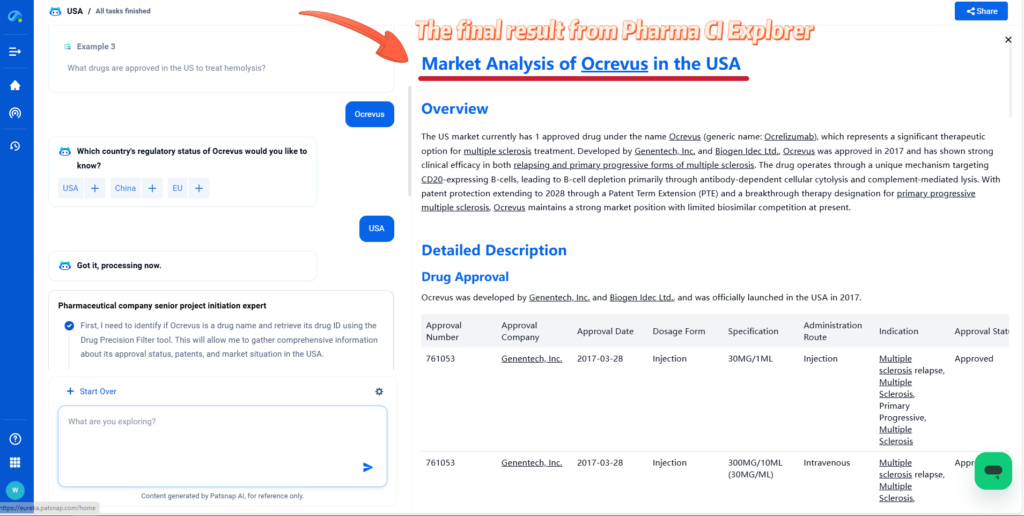

Amisulpride Market Landscape: Patent Barriers, Clinical Insights, and Global Entry Strategies

Overview

Amisulpride is an approved drug with a global presence, particularly in the US and China markets. There is currently 1 approved drug for amisulpride, indicating a relatively focused market. The drug is primarily used for Postoperative Nausea and Vomiting in the US market (approved in 2020), while in China it has broader applications including schizophrenia with multiple approved formulations. Amisulpride acts as a D2 and D3 receptor antagonist, providing a targeted mechanism of action for its therapeutic effects.

Detailed Description

Drug Information

Amisulpride was originally developed by Acacia Research Corp. and has been approved in multiple countries with various indications.

Patent Statement Information

Patent Statement for China

| Drug Type | Registration Classification | Patent Certification Type | Listing Permit Holder | Listing Permit Applicant |

|---|---|---|---|---|

| 化学药品 | 4类 | 1类 | SANOFI-AVENTIS FRANCE | 浙江华海药业股份有限公司 |

| 化学药品 | 4类 | 1类 | SANOFI-AVENTIS FRANCE | 浙江华海药业股份有限公司 |

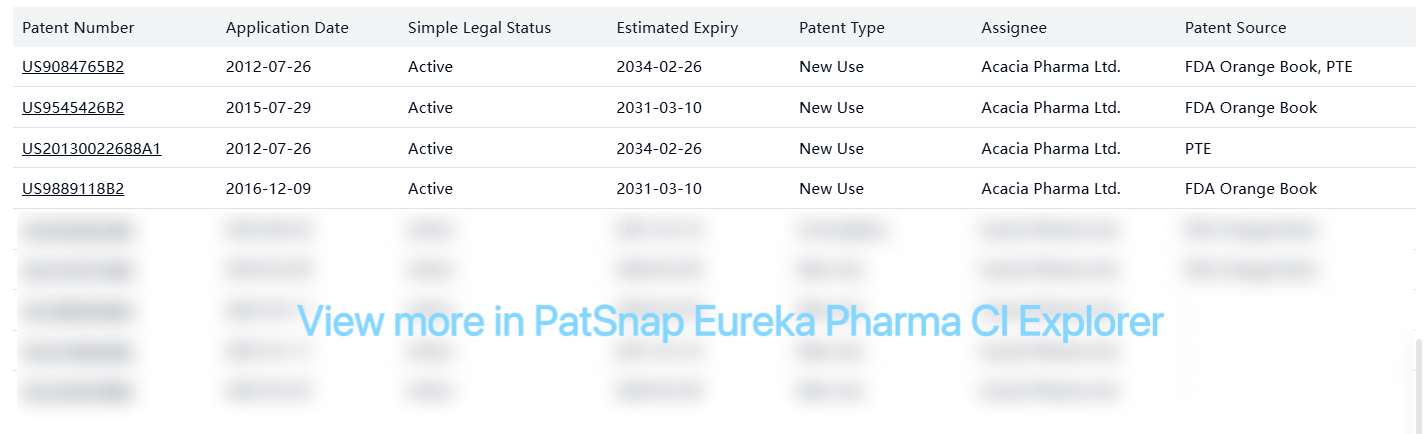

Registration Patent Barrier Analysis

FDA Orange Book patents for amisulpride in the US market:

PTE (Patent Term Extension) patents:

| Patent Number | Application Date | Simple Legal Status | Estimated Expiry | Patent Type | Assignee | Patent Source |

|---|---|---|---|---|---|---|

| US9084765B2 | 2012-07-26 | Active | 2034-02-26 | New Use | Acacia Pharma Ltd. | FDA Orange Book, PTE |

| US20130022688A1 | 2012-07-26 | Active | 2034-02-26 | New Use | Acacia Pharma Ltd. | PTE |

Other Patent Barrier Analysis

There are numerous other patents related to amisulpride, primarily focusing on process, formulation, and new use applications. Key active patents include:

Clinical Results

Based on FDA Label Clinical Insight, amisulpride has been extensively studied in both preclinical and clinical settings:

In Vitro Experiments

- Metabolism Studies: Amisulpride does not inhibit key cytochrome P450 enzymes (CYP1A2, CYP2A6, CYP2B6, CYP2C9, CYP2C19, CYP2D6, CYP3A4) and does not induce CYP1A2, CYP2C9, CYP2C19, or CYP3A4.

- Transporter Interactions: Inhibits MATE1 and MATE2-K transporters but does not inhibit P-glycoprotein (P-gp), BCRP, OCT1, OCT2, OAT1, OAT3, OATP1B1, or OATP1B3 at therapeutic concentrations. Amisulpride is a substrate for P-gp, BCRP, OCT1, MATE1, and MATE2-K.

Nonclinical (In Vivo) Experiments

- Genotoxicity: Non-genotoxic based on bacterial reverse mutation assay (Ames test), human peripheral blood lymphocytes assay, and rat bone marrow micronucleus assay.

- Fertility Studies: In rats, doses up to 160 mg/kg/day resulted in most female animals (90-95%) remaining in diestrus and failing to mate during treatment, though this effect was reversible.

- Reproductive Studies: No adverse developmental effects observed in rats and rabbits at high exposure levels.

- Mechanism of Action: Selective antagonism of dopamine D₂ and D₃ receptors, which are implicated in emesis control.

- Anti-emetic Studies: In ferrets, amisulpride inhibited emesis induced by various agents including apomorphine, cisplatin, and morphine.

- Cardiac Electrophysiology: QT interval studies showed dose-dependent effects on QTcF interval.

Clinical Studies

- PONV Prevention Trials:

- Study 1 (NCT01991860): 342 patients, evaluated amisulpride as monotherapy for PONV prevention.

- Study 2 (NCT02337062): 1,147 patients, evaluated amisulpride in combination with non-dopaminergic antiemetics.

- PONV Treatment Trials:

- Study 3 (NCT02449291): 369 patients without prior PONV prophylaxis.

- Study 4 (NCT02646566): 465 patients who experienced PONV despite prophylaxis.

Infringement Cases

No infringement cases were found for amisulpride.

Policy and Regulatory Risk Warning

Based on a comprehensive search of regulatory information, amisulpride's US approval in 2020 as Barhemsys® (for postoperative nausea and vomiting) may be subject to market exclusivity periods. The FDA typically grants 5 years of exclusivity for new chemical entities, which would extend until 2025. Additionally, the numerous active patents listed in the FDA Orange Book with expiration dates ranging from 2031 to 2038 create significant barriers to generic entry in the US market.

In China, amisulpride has multiple approvals from different manufacturers, suggesting that basic compound patents have expired, allowing for generic competition in this market.

Market Entry Assessment & Recommendations

Market Segmentation Analysis:

- US Market: Highly restricted due to multiple active patents extending to 2038 and potential regulatory exclusivity until 2025. The US market is narrowly focused on PONV indication.

- China Market: More accessible with multiple generic manufacturers already approved, broader indications including schizophrenia, and various formulations (tablets, oral solutions, injections).

- EU Market: Limited data available, but patents from Acacia Pharma Ltd. and Sumitomo Pharma America, Inc. may create barriers.

Strategic Recommendations:

US Market Strategy: Given the strong patent protection until 2038, generic entry is not feasible in the near term. Consider:

- Licensing agreements with patent holders for authorized generics

- Developing non-infringing formulations or novel delivery systems

- Focusing on new indications not covered by existing patents

- Preparing for patent challenge strategies for post-2031 entry

China Market Strategy: With multiple generics already approved:

- Focus on differentiation through quality, manufacturing efficiency, or novel formulations

- Consider value-added services or patient support programs

- Target hospital formulary inclusion through competitive pricing

- Explore combination products for psychiatric indications

Innovation Strategy:

- Investigate extended-release formulations for improved patient compliance

- Develop combination therapies with complementary mechanisms for enhanced efficacy

- Explore additional indications beyond PONV and schizophrenia

- Consider alternative routes of administration for specific patient populations

Risk Mitigation:

- Conduct thorough freedom-to-operate analyses before entering any market

- Monitor patent expiration dates and regulatory exclusivity periods

- Stay informed about potential patent term extensions or additional exclusivity grants

- Consider challenging weak patents while respecting strong IP positions

Regulatory Pathway Recommendations:

- For US market: Consider 505(b)(2) applications for novel formulations or new indications

- For China market: Leverage the established generic approval pathway with focus on quality and cost-efficiency

- Monitor changes in regulatory requirements in target markets

The amisulpride market presents a complex landscape with significant barriers in the US due to patent protection but opportunities in markets like China where generic competition is already established. Strategic planning around patent expiration dates, differentiation strategies, and careful regulatory pathway selection will be critical for successful market entry.

For more scientific and detailed information of amisulpride , try PatSnap Eureka Pharma CI Explorer.