Request Demo

Last update 08 May 2025

Jama Claims Processing LLC

Last update 08 May 2025

Overview

Related

100 Clinical Results associated with Jama Claims Processing LLC

Login to view more data

0 Patents (Medical) associated with Jama Claims Processing LLC

Login to view more data

40

News (Medical) associated with Jama Claims Processing LLC12 Mar 2025

Can Gilead be held accountable for holding back the sale of an HIV drug it allegedly knew was safer than its blockbuster predecessor?

That’s the question before the California Supreme Court, and the answer could offer a unique example of a situation where a pharma company can be liable for a product that isn’t defective.

Two academics from the University of West Virginia and Dartmouth

wrote in a

JAMA Viewpoint

on Wednesday that there’s a strong case to be made against Gilead because it knew that the later product was safer and deliberately delayed the launch of that drug.

The original lawsuit, filed in San Francisco by 24,000 AIDS patients, similarly alleges that Gilead slow-walked the safer HIV drug, known as tenofovir alafenamide fumarate (TAF), to maximize profits from an older HIV drug, tenofovir disoproxil fumarate (TDF). The company delayed entry of TAF while knowing that TAF had fewer serious bone and kidney side effects, the plaintiffs said.

A California appeals court

ruled in January 2024

that delaying TAF may make Gilead liable for negligence. The court said that the “legal duty of a manufacturer to exercise reasonable care can … extend beyond the duty not to market a defective product” and that the plaintiffs should be able to present the evidence to a jury. Gilead appealed to the California Supreme Court, which agreed last May to review the case. The case has yet to be scheduled for arguments.

The California high court’s question is: “Does a drug manufacturer have a duty of reasonable care to users of a drug it is currently selling, which is not alleged to be defective, when making decisions about the commercialization of an allegedly safer, and at least equally effective, alternative drug?”

Many major biopharmas back Gilead in the case.

JAMA co-author Sean Tu of West Virginia, whose research is partially funded by Arnold Ventures, told

Endpoints News

that the question “essentially amounts to whether pharma companies can delay the commercialization of drugs that could be safer than currently marketed products.” He said PhRMA and other pharma companies are wrong to tout this case as a “duty to innovate” case, meaning that if Gilead loses, manufacturers would have a legal obligation to develop and market improved, or safer, alternative drugs, even if the existing product isn’t defective.

“Gilead had a safer product in the works, but decided not to release it because they were afraid it would ‘cannibalize’ profits from the older (TDF) product,” Tu said. “What resulted? Probably thousands of patient deaths and tens of thousands of adverse serious events. But it also resulted in hundreds of millions of added revenues for Gilead.”

The twists and turns of the lawsuit against Gilead also highlight the difficulties in compensating patients who have been harmed by pharmaceuticals, according to the JAMA Viewpoint. They coin the term “drug versioning” to explain what Gilead did, which the authors call a new form of product hopping.

“Drug versioning occurs when a manufacturer delays a newer version of an existing product to maximize profits from an older one,” they write. But they also note that Gilead would be liable only for withholding a product that was already developed and planned for commercialization, not for failing to invent a safer version in the first place.

“Gilead’s liability is predicated on its proven knowledge of TAF’s benefits, not its mere possession of positive Phase 1 and 2 results,” the authors write.

Patent Infringement

17 Jan 2025

Taylor Tieden for

BioSpace

Drugmakers will have until the end of February to decide whether they want to participate in the second round of Medicare negotiations or not. CMS has until June 1 to send an initial offer for the adjusted prices.

Two weeks ahead of its Feb. 1 deadline, the Centers for Medicare and Medicaid Services on Friday

named the next 15 drug products

that would be included in the second round of the drug price negotiations prescripted under the Inflation Reduction Act.

Most notably—and

unsurprisingly

—the CMS has selected Novo Nordisk’s blockbuster GLP-1 therapy semaglutide, approved as Ozempic in type 2 diabetes and Wegovy in weight loss. Novo’s sister semaglutide type 2 diabetes drug Rybelsus will also be subject to negotiation.

Together, these three therapies racked up almost $14.5 billion in gross Medicare Part D spending from November 2023 to October 2024, according to a

factsheet

that the CMS released alongside its Friday announcement. There are nearly 2.3 million Part D enrollees who used these three drugs during the same time span.

The other drugs included in the second round of negotiations are:

GSK’s Trelegy Ellipta asthma and chronic obstructive pulmonary disease (COPD)

Astellas and Pfizer’s Xtandi, approved for prostate cancer

Bristol Myers Squibb’s Pomalyst, approved for multiple myeloma

Pfizer’s Ibrance, approved for breast cancer

Boehringer Ingelheim’s Ofev, approved for idiopathic pulmonary fibrosis

AbbVie’s Linzess, approved for irritable bowel syndrome

AstraZeneca’s Calquence, approved for certain blood cancers

Teva’s Austedo, approved for Huntington’s disease chorea or tardive dyskinesia

GSK’s Breo Ellipta, approved for COPD and asthma

Boehringer Ingelheim’s Tradjenta, approved for type 2 diabetes

Salix’s Xifaxan, approved for travelers’ diarrhea caused by noninvasive strains of

E. coli

AbbVie’s Vraylar, approved for major depressive disorder and bipolar I disorder

Merck’s Janumet, approved for type 2 diabetes

Amgen’s Otezla, approved for inflammatory diseases such as plaque psoriasis and psoriatic arthritis

According to the CMS, these drugs were selected based on their “gross covered prescription drug costs,” among other criteria. Between November 2023 and October 2024, approximately 5.3 million Part D beneficiaries used the selected drugs, costing the government around $41 billion in gross drug spending.

Xavier Becerra, Secretary of the Department of Health and Human Services (HHS), in a statement called Friday’s list “pivotal,” noting that the first round of the Medicare program “proved that negotiating for lower drug prices works.” HHS, through CMS, will “build on that record,” he continued, “negotiating in the best interest of people with Medicare to have access to innovative, life-saving treatments at lower costs.”

Companies now have until Feb. 28 to signify their intent to participate in the negotiations—or not. Through March and April 2025, CMS will host several stakeholder engagement sessions as well as one town hall to gather feedback from relevant parties regarding the pricing of the selected drugs. CMS has until June 1 to send its initial offer to the drugmakers, which will then have a month to either accept or counter offer. The final prices will take effect in 2027.

A Predictable List

Experts and industry observers have in recent months released multiple forecasts for drugs that would most likely be included in the second cycle of the Medicare negotiation program. Friday’s list confirms many of those predictions.

A September 2024 list published in the

Journal of Managed Care & Specialty Pharmacy

, for instance,

correctly identified

more than 10 products that eventually made it onto CMS’s list, including Ozempic, Ibrance, Linzess and Calquence.

Of these drugs, Ozempic was the most obvious candidate for the second round of negotiations. In an

interview with

BioSpace

last fall, Barclays’ Emily Field said “there’s no way [Ozempic’s] not going to be in there.” A month earlier,

Reuters

reported that analysts on Wall Street had also largely expected Ozempic to be on the list.

Ozempic and its sister brands were predicted to make the list in large part because they’ve been on the receiving end of very public calls for price cuts. In April 2024, for instance, Sen. Bernie Sanders (I-Vt.)

opened a probe

on Ozempic, blasting what he called the “outrageously high prices” of the drug. Sanders was spurred by a study published in

JAMA

that found that semaglutide could profitably be produced at less than $5 a month.

A few months later, in July, President Biden joined Sanders in penning an

opinion piece for

USA Today

, calling on Novo and fellow obesity leader Eli Lilly to lower their drug prices.

Drug Approval

09 Jan 2025

iStock,

JHVEPhoto

According to BMO Capital Markets, Medicare coverage of Lilly’s Zepbound opens the door to using secondary indications to secure CMS coverage for obesity drugs.

The Centers for Medicare and Medicaid Services on Wednesday confirmed that certain Medicare plans can now cover the use of

Eli Lilly

’s blockbuster obesity drug Zepbound (tirzepatide) for use in obstructive sleep apnea, according to

CNBC

.

The news is a “significant positive” for Lilly, BMO Capital Markets analysts wrote in an investor note on Wednesday, adding that coverage would likely expand patient access to the weight-loss medication. This greater availability “could add another ~$1.4B to Zepbound’s peak revenue opportunity, with ~$1B coming from a Medicare patient population that would see significantly improved access,” the BMO analysts claimed.

Zepbound was approved by the FDA for obstructive sleep apnea

late last month

, making it the first drug available for certain patients with the illness. In the Phase III SURMOUNT-OSA trial, Zepbound was around five times more effective than placebo at cutting breathing disruptions in patients who were not on positive airway pressure therapy.

Under its current guidelines, CMS

does not offer

coverage for Zepbound and other GLP-1 receptor agonists when they are used for chronic weight management. Medicare covers only a

limited number

of obesity interventions, including bariatric surgery and behavioral therapy.

In November 2024, however, the agency

announced

that it is proposing changes in its Medicare Part D program, which would allow the plan to cover weight-loss drugs to treat obesity. If approved, the changes would also “require” Medicaid to cover these medications, CMS noted at the time.

In the meantime, drugmakers have been able to secure Medicare coverage for some secondary indications of their weight-loss therapies. For instance, Novo Nordisk in March 2024

won CMS coverage

for Wegovy (semaglutide), which was originally only indicated for weight management but later

secured the FDA’s approval

for lowering cardiovascular risk in overweight and obese adults.

According to the BMO analysts on Wednesday, Medicare coverage for Zepbound in sleep apnea “marks a proverbial opening of the door for Medicare coverage of secondary outcomes indications,” a milestone that they claimed in an investor note is “positive for the class and patients.”

Wide coverage for these obesity treatments could prove very costly, however. An August 2024 study published in the

Annals of Internal Medicine

found that Part D coverage for Novo’s semaglutide alone could run the U.S. government

up to $145 billion annually

—confirming a March 2024 report from the Congressional Budget Office (CBO), which

cautioned

that Medicare would not able to sustain coverage of semaglutide at a price tag of $1,000 to $1,300 for a monthly supply.

The same month the CBO report was released, Sen. Bernie Sanders (I-Vt.)

criticized

Novo Nordisk for what he called the “outrageously high price” of semaglutide and cited a study published in

JAMA

that found the drug could be profitably made for under $5 a month.

Phase 3Drug Approval

100 Deals associated with Jama Claims Processing LLC

Login to view more data

100 Translational Medicine associated with Jama Claims Processing LLC

Login to view more data

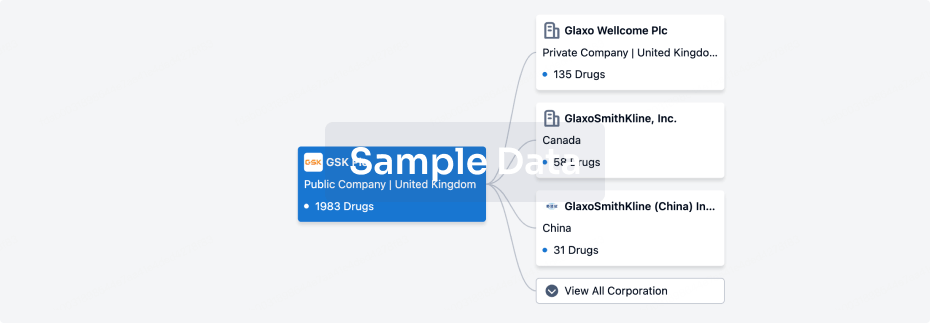

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 21 Sep 2025

No data posted

Login to keep update

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

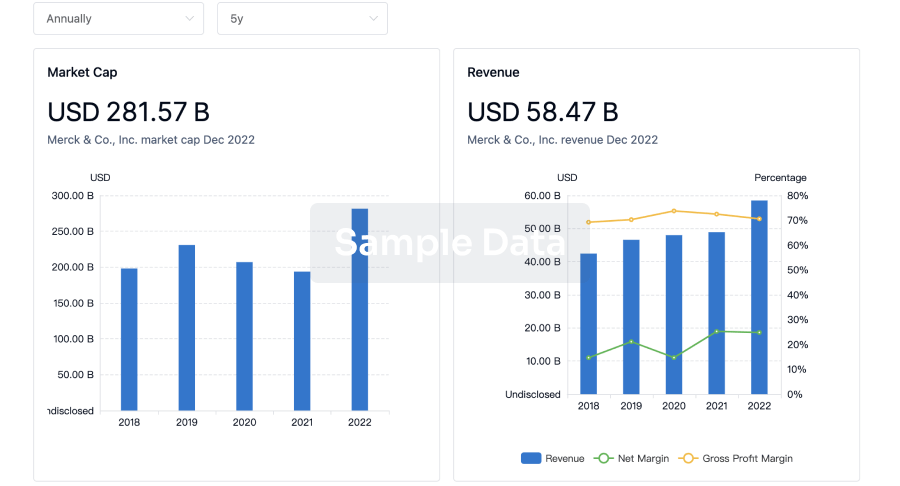

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

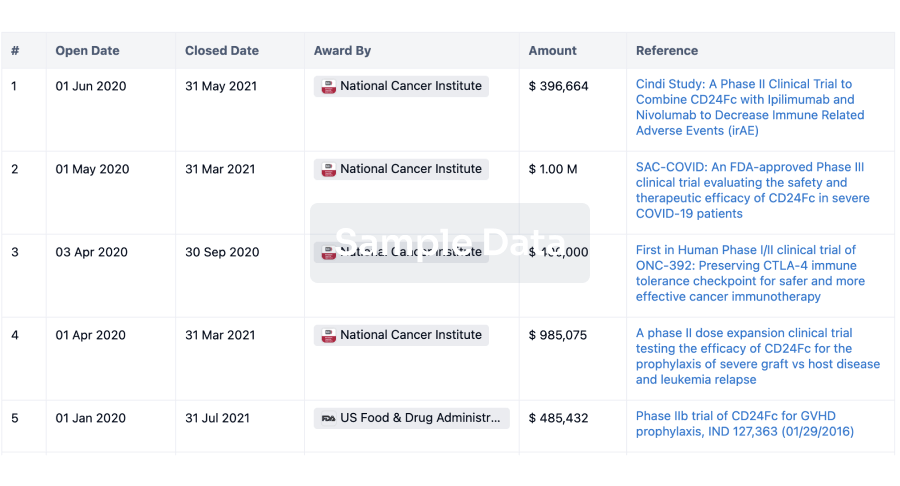

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

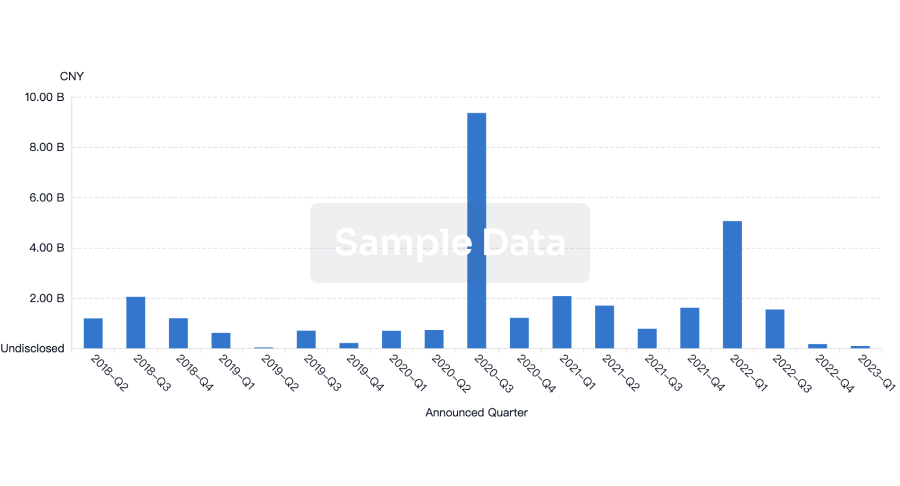

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free