Summary of ADC Drug Development Trends! Revenue to Exceed 26 Billion US Dollars

In the field of tumor treatment, antibody-drug conjugates (ADCs) have the potential to enhance the efficacy and specificity of cancer therapy by combining monoclonal antibodies with potent cytotoxic drugs. Recently, the rapid development of ADC technology has attracted the attention of numerous pharmaceutical companies, leading to a series of important acquisitions and collaborations. It is projected that by 2028, the revenue from approved ADCs and those in Phase III development will reach 26 billion US dollars.

Key Players in the ADC Field

According to the Synapse database, the ADC (antibody-drug conjugate) field is rapidly advancing, with over 240 projects currently in the clinical research phase, including about 20 that have entered Phase 3 clinical trials. This data suggests that the ADC market is expected to continue making significant progress over the next few years. Companies such as ImmunoGen, ADC Therapeutics, and Daiichi Sankyo play key roles in the ADC market, highlighting the innovative dynamics of the field.

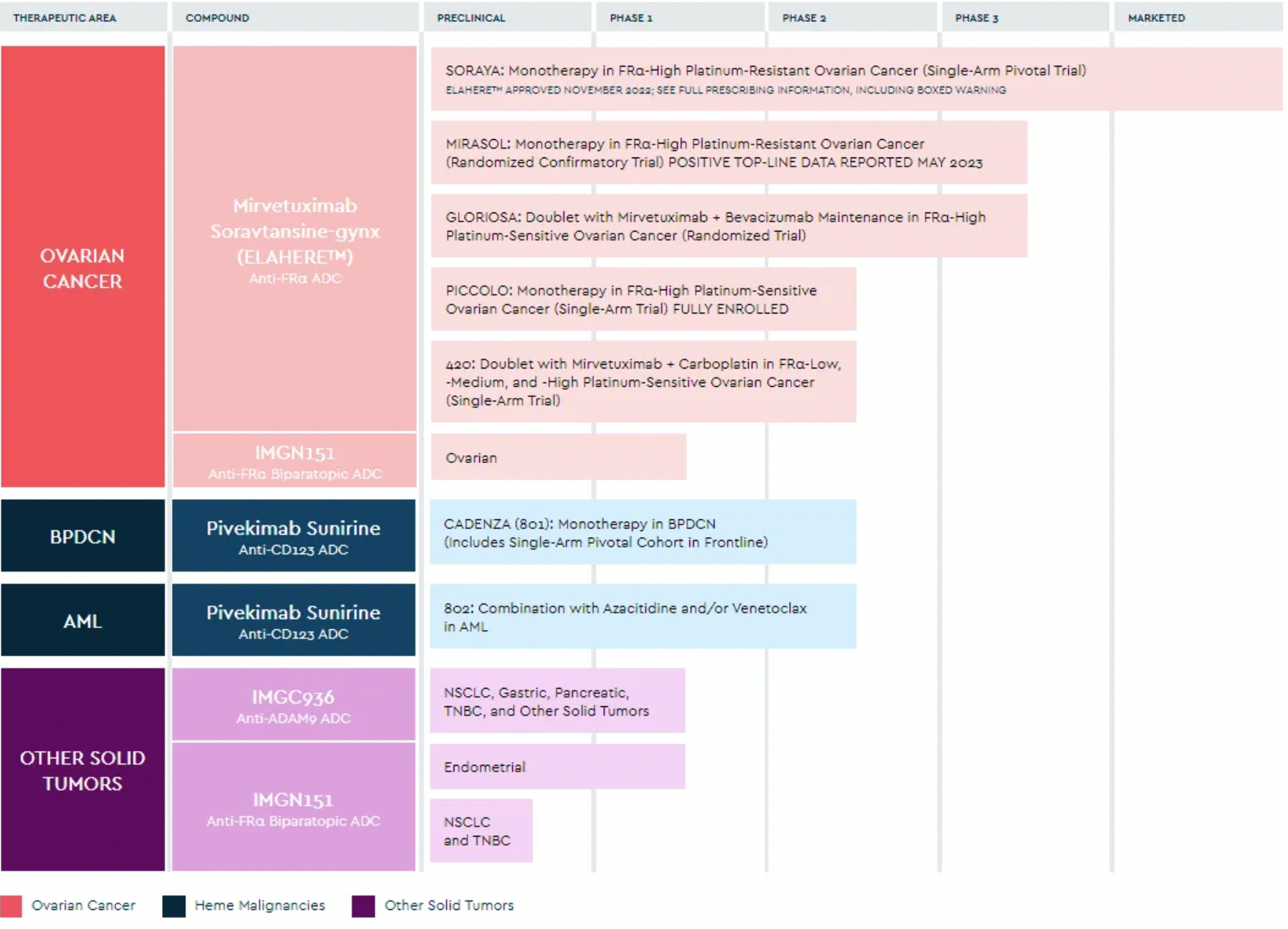

ImmunoGen

ImmunoGen is a company dedicated to the development of next-generation antibody-drug conjugates (ADCs) for oncology, with a research pipeline that encompasses multiple potential treatment projects for various solid tumors and hematologic malignancies. In November 2022, ImmunoGen's flagship ADC product, Elahere, received accelerated approval from the FDA. It successfully reduced the risk of disease progression or death by 35% in the treatment of some resistant ovarian cancers, compared to traditional chemotherapy.

Roche's ADC product, Kadcyla, also utilizes ImmunoGen's targeted cytotoxic technology. In parallel, Oxford BioTherapeutics (OBT) has established a partnership with ImmunoGen. OBT's primary ADC project, OBT076, is an example that employs ImmunoGen's technology platform and its DM4 payload. Currently, OBT076 is under clinical trial testing as monotherapy or in combination with checkpoint inhibitors to treat patients with advanced or refractory solid tumors, including stomach cancer, bladder cancer, ovarian cancer, and lung cancer.

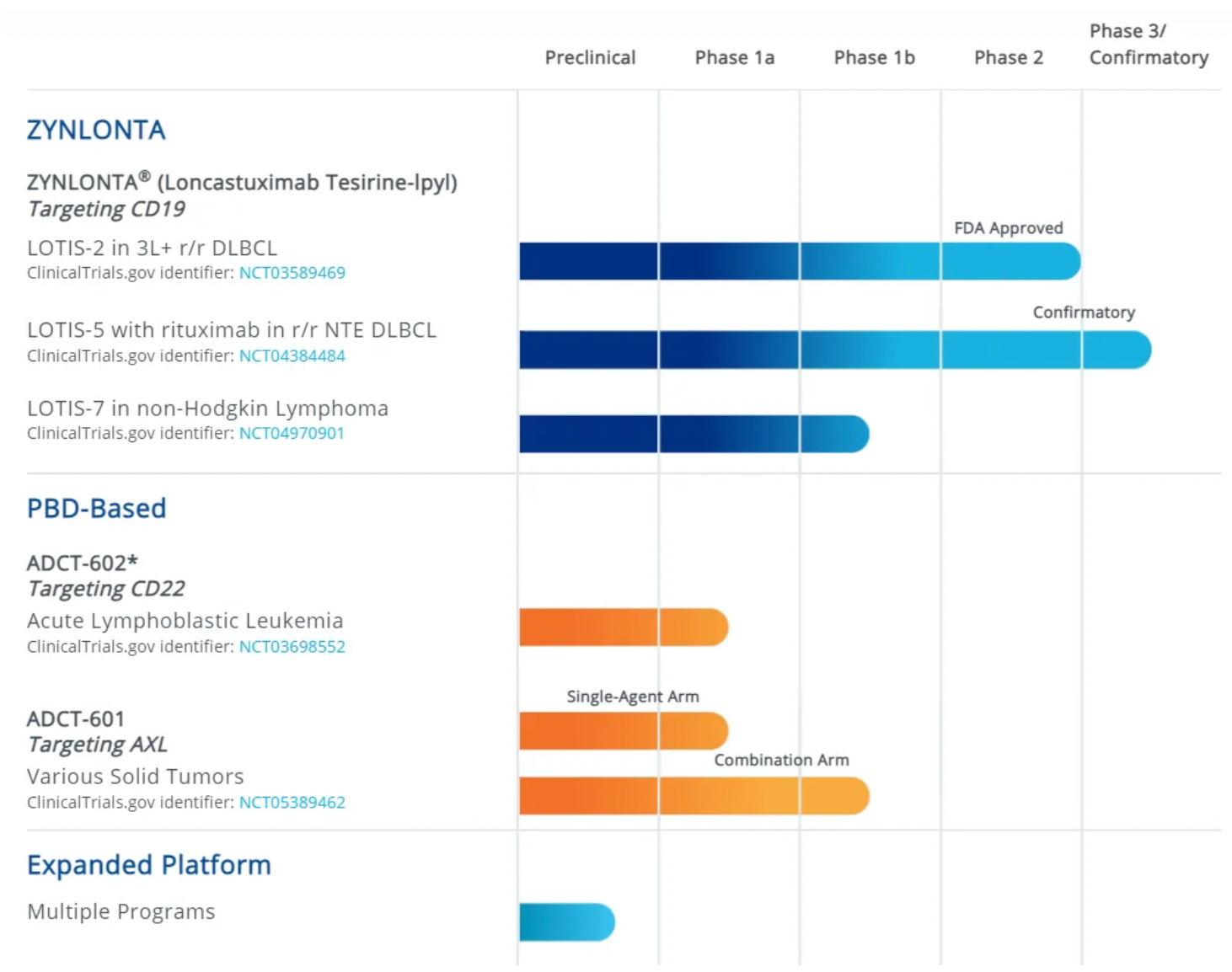

ADC Therapeutics

ADC Therapeutics is a biotechnology company that is in the commercialization stage, advancing its proprietary ADC (Antibody-Drug Conjugate) technology based on PBD (pyrrolobenzodiazepine) to transform the treatment paradigm for patients with hematologic malignancies and solid tumors. The company's CD19-targeting ADC product, Zynlonta, has received accelerated approval from the U.S. FDA and conditional approval from the European Commission for the treatment of relapsed or refractory diffuse large B-cell lymphoma after two or more lines of systemic therapy. Furthermore, Zynlonta is also in development for combination use with other drugs and as an early therapy. In addition to Zynlonta, ADC Therapeutics has several other ADC products in clinical and preclinical development.

Daiichi Sankyo

Daiichi Sankyo is a global pharmaceutical company with a history of over 120 years, with a product pipeline spanning multiple disease areas with urgent medical needs, including cancer and cardiovascular diseases. Antibody-drug conjugates (ADCs) are one of its key research and development focuses. Currently, Daiichi Sankyo's ADC portfolio includes five ADC therapeutics in clinical development, targeting various types of cancer. Among these, Enhertu and Dato-DXd targeting Trop-2 are being developed in collaboration with AstraZeneca, while other products such as HER3-DXd, DS-7300 targeting B7-H3, and DS-6000 targeting CDH6 developed in collaboration with Merck, demonstrate the company's extensive commitment to the ADC field. Daiichi Sankyo's ADC products utilize its proprietary DXd ADC technology design. These ADC therapeutics connect monoclonal antibodies to the potent payload DXd (a derivative of exatecan) via a tetrapeptide-based cleavable linker.

ProfoundBio

ProfoundBio was established in 2018 and is dedicated to the development of the next generation of macromolecule-targeting therapeutics. Its product pipeline primarily includes ADCs (antibody-drug conjugates) and other antibody-based treatment strategies. In February of this year, ProfoundBio completed an oversubscribed Series B financing round of $112 million to advance the development of four ADC candidates. The company's key programs include:

(1) Rina-S, an FRα-targeting ADC that is currently in Phase 2 trials for ovarian and endometrial cancer, with plans to conduct pivotal studies for ovarian cancer later this year.

(2) PRO1160, a CD70-targeting ADC, is in Phase 1 trials with preliminary results expected in 2024.

(3) PRO1107, a protein tyrosine kinase 7 (PTK7)-targeting ADC, is also in Phase 1 trials with preliminary results anticipated in 2025.

(4) PRO1286, a dual-specificity ADC, is expected to enter clinical trials in 2024.

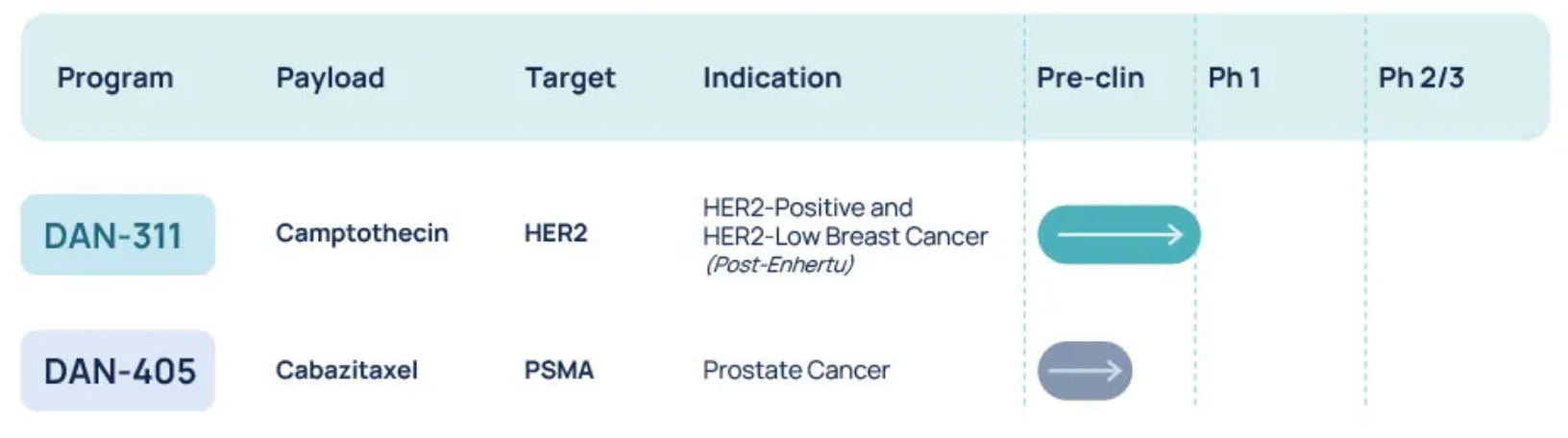

Dantari

Dantari is a clinical-stage biotechnology company dedicated to the development of targeted therapies for the treatment of cancer and other diseases. The company's Targeted High-Capacity Drug Conjugate (T-HDC) technology allows for a higher drug-to-antibody ratio compared to current ADCs and offers controlled release of chemotherapeutic drugs. Their next-generation targeted therapies are capable of delivering payloads with drug-to-antibody ratios exceeding 60, and their biodistribution reduces marrow toxicity, offering broad therapeutic potential. Dantari's research and development pipeline currently includes two therapies under investigation, one of which, DAN-311, is for the treatment of HER2-positive or low-expressing breast cancer.

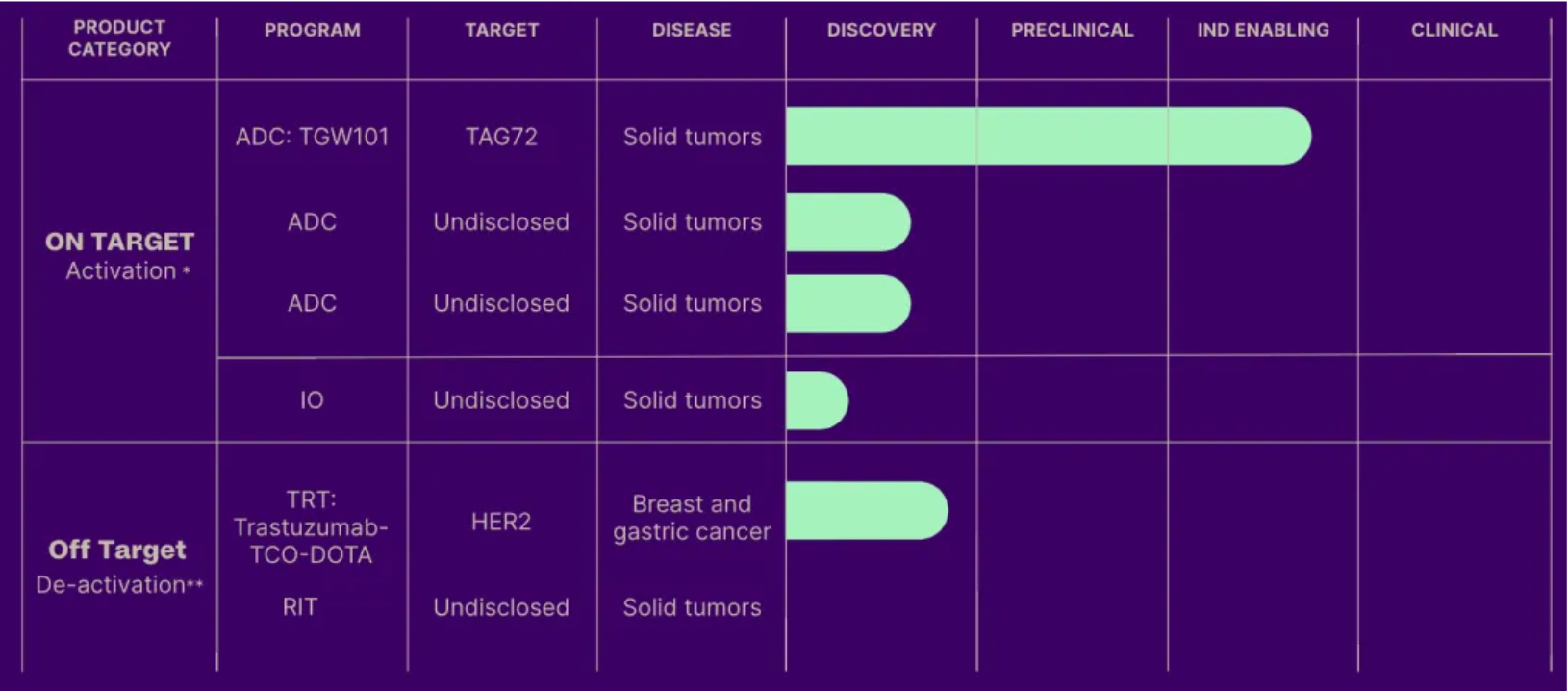

Tagworks Pharmaceuticals

Tagworks Pharmaceuticals spun off from Philips Healthcare in 2011 and secured $65 million in Series A funding in June 2023. The Tagworks platform enables the controlled release of drugs by triggering click chemistry reactions, which could potentially enhance efficacy in a safer manner and improve the therapeutic index. The company's click-release platform comprises two types of molecules: a linker that can be cleaved by click chemistry reactions, and a small molecule (trigger) that initiates the click chemistry reaction. Once the click-cleavable antibody-drug conjugate (ADC) binds to its target, the payload can be released in the tumor microenvironment with precision using the trigger molecule that induces the click chemistry reaction. The company's lead project, TGW101, is a click-cleavable ADC targeting the tumor-associated glycoprotein 72 (TAG72), which is currently undergoing preclinical studies in support of an Investigational New Drug (IND) application.

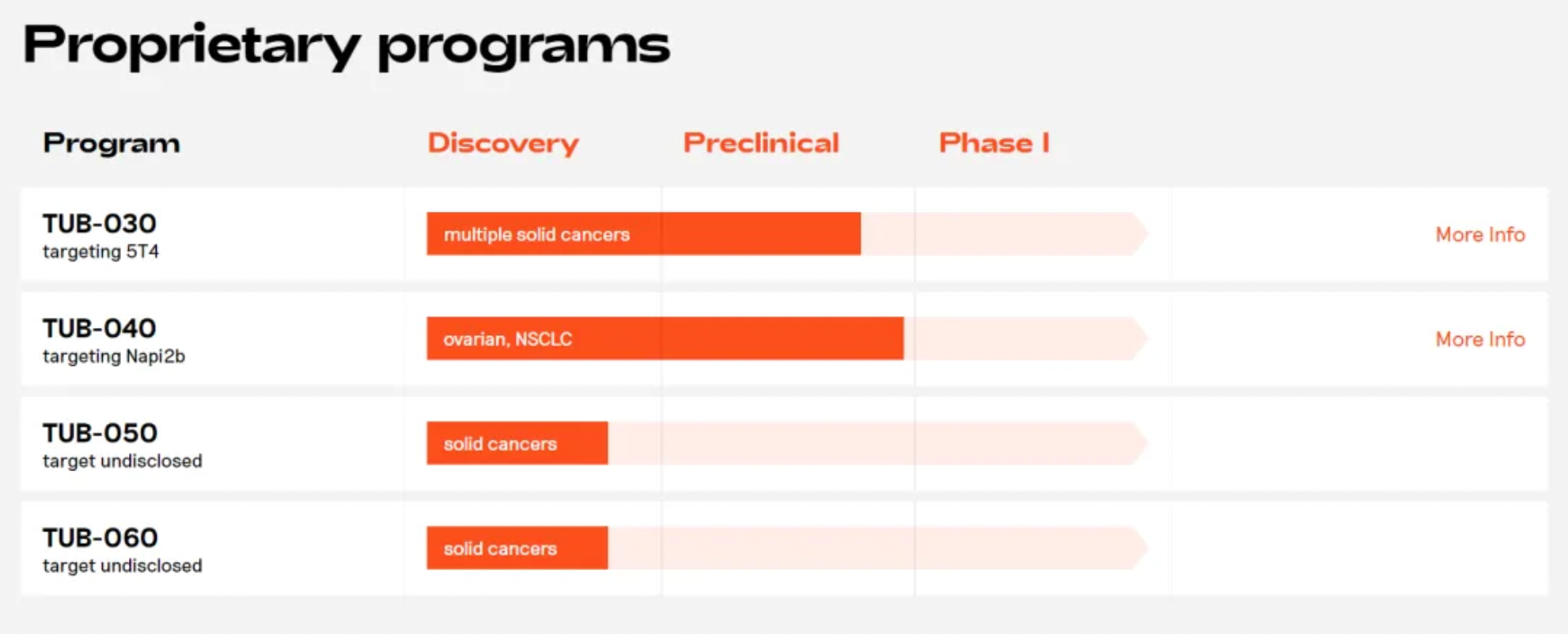

Tubulis

Tubulis is a preclinical-stage pharmaceutical company with an effective payload platform based on topoisomerase inhibitors. Tubulis' proprietary P5 conjugation technology enables the rapid generation of ultra-stable ADCs (antibody-drug conjugates) with both connection stability and chemical flexibility, facilitating the development of truly differentiated ADCs. ADCs generated through the P5 platform exhibit the following characteristics: novel cysteine-selective chemical reactions, unique stability and selectivity, uniform DAR8 (Drug-to-Antibody Ratio of 8) conjugation, chemical flexibility, and a wide range of ADC design possibilities. Notably, in April of last year, Tubulis entered into a strategic licensing agreement worth up to $1 billion with Bristol Myers Squibb for the development of differentiated ADCs.

Recent Significant Mergers and Acquisitions and Partnerships in the ADC Market

Pfizer & Seagen

In March of last year, Pfizer acquired Seagen for $43 billion to expand its oncology pipeline. Seagen is a pioneering company in the development of ADCs (antibody-drug conjugates), with four out of the twelve FDA-approved ADCs to date utilizing its technology. Among the four approved drugs Seagen owns, three are “first-in-class” ADC therapeutics, including Adcetris targeting CD30, Padcev targeting nectin-4, and Tivdak approved for the treatment of cervical cancer targeting tissue factor. These therapies have the potential to extend their indications in the future, benefiting a larger patient population. In addition, Seagen's R&D pipeline also includes 15 investigational therapies in Phase 1/2 clinical trials. Among them, disitamab vedotin, co-developed with RemeGen, is an anti-HER2 (human epidermal growth factor receptor 2) antibody-drug conjugate, which has been approved in China for the treatment of specific gastric and urothelial cancers. Currently, a Phase 3 clinical trial has been initiated for the first-line treatment of urothelial cancer patients using disitamab vedotin in combination with Keytruda.

AbbVie & ImmunoGen

In December of last year, AbbVie acquired ImmunoGen for a total sum of approximately $10.1 billion, obtaining its "first-in-class" antibody-drug conjugate, Elahere (mirvetuximab soravtansine). In November 2022, the U.S. FDA granted accelerated approval for Elahere as a single-agent treatment for patients with advanced ovarian cancer characterized by high expression of folate receptor alpha (FRα) and resistance to platinum-based therapies. According to the press release, AbbVie expects this acquisition to accelerate its development in the ovarian cancer treatment field. Furthermore, ImmunoGen's next-generation ADC pipeline also complements AbbVie’s existing ADC platform and pipeline, which includes IMGN-151 currently in phase I clinical studies and pivekimab sunirine in phase II clinical trials. The former is a next-generation FRα-targeting ADC for treating ovarian cancer with the potential to extend to other solid tumor indications, while the latter is a CD123-targeting ADC for the treatment of blastic plasmacytoid dendritic cell neoplasm (BPDCN).

Daiichi Sankyo & Merck

In October of last year, Daiichi Sankyo and Merck entered into a global agreement for the development and commercialization of three of Daiichi Sankyo's antibody-drug conjugate (ADC) candidates: patritumab deruxtecan (HER3-DXd), ifinatamab deruxtecan (I-DXd), and raludotatug deruxtecan (R-DXd). The collaboration covers the joint worldwide development and potential commercialization of these ADC therapies. These three ADCs are designed using Daiichi Sankyo's proprietary DXd ADC technology, which comprises monoclonal antibodies linked to multiple topoisomerase I inhibitor payloads through a cleavable peptide-based linker. According to the terms of the agreement, Merck will make an upfront payment of $4 billion to Daiichi Sankyo, followed by additional payments of $1.5 billion over the next 24 months. Moreover, Merck may make future commercialization milestone payments of up to $16.5 billion, bringing the total potential value of the collaboration to $22 billion.

Johnson & Johnson & Ambrx Biopharma

In January this year, Johnson & Johnson announced a proposed acquisition of Ambrx Biopharma for an amount of approximately $2 billion. Ambrx is a clinical-stage biopharmaceutical company that utilizes an expanded genetic code technology platform for the discovery and development of next-generation Antibody-Drug Conjugates (ADCs) and other therapies aimed at modulating the immune system. Its pipeline includes the ADCs ARX517 and ARX788, which target Prostate-Specific Membrane Antigen (PSMA) and HER2, respectively. ARX517 is composed of a humanized anti-PSMA monoclonal antibody conjugated to Ambrx's proprietary potent microtubule inhibitor AS269. Preclinical studies have shown that the cytotoxic payload AS269 of ARX517, when released into cancer cells via the monoclonal antibody, exhibits strong cytotoxicity. ARX788, on the other hand, is an ADC targeting HER2, which is currently being investigated in clinical trials for the treatment of breast cancer, gastric cancer/gastroesophageal junction (GEJ) cancer, and other solid tumors.

Roche & MediLink Therapeutics

In January this year, MediLink Therapeutics announced that it has entered into a global collaboration and licensing agreement with Roche to jointly develop the next-generation antibody-drug conjugate (ADC) candidate YL211 (c-MET ADC), targeting the mesenchymal-epithelial transition factor (c-MET), for the treatment of solid tumors. Roche will pay MediLink Therapeutics an upfront and near-term milestone payment of $50 million, along with potential development, regulatory, and commercial milestone payments of nearly $1 billion. Under the terms of the agreement, Roche will have exclusive global rights to develop, manufacture, and commercialize MediLink's next-generation c-MET targeting ADC project YL211. MediLink will collaborate with Roche's China Innovation Center (CICoR) to advance the YL211 project into Phase 1 clinical trials.

The core concept of ADC (Antibody-Drug Conjugate) technology lies in leveraging the targeting properties of antibodies to deliver cytotoxic drugs directly to cancer cells. While the idea may sound straightforward, the actual implementation of this goal requires precise matching of appropriate antibodies, linker technology, and cytotoxic drugs, which is a highly challenging task. The type of linker determines the effective payload capacity (i.e., the "drug-to-antibody ratio") and controls the timing and location of payload release. Premature or off-target release of the payload can not only affect the therapeutic effectiveness of ADCs but may also harm healthy tissues.

Given the critical importance of linkers in the development of ADCs, acquiring key linker development and related conjugation technologies has become a target for pharmaceutical company transactions. For instance, in June 2023, Eli Lilly acquired the German startup company Emergence, which uses linker technology licensed by Mablink Bioscience for its nectin-4-targeted ADC. Subsequently, Eli Lilly acquired Mablink Bioscience to utilize its ADC platform technology to achieve targeted payload release and improve the drug-to-antibody ratio. In the same year, Bristol Myers Squibb spent a substantial sum to acquire Tubulis's conjugation technology and paid a $100 million upfront payment to purchase the Phase I clinical antibody-protein degrader conjugate project from Orum Therapeutics. Moreover, Bristol Myers Squibb further deepened its ADC portfolio through collaboration with SystImmune.

Additionally, GSK acquired development rights for an Antibody-Drug Conjugate (ADC) targeting ovarian/endometrial tumors outside of China through its collaboration with Hansoh Pharma. BioNTech also bolstered its ADC portfolio by securing exclusive licenses for two ADC projects from DualityBio, and six months later, obtained a license for an ADC project aimed at HER3 from MediLink Therapeutics. Similarly, AstraZeneca and Pfizer each obtained licenses for ADC projects from LaNova Medicines and Nona Biosciences, respectively, further highlighting the pharmaceutical industry's continued interest in ADC technology.

How to search for and analyze the development progress of ADC pharmaceuticals?

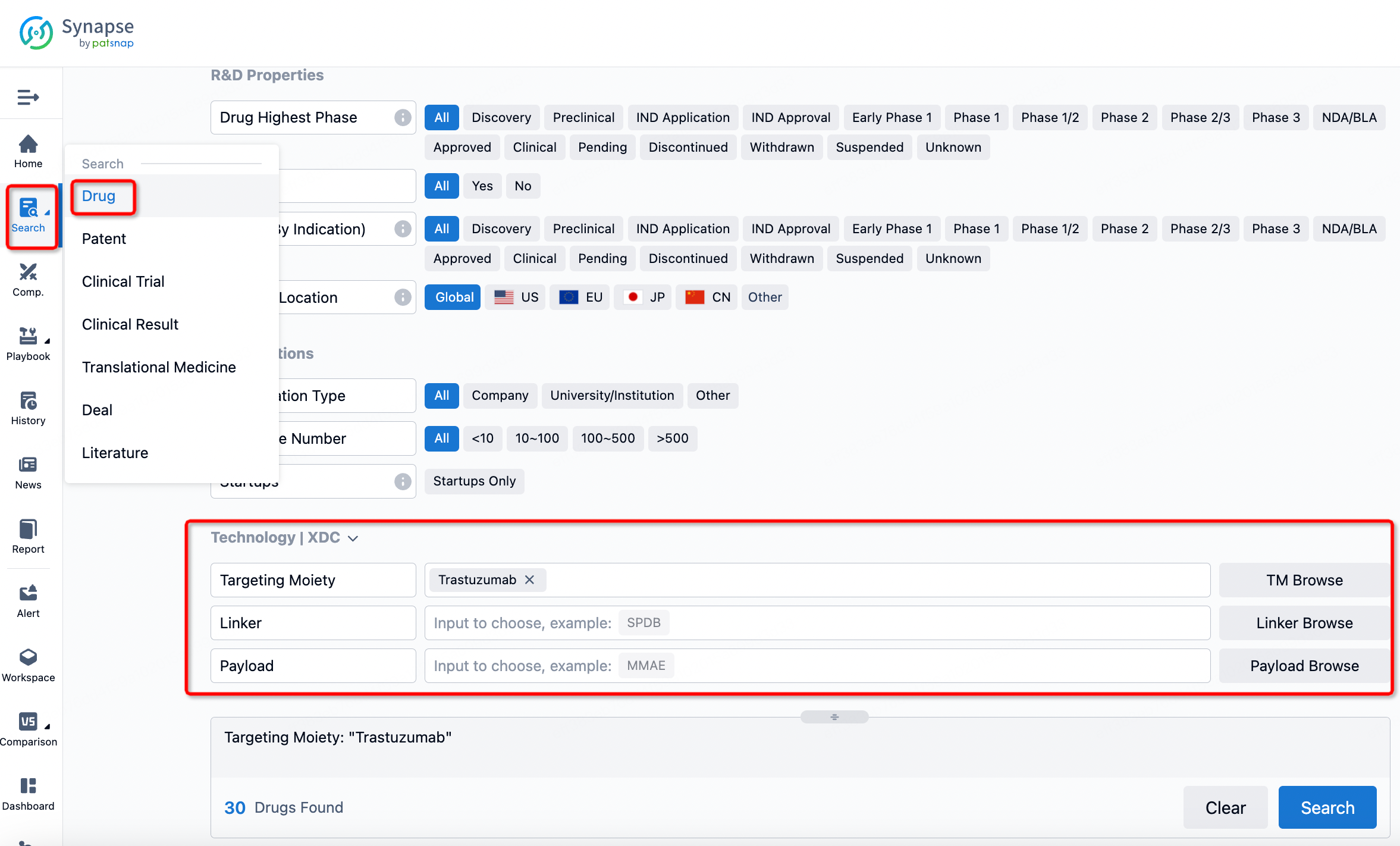

If you want to learn about the latest developments in ADC drugs, you can use the drug search module of the Synapse database. This module supports searching for ADC drugs by classification through Targeting Moiety, Linker, and Payload.

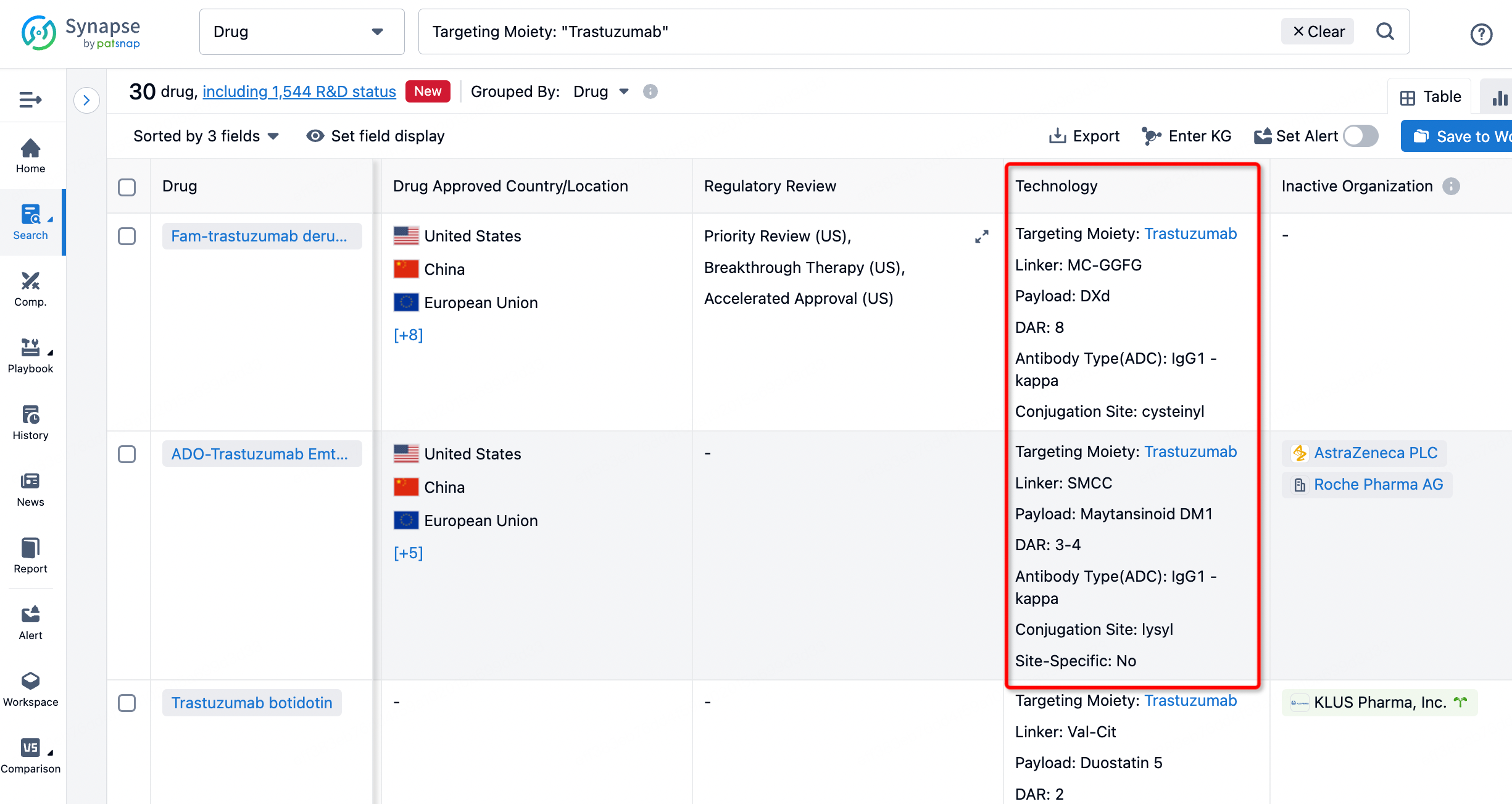

On the search results page, you can easily review information related to the ADC's technical category of the drugs.

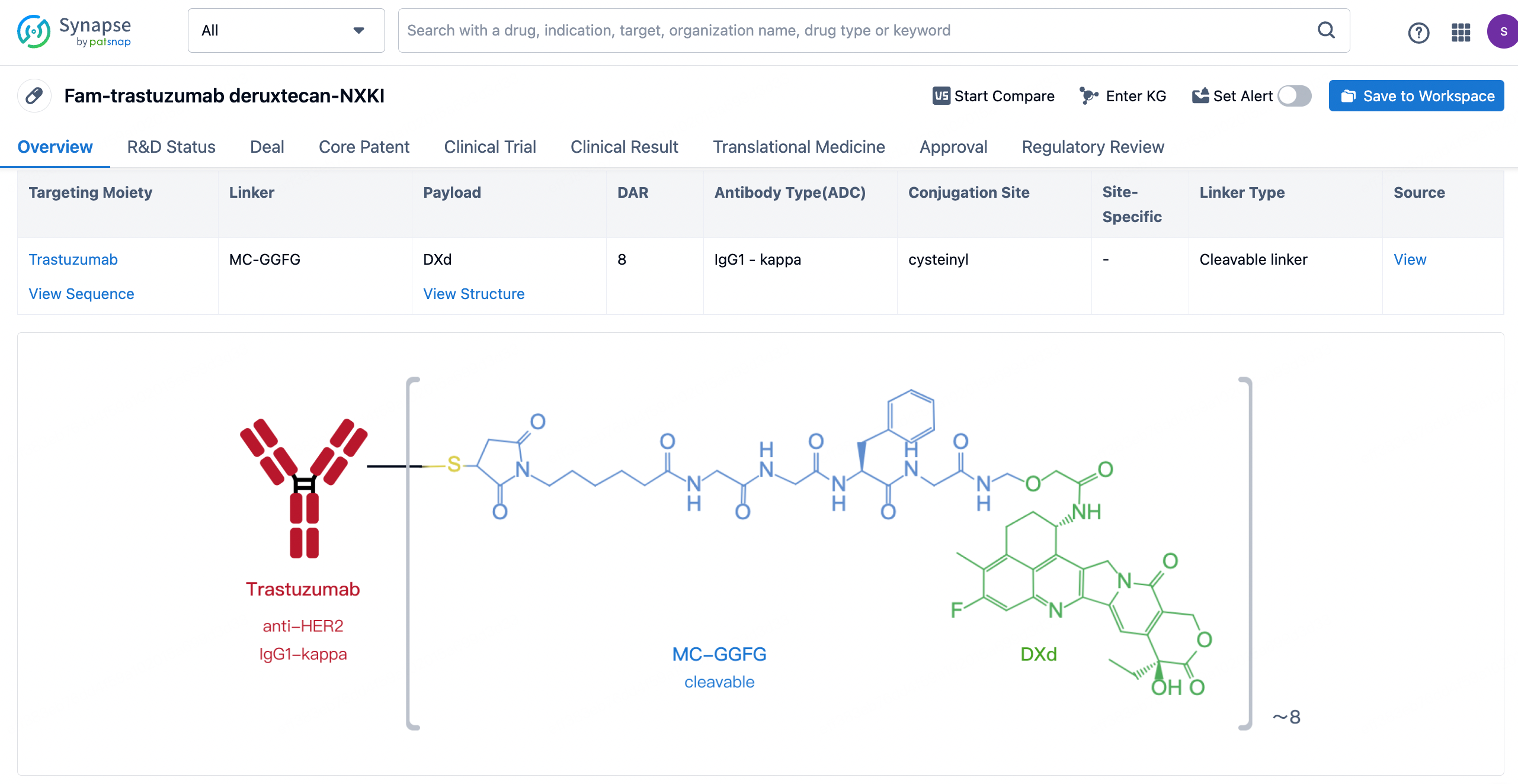

After clicking to enter the drug details page, you can also effortlessly obtain structural information about the ADC drug.

Click on the image below to embark on a brand new journey of drug discovery!