Request Demo

Last update 08 May 2025

Last update 08 May 2025

Overview

Related

100 Clinical Results associated with Fme Feinmechanik AG

Login to view more data

0 Patents (Medical) associated with Fme Feinmechanik AG

Login to view more data

2

News (Medical) associated with Fme Feinmechanik AG04 Mar 2025

Contact

Dennis Hofmann

Head of Corporate Communications

T +49 (0) 6172 608-96008

pr-fre@fresenius.com

Contact

Timo Lindemann

T +49 (0) 6172 608-7939

timo.lindemann@fresenius.com

The information and documents contained on the following pages of this website are for information purposes only. These materials do neither constitute an offer nor an invitation to subscribe to or to purchase securities, nor any investment advice or service, and are not meant to serve as a basis for any kind of obligation, contractual or otherwise. The securities described on the following pages have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the "Securities Act"), and may not be offered or sold in the United States of America (the "United States") absent registration or an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will be no public offering of such securities in the United States or anywhere else and, if offered, any such securities will be offered and sold only (i) outside of the United States in "offshore transactions" in accordance with Regulation S of the Securities Act and (ii) in the United States to "qualified institutional buyers" (as defined in Rule 144A under the Securities Act) in transactions exempt from the registration requirements of the Securities Act.

THE FOLLOWING INFORMATION AND DOCUMENTS ARE NOT DIRECTED AT AND ARE NOT INTENDED FOR USE BY (I) PERSONS WHO ARE RESIDENTS OF OR LOCATED IN THE UNITED STATES, CANADA, AUSTRALIA, JAPAN OR SOUTH AFRICA, OR (II) PERSONS IN ANY OTHER JURISDICTION WHERE THE COMMUNICATION OR RECEIPT OF SUCH INFORMATION IS RESTRICTED IN SUCH A WAY THAT PROVIDES THAT SUCH PERSONS SHALL NOT RECEIVE IT. SUCH PERSONS, OR PERSONS ACTING FOR THE BENEFIT OF ANY SUCH PERSONS, ARE NOT PERMITTED TO VISIT THE FOLLOWING PAGES OF THE WEBSITE.

To visit the following parts of this website you must confirm that

(i) you are not a resident of or located in the United States, Canada, Australia, Japan or South Africa,

(ii) you are not a person to whom the communication of the information contained on the website is restricted,

(iii) you will not distribute any of the information and documents contained thereon to any such person, and

(iv) you are not acting for the benefit of any such person.

By clicking on the "Accept" button below, you will be deemed to have made this confirmation.

Accept

Cancel

Submit

Contact

Dennis Hofmann

Head of Corporate Communications

T +49 (0) 6172 608-96008

pr-fre@fresenius.com

Contact

Timo Lindemann

T +49 (0) 6172 608-7939

timo.lindemann@fresenius.com

Documents

Text as PDF document

(PDF, 179 KB)

THIS ANNOUNCEMENT, INCLUDING THE INFORMATION INCLUDED HEREIN, IS RESTRICTED AND IS NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE IN OR INTO THE UNITED STATES OF AMERICA, CANADA, AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH OFFERS OR SALES OF THE SECURITIES WOULD BE PROHIBITED BY APPLICABLE LAW.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

Decisive step in #FutureFresenius highlights another strategic milestone to evolve into a more focused and stronger company.

Enhances strategic flexibility and financial profile to strengthen the balance sheet

Demonstrates commitment to long-term sustainable value creation and provides the basis to further strengthen the growth platforms as part of REJUVENATE

Transaction leverages recent share price gains while keeping options open to participate in future success

Fresenius intends to retain 25% plus one share of Fresenius Medical Care demonstrating it remains a committed shareholder

Gross proceeds of approximately EUR 1.1 billion which will be used in line with stated capital allocation priorities

Fresenius is now positioned to seize new opportunities and drive forward ambitious plans to create long-term profitable growth and shareholder value

Fresenius SE & Co. KGaA (Frankfurt/Xetra: FRE) announces the successful sale of 10.6 million existing shares of Fresenius Medical Care AG ("FME") equivalent to approximately 3.6% of FME's share capital by way of an accelerated bookbuilding procedure at a price of EUR 44.50 per each share (the "Equity Offering"). Fresenius also announces the successful placement of senior unsecured bonds exchangeable into shares maturing in 2028 in an aggregate principal amount of EUR 600 million (the "Bonds") with approximately 10.4 million shares underlying, equivalent to approximately 3.5% of FME's share capital (the "Exchangeable Bond Offering" and together with the Equity Offering, the "Combined Offering"). In total, the Combined Offering generates approximately EUR 1.1 billion of gross proceeds for Fresenius.

The Bonds will have a maturity of 3 years, will be issued at a price of 101.50% of their principal amount and bear no interest, resulting in a yield-to-maturity of (0.50)% per annum. The exchange price was set at EUR 57.85, which corresponds to an exchange premium of 30% above the placement price per share of the Equity Offering, expressing Fresenius' confidence in FME.

Michael Sen, CEO and Chairman of the Fresenius Management Board

said: "This pivotal milestone of selling a stake in Fresenius Medical Care marks another significant step in #FutureFresenius, providing us with enhanced strategic flexibility to further strengthen our growth platforms while setting the basis for long-term profitable growth as we prepare for the next phase, REJUVENATE. By capitalizing on recent share price gains, and the combined transaction structure, we have realised value while continuing to be involved in their future success. This action highlights another strategic step for Fresenius to evolve into a more focused and stronger company, ready to seize new opportunities and drive forward our ambitious plans to deliver long-term profitable growth and shareholder value."

Fresenius will use the proceeds in line with the #FutureFresenius strategy and Fresenius' stated capital allocation priorities, including further strengthening the balance sheet, reducing leverage, and delivering long-term growth and shareholder value.

Sara Hennicken, CFO of Fresenius

added: "By executing this transaction, we have strengthened our balance sheet in line with our capital allocation priorities and financing strategy. It allows us to benefit from Fresenius Medical Care’s recent strong share price performance while maintaining involvement in the company’s future development. The exchangeable bond with a premium of 30% enables us to realize future value creation while also providing cost-effective funding at a zero percent coupon. The well-covered placement highlights strong demand and confidence in Fresenius Medical Care's operational improvements and potential. I am proud of our team's successful execution."

Notwithstanding this disposal, Fresenius remains by far the largest shareholder in FME and will keep a stake of at least 25% plus one share in FME upon full exchange of the Bonds. Upon exchange, Fresenius will have the flexibility to pay in cash, deliver the relevant underlying shares or deliver and pay a combination thereof. Fresenius, which previously held around 32.2% of FME prior to the Combined Offering, has agreed to a lock-up period of 180 days, subject to certain customary exceptions. Settlement of the Equity Offering is expected to take place on 6 March 2025. The Exchangeable Bond Offering is expected to close on 11 March 2025.

Fresenius has been advised by the Joint Bookrunners (as defined below) that the Joint Bookrunners have organized a simultaneous placement of existing shares on behalf of certain subscribers of the Bonds who wish to sell these Shares in short sales to purchasers procured by the Joint Bookrunners in order to hedge the market risk to which the subscribers are exposed with respect to the Bonds that they acquire in the Exchangeable Bond Offering (the "Delta Placement"). The placement price for the shares sold in the Delta Placement was equivalent to the price per share sold in the Equity Offering. The Company will not receive any proceeds, directly or indirectly, from any existing shares sold pursuant to the Delta Placement. Subscribers of Bonds on whose behalf the Delta Placement, if any, is organized will bear all costs associated therewith and any and all customary commissions.

The Combined Offering and the Delta Placement were exclusively aimed at institutional investors. The Bonds were offered and sold outside the United States to institutional investors in accordance with Regulation S ("Regulation S") under the U.S. Securities Act of 1933 (the "Securities Act"). The Concurrent Equity Offering was made to institutional investors in accordance with Regulation S of the Securities Act outside the United States to non-US persons, and within the United States to qualified institutional buyers (as defined in Rule 144A under the Securities Act) pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act.

BofA Securities Europe SA and Goldman Sachs Bank Europe SE acted as Joint Global Coordinators and alongside BNP Paribas and Deutsche Bank Aktiengesellschaft as Joint Bookrunners on the Combined Offering and Banco Santander, S.A. acted as Co-Lead Manager.

24 Feb 2025

Quest to provide comprehensive dialysis-related laboratory and water testing services to Fresenius Medical Care owned and affiliated clinics in the United States

BAD HOMBURG, Germany and SECAUCUS, N.J., Feb. 24, 2025 /PRNewswire/ -- Fresenius Medical Care (XETRA: FME; NYSE: FMS), the world's leading provider of products and services for individuals with renal disease, and Quest Diagnostics (NYSE: DGX), a leading provider of diagnostic information services, today announced that, under terms of a definitive acquisition agreement, Quest will acquire select assets of FME's wholly owned Spectra Laboratories, a leading provider of renal-specific laboratory testing services in the U.S.

In addition, under a separate agreement, Quest will provide comprehensive laboratory services related to end-stage kidney disease (ESKD) and specialized water testing for patients and providers served by dialysis centers operated by Fresenius Medical Care and its wholly owned and joint-venture partners in the United States.

By acquiring select laboratory assets from FME, Quest will add dialysis-related water testing, a new capability, to Quest's comprehensive portfolio. The arrangement will enable FME to gain operational efficiencies and allow FME and other providers and patients at dialysis clinics to benefit from Quest's clinical leadership and diagnostic innovation in chronic kidney disease and transplantation services. It will also leverage Quest's national scale, as multiple Quest laboratories spread across the U.S. will provide testing for nearby dialysis clinics, reducing transportation time and speeding results reporting for some test services. Quest expects to perform testing across several of its laboratories during lower-volume daytime hours, optimizing the return on capital invested into its laboratory network.

Financial terms were not disclosed. The acquisition is expected to close in the second half of 2025, pending customary state regulatory reviews. The transition of services is expected to be complete by early 2026.

"This transaction is part of our comprehensive portfolio optimization strategy to drive operational efficiencies and will provide enhanced experiences for patients and our clinical employees by integrating Quest Diagnostic's industry-leading expertise in laboratory medicine into our dialysis centers. This agreement is a step forward to allow us to remain focused on our core business of providing world-class dialysis care to every patient, every day," said Helen Giza, Chief Executive Officer of Fresenius Medical Care. "Much like Fresenius Medical Care, Quest Diagnostics is passionate about creating a healthier future for patients. These shared values, along with Quest's proven track record for quality care and service, make us confident that they are the right company to continue to deliver a high-quality experience to our patients, physician partners, and clinical staff."

"Our relationship with Fresenius Medical Care will extend our industry-leading test portfolio in chronic kidney disease, one of the nation's most prevalent chronic diseases, to include dialysis-related laboratory and water testing," said Jim Davis, Chairman, CEO and President, Quest Diagnostics. "It will also optimize Quest's national scale to bring high-quality laboratory services closer to FME's dialysis clinics and the patients under their care across the United States."

Fresenius Medical Care recently successfully finished year two of a three-year strategic turnaround and transformation plan. Focusing on businesses and markets with the best strategic fit and greatest scale and sustainable profitable growth potential, Fresenius Medical Care is continuing to execute against its portfolio optimization plan to divest non-core and dilutive assets.

Chronic kidney disease affects about 35.5 million people, or 14%, of the U.S. population, making it one of the nation's 10 most prevalent and costly chronic diseases in the U.S. Up to 9 in 10 adults who have CKD are not aware that they have the disease. Once the disease has progressed to end-stage kidney disease (ESKD), patients typically require transplant or dialysis. More than 800,000 people in the U.S. receive dialysis. Dialysis requires periodic lab testing to manage the disease as well as testing water for contaminants.

About Fresenius Medical Care:

Fresenius Medical Care is the world's leading provider of products and services for individuals with renal diseases of which around 4.1 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,732 dialysis clinics, Fresenius Medical Care provides dialysis treatments for approx. 308,000 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the company's website at .

About Quest Diagnostics

Quest Diagnostics works across the healthcare ecosystem to create a healthier world, one life at a time. We provide diagnostic insights from the results of our laboratory testing to empower people, physicians and organizations to take action to improve health outcomes. Derived from one of the world's largest databases of de-identifiable clinical lab results, Quest's diagnostic insights reveal new avenues to identify and treat disease, inspire healthy behaviors and improve healthcare management. Quest Diagnostics annually serves one in three adult Americans and half the physicians and hospitals in the United States, and our more than 55,000 employees understand that, in the right hands and with the right context, our diagnostic insights can inspire actions that transform lives and create a healthier world. .

Disclaimer:

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care does not undertake any responsibility to update the forward-looking statements in this release.

FME Media contact

Christine Peters

T +49 160 60 66 770

[email protected]

FME Contact for analysts and investors

Dr. Dominik Heger

T +49 6172 609 2601

[email protected]

Quest Media contact

Jen Petrella

T +1 973-520-2800

[email protected]

Quest Contact for analysts and investors

Shawn Bevec

T +1 973-520-2900

[email protected]

SOURCE Fresenius Medical Care Holdings, Inc.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

AcquisitionDiagnostic Reagents

100 Deals associated with Fme Feinmechanik AG

Login to view more data

100 Translational Medicine associated with Fme Feinmechanik AG

Login to view more data

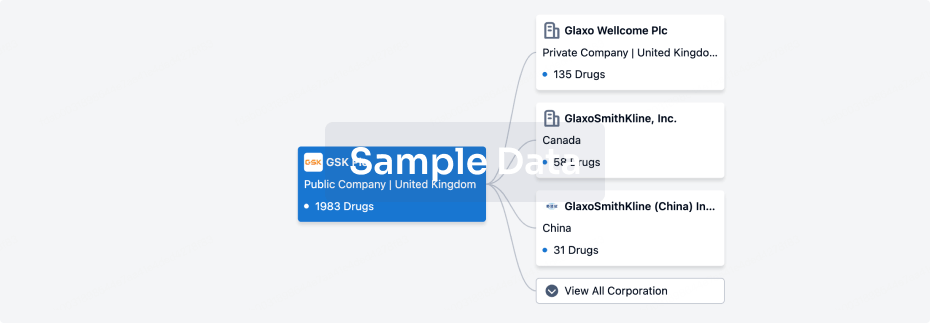

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 31 May 2025

No data posted

Login to keep update

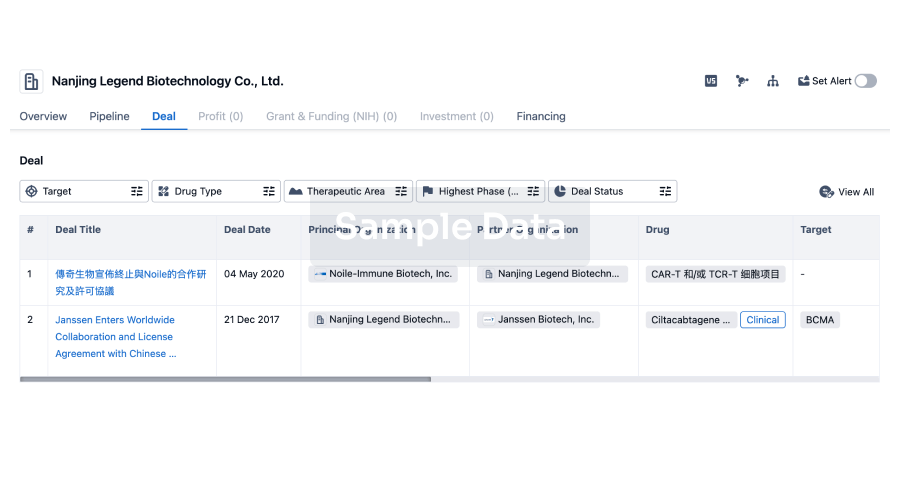

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

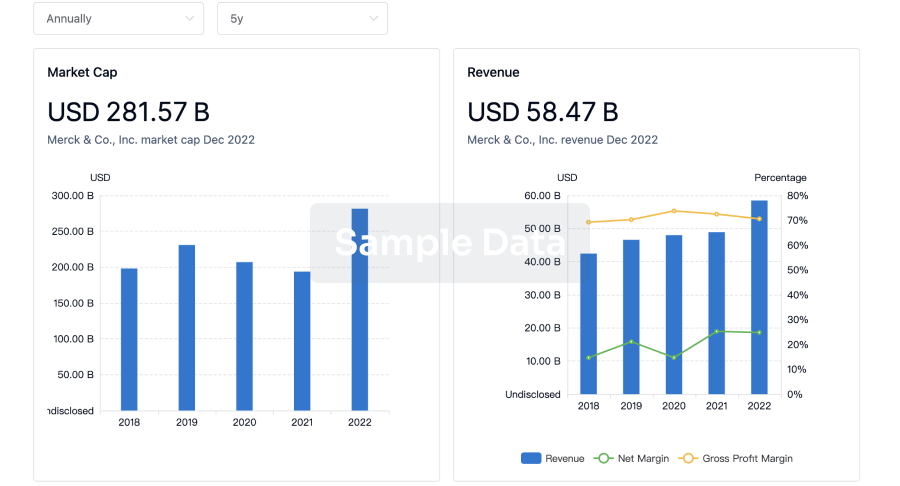

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

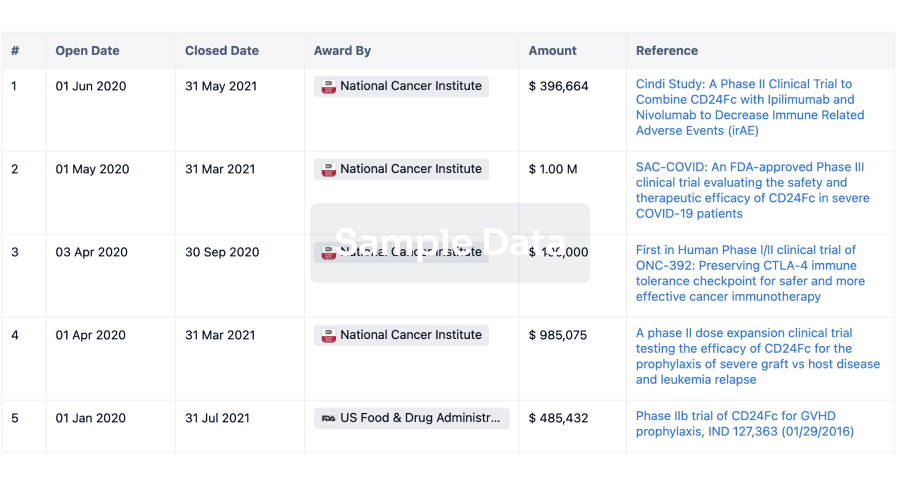

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free