Request Demo

Last update 08 May 2025

University of Pennsylvania School of Nursing

Last update 08 May 2025

Overview

Related

100 Clinical Results associated with University of Pennsylvania School of Nursing

Login to view more data

0 Patents (Medical) associated with University of Pennsylvania School of Nursing

Login to view more data

4,818

Literatures (Medical) associated with University of Pennsylvania School of Nursing01 Jun 2025·International Journal of Nursing Studies Advances

Background and design of the Physical Frailty and Symptom Monitoring and Management Behaviors in Heart Failure (PRISM-HF) study: A mixed methods study

Review

Author: Hiatt, Shirin O ; Chien, Christopher V ; Rosenkranz, Susan J ; Hansen, Lissi ; Denfeld, Quin E ; Riegel, Barbara ; Lee, Christopher S ; Camacho, S Albert ; Ramos, Tyler B ; Dieckmann, Nathan F

01 Jun 2025·Clinical Nutrition

The GLIM consensus approach to diagnosis of malnutrition: A 5-year update

Article

Author: Klek, Stanislaw ; Steiber, Alison ; Correia, M Isabel T D ; Evans, David C ; Mori, Naoharu ; Muscaritoli, Maurizio ; Schueren, Marian de van der ; Cuerda, Cristina ; Hiesmayr, Michael ; Jager-Wittenaar, Harriët ; Jáquez, Anayanet ; van Gossum, André ; Hasse, Jeanette M ; Wang, Jaw-Yuan ; Barazzoni, Rocco ; Carrasco, Fernando ; Mundi, Manpreet ; Shi, Han Ping ; Cruz Jentoft, Alfonso J ; Singer, Pierre ; Nyulasi, Ibolya ; Braz, Diana Cardenas ; Gonzalez, M Cristina ; Jensen, Gordon L ; Tappenden, Kelly A ; Schneider, Stephane ; Blaauw, Renee ; Jahit, Shukri ; Gramlich, Leah ; Fukushima, Ryoji ; Yu, Jianchun ; Compher, Charlene ; Hiki, Naoki ; Siltharm, Soranit ; Keller, Heather ; Mogensen, Kris M ; Fuchs-Tarlovsky, Vanessa ; Ng, Doris ; Cederholm, Tommy ; Pisprasert, Veeradej ; Winkler, Marion F ; Malone, Ainsley ; Pirlich, Matthias

01 May 2025·JONA: The Journal of Nursing Administration

Nurses Perception of the Health of the Work Environment in Hospitals With Nursing Workplace Environment and Staffing Councils

Article

Author: Vitale, Tracy R ; Mastro, Kari A ; Weaver, Susan H ; Kowalski, Mildred Ortu ; Giordano, Nicholas A ; Caruso, Judith T ; Mapp, Marilyn

12

News (Medical) associated with University of Pennsylvania School of Nursing21 Mar 2025

Lund, Sweden – March 21, 2025 – BioInvent International AB (“BioInvent”) (Nasdaq Stockholm: BINV), a biotech company focused on the discovery and development of novel and first-in-class immune-modulatory antibodies for cancer immunotherapy, today announced that one of the company’s lead program; BI-1808 as monotherapy in Cutaneous T Cell Lymphoma (CTCL) will be presented at the 16th Annual T-Cell Lymphoma Forum held March 20-22, 2025 in La Jolla, California.

The data, previously disclosed in a press release in September 2024, will be featured in a poster presentation highlighting the early efficacy of BI-1808 monotherapy in the ongoing Phase 2a dose expansion study in CTCL. So far three partial responses (PR) and one stable disease (SD) out of four evaluable patients have been reported. The Company anticipates reporting additional data from the study in mid-2025.BI-1808, a first-in-class anti-TNFR2 antibody, was recently granted Orphan Drug Designation by the U.S. Food and Drug Administration (FDA) for the treatment of TCL.

Poster presentation details:

Title: Evidence of T reg depletion and Corresponding Early Efficacy after Tumor Necrosis Factor Receptor 2 (TNFR2) Blockade by BI-1808 in Cutaneous T Cell Lymphoma (CTCL) PatientsSession Date and Time: March 21st, 2025, 5:30 pm PTLead Author: Stefan Barta, University of Pennsylvania Hospital, PA, USAAbstract Number: TCLF34

The poster will be uploaded on the company website in the Scientific Publications section: https://www.bioinvent.com/en/our-science/scientific-publications.

About BI-1808The anti-TNFR2 antibody BI-1808 is part of BioInvent’s tumor-associated regulatory T cells (Treg)-targeting program. TNFR2 is particularly upregulated on Tregs of the tumor microenvironment and has been shown to be important for tumor expansion and survival, representing a new and promising target for cancer immunotherapy. BI-1808 is a first-in-class drug candidate in clinical development for the treatment of solid tumors and blood cancer. BI-1808 has shown single agent activity and excellent tolerability in an ongoing Phase 2a study and signs of efficacy and favorable safety profile in combination with pembrolizumab in the ongoing Phase 1/2a study.

About the Phase 1/2a study During the first part of the Phase 1/2a study (NCT04752826) the safety, tolerability, and potential signs of efficacy of BI-1808 as a single agent (part A) and in combination with the anti-PD-1 therapy pembrolizumab (part B) are evaluated in patients with advanced solid tumors and T-cell lymphoma. The efficacy of BI-1808 as single agent is currently explored in the Phase 2a part of the trial in a larger sample of patients. Expansion cohorts include ovarian cancer, all tumor types and T-cell lymphoma (including CTCL). The dose escalation in Phase 1 part B has been completed and the Phase 2a dose expansion study for the combination is ongoing. The expansion cohorts are planned to include ovarian cancer, all tumor types and T-cell lymphoma (including CTCL).

To date, results from the single agent CTCL cohort show three patients with partial response (PR) and one with stable disease (SD) out of four evaluable patients. All these patients had previously deteriorated after standard treatment. These data support the single agent data disclosed earlier in 2024, showing one complete response (CR), one PR and nine patients with SD, presented at the American Society of Clinical Oncology conference (ASCO) in June 2024. Additional data from Phase 2a study of single agent BI-1808 are expected by mid-2025.

About BioInventBioInvent International AB (Nasdaq Stockholm: BINV) is a clinical-stage biotech company that discovers and develops novel and first-in-class immuno-modulatory antibodies for cancer therapy, with currently five drug candidates in six ongoing clinical programs in Phase 1/2 trials for the treatment of hematological cancer and solid tumors. The Company's validated, proprietary F.I.R.S.T™ technology platform identifies both targets and the antibodies that bind to them, generating many promising new immune-modulatory candidates to fuel the Company's own clinical development pipeline and providing licensing and partnering opportunities.

The Company generates revenues from research collaborations and license agreements with multiple top-tier pharmaceutical companies, as well as from producing antibodies for third parties in the Company's fully integrated manufacturing unit. More information is available at www.bioinvent.com.

For further information, please contact:Cecilia Hofvander, VP Investor RelationsPhone: +46 (0)46 286 85 50Email: cecilia.hofvander@bioinvent.comBioInvent International AB (publ)Co. Reg. No.: 556537-7263Visiting address: Ideongatan 1Mailing address: 223 70 LUNDPhone: +46 (0)46 286 85 50www.bioinvent.comThe press release contains statements about the future, consisting of subjective assumptions and forecasts for future scenarios. Predictions for the future only apply as the date they are made and are, by their very nature, in the same way as research and development work in the biotech segment, associated with risk and uncertainty. With this in mind, the actual outcome may deviate significantly from the scenarios described in this press release.

ImmunotherapyPhase 2Orphan DrugASCOClinical Result

30 Sep 2024

Newly Announced CDC Guidelines Aim to Reduce Avoidable Rehospitalizations

NEW YORK, Sept. 30, 2024 /PRNewswire/ -- Taking effect October 1, the Centers for Disease Control and Prevention (CDC) is adding an important new diagnostic code to their annual update of the International Classification of Diseases (ICD-10) list. The new

"Encounter for Sepsis Aftercare" update came about as the result of ground-breaking research from the Center for Home Care Policy & Research at VNS Health and the University of Pennsylvania School of Nursing (Penn Nursing). The new code, z51A, supports providers in hospitals and health facilities nationwide by alerting home care clinicians and other post-acute care providers when a patient is being discharged to aftercare following hospitalization for sepsis, a life-threatening medical condition triggered by an extreme response to infection.

Continue Reading

Kathryn H. Bowles, PhD, RN, Director of the VNS Health Center for Home Care Policy & Research; Professor and van Ameringen Chair in Nursing Excellence at Penn Nursing

The need for a new ICD-10 code for sepsis survivors was spurred by findings from a VNS Health study where analysis of the records of over 165,000 sepsis survivors entering home care showed that sepsis was noted in admission assessments only 7% of the time. This alarming discovery caused the researchers to question whether home health providers were even aware that a patient had been diagnosed with sepsis. This study also identified risk factors associated with early readmission of sepsis survivors. The study, led by

Kathryn H. Bowles,

PhD, RN,

Director of the VNS Health Center for Home Care Policy & Research; Professor and van Ameringen Chair in Nursing Excellence at Penn Nursing, was published in the

Journal of the American Medical Directors Association, in 2020.

"Our work has shown that timely attention by home care and outpatient clinicians is highly effective for sepsis survivors. It is critically important to communicate sepsis survivorship across transitions in care because among those readmitted from home health care, one-third occur in the first seven days," said Dr. Bowles. "We are hopeful this new ICD code will direct the necessary attention to sepsis survivors and improve outcomes for the 1.7 million Americans who encounter sepsis each year."

In an ongoing NIH funded study (R01NR016014) also led by Dr. Bowles with VNS Health colleagues, interviews with personnel at 16 hospitals and five affiliated home health agencies across the U.S. revealed the lack of a diagnostic code to identify sepsis survivors after discharge. Home health personnel explained that because sepsis is an acute care condition treated and resolved in the hospital, they are not able to place it on the home care record. The study provided evidence that because of this communication gap, home care providers and clinicians may not be prompted to provide the timely attention and close monitoring that sepsis recovery warrants. Between one-third and one-half of readmissions are due to sepsis recurrence and up to 50% of sepsis survivors are left with long-term physical and/or psychological effects. It is critical that post-acute care clinicians are aware they are caring for a sepsis survivor.

Following publication of these research findings, Dr. Bowles and her team led a coordinated advocacy effort aimed at persuading the CDC of the need for a diagnostic code that defines sepsis aftercare as a separate condition. After a formal presentation by the team to a CDC committee in March of 2023, a new ICD-10 code was accepted and announced in July of this year. The code takes effect October 1, 2024.

About VNS Health and the

Center for Home Care Policy & Research

:

VNS Health is one of the nation's largest nonprofit home- and community-based health care organizations. Innovating in health care for more than 130 years, our commitment to health and well-being is what drives us—we help people live, age, and heal where they feel most comfortable, in their own homes, connected to their family and community. The organization offers a full range of health care services, solutions and health plans designed to simplify the health care experience and meet the diverse and complex needs of those we serve in New York and beyond. These include

The Center for Home Care Policy & Research, which for over 30 years has been advancing the national knowledge base underpinning home- and community-based services by conducting scientifically rigorous research and supporting informed decision-making by providers, policymakers, and consumers.

SOURCE VNS Health

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

24 Jun 2024

MONDAY, June 24, 2024 -- Older patients with COVID-19 are more likely to survive hospitalization in facilities with adequate nursing resources, according to a study published online June 7 in the

International Journal of Nursing Studies

.

Karen B. Lasater, Ph.D., R.N., from the University of Pennsylvania School of Nursing in Philadelphia, and colleagues evaluated whether hospital differences in prepandemic and during pandemic nursing resources (e.g., average patient-to-registered nurse [RN] staffing ratios, proportion of bachelors-qualified RNs, nurse work environments, and Magnet recognition) explain differences in risk-adjusted COVID-19 mortality. Analysis included 87,936 Medicare beneficiaries (65 to 99 years old) hospitalized with COVID-19 and discharged (or died) between April 1 and Dec. 31, 2020, from 237 general acute care hospitals in New York and Illinois.

The researchers found that 23 percent of admitted patients died during the hospitalization, and 31.5 percent died within 30 days of admission. Risk of death was significantly lower for patients admitted with COVID-19 to hospitals with better nursing resources prepandemic and during the pandemic. Each additional patient in the average nurses' workload prepandemic was associated with significantly higher odds of in-hospital mortality (odds ratio, 1.20) and of 30-day mortality (odds ratio, 1.15). Similar protective effects were seen for hospitals with greater proportions of bachelors-qualified RNs, better quality nurse work environments, and Magnet recognition.

"If all hospitals in the study had superior nursing resources prior to or during the pandemic, models estimate many thousands of deaths among patients hospitalized with COVID-19 could have been avoided," the authors write.

Abstract/Full Text

Whatever your topic of interest,

subscribe to our newsletters

to get the best of Drugs.com in your inbox.

Clinical Result

100 Deals associated with University of Pennsylvania School of Nursing

Login to view more data

100 Translational Medicine associated with University of Pennsylvania School of Nursing

Login to view more data

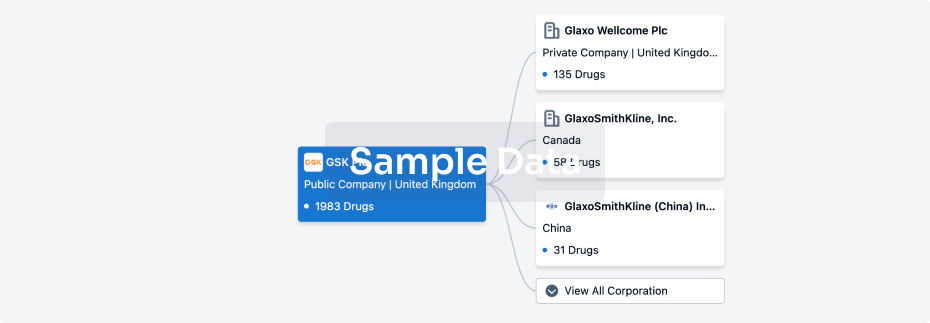

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 23 Dec 2025

No data posted

Login to keep update

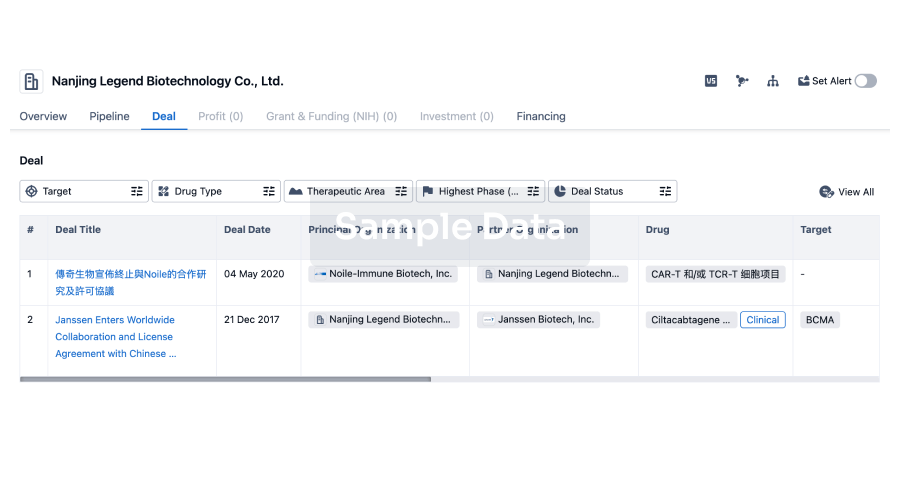

Deal

Boost your decision using our deal data.

login

or

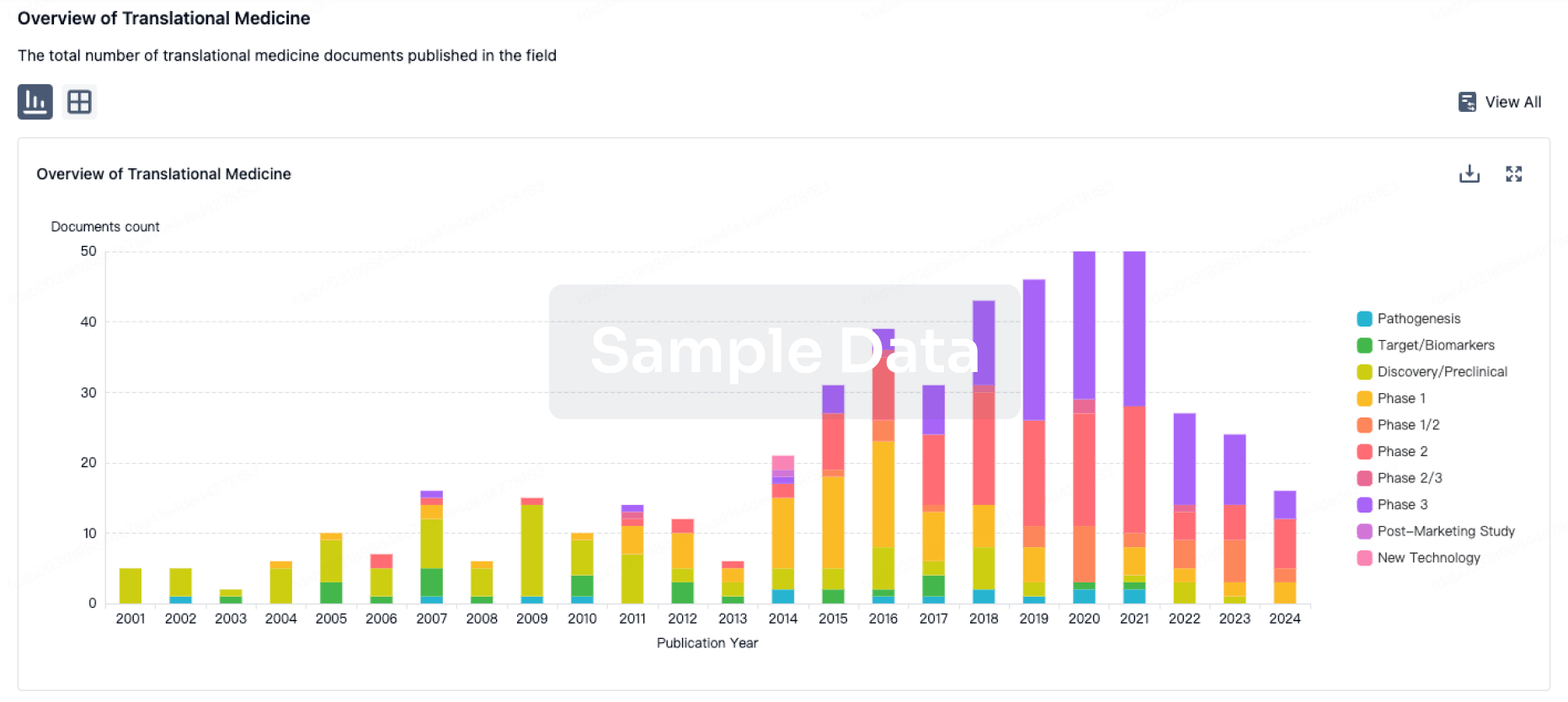

Translational Medicine

Boost your research with our translational medicine data.

login

or

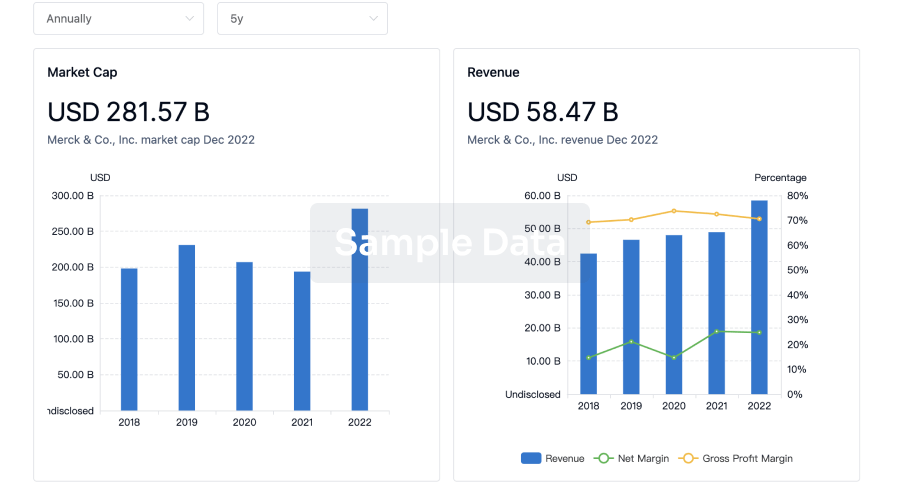

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

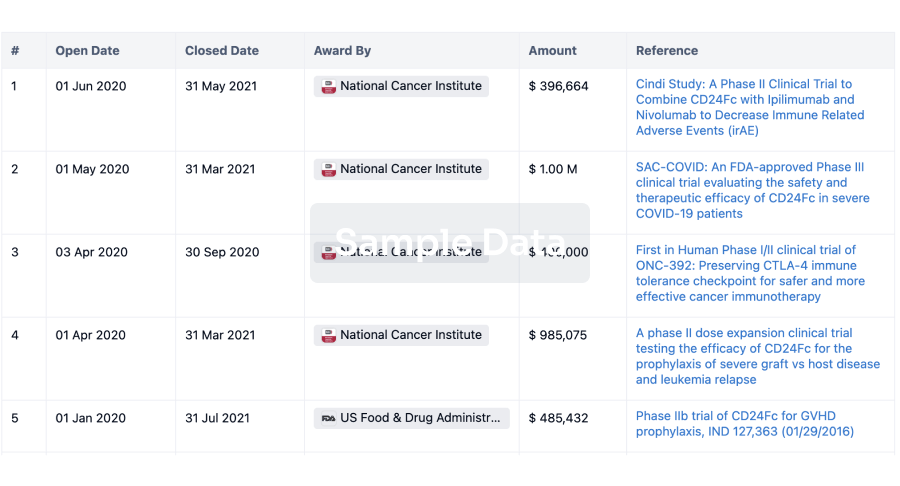

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

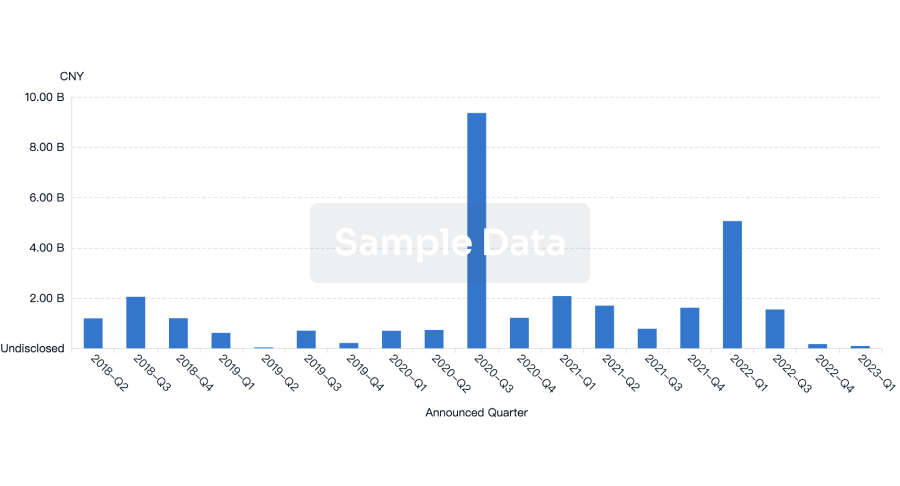

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

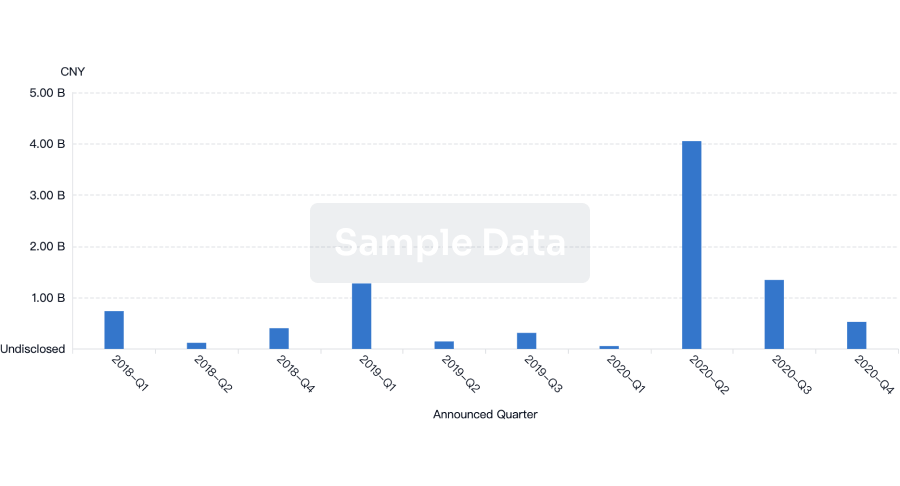

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free