Request Demo

Last update 08 May 2025

HBM Healthcare Investments

Last update 08 May 2025

Overview

Related

100 Clinical Results associated with HBM Healthcare Investments

Login to view more data

0 Patents (Medical) associated with HBM Healthcare Investments

Login to view more data

68

News (Medical) associated with HBM Healthcare Investments21 Mar 2025

AstraZeneca and Alteogen's subcutaneous drug delivery deal, Taiho's acquisition of an ADC biotech and WuXi AppTec's 2025 growth projection made our news this week.

AstraZeneca has tapped Korea's Alteogen to develop subcutaneous cancer drugs. Taiho Pharmaceutical is paying $400 million to acquire antibody-drug conjugate expert Araris Biotech. WuXi AppTec expects sales to grow 10% to 15% in 2025 as the fate of the BIOSECURE Act remains uncertain. And more.1. AstraZeneca signs Alteogen deal worth up to $1.35B for subcutaneous cancer drugs despite Merck-Halozyme patent dramaAstraZeneca has enlisted Alteogen and its hyaluronidase technology, ALT-B4, to advance subcutaneous formulations of “several oncology assets.” In its filings to the Korea Exchange, Alteogen disclosed two separate agreements together potentially worth up to $1.35 billion. The deal comes as Halozyme is engaged in a patent dispute with Merck & Co. on its subcutaneous formulation of Keytruda, which also uses ALT-B4.2. Otsuka's Taiho pays $400M for Swiss partner to 'turbocharge' 3 ADCs to clinicTaiho Pharmaceutical is paying $400 million upfront and committing up to $740 million in milestones to acquire Swiss antibody-drug conjugate specialist Araris Biotech. In 2023, the Otsuka unit inked a licensing deal to use Araris’ AralinQ platform to develop ADCs. Araris has three preclinical programs expected to enter the clinic over the course of 2025 and 2026.3. WuXi AppTec offers rosy 2025 guidance despite threat of US-China trade tensionsWuXi AppTec expects to grow sales by 10% to 15% in 2025. The rosy projection comes as the fate of the BIOSECURE Act remains uncertain. The company’s revenue slipped about 3% to 39.24 billion Chinese yuan ($5.4 billion) last year. Nevertheless, U.S. sales, which made up the bulk of the CRDMO’s business, still grew nearly 8% despite the draft bill’s threats of forced industry decoupling.4. Curevo rounds up $110M to challenge GSK’s Shringrix, nabs Moncef Slaoui to lead boardCurevo Vaccines, founded and invested in by Korea’s GC Biopharma, has raised $110 million in series B led by new investor Medicxi. OrbiMed, Sanofi Ventures and HBM Healthcare Investments also joined as new backers of the U.S. biotech. The money will be used on a phase 2 extension program for amezosvatein, a potential competitor to GSK’s blockbuster shingles vaccine Shingrix.5. Elevation drops sole clinical-stage ADC over poor phase 1 data, lays off 70% of staffElevation Oncology has decided to ditch its sole clinical asset, a Claudin18.2 antibody-drug conjugate coded EO-3021, which it licensed from China’s CSPC Pharma for $27 million upfront in 2022. Elevation unveiled lackluster tumor response data from a small group of stomach patients last year but pressed on by focusing on a subgroup. Updated data only showed a 22% response rate among those biomarker-enriched patients.6. AstraZeneca offers early look at Datroway-Tagrisso combo in EGFR lung cancer as phase 3 trial rolls onAstraZeneca found that a combination of its Daiichi Sankyo-partnered Datroway and Tagrisso induced a 36% response rate in a small group of patients with EGFR-mutated non-small cell lung cancer (NSCLC) who had progressed on first-line Tagrisso, according to results from the phase 2 Orchard trial. The two companies in October launched a phase 3 trial to test Datroway either alone or together with Tagrisso in post-Tagrisso NSCLC.Other News of Note:7. Dr. Reddy’s, Sun Pharma and Zydus issue US recalls, citing failed specs and labeling issues8. Chiesi bails on TiumBio’s respiratory drug deal (Korea Biomedical Review)9. Klick buys Ward6 Singapore’s operations to fuel Asian expansion10. Japan’s RegCell moves to US with $45.8M to advance Treg platform (release)

Phase 2VaccineLicense out/inClinical ResultPhase 3

17 Mar 2025

A midstage study found that Curevo\'s candidate elicited a 100% vaccine response rate compared to 97.9% for GSK\'s Shingrix. \n In its effort to rival GSK’s shingles vaccine Shingrix, Curevo Vaccine has circled up $110 million and recruited two former GSK leaders to its board.The biotech’s series B was led by new investor Medicxi, a European biotech VC with vaccine companies such as Vaxcyte and ViceBio already in its portfolio, according to a March 17 release. Other new Curevo backers include OrbiMed, Sanofi Ventures and HBM Healthcare Investments.Existing investors RA Capital Management, Janus Henderson Investors and Adjuvant Capital participated in the round, along with founding investor GC Biopharma.The Seattle-based biotech will inject the money into a phase 2 extension program for amezosvatein, a non-mRNA adjuvanted sub-unit vaccine designed to prevent shingles. The extension builds off midstage results that found the candidate elicited a 100% vaccine response rate compared to 97.9% for GSK\'s Shingrix, along with being linked to lower rates of solicited local and systemic adverse events. The extended program will include 640 more participants in efforts to finalize dose selection for phase 3.The extension trial is slated to launch in mid-2025, Curevo CEO George Simeon said in the release.The small biotech plans to go head-to-head with Shingrix with an assist from some former GSK execs, one being Operation Warp Speed’s chief scientific advisor Moncef Slaoui, Ph.D. Before advising the federal government during the COVID-19 pandemic, Slaoui served as vaccine head at GSK and contributed to the creation of several new vaccines—including Shingrix—during his almost 30 years with the Big Pharma. Now, he’ll serve as chair of Curevo’s board of directors.“I have been collaborating with the Curevo team for several weeks now,” Slaoui said in a company statement. “I’m very excited to work with them to help perfect shingles vaccination, adding good tolerability to the exceptional efficacy achieved by the current vaccine. The data so far show Curevo’s adjuvant technology has the attributes to succeed in this endeavor.”The vaccine biotech has also landed Tal Zaks, M.D., Ph.D., to serve on its board on behalf of OrbiMed. Zaks served as Moderna’s chief medical officer for more than six years, overseeing the development of the company\'s mRNA vaccine Spikevax against COVID-19 during part of that time. Before that, he had held senior drug development roles at GSK and Sanofi. Curevo’s mission is to develop varicella zoster virus (VZV) vaccines that boost tolerability and efficacy, with amezosvatein also being tested in an early-stage chickenpox study for children.The series B financing nearly doubles Curevo’s $60 million series A raised in August 2022 and it still tops the round after $26 million was tacked on in November of the same year.

VaccinePhase 2mRNAExecutive Change

17 Mar 2025

A Seattle biotech trying to take on one of the world’s biggest vaccines has nabbed a megaround. It also named former Operation Warp Speed chief scientific advisor Moncef Slaoui as its board chair and added Moderna’s ex-chief medical officer Tal Zaks to its board.

The startup, Curevo Vaccine, reeled in a $110 million Series B Monday morning to fund a large extension to a Phase 2 trial of its shingles vaccine. Curevo thinks its shot, codenamed amezosvatein, can be as efficacious as GSK’s blockbuster vaccine Shingrix. Importantly, the startup thinks its shot will carry less baggage on the safety front than the nearly decade-old incumbent, which continues to show

long-term efficacy

.

The decision to extend the existing Phase 2 — which

already cleared

the co-primary efficacy and safety endpoints when it pitted the vaccine against Shingrix — means the Pacific Northwest upstart has fallen more than a year behind its original clinical development timelines.

But the move could make for improved chances of success for amezosvatein in a multinational pivotal program, CEO George Simeon said in an interview.

Curevo will need all odds in its favor to take on Shingrix, which garnered

$4.3 billion

for GSK last year. The 40-employee startup will include another 640 people in its trial extension, which will kick off midyear, so it can get data from adults over the age of 70.

The new chair is quite familiar with Shingrix. Slaoui was a decadeslong GSK leader who helmed their vaccine work, including that of Shingrix. He’s also on the boards of Arcturus, Abzena, Vicebio and others.

Shingrix “has only, over a period of 10 years, penetrated 40% of the target population here in the US and only 10% in Europe,” Slaoui said in an interview. “In part because while it’s exceptionally efficacious, it’s highly reactogenic. It’s safe, but it’s reactogenic.” That includes injection site pain, chills, fever, headache and myalgia (muscle pain), he said.

Curevo’s adjuvanted subunit vaccine is quite similar to Shingrix, but the company says it uses an improved version of the TLR4 agonist. Slaoui said he could see amezosvatein becoming a booster shot for the very elderly as well.

Once the company has that new batch of Phase 2 data next year, it could explore a variety of additional funding options, be it a Series C, crossover or initial public offering, Simeon said. The company has enough capital now to take it through an end-of-Phase 2 meeting with regulators and prepare for the broad Phase 3 program. It’s already held some discussions with the FDA and European regulatory agencies on its Phase 3 ambitions, Simeon said.

There’s also the chance of getting bought out by one of the large vaccine companies. In shingles, Curevo is competing with vaccines in development from Pfizer-partnered BioNTech, Moderna and Dynavax.

“I would be surprised if there isn’t an interest from some of the big players,” Slaoui said. “Obviously I’m very connected to all the big players, but at the same time because it’s a very clear Phase 3 plan, very clear path, very low risk, it can also be a highly attractive public market opportunity in the next 18 months or so or less.”

The company works with external CDMOs. Manufacturing, and CMC more broadly, is one of the key components involved in vaccine development.

While Curevo collects new data on its adult vaccine, the health regulatory oversight in the US is drastically changing.

“There is noise in the air for vaccines, but we think this is some short-term disturbance,” said Medicxi partner and co-founder Giovanni Mariggi, who is also joining Curevo’s board. “We are still big believers in these products for the good that they can do for the world. Hopefully, this is not the last vaccine deal you see us do.”

Medicxi led the Series B. It also bankrolled another vaccine company last year,

Vicebio

, that is attempting to take on GSK and other companies in RSV and other respiratory viruses.

Mariggi noted the term sheet for Curevo came together just before Christmas and the syndicate was completed shortly after, meaning the bulk of the financing discussions occurred after the US presidential election. Other investors in the round include OrbiMed, HBM Healthcare Investments and Sanofi Ventures. Existing backers RA Capital, Janus Henderson Investors, Adjuvant Capital and founding investor GC Biopharma also took part.

Much of the vaccine conversations lately have focused on younger populations, Slaoui noted. Shingles can lead to annoying and painful rashes for multiple weeks, but in some cases also leads to long-term nerve pain, damage to the eyes or other serious outcomes.

“The foundational rules are not going to change and elderly vaccines are needed,” Slaoui said. “In this case, there’s nothing you can do. You can diet, you can run, you can do anything you want. You have varicella inside. You’re stuck with it, and it will reactivate because, I hope, it means you’re aging and that’s what everybody would like to do.”

VaccinePhase 2Executive ChangePhase 3

100 Deals associated with HBM Healthcare Investments

Login to view more data

100 Translational Medicine associated with HBM Healthcare Investments

Login to view more data

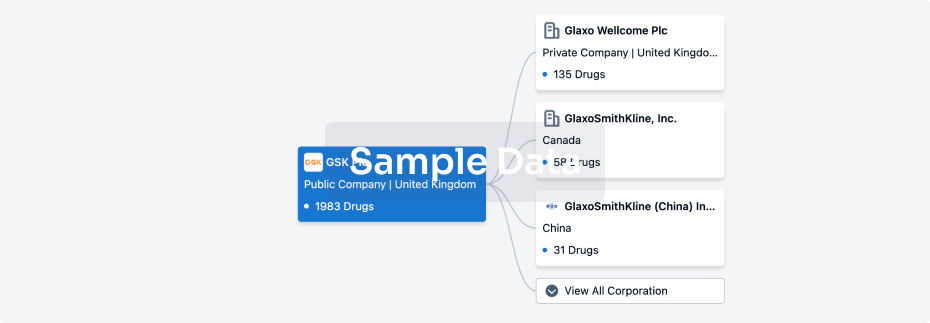

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 15 Dec 2025

No data posted

Login to keep update

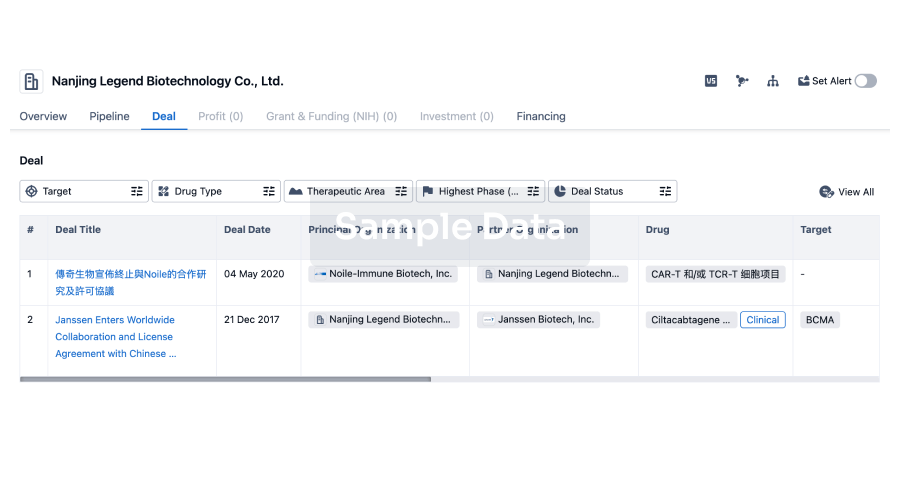

Deal

Boost your decision using our deal data.

login

or

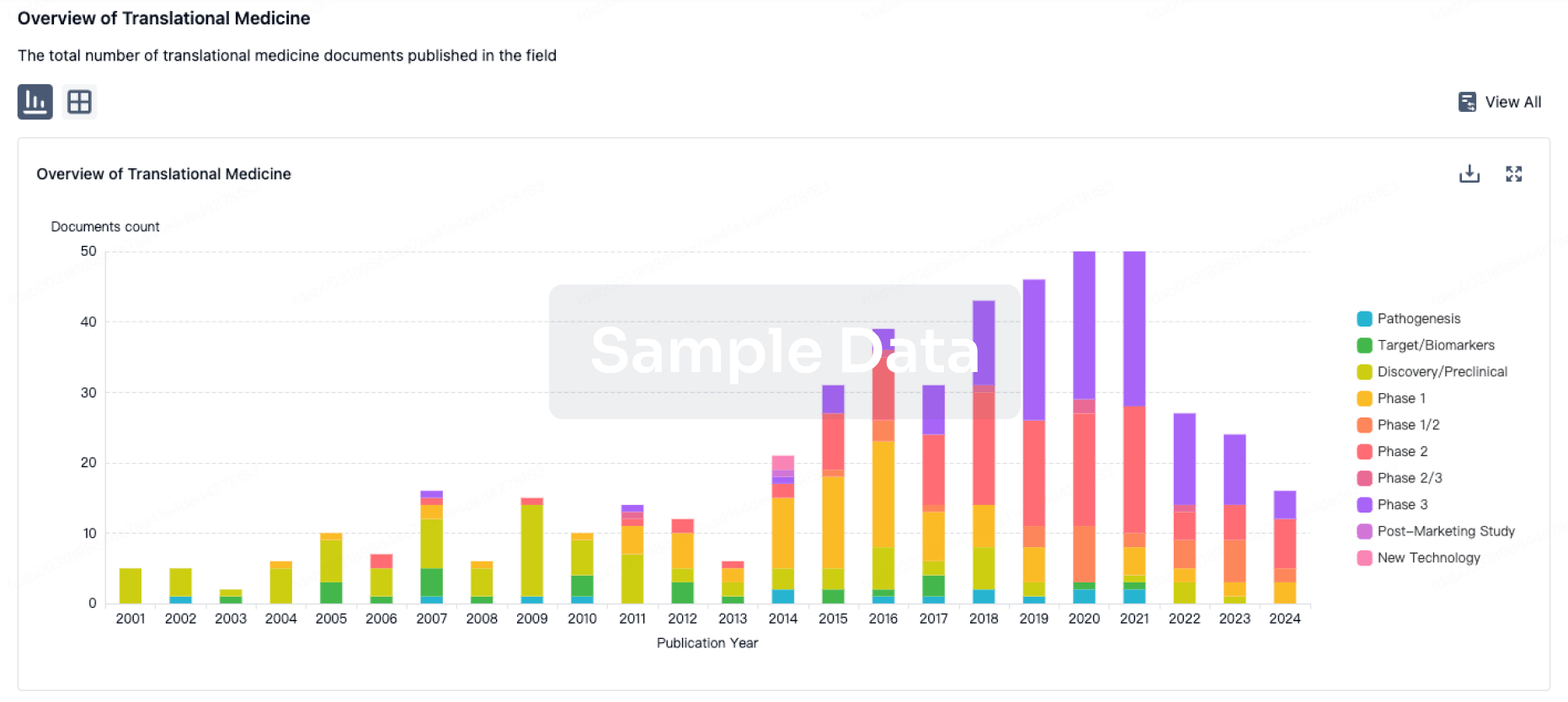

Translational Medicine

Boost your research with our translational medicine data.

login

or

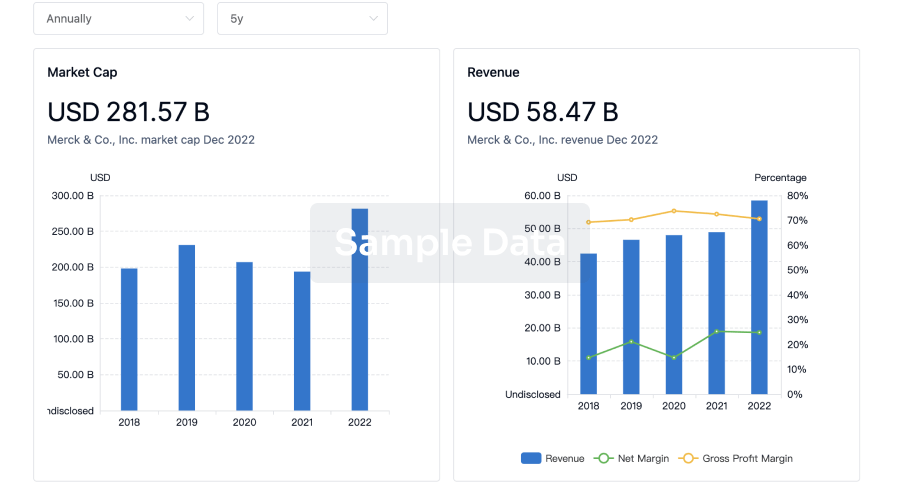

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

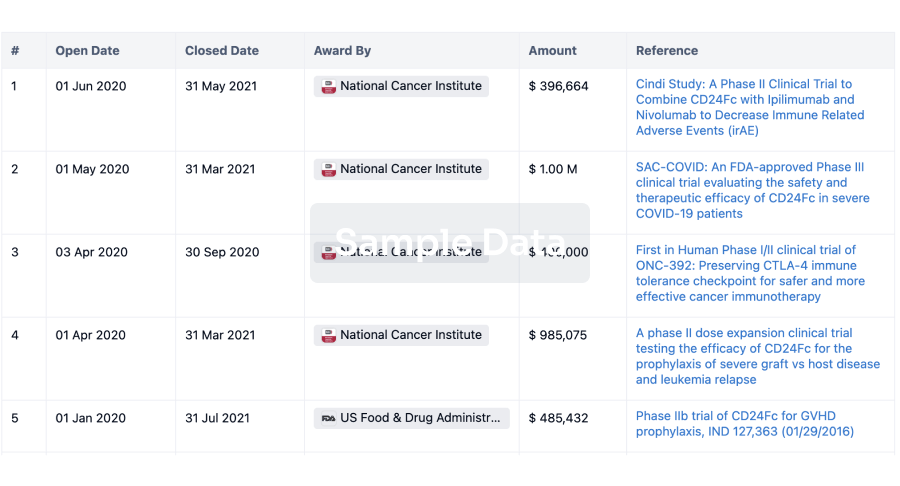

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

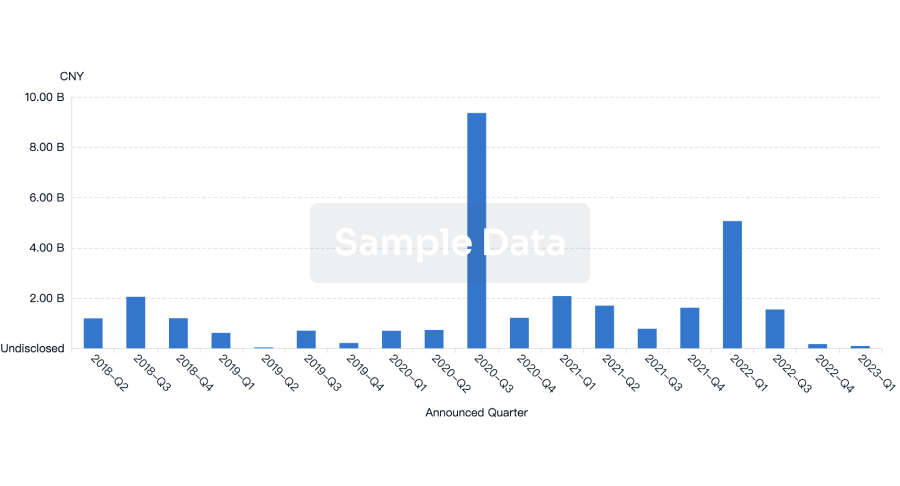

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

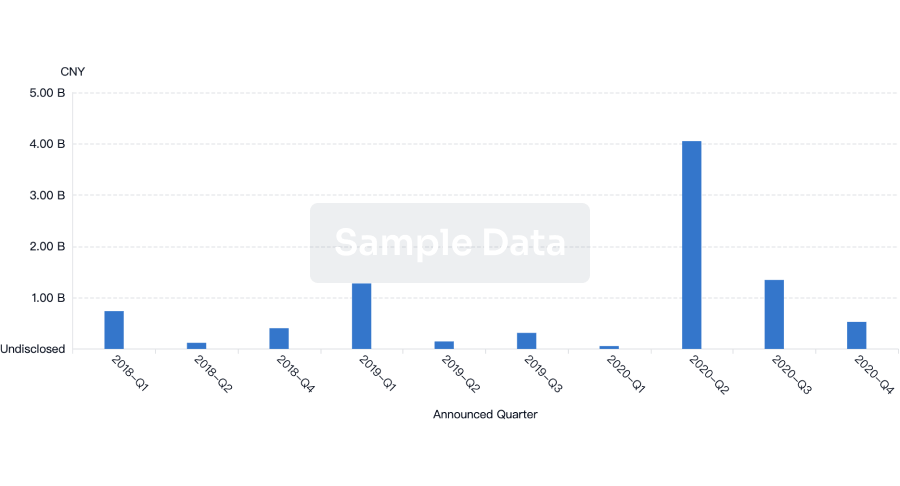

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free