Request Demo

Last update 08 May 2025

PCDHA7

Last update 08 May 2025

Basic Info

Synonyms CNR4, CNRS4, CRNR4 + [4] |

Introduction Calcium-dependent cell-adhesion protein involved in cells self-recognition and non-self discrimination. Thereby, it is involved in the establishment and maintenance of specific neuronal connections in the brain. |

Related

100 Clinical Results associated with PCDHA7

Login to view more data

100 Translational Medicine associated with PCDHA7

Login to view more data

0 Patents (Medical) associated with PCDHA7

Login to view more data

243

Literatures (Medical) associated with PCDHA701 Sep 2022·World Journal for Pediatric and Congenital Heart Surgery

Novel Insights into the Etiology, Genetics, and Embryology of Hypoplastic Left Heart Syndrome

Article

Author: Lo, Cecilia W. ; Yagi, Hisato ; Gabriel, George C. ; Xu, Xinxiu

01 Jun 2021·Molecular PsychiatryQ1 · MEDICINE

Cis-effects on gene expression in the human prenatal brain associated with genetic risk for neuropsychiatric disorders

Q1 · MEDICINE

Article

Author: O'Brien, Heath E ; O'Donovan, Michael C ; Walters, James T R ; Bray, Nicholas J ; Owen, Michael J ; Hall, Lynsey S ; Pain, Oliver ; Anney, Richard

01 Jun 2021·Molecular PsychiatryQ1 · MEDICINE

Conditional GWAS analysis to identify disorder-specific SNPs for psychiatric disorders

Q1 · MEDICINE

Article

Author: Wray, Naomi R ; Yang, Jian ; O'Donovan, Michael C ; Rietschel, Marcella ; Stahl, Eli ; Hjerling-Leffler, Jens ; Smoller, Jordan W ; Qi, Ting ; Skene, Nathan G ; Bryois, Julien ; Pardinas, Antonio F ; Zhu, Zhihong ; Byrne, Enda M ; Visscher, Peter M ; Walters, James T R ; Owen, Michael J ; Goddard, Michael E ; McGrath, John G ; Sullivan, Patrick F

29

News (Medical) associated with PCDHA708 Jan 2025

VANCOUVER, British Columbia & DALLAS--(

BUSINESS WIRE

)--Alpha Cognition, Inc. (Nasdaq: ACOG) (“ACI” or the “Company”), a biopharmaceutical company developing novel therapeutics for debilitating neurodegenerative disorders, and China Medical System Holdings Limited (CMS) (867.HK), a platform company linking pharmaceutical innovation and commercialization with strong product lifecycle management capability in the People’s Republic of China, today announced an exclusive licensing agreement for the development, manufacturing and commercialization of ZUNVEYL (benzgalantamine) in Asia (excluding Japan), Australia and New Zealand. ZUNVEYL is a next generation acetylcholinesterase inhibitor approved in the US for the treatment of mild-to-moderate Alzheimer’s disease.

Terms of the agreement total $44 million, which includes $6 million in total upfront payments split into tranches and development and commercial milestone payments. Additionally, ACI is eligible to receive royalties on net sales of ZUNVEYL in Asia (excluding Japan), Australia and New Zealand. CMS will be responsible for the regulatory, development, manufacturing, and commercialization of ZUNVEYL in the licensed territories.

“We are excited to partner with CMS to distribute ZUNVEYL, an FDA-approved oral treatment for mild-to-moderate Alzheimer’s disease. The product has significant potential in China and we believe that CMS has the commitment and expertise to manage the complex regulatory and commercial landscape in these territories,” said Michael McFadden, CEO of Alpha Cognition. “With their strong track record of developing and commercializing CNS therapies in China, we believe CMS is the ideal partner to advance ZUNVEY’s regulatory development in a region where 50 million people are estimated to have Alzheimer’s disease.”

Alpha Cognition remains on track to launch ZUNVEYL in the United States in Q1 2025. The company will provide a corporate update and present its Launch Strategy on January 28, 2025 at 4pm EST.

About CMS

CMS is a platform company linking pharmaceutical innovation and commercialization with strong product lifecycle management capability, dedicated to providing competitive products and services to meet unmet medical needs. CMS focuses on the global FIC and BIC innovative products, and efficiently promotes the clinical research, development and commercialization of innovative products. CMS deeply engages in several specialty therapeutic fields, such as cardio-cerebrovascular, central nervous system, gastroenterology, dermatology and ophthalmology, and has developed proven commercialization capabilities, extensive networks and expert resources, resulting in leading academic and market positions for its major marketed products. For more information about CMS, please visit

https://web.cms.net.cn/en/home

.

About Alpha Cognition Inc.

Alpha Cognition Inc. is a commercial stage, biopharmaceutical company dedicated to developing treatments for patients suffering from neurodegenerative diseases, such as Alzheimer’s disease and Cognitive Impairment with mild Traumatic Brain Injury (“mTBI”), for which there are currently no approved treatment options.

ZUNVEYL is a patented drug approved as a new generation acetylcholinesterase inhibitor for the treatment of Alzheimer’s disease, with expected minimal gastrointestinal side effects. ZUNVEYL’s active metabolite is differentiated from donepezil and rivastigmine in that it binds neuronal nicotinic receptors, most notably the alpha-7 subtype, which is known to have a positive effect on cognition. ALPHA-1062 is also being developed in combination with memantine to treat moderate to severe Alzheimer’s dementia, and as an intranasal formulation for Cognitive Impairment with mTBI.

Forward-looking Statements

This news release includes forward-looking statements within the meaning of applicable securities laws. Except for statements of historical fact, any information contained in this news release may be a forward‐looking statement that reflects the Company’s current views about future events and are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. In some cases, you can identify forward‐looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “target,” “seek,” “contemplate,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward‐looking statements may include statements regarding the potential benefits of the licensing agreement for the development and commercialization of ZUNVEYL in Asia (excluding Japan), Australia and New Zealand, the Company’s timing and planned activities to launch ZUNVEYL in the U.S. and China, the timing for the Company’s planned corporate update call, the potential timing for the availability of ZUNVEYL in the U.S. and China, the potential future developments of ZUNVEYL in China, the potential market size for ZUNVEYL in China, the Company’s business strategy for the launch of ZUNVEYL in China, the market size and demand for ZUNVEYL in China, the Company’s potential growth opportunities in China, the timing and results of the Company’s milestone payments for China, the Company’s regulatory submissions in China, and the potential regulatory approval and commercialization of the Company’s products in China. Although the Company believes to have a reasonable basis for each forward-looking statement, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. The Company cannot assure that the actual results will be consistent with these forward-looking statements. These forward-looking statements are subject to certain risks, including risks regarding our ability to raise sufficient capital to implement our plans to commercialize ZUNVEYL, risks regarding the efficacy and tolerability of ZUNVEYL, risks related to ongoing regulatory oversight on the safety of ZUNVEYL, risk related to market adoption of ZUNVEYL, risks related to the Company’s intellectual property in relation to ZUNVEYL, risks related to the commercial manufacturing, distribution, marketing and sale of ZUNVEYL, risks related to product liability and other risks as described in the Company’s filings with Canadian securities regulatory authorities and available at

www.sedar.com

and the Company’s filings with the United States Securities and Exchange Commission (the “SEC”), including those risk factors under the heading “Risk Factors” in the Company’s Form S-1/A registration statement as filed with the SEC on November 6, 2024 and available at

www.sec.gov

. These forward‐looking statements speak only as of the date of this news release and the Company undertakes no obligation to revise or update any forward‐looking statements for any reason, even if new information becomes available in the future, except as required by law.

License out/inDrug Approval

08 Jan 2025

January 8, 2025 VANCOUVER, B.C. and Dallas, TX. Alpha Cognition, Inc. (Nasdaq: ACOG) (“ACI” or the “Company”), a biopharmaceutical company developing novel therapeutics for debilitating neurodegenerative disorders, and China Medical System Holdings Limited (CMS) (867.HK), a platform company linking pharmaceutical innovation and commercialization with strong product lifecycle management capability in the People’s Republic of China, today announced an exclusive licensing agreement for the development, manufacturing and commercialization of ZUNVEYL (benzgalantamine) in Asia (excluding Japan), Australia and New Zealand. ZUNVEYL is a next generation acetylcholinesterase inhibitor approved in the US for the treatment of mild-to-moderate Alzheimer’s disease.

Terms of the agreement total $44 million, which includes $6 million in total upfront payments split into tranches and development and commercial milestone payments. Additionally, ACI is eligible to receive royalties on net sales of ZUNVEYL in Asia (excluding Japan), Australia and New Zealand. CMS will be responsible for the regulatory, development, manufacturing, and commercialization of ZUNVEYL in the licensed territories.

“We are excited to partner with CMS to distribute ZUNVEYL, an FDA-approved oral treatment for mild-to-moderate Alzheimer’s disease. The product has significant potential in China and we believe that CMS has the commitment and expertise to manage the complex regulatory and commercial landscape in these territories,” said Michael McFadden, CEO of Alpha Cognition. “With their strong track record of developing and commercializing CNS therapies in China, we believe CMS is the ideal partner to advance ZUNVEY’s regulatory development in a region where 50 million people are estimated to have Alzheimer’s disease.”

Alpha Cognition remains on track to launch ZUNVEYL in the United States in Q1 2025. The company will provide a corporate update and present its Launch Strategy on January 28, 2025 at 4pm EST.

About CMS

CMS is a platform company linking pharmaceutical innovation and commercialization with strong product lifecycle management capability, dedicated to providing competitive products and services to meet unmet medical needs. CMS focuses on the global FIC and BIC innovative products, and efficiently promotes the clinical research, development and commercialization of innovative products. CMS deeply engages in several specialty therapeutic fields, such as cardio-cerebrovascular, central nervous system, gastroenterology, dermatology and ophthalmology, and has developed proven commercialization capabilities, extensive networks and expert resources, resulting in leading academic and market positions for its major marketed products. For more information about CMS, please visit https://web.cms.net.cn/en/home.

About Alpha Cognition Inc.

Alpha Cognition Inc. is a commercial stage, biopharmaceutical company dedicated to developing treatments for patients suffering from neurodegenerative diseases, such as Alzheimer’s disease and Cognitive Impairment with mild Traumatic Brain Injury (“mTBI”), for which there are currently no approved treatment options.

ZUNVEYL is a patented drug approved as a new generation acetylcholinesterase inhibitor for the treatment of Alzheimer’s disease, with expected minimal gastrointestinal side effects. ZUNVEYL’s active metabolite is differentiated from donepezil and rivastigmine in that it binds neuronal nicotinic receptors, most notably the alpha-7 subtype, which is known to have a positive effect on cognition. ALPHA-1062 is also being developed in combination with memantine to treat moderate to severe Alzheimer’s dementia, and as an intranasal formulation for Cognitive Impairment with mTBI.

For further information: Investor Relations IR@alphacognition.com https://www.alphacognition.com/

Forward-looking Statements

This news release includes forward-looking statements within the meaning of applicable securities laws. Except for statements of historical fact, any information contained in this news release may be a forward‐looking statement that reflects the Company’s current views about future events and are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. In some cases, you can identify forward‐looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “target,” “seek,” “contemplate,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward‐looking statements may include statements regarding the potential benefits of the licensing agreement for the development and commercialization of ZUNVEYL in Asia (excluding Japan), Australia and New Zealand, the Company’s timing and planned activities to launch ZUNVEYL in the U.S. and China, the timing for the Company’s planned corporate update call, the potential timing for the availability of ZUNVEYL in the U.S. and China, the potential future developments of ZUNVEYL in China, the potential market size for ZUNVEYL in China, the Company’s business strategy for the launch of ZUNVEYL in China, the market size and demand for ZUNVEYL in China, the Company’s potential growth opportunities in China, the timing and results of the Company’s milestone payments for China, the Company’s regulatory submissions in China, and the potential regulatory approval and commercialization of the Company’s products in China. Although the Company believes to have a reasonable basis for each forward-looking statement, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. The Company cannot assure that the actual results will be consistent with these forward-looking statements. These forward-looking statements are subject to certain risks, including risks regarding our ability to raise sufficient capital to implement our plans to commercialize ZUNVEYL, risks regarding the efficacy and tolerability of ZUNVEYL, risks related to ongoing regulatory oversight on the safety of ZUNVEYL, risk related to market adoption of ZUNVEYL, risks related to the Company’s intellectual property in relation to ZUNVEYL, risks related to the commercial manufacturing, distribution, marketing and sale of ZUNVEYL, risks related to product liability and other risks as described in the Company’s filings with Canadian securities regulatory authorities and available at www.sedar.com and the Company’s filings with the United States Securities and Exchange Commission (the “SEC”), including those risk factors under the heading “Risk Factors” in the Company’s Form S-1/A registration statement as filed with the SEC on November 6, 2024 and available at www.sec.gov. These forward‐looking statements speak only as of the date of this news release and the Company undertakes no obligation to revise or update any forward‐looking statements for any reason, even if new information becomes available in the future, except as required by law.

License out/inDrug Approval

16 Dec 2024

VANCOUVER, British Columbia and Dallas, TX — December 16, 2024 (BUSINESS WIRE) — Alpha Cognition Inc. (Nasdaq: ACOG) (“Alpha Cognition”, or the “Company”), a biopharmaceutical company committed to developing novel therapies for debilitating neurodegenerative disorders, today announced that the underwriters of its underwritten U.S. public offering (the “Offering”) have partially exercised their over-allotment option to purchase an additional 488,506 common shares at the public offering price of US$5.75 per share for an additional US$2.8 million in gross proceeds. After giving effect to the partial exercise of the over-allotment option, the Company sold an aggregate 9,184,159 common shares for gross proceeds of approximately US$52.8 million, before deducting underwriter discounts and other related expenses. The option closing date was December 16, 2024. The common shares began trading on The Nasdaq Capital Market on November 12, 2024, under the ticker symbol “ACOG”.

The Company intends to use the proceeds towards the commercialization and launch of ZUNVEYLTM in Alzheimer’s Disease, further research and development of its pipeline product candidates, continued commercial CMC activities (chemistry, manufacturing, and controls), and for working capital and general corporate purposes.

Titan Partners Group, a division of American Capital Partners, is acting as Sole Bookrunner for the offering.

The securities were sold pursuant to a registration statement on Form S-1 (File No. 333-280196) relating to these securities and a related registration statement on Form S-1 MEF that became effective upon its filing in accordance with Rule 462(b) under the Securities Act of 1933, as amended. The Offering is being made only by means of a prospectus. A copy of the final prospectus related to the Offering may be obtained from Titan Partners Group LLC, a division of American Capital Partners, LLC, 4 World Trade Center, 29th Floor, New York, NY 10007, or via email at prospectus@titanpartnersgrp.com or telephone at (929) 833-1246. In addition, a copy of the final prospectus relating to the Offering may be obtained via the SEC's website at www.sec.gov.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Alpha Cognition Inc.

Alpha Cognition Inc. is a commercial stage, biopharmaceutical company dedicated to developing treatments for patients suffering from neurodegenerative diseases, such as Alzheimer’s disease and Cognitive Impairment with mild Traumatic Brain Injury (“mTBI”), for which there are currently no approved treatment options.

ZUNVEYL is a patented drug approved as a new generation acetylcholinesterase inhibitor (AChEI) for the treatment of Alzheimer’s disease, with expected minimal gastrointestinal side effects. ZUNVEYL’s active metabolite is differentiated from donepezil and rivastigmine in that it improves the function of neuronal nicotinic receptors, most notably the alpha-7 subtype, which is known to have a positive effect on cognition. Benzgalantamine is also being developed in combination with memantine to treat moderate to severe Alzheimer’s dementia, and as an intranasal formulation for Cognitive Impairment with mTBI.

Forward-looking Statements

This news release includes forward-looking statements within the meaning of applicable securities laws. Except for statements of historical fact, any information contained in this news release may be a forward‐looking statement that reflects the Company’s current views about future events and are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. In some cases, you can identify forward‐looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “target,” “seek,” “contemplate,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward‐looking statements may include statements regarding the potential use of proceeds of the Offering. Although the Company believes to have a reasonable basis for each forward-looking statement, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. The Company cannot assure that the actual results will be consistent with these forward-looking statements. These forward‐looking statements speak only as of the date of this news release and the Company undertakes no obligation to revise or update any forward‐looking statements for any reason, even if new information becomes available in the future.

Contacts

For further information: Michael McFadden, CEO Tel: 1-858-344-4375 info@alphacognition.com

Titan Partners Contact: Tel: (929) 833-1246 info@titanpartnersgrp.com.

Clinical Study

Analysis

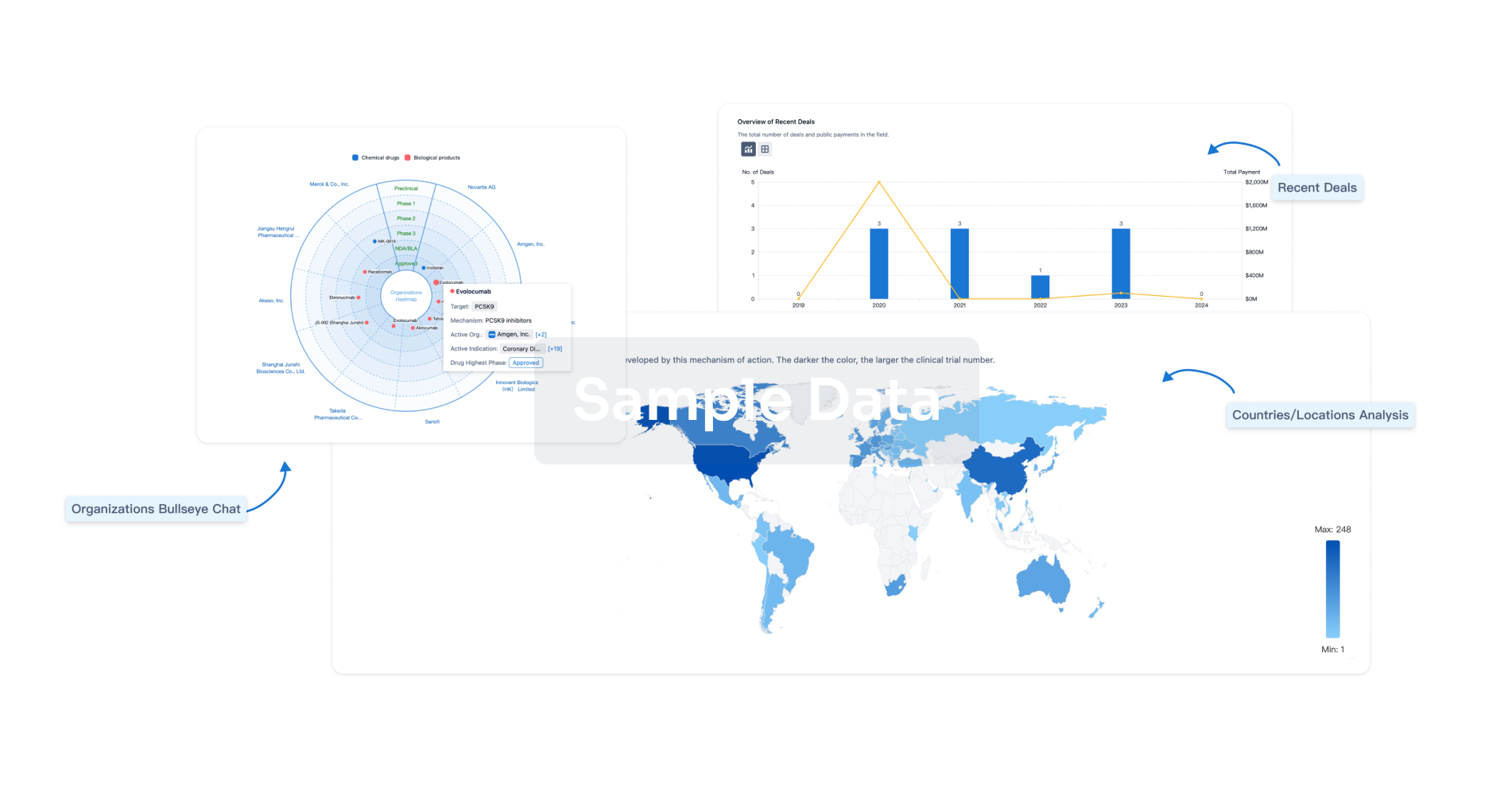

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free