The Technology and Trends Behind the Surge in Healthcare Startup Funding in February 2025

February 2025 brought a wave of exciting news for innovators in the global healthcare industry. From breakthrough therapies for neuropsychiatric disorders to cutting-edge advancements in ENT surgical devices, a series of startups have laid a solid foundation for future growth through successful financing activities. These companies have not only attracted significant capital but also showcased the most forward-thinking technologies and solutions in their respective fields. In this era of both challenges and opportunities, their success is not only a recognition of their own capabilities but also a profound insight into future healthcare trends. With technological advancements and growing market demand, these emerging forces are reshaping the healthcare landscape, offering patients unprecedented treatment options and service experiences.

1. Newleos Therapeutics Secures $93.5 Million in Series A Financing to Advance Neuropsychiatric Therapies

On February 13, 2025, Newleos Therapeutics successfully completed a $93.5 million Series A financing, marking a significant milestone in its journey toward developing innovative treatment solutions. This funding will primarily be used to advance its core product pipeline, support ongoing clinical trials, and accelerate drug development and commercialization.

Specializing in neuropsychiatric disorders, Newleos focuses on conditions such as generalized anxiety disorder, social anxiety disorder, substance use disorder, and cognitive impairment. Its flagship program, NTX-1955 (RO7308480), is a potential “first-in-class” GABAA-γ1 selective positive allosteric modulator (PAM). By targeting the γ1-subunit-containing GABAA receptors highly concentrated in the amygdala, this novel approach aims to modulate GABAergic transmission in anxiety-related neural circuits, offering a potentially safer and more effective treatment option compared to existing therapies.

This financing round was led by Goldman Sachs Alternatives, with participation from Novo Holdings A/S, Longwood Fund, DCVC Bio, and Arkin Bio Capital. This strong backing from prominent investors not only highlights Newleos’ significant potential in the biopharmaceutical sector but also underscores confidence in its research direction and business model. The infusion of funds will significantly enhance the company’s R&D capabilities, optimize its technology platform, and facilitate international collaborations, further strengthening its competitiveness in the global pharmaceutical market.

Newleos plans to leverage this capital to accelerate key projects and expedite the translation of research from the laboratory to clinical application. With continued investment in R&D and technological breakthroughs, the company is poised to introduce more innovative therapies, bringing new hope to patients worldwide. In light of increasing global attention on mental health, Newleos' efforts are expected to make a substantial impact on improving patient quality of life. The successful Series A financing has laid a solid foundation for the company’s vision of becoming a leader in the field of neurological and psychiatric diseases.

2. Bambusa Therapeutics Secures $90 Million in Series A Financing to Drive Bispecific Antibody Therapies for Immune and Inflammatory Diseases

On February 14, 2025, Bambusa Therapeutics announced the successful completion of a $90 million Series A financing. This round was led by new investor RA Capital Management, with participation from Janus Henderson Investors, Redmile Group, Invus, and ADAR1 Capital Management, alongside all existing investors.

The funds will be used to advance Bambusa’s lead programs into Phase 1 clinical trials and further develop additional pipeline candidates. The company specializes in long-acting bispecific antibodies for immune and inflammatory (I&I) diseases, aiming to provide more effective and convenient treatment options compared to existing therapies.

Bambusa’s leading drug candidate, BBT001, is a bispecific antibody designed to replace current standard-of-care treatments for various dermatological conditions. This breakthrough therapy offers new hope for patients with hard-to-treat skin conditions, particularly those who have not responded well to existing treatments. Additionally, BBT002 serves as a "molecular platform," designed for multiple indications, with potential applications across respiratory, dermatological, and gastrointestinal diseases.

Since its founding in May 2024, Bambusa has rapidly established a robust pipeline of long-acting bispecific antibodies, leveraging validated targets and biological synergies to develop optimal treatments for I&I indications. In addition to BBT001 and BBT002, the company is also developing BBT003 and BBT004 for inflammatory bowel disease and rheumatological disorders, respectively, both of which have shown promising therapeutic potential.

This successful financing round will not only accelerate Bambusa’s lead programs but also enhance its R&D capabilities, driving further innovation and commercialization. The funding represents a major milestone for the company, positioning it as a future leader in the treatment of immune and inflammatory diseases. With ongoing research advancements and technological progress, Bambusa is set to provide more efficient and safer therapeutic options for patients worldwide.

3. Stellaromics Secures $80 Million in Series B Financing to Accelerate the Development and Commercialization of Its 3D Spatial Biology Platform, Pyxa

On February 11, 2025, Stellaromics successfully closed an $80 million Series B financing round, led by Catalyst4, with participation from Stanford University Ventures. This funding will be used to advance the development and commercialization of Stellaromics' groundbreaking 3D spatial biology platform, Pyxa.

Founded in 2022 and headquartered in Boston, USA, Stellaromics is dedicated to leveraging its proprietary technology to decode the complex three-dimensional transcriptional and translational patterns within natural biological tissues. The company’s flagship product, STARmap (Spatially Resolved Transcript Amplicon Readout Mapping), reveals gene expression patterns within intact tissues, aiding in the identification of therapeutic targets and supporting biomedical research.

Beyond STARmap, Stellaromics is advancing the late-stage development of its Plexa™ product series, designed to enable researchers and clinicians to create detailed cellular maps, enhancing disease understanding. With the introduction of the Pyxa platform, Stellaromics will further empower scientists to analyze thick tissue samples with unprecedented resolution, simultaneously examining the spatial distribution of hundreds to thousands of genes. This innovation offers a new perspective on cell-to-cell interactions.

The success of this financing round not only reflects investor recognition of Stellaromics' technological advancements but also underscores confidence in its business model and growth potential. For a startup to attract such substantial investment within just three years of its founding demonstrates Stellaromics’ significant industry standing. With this funding, the company plans to expand its R&D activities, advance its product pipeline, and potentially increase its global market share.

Notably, the spatial genomics market is projected to grow at a compound annual growth rate (CAGR) of 10.60%, from approximately $497.6 million in 2024 to around $829.81 million by 2029. This growth indicates that as technology advances and application areas expand, companies like Stellaromics will have the opportunity to establish a strong presence in this rapidly evolving market, making significant contributions to global healthcare. Thus, Stellaromics' successful Series B financing not only validates its past efforts but also lays a solid foundation for sustained growth in the coming years.

4. OpenEvidence Raises $75 Million in Series A Financing

On February 19, 2025, OpenEvidence successfully completed a $75 million Series A financing round, led by Sequoia Capital. This marks the first major institutional investment since Daniel Nadler founded OpenEvidence in 2021 and brings the company’s valuation to an impressive $1 billion.

OpenEvidence, based in Cambridge, Massachusetts, is a healthcare AI solutions provider focused on developing an AI-powered medical information platform. The platform aims to support healthcare professionals in making more informed clinical decisions by providing accurate and easily accessible medical information. Its core product is a chatbot specifically designed for physicians, assisting them in making optimized diagnostic and treatment decisions while ensuring data security and accuracy by avoiding connections to the public internet.

With this new funding, OpenEvidence plans to intensify its investment in technology R&D, particularly in advancing and training its next-generation large language model (LLM) and expanding the capabilities and service range of its physician-focused chatbot. Additionally, the company has established a content partnership with The New England Journal of Medicine, allowing clinicians using the OpenEvidence platform to access rigorously peer-reviewed, up-to-date medical research findings.

OpenEvidence has adopted a unique business model—offering the chatbot service to physicians for free while generating revenue through advertising. This approach, relying on word-of-mouth referrals among doctors, has already led to approximately one-quarter of U.S. physicians using the platform. Sequoia Capital partner Pat Grady noted that OpenEvidence exhibits organic growth characteristics similar to those of consumer internet companies, which is exceptionally rare in the healthcare sector.

With the infusion of fresh capital, OpenEvidence is well-positioned to strengthen its leadership in the competitive healthcare AI market, explore new market opportunities, and expand its technological applications, driving positive transformation in the global healthcare industry. For medical institutions seeking innovative healthcare technologies and reliable partners to navigate future challenges, OpenEvidence is undoubtedly a company worth watching. This successful funding round also highlights continued investor interest and support for startups with the potential to reshape industries.

5.Candid Health Raises $52.5 Million to Drive Innovation in Healthcare Revenue Cycle Management

On February 12, 2025, Candid Health, a leading provider of revenue cycle automation solutions, announced the successful completion of a $52.5 million Series C financing round. Led by Oak HC/FT, this latest investment brings the company’s total funding to $99.5 million, underscoring both the capital market’s recognition of Candid Health and its ability to solve revenue cycle management (RCM) challenges in the healthcare sector.

Candid Health leverages advanced AI technology to streamline the complexity of RCM processes, improving accuracy and minimizing the need for manual intervention through automation. Unlike traditional RCM solutions that focus on correcting errors and increasing the efficiency of manual cleanup, Candid Health prioritizes error prevention at the source, ensuring that claims are submitted correctly the first time. This proactive approach significantly reduces the time and resources required for post-submission corrections, helping healthcare providers cut costs and enhance overall operational efficiency.

The newly raised capital will be used primarily to expand Candid Health’s client base among multi-site provider groups across the U.S. and further advance its technology and service offerings. Specifically, the company aims to enhance its platform’s capabilities to better support healthcare organizations in optimizing their revenue cycle management while reducing costs and improving patient experience. Additionally, Candid Health plans to use these funds for market expansion and continued technological innovation, broadening its user base and providing more personalized and efficient solutions.

Notably, Candid Health has demonstrated rapid growth, securing its Series C funding just months after closing a $29 million Series B round in September last year. This progression reflects strong investor confidence in the company’s solutions and market potential. As the healthcare industry increasingly prioritizes operational efficiency and cost control, technology-driven innovators like Candid Health are becoming key drivers of industry transformation.

6.Berry Street Secures $50 Million Series B Funding to Expand Nutrition Counseling Services

On February 5, 2025, Berry Street, a platform that provides independent practice management tools for registered dietitians, announced the completion of a $50 million Series B financing round led by Goldman Sachs, bringing the company’s valuation to $500 million. This milestone not only reflects investor confidence in Berry Street’s business model but also solidifies its position in the rapidly growing nutrition counseling market.

Berry Street’s growth is closely tied to the rising popularity of GLP-1 medications such as Ozempic, which are widely prescribed for weight loss. Physicians frequently recommend that patients undergoing GLP-1 therapy also receive professional guidance from dietitians. As more individuals focus on health management and weight control, the demand for professional nutrition counseling services continues to rise. Berry Street has capitalized on this trend by creating an innovative service model that bridges the gap between dietitians and patients, making personalized nutritional guidance more accessible.

A key driver of the industry’s expansion is the generous coverage of nutrition counseling services by commercial health insurance. Many patients can access high-quality dietitian consultations at no out-of-pocket cost, further fueling the industry’s growth and providing startups like Berry Street with vast market opportunities.

Additionally, Berry Street’s platform allows registered dietitians to establish private practices outside of their full-time jobs, offering greater flexibility while making nutrition counseling more accessible to patients with busy schedules. This flexible service model enhances patient engagement and satisfaction, ultimately improving overall health outcomes.

With this successful funding round, Berry Street aims to continue expanding its market presence, enhancing service quality, and developing new features and offerings tailored to customer needs. Looking ahead, Berry Street is well-positioned to become a leader in the nutrition counseling sector, driving the industry toward greater efficiency and accessibility. As public awareness of health and wellness continues to rise, Berry Street’s fusion of technology and professional services is poised to unlock significant potential and opportunities.

7.Eikon Therapeutics Secures $350.7 Million in Series D Financing

On February 26, 2025, Eikon Therapeutics successfully closed its $350.7 million Series D financing round, further solidifying its presence in the biopharmaceutical sector. Since its inception, Eikon has raised over $1.1 billion, providing substantial financial backing for its research and development initiatives.

Eikon’s core technology platform is based on cutting-edge microscopy techniques that allow researchers to observe the movement of proteins in live cells in real time, enabling the discovery and development of novel therapies. This technology originates from Nobel Prize-level research and was pioneered by one of Eikon’s co-founders, Dr. Eric Betzig.

The newly secured funding will primarily support the advancement of EIK1001 into a Phase 3 clinical trial for late-stage melanoma. EIK1001 is a TLR7/8 agonist designed to stimulate the immune system in its fight against cancer. Additionally, Eikon has acquired multiple drug candidates from Biotheus and Impact Therapeutics, including EIK1003, a highly selective PARP1 inhibitor currently in a Phase 1 clinical trial for multiple cancer types.

Dr. Roger M. Perlmutter, CEO of Eikon, emphasized that the company is conducting clinical research across 28 countries on five continents, showcasing its commitment and capability to drive global drug development. With extensive industry experience, Dr. Perlmutter previously held executive positions at Merck, where he led the development of several groundbreaking therapies.

Beyond supporting clinical trials, this funding will enable Eikon to expand its pipeline and explore novel therapeutic approaches for severe diseases. Investors in this round include prominent firms such as Lux Capital and Alexandria Venture Investments, whose backing not only provides critical financial resources but also reinforces confidence in Eikon’s future growth.

8.Abcuro Secures $200 Million in Series C Financing to Advance Ulviprubart for Inclusion Body Myositis

On February 12, 2025, Abcuro successfully raised $200 million in its Series C financing round, led by prominent investment firm New Enterprise Associates (NEA), with participation from Foresite Capital. Existing investors, including RA Capital Management, Bain Capital Life Sciences, and Redmile Group, also reaffirmed their support in this round.

Abcuro, a clinical-stage biotechnology company, is focused on developing novel therapies that precisely regulate cytotoxic T cells to treat autoimmune diseases and cancer. The newly acquired funds will primarily support its pivotal Phase 2/3 clinical trial evaluating ulviprubart (ABC008), a first-in-class monoclonal antibody targeting killer cell lectin-like receptor G1 (KLRG1) for the treatment of inclusion body myositis (IBM), a rare disease with no currently approved therapies.

IBM is characterized by the abnormal attack of healthy muscle tissue by highly cytotoxic T cells, leading to progressive weakness and muscle atrophy. Ulviprubart is designed to selectively eliminate these harmful T cells while preserving normal immune function, potentially offering a groundbreaking therapeutic option. Additionally, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have granted ulviprubart orphan drug designation, underscoring its significance in addressing an unmet medical need.

This financing not only strengthens Abcuro’s ability to advance ulviprubart toward commercialization but also provides critical financial support for future research and development activities. As further clinical data emerges and commercialization efforts progress, Abcuro aims to bring new hope and effective treatment options to patients suffering from IBM and other related conditions.

9.Prenuvo Raises $120 Million to Accelerate Early Cancer Screening and Global AI Health Management Expansion

On February 13, 2025, Prenuvo successfully completed its Series B financing, raising $120 million. The round was co-led by Left Lane Capital, Forerunner Ventures, and Felicis, highlighting strong market recognition and support for Prenuvo’s innovative approach in preventive healthcare.

Prenuvo specializes in early cancer screening, utilizing advanced whole-body MRI technology and AI algorithms to provide comprehensive diagnostic results in under an hour. Backed by over a decade of clinical research, its technology can detect stage-one solid tumors and over 500 other diseases, marking a significant shift from reactive treatment to proactive prevention in healthcare.

With this funding, Prenuvo plans to allocate resources toward several key areas. Firstly, it will enhance the capabilities of its whole-body MRI platform to further improve diagnostic accuracy. Secondly, the company will support the development of its new AI-driven body composition reporting software, which has already received FDA approval. This software provides precise data on visceral fat, subcutaneous fat, liver fat, muscle volume, and key abdominal organ volumes, enabling individuals to make more informed lifestyle decisions.

Additionally, Prenuvo aims to expand its global market presence, with new product and service launches planned in Silicon Valley, Los Angeles, and New York, followed by further regional expansions in the spring. The company also intends to deepen its vertically integrated model by establishing additional imaging centers. Currently, Prenuvo operates 17 dedicated imaging centers across the U.S. and Canada, with plans to build 15 more, including its first international locations in Europe and Australia.

Despite Prenuvo’s promising outlook in preventive healthcare, industry challenges remain. Organizations such as the American College of Radiology have raised concerns about the cost-effectiveness of widespread screening in asymptomatic populations and the potential risks of overdiagnosis. To address these challenges, Prenuvo must demonstrate the long-term value of its early detection methods while ensuring that its services remain both safe and economically viable.

10.AdvanCell Secures $112 Million in Series C Financing to Advance Targeted Alpha Radiotherapy in Partnership with Eli Lilly

AdvanCell, an Australian company specializing in radiopharmaceutical cancer treatments, reached a significant milestone in 2025. On February 3, the company successfully completed its Series C financing, raising $112 million. The funding round was co-led by SV Health Investors, Sanofi Ventures, Abingworth, and SymBiosis, with continued support from existing investors such as Morningside, Tenmile, and Brandon Capital.

The newly secured funds will primarily support the clinical development of AdvanCell’s lead candidate, ADVC001. ADVC001 is a lead-212 (Pb-212)-based radiopharmaceutical therapy currently in a Phase 1/2 dose-escalation clinical trial for metastatic prostate cancer. The therapy employs a ligand targeting prostate-specific membrane antigen (PSMA) to precisely deliver alpha particles to tumor cells, ensuring highly selective and effective cancer cell destruction while minimizing damage to surrounding healthy tissues.

Beyond clinical trials, the funding will also be used to scale up AdvanCell’s production capabilities and accelerate the development of its broader pipeline of radioligand therapies. The company has established itself as a leader in the field, being the first globally to bring a Pb-212-based targeted alpha therapy into clinical trials for metastatic prostate cancer.

Notably, AdvanCell has also entered into a collaboration agreement with pharmaceutical giant Eli Lilly. This partnership will leverage both companies’ technological strengths to co-develop additional targeted alpha radiopharmaceutical therapies and expedite their clinical progression. Through this collaboration, AdvanCell not only demonstrates its innovation potential in cancer treatment but also reflects the growing investment by multinational pharmaceutical companies in nuclear medicine.

11. Nanos Medical Secures Over RMB 300 Million in Strategic Financing to Accelerate Innovation and Global Expansion in ENT and Craniospinal Surgical Devices

In February 2025, Nanos Medical successfully completed a strategic financing round exceeding RMB 300 million. The company specializes in the R&D, production, and sales of ENT (Ear, Nose, and Throat) and craniospinal surgical medical devices. Through a series of strategic acquisitions, Nanos Medical has rapidly expanded its product portfolio, establishing a diversified lineup covering the ENT field.

Nanos Medical’s products have been sold in over 40 countries and regions, serving more than 3,000 hospitals—primarily ENT specialty hospitals and top-tier tertiary hospitals in China. The company holds a market share of over 30% for its core products, solidifying its position as a leader in China’s ENT and craniospinal surgical device sector. These achievements stem from the company’s sustained R&D investments and strong commitment to innovation. For instance, its Temperature-Controlled Ablation (TCA) product leverages nerve ablation technology to precisely target posterior nasal nerves and their branches, effectively alleviating rhinitis symptoms. Since its launch, the TCA system has garnered widespread acclaim for its clinical efficacy and high patient satisfaction.

The newly raised funds will primarily support market expansion and product development. Nanos Medical plans to further consolidate its leading position in China’s ENT and craniospinal surgical device market while advancing its global strategy to strengthen its international footprint. Additionally, the company aims to enhance product quality and service capabilities through continuous technological innovation to meet growing customer demands.

Summary

The significant financing activities in February 2025 highlight a clear trend: companies like Newleos Therapeutics (focused on neuropsychiatric therapies) and Nanos Medical (specializing in ENT and craniospinal devices) are leading their respective niches by addressing unmet medical needs through innovation. Their funding will accelerate R&D, market penetration, and global strategies, positioning them for substantial growth in the coming years.

Notably, this financing wave extended beyond traditional drug development to include companies like Candid Health (revenue cycle automation) and Prenuvo (AI-powered early cancer screening via advanced imaging), reflecting investor enthusiasm for technologies that improve healthcare efficiency, reduce costs, and enhance patient outcomes.

Moreover, backing from prominent institutional investors—such as Goldman Sachs Alternatives’ investment in Newleos and Qiming Venture Partners’ strategic support for Nanos Medical—underscores confidence in the long-term potential of the healthcare sector. These cross-sector investments provide not only capital but also valuable networks and strategic guidance, fueling further innovation and scalability.

How to get the latest progress on drug deals?

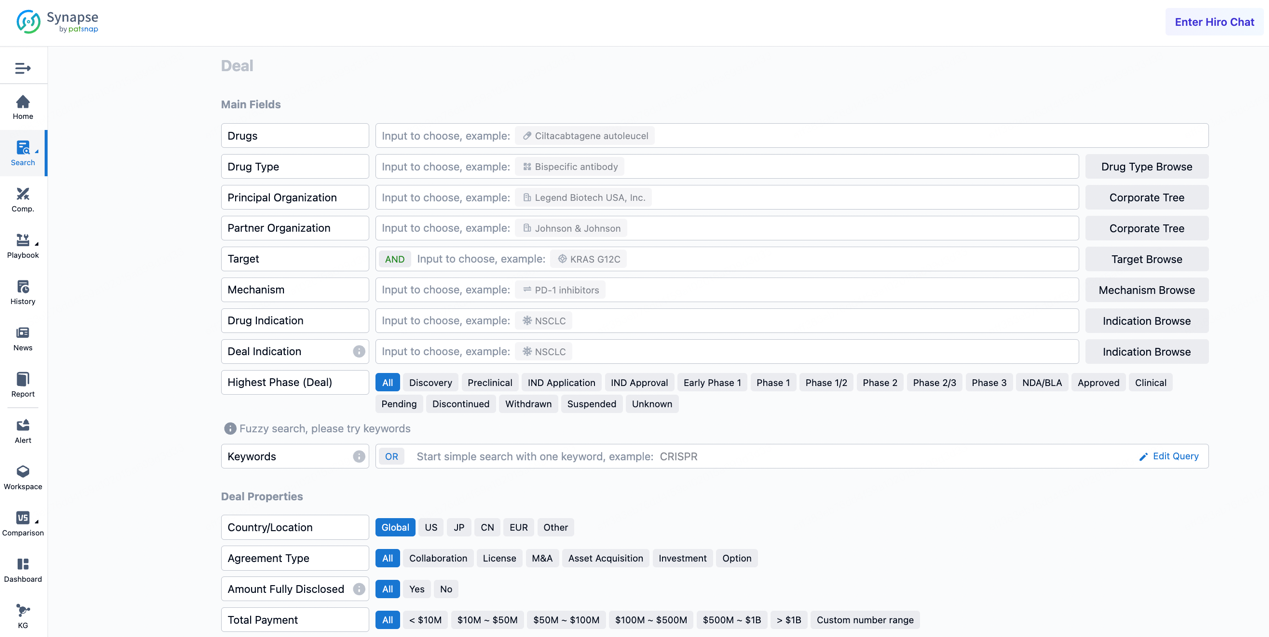

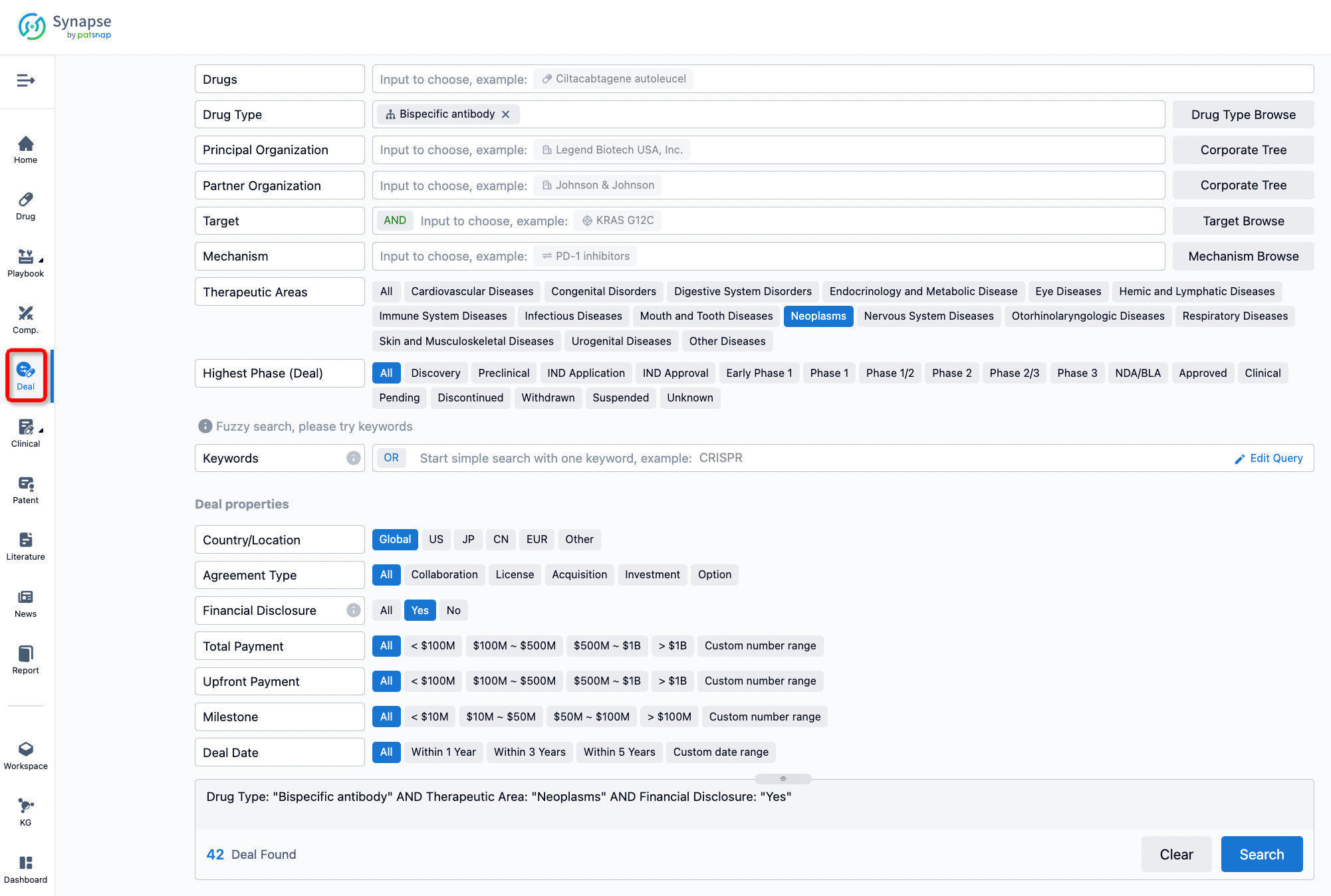

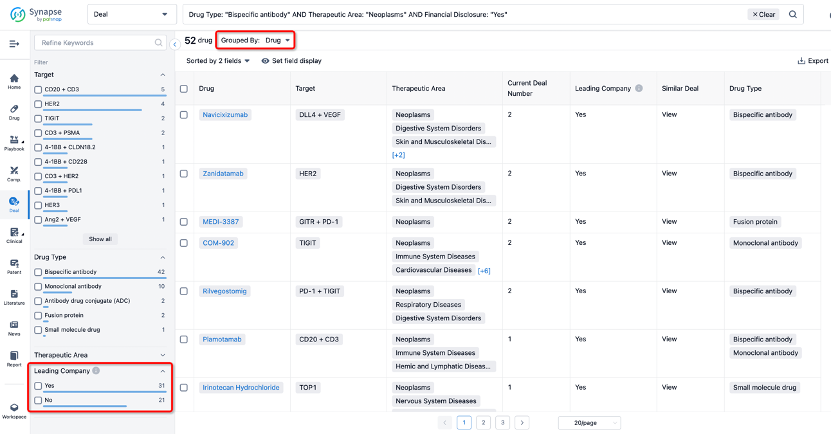

If you would like to access the latest transaction event information, you can click on the 'Deal' module from the homepage of the Synapse database. Within the Deal module, you can search for global pharmaceutical transaction information using labels such as Drugs, Organization, Target, Drug Type, Deal Date.

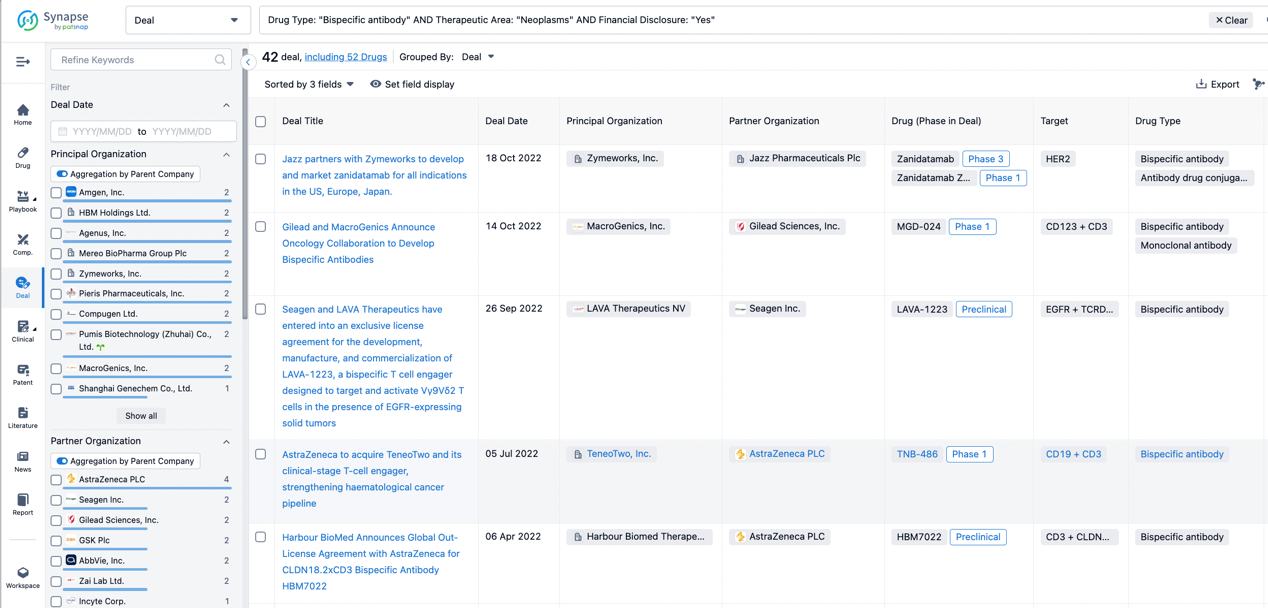

Furthermore, you can obtain the original link to the transaction coverage by clicking on the "Deal Name."

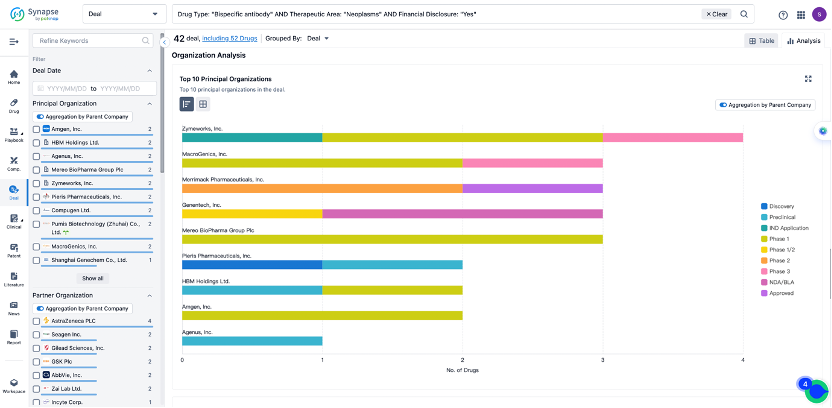

In the analysis view, you can see the most active assignors, assignees, popular targets, and other dimensions of analysis, as well as the distribution of research and development statuses at the time of the transaction, to help you better understand the search results.

The Synapse database also supports the ability to view current transactions from the dimension of "drugs" (by selecting "drugs" from the "Adjust Dimension" dropdown menu above). Targeting transactions involving renowned pharmaceutical companies that are of interest to the industry, such as Merck, Roche, etc., Synapse has identified a group of "leading companies" through drugs that have achieved global sales exceeding 1 billion US dollars in 2022. Transactions involving drugs from these leading companies can be filtered by clicking on the "Leading Company" tag on the left-hand side.

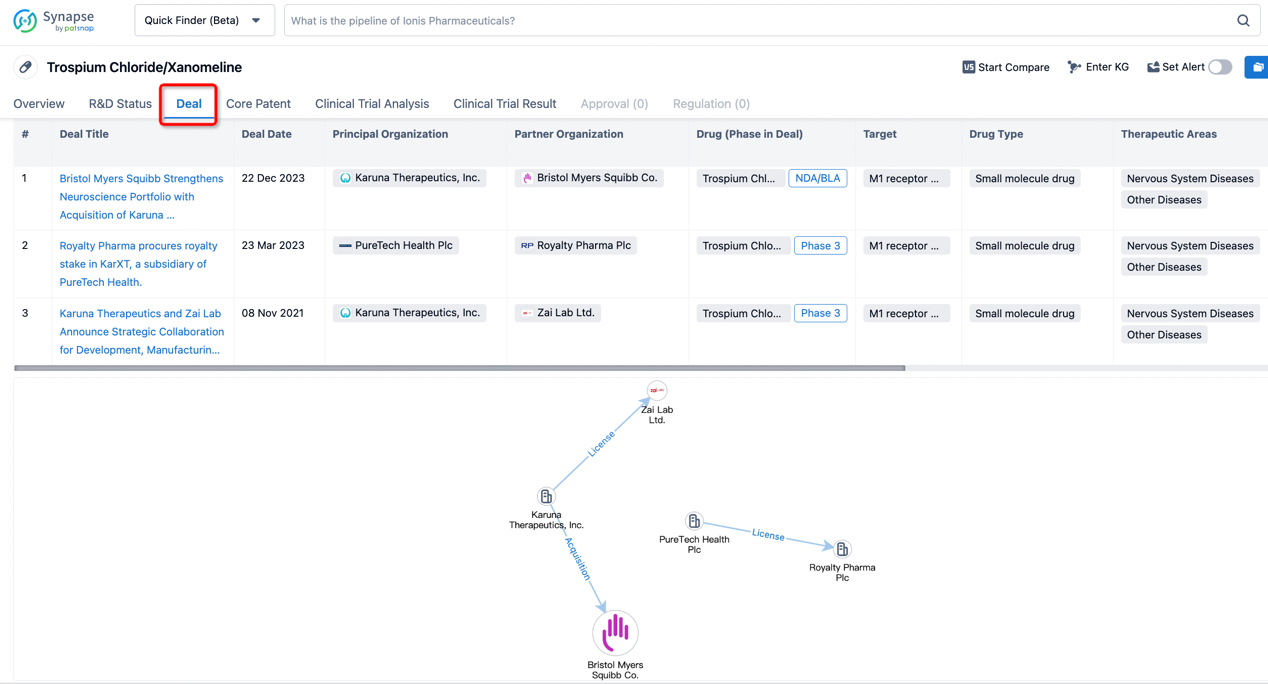

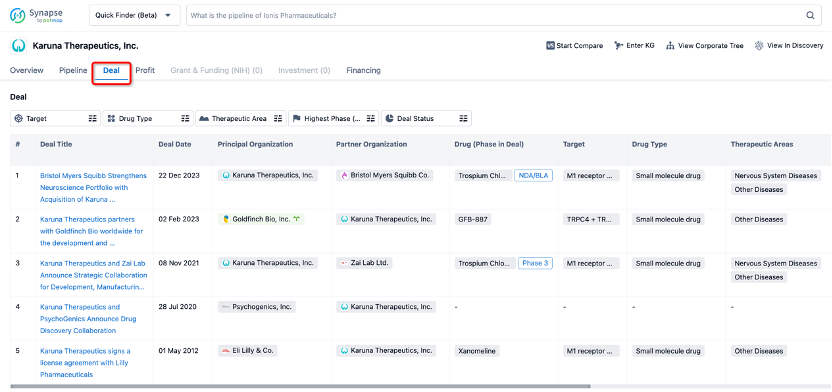

In addition to the drug transaction module, you can also view related transaction history on the drug detail page and the institution detail page.

Click on the image below to explore new pharmaceutical funding transactions!