Request Demo

Last update 08 May 2025

Tourmaline Sub, Inc.

Startups

10-50

| NASDAQ: TRML| Startups

10-50

| NASDAQ: TRML| Last update 08 May 2025

Overview

Related

100 Clinical Results associated with Tourmaline Sub, Inc.

Login to view more data

0 Patents (Medical) associated with Tourmaline Sub, Inc.

Login to view more data

3

News (Medical) associated with Tourmaline Sub, Inc.18 Oct 2023

Combined Company to Trade on Nasdaq Under Ticker “TRML”

Talaris Announces 1-for-10 Reverse Stock Split of Common Stock

Talaris Therapeutics, Inc. (Nasdaq: TALS) (“Talaris”) today announced the results of the special meeting of its stockholders held on October 17, 2023. At the special meeting, Talaris’ stockholders voted in favor of all proposals, including the proposal to approve the issuance of shares of Talaris’ common stock to the stockholders of Tourmaline Bio, Inc. (“Tourmaline”) pursuant to the terms of the Agreement and Plan of Merger, dated as of June 22, 2023, pursuant to which a direct wholly owned subsidiary of Talaris will merge with and into Tourmaline, with Tourmaline surviving the merger as a direct wholly owned subsidiary of Talaris (the “Merger”).

The closing of the Merger is anticipated to take place on or around Thursday, October 19, 2023. Following the closing of the Merger, the combined company plans to change its name from Talaris Therapeutics, Inc. to Tourmaline Bio, Inc., trade on The Nasdaq Global Market under the ticker symbol “TRML” and will be led by Tourmaline’s existing management team. The combined company will focus on Tourmaline’s mission to develop transformative medicines that dramatically improve the lives of patients with life-altering immune diseases.

In addition, Talaris today announced that it will effect a 1-for-10 reverse stock split of its common stock that will be effective on Thursday, October 19, 2023, prior to the closing of the Merger. At the special meeting of stockholders, the holders of a majority of Talaris’ outstanding shares of common stock also approved the reverse stock split and gave Talaris’ board of directors discretionary authority to select a ratio for the split ranging from 1-for-10 to 1-for-14. The combined company’s common stock is expected to begin trading on Nasdaq on a split-adjusted basis on Friday, October 20, 2023. The new CUSIP number for the combined company’s common stock following the Merger and the reverse stock split is 89157D 105.

The reverse stock split affects all issued and outstanding shares of Talaris common stock, as well as the number of shares of common stock reserved for issuance under Talaris’ equity plans. The reverse stock split will reduce the number of shares of Talaris’ issued and outstanding common stock from approximately 42.8 million to approximately 4.28 million (which numbers do not give effect to the shares of Talaris’ common stock to be issued in connection with the Merger). In addition, the reverse stock split will effect a reduction in the number of shares of common stock issuable upon the exercise of stock options and upon the vesting of restricted stock units outstanding immediately prior to the reverse stock split, with a proportional increase in the stock option exercise prices. The reverse stock split will not change the par value of Talaris’ common stock and preferred stock or the authorized number of shares of Talaris’ common stock and preferred stock.

The reverse stock split will affect all holders of common stock uniformly and (before giving effect to the shares of Talaris’ common stock to be issued in connection with the Merger) will not alter any stockholder’s percentage ownership interest in Talaris, except to the extent that the reverse stock split would result in a stockholder owning a fractional share. No fractional shares of common stock will be issued in connection with the reverse stock split; stockholders who otherwise would be entitled to a fractional share of common stock will be entitled to receive a cash payment equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing price of the common stock on Nasdaq on the date of the filing of the certificate of amendment to Talaris’ charter effecting the reverse stock split.

Talaris’ transfer agent, Computershare, is acting as the exchange agent for the reverse stock split. Stockholders holding their shares in book-entry form or in brokerage accounts need not take any action in connection with the reverse stock split. Beneficial holders are encouraged to contact their bank, broker or custodian with any procedural questions.

The Company previously announced a special dividend, which the Company estimated to be $1.5118 per share of Talaris common stock, payable in cash in connection with the Merger. As previously announced, the ex-dividend date in respect of such special cash dividend will be before market open on October 20, 2023. As a result of the reverse stock split, the Company estimates that the stockholders of record as of October 16, 2023, record date for the special dividend, that continue to hold their eligible shares until market open on October 20, 2023 will be entitled to receive $15.118 per share of the combined company’s common stock.

About Tourmaline

Tourmaline is a late-stage clinical biotechnology company driven by its mission to develop transformative medicines that dramatically improve the lives of patients with life-altering immune diseases. Tourmaline’s lead program, TOUR006, is an anti-IL-6 antibody which exhibits differentiated properties including high binding affinity to IL-6 and a naturally long half-life. To date, TOUR006 has been studied in over 400 autoimmune patients across six clinical trials. Tourmaline plans to develop TOUR006 in thyroid eye disease (TED) and atherosclerotic cardiovascular disease (ASCVD) as its lead and secondary indications, respectively, with additional indications under consideration.

About Talaris

Talaris, prior to its review of strategic alternatives, was a cell therapy company developing an innovative method of allogeneic hematopoietic stem cell transplantation (“allo-HSCT”), called Facilitated Allo-HSCT Therapy.

The content above comes from the network. if any infringement, please contact us to modify.

AcquisitionCell Therapy

10 Oct 2023

Special dividend estimated to be $1.5118 per share

Payment of special dividend conditioned upon closing of merger, which is subject to stockholder approval

Talaris Therapeutics, Inc. (Nasdaq: TALS) (“Talaris” or the “Company”) today announced that its Board of Directors has declared a special dividend in connection with the previously announced merger (the “Merger”) with Tourmaline Bio, Inc. (“Tourmaline”) pursuant to the Agreement and Plan of Merger, dated June 22, 2023 (the “Merger Agreement”).

The special dividend, which the Company estimates will be $1.5118 per share of Talaris common stock, will be payable in cash. The exact amount of the special dividend will be calculated after deducting certain cash amounts as set forth in the Merger Agreement. The ex-dividend date in respect of such special cash dividend will be before market open on October 20, 2023. As such, only the stockholders of record as of October 16, 2023, record date for the Special Dividend, that continue to hold their eligible shares of Talaris until market open on October 20, 2023 will be entitled to the dividend payment. The Special Dividend will not exceed an amount equal to $67.5 million, net of the Aggregate Cash Amount (as defined in the Merger Agreement).

Payment of the special dividend is conditioned upon the closing of the Merger with Tourmaline, which remains subject to the approval of Talaris’ stockholders and other closing conditions. The special meeting of Talaris’ stockholders to consider and vote upon the Merger is scheduled for October 17, 2023 with closing expected to occur after market close on October 19, 2023, assuming the transaction is approved by the Talaris stockholders and the satisfaction or waiver of all conditions under the Merger Agreement.

Every stockholder’s vote is important, regardless of the number of shares held. Accordingly, Talaris requests that each stockholder of record as of September 7, 2023, complete, sign, date and return a proxy card (online or by mail) as soon as possible to ensure that the stockholder’s shares will be represented at the special meeting. Stockholders who hold shares in “street name” (i.e., those stockholders whose shares are held of record by a broker, bank or other nominee) should contact their broker, bank or nominee to ensure that their shares are voted.

If any Talaris stockholder did not receive the proxy statement, such stockholder should (i) confirm his or her proxy statement’s status with his or her broker or (ii) contact Mediant Communications Inc. at engage@mediant.com or (888) 656-7251.

About Tourmaline Bio, Inc.

Tourmaline Bio is a late-stage clinical biotechnology company driven by its mission to develop transformative medicines that dramatically improve the lives of patients with life-altering immune diseases. Tourmaline’s lead program, TOUR006, is an anti-IL-6 antibody which exhibits differentiated properties including high binding affinity to IL-6 and a naturally long half-life. To date, TOUR006 has been studied in over 400 autoimmune patients across six clinical trials. Tourmaline plans to develop TOUR006 in thyroid eye disease (TED) and atherosclerotic cardiovascular disease (ASCVD) as its lead and secondary indications, respectively, with additional indications under consideration.

About Talaris Therapeutics, Inc.

Talaris Therapeutics, Inc., prior to its review of strategic alternatives, was a cell therapy company developing an innovative method of allogeneic hematopoietic stem cell transplantation (“allo-HSCT”), called Facilitated Allo-HSCT Therapy.

The content above comes from the network. if any infringement, please contact us to modify.

AcquisitionCell Therapy

31 Aug 2023

Tourmaline Bio, Inc. (Tourmaline), a late-stage clinical biotechnology company developing transformative medicines to dramatically improve the lives of patients with life-altering immune diseases, today announced U.S. Food and Drug Administration (FDA) clearance of Tourmaline’s IND application for TOUR006.

TOUR006 is a fully-human, anti-IL-6 antibody with differentiated properties including high binding affinity to IL-6 and a naturally long half-life. TED, also known as Graves’ ophthalmopathy, is an autoimmune disease characterized by inflammation and disfigurement around the eye, which can be sight-threatening in severe cases. Off-label use of IL-6 pathway inhibitors in TED has resulted in reduced inflammation and eye-bulging and has been shown to impact key biomarkers such as levels of pathogenic autoantibodies.

“We are excited to advance TOUR006 into late-stage development in TED. We believe TOUR006 could be an ideal treatment option for patients suffering from TED, in light of its anti-inflammatory mechanism of action, established tolerability profile, attractive dosing schedule, and convenient subcutaneous administration,” said Sandeep Kulkarni, MD, Chief Executive Officer of Tourmaline. “We anticipate top-line data from this trial in the first half of 2025 and expect to further expand the development of TOUR006 into atherosclerotic cardiovascular disease (ASCVD) and other indications. We are also looking forward to the expected closing of our merger with Talaris Therapeutics and listing on Nasdaq in the fourth quarter of 2023.”

The planned Phase 2b trial of TOUR006 in TED is expected to evaluate 20mg and 50mg doses against placebo given by a subcutaneous injection every eight weeks. The approximately 81 participants planned to be enrolled (27 in each arm) will be moderate to severe TED patients who are in the active phase of disease. The primary endpoint for this trial will be proptosis response, or reduction of abnormal eye protrusion, measured at week 20.

About Tourmaline Bio, Inc.

Tourmaline Bio is a late-stage clinical biotechnology company driven by its mission to develop transformative medicines that dramatically improve the lives of patients with life-altering immune diseases. Tourmaline’s lead program, TOUR006, is an anti-IL-6 antibody that exhibits differentiated properties including high binding affinity to IL-6 and a naturally long half-life. To date, TOUR006 has been studied in over 400 autoimmune patients across six clinical trials. Tourmaline plans to develop TOUR006 in thyroid eye disease (TED) and atherosclerotic cardiovascular disease (ASCVD) as its first two indications, with additional indications under consideration. In June 2023, Tourmaline announced it had entered into a definitive agreement with Talaris Therapeutics under which Tourmaline is expected to combine with Talaris. The combined company will operate under Tourmaline’s name and be led by Tourmaline’s current management team, focused on advancing the development of TOUR006.

The content above comes from the network. if any infringement, please contact us to modify.

IND

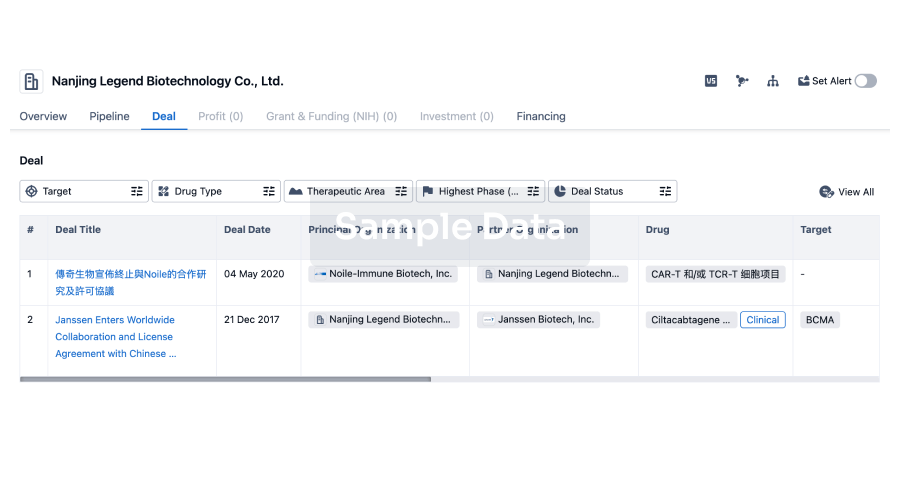

100 Deals associated with Tourmaline Sub, Inc.

Login to view more data

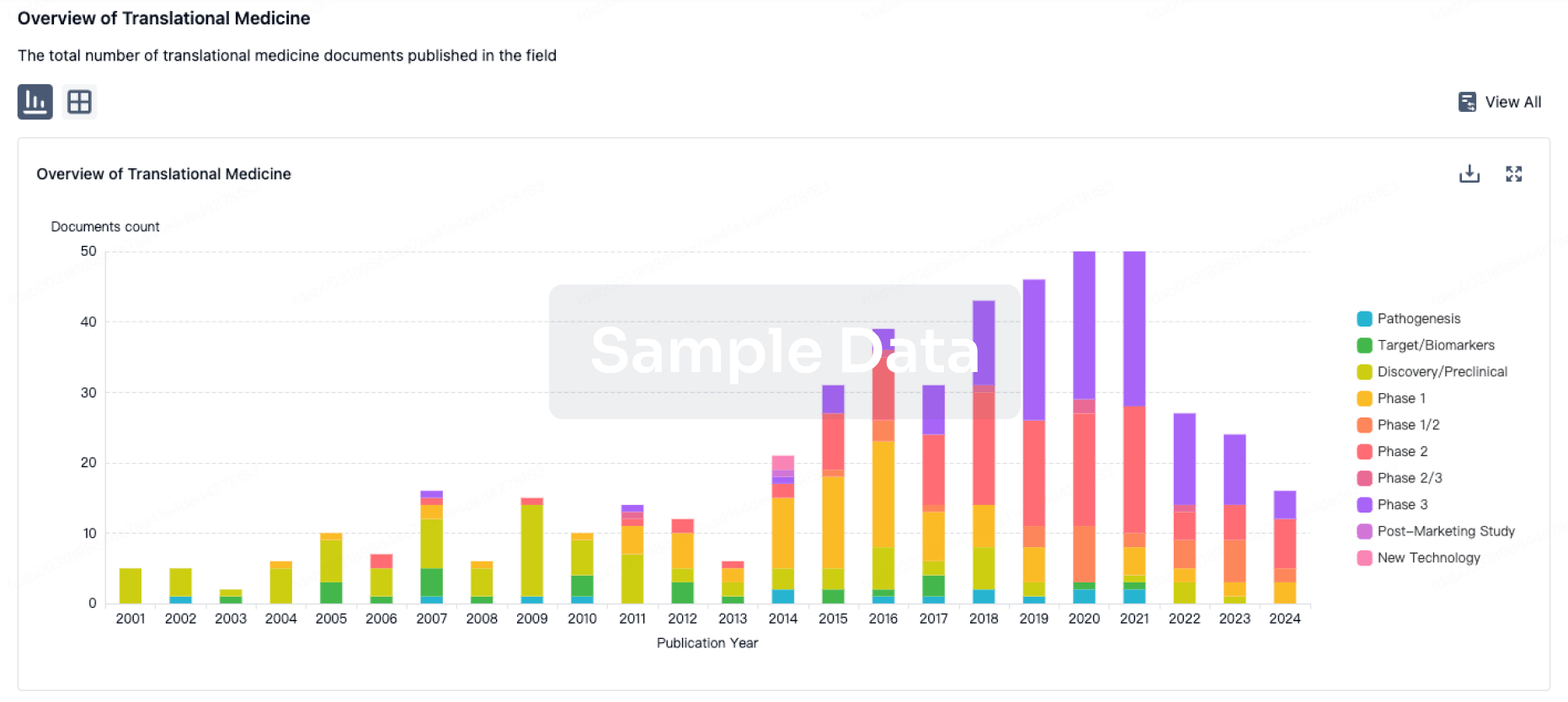

100 Translational Medicine associated with Tourmaline Sub, Inc.

Login to view more data

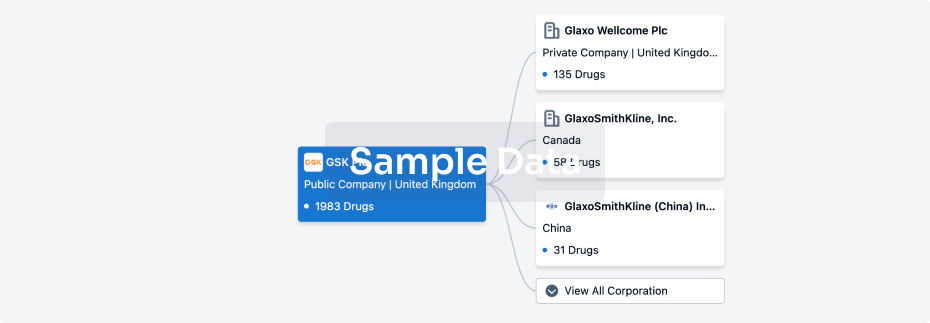

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 06 Dec 2025

No data posted

Login to keep update

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

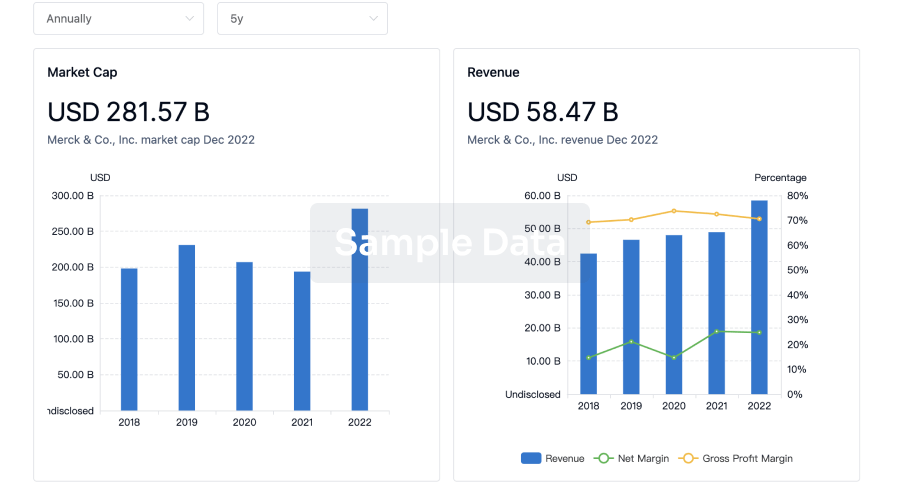

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

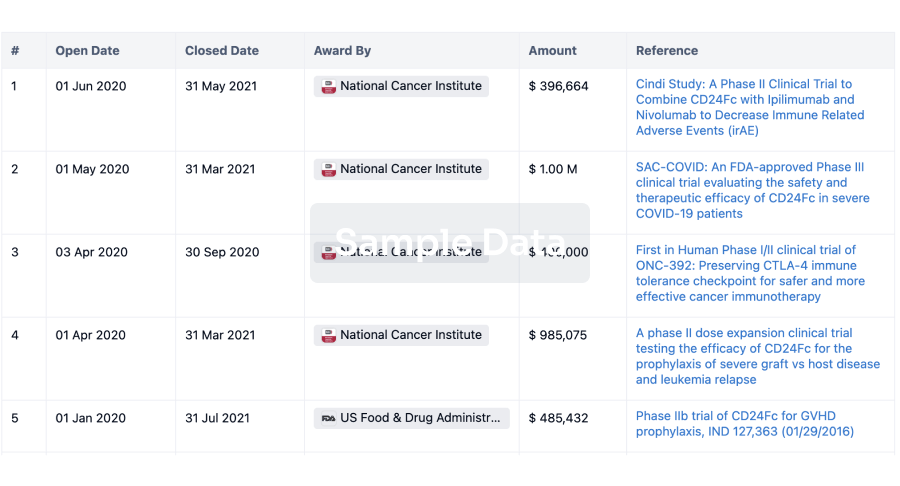

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

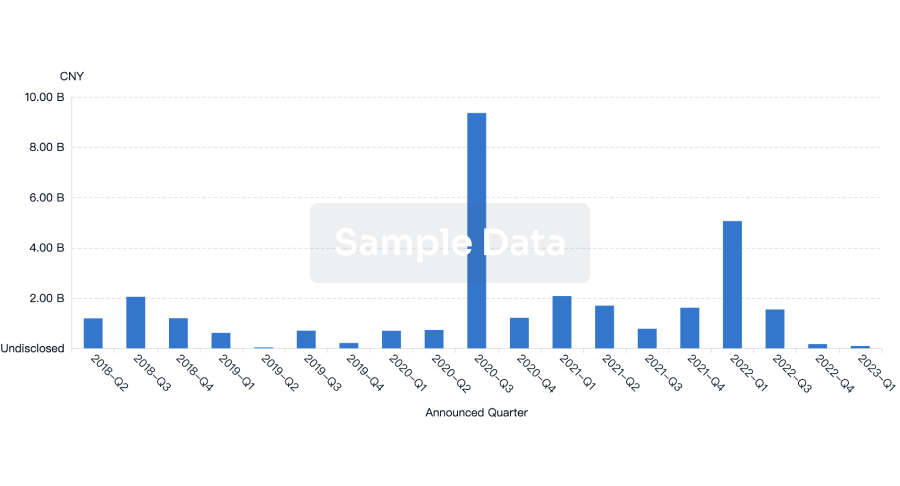

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

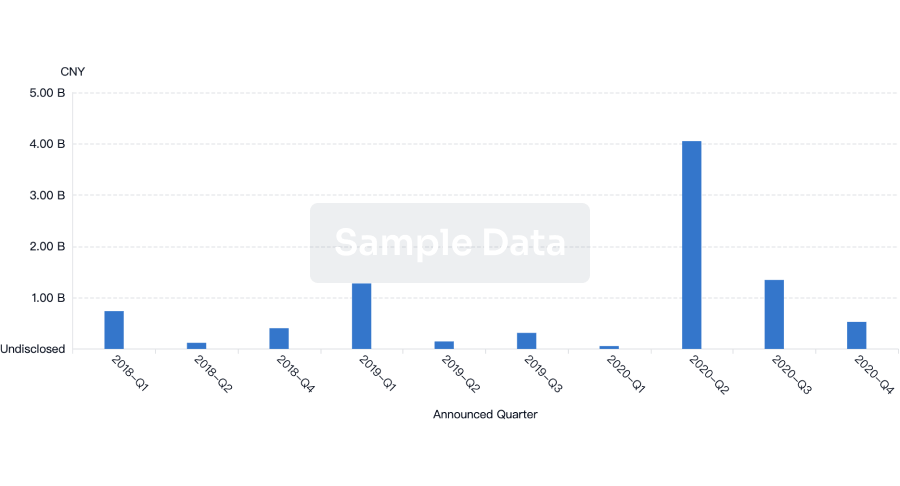

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free