Request Demo

Last update 08 May 2025

Pacira Pharmaceuticals, Inc.

Last update 08 May 2025

Overview

Related

100 Clinical Results associated with Pacira Pharmaceuticals, Inc.

Login to view more data

0 Patents (Medical) associated with Pacira Pharmaceuticals, Inc.

Login to view more data

35

Literatures (Medical) associated with Pacira Pharmaceuticals, Inc.01 Mar 2025·Gene Therapy

PCRX-201, a novel IL-1Ra gene therapy treatment approach for low back pain resulting from intervertebral disc degeneration

Article

Author: Whitt, Joshua P ; Le Maitre, Christine L. ; Jackson, J Derek ; Whitt, Joshua P. ; Senter, Rebecca K ; Snuggs, Joseph W ; Senter, Rebecca K. ; Snuggs, Joseph W. ; Jackson, J. Derek ; Le Maitre, Christine L

02 Jan 2019·Journal of Medical EconomicsQ4 · MEDICINE

Impact of treatment with liposomal bupivacaine on hospital costs, length of stay, and discharge status in patients undergoing total knee arthroplasty at high-use institutions

Q4 · MEDICINE

Article

Author: Asche, Carl V. ; Maurer, Brian T. ; Kang, Amiee ; Ren, Jinma ; Dagenais, Simon

01 Aug 2018·The Journal of PainQ2 · MEDICINE

Research Agenda for the Prevention of Pain and Its Impact: Report of the Work Group on the Prevention of Acute and Chronic Pain of the Federal Pain Research Strategy

Q2 · MEDICINE

Article

Author: Hershey, Andrew D ; Licciardone, John C ; Gatchel, Robert J ; Horn, Susan D ; Hicks, Gregory E ; Chou, Roger ; Reuben, David B ; Turk, Dennis C ; Dagenais, Simon

2

News (Medical) associated with Pacira Pharmaceuticals, Inc.13 Nov 2023

Pictured: FDA Headquarters/iStock, JHVEPhoto

The FDA has a busy schedule leading up to Thanksgiving, with three target action dates and an advisory committee meeting to discuss delayed confirmatory trials for two investigational cancer assets.

Pacira Pushes to Expand Anesthetic’s Label

The first FDA verdict this week is expected for Pacira BioSciences, which is proposing to expand the label of its anesthetic Exparel (bupivacaine liposome injectable suspension) to include both single-dose use for sciatic nerve block in the popliteal fossa and to block the femoral nerve in the adductor canal. The regulator has a deadline of Nov. 13.

Exparel uses multivesicular liposomes to deliver bupivacaine, a potent local anesthetic. This combination allows Exparel to gradually release bupivacaine over time, leading to strong and durable reduction in pain scores and a notable decrease in the need for opioid medication.

Currently, Exparel is only approved as a single-dose infiltration to induce postsurgical local anesthesia in patients 6 years and above and as an interscalene brachial plexus nerve block for postsurgical regional anesthesia in adults. Since its initial approval in 2011, Exparel has been administered to over 12 million patients in the U.S., according to its maker.

To support the label expansion, Pacira’s supplemental New Drug Application (sNDA) included data from two Phase III studies, which together showed “statistically significant and clinically meaningful” reductions in postsurgical pain through 96 hours compared with bupivacaine HCl in patients who had undergone surgeries in their lower extremities. Exparel also resulted in lower opioid consumption and demonstrated a favorable tolerability and safety profile.

CorMedix Hopes for Light at the End of Regulatory Tunnel

By Nov. 15, the FDA is expected to release its decision on CorMedix’s New Drug Application for DefenCath, a proprietary antimicrobial formulation being proposed to cut the risk of catheter-related bloodstream infections associated with the use of central venous catheters.

DefenCath leverages the strong antimicrobial properties of taurolidine, a derivative of the amino acid taurine, which has demonstrated potent activity against both gram-positive and gram-negative bacteria—including strains that have gained antibiotic resistance. Taurolidine is also effective against several clinically important fungi, including Aspergillus. DefenCath also uses the anticoagulant heparin.

The FDA has already twice rejected DefenCath, both times citing manufacturing issues. The first Complete Response Letter (CRL), filed in March 2021, pointed to “concerns at the third-party manufacturing facility” detected during a review of records obtained from the third-party service provider.

CorMedix received the second CRL in August 2022, which likewise flagged issues at a contract manufacturing organization (CMO) and with the supplier of heparin.

In March, the company announced that both the CMO and heparin supplier had implemented corrective actions in accordance with the FDA’s inspection. However, at the time, it was unclear whether a formal resolution of the warning letter for the supplier was required for the NDA’s approval.

The FDA accepted CorMedix’s resubmission for DefenCath in June and classified it as a complete Class 2 response.

Two Acrotech Cancer Assets Face ODAC

The FDA’s Oncologic Drugs Advisory Committee (ODAC) is scheduled to convene on Nov. 16 to discuss two cancer products from Acrotech Biopharma: Folotyn (pralatrexate) and Beleodaq (belinostat), both for the treatment of relapsed or refractory peripheral T-cell lymphoma.

Both drugs are currently on the market under the FDA’s accelerated approval pathway. Folotyn won its regulatory approval in October 2009, while Beleodaq was approved in July 2014. The treatments were still owned by different companies at the time, but Acrotech bought them in 2019—along with five other drugs—for $300 million.

To stay on the market and earn full regulatory approval, drugs approved under the accelerated pathway must show additional evidence of clinical efficacy in follow-up confirmatory trials.

However, according to a September 2022 report from the Department of Health and Human Services’ Office of the Inspector General, both drugs have already gone past the originally planned completion dates for their confirmatory studies. At the time of the report, Beleodaq was 15 months overdue, while Folotyn was delayed by 72 months.

On Thursday, the ODAC will receive updates on these two drugs and will deliberate on next steps. The panel will also have a more general discussion on delayed confirmatory trials under the accelerated approval pathway.

Anticipating Rejection, Aldeyra Awaits Decision on Dry Eye Drug

By Nov. 23, the FDA is set to release its decision on Aldeyra Therapeutics’ NDA for its investigational RASP inhibitor reproxalap, which the company is proposing as a treatment for dry eye disease.

However, in an SEC filing posted last month, the Massachusetts-based biotech said it was anticipating a rejection from the regulator.

According to Aldeyra, the FDA flagged “substantive review issues” with reproxalap’s application during a late-cycle review meeting, noting that the company does not appear to have enough “data to support the clinical relevance of the ocular signs” to support approval in this indication.

Aldeyra has since responded to the FDA’s concerns, but the regulator has not yet indicated whether the additional information submitted is sufficient, and has suggested that Aldeyra might need to conduct an additional clinical trial to support its application.

Reproxalap, an orally available small-molecule drug, works by covalently binding to and inhibiting reactive aldehyde species (RASP), a key driver of inflammation in the eye. In December 2021, the Phase III TRANQULITY study showed mixed results for reproxalap, which missed its primary endpoint of reduction in ocular redness but led to significant improvements in the Schirmer test, a measure of tear production.

Aldeyra ran a subsequent trial called TRANQUILITY-2, which did not have ocular redness as a primary measure of efficacy and instead relied on tear production and a responder analysis. Reproxalap met both of these endpoints.

Tristan Manalac is an independent science writer based in Metro Manila, Philippines. He can be reached at tristan@tristanmanalac.com or tristan.manalac@biospace.com.

For more great regulatory insights from BioSpace, sign up for our weekly ClinicaSpace newsletter:

Phase 3Clinical ResultDrug ApprovalAcquisitionNDA

30 Jul 2021

The U.S. FDA is starting off August with a mix of PDUFA dates for acne products, seizure medications and a new manufacturing process for a non-opioid pain killer. Here’s a look.

The U.S.

Food and Drug Administration (FDA)

is starting off August with a mix of PDUFA dates for acne products, seizure medications and a new manufacturing process for a non-opioid pain killer. Here’s a look.

Sol-Gel’s Twyneo for Acne

Sol-Gel Technologies

, headquartered in Ness Ziona, Israel, had a

target action date

of August 1, 2021, for its New Drug Application (NDA) for Twyneo (benzoyl peroxide, 3%, and tretinoin, 0.1%, cream). On July 27, the FDA

approved

the product. It is the first FDA-approved treatment for acne that contains a fixed-dose combination of benzoyl peroxide and tretinoin. As part of its preparation for a U.S. launch, the company opened U.S. headquarters in Whippany, New Jersey.

Both tretinoin and benzoyl peroxide are commonly prescribed individually as a combination treatment for acne. Benzoyl peroxide degrades the tretinoin molecule, which potentially decreases its effectiveness if used simultaneously or combined in the same formulation. The company’s silica-based microcapsule is engineered to prevent tretinoin from being oxidated by benzoyl peroxide, which improves the stability of the two ingredients. The shell is also built to release the ingredients gradually over time.

“The FDA approval of Twyneao underscores our ability to deliver innovative, proprietary drugs to the market,” said Alon Seri-Levy, co-founder and chief executive officer of Sol-Gel. “Based on the clinical data observed, we believe that Twyneo has the potential to change the treatment landscape for the tens of millions of patients suffering from acne vulgaris. With market leader, Galderma, handling the product launch of Twyneo, we are excited that Twyneo will soon be able to patients in the U.S.”

Eton’s Topiramate for Seizures and Migraine

Eton Pharmaceuticals

, based in Deer Park, Illinois, has a

target action date

of August 6 for its NDA for topiramate oral solution, which was submitted for three indications: monotherapy for partial-onset or primary general tonic-clonic seizures in patients two years and older; adjunctive therapy for partial-onset seizures, including seizures associated with Lennox-Gastaut syndrome in patients two years and older; and as preventative treatment of migraine in people 12 years of age and older.

In October 2020, when the FDA

accepted

the NDA, Sean Brynjelsen, chief executive officer of Eton, said, “Topiramate is one of the most widely compounded oral liquids, and our product addresses the unmet need for pediatric-friendly formulations of the molecule. We look forward to working with the FDA to bring a safe, effective, FDA-approved product to patients and caregivers as quickly as possible.”

Pacira BioSci’s New Manufacturing Process for Exparel

Pacira Biosciences

, located in Parsippany, New Jersey, has a

target action date

of August 6 for its supplemental New Drug Application (sNDA) for its new manufacturing process for Exparel (bupivacaine liposome injectable suspension). Exparel is

indicated

for single-dose infiltration in adults for local analgesia after surgery and as an interscalene brachial plexus nerve block for postsurgical regional analgesia. In August 2020, the FDA accepted the sNDA for expansion of the drug to include children aged six and over, with a target action date of March 22, 2021. On March 22, the FDA

approved

Exparel for children.

On May 18, 2021, Pacira announced that the U.S. Patent and Trademark Office (USPTO) had issued a Notice of Allowance for the patent related to Exparel’s new manufacturing process.

“This new patent marks the first deliverable from our comprehensive patent strategy and adds yet another layer of market exclusivity that extends our proprietary position for Exparel into the 2040s,” said Dave Stack, chairman and chief executive officer of Pacira. “The comprehensives nature of the allowed claims underscores the deep multivesicular liposome manufacturing expertise that Pacira has accumulated over more than 25 years. Over the last six years, we have invested more than $100 million to create, design and commercialize a more efficient method for making Exparel, exceeding the U.S. Food and Drug Administration’s rigorous standards for safety and bioequivalence. Our innovative manufacturing processes for Exparel are a core competency that we are committed to safeguarding globally.”

Drug ApprovalNDA

100 Deals associated with Pacira Pharmaceuticals, Inc.

Login to view more data

100 Translational Medicine associated with Pacira Pharmaceuticals, Inc.

Login to view more data

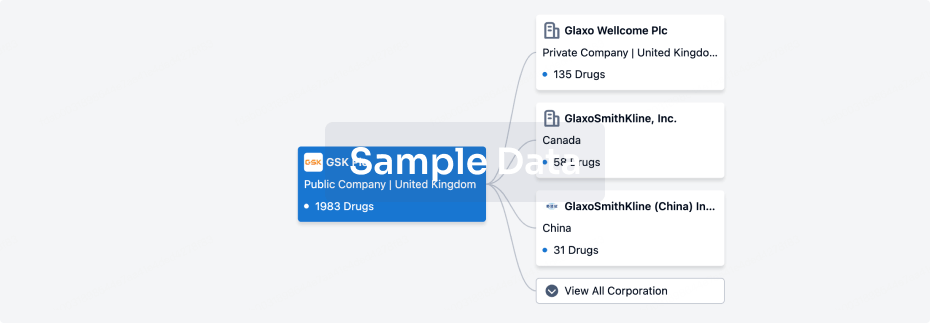

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 21 Sep 2025

No data posted

Login to keep update

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

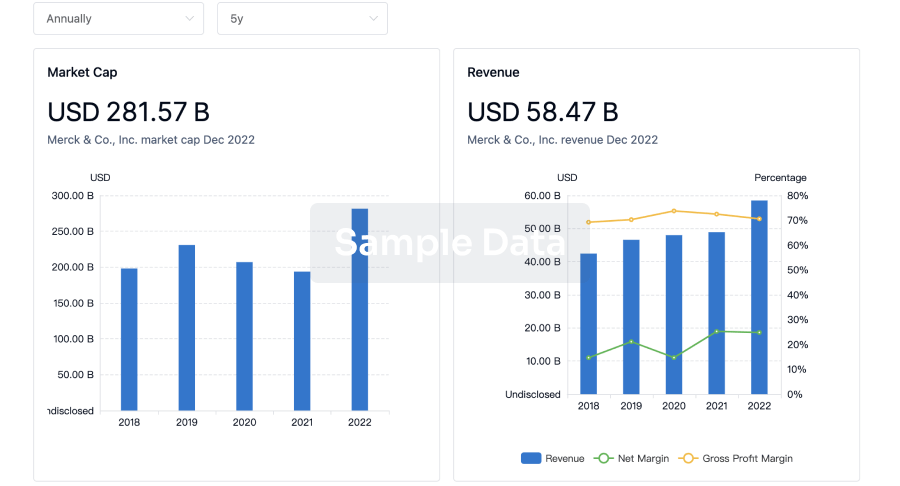

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

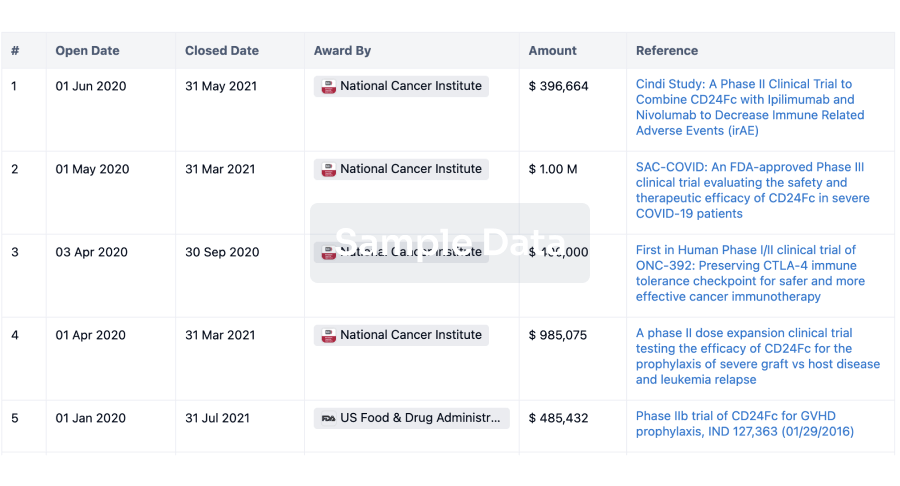

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

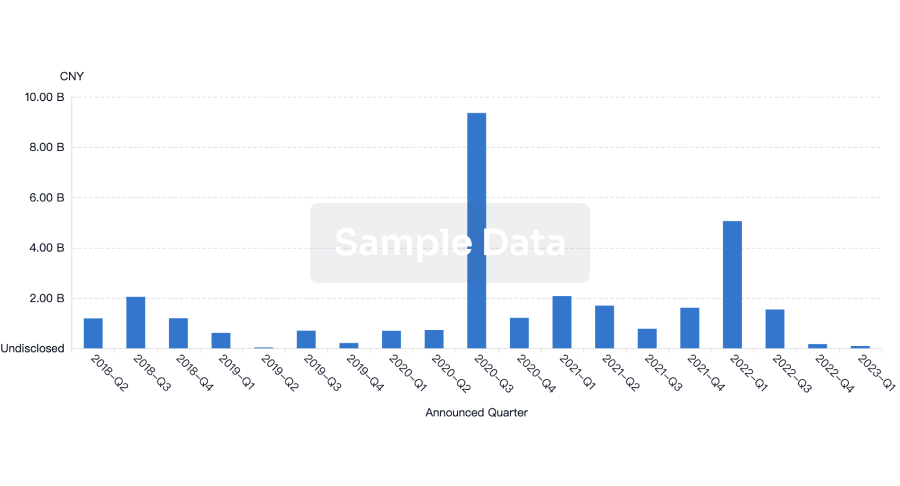

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free