Request Demo

Last update 08 May 2025

Green Cross LabCell Corporation

Last update 08 May 2025

Overview

Related

100 Clinical Results associated with Green Cross LabCell Corporation

Login to view more data

0 Patents (Medical) associated with Green Cross LabCell Corporation

Login to view more data

3

News (Medical) associated with Green Cross LabCell Corporation06 Apr 2023

Obtained ISO 37001 from Korea Compliance Initiative (KCI)

To practice ESG management by enhancing management transparency and ethical management

YONGIN, South Korea, April 6, 2023 /PRNewswire/ -- GC Cell (KOSDAQ: 144510), a Korean biotech company, announced on Apr. 6th that it has successfully attained the international certification for the anti-bribery management system, ISO 37001, from Korea Compliance Initiative (KCI), an international certification body.

ISO 37001 is the international standard for meeting global anti-bribery efforts, such as the OECD Anti-bribery Convention and the UN Convention against Corruption. It defines the control and prevention guidelines against corruption risks that may arise in any organization. The International Organization of Standardization issues it based on a rigorous assessment of whether an organization's management system complies with the international standards for anti-corruption.

With the accreditation by ISO 37001, GC Cell is now equipped with control measures for detecting corruption risks as well as a system to prevent corruption and misconduct.

The company plans to continue strengthening employee training on the anti-bribery management system and ensuring strict compliance with relevant laws and regulations so that all employees internalize ethical and compliant practices as they perform everyday work.

"We will practice ESG management by enhancing management transparency and further strengthening ethical management so that GC Cell can fulfill its social role and responsibilities." said James Park, CEO of CG Cell.

About GC Cell

GC Cell is an integrated corporation created through the recent merger of Green Cross Labcell and Green Cross Cell and focuses on the development and production of treatments using immune cells and stem cells. In particular, it has a variety of pipelines for autologous and allogeneic cell therapies. It also has global competitiveness based on platform technology and experience throughout the entire period from the initial research stage to the commercialization stage.

View original content to download multimedia:

SOURCE GC Cell

Company Codes: Korea:144510

Cell Therapy

26 Feb 2021

Not even one month after Big Pharma took notice of Artiva when Merck

signed

a collaboration worth nearly $2 billion in milestones, the off-the-shelf NK cell biotech already has its next big fundraise.

Artiva returns from the venture well Friday with a $120 million Series B round, money they will use to get their first program into the clinic and to file INDs for another two candidates. The raise marks the latest development in a rapidly expanding footprint for Artiva, which, in addition to the Merck deal last month, has now raised almost $200 million since its

Series A

last June.

So what’s been driving this quick ascent? CEO Fred Aslan told

Endpoints News

it’s been the company’s focus on the NK cell manufacturing process, rather than trying to get efficacy data on their programs as quickly as they can. Artiva exclusively teamed with South Korean NK cell maker Green Cross LabCell, giving Aslan access to more than 10 years of research in the field.

As a result of that partnership, Artiva can not only develop NK cell therapies, but preserve, freeze and ship them without the loss of quality. That scalability is what attracted Merck and other Big Pharmas in the first place — the companies had been taking a wait-and-see approach until allogeneic NK cell development resembled the biologics production they were familiar with, Aslan said.

But now that Artiva has manufacturing locked and loaded, they are ready to “press on the gas” on their own pipeline, he told Endpoints.

The lead program is an NK cell therapy meant to work in combination with monoclonal antibodies, enhancing patients’ response to the drugs. Specifically, Artiva is looking to boost the process known as antibody-dependent cell cytotoxicity, or ADCC. A patient’s own NK cells are responsible for ADCC, which is the mechanism that allows antibodies to work against cancer antigens.

But in some later-line settings, an individual’s NK cells may not be strong enough to mount this response on their own, or they simply may not have enough NK cells circulating in their bodies after going through many different therapies. Once the mechanism is restored, Artiva hopes it can make the antibodies more effective.

Aslan said Artiva is going after non-Hodgkin’s lymphoma as its first target population, and the company has already begun screening patients for enrollment. The company plans to pair the candidate, dubbed AB-101, with rituximab.

Researchers will be conducting a dose-escalating Phase I study with about a dozen patients at first. Aslan declined to say how long the trial is expected to run, but said initial safety data could be available as early as the end of this year.

Artiva’s ultimate goal is to make therapies that have a similar impact as CAR-Ts accessible in a community setting. Friday’s round is a validating step toward that mission, Aslan said, and one that could take the company toward an IPO.

But Aslan played coy when asked about taking Artiva public, saying only that while he’s had thoughts about jumping to Nasdaq, “every company at our stage thinks about an IPO.” No concrete plans for such a leap have been announced as of Friday, he added.

Friday’s round was led by Venrock Healthcare Capital Partners, and was joined by other new investors Acuta Capital Partners, Cormorant Asset Management, EcoR1 Capital, Franklin Templeton, Janus Henderson Investors, Logos Capital, RTW Investments, LP, Surveyor Capital (a Citadel Company), Wellington Management Company, and an undisclosed leading global investment firm.

Existing investors such as 5AM Ventures, RA Capital Management, and venBio Partners, along with strategic partners GC LabCell and GC also participated.

AntibodyCell TherapyIPO

26 Jan 2021

Even though Dean Li has now officially taken over for Roger Perlmutter as R&D chief, Merck’s appetite for dealmaking continues to be ravenous.

Li struck his first big deal at the helm Thursday morning, hammering out a collaboration with Artiva Biotherapeutics that could earn the biotech nearly $1.9 billion when all is said and done. It’s a quick rise and validation for Artiva, which just last June launched with a $78 million Series A.

The agreement focuses on Artiva’s off-the-shelf CAR-NK cell manufacturing platform, with Merck choosing two solid tumor targets for the biotech to tackle. There’s also an option for a third program. Artiva will get $30 million upfront for the first two candidates and another $15 million should the option be exercised.

And the milestones? Artiva can earn up to $612 million for each program, bringing the total potential payout to $1.881 billion.

Artiva’s big idea centers around trying to upscale production of NK cell therapies so they can be more widely available in places like outpatient and community settings. The biotech arose through a partnership with the South Korean biotech Green Cross LabCell, which had built a natural killer cell factory but hadn’t yet developed any drugs outside the country.

By owning the manufacturing process, Artiva is looking to create therapies with the efficacy of the more prominent CAR-Ts but few, if any, of the liabilities, CEO Fred Aslan said. One of CAR-NK cell therapy’s benefits over CAR-T is that, unlike the T cells, NK cells can be delivered to patients who aren’t the donor. With CAR-Ts, physicians can take cells out of a patient but only place them back into that same individual after they’ve been re-engineered.

Thanks in part to the work done over the last 10 years by Green Cross, Artiva can not only develop NK cell therapies, but preserve, freeze and ship them without the loss of quality. When used in an outpatient setting, for example, physicians need only to thaw the IV bags to prepare them for patients.

Fred Aslan

That scalability is ultimately what attracted Merck and other Big Pharma companies in the first place, Aslan said. The fact that Artiva is already starting clinical trials on some in-house programs, using products that have been shipped while cryopreserved, is a sign the company is ready to take it to the next level, he added.

Most pharma companies have taken “a watchful, waiting approach until it’s clear that there’s a biologics business model available for cell therapy,” Aslan told Endpoints News. Artiva believes that’s exactly what they have, “because of our manufacturing first approach, and our ability to turn cell therapy into a biologics business model that pharma is used to.”

Merck and Artiva aren’t disclosing what Thursday’s targets are, only that they involve antigens that present on solid tumors and are completely separate from Artiva’s current candidates. Artiva will carry development through the first manufacturing campaign and IND studies, at which point Merck will take over responsibility.

Mum’s also the word on the timelines for these therapies, though COO Peter Flynn said they have a good idea how long development could take based on previous markers by the internal programs.

Cell TherapyCollaborate

100 Deals associated with Green Cross LabCell Corporation

Login to view more data

100 Translational Medicine associated with Green Cross LabCell Corporation

Login to view more data

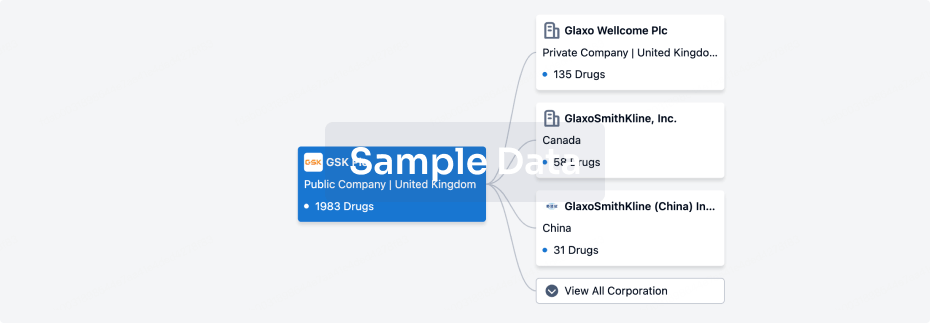

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 19 Oct 2025

No data posted

Login to keep update

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

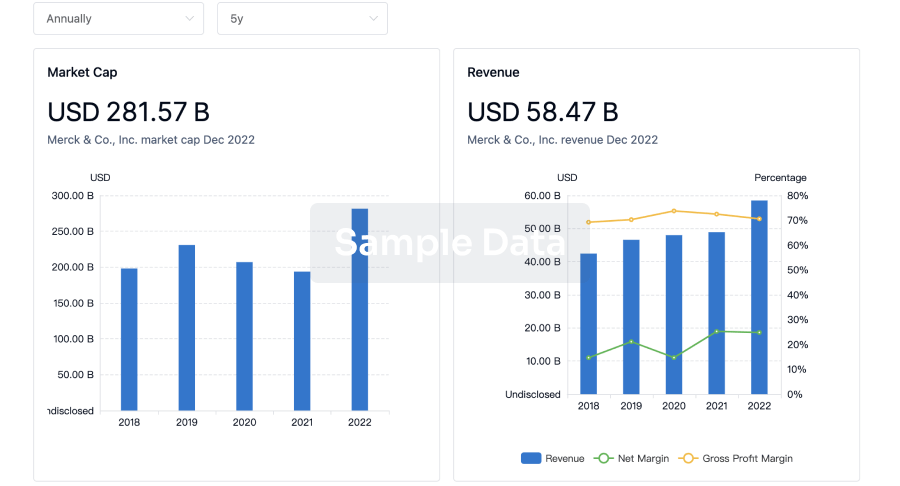

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

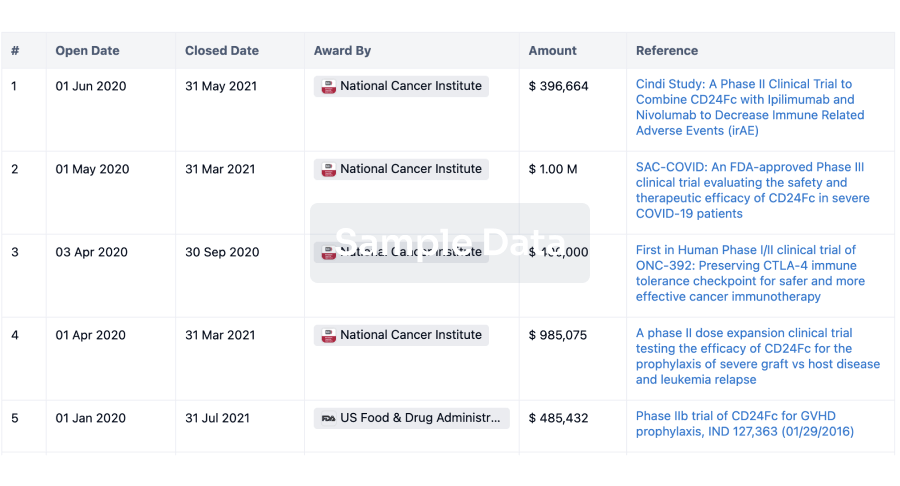

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

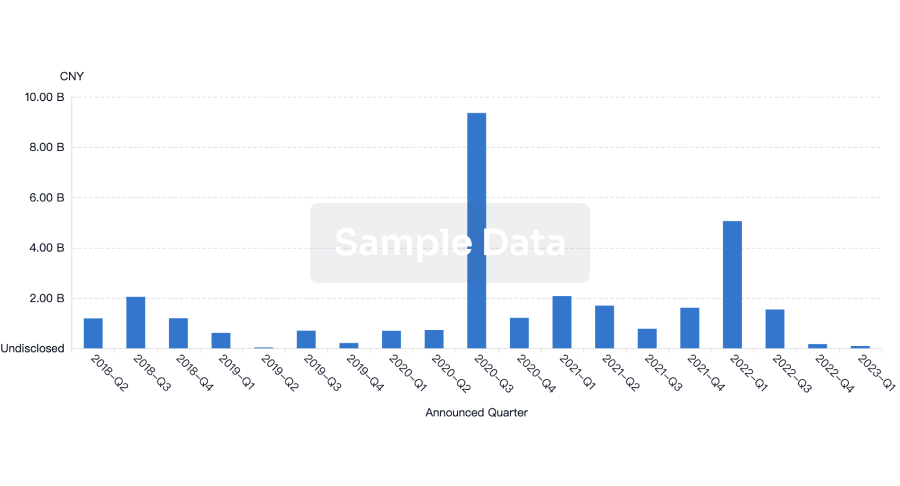

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free