The mRNA Therapeutics Revolution: Market Growth, Mechanism of Action, and Global Development Landscape

The mRNA therapeutics market has experienced explosive growth over the past few years. According to estimates by QY Research, the global mRNA therapeutics market reached a total sales value of RMB 248.4 billion (approx. USD 35 billion) in 2023. Preventive mRNA vaccines are projected to achieve a 20% penetration rate in the USD 50.3 billion vaccine market by 2025, corresponding to a market size of USD 10.1 billion. Meanwhile, mRNA cancer vaccines are expected to reach a 0.5% penetration rate by 2025. From 2023 to 2028, the mRNA vaccine and therapeutics market is forecasted to grow at a compound annual growth rate (CAGR) of 16.8%, reaching USD 101.8 billion by 2028 and RMB 574.3 billion (approx. USD 80 billion) by 2030, with a CAGR of 13.2% between 2024 and 2030.

Mechanism of Action and Core Advantages of mRNA Drugs

The core advantages of mRNA therapeutics lie in their flexibility and high efficiency. These features make mRNA an ideal platform for diverse applications such as preventive vaccines, cancer immunotherapies, and protein replacement therapies. As a single-stranded long RNA molecule, mRNA delivers genetic information from DNA and undergoes translation to synthesize proteins, offering immense therapeutic potential.

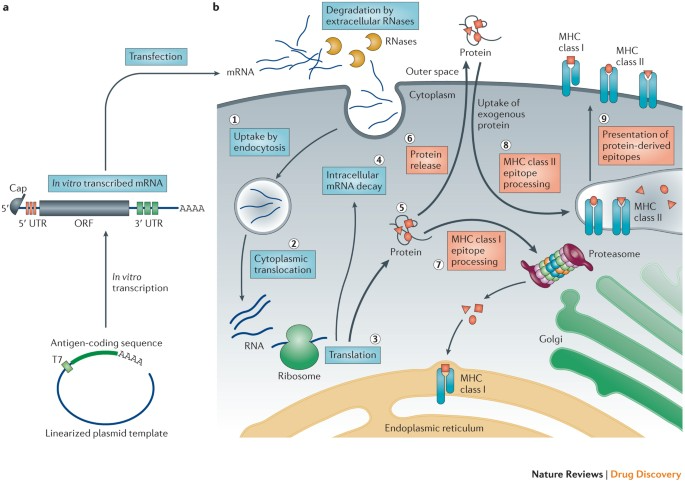

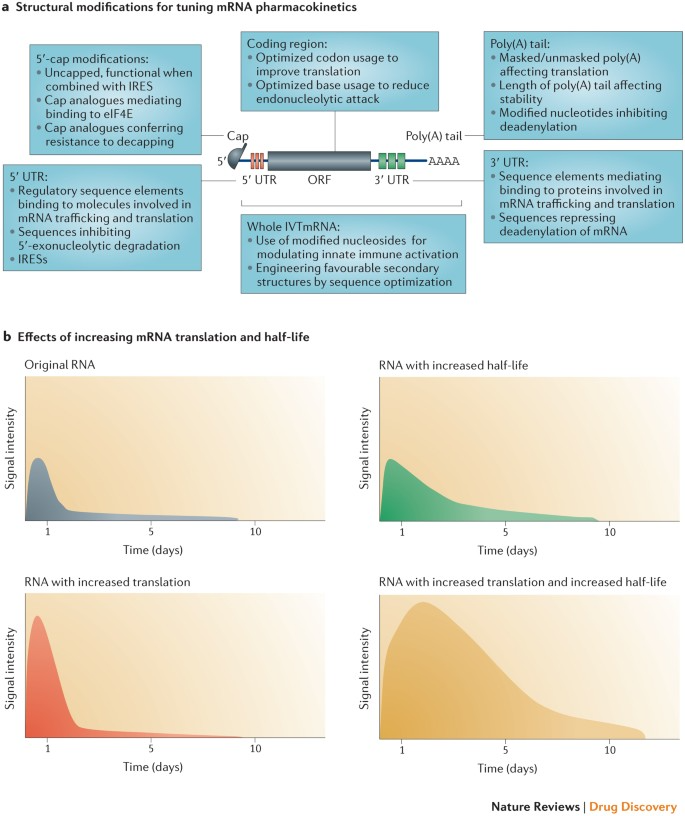

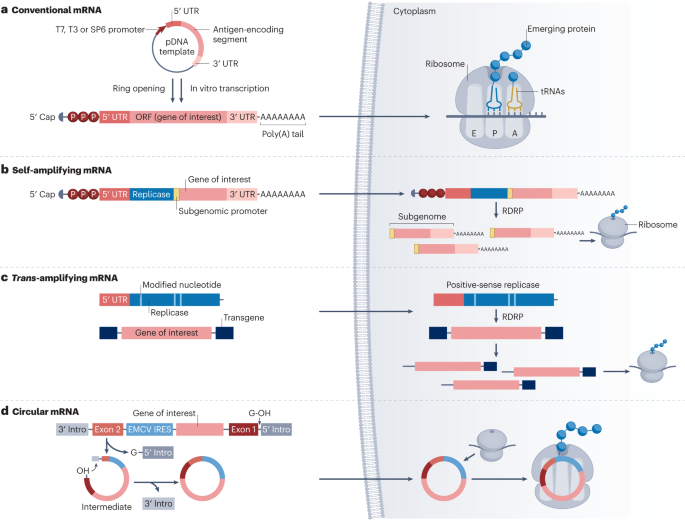

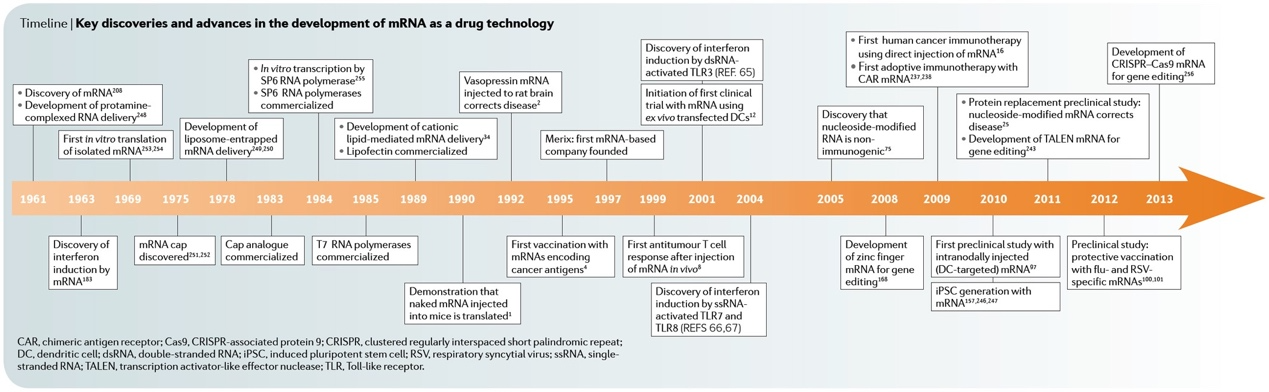

mRNA production begins with in vitro transcription (IVT), using linearized plasmid DNA containing the target antigen coding sequence as a template. This DNA is usually obtained via PCR amplification or chemical synthesis and is linearized to prevent circularization during transcription. RNA polymerases such as T7, T3, or SP6 transcribe the DNA in a reaction mixture containing nucleoside triphosphates (NTPs), enzymes, buffers, and cofactors. The resulting mRNA molecules are structurally complete, featuring a 5’ cap, untranslated regions (UTRs), an open reading frame (ORF), and a poly(A) tail—elements essential for intracellular stability and translational efficiency.

·The 5' cap, added via co-transcriptional or post-transcriptional methods, is crucial for stability and translation initiation.

·The 5' UTR influences translation initiation efficiency.

·The ORF encodes the target protein and represents the functional core of the mRNA.

·The 3' UTR and poly(A) tail enhance stability and translation efficiency.

The synthesized mRNA must be purified and chemically modified to increase stability and reduce immunogenicity. Common purification methods include chromatography, precipitation, and filtration to eliminate impurities such as residual DNA templates, unincorporated NTPs, and enzymes.

Chemical modifications serve to enhance translational efficiency and minimize immune responses. These include:

·Nucleoside modifications, such as replacing uridine with 1-methylpseudouridine, to improve translation and reduce innate immune activation.

·Phosphorothioate (PS) backbone modifications, which substitute sulfur atoms in the phosphate backbone to improve mRNA stability.

·2’-O-methylation of ribose sugars, increasing mRNA resistance to degradation and decreasing immunogenicity.

These enhancements make mRNA therapeutics more viable for clinical applications.

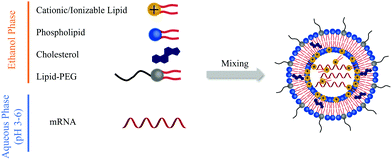

To protect mRNA from degradation and enable efficient cellular delivery, it is typically encapsulated in delivery vehicles—most commonly lipid nanoparticles (LNPs). LNPs consist of ionizable lipids, helper lipids (e.g., DOPE), PEGylated lipids, and cholesterol, which work synergistically to form stable nanoparticles:

·Ionizable lipids form electrostatic complexes with negatively charged mRNA.

·Helper lipids contribute to particle stability.

·PEG-lipids reduce opsonization and extend circulation time.

·Cholesterol enhances membrane rigidity and prevents premature mRNA release.

Other delivery systems under investigation include polymeric nanoparticles, viral vectors, and cell-penetrating peptides (CPPs), but LNPs remain the most clinically validated method to date.

Once administered, mRNA-loaded LNPs are taken up by antigen-presenting cells through endocytosis, including phagocytosis (mainly in immune cells like macrophages) and pinocytosis (common to most eukaryotic cells). The endocytic vesicles gradually acidify, triggering structural changes in the LNPs and facilitating mRNA release into the cytoplasm. The precise mechanisms behind endosomal escape are still under investigation.

Inside the cytoplasm, mRNA is recognized by ribosomes and translated into proteins or antigens via the host cell's translational machinery. This process includes:

·Initiation: Ribosomal subunits and initiation factors recognize the 5' cap and start codon (AUG).

·Elongation: Ribosomes move along the mRNA, synthesizing polypeptides.

·Termination: Translation ends upon encountering a stop codon (UAA, UAG, UGA), and the protein is released.

The nature of the protein or peptide encoded by the mRNA determines its therapeutic effect—be it to stimulate an immune response (as in vaccines) or to replace or modulate dysfunctional proteins (as in gene therapies).

For mRNA drugs used as vaccines, the translated antigen proteins are degraded by proteasomes into peptide fragments, which are then presented via MHC class I molecules to cytotoxic T lymphocytes (CD8+ T cells), thereby activating a cellular immune response. Concurrently, secreted antigens can be taken up by antigen-presenting cells and presented through MHC class II molecules to helper T cells (CD4+ T cells), further stimulating B cells to produce neutralizing antibodies. Cytotoxic T cells recognize and eliminate infected or tumor cells expressing the specific antigen, directly clearing the source of infection or malignancy. Helper T cells secrete cytokines that regulate the magnitude and type of immune response and promote the proliferation and differentiation of B cells to generate antibody-producing plasma cells. This dual activation of both humoral and cellular immunity results in comprehensive immune protection. This feature of mRNA vaccines gives them a significant advantage in both prophylactic vaccination and cancer immunotherapy applications.

mRNA has a relatively short intracellular half-life—typically around 7 hours—after which it is rapidly degraded by ribonucleases (RNases), resulting in the loss of its protein-coding capability. The protein products translated from mRNA may undergo post-translational modifications and exert their effects either within host cells or via autocrine, paracrine, or endocrine pathways. The transient expression nature of mRNA ensures a high level of safety and controllability within cells. The expressed proteins can serve diverse biological functions—for instance, antigens can stimulate immune responses, and therapeutic proteins can directly act on specific pathological processes. Furthermore, the transient nature of mRNA expression avoids the risk of genomic integration, thereby reducing the potential for insertional mutagenesis. These characteristics make mRNA therapeutics highly promising across a broad range of treatment areas.

Regional Landscape of mRNA Drug Development

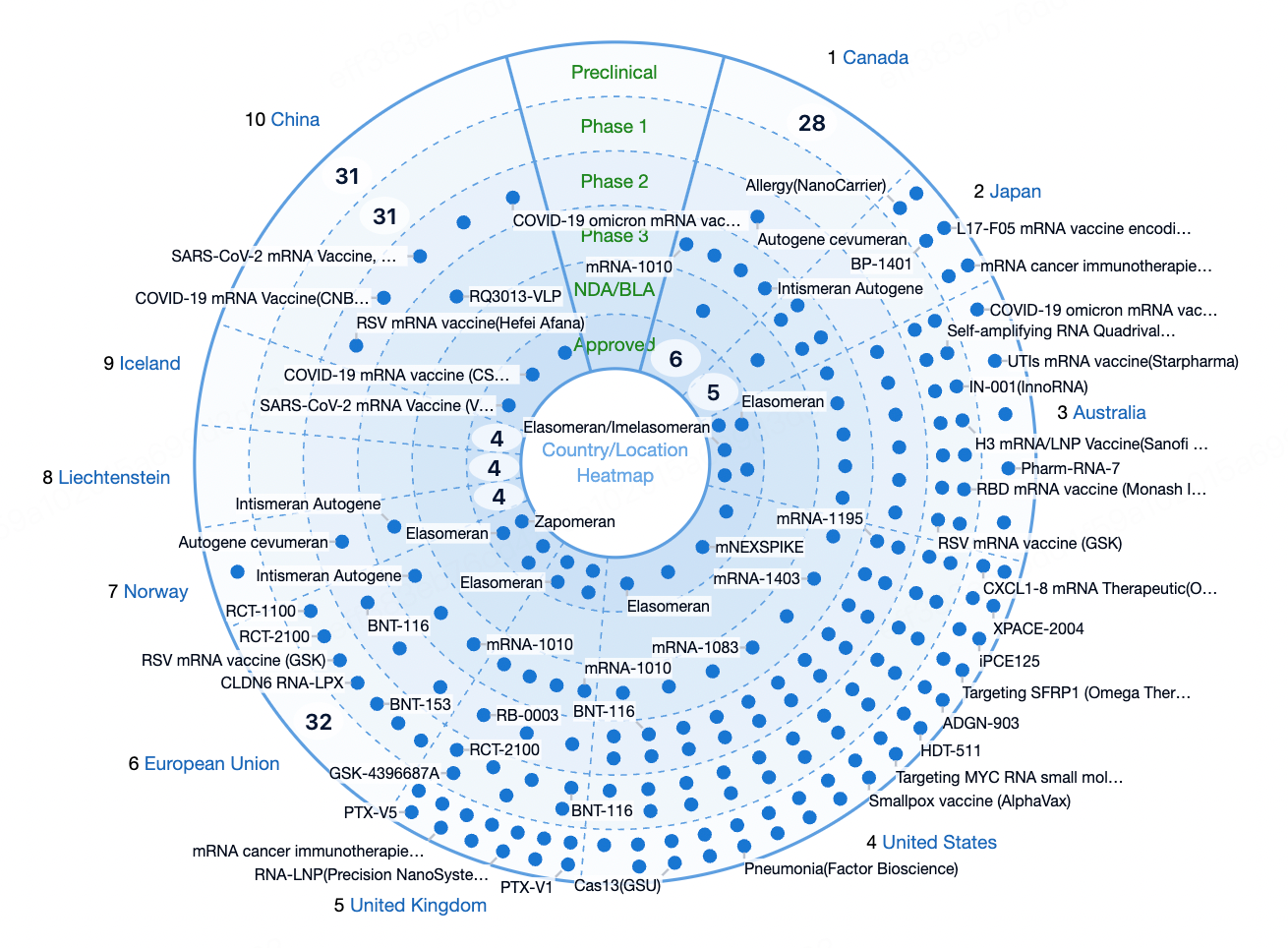

The United States is the global epicenter for mRNA drug development, home to the most active mRNA technology platforms and biopharmaceutical companies such as Moderna, BioNTech (which has U.S. operations), and CureVac (which maintains a U.S. subsidiary). The rapid growth of mRNA research in the U.S. is supported by a strong foundation in scientific research, ample funding, and a robust regulatory framework. The U.S. Food and Drug Administration (FDA)’s expedited review and supportive stance on mRNA technologies have positioned the country as a global leader in the development and commercialization of both mRNA vaccines and therapeutic mRNA-based drugs.

Europe is another major hub for mRNA innovation, particularly in countries such as Germany, the United Kingdom, and France. BioNTech, headquartered in Germany, co-developed the BNT162b2 COVID-19 vaccine with Pfizer, marking the first mRNA vaccine approved globally. CureVac, also based in Germany, is a pioneer in applying mRNA technology to cancer treatment and infectious disease prevention. Leading academic institutions such as the University of Oxford and Imperial College London have made significant contributions to the basic research of mRNA technologies. Regulatory support from the European Medicines Agency (EMA) has further accelerated development in the region.

In Asia, countries such as China and Japan have made notable breakthroughs in mRNA vaccine and therapeutic development, supported by favorable government policies and incentives. India and South Korea are also actively investing in mRNA capabilities and pursuing international collaborations to accelerate R&D progress in this field.

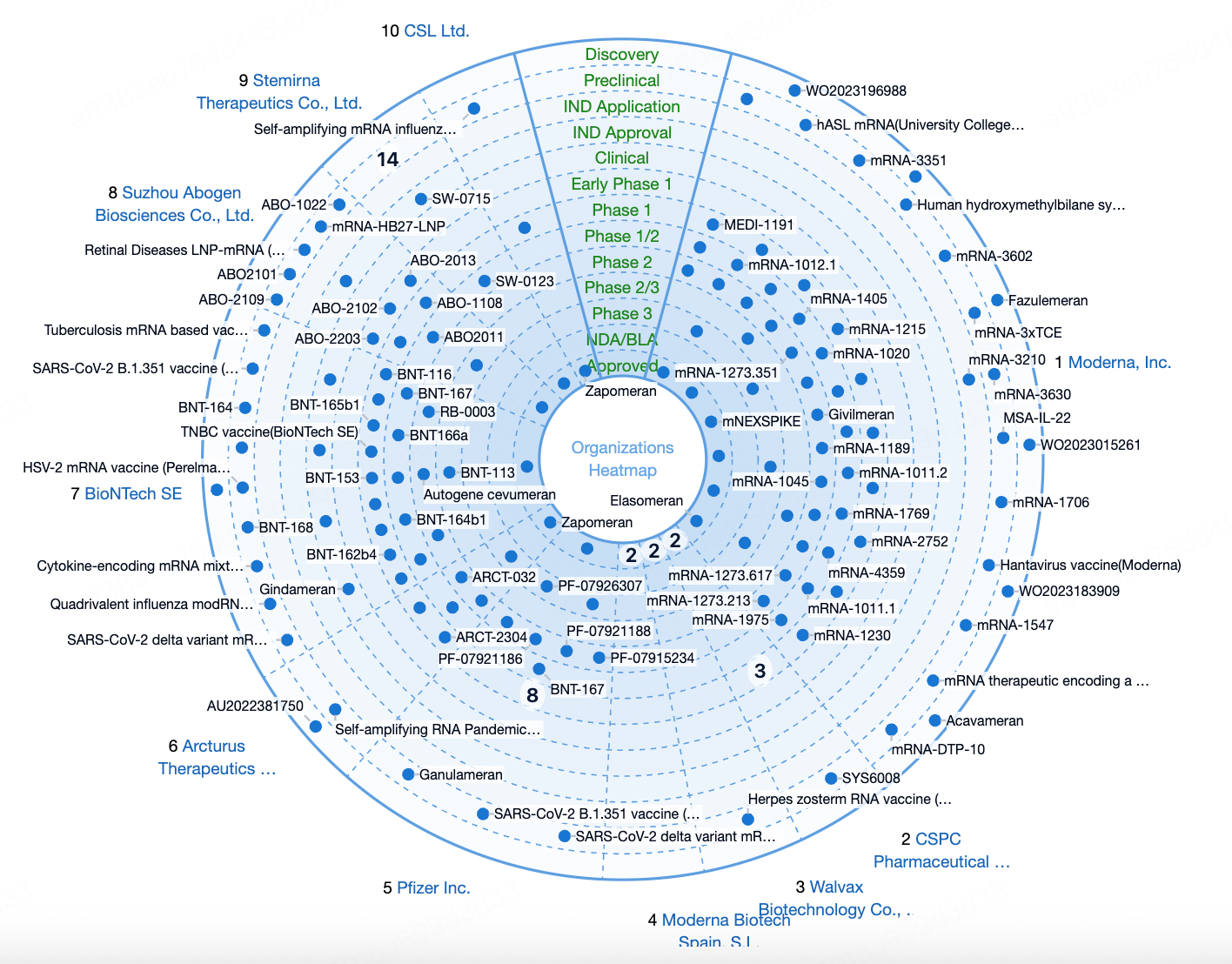

Global Competitive Landscape of mRNA Drugs

The global mRNA drug market is currently dominated by a few leading players, including Moderna, BioNTech, and CureVac. These companies are at the forefront of mRNA technology innovation and clinical application. Thanks to their successful COVID-19 vaccine launches, Moderna and BioNTech have seen massive increases in market capitalization, rising from USD 6.58 billion and USD 7.68 billion at the beginning of 2020 to USD 36.18 billion and USD 25.25 billion, respectively, by the end of 2023. In addition, global pharmaceutical giants such as AstraZeneca, GSK, Merck, Eli Lilly, Sanofi, and Pfizer are actively expanding into the mRNA field, further intensifying market competition and accelerating development.

Moderna

Moderna is a U.S.-based biotechnology company headquartered in Massachusetts, founded in 2010. It is dedicated to developing innovative therapies based on mRNA technology. In December 2018, Moderna went public on NASDAQ, raising over USD 600 million at USD 23 per share—a record-setting IPO for a biotech company. Its market value surged more than 440% from USD 6.58 billion in early 2020 to USD 36.18 billion by the end of 2023. Moderna’s success is largely attributed to its breakthrough with the mRNA-1273 COVID-19 vaccine, which became the first COVID-19 mRNA vaccine to enter Phase I clinical trials and was granted Emergency Use Authorization by the FDA at the end of 2020. The company is also actively developing mRNA vaccines targeting RSV, HIV, Zika virus, Epstein-Barr virus, and more, aiming to launch up to 15 new products and advance up to 50 mRNA drug candidates into clinical trials within the next five years.

BioNTech

BioNTech is a Germany-based biotechnology company founded in 2008. It focuses on the application of mRNA technology in cancer immunotherapy, infectious disease vaccines, and protein replacement therapies. BioNTech successfully went public on NASDAQ in October 2019. Its market capitalization grew from USD 7.68 billion in early 2020 to USD 25.25 billion by the end of 2023, an increase of more than 220%. The BNT162b2 vaccine, co-developed with Pfizer, was the world’s first officially approved mRNA COVID-19 vaccine and has received emergency use authorization in multiple countries and regions. Beyond COVID-19, BioNTech is also advancing vaccines for tuberculosis, malaria, HIV, shingles, and influenza, while exploring mRNA applications in cancer treatment.

CureVac

CureVac, headquartered in Tübingen, Germany, is one of the pioneers in mRNA technology. Founded in 2000, CureVac has over 20 years of experience in developing and optimizing multifunctional mRNA molecules for medical use and was the first company to successfully apply mRNA in therapeutic contexts. In August 2020, CureVac went public on NASDAQ with a market capitalization of USD 18.105 billion. Its pipeline includes cancer immunotherapies (cancer vaccines), antibody therapies for rare diseases, and prophylactic vaccines for infectious diseases. Although CureVac’s mRNA vaccine candidates have lagged behind in development compared to its competitors, its deep technical expertise and innovation capacity continue to secure its relevance in the competitive landscape.

Conclusion

As a revolutionary biotechnology platform, mRNA drugs have demonstrated enormous potential in prophylactic vaccination and cancer immunotherapy. With ongoing technological advances and deeper clinical research, the mRNA drug market is expected to enter a new phase of expansive growth. In the future, mRNA therapies are likely to play a critical role in the treatment of a wider range of diseases, offering patients more therapeutic options and hope. At the same time, progress in delivery systems and chemical modifications will provide a strong foundation for broader clinical applications. With the active involvement of global pharmaceutical giants and increasing policy support, the mRNA drug market is poised to maintain rapid growth and become a key direction in the development of the biopharmaceutical industry.

How to obtain the latest research advancements in the field of biopharmaceuticals?

In the Synapse database, you can keep abreast of the latest research and development advances in drugs, targets, indications, organizations, etc., anywhere and anytime, on a daily or weekly basis. Click on the image below to embark on a brand new journey of drug discovery!

Reference

- 1.Sahin U, Karikó K, Türeci Ö. mRNA-based therapeutics--developing a new class of drugs. Nat Rev Drug Discov. 2014 Oct;13(10):759-80. doi: 10.1038/nrd4278. Epub 2014 Sep 19. PMID: 25233993.

- 2.Liu C, Shi Q, Huang X, Koo S, Kong N, Tao W. mRNA-based cancer therapeutics. Nat Rev Cancer. 2023 Aug;23(8):526-543. doi: 10.1038/s41568-023-00586-2. Epub 2023 Jun 13. PMID: 37311817.

- 3.Xiao Y, Tang Z, Huang X, Chen W, Zhou J, Liu H, Liu C, Kong N, Tao W. Emerging mRNA technologies: delivery strategies and biomedical applications. Chem Soc Rev. 2022 May 23;51(10):3828-3845. doi: 10.1039/d1cs00617g. PMID: 35437544.