One of the key ways in which Novartis CEO Vas Narasimhan hopes to stave off generic competition took a giant leap forward Wednesday afternoon.

The FDA approved Lu-PSMA-617, Novartis’ radioligand program acquired in the $2.1 billion buyout of Endocyte back in 2018, to treat PSMA-positive metastatic castration-resistant prostate cancer. Novartis will brand the drug as Pluvicto, and a spokesperson told

Endpoints News that the drug’s wholesale acquisition cost will be set at $42,500 per dose.

Patients will be capped at six doses administered six weeks apart, leading to a potential maximum annual cost of $255,000, the spokesperson added.

Narasimhan touted Lu-PSMA-617 during Novartis’ R&D day in December as a potential big sales driver, putting the drug under its “high evidence” umbrella among other mid- and late-stage assets. The decision proved notable as Novartis is anticipating generics will cut into sales of its previously approved drugs by $9 billion over the next five years.

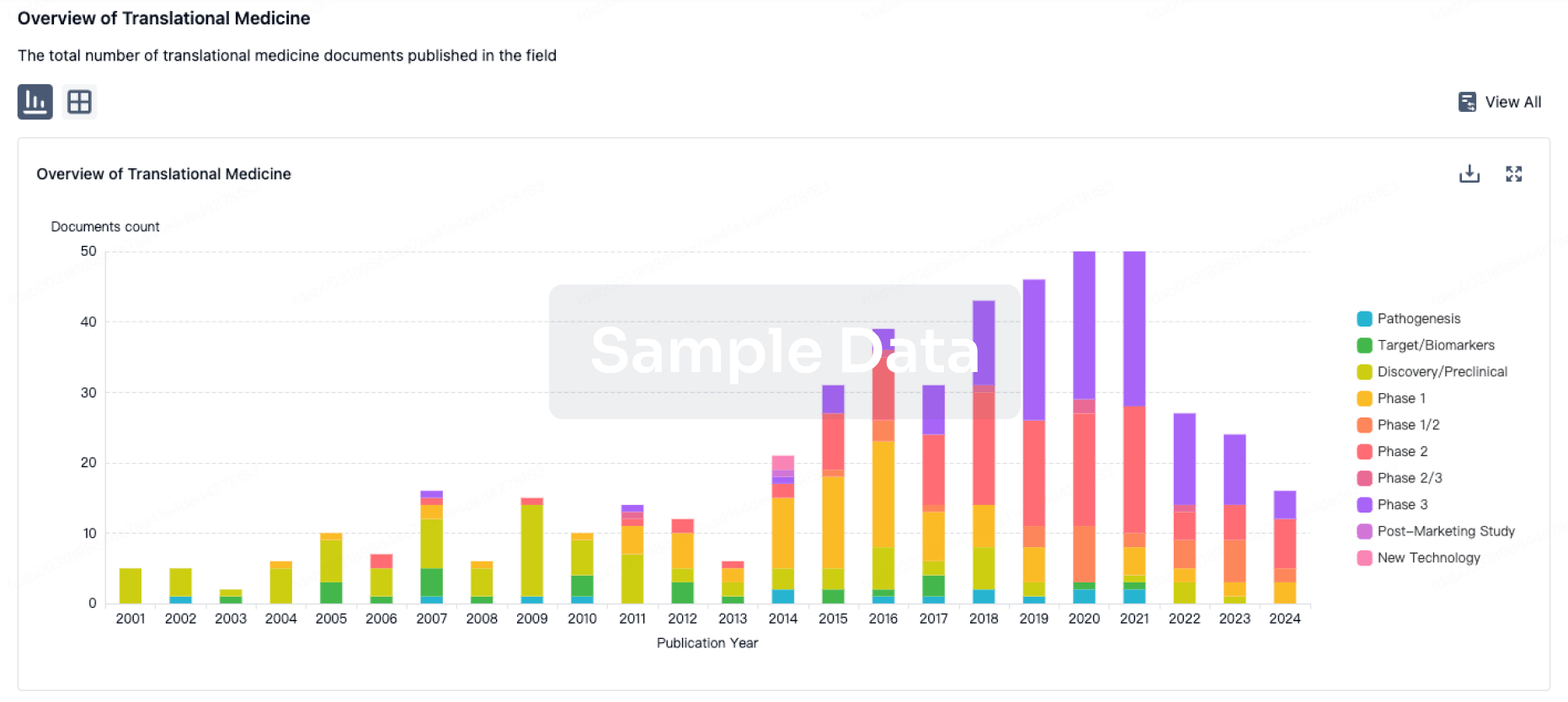

Regulators approved the drug based on Phase III data Novartis presented at ASCO last June, which showed the drug reduced patients’ risk of death by 38% on top of standard of care. Lu-PSMA-617 also posted a 60% reduction in radiographic PFS or death compared to the standard on its own, and hit on every other secondary measure in the Phase III study.

Novartis had previously described the data as “groundbreaking” and won breakthrough therapy designation for the drug shortly after ASCO. The company said at the end of September that the drug had been accepted for priority review, putting Wednesday’s approval right around the six-month mark.

In an interview with Endpoints last month ahead of the decision, Novartis Oncology president Susanne Schaffert said about 80% of those with prostate cancer see their tumors become metastatic, with a five-year survival rate of roughly 30%. That makes the medical need — and the potential commercial opportunity — substantial.

Additionally, Schaffert addressed some of the safety concerns that come along with radiopharma drugs, and emphasized that the ligand used with Pluvicto — known as lutetium — has a half-life of only 72 hours. The short length could help adverse events subside after only a short while, but also means clinicians will have to dose patients quickly after receiving the drug.

“We, as Novartis, may have only 24 hours to deliver it to still deliver enough radioactivity to patients,” Schaffert told Endpoints. “And that, of course, is something you have to carefully set up, you need to be able to get this product to the patient. And it’s individual, it’s not warehouse, it’s really individual by order to the patient.”

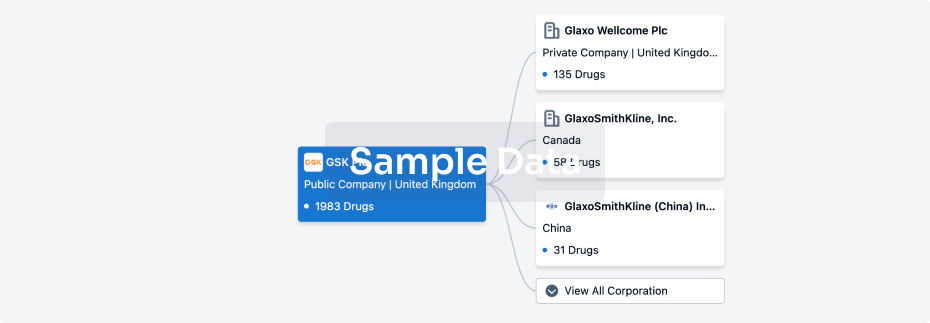

Novartis has been at the forefront of the radiopharma push, acquiring the French company Advanced Accelerator Applications in late October 2017 for $3.9 billion that gave it Lutathera and a radiopharma platform. The buyout was followed by the Endocyte deal about a year later, and VC and more Big Pharma cash has poured into the space in the years since.

Versant and venBio teamed up in 2020 to back a $45M launch round for German biotech RayzeBio, and Bayer bought out two tiny companies in June in its own foray into the space.