Behind the Approval of Lecanemab: A Decade of Hardship Cannot Dampen Passion

Following the controversy of Aducanumab, Biogen and Eisai have finally earned a potentially game-changing drug, Lecanemab (trade name: Leqembi), with blockbuster potential in their decades-long struggle with Alzheimer's disease. This is undoubtedly a necessary lifeline for Biogen, which has had several tough years, and as the only Alzheimer's drug fully approved by the FDA in the last 20 years, it may genuinely bring a ray of hope to patients plagued by the disease worldwide.

From the accelerated approval in January to the FDA expert consultation meeting in June, all the way to this full approval, Lecanemab's milestones have been smooth. Credit can't be taken away from the painstaking efforts of Biogen and Eisai over the decades, the failures of various drugs represented by Aducanumab, as well as the ongoing refinement of the Alzheimer's drug regulation system by regulatory bodies symbolized by the FDA.

Behind Lecanemab's approval is a brief period of success for Biogen and Eisai, who now face the ultimate test as corporations—commercialization. This success reflects favorably on the FDA as well, who may have figured out more ways to speed up the review and guideline documents for Alzheimer's drugs after facing doubt and criticism. However, given the extreme complexity of Alzheimer's disease pathogenesis, it still warrants continuous exploration into the future.

Reviewing Aβ: Lessons from the Past

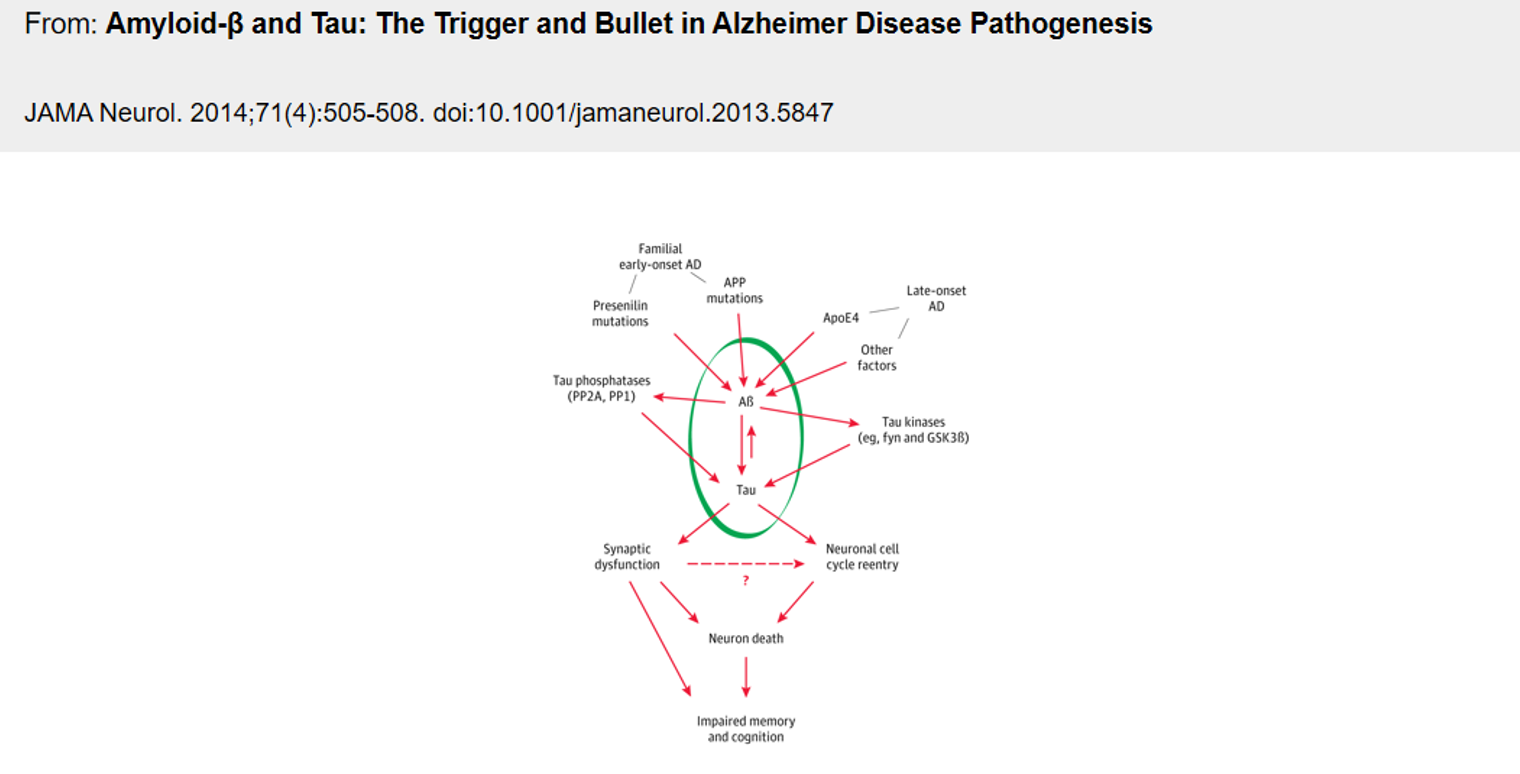

The pathology of Alzheimer's disease tends to be attributed to either the deposition of extracellular β-amyloid protein (Aβ) or the excessive phosphorylation of Tau protein causing neurofibrillary tangles (NFT). These are the two most popular hypotheses. Multiple studies suggest that the pathway in which amyloid proteins are composed might play a significant role in the development of Alzheimer's disease. Aβ, such as Aβ40, Aβ42, and Aβ43, are the byproducts of amyloid precursor protein (APP) being sequentially cleaved by β- and γ- secretase. These proteins can assemble into insoluble β-sheet fibrillar aggregates, depositing outside brain tissue and cerebral vessels. This deposition results in the structural and functional damage of synapses, leading to cognitive impairment and dementia.

Lecanemab is not the first drug targeting Aβ, and it was even lagging behind at the beginning, with its competitors mainly developed by MNCs. However, it is the only one that has been successful to date. This has not only triggered my thoughts, but it also raises the question - compared to the failed drugs that also targeted Aβ, what unique features does Lecanemab have that enabled it to stand out eventually.

By consulting data from Synapse and related literature, aside from Aducanumab and Lecanemab, four previously developed drugs targeting Aβ have failed in Phase III clinical trials, namely Bapineuzumab, Crenezumab, Gantenerumab, and Solanezumab. Without a doubt, these drugs were developed by MNCs represented by Pfizer/Lilly/Johnson & Johnson.

In 17 clinical studies, 12,585 AD patients were divided into several subgroups that each received different treatments, using the above drugs that have been essentially declared failures (including Aducanumab). Considering the number of trial participants, the progression of Alzheimer's represents a significant challenge in terms of human and financial resources. Clinical studies demand large sample sizes, entail high failure rates, and are predominantly conducted by MNCs. Considering the unlikely prospect of MNCs making mistakes in clinical design leading to study failure, the challenges are likely related to the diverse forms of Aβ protein, which include monomers, oligomers, protofibrils, fibrils, and plaques. The formation process of plaque is complex and its forms are diverse, leading to significant challenges in the development and design of antibodies. Therefore, the variations in clinical outcomes may be due to differences in immune responses and pathological changes resulting from the design of the antibodies themselves.

From failure to temporary success, Aβ and Lecanemab have gone through nearly two decades. In the future, further exploring the role of the Aβ hypothesis in the pathogenesis of Alzheimer's disease will still be a top priority. Moreover, based on the experiences of previous failed drugs, preclinical research on Aβ drugs for treating Alzheimer's Disease must be thorough. Alzheimer's disease onset begins with the accumulation of amyloid proteins, and cognitive impairment is the final event in the pathological process. Therefore, it is essential to start disease-modifying therapy (DMT) containing Aβ monoclonal antibodies as early as possible. Continuing to explore the possibility of monoclonal antibodies entering the brain directly through nasal administration or brain injection is also a direction worthy of attention and progress for Aβ drugs in the future.

Reviewing Biogen: A Decade's Wait for a Lifesaving Straw.

As one of the few companies in the United States and globally that transitioned from being a Biotech company to a known Biopharma, Biogen has spent nearly 30 years since its establishment in 1978. It underwent several mergers and collaborations, and finally in 1996, the company welcomed its blockbuster product Avonex (Interferon β-1a) approved for marketing. After becoming a major bombshell in 2002, the company relied on Avonex for rapid growth. In 2013, Tecfidera (Dimethyl fumarate) was approved by the FDA, quickly becoming the company's cash cow, and making it the leader in multiple sclerosis (MS).

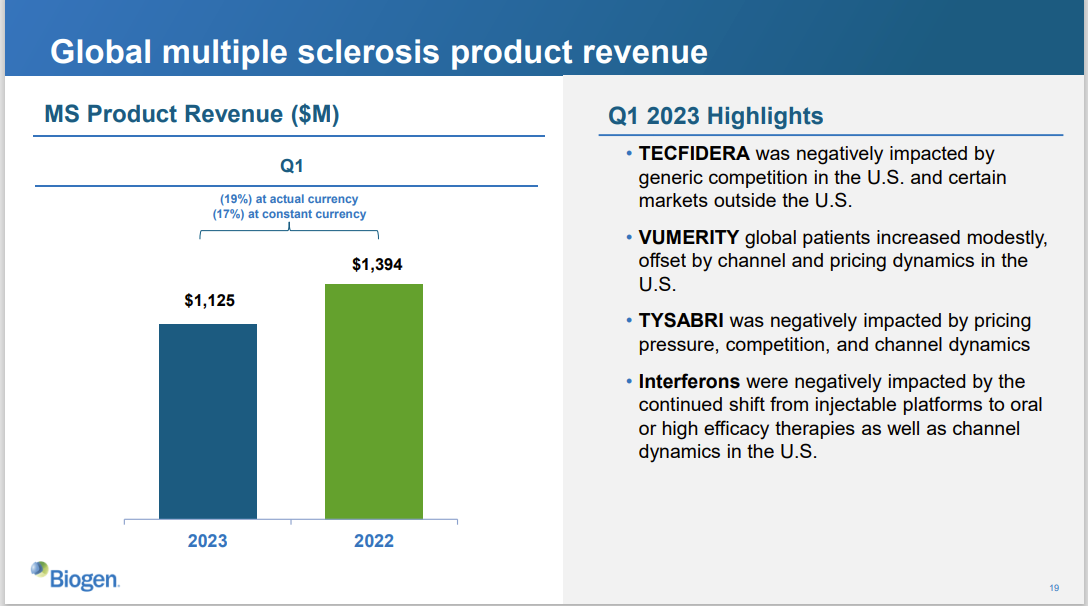

However, with Roche (Genentech) taking 14 years to refine its CD20 inhibitor Ocrevus (ocrelizumab), and with Tecfidera's patent successfully challenged by generic drugs themselves, MS sales continued to decline in recent years. It should be noted that according to Biogen's 2022 financial report, Biogen's annual revenue was $10.173 billion, of which MS product revenue was $5.43 billion, accounting for 53.3% of Biogen's annual revenue. The total revenue for the first quarter of the year was $2.463 billion, a 2.7% decrease compared to the same period last year, The continuous decline in MS drug revenue directly led to Biogen's predicament.

However, as one of the global leaders in neuroscience companies, Biogen clearly has traction in ALS, Alzheimer's, Spinal Muscular Atrophy, and Depression. Yet undoubtedly, the Alzheimer's domain holds immense importance for Biogen. After the inception of Aducanumab from Neurimmune in 2007, Biogen, partnered with Weimai in March 2014 for the research and development of new drugs for Alzheimer's. Together they completed the clinical development work of Aducanumab and Lecanemab, and a decade-long layout finally reaped a temporary victory fruit.

My personal understanding is that Biogen's original vision was to establish a Multiple Sclerosis (MS) product dynasty, supplemented by the gradually advanced Alzheimer's drugs. Its intent was to continue reigning in this blue ocean market. These two horse carriages could directly boost its business takeoff. But the consecutive setbacks in the MS field and numerous adversities with Aducanumab seem to push Biogen to put all its eggs in Lecanemab's basket. One can predict that Biogen will definitely pull all stops in Lecanemab's global commercialization, and thus we can look forward to Biogen's financial report data.

The above, in fact, did not mention that Lecanemab still has a major competitor, that is, Eli Lilly's Donanemab. The two have too many similarities in this field. Their mechanism of action is also very similar. Both drugs target early Alzheimer's patients with β-amyloid protein deposits confirmed by brain imaging. Their effects are to delay cognitive deterioration by clearing the β-amyloid proteins. The two are expected to engage in direct dialogue in the future. As of now, considering the progress timeline, Biogen is ahead of Eli Lilly by at least half a year. The certain extent of Aducanumab's overdrawn commercial credibility imposes Biogen the responsibility to quickly appease patient and doctor skepticism and open up the market for Lecanemab.

References

1. https://www.biogen.com

2. FDA grants Eisai’s Leqembi full approval, opening door to wider use of Alzheimer’s drug

3. lmpact of Anti-amyloid-β MonoclonaAntibodies on the Pathology and Clinical Profile of Alzheimer'sDisease: A Focus on Aducanumaband Lecanemab,Front. Aging Neurosci. 14:870517.doi: 10.3389/fnagi.2022.870517

4. Amyloid-β and Tau: The Trigger and Bullet in Alzheimer Disease Pathogenesis,JAMA Neurol. 2014;71(4):505-508. doi:10.1001/jamaneurol.2013.5847

5. Solanezumab in-depth outcomes: results of the DIAN-TU prevention trial of solanezumab and gantenerumab in dominantly inherited AD. Alzheimers Dement. 16:e038028. doi: 10.1002/alz.038028