Request Demo

Last update 07 Dec 2025

Allurion Technologies, Inc.

Public Company | Subsidiary Company|2009|Massachusetts, United States|

250-500

| NYSE: ALUR| Public Company | Subsidiary Company|2009|Massachusetts, United States|

250-500

| NYSE: ALUR| Last update 07 Dec 2025

Overview

Related

5

Clinical Trials associated with Allurion Technologies, Inc.NCT05368259

A Prospective, Open-Label, Multi-Center, Randomized, Pivotal Safety and Efficacy Study of the Allurion Gastric Balloon System + Moderate Intensity Lifestyle Modification Therapy Program vs. Moderate Intensity Lifestyle Modification Therapy Program for the Treatment of Adults With Obesity

The objective for this clinical study is to provide FDA with clinical evidence regarding the effectiveness and safety of the AGBS + moderate intensity lifestyle modification therapy program, indwell time of the AGBS inside the stomach, and outcomes at 48 weeks.

Start Date12 May 2022 |

Sponsor / Collaborator |

NL-OMON49911

A Prospective Pilot Study of the Allurion Digital Behaviour Change Intervention - DBCI

Start Date27 Aug 2021 |

Sponsor / Collaborator |

NCT05884606

A Prospective Pilot Study of the Allurion Digital Behaviour Change Intervention

The proposed study is a prospective, non-randomized, pilot study to test the impact of the Allurion Digital Behaviour Change Intervention (DBCI) in participants who have been treated with the Allurion™ Gastric Balloon System. The study will include a nested qualitative and quantitative evaluations of the intervention from both the participant and Allurion provider perspective.

Start Date19 Jun 2021 |

Sponsor / Collaborator |

100 Clinical Results associated with Allurion Technologies, Inc.

Login to view more data

0 Patents (Medical) associated with Allurion Technologies, Inc.

Login to view more data

57

News (Medical) associated with Allurion Technologies, Inc.12 Nov 2025

NATICK, Mass.--(BUSINESS WIRE)--Allurion Technologies, Inc. (NYSE: ALUR), a pioneer in metabolically healthy weight loss, today announced its financial results for the third quarter and provided a business update.

Recent Company Highlights

Successfully passed U.S. Food and Drug Administration (“FDA”) Pre-Approval Inspection and Bioresearch Monitoring (BIMO) audit with zero observations and no Form 483 issued

Completed Premarket Approval (“PMA”) Acceptance and Filing Reviews, entered Substantive Review for the Allurion Smart Capsule and successfully completed Day-100 meeting

Entered into transaction to exchange all outstanding debt for convertible preferred equity and concurrently announced private placement financing of $5 million to strengthen balance sheet

Explored initial development of drug-eluting intragastric device and process validation of new R&D and manufacturing line in collaboration with strategic partner

Operating expenses of $10.9 million and operating loss of $9.6 million reduced by 29% and 22%, respectively, compared to last year. Adjusted operating expenses of $8.4 million and operating loss of $6.9 million reduced by 42% and 39%, respectively, compared to last year.

“In this past quarter at Allurion, we achieved several significant milestones toward FDA approval,” said Dr. Shantanu Gaur, Founder and CEO of Allurion. “From July through October, we passed two FDA inspections with zero observations and successfully conducted our Day-100 meeting. We believe that we are now entering the final stages of the process.

“As we near a potential FDA approval, we also took several steps to strengthen our balance sheet and set Allurion up for long-term success,” said Dr. Gaur. “By entering into a transaction to exchange all of our outstanding debt for convertible preferred equity and closing the private placement, we believe we are better positioned to deliver on key catalysts, including FDA approval.

“In the third quarter, we began executing across our strategy to focus on accounts that can offer comprehensive obesity care and distributors who have access to those networks,” said Dr. Gaur. “Even with the restructuring that we conducted in August, we were able to deliver on revenue expectations and continued to narrow our operating loss and reduce expenses. We believe the strategy we are executing now could be a useful playbook for US market entry.

“Finally, as we explore next-generation R&D and manufacturing initiatives with our new strategic partner, we have begun to view the Allurion Smart Capsule as more of a platform technology that could, longer-term, deliver drugs of all kinds—not just GLP-1s—to address adherence issues that are inherent to pharmacotherapy,” said Dr. Gaur. “We believe that with this approach, we could one day build a new standard of care in not only obesity management but also across several other disease areas, and we are looking forward to proving this out in the future.”

Third Quarter Financial Results

Total revenue for the quarter ended September 30, 2025 was $2.7 million, compared to $5.4 million for the same period in 2024. The year-over-year decrease in revenue was primarily due to the distributor transitions initiated in the second quarter of 2025 and lower investments in sales and marketing as a result of restructuring.

Gross profit for the quarter was $1.3 million, or 49% of revenue, compared to $3.1 million, or 58% of revenue, for the same period in 2024, and included $0.1 million in restructuring costs. The decrease in gross profit was driven by a decrease in sales and lower production volumes leading to less absorption of labor and overhead costs.

Sales and marketing expenses for the quarter were $3.1 million, compared to $5.2 million for the same period in 2024, and included $1.1 million in restructuring costs. The reduction in expense was primarily driven by increased operating efficiency and the restructuring initiatives implemented previously.

Research and development expenses for the quarter were $2.0 million, compared to $3.2 million for the same period in 2024, and included $0.5 million in restructuring costs. The reduction was primarily driven by reduced costs related to the AUDACITY trial and restructuring initiatives implemented previously.

General and administrative expenses for the third quarter were $5.8 million, compared to $7.0 million for the same period in 2024, and included $0.9 million in restructuring costs. The reduction year over year was primarily driven by previous restructuring initiatives.

Loss from operations for the third quarter was $9.6 million compared to $12.3 million for the same period in 2024. Adjusted loss from operations for the third quarter of 2025 was $6.9 million, excluding restructuring costs of $2.7 million. Adjusted loss from operations for the third quarter of 2024 was $11.4 million, excluding one-time financing costs of $0.9 million. The reduction was driven by previous restructuring initiatives.

As of September 30, 2025, cash and cash equivalents were $6.1 million, not including the private placement financing of $5 million.

Conference Call and Webcast Details

Company management will host a conference call to discuss financial results and provide a business update on November 12, 2025 at 8:30 AM ET.

To access the conference call by telephone, please dial (888) 330-3417 (domestic) or +1 (646) 960-0804 (international) and use Conference ID 1905455. To listen to the conference call via live audio webcast, please visit the Events section of Allurion’s Investor Relations website at Allurion - Events & Presentations.

About Allurion

Allurion is a pioneer in metabolically healthy weight loss. The Allurion Program is a weight-loss platform that combines the Allurion Smart Capsule, the world’s first and only swallowable, Procedureless™ gastric balloon for weight loss, the Allurion Virtual Care Suite, including the Allurion Mobile App for consumers and Allurion Insights for healthcare providers featuring the Iris AI Platform, and the Allurion Connected Scale. The Allurion Virtual Care Suite is also available to providers separately from the Allurion Program to help customize, monitor, and manage weight-loss therapy for patients regardless of their treatment plan. The Allurion Smart Capsule is an investigational device in the United States.

For more information about Allurion and the Allurion Virtual Care Suite, please visit www.allurion.com.

Allurion is a trademark of Allurion Technologies, Inc. in the United States and countries around the world.

Non-GAAP Financial Measures

Relevant income statement items contained in this release are also presented on an “adjusted” basis, which exclude items that are of a one-time nature that do not impact the ongoing performance of the business and reflect the way the Company’s management and the Board of Directors view the performance of the Company internally. The Company believes that excluding the effects of these items from its operating results allows management and investors to effectively compare the true underlying financial performance of its business from period to period and against its global peers.

Forward-Looking Statements

This press release contains forward-looking statements that reflect Allurion’s beliefs and assumptions based on information currently available. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terms, although not all forward-looking statements contain these words. Although Allurion believes it has a reasonable basis for each forward-looking statement contained in this release, these statements involve risks and uncertainties that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Forward-looking statements in this press release include, but are not limited to, statements regarding: the impact of the exchange of our outstanding debt for convertible preferred stock and the recently completed private placement; the potential of the Allurion Smart Capsule to be combined with other treatments, including treatments for conditions other than weight loss; establishing a new standard for weight loss; combination with other treatments; choosing appropriate strategic, distribution, or other partners; pioneering in healthy weight loss and maintenance of muscle mass; the uniqueness of Allurion’s product and service offerings, including the Allurion Program; the status of the FDA’s review of the Company’s PMA application for the Allurion Smart Capsule; expectations regarding entry into the U.S. market; and other statements about future events that reflect the current beliefs and assumptions of Allurion’s management based on information currently available to management.

Allurion cannot assure you that the forward-looking statements in this press release will prove to be accurate. These forward looking statements are subject to a number of risks and uncertainties, including, among others, general economic, political and business conditions; the ability of Allurion to obtain and maintain regulatory approval for, and successfully commercialize, the Allurion Program, including the Allurion Smart Capsule; the timing of, and results from, Allurion’s clinical studies and trials, including with respect to the combination of GLP-1s with the Allurion Smart Capsule; the evolution of the markets in which Allurion competes, including the impact of GLP-1 drugs; the ability of Allurion to maintain its listing on the New York Stock Exchange; a changing regulatory landscape in the highly competitive industry in which Allurion competes; the impact of the imposition of current and potential tariffs and trade negotiations, and those factors discussed under the heading “Risk Factors” in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 27, 2025, as amended by Amendment No. 1 thereto filed on August 19, 2025, and updated from time to time by its other filings with the SEC, and its Quarterly Report on Form 10-Q filed with the SEC on August 19, 2025. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made. Allurion undertakes no obligation to update any forward-looking statements to reflect any new information, events, or circumstances after the date they are made, or to reflect the occurrence of unanticipated events, other than as required by applicable law.

Condensed Consolidated Statements of Operations

(dollars in thousands, except per share amounts)(unaudited)

Three Months Ended September 30,

Nine Months Ended September 30,

2025

2024

2025

2024

Revenue

$

2,658

$

5,367

$

11,617

$

26,519

Cost of revenue

1,354

2,256

3,654

7,549

Gross profit

1,304

3,111

7,963

18,970

Operating expenses:

Sales and marketing

3,129

5,197

9,162

18,060

Research and development

2,016

3,212

6,440

13,247

General and administrative

5,789

7,043

16,224

20,746

Total operating expenses:

10,934

15,452

31,826

52,053

Loss from operations

(9,630

)

(12,341

)

(23,863

)

(33,083

)

Other income (expense):

Interest expense

—

—

—

(2,264

)

Changes in fair value of warrants

1,482

9,703

9,214

14,210

Changes in fair value of debt

(1,250

)

7,930

(2,450

)

16,000

Changes in fair value of Revenue Interest Financing and PIPE Conversion Option

(2,571

)

496

(6,331

)

(7,598

)

Changes in fair value of earn-out liabilities

(18

)

2,260

997

22,140

Loss on extinguishment of debt

—

—

(660

)

(8,713

)

Other income (expense), net

112

757

520

1,928

Total other income (expense):

(2,245

)

21,146

1,290

35,703

Loss before income taxes

(11,875

)

8,805

(22,573

)

2,620

Provision for income taxes

(9

)

(69

)

(147

)

(210

)

Net (loss) income

(11,884

)

8,736

(22,720

)

2,410

Cumulative undeclared preferred dividends

—

—

—

—

Net loss attributable to common shareholders

$

(11,884

)

$

8,736

$

(22,720

)

$

2,410

Net loss per share

Basic

$

(1.53

)

$

3.41

$

(3.43

)

$

1.13

Diluted

$

(1.53

)

$

3.40

$

(3.43

)

$

(2.42

)

Weighted-average shares outstanding

Basic

7,762,703

2,563,459

6,624,839

2,132,416

Diluted

7,762,703

2,566,321

6,624,839

2,392,202

Condensed Consolidated Balance Sheets

(dollars in thousands, except share amounts)(unaudited)

September 30,

2025

December 31,

2024

Assets

Current assets:

Cash and cash equivalents

$

6,136

$

15,379

Accounts receivable, net of allowance of doubtful accounts of $7,613 and $6,701, respectively

3,983

7,134

Inventory, net

3,665

3,400

Prepaid expenses and other current assets

812

1,243

Total current assets

14,596

27,156

Property and equipment, net

1,514

2,469

Right-of-use asset

1,078

2,079

Other long-term assets

953

1,109

Total assets

$

18,141

$

32,813

Liabilities and Stockholders’ Deficit

Current liabilities:

Accounts payable

$

2,813

$

6,572

Current portion of lease liabilities

471

869

Accrued expenses and other current liabilities

8,336

11,422

Total current liabilities

11,620

18,863

Warrant liabilities

5,718

4,567

Revenue Interest Financing liability

49,900

49,200

Earn-out liabilities

93

1,090

Convertible notes payable

32,240

35,710

Lease liabilities, net of current portion

682

1,344

Other liabilities

816

17

Total liabilities

101,069

110,791

Commitments and Contingencies

Stockholders’ deficit:

Preferred stock, $0.0001 par value — 100,000,000 shares authorized as of September 30, 2025; and no shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively

—

—

Common stock, $0.0001 par value — 1,000,000,000 shares authorized as of September 30, 2025; and 7,767,027 and 2,710,607 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively

5

3

Additional paid-in capital

163,354

152,596

Accumulated other comprehensive (loss) income

(1,360

)

(8,370

)

Accumulated deficit

(244,927

)

(222,207

)

Total stockholders’ deficit

(82,928

)

(77,978

)

Total liabilities and stockholders’ deficit

$

18,141

$

32,813

Non-GAAP Net Operating Loss Reconciliation

(dollars in thousands)(unaudited)

Three Months Ended September 30, 2025

GAAP Results

Restructuring Costs

Adjusted Results

Revenue

$

2,658

$

—

$

2,658

Cost of revenue

1,354

149

1,205

Gross profit

1,304

(149

)

1,453

Operating expenses:

Sales and marketing

3,129

1,117

2,012

Research and development

2,016

514

1,502

General and administrative

5,789

916

4,873

Total operating expenses:

10,934

2,547

8,387

Loss from operations

(9,630

)

(2,696

)

(6,934

)

Other income (expense):

Interest expense

—

—

—

Changes in fair value of warrants

1,482

—

1,482

Changes in fair value of debt

(1,250

)

—

(1,250

)

Changes in fair value of Revenue Interest Financing and PIPE Conversion Option

(2,571

)

—

(2,571

)

Changes in fair value of earn-out liabilities

(18

)

—

(18

)

Loss on extinguishment of debt

—

Other income (expense), net

112

—

112

Total other income:

(2,245

)

—

(2,245

)

Income before income taxes

(11,875

)

(2,696

)

(9,179

)

Provision for income taxes

(9

)

—

(9

)

Net income

$

(11,884

)

$

(2,696

)

$

(9,188

)

Three Months Ended September 30, 2024

GAAP Results

Financing Costs

Adjusted Results

Revenue

$

5,367

$

—

$

5,367

Cost of revenue

2,256

—

2,256

Gross profit

3,111

—

3,111

Operating expenses:

Sales and marketing

5,197

—

5,197

Research and development

3,212

—

3,212

General and administrative

7,043

946

6,097

Total operating expenses:

15,452

946

14,506

Loss from operations

(12,341

)

(946

)

(11,395

)

Other income (expense):

Interest expense

—

—

—

Changes in fair value of warrants

9,703

—

9,703

Changes in fair value of debt

7,930

—

7,930

Changes in fair value of Revenue Interest Financing and PIPE Conversion Option

496

—

496

Changes in fair value of earn-out liabilities

2,260

—

2,260

Other income (expense), net

757

—

757

Total other income:

21,146

—

21,146

Income before income taxes

8,805

(946

)

9,751

Provision for income taxes

(69

)

—

(69

)

Net income

$

8,736

$

(946

)

$

9,682

Additional Non-GAAP Reconciliations

(unaudited)

Three Months Ended September 30, 2025

Change in Operating Expenses, as reported

(29

)%

Non-GAAP adjustments

(13

)%

Change in Operating Expenses, adjusted

(42

)%

Three Months Ended September 30, 2025

Change in Net Operating Loss, as reported

(22

)%

Non-GAAP adjustments

(17

)%

Change in Net Operating Loss, adjusted

(39

)%

Financial Statement

11 Nov 2025

NATICK, Mass.--(BUSINESS WIRE)--Allurion Technologies, Inc. (NYSE: ALUR) (“Allurion” or the “Company”), a pioneer in metabolically healthy weight loss, today announced it has passed critical milestones in the U.S. Food and Drug Administration (the “FDA”) Pre-Market Approval (“PMA”) process for the Allurion Smart Capsule.

Passing these FDA inspections with no findings and completing the Day-100 Meeting are major milestones for Allurion, and we believe we are now entering the final stages of the review process

In addition, the Company announced it has entered into a transaction with its creditor to exchange all of its outstanding debt and obligations under its Revenue Interest Financing Agreements for shares of a newly created Series B Convertible Preferred Stock (the “Series B Preferred Stock”) that will be convertible into shares of common stock (the “Conversion Shares”) under certain circumstances (the “Exchange Transaction”). The Company also announced the consummation of a $5 million private placement financing with participation from new and existing stockholders and a strategic partner with deep obesity expertise, which significantly strengthens the Company’s financial position as the Company seeks FDA approval for the Allurion Smart Capsule.

Passing of Critical FDA Milestones Shows Continued Progress Towards Approval

In June 2025, the Company submitted the fourth and final module of its PMA for the Allurion Smart Capsule to the FDA.

In July 2025, the FDA completed its Acceptance and Filing Reviews process and entered the Substantive Review phase.

In August 2025, the Company successfully passed the FDA’s pre-approval inspection with zero findings, no observations raised, and no Form 483 issued. The pre-approval inspection is designed to assess the company’s systems, methods, and procedures to ensure that the quality management system is effectively established. The inspection covered compliance with regulatory requirements, process quality, and documentation standards.

In October 2025, the Company underwent a Bioresearch Monitoring (“BIMO”) inspection by the FDA. The BIMO inspection is designed to assess a company’s clinical trial systems, methods, and procedures to ensure data integrity. Again, no observations were raised and no Form 483 was issued.

Also in October 2025, the Company held its Day-100 Meeting with the FDA, where the FDA provided feedback after reviewing the PMA submission. The FDA did not request any additional human clinical data.

“Passing these FDA inspections with no findings and completing the Day-100 Meeting are major milestones for Allurion, and we believe we are now entering the final stages of the review process,” said Dr. Shantanu Gaur, Founder and Chief Executive Officer of the Company. “This achievement is a testament to our commitment to upholding the highest quality standards across our entire company and is another step towards Allurion serving the U.S. market, pending FDA approval.”

Debt Exchange Would Result in Company Being Debt-Free

The Company has entered into a transaction with its creditor to exchange all of its outstanding debt and obligations under its Revenue Interest Financing Agreements for shares of Series B Preferred Stock that will be convertible into unissued shares of common stock under certain circumstances.

The Series B Preferred Stock is initially convertible at a conversion price of $3.37 per share and is subject to certain limitations in the certificate of designations that will govern the Series B Preferred Stock (the “Certificate of Designations”). The Series B Preferred Stock will accrue dividends at a rate of 8.25% per annum, payable in kind or in cash, as set forth in the Certificate of Designations.

The consummation of the Exchange Transaction is subject to certain closing conditions, including (i) stockholder approval for the issuance of the Series B Preferred Stock and the Conversion Shares, (ii) compliance with the listing requirements of the national securities exchange on which the common stock is then listed, and (iii) the approval for listing of the Conversion Shares by such national securities exchange.

“As we pursue FDA approval and a potential U.S. launch of the Allurion Smart Capsule, we wanted to have a clear path to being debt-free, and this transaction provides that path,” said Dr. Shantanu Gaur, Founder and CEO of Allurion.

Pricing of Private Placement Financing Significantly Strengthens Financial Position

In addition, the Company announced that it has consummated a private placement with participation from new and existing stockholders and a strategic partner with deep obesity expertise for the purchase and sale of 2,994,012 shares of common stock and warrants to purchase up to 2,994,012 shares of common stock at a purchase price of $1.67 per share and accompanying warrant. Roth Capital Partners acted as sole placement agent for the private placement. The private placement is expected to close on November 12, 2025. In connection with the private placement, the Company agreed to seek stockholder approval for issuance of the shares of common stock underlying the warrants sold to the purchasers.

The aggregate gross proceeds to the Company from the private placement are expected to be approximately $5 million, before deducting placement agent’s fees and other offering expenses payable by the Company. The Company intends to use the net proceeds from the private placement for working capital and general corporate purposes.

For additional information related to the Exchange Transaction and the private placement, see the Company’s Form 8-K to be filed with the U.S. Securities and Exchange Commission.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities of Allurion, nor will there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state, province, territory or other jurisdiction.

About Allurion

Allurion is a pioneer in metabolically healthy weight loss. The Allurion Program is a weight-loss platform that combines the Allurion Smart Capsule, the world’s first and only swallowable, ProcedurelessTM gastric balloon for weight loss, the Allurion Virtual Care Suite, including the Allurion Mobile App for consumers and Allurion Insights for healthcare providers featuring the Iris AI Platform, and the Allurion Connected Scale. The Allurion Virtual Care Suite is also available to providers separately from the Allurion Program to help customize, monitor, and manage weight-loss therapy for patients regardless of their treatment plan. The Allurion Smart Capsule is an investigational device in the United States.

For more information about Allurion and the Allurion Virtual Care Suite, please visit www.allurion.com.

Allurion is a trademark of Allurion Technologies, Inc. in the United States and countries around the world.

Forward-Looking Statements

This press release contains forward-looking statements that reflect Allurion’s beliefs and assumptions based on information currently available. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terms, although not all forward-looking statements contain these words. Although Allurion believes it has a reasonable basis for each forward-looking statement contained in this release, these statements involve risks and uncertainties that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Forward-looking statements in this press release include, but are not limited to, statements regarding: the successful exchange of all of Allurion’s debt into shares of Series B Preferred Stock; the possibility of Allurion receiving FDA approval and the possibility of launching its product candidates in the United States; Allurion’s ability to capitalize on future catalysts; the expected benefits of any collaborations or other initiatives with strategic partners; the intended use of proceeds for the Exchange Transaction and private placement; the extension of the Company’s cash runway; and the ability for Allurion to obtain any stockholder approvals required to consummate the Exchange Transaction and private placement.

Allurion cannot assure you that the forward-looking statements in this press release will prove to be accurate. These forward looking statements are subject to a number of risks and uncertainties, including, among others, general economic, political and business conditions; the ability of Allurion to obtain and maintain regulatory approval for, and successfully commercialize, the Allurion Program, including the Allurion Smart Capsule and Allurion Balloon; the timing of, and results from, Allurion’s clinical studies and trials, including with respect to the combination of GLP-1s with the Allurion Balloon; the evolution of the markets in which Allurion competes, including the impact of GLP-1 drugs; the ability of Allurion to maintain its listing on the New York Stock Exchange; a changing regulatory landscape in the highly competitive industry in which Allurion competes; the impact of the imposition of current and potential tariffs and trade negotiations, and those factors discussed under the heading “Risk Factors” in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 27, 2025 and as amended on August 19, 2025, and updated from time to time by its other filings with the SEC, and its Quarterly Reports on Form 10-Q filed with the SEC on May 15, 2025 and August 19, 2025. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made. Allurion undertakes no obligation to update any forward-looking statements to reflect any new information, events, or circumstances after the date they are made, or to reflect the occurrence of unanticipated events, other than as required by applicable law.

14 May 2025

NATICK, Mass.--(BUSINESS WIRE)--Allurion Technologies, Inc. (NYSE: ALUR) (“Allurion” or the “Company”), a pioneer in metabolically healthy weight loss, today announced its financial results for the first quarter and provided a business update.

Recent Company Highlights and Outlook

Maintaining 2025 revenue guidance of approximately $30 million with a reduction of approximately 50% in operating expenses compared to 2024

First quarter revenue of $5.6 million and operating expenses of $11.4 million, a 37% decrease in operating expenses compared to prior year; adjusted operating expenses of $10.1 million, a 45% decrease compared to prior year

Net operating loss of $7.3 million, a 36% reduction compared to prior year; adjusted net operating loss of $5.9 million, a 48% reduction compared to prior year

Gross margin of 75% compared to 73% in the prior year and 45% in the previous quarter, with no material impact expected from tariffs

Presented topline AUDACITY results to FDA, successfully completed Pre-PMA meeting, and on track for submission of final module of PMA by end of June

Selected sites and drafted protocol for prospective trial on combination of Allurion Program with low-dose GLP-1 medications to maintain muscle mass and increase GLP-1 adherence

“We are excited about our strong start to 2025, a year we expect to be rich in potential catalysts,” said Dr. Shantanu Gaur, Founder and Chief Executive Officer. “Our financial results reflect increased efficiency as we move toward profitability, with expenses continuing to reduce, gross margin expanding, and operating loss narrowing. After completing our pre-PMA meeting with FDA, where we discussed our topline results from our AUDACITY trial, we expect to complete our PMA submission on schedule.

“We believe there is a massive and largely untapped opportunity for the Allurion Program to be not just an alternative to GLP-1 medications, but complementary to them,” continued Dr. Gaur. “Our focus on ‘Metabolically Healthy Weight Loss’—losing weight, keeping it off, and maintaining muscle—through the combination of the Allurion Program with low-dose GLP-1s has resonated with providers, patients, and potential partners, because we believe the combination addresses the shortcomings of GLP-1s. We look forward to further strengthening the evidence behind this combination approach in our prospective trial, which we expect to start enrolling this year.”

First Quarter Financial Results

Total revenue for the quarter ended March 31, 2025 was $5.6 million, compared to $9.4 million for the same period in 2024.

Gross profit for the first quarter ended March 31, 2025 was $4.2 million, or 75% of revenue, compared to $6.9 million, or 73% of revenue, for the same period in 2024.

Total operating expenses for the first quarter ended March 31, 2025 were $11.4 million, compared to $18.3 million for the same period in 2024. Adjusted operating expenses for the first quarter were $10.1 million, excluding $1.4 million of one-time costs related to financings.

Sales and marketing expenses for the first quarter ended March 31, 2025 were $3.6 million, compared to $6.1 million for the same period in 2024. The reduction in expense was primarily driven by increased operating efficiency and the restructuring initiatives implemented during the fourth quarter of 2024, which re-focused spending on more efficient channels.

Research and development expenses for the first quarter ended March 31, 2025 were $2.6 million, compared to $5.7 million for the same period in 2024. The reduction was primarily driven by reduced costs related to the AUDACITY trial and restructuring initiatives implemented during the fourth quarter of 2024.

General and administrative (“G&A”) expenses for the first quarter ended March 31, 2025 were $5.2 million, compared to $6.4 million for the same period in 2024. Adjusted G&A expenses were $3.8 million, excluding one-time financing costs of $1.4 million. The reduction was primarily driven by the restructuring initiatives implemented during the fourth quarter of 2024.

Net operating loss for the first quarter ended March 31, 2025 was $7.3 million, which included $1.4 million of one-time financing costs, compared to $11.4 million for the same period in 2024. Adjusted loss from operations for the first quarter ended March 31, 2025 was $5.9 million, which excluded one-time financing costs of $1.4 million. The reduction compared to prior year was driven by restructuring initiatives implemented during the fourth quarter of 2024.

Cash balance on March 31, 2025 was $20.4 million.

Conference Call and Webcast Details

Company management will host a conference call to discuss financial results and provide a business update on May 14, 2025 at 8:30 AM ET.

To access the conference call by telephone, please dial (888) 330-3417 (domestic) or +1 646 960 0804 (international) and use Conference ID 1905455. To listen to the conference call via live audio webcast, please visit the Events section of Allurion’s Investor Relations website at Allurion - Events & Presentations.

About Allurion

Allurion is a pioneer in metabolically healthy weight loss. The Allurion Program is a weight loss platform that features the Allurion Gastric Balloon, the world’s first and only swallowable, procedure-less™ intragastric balloon for weight loss, and offers access to the Allurion Virtual Care Suite, including the Allurion Mobile App for consumers, Allurion Insights for health care providers featuring the Coach Iris AI Platform, and the Allurion Connected Scale. The Allurion Virtual Care Suite is also available to providers separately from the Allurion Program to help customize, monitor and manage weight loss therapy for patients regardless of their treatment plan, which may include a gastric balloon, surgical treatment, medical treatment, or nutritional solutions. The Allurion Gastric Balloon is an investigational device in the United States.

For more information about Allurion and the Allurion Program, please visit www.allurion.com.

Allurion is a trademark of Allurion Technologies, Inc. in the United States and countries around the world.

Non-GAAP Financial Measures

Relevant income statement items contained in this release are also presented on an “adjusted” basis, which exclude items that are of a one-time nature that do not impact the ongoing performance of the business and reflect the way the Company's management and the Board of Directors view the performance of the Company internally. The Company believes that excluding the effects of these items from its operating results allows management and investors to effectively compare the true underlying financial performance of its business from period to period and against its global peers.

Forward-Looking Statements

This press release contains forward-looking statements that reflect Allurion’s beliefs and assumptions based on information currently available. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terms, although not all forward-looking statements contain these words. Although Allurion believes it has a reasonable basis for each forward-looking statement contained in this release, these statements involve risks and uncertainties that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Forward-looking statements in this press release include, but are not limited to, statements regarding: the Company’s financial outlook for 2025, including the anticipated impact of the 2024 restructuring plan on the Company’s operating expenses and its ability to achieve profitability; the outcome of the Company’s PMA seeking FDA approval of the Allurion Balloon following the topline readout of the AUDACITY clinical trial; the performance and market acceptance of Allurion’s products for patients using different weight loss therapies, as well as the Company’s ability to expand this aspect of its business further in 2025; the outcomes of anticipated studies on the combination of GLP-1s with the Allurion Balloon and the impact on demand for our products and services; ; and the market and demand for our products and weight-loss solutions in general, including GLP-1 drugs and elective procedures.

Allurion cannot assure you that the forward-looking statements in this press release will prove to be accurate. These forward looking statements are subject to a number of risks and uncertainties, including, among others, general economic, political and business conditions; the ability of Allurion to obtain and maintain regulatory approval for, and successfully commercialize, the Allurion Program; the timing of, and results from, Allurion’s clinical studies and trials, including with respect to the combination of GLP-1s with the Allurion Balloon; the evolution of the markets in which Allurion competes, including the impact of GLP-1 drugs; the ability of Allurion to maintain its listing on the New York Stock Exchange; a changing regulatory landscape in the highly competitive industry in which Allurion competes; and those factors discussed under the heading “Risk Factors” in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 27, 2025, and updated from time to time by its other filings with the SEC. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made. Allurion undertakes no obligation to update any forward-looking statements to reflect any new information, events, or circumstances after the date they are made, or to reflect the occurrence of unanticipated events, other than as required by applicable law.

Condensed Consolidated Statements of Operations

(dollars in thousands, except per share amounts)(unaudited)

Three Months Ended March 31,

2025

2024

Revenue

$

5,580

$

9,386

Cost of revenue

1,419

2,520

Gross profit

4,161

6,866

Operating expenses:

Sales and marketing

3,621

6,145

Research and development

2,624

5,725

General and administrative

5,198

6,386

Total operating expenses:

11,443

18,256

Loss from operations

(7,282

)

(11,390

)

Other income (expense):

Interest expense

—

(1,931

)

Changes in fair value of warrants

5,669

3,131

Changes in fair value of debt

6,170

—

Changes in fair value of Revenue Interest Financing and PIPE Conversion Option

2,220

1,490

Changes in fair value of earn-out liabilities

910

14,190

Other income (expense), net

(213

)

172

Total other income (expense):

14,756

17,052

Income before income taxes

7,474

5,662

Provision for income taxes

(95

)

(76

)

Net income

$

7,379

$

5,586

Net income per share

Basic

$

1.54

$

2.92

Diluted

$

0.20

$

2.78

Weighted-average shares outstanding

Basic

4,778,542

1,911,181

Diluted

6,017,438

1,967,885

Condensed Consolidated Balance Sheets

(dollars in thousands, except share amounts)(unaudited)

March 31,

December 31,

2025

2024

Assets

Current assets:

Cash and cash equivalents

$

20,408

$

15,379

Accounts receivable, net of allowance of doubtful accounts of $6,455 and $6,701, respectively

8,309

7,134

Inventory, net

3,352

3,400

Prepaid expenses and other current assets

1,097

1,243

Total current assets

33,166

27,156

Property and equipment, net

2,297

2,469

Right-of-use asset

1,870

2,079

Other long-term assets

1,081

1,109

Total assets

$

38,414

$

32,813

Liabilities and Stockholders’ Deficit

Current liabilities:

Accounts payable

$

4,976

$

6,572

Current portion of lease liabilities

829

869

Accrued expenses and other current liabilities

10,092

11,422

Total current liabilities

15,897

18,863

Convertible notes payable

30,960

35,710

Warrant liabilities

9,264

4,567

Revenue Interest Financing liability

50,000

49,200

Earn-out liabilities

180

1,090

Lease liabilities, net of current portion

1,186

1,344

Other liabilities

717

17

Total liabilities

$

108,204

$

110,791

Commitments and Contingencies

Stockholders’ deficit:

Preferred stock, $0.0001 par value — 100,000,000 shares authorized as of March 31, 2025; no shares issued and outstanding as of March 31, 2025 and December 31, 2024

—

—

Common stock, $0.0001 par value - 1,000,000,000 shares authorized as of March 31, 2025; 5,963,549 and 2,710,607 shares issued and outstanding as of March 31, 2025 and December 31, 2024, respectively

5

3

Additional paid-in capital

157,843

152,596

Accumulated other comprehensive income

3,930

8,370

Accumulated deficit

(231,568

)

(238,947

)

Total stockholders’ deficit

(69,790

)

(77,978

)

Total liabilities and stockholders’ deficit

$

38,414

$

32,813

Non-GAAP Net Operating Loss Reconciliation

(dollars in thousands)(unaudited)

Three Months Ended March 31, 2025

GAAP Results

One-time

Financing Costs

Adjusted

Results

Revenue

$

5,580

$

—

$

5,580

Cost of revenue

1,419

—

1,419

Gross profit

4,161

—

4,161

Operating expenses:

Sales and marketing

3,621

—

3,621

Research and development

2,624

—

2,624

General and administrative

5,198

1,390

3,808

Total operating expenses:

11,443

1,390

10,053

Loss from operations

(7,282

)

(1,390

)

(5,892

)

Other income (expense):

Interest expense

—

—

—

Changes in fair value of warrants

5,669

—

5,669

Changes in fair value of debt

6,170

—

6,170

Changes in fair value of Revenue Interest Financing and PIPE Conversion Option

2,220

—

2,220

Changes in fair value of earn-out liabilities

910

—

910

Other income (expense), net

(213

)

—

(213

)

Total other income:

14,756

—

14,756

Income before income taxes

7,474

(1,390

)

8,864

Provision for income taxes

(95

)

—

(95

)

Net income

$

7,379

$

(1,390

)

$

8,769

Additional Non-GAAP Reconciliations

(unaudited)

Three Months Ended

March 31, 2025

Change in Operating Expenses, as reported

(37

)%

Non-GAAP adjustments

(8

)%

Change in Operating Expenses, adjusted

(45

)%

Three Months Ended

March 31, 2025

Change in Net Operating Loss, as reported

(36

)%

Non-GAAP adjustments

(12

)%

Change in Net Operating Loss, adjusted

(48

)%

Financial Statement

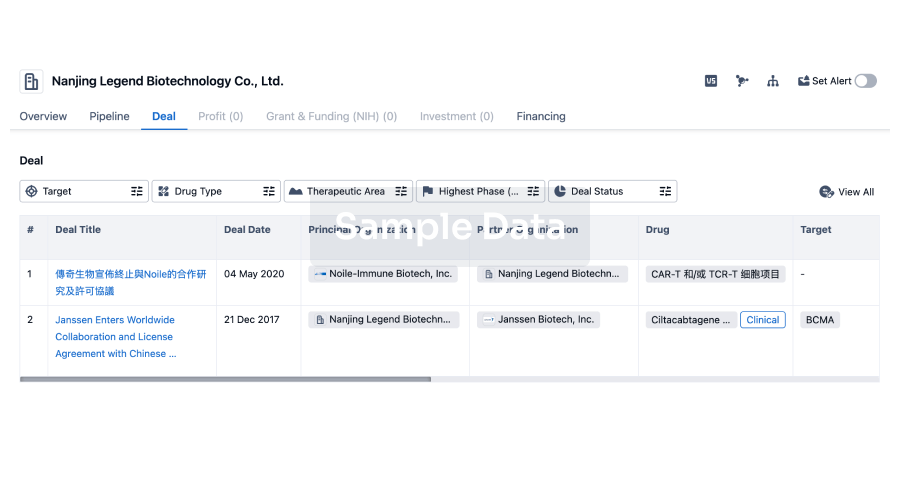

100 Deals associated with Allurion Technologies, Inc.

Login to view more data

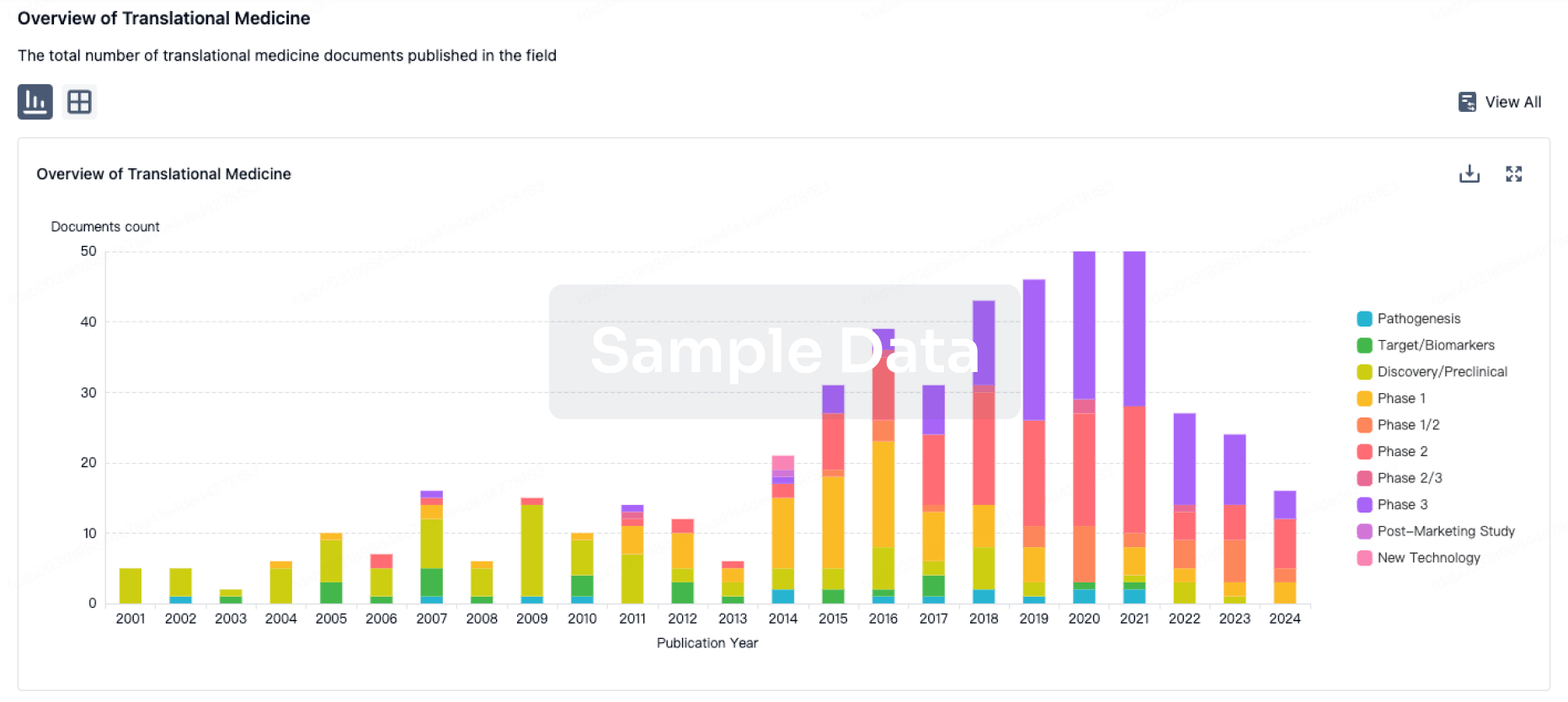

100 Translational Medicine associated with Allurion Technologies, Inc.

Login to view more data

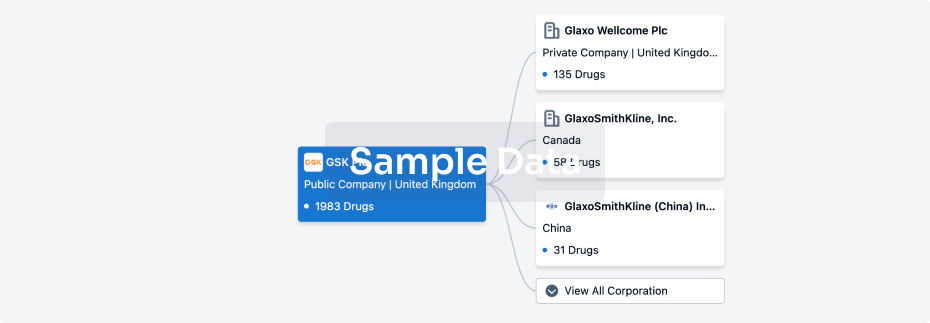

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 07 Dec 2025

No data posted

Login to keep update

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

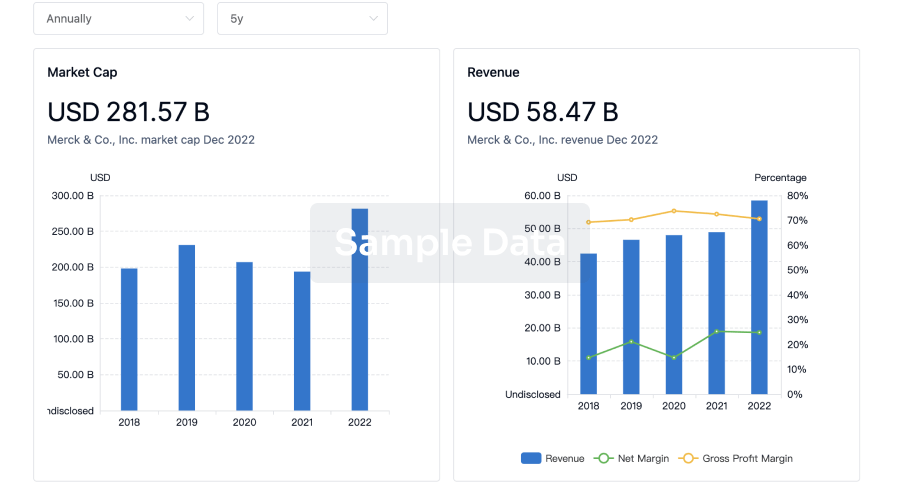

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

Investment

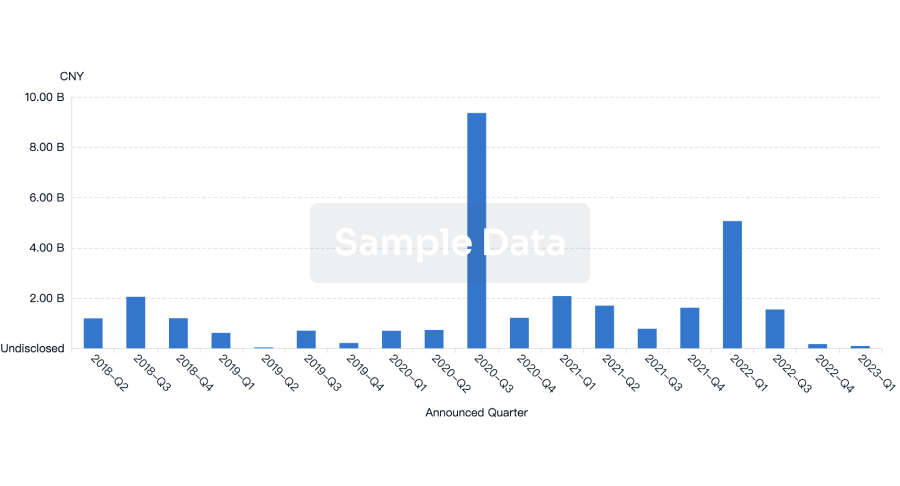

Gain insights on the latest company investments from start-ups to established corporations.

login

or

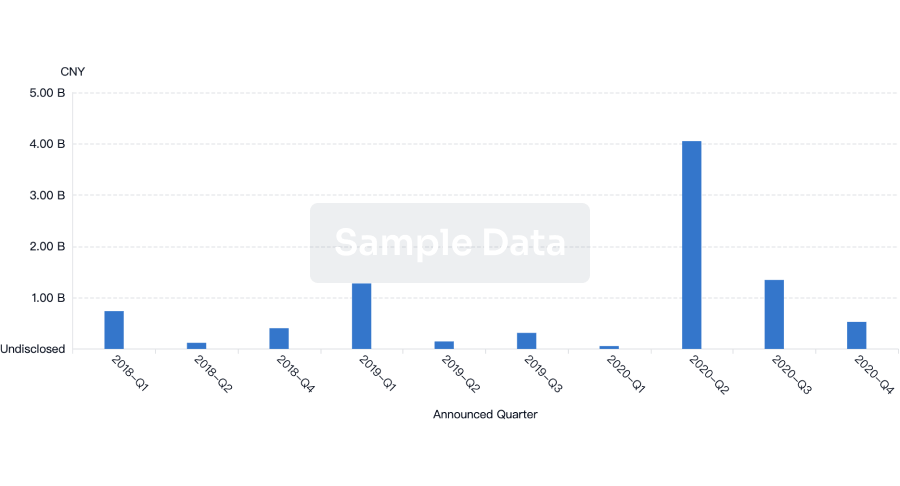

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free