyzed by application.

One of Europe's most significant strategic assets is the life science industry, which produces cutting-edge drugs and vaccines essential to the long-term health and security of European residents. Innovation in the field of life science has transformed the trajectory of a number of diseases. According to the EFPIA article on Competitiveness Strategy for European Life Science, HIV, which was once considered a deadly disease, has now been changed to a manageable disease, significant advances in cancer care have transformed survival rates, 95% of patients can now be cured of hepatitis C, and new tools have been developed to manage cardiovascular diseases and obesity.

During the 1980s Europe was considered the global leader in pharmaceutical discovery, development and manufacturing. However, that position has gradually been ceded to the U.S., which is currently dominating the global healthcare industry. Of the top 50 global pharmaceutical companies, only 10 are headquartered in Europe. As the highest revenue-generating companies will invest more in R&D, U.S. companies are expected to hold a competitive edge in the near future.

A recent report published in 2023, as an initiative of Biomed Alliance in Europe, EuropaBio, and Johnson & Johnson, highlights that by 2021, the public investments in healthcare research in the U.S. reached $43.6 billion (€40 billion), compared to $9.4 billion (€8.4 billion) annually in the Europe. The number of clinical trials conducted in European countries is also lower than in the U.S. In addition, as emerging markets such as China and Korea continue to expand, research activity is moving from Europe to these regions. Therefore, it is imperative for the European government to take certain measures to regain its position in the healthcare industry. Such measures include slowly increasing spending on research and ensuring research and development activities are not moving to other countries in the future.

The European market for life science tools and reagents is expected to grow from $12.5 billion in 2024 to $15.3 billion by the end of 2029, at a CAGR of 4.2% from 2024 through 2029. The European market for life science COVID-19 diagnostics products is expected to decline from $479.6 million in 2024 to $29.4 million by the end of 2029, at a negative CAGR of 42.8% from 2024 through 2029.

European Life Science Tools and Reagents Market Scope

An analysis of the European market for life science tools and reagents, including COVID-19 diagnostics products

Analyses of the market trends, with historic market revenue data (sales figures) for 2021-2023, estimates for 2024, and projected CAGRs through 2029

Estimates of the market size and revenue forecasts for the market for life science tools and reagents, with market share analysis by product, application, and country

Discussions of the market dynamics, opportunities and challenges, as well as emerging technologies

Overview of the sustainability trends and ESG developments in the industry, with emphasis on the ESG practices of leading companies, their ESG scores, and consumer attitudes

Competitive intelligence, including companies' market shares, recent M&A activity and venture funding

Profiles of the leading companies, including Thermo Fisher Scientific Inc., Danaher Corp., Merck KGaA, Qiagen and Roche

Full List of Company Profiles Included in this Report:

Agilent Technologies Inc.

Altona Diagnostics Gmbh

Analytik Jena GmbH+Co. KG

BD

Bio-Rad Laboratories Inc.

Danaher Corp.

F. Hoffmann-La Roche Ltd.

Merck KGaA

Promega Corp.

Qiagen

Revvity Inc.

Thermo Fisher Scientific Inc.

Key Attributes:

Report Attribute

Details

No. of Pages

128

Forecast Period

2024 - 2029

Estimated Market Value (USD) in 2024

$13 Billion

Forecasted Market Value (USD) by 2029

$15.4 Billion

Compound Annual Growth Rate

3.4%

Regions Covered

Europe

Key Topics Covered:

Chapter 1 Executive Summary

Market Outlook

Scope of Report

Market Summary

Chapter 2 Market Overview

Overview

Product Development in Life Science

Chapter 3 Market Dynamics

Market Drivers

Increasing Investments in R&D

Increasing Prevalence of Chronic Diseases

Increasing Demand for Various Diagnostics Pathways and In Vitro Diagnostics

Growth in Genomic and Biomarker Research

Increasing Demand for Personalized Medicine

Technological Advances

Market Restraints

End of COVID-19 Pandemic

High Cost of Instruments

Lack of Skilled Personnel

Market Challenges

Regulatory Hurdles

Market Opportunities

Positive Impact from Some Revisions in Pharmaceutical Legislation

New Technologies

Chapter 4 Emerging Technologies and Developments

Overview

Next-Generation Therapeutics

Next-Generation Diagnostics

Digitalization

AI and Machine Learning

Internet of Things (IoT)

Robots in Life Science Labs

Chapter 5 Market Segmentation Analysis

European Market for Life Science Tools and Diagnostics, by Product Type

COVID-19 Diagnostic Tests Market

Market for Life Science Tools and Reagents

European Market for Life Science Tools and Diagnostics, by Application

Genomics

Proteomics

Cell Biology, Antibodies and Recombinant Proteins

Stem Cells Research

Imaging Tools and Techniques

Animal Models

Epigenetics

Metabolomics

Other Applications

European Market for Life Science Tools and Diagnostics, by Country

United Kingdom

Germany

France

Switzerland

Spain

Italy

Rest of Europe

Chapter 6 Competitive Intelligence

PCR Technologies and Reagents

Antibodies

ELISA Instruments

ELISA Kits and Assays

Life Science Kits and Assays

COVID-19 Diagnostics

Strategic Initiatives

Recent Product Introductions in the Market

Chapter 7 Sustainability in Life Science Tools and Reagents in the European Market: An ESG Perspective

Introduction to ESG

ESG Practices in the Industry

Status of ESG in the Industry

Concluding Remarks

Chapter 8 Appendix

For more information about this report visit

https://www.researchandmarkets.com/r/vzsyqe

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Diagnostic Reagents

13 Feb 2024

DUBLIN--(

BUSINESS WIRE

)--The

"Molecular Diagnostics for Infectious Disease By Syndrome, Plex, Place and by Country. With Analysis and Executive Guides. 2023-2027"

report has been added to

ResearchAndMarkets.com's

offering.

In a Post Pandemic world molecular diagnostics sees technologies boom. Nucleic acids become key.

The global market for molecular diagnostics (MDx) in infectious diseases is analyzed across various dimensions in this report. It begins with an overview of the global market by country, providing insights into regional trends and dynamics. The market is further segmented by syndrome, offering detailed analysis of key areas such as respiratory, gastrointestinal, blood, meningitis/encephalitis, sexually transmitted diseases, and others.

Additionally, the report examines the market by plex, distinguishing between single plex, duplex, triplex, and multiplex technologies and their respective market landscapes. Furthermore, the analysis extends to different places where MDx testing is conducted, including hospital labs, outpatient labs, point-of-care settings, and other locations.

This comprehensive examination provides valuable insights into the global MDx infectious disease markets, enabling stakeholders to make informed decisions and capitalize on emerging opportunities.

The Molecular Diagnostics - Infectious Disease sector of the clinical diagnostics industry is poised for record growth. A market that just keeps on growing but is spiking as an enormous C19Dx demand sweeps over the globe. Find out what the numbers are in this informative report. And find out about the exciting developments in multiplex assays which threaten to change diagnosis and treatment while limiting the threat of anti microbial drug resistance.

Infectious disease testing directly benefits from the explosion in biotechnology, especially genomics. Learn all about it in this report. A range of dynamic trends are pushing market growth and company valuations.

Trends like:

Multiplex testing

Pathogen evolution and pandemics

Biotechnology advances in genetics

Climate change

Globalization

The rise of rapid testing

Exciting technical developments especially in the seesaw between nucleic acid testing and immunoassay, hold the promise of a dynamic, growing and evolving world market that holds the promise of diagnostics taking the lead in infectious disease eradication.

The report has hundreds of pages of information including a complete list of Current United States Medicare Fee Payment Schedules to help sharpen your pricing. Again, assistance in using the information is normally provided without additional charges. The report includes detailed breakouts for 15 Countries and 4 Regions. A detailed breakout for any country in the world is available to purchasers of the report.

Key Topics Covered:

1 Market Guides

1.1 Strategic Situation Analysis

1.2 Guide for Executives and Business Development Staff

1.3 Guide for Management Consultants and Investment Advisors

2 Introduction and Market Definition

2.1 What are Molecular Diagnostics?

2.2 The Diagnostics Revolution

2.3 Market Definition

2.3.1 Revenues

2.4 Methodology

2.4.1 Methodology

2.4.2 Sources

2.4.3 Authors

2.5 Perspective: Healthcare and the IVD Industry

2.5.1 Global Healthcare Spending

2.5.2 Spending on Diagnostics

2.5.3 Important Role of Insurance for Diagnostics

3 The Infectious Diseases - Market Analysis by Disease

3.1 HIV - Human Immunodeficiency Virus (AIDS)

3.1.1 Virology

3.1.1.1 Classification

3.1.1.2 Structure and Genome

3.1.1.3 Tropism

3.1.1.4 Replication cycle

3.1.1.5 Genetic variability

3.1.2 Diagnosis

3.1.3 Testing

3.1.3.1 Antibody tests

3.1.3.2 Point of Care Tests (POCT)

3.1.3.3 Antigen Tests

3.1.3.4 Nucleic acid-based tests (NAT)

3.1.3.5 Other tests used in HIV treatment

3.1.4 Market Opportunity Analysis

3.2 HBV - Hepatitis B

3.2.1 Virology

3.2.1.1 Genome

3.2.1.2 Pathogenesis

3.2.1.3 Hepatitis B virus replication

3.2.1.4 Serotypes and genotypes

3.2.2 Mechanisms

3.2.3 Diagnosis

3.2.4 Market Opportunity Analysis

3.3 HCV - Hepatitis C

3.3.1 Taxonomy

3.3.2 Structure

3.3.2.1 Genome

3.3.3 Molecular biology

3.3.4 Replication

3.3.5 Genotypes

3.3.5.1 Clinical importance

3.3.6 Market Opportunity Analysis

3.4 HPV - Human papillomavirus

3.4.1 Virology

3.4.1.1 E6/E7 proteins

3.4.1.2 Role in Cancer

3.4.1.3 E2 research

3.4.1.4 Latency period

3.4.1.5 Clearance

3.4.2 Diagnosis

3.4.2.1 Cervical testing

3.4.2.2 Oral testing

3.4.2.3 Testing men

3.4.2.4 Other testing

3.4.3 Market Opportunity Analysis

3.5 Influenza

3.5.1 Virology

3.5.1.1 Types of virus

3.5.1.2 Influenzavirus A

3.5.1.3 Influenzavirus B

3.5.1.4 Influenzavirus C

3.5.1.5 Structure, properties, and subtype nomenclature

3.5.1.6 Replication

3.5.2 Testing

3.5.2.1 Advantages/Disadvantages of Molecular Assays

3.5.3 Market Opportunity Analysis

3.6 CTGC - Chlamydia/Gonorhea

3.6.1 Gonorrhea

3.6.1.1 Diagnosis

3.6.1.2 Screening

3.6.2 Chlamydia

3.6.2.1 Diagnosis

3.6.2.2 Screening

3.6.3 Testing

3.6.3.1 Nucleic acid amplification tests (NAATs).

3.6.3.2 Performance of NAAT Tests

3.6.4 Market Opportunity Analysis

3.7 Tuberculosis

3.7.1 Mycobacteria

3.7.2 Diagnosis

3.7.2.1 Active tuberculosis

3.7.2.2 Latent tuberculosis

3.7.3 Epidemiology

3.7.4 Molecular Diagnostic Tests

3.7.5 Market Opportunity Analysis

3.8 MRSA - Methicillin-resistant Staphylococcus aureus

3.8.1 Diagnosis

3.8.2 FDA Approved Molecular Tests

3.8.3 Market Opportunity Analysis

3.9 VRE - Vancomycin-resistant Enterococcus

3.9.1 FDA-Approved MDx Tests for VRE

3.9.2 Market Opportunity Analysis

3.10 Blood Screening

3.10.1 Collection and Testing

3.10.2 FDA Approved Multiplex Assays

3.10.3 Market Opportunity Analysis

3.11 COVID-19

3.11.1 Signs and symptoms

3.11.2 Transmission

3.11.3 Diagnosis

3.11.4 Prevention

3.11.5 Management

3.11.6 Prognosis

3.12 Pandemic Diagnostics

3.12.1 Risk Management - Spark and Spread

3.12.2 Dx Technology - Nucleic Acid-Based

3.12.3 Dx Technology - Immunoassay & Serology

3.12.4 Time to Market and Preparedness Issues

3.12.5 Unrecognized Role of Multiplex in Pandemic Management

4 Industry Overview

4.1 Players in a Dynamic Market

4.1.1 Academic Research Lab

4.1.2 Diagnostic Test Developer

4.1.3 Instrumentation Supplier

4.1.4 Chemical/Reagent Supplier

4.1.5 Pathology Supplier

4.1.6 Independent Clinical Laboratory

4.1.7 Public National/regional Laboratory

4.1.8 Hospital Laboratory

4.1.9 Physicians Office Lab (POLS)

4.1.10 Audit Body

4.1.11 Certification Body

4.2 The Clinical Laboratory Market Segments

4.2.1 Traditional Market Segmentation

4.2.2 Laboratory Focus and Segmentation

4.3 Industry Structure

4.3.1 Hospital Testing Share

4.3.2 Economies of Scale

4.3.2.1 Hospital vs. Central Lab

4.3.3 Physician Office Lab's

4.3.4 Physicians and POCT

5 Profiles of Key MDx Companies

6 Market Trends

6.1 Factors Driving Growth

6.1.1 New Genotypes Creating New Markets

6.1.2 The Aging Effect

6.1.3 Developing World Driving ID Dx Growth

6.1.4 Point of Care - Why Centralization is Losing Steam

6.1.5 Self Testing

6.1.6 The Need for Speed

6.1.7 The COVID Pandemic

6.2 Factors Limiting Growth

6.2.1 Lower Costs

6.2.2 Infectious Disease is Declining

6.2.3 Wellness Hurts

6.2.4 Economic Growth Improves Living Standards

6.3 Instrumentation and Automation

6.3.1 Instruments Key to Market Share

6.3.2 The Shrinking Machine

6.3.3 Multiplex, Point of Care, and The Speed Factor

6.4 Diagnostic Technology Development

6.4.1 The Sepsis Testing Market - A New Direction?

6.4.2 POCT/Self Testing as a Disruptive Force

6.4.3 The Genetics Play - One Test for All Known Infections

6.4.4 Antibiotic Resistance Genes - Simplifying Diagnostics

7 Molecular Dx - Infectious Disease Recent Developments

7.1 Recent Developments - Importance and How to Use This Section

7.1.1 Importance of These Developments

7.1.2 How to Use This Section

Company Profiles

Abacus Diagnostica

Abbott Laboratories

Accelerate Diagnostics

Access Bio

Ador Diagnostics

ADT Biotech

Akonni Biosystems

Altona Diagnostics

Alveo Technologies

Anatolia Geneworks

Anitoa

Antelope Dx

Applied BioCode

Assurance Scientific Laboratories

Aureum Diagnostics

Aus Diagnostics

Beckman Coulter Diagnostics

Becton, Dickinson, and Company

Binx Health

Biocartis

BioFire Diagnostics (bioMerieux)

bioMerieux Diagnostics

Bio-Rad Laboratories, Inc

Bosch Healthcare Solutions GmbH

Celemics

Cepheid (Danaher)

Chembio

Co Diagnostics

Credo Diagnostics Biomedical

Cue Health

Curetis N.V. / Curetis GmbH

Detect

Diagenode Diagnostics

Diascopic

Diasorin S.p.A.

Domus Diagnostics

Eiken Chemical

Element Biosciences

Enzo Biochem

Eurofins Scientific

Fluxergy

Fulgent Genetics

Fusion Genomics.

Genedrive

Genetic Signatures

GenMark Dx (Roche)

Genomadix

Grifols

Grip Molecular Technologies

Hibergene Diagnostics

Hologic

Illumina

Immunexpress

Inflammatix

Invetech

Janssen Diagnostics

Karius

Lexagene

LightDeck Diagnostics

Lucira Health

Luminex Corp (DiaSorin)

LumiraDx

Lumos Diagnostics

Mammoth Biosciences

Maxim Biomedical

Meridian Bioscience

Mesa Biotech (Thermo Fisher)

MicroGem

Millipore Sigma

Mindray

Minute Molecular

Mobidiag (Hologic)

Molbio Diagnostics

NanoDx

Nanomix

Novacyt

Novel Microdevices

OnsiteGene

Operon

Oxford Nanopore Technologies

Panagene

Pathogenomix

Perkin Elmer

Prenetics

Primerdesign (Novacyt)

Prominex

Proof Diagnostics

Qiagen

QuantuMDx

Quest Diagnostics

QuidelOrtho

Randox Toxicology

Roche Molecular Diagnostics

Saw Diagnostics

Scope Fluidics

SD Biosensor

Seegene

Siemens Healthineers

Singular Genomics

SomaLogic

Sona Nanotech

SpeeDx

T2 Biosystems

Talis Biomedical

Thermo Fisher Scientific Inc.

Ultima Genomics

Vela Diagnostics

Veramarx

Veredus Laboratories

Vir

Vircell

Visby Medical

XCR Diagnostics

YD Diagnostics

Zhejiang Orient Gene Biotech

For more information about this report visit

https://www.researchandmarkets.com/r/twbxfg

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

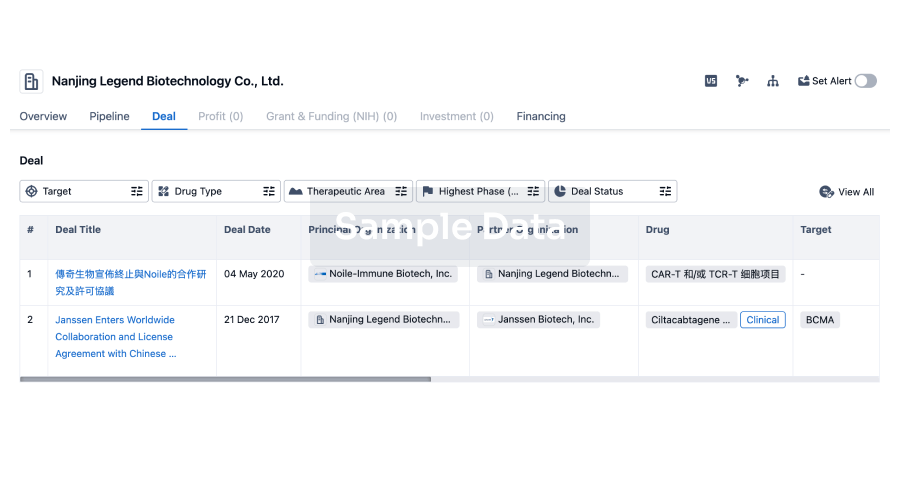

100 Deals associated with altona Diagnostics GmbH

Login to view more data

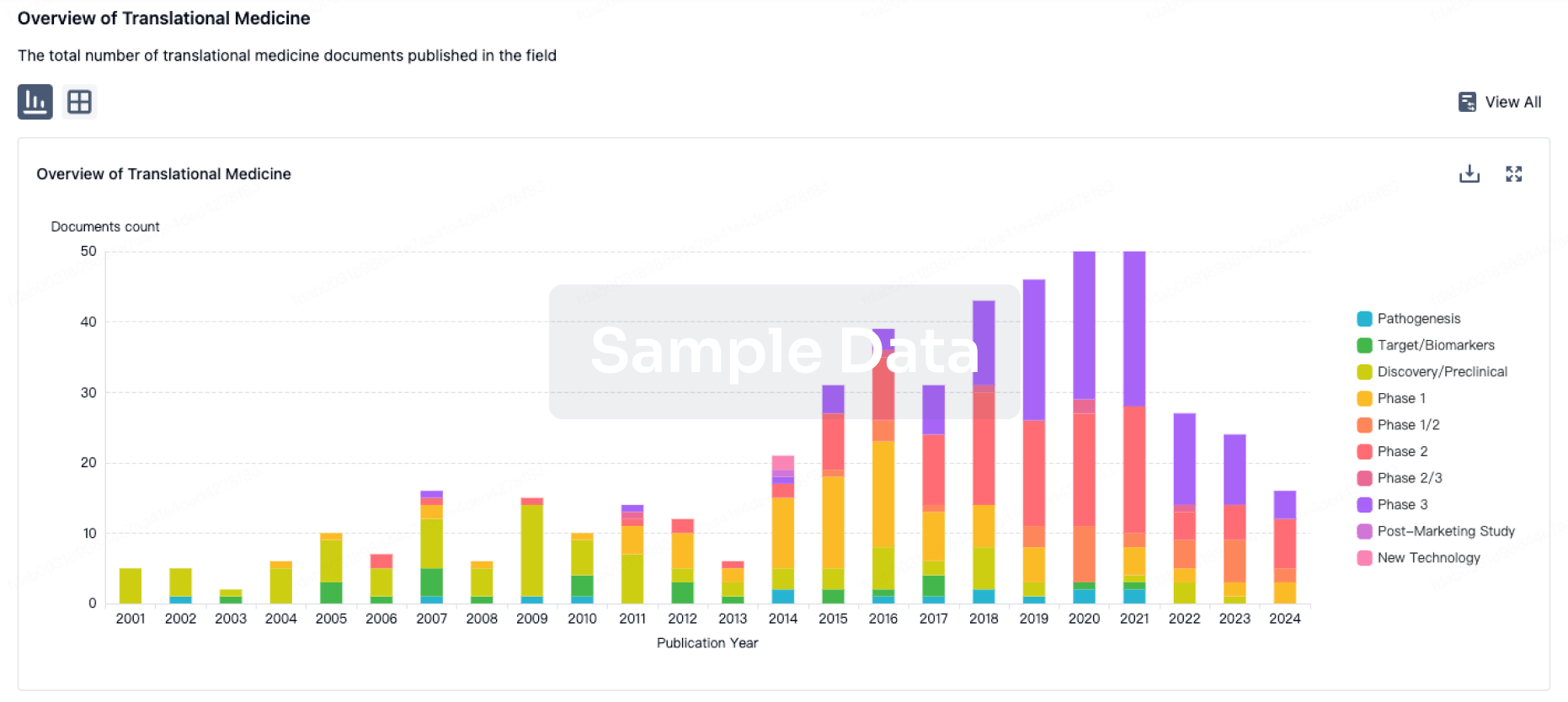

100 Translational Medicine associated with altona Diagnostics GmbH

Login to view more data

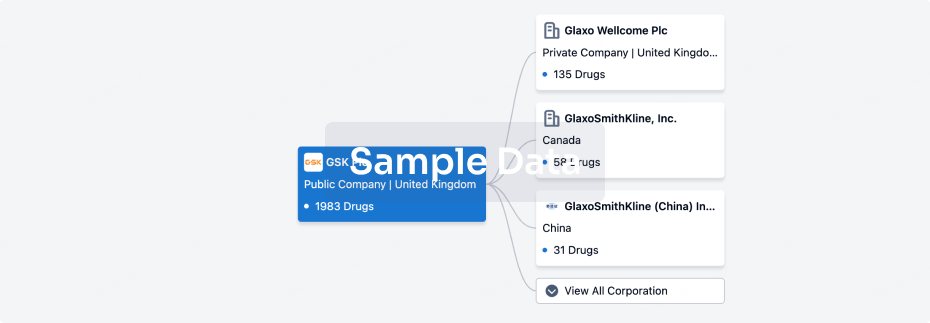

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 09 Jul 2025

No data posted

Login to keep update

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

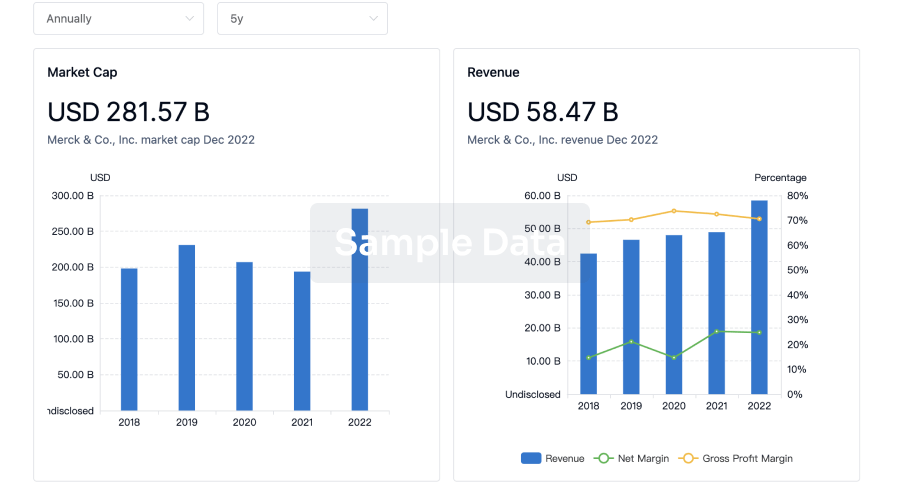

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free